Understanding ZeroLiquid: A Non-Liquidating Zero-Interest Lending Agreement Secured by LST

ZeroLiquid: A Non-Liquidating, LST-Secured Zero-Interest Lending Agreement

author: Yuuki

Currently the ETH staking rate has reached 19.6%, with a market value of staked ETH of 44.3 billion. The market value of LSTETH has reached 16.4 billion US dollars and is still growing, which undoubtedly corresponds to a huge market demand for releasing liquidity for such a large-scale interest-bearing asset. Currently, the development of USD stablecoin mortgage lending protocols based on LST assets is relatively mature, and the competition in the field is gradually stabilizing, such as CrvUSD, Prisma, Raft, Gravita, etc. However, the protocols based on LST asset collateral and lending of WrapETH are still relatively few, and the development of the track is in the early stage. Since WrapETH and the underlying LST assets have the same direction of price fluctuations, this type of product can hedge the risk of collateral price fluctuations to achieve non-liquidation loans, while accumulating leverage on the yield position. (For the impact of the expansion of LST asset scale on the lending track, see “Inventory of Potential LSDFi Early Projects”)

ZeroLiquid is currently in the testnet stage, allowing users to mint zETH with up to 50% LTV by collateralizing LST (when a user deposits ETH, ZeroLiquid will convert it to LST). zETH is a borrowing certificate anchored to the price of ETH. Since it has the same direction of price fluctuations as ETH, ZeroLiquid can achieve non-liquidation without considering the risks of underlying LST assets from the LSD protocol (hacker attacks, large-scale fund confiscation, etc.), and hedge the price fluctuations of the borrowing part, while taking a long position on the interest rate exposure of ETH collateral. ZeroLiquid does not charge borrowing fees, and the protocol’s income comes from 8% interest on staked LST. 55% of the protocol income is distributed to ZERO single coin staking users. The above parameter ratios can be adjusted through governance.

Project risks: The ZeroLiquid team is anonymous, the development progress is delayed, and the current product is still in the testnet stage. According to information released by the team on Telegram, the product code is expected to be submitted for audit in early July. The cooperating audit companies are code4arena and immunify, both top audit institutions in the industry, and have participated in the code audit of multiple well-known projects such as ENS, BLUR, GMX, etc. It should be noted that ZeroLiquid has not yet been seen in the pre-audit list disclosed by code4arena.

- Development of Polkadot parallel threads has already begun. Learn how it works.

- Will the combination of the ZK and OP methods become the future of Ethereum Rollup?

- Has the PoW Narrative Renaissance become a dream as BCH tripled in two weeks?

1. Specific product mechanism

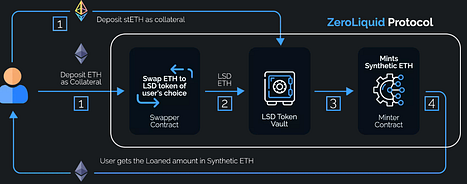

ZeroLoan module — minting zETH:

ZeroLoan is a basic functional module of the ZeroLiquid Protocol. Users can provide LST or assets that can be converted into LST as collateral through ZeroLoan, and borrow synthetic assets issued by the protocol with a 50% LTV and 0 borrowing interest rate (for example, users can provide up to 0.5 zETH by offering 1 ETH or stETH). At the same time, the protocol regularly collects interest generated by LST to repay the user’s debt according to the user’s deposit ratio; users can also repay at any time to retrieve the collateral.

ZeroLoans provide users with relatively flexible borrowing tools, which can allow users to enjoy the interest income brought by collateral while obtaining some liquidity. At the same time, due to the price fluctuations of debt and collateral in the same direction, there is no liquidation risk for debt. Since the collateral accepted by ZeroLoans are all interest-bearing assets, and there is a feature of self-repayment without liquidation, the product function of ZeroLoans can also be understood as the advance withdrawal of collateral income.

ZeroLoan functional module flow chart

Source: zeroliquid.gitbook, LD Capital

Steamer module – maintaining the anchoring of ZETH:

The Steamer module is the key to the smooth implementation of the ZeroLiquid protocol and the adoption rate of the protocol. Steamer allows any user (with or without outstanding debt positions) to redeem zETH for stETH at a ratio of 1:1. The stETH in Steamer comes from the interest generated by the user’s collateral minus the protocol fee (8%), so when the funds flowing into Steamer are greater than the funds flowing out for redeeming zETH, the size of Steamer will grow, and zETH will not be discounted in the secondary market; but when the funds flowing out of Steamer are greater than the funds flowing in, the redemption of zETH will need to wait for a period of time, and zETH may also appear to varying degrees of secondary market discounts. The key to avoiding zETH discounts and large-scale redemptions is to expand the use cases of zETH. The protocol will use tokens and 35% of the protocol revenue to provide incentives for the zETH/ETH LP; the income generated by the protocol POL (the ZERO/ETH LP controlled by the protocol and future zETH/ETH LP) and Zero Fund income will maintain the anchoring of zETH, and actively promote the integration of zETH with other protocols.

Overall, Steamer provides liquidity for the 1:1 exchange of zETH and stETH for market arbitrageurs to balance the price and maintain anchoring. Recently, many LSDFi protocols, which are Liquity Fork, have appeared in the market. The liquidity of the exchange is provided by some borrowers, and the protocol needs to pay additional incentive costs for this. In comparison, the arbitrage model of ZeroLiquid is simpler, with fewer participants and lower protocol costs, but the corresponding risk of secondary market discounts due to insufficient exchange liquidity is increased.

Steamer Functional Module Flowchart

Source: zeroliquid.gitbook, LD Capital

2. Token Distribution

ZERO tokens were sold on the Uniswap platform on March 19th in the form of self-raised funds, with a total of 30.5 million tokens (initially 100 million, but 69.42% was burned by community proposals), including 6 million for initial liquidity, 13.7 million belongs to the community, 1 million belongs to the treasury, and 700,000 belongs to core contributors. The initial secondary market circulation is 6.9 million, with the remaining portions gradually vesting over 3 years. The team has already executed the first token burn, burning 3.49 million ZERO tokens. The current circulating supply of 7.84 million has a market value of approximately $3.5 million (data websites such as Coingecko do not account for the burned portion, resulting in distorted data).

ZERO Token Allocation and Unlocking

Source: zeroliquid.gitbook, LD Capital

3. Protocol Income Distribution

The protocol does not charge borrowing fees and instead collects 8% of the collateral earnings as protocol income. 10% of the protocol income is distributed to ZeroFund for anchor maintenance and protocol development; 35% is distributed to the LP incentive liquidity of zETH/ETH; and 55% is distributed to the single currency stakers of ZERO. Therefore, ZERO not only has protocol governance rights, but also dividend rights. Based on simple calculations, if the protocol has $100 million in TVL (currently LSTETH market value is $16.4 billion), assuming an ETH collateral yield of 5%, ZERO stakers are expected to earn $220,000 in annual income.

Protocol Income Distribution

Source: zeroliquid.gitbook, LD Capital

4. Comparison with Similar Protocols

ZeroLiquid’s product model is similar to Curve’s Clever and Alchemix. The main difference between Zeroliquid and Clever is that Clever’s underlying collateral is mainly CVX (with a small portion of stablecoins), while Zero’s underlying collateral is ETH. There is a difference of several orders of magnitude in asset size between the two (CVX currently has a market value of $275 million, ETH has a market value of $221.2 billion, and LSTETH has a market value of $16.4 billion). Currently, Clever’s market value is around $3.4 million, which is similar to ZERO; however, if ZeroLiquid’s product is successfully launched, its growth potential is undoubtedly greater than that of Clever. The main difference between Alchemix and ZeroLiquid is that its protocol token does not have dividend rights, while ZERO’s single currency staking can share protocol income. Currently, the deposit amount of LST/ETH in Alchemix is $42.7 million, and the circulating market value of ALCX is $26.5 million, about 7.5 times that of ZERO.

The selected text contains HTML code that is not translatable to plain text as it is a markup language used for creating web pages.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- I have drawn over 100,000 robot images, and my Twitter avatar is full of these pictures. This AI painting competition is becoming very popular.

- The New Frontier of DeFi: the Rise of Repeated Collateralization, Liquidity Mining, and LSD Tokens

- The bankruptcy judge in the southern district of New York has approved Celsius’ exchange of altcoins for BTC and ETH starting from July 1st.

- Exclusive Interview with HashKey PRO: Has Reached Cooperation with Zhongan Bank, Currently Supporting SWIFT Bank Transfers in 16 Countries and Regions

- ZeroLiquid: Zero-Collateral, Zero-Interest Loan Agreement with LST as Collateral

- Unveiling the New Future of ZK-Rollup: Taiko – Pioneering the Challenge of zkEVM

- Azuki founder’s first response to the disaster: Overestimated oneself, underestimated the community, won’t sell the company