Can the presidential candidate’s stance on Bitcoin make Argentina the next El Salvador?

Will the presidential candidate's Bitcoin stance make Argentina the next El Salvador?Authors: Jaleel, Kaori, BlockBeats

“Due to the current situation, we are unable to display prices on the shelves. Please inquire about the prices at the cashier. All cash promotions are suspended until further notice. Thank you for your understanding.” This is a notice posted outside a small market in Argentina, which fully reflects the chaos in the Argentine economy in recent years.

Nathan is a journalist who returned to the Argentine capital in early April this year, after a gap of 10 years, and personally experienced this. Like everyone else, the first thing Nathan did after landing was to exchange currency, but the difference in exchange rates in this place is huge, depending on the method and location of obtaining pesos.

- LianGuai Morning Post | Europe’s First Spot Bitcoin ETF Listed, Embedded with Renewable Energy Certificates

- LD Capital interprets the past and present of OPNX How is the price performing? What challenges exist?

- What’s happening to the whales on the Bitcoin rich list now?

The official exchange rate is 1 US dollar to 220 pesos; after visiting several Western Union offices to exchange currency, Nathan was told that there was no cash available; guided by local friends, Nathan found a “cuevas” or black market on a street, where the exchange rate was close to 400 pesos.

But Nathan faced a second major problem because the largest denomination of banknotes currently in circulation is 1000 pesos, worth less than 2.04 US dollars. After exchanging currency, Nathan had stacks of banknotes in his wallet and pockets, and carrying a backpack full of pesos for outings and daily expenses was extremely conspicuous and nerve-wracking.

It is hard to imagine that this is Argentina, which ranked among the top ten economies in the world in terms of total economic output in the early 20th century. In recent years, affected by factors such as the international economic and financial situation and the pandemic, Argentina’s domestic economic growth has not only significantly slowed down, but the inflation rate has reached 100%, and the value of the peso has depreciated again and again. It can be said to be the weakest currency in the world this year. Pessimistic forecasts from Bank of America suggest that the official exchange rate of the peso will fall to 545 by the end of this year and to 1193 by the end of next year.

Therefore, in the complex situation of the domestic economy, the new Argentine election is highly anticipated by many people.

Presidential candidate threatens to destroy the country’s central bank

The new election will be held on October 22nd. The preliminary election results on August 13th showed that the presidential candidate with the highest vote percentage is Javier Milei from the minor party Liberal Libertarian, with a vote percentage of 31.57%, far exceeding expectations.

As the current frontrunner in the polls, Javier Milei’s various proposals have sparked great discussion. The most discussed among them is how to solve the core problem of the Argentine economy, inflation. On this issue, Javier Milei’s solution is quite unexpected – to close the central bank. Javier Milei has even published a book called “The End of Inflation,” in which he provides a detailed explanation of the measures he will take as the elected president.

In Javier Milei’s view, the establishment of the central bank in 1935 marked the beginning of all of Argentina’s problems. Without a central bank, Argentina was the wealthiest country in the world, with an average annual inflation rate of only 0.9% from 1880 to 1935. The establishment of the central bank in 1935 fooled the people: the average annual inflation rate skyrocketed to 6%. After the nationalization of the central bank in 1946, the average annual inflation rate was 250% by 1991. It was a complete disaster.

Javier Milei, an economist and economic analyst, supports the economic thought of the Austrian School and is a staunch advocate of laissez-faire capitalism. He calls himself a “short-term anarchist” and a “long-term anarchist capitalist”.

In the field of blockchain, the Austrian School is not a foreign concept. The founder of the Austrian School believed that “money is not an invention of the state”. Currently, Hayek’s “Denationalization of Money” is a must-read book for the Austrian School in the industry, which clearly expresses the need for a complete separation of government and monetary systems. The views in this book were considered shocking in 1974, but the emergence of Bitcoin in 2009 made it seem less crazy and even a great prophecy. Many people even believe that it was this book that helped inspire Satoshi Nakamoto, who himself is highly likely a libertarian based on the Austrian School.

Young Argentines Need Cryptocurrency

In Javier Milei’s vision, after closing the country’s central bank, Bitcoin will become the main remedy for Argentina’s inflation. Before the presidential election, Javier Milei appeared on multiple talk shows and often promoted the benefits of Bitcoin and cryptocurrencies. “Bitcoin can eliminate central banks,” Javier Milei said.

Javier Milei’s unconventional stance resonates with many people, especially young voters who are knowledgeable about the internet and technology.

Bitcoin Argentina spokesperson Zocaro believes that Argentina has seen a growth trend in the use of cryptocurrencies since around 2020, with many people starting to buy Bitcoin and stablecoins. Sending funds to family and friends abroad or buying goods from overseas, more and more people are turning to cryptocurrencies because, under all international restrictions, it is a way for Argentines who may only be able to afford bread with the money they have for buying bacon in the morning to protect their value.

Unlike the mysterious “cuevas” (caves), Zocaro says, “cryptocurrencies are completely legal in Argentina, and people are also starting to notice the inflation of the US dollar and see Bitcoin as a possible alternative. Most young Argentines prefer Bitcoin, Ethereum, and stablecoins. In some provinces like Mendoza, measures have been taken to allow people to pay taxes with cryptocurrencies.”

According to a survey conducted by Americas Market Intelligence in April 2022, nearly 51% of Argentine consumers purchased it. This proportion is higher than the data of only about 12% in a similar survey conducted at the end of 2021. The survey also found that as many as 27% of Argentine consumers regularly purchase cryptocurrencies, with the main reasons for purchase including investment, protection against inflation, and avoiding government control.

Although many older Argentines still prefer to hold US dollars in cash, more and more young people and residents are starting to prefer USD stablecoins. “They don’t need to deal with cash and can complete transactions through their mobile phones,” said a platform that provides cryptocurrency trading for Argentine users, adding that two-thirds of Argentine users are under the age of 35.

Is the pro-bitcoin stance a political tactic?

Javier Milei’s bold vision and radical reforms have garnered support from the majority of groups, but they are also facing firm resistance from many large institutions, authoritative figures, and social forces.

Some people believe that cryptocurrencies have not been widely adopted worldwide, and many people do not have the technical literacy required to truly use them, especially vulnerable groups such as children, the elderly, and disabled people. Currently, most of the users of cryptocurrencies come from the middle and upper elite class and culturally young people, as they have the ability to access information and foreign currencies.

Some people express fear of cryptocurrencies, and this fear is justified. Although Argentines are accustomed to volatility, the fluctuations of cryptocurrencies have scared many people because they hope to seek stable savings. Without financial knowledge and economic literacy, cryptocurrencies do not seem to be a good safeguard, as this is a sea full of Ponzi schemes.

Most importantly, professionals have stated that Argentina is unlikely to adopt a Bitcoin payment scheme because the Argentine Senate has approved a $45 billion debt agreement with the International Monetary Fund (IMF), one of the terms of which discourages the use of cryptocurrencies.

Subsequently, critics began to question Javier Milei’s stance, questioning whether it is truly beneficial to the country or just a political strategy to gain votes from young voters who have a deep understanding of technology. These young people are disappointed with the stagnation of the Argentine economy and even strongly resent traditional financial policy methods.

After all, some savvy politicians have discovered that the young vote in the crypto world is the “must-win territory” of national electoral battles, especially in South Korea, where young people are eager to get rich and turn their lives around through crypto trading in an extremely competitive environment. According to the Financial Services Commission (FSC) of South Korea, there are a total of 3.08 million young people aged 20-39 who speculate on cryptocurrencies, accounting for 23% of the population in this age group (13.431 million people), close to one-fifth of the population.

During the South Korean presidential election in March last year, the current South Korean President Moon Jae-in promised to relax the regulation of the cryptocurrency industry, and also promised to “take legal measures” against those who illegally profit from cryptocurrencies, confiscating their assets and returning them to the victims. Moon Jae-in’s biggest competitor at the time, Democratic Party candidate Lee Jae-myung, who was seen as the successor to former President Moon Jae-in, not only announced earlier that he would accept cryptocurrency as political donations for his campaign, but also stated that he would mint NFTs for campaign donors as proof of donation and memorabilia, and the NFTs issued would also include Lee Jae-myung’s photos and political views.

Perhaps politicians see pro-cryptocurrency measures as a golden ticket on their political path, but in some parts of the world, the existence of cryptocurrencies is synonymous with the livelihood and future of the local people.

Related reading: “In these countries, Web3.0 is their bread and butter tomorrow.”

How is El Salvador’s Bitcoin experiment going now?

The beauty of cryptocurrencies lies in their decentralization and autonomy. Javier Milei’s preference for cryptocurrencies is further enhanced by the specific characteristics of the current Argentine economy: long-term inflation and distrust of the government, which reduces the value of the currency and drives people to other sources of value not controlled by the state.

This brings to mind the world’s first country to adopt Bitcoin as legal tender, El Salvador. On September 7, 2021, the law officially came into effect, making Bitcoin the country’s legal tender. El Salvador’s ongoing Bitcoin “adventure experiment” has attracted attention from countries around the world.

The first year of the Bitcoin “adventure experiment” in El Salvador seems to have not gone smoothly. After the Bitcoin Law was passed in 2021, rating agencies Moody’s and Fitch downgraded El Salvador’s ratings and removed them from the Rating Watch (UCO) list, and the country’s dollar-denominated bonds came under pressure.

According to a report from The Block in September 2022, based on the Bitcoin purchase disclosed by El Salvador President Nayib Bukele, calculating the average purchase price and the value of Bitcoin earlier on September 7, their Bitcoin investment portfolio has lost about 58% of its book value. Then, a month later, a new opinion poll showed that 77% of people believed that making Bitcoin legal tender alongside the US dollar was a “failure” and the president “should not continue to use public funds to buy Bitcoin.”

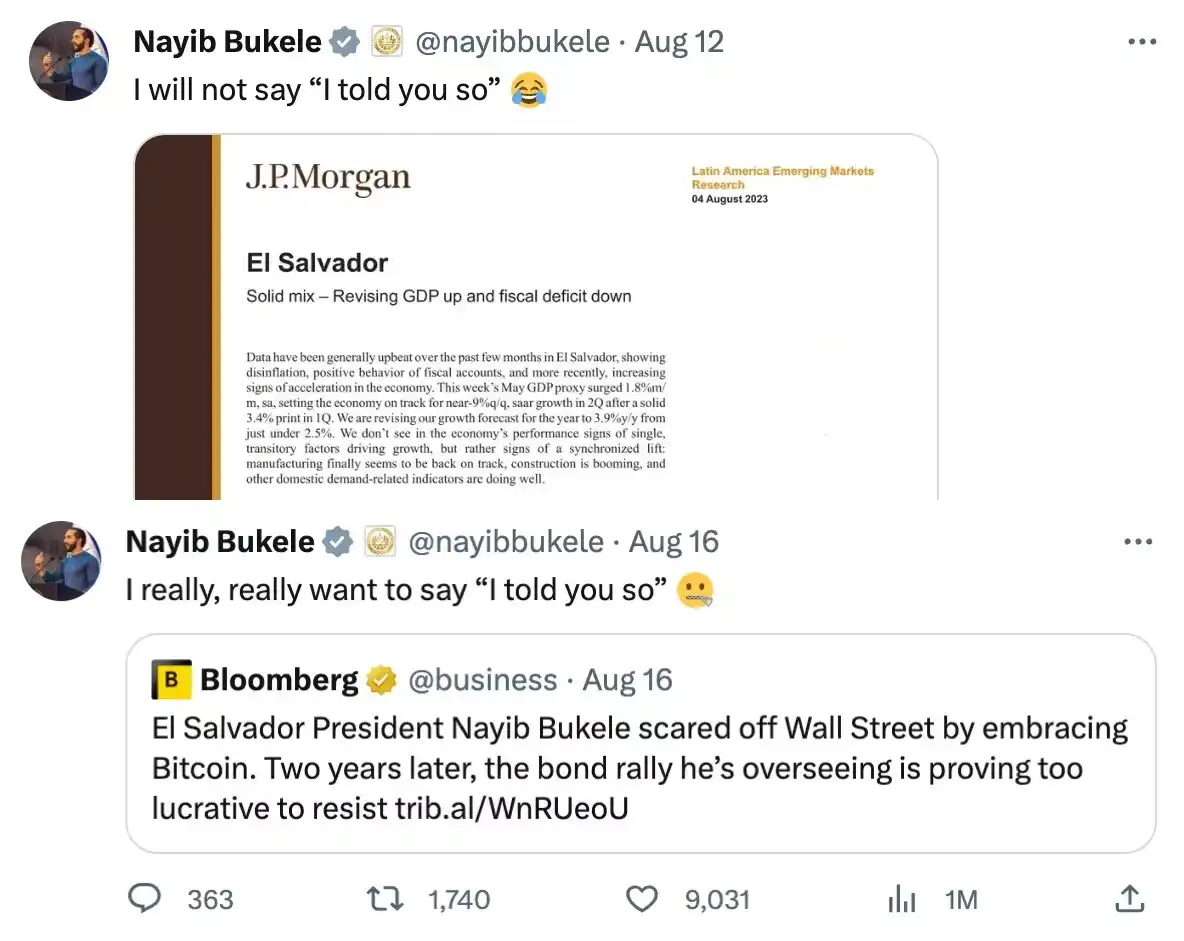

However, President Nayib Bukele has not been affected by these opinions. In November 2022, he announced on social media platforms that starting tomorrow, he will purchase one Bitcoin every day. With Nayib Bukele’s persistence, the status quo of El Salvador’s Bitcoin “adventure experiment” has undergone significant changes two years later as the price of Bitcoin rises from the bottom.

On January 24th of this year, the Salvadoran government repaid $800 million in maturing bonds, including all principal and interest. Some investors in Salvadoran international bonds claimed to have earned a 60% return just this year. Even with such a high return rate, there are still people who believe it is worth continuing to hold. In early August, a report on Latin American emerging markets research released by JPMorgan stated that Salvadoran data in recent months has been generally optimistic, with the fiscal deficit continuing to decline.

Clearly, Salvadoran bonds have also attracted attention on Wall Street. JPMorgan, Eaton Vance, and PGIM Fixed Income, among others, have recommended or purchased Salvadoran national bonds and are betting that the bonds will continue to rise. According to Bloomberg data, Lord Abbett & Co LLC, Neuberger Berman Group LLC, and UBS Group AG have also purchased Salvadoran bonds since April.

Nayib Bukele recently posted “I told you so” multiple times on social media, proudly showcasing his governance achievements. Nayib Bukele also claimed that since Bitcoin became legal tender, El Salvador’s tourism industry has grown by 95%. Now, according to a new public opinion survey report by TResearch, about 94% of Salvadorans intend to vote to support incumbent President Nayib Bukele to continue serving as president.

In retrospect, many of the doubts people had about El Salvador’s Bitcoin experiment still exist. However, El Salvador’s progress from being rated as one of the world’s most dangerous countries by the media to a corner of Latin America where official reports show zero homicides is a testament to the stability of its economic order.

The leading vote share of Javier Milei, an Argentine presidential candidate who is pro-Bitcoin, also proves that Argentina may also follow El Salvador’s path in the future.

Although the volatility of Bitcoin often makes investors nervous, compared to the economic fluctuations of some third-world countries, cryptocurrencies are one of their few breakthrough tools. Perhaps what these young people want is just a stable income, so that their newly earned salary does not depreciate by 50%. Politicians use cryptocurrencies as campaign tools, but ordinary people who hold the power of one vote just want to make their own choices for a visible future.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Exploring the African Cryptocurrency Market Opportunities and Challenges Coexist

- Explaining RGB Protocol Exploring a New Second Layer for Bitcoin Asset Issuance

- LST will replace ETH as the new underlying asset, and LSDFi may open up a 50x growth market.

- ETH skyrockets A discussion on the future trends of the inscription pathway

- Will Wall Street scare away crypto punks after showing interest in Bitcoin?

- LianGuai Morning News | Bitcoin futures open interest reaches highest level since 2023

- The Bitcoin greed and fear index of Matrixport indicates that BTC will rise in the future.