Did BCH triple in two weeks? Is the resurrection of PoW narrative just a dream?

Did BCH triple in two weeks? Is the PoW narrative revival just a dream?Unpredictably, the current round of the market driven by mainstream financial institutions applying for Bitcoin spot ETFs has ultimately benefited the Bitcoin fork project – BCH (Bitcoin Cash).

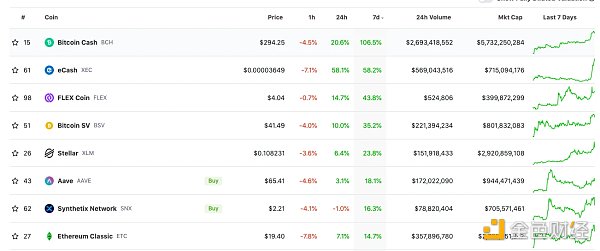

Coingecko data shows that in the past week, BCH has led other cryptocurrencies with a 106.5% increase. In the past two weeks, BCH has risen from $101 to $325, a maximum increase of 221%, and is currently at $294.

Interestingly, as BCH rises, several other forked coin projects have also achieved good increases: BCH forked project eCash (formerly known as BCHA) has risen by 58.2% this week, ranking second; another BCH forked project Bitcoin SV (BSV) led by CSW (known as “Australian Satoshi”) ranked fourth with a weekly increase of 35.2%. As these tokens are all POW mechanisms, the community is shouting “Make Pow Great Again”, and a batch of old POW public chain tokens such as Litecoin (LTC), DASH, and Ethereum Classic (ETC) have also generally increased by more than 10% today.

- Exploring Whether LUSD Will Become the Best Choice in the Stablecoin Competition Landscape?

- Understanding ZeroLiquid: A Non-Liquidating Zero-Interest Lending Agreement Secured by LST

- Development of Polkadot parallel threads has already begun. Learn how it works.

In addition to the increase in token prices, the BCH community is also circulating and discussing: BCH’s former king Wu Jihan will return to construction, and the community is shouting that the next pressure level of BCH is $1,000 (the historical high is $1,650). Although there is no official news to verify the rumors, Wu Jihan’s name weighs heavily in the BCH community – just like Vitalik Buterin is to Ethereum.

For crypto newcomers who started investing after the DeFi boom, Wu Jihan, who has rarely spoken out in the past two years, seems to be a stranger, but before 2021, he was definitely a top player. As one of the founders of the world’s largest mining machine manufacturer Bitmain and the “mining tyrant” written by the media, Wu Jihan is a “godfather” figure in the currency circle, and every word and action has an important impact on the entire market, just like CZ, the founder of Binance, today.

BCH was also the hottest forked coin in the market in 2017 under Wu Jihan’s promotion, but with two hard forks and Wu Jihan deeply involved in the “palace fight” of Bitmain, he could not chase the DeFi wave that truly ignited the next bull market. BCH has gradually faded out of the mainstream circle.

However, the spectacular show of BCH is no less than the various industry stories and accidents of today.

(1) Wu Jihan forked Bitcoin, and BCH was born

In 2017, the Bitcoin community erupted in fierce conflict: on one side was the big block plan represented by Bitcoin ABC, advocating increasing the block size limit (from 1 MB to 8 MB) to improve the transaction speed of Bitcoin; on the other side, represented by Bitcoin Core, the purist, advocated solving scalability problems through advanced technology (such as Lightning Network) without changing the Bitcoin network code.

Finally, with the support of Bitmain, which controls a large amount of computing power, the first fork in Bitcoin’s history occurred, giving birth to Bitcoin Cash (BCH). At its peak, the market value of BCH once squeezed into the top four. In December 2017, the BCH/BTC exchange rate reached a historical high of 0.284 (now it is 0.01), and has never reached that level again.

After BCH, hundreds of Bitcoin fork projects were born on the market, but none of them survived and achieved the results of BCH. Wu Jihan, who took the lead in forking Bitcoin, was also called various names, but this did not affect his satisfaction with the “work” he created.

“Bitcoin Cash has become an important role in the digital currency market. It not only has its own unique characteristics and advantages, but also can complement and coexist with other digital currencies.” “Although the forking of Bitcoin Cash has caused some controversy and fluctuations, it has also brought more opportunities and challenges to the entire digital currency market.”

Although in an interview in February 2018, Wu Jihan criticized some of the design and implementation plans of BCH, and believed that the project could not achieve its originally set goals, he did not give up on BCH. This can also be seen from the subsequent fork war.

(2) BCH fork, Wu Jihan vs. CSW

A year after the birth of BCH, Craig Wright, an Australian who claimed to be Satoshi Nakamoto, began to fork BCH, and Wu Jihan also experienced the pain of forking.

In November 2018, BCH underwent an upgrade, introducing a new feature called Canonical Transaction Ordering (CTOR). However, this upgrade did not receive consensus from all members. Radicalist CSW proposed to directly adopt 128M super large blocks and “lock” the client in the 0.1 version of the Satoshi Nakamoto era, which was opposed by Wu Jihan and the Bitcoin ABC team. Wu and CSW quickly started a long-lasting battle, with both sides hurling insults at each other.

Ultimately, two incompatible versions were born, BCHABC (supported by Wu Jihan and Roger Ver, among others) and BCHSV (supported by CWS and others). At the beginning of the fork, both sides claimed to be the orthodox BCH and sought community support and market recognition. Later, the competition between the two sides became more and more intense, including mining power struggle, community voting, and various propaganda offensives and defenses. In the end, Wu Jihan’s side won, BCH ABC was renamed BCH again, and BCHSV was replaced by BSV.

Although Wu Jihan won, BCH experienced a sharp drop in price after the fork. In just one month, the price of BCH plummeted from $552 before the fork to $74, a drop of 83%; even with the BSV generated after the fork, investors still suffered heavy losses.

(3) ABC team betrayed Wu Jihan and BCH forked again.

“Congratulations! There will be no more troublemakers in the BCH community after this new block!” Wu Jihan tweeted after defeating CSW on November 16, 2018. But at that time, he did not expect that BCH would experience another fork two years later.

The core of the fork was an upgrade called the Infrastructure Funding Plan (IFP), which would force 8% of each block reward (earned in Bitcoin Cash by miners) to be delegated to software projects that support BCH, such as Bitcoin ABC.

The IFP requires all BCH miners to give up more profits to donate to developers, which is not what miners want to see. Therefore, Freetrader, an early BCH developer, chose to fork and received the favor of many miners, communities, and users. In the end, BCH was hard forked into two chains again: BCHN (Bitcoin Cash Node, without IFP restrictions) and BCHA (Bitcoin Cash ABC, with IFP restrictions).

As the fork approached, a new round of “BCH” naming rights dispute began. It was originally thought that the ABC team, which dominated the development of BCH for three years, would win, but the final result was that BCHN, which was in a public opinion and support rate advantage, won the BCH naming rights, and BCHA also announced in August 2021 that it was renamed eCash (XEC).

Here’s the translation of the provided HTML:

Here comes the question, why didn’t Wu Jihan stand up when his gold medal team ABC stabbed the community and caused division? The answer is that Wu Jihan was deeply involved in the Bitcoin mainland power struggle at that time and had no intention of managing BCH.

(4) Power Struggle in Bitcoin Mainland

Since 2019, the conflict between Wu Jihan and another founder of Bitmain, Zhan Ketuan, has been made public.

In October of that year, Wu Jihan issued an internal letter to employees, dismissing Zhan Ketuan from all positions in Bitmain; in November, Wu Jihan held a “special shareholders meeting” in Beijing, which completely deprived Zhan Ketuan of absolute control over the company.

Zhan Ketuan, who was ousted from the company, had to go to court. He also wrote an open letter, saying that he was stabbed in the back by the most trusted partner and brother he had ever worked with. Later, Zhan Ketuan sued in many places and in January 2020, he won the support of the Haidian District People’s Government and asked the Market Supervision Bureau to change the legal person of Bitmain to Zhan Ketuan. On May 8 of that year, a dramatic scene was staged. After Zhan Ketuan received the business license at the Haidian District Government Service Center, a group of unidentified men took it away, causing a public outcry.

After that, the two sides entered into negotiations, which lasted for several months and finally reached an agreement in January 2021. Zhan Ketuan purchased nearly half of Bitmain’s shares held by Wu Jihan and a group of founding shareholders for $600 million, and Wu Jihan officially resigned from Bitmain; Bitmain will divest its mining pool and cloud mining business, that is, BitDeer, together with mining fields in the United States and Norway, from Bitmain. Wu Jihan serves as the chairman of BitDeer.

Over the next two years, Wu Jihan’s public voice began to decrease, and BCH was no longer valued by Bitmain after several splits and Wu Jihan’s departure, eventually becoming desolate. At the same time, as Ethereum turned to PoS according to the established route, the mainstream narrative and direction of the industry also changed, and multiple PoS new public chain ecosystems emerged, DeFi ignited a new bull market, and the POW narrative and mining industry that once grasped the industry’s lifeline gradually left the center of the stage under heavy regulatory hammer. BCH developers also tried to embrace DeFi at one time, but did not cause too much splash.

However, for BCH, it seems to be a turning point. First, the attractiveness of Bitcoin spot ETFs is increasing, with the potential to ignite a bull market. Second, the Bitcoin ecosystem has a new story with the hotness of Ordinals. In addition, EDX Markets, which is supported by top traditional financial giants, has launched four token trades, including BCH. BCH is not listed as a security by the SEC, while multiple PoS tokens are listed as securities.

Is this a short-term manipulation by the market makers, or a narrative revival or even a value return of the cryptocurrency industry? It’s still too early to tell.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Will the combination of the ZK and OP methods become the future of Ethereum Rollup?

- Has the PoW Narrative Renaissance become a dream as BCH tripled in two weeks?

- I have drawn over 100,000 robot images, and my Twitter avatar is full of these pictures. This AI painting competition is becoming very popular.

- The New Frontier of DeFi: the Rise of Repeated Collateralization, Liquidity Mining, and LSD Tokens

- The bankruptcy judge in the southern district of New York has approved Celsius’ exchange of altcoins for BTC and ETH starting from July 1st.

- Exclusive Interview with HashKey PRO: Has Reached Cooperation with Zhongan Bank, Currently Supporting SWIFT Bank Transfers in 16 Countries and Regions

- ZeroLiquid: Zero-Collateral, Zero-Interest Loan Agreement with LST as Collateral