ZeroLiquid: Zero-Collateral, Zero-Interest Loan Agreement with LST as Collateral

ZeroLiquid: Zero-Collateral, Zero-Interest Lending with LST CollateralCurrently, the ETH collateralization rate has reached 19.6%, with a market value of 44.3 billion for the collateralized ETH. The market value of LSTETH has reached 16.4 billion US dollars and is still growing, indicating a significant market demand for releasing liquidity from such a large income-generating asset. Currently, the development of USD stablecoin mortgage lending protocols based on LST assets is relatively mature, and the competition in the track is gradually stabilizing, such as CrvUSD, Prisma, Raft, and Gravita. However, there are relatively few protocols based on LST asset collateral for lending WrapETH, and the development of the track is still in its early stages. Since WrapETH and the underlying LST assets have the same direction of price fluctuations, such products can hedge the risk of collateral price fluctuations to achieve a non-liquidation loan, while accumulating a leveraged position for yield. (The impact of the expansion of LST asset scale on the lending track is detailed in “Inventory of Early LSDFi Potential Projects”)

ZeroLiquid is currently in the testnet phase, allowing users to mint zETH with a maximum LTV of 50% by collateralizing LST (when a user deposits ETH, ZeroLiquid converts it into LST). zETH is a borrowing certificate anchored to the price of ETH. Since it has the same direction of price fluctuations as ETH, ZeroLiquid can achieve non-liquidation, hedge the price fluctuation risk of the borrowing section, and take a long ETH collateral interest rate exposure without considering the risk that the underlying LST assets come from the LSD protocol (hacker attacks, large-scale fund confiscation, etc.). ZeroLiquid does not charge borrowing fees, and the protocol’s revenue comes from the 8% interest on the collateralized LST, with 55% of the protocol’s revenue allocated to ZERO’s single-coin stakers; the above parameter ratios can be adjusted through governance.

Project risks: ZeroLiquid team is anonymous, development progress is delayed, and the product is still in the testnet phase; according to information released by the team on Telegram, the product code is expected to be audited in early July; code4arena and immunify are the cooperating audit companies, both of which are top audit institutions in the industry and have participated in the code audits of many well-known projects such as ENS, BLUR, and GMX; it is noteworthy that ZeroLiquid has not yet appeared in the pre-audit list disclosed by code4arena.

1. Specific product mechanism

- Unveiling the New Future of ZK-Rollup: Taiko – Pioneering the Challenge of zkEVM

- Azuki founder’s first response to the disaster: Overestimated oneself, underestimated the community, won’t sell the company

- The Five Paths of Layer 2 Evolution: Why They Converge on Superchains and L3

ZeroLoan module – minting zETH:

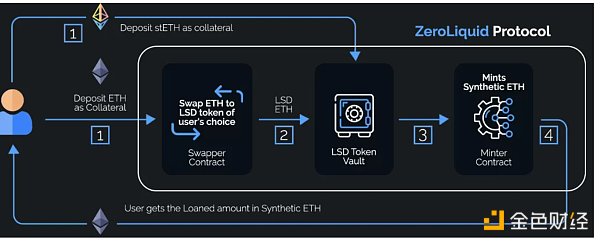

ZeroLoan is the basic functional module of the ZeroLiquid protocol. Users can provide LST or assets that can be converted into LST as collateral through ZeroLoan, borrow synthetic assets issued by the protocol at an LTV of 50% and a borrowing rate of 0% (for example, if a user provides 1 ETH or stETH, they can borrow up to 0.5 zETH). At the same time, the protocol regularly collects interest generated by LST to repay the user’s debt based on the user’s deposit ratio; users can also repay at any time to retrieve the collateral.

ZeroLoans provides users with relatively flexible borrowing tools that allow users to enjoy interest income from collateral while obtaining some liquidity. Due to the price fluctuations of debt and collateral in the same direction, there is no liquidation risk for debt. Since ZeroLoans accepts interest-bearing assets as collateral and has the characteristic of self-repayment without liquidation, the product function of ZeroLoans can also be understood as the pre-withdrawal of collateral income.

ZeroLoan functional module flowchart

Source: zeroliquid.gitbook, LD Capital

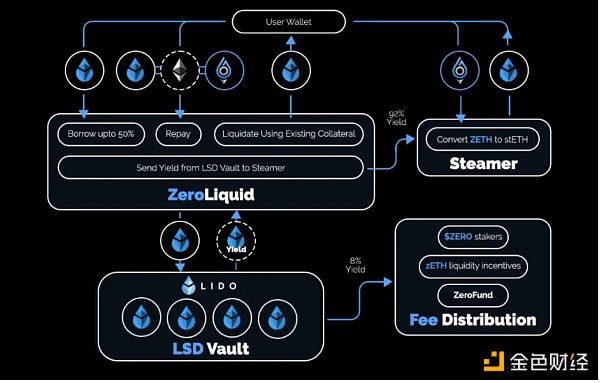

Steamer Module – Maintain the Anchoring of ZETH:

The Steamer module is the key to whether the ZeroLiquid protocol can be implemented smoothly and the adoption rate of the protocol. Steamer allows any user (with or without debt position) to redeem zETH for stETH at a ratio of 1:1. The stETH in Steamer comes from the interest generated by the user’s collateral minus the protocol fee (8%). Therefore, when the inflow of funds into Steamer is greater than the outflow of funds used to redeem zETH, the size of Steamer will grow, and zETH will not be discounted in the secondary market. However, when the outflow of funds from Steamer is greater than the inflow, the redemption of zETH will need to wait for a period of time, and zETH may also experience different degrees of secondary market discounts. The key to avoiding zETH discounts and massive redemptions is to expand the use cases of zETH. The protocol will use tokens and 35% of the protocol’s revenue to provide incentives for zETH/ETH LP, and use the revenue generated by the protocol POL (ZERO/ETH LP controlled by the protocol and future zETH/ETH LP) and Zero Fund revenue to maintain the anchoring of zETH, and actively promote the integration of zETH with other protocols.

Overall, Steamer provides liquidity for the 1:1 pegging of zETH and stETH for market arbitrageurs to flatten prices and maintain anchoring. Recently, many LSDFi protocols, similar to Liquity Fork, have appeared in the market. The liquidity for the pegging of such protocols is provided by some borrowers, resulting in additional incentive costs for the protocol. In contrast, ZeroLiquid’s arbitrage model is simpler, with fewer participants and lower protocol costs. However, the risk of secondary market discounts due to insufficient pegging liquidity cannot be quickly offset.

Steamer functional module flowchart

Source: zeroliquid.gitbook, LD Capital

2. Token Distribution

ZERO tokens were sold through a self-funded offering on the Uniswap platform on March 19th. The total amount of tokens was 30.5 million (initially 100 million, but 69.42% was burned due to a community proposal). Of the total, 6 million tokens were used to provide initial liquidity, 13.7 million tokens belong to the community, 1 million tokens belong to the treasury, and 700,000 tokens belong to core contributors. The initial secondary market circulation was 6.9 million tokens, with the remainder gradually being allocated over the course of 3 years. The team has already executed the first token burn, destroying 3.49 million ZERO tokens. The current circulating supply is 7.84 million tokens, corresponding to a circulating market value of about $3.5 million (data websites such as Coingecko do not take into account the burned portion, causing data distortion).

Source: zeroliquid.gitbook, LD Capital

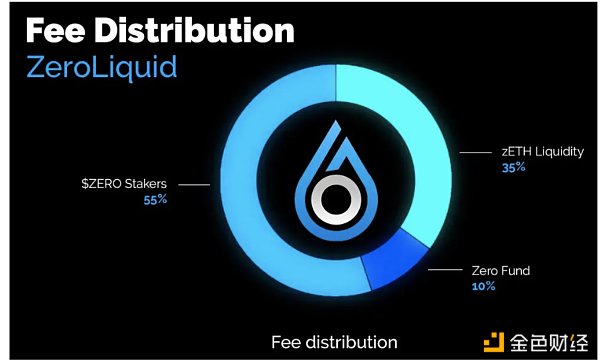

3. Protocol Revenue Distribution

The protocol does not charge borrowing fees, but collects 8% of the collateral income as protocol revenue. 10% of the protocol revenue is allocated to ZeroFund for anchoring and protocol development, 35% is allocated to LP incentives for zETH/ETH liquidity, and 55% is allocated to single-coin stakers of ZERO. Therefore, ZERO not only has protocol governance rights but also dividend rights. Simple calculation: if the protocol has $100 million of TVL (currently LSTETH market value is $16.4 billion), assuming an ETH staking yield of 5%, the expected annual income of ZERO stakers is $220,000.

Source: zeroliquid.gitbook, LD Capital

4. Comparison with Similar Protocols

The product model of ZeroLiquid is similar to that of Curve ecosystem project Clever and Alchemix. The main difference between ZeroLiquid and Clever is that the underlying collateral of Clever is mainly CVX (with a small amount of stablecoins), while the underlying collateral of Zero is ETH. There is a difference of several orders of magnitude in the asset scale between the two (CVX currently has a market value of $275 million, ETH has a market value of $2.212 trillion, and LSTETH has a market value of $1.64 billion). Currently, the market value of Clever is close to ZERO, at $3.4 million. However, if the ZeroLiquid product is successfully launched, its growth potential is undoubtedly greater than that of Clever. The main difference between Alchemix and ZeroLiquid is that the protocol token of Alchemix does not have dividend rights, while single-coin staking of ZERO can share protocol revenue. Currently, the deposit amount of LST/ETH in Alchemix is $42.7 million, and the circulating market value of ALCX is $26.5 million, about 7.5 times that of ZERO.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Reserve Bank of New Zealand: Cryptocurrencies “do not currently require regulatory measures”

- Mastercard is fully entering the crypto market: it is about to launch a “multi-token network” product.

- Holder Faith Collapses after “Double Kill” of Funds and Trust; Azuki Official Latest Response Not Accepted by Community

- Azuki Founder’s First Response to Disaster: Underestimated Community Emotions, Overestimated Product Delivery

- Can Ribbon Finance be reborn from structured option products to on-chain derivatives exchanges?

- Deep Dive: Evolution of Asset Management Tools from Debank’s Perspective

- Has zkSync Era risen to become the third largest Layer2 network within three months, and is it a bubble or a real ecosystem?