LST will replace ETH as the new underlying asset, and LSDFi may open up a 50x growth market.

LST replaces ETH as the underlying asset, and LSDFi may create a 50x growth market.Author: Pioneers of the Web3 World

Endorsed by strong consensus underlying assets, LSD and LSDFi are constantly evolving in supply-demand matching and supply-demand balance, and are about to enter three different stages of development, with over 50 times growth potential.

Table of Contents

1. LS: Opening a new narrative for liquidity staking

2. YBT: Strong consensus income-generating assets and their considerations

- ETH skyrockets A discussion on the future trends of the inscription pathway

- Will Wall Street scare away crypto punks after showing interest in Bitcoin?

- LianGuai Morning News | Bitcoin futures open interest reaches highest level since 2023

2.1 Typical attributes of strong consensus underlying assets

2.2 Matching and balancing of new asset supply and demand

2.2.1 Continuous feasibility brought by supply-demand matching

2.2.2 Supply-side innovation reactivates DeFi

2.2.3 Achieving sustainable development through supply-demand balance

3. LSD: Liquidity staking ecosystem pattern

3.1 LS leads ETH staking

3.2 LS market pattern dominated by multiple strong players

3.3 Development opportunities for LS on various public chains

3.4 LSD gains mainstream DeFi support

4. LSDFi: Who will play a good hand

4.1 LSDFi ecosystem overview

4.2 Mainstream LSDFi protocols

4.3 Empowerment and risks of LSDFi

5. Outlook: Growth potential of LSDFi

5.1 Growth drivers and limiting factors

5.2 Future prospects for LSDFi

1. LS: Opening a new narrative for liquidity staking

Shanghai upgrade has become a focus of attention in the industry, as the pledged Ethereum can be redeemed afterwards, which may bring variables to the development of the Ethereum network and even the industry. Some people on Twitter believe that a large number of redemptions may bring selling pressure, and if the selling pressure causes a significant drop in the ETH price, it will inevitably lead to a chain reaction in the ecosystem, adding more difficulties to the bear market.

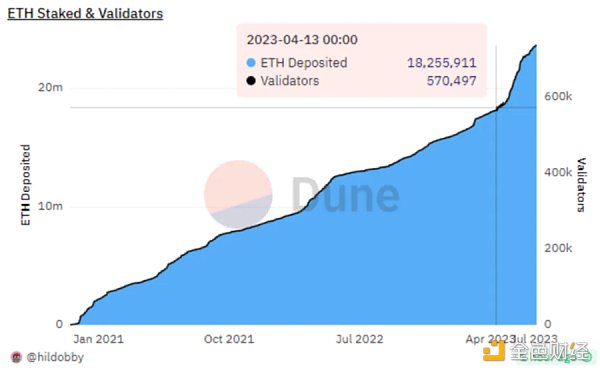

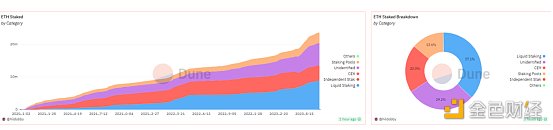

However, the development of the situation has exceeded expectations, as shown in Figure 1-1. After the Shanghai upgrade was completed on April 13th, both the amount of Ethereum staked and the number of validators did not decrease. Instead, they quickly climbed in a short period of time, showing a steeper curve than before.

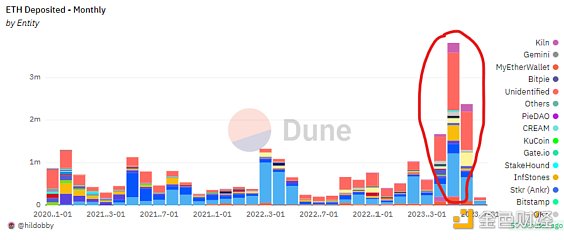

As can also be seen in Figure 1-2, the monthly amount of ETH staked in April to June has significantly increased compared to before.

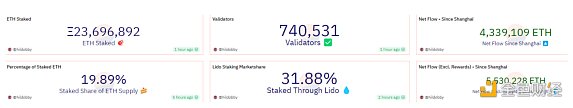

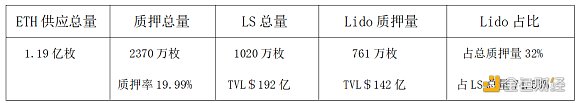

As of today (July 6th), as shown in Figure 1-3, the total amount of Ethereum staked is approximately 23.7 million, an increase of 30% since April 13th, and the number of validators is about 740,000, an increase of 29.8%. The staking rate of Ethereum has reached 19.89%, and the net flow of staking has reached 5.53 million ETH. These data indicate that a large number of new users and new ETH have actively participated in liquidity staking.

From the distribution of staking entities shown in Figure 1-4, as the total amount of Ethereum staking increases, the staking amounts of various categories also increase, but their proportions change. Initially, staking was mainly dominated by mining pools and centralized exchanges (CEX), with relatively little liquidity staking (LS). However, liquidity staking has become dominant, accounting for 37.1% of the share, while CEX accounts for 20% and staking pools for 13.6%. It is evident that the proportions of the latter two are being squeezed by liquidity staking.

This changing trend is even more evident in the 100% proportion chart, as shown in Figure 1-5. In the area charts of various colors, the blue part represents liquidity staking, which expands over time, while the red and orange parts represent CEX and staking pools, which tend to shrink.

It can be seen that after the upgrade, investors in Shanghai show a clear preference for liquidity staking (LS). What is the logic behind this change?

This is the new narrative being opened by the highly anticipated Liquid Staking Derivatives (LSD) and LSDFi in the DeFi and even the crypto industry.

2. YBT: Strong Consensus Income-Generating Assets and Considerations

2.1 Typical Attributes of Strong Consensus Underlying Assets

What is LSD? What is LSDFi?

LSD, known as Liquid Staking Derivatives, is a derivative product that must have underlying assets to support it. Liquidity staking is the way to generate derivative products, which means that underlying digital assets are pledged through liquidity staking platforms to obtain a staking certificate, thus generating the derivative asset LSD.

Since the underlying assets lock up liquidity and require a relatively stable interest rate as a return, this interest is loaded onto the derivative product LSD. Therefore, LSD = underlying assets (principal) + interest. It can be seen that LSD is essentially a stable income-generating asset, a yield-bearing token (YBT). For example, by staking ETH through Lido, stETH is generated, which has an APR of about 4%. By staking ETH through Frax, rETH is generated, which has an APR of 4.6%. Therefore, stETH and rETH are income-generating assets derived from liquidity staking platforms.

When LSD is used as input assets in various DeFi DApps, it gives rise to LSDFi, which is essentially a variety of derivatives based on LSD interest-bearing assets, i.e. derivatives and derivative applications generated by LSD through DeFi.

Currently, LSD, mainly represented by stETH, has received support from some of the largest traditional DeFi DApps on Ethereum, such as Curve, Aave, Yearn.finance, MakerDAO, Harvest, and SushiSwap. At the same time, the LSDFi protocol is also constantly innovating, such as Lybra, Raft, Gravita, unshETH, Pendle, etc. They use LSD to construct liquidity pools, mint stablecoins, collateralize loans, engage in rate trading, risk hedging, and other financial activities, and the derivatives generated in this process can be nested layer by layer to participate in various DeFi applications. The innovation and development of LSDFi demonstrate explosive power and present a prosperous scene, like opening up a wonderful world like a kaleidoscope.

Concerns about false prosperity and thoughts on strong consensus digital assets

But at the same time, it also gives rise to some concerns, reminiscent of the subprime mortgage crisis in 2008, which caused direct economic losses of hundreds of billions globally, with incalculable losses resulting from the subsequent economic recession.

The main protagonists of this crisis were MBS and CDO. Mortgage-backed securities (MBS) are bonds secured by packaged mortgage loans, which include the principal and interest repaid by mortgage borrowers. For MBS buyers, it is equivalent to an interest-bearing asset. CDO is a bond that uses a series of financial products as collateral to pay future interest and principal. It includes not only MBS but also packaged securitized loans and even other CDOs. In short, after multiple layers of packaging, it becomes difficult for general investors to understand.

With the help of false ratings from centralized rating agencies, inferior assets were packaged layer by layer into high-quality assets, and the bubble kept accumulating. Loose lending policies and optimistic expectations acted as catalysts, causing the bubble to expand continuously. But as the high-rise building went up, it eventually collapsed, and the bursting of one bubble triggered a comprehensive collapse. The crisis eventually swept the globe, causing incalculable economic losses.

Looking back at LSD, from the native token of the public chain to LSD, and then to LSDFi with various leverage effects, derivatives and nesting all the way, will it eventually follow the path of collapse like MBS and CDO? Here, we believe that the fundamental problem lies in the initial underlying assets, which are the source of subsequent derivatives and leverage.

So, what kind of digital assets can be used as underlying assets to avoid false prosperity as much as possible, and serve as a solid foundation to establish stable, prosperous, and sustainable development of DeFi?

We believe this is “strong consensus digital assets”. Strong consensus digital assets are first and foremost a type of encrypted digital currency built on a blockchain technology system. They possess the basic characteristics of blockchain digital assets, such as consensus mechanisms. Whether it is proof-of-work (PoW) or proof-of-stake (PoS) consensus mechanisms, they need to ensure that all nodes in the network reach a consensus. They are secure and transparent, with the ability to resist attacks and manipulation, and allow applications or blockchains running on them to achieve an equal level of security. At the same time, the ledger and governance are open and transparent, reducing collaboration friction and building a highly trusted decentralized system.

In addition to the above basic characteristics, strong consensus digital assets should also have the following typical characteristics:

● Decentralization: Highly decentralized to ensure that no single controlling organization or individual can manipulate the network, making it more resistant to attacks and robust.

● High liquidity: Digital assets are widely adopted and held by various DeFi DApps, bringing external increments. They can be flexibly allocated, used for derivative assets, create credit, hedge risks, etc., with broad liquidity.

● Real value: Whether they are utility, equity, or governance “tokens”, they should all come from real application scenarios and demand, and create and capture value within them. In the end, encrypted digital assets are the condensation and high-level abstraction of the value of the blockchain network. They are the result of consensus formation and value creation, and realize value distribution through sufficient liquidity.

● Thriving ecosystem: The blockchain based on these digital assets forms a complex and thriving ecosystem. The thriving ecosystem is the external manifestation of strong consensus and further strengthens and consolidates the consensus of digital assets, forming a positive cycle and further promoting the development of the ecosystem.

It can be seen that most of the digital assets with these basic characteristic attributes are public chain tokens, such as BTC and ETH, which already have strong consensus globally. They are developing into strong consensus digital assets like DOT. Some new types of public chain tokens like APT, as well as some blockchain tokens that have developed well in vertical fields, may also become strong consensus digital assets.

Among these strong consensus digital assets, except for BTC which adopts the PoW consensus mechanism, most of the others use the PoS consensus mechanism, such as ETH, DOT, and APT. They require staking public chain tokens to build node networks, produce blocks, and validate transactions. In other words, the PoS mechanism provides a rigid demand for staking public chain tokens, which is a real application scenario.

By staking strong consensus public chain tokens for liquidity pledging (LS) and using them as underlying assets for credit endorsement, strong consensus interest-bearing assets (LSD) are derived. Combined with various DeFi applications, a variety of complex LSDFi (Liquidity Staking DeFi) models are developed. If we compare LSDFi to a kaleidoscope with ever-changing and mesmerizing patterns, then the changes are the various derivative methods and Fi, but the underlying strong consensus digital assets remain constant.

Given that Ethereum is currently the most active and prosperous encrypted ecosystem, this article will analyze LSD and LSDFi based on ETH, which can explain various phenomena happening in the field of liquidity staking and establish a framework to enhance understanding. Of course, we will also mention liquidity staking happening on other public chains in appropriate chapters.

2.2 Matching and Balancing of New Asset Supply and Demand

2.2.1 Continuous Feasibility Brought by Supply and Demand Matching

Consider human development. Clothing, food, housing, and transportation are necessities for survival, and the seven emotions and six desires are inherent. Industries (supply) that meet these needs continue to exist and thrive. Why? Because they are real needs. Supply can meet existing demands, and innovative supply can create new demands.

Innovations in several dishes will keep the flow of customers in roadside “fly restaurants” continuous, because people can enjoy a hearty meal, and the restaurant can become a “time-honored brand”. The followers of Twitter users who promote “blockbuster movies for adults” can reach hundreds of thousands or even millions, because they satisfy people’s insatiable desires, and the users can achieve continuous “thriving” (Note: I do not endorse this behavior, it is only used for illustration). Steve Jobs innovated the iPhone and the App Store operation model, innovatively supplying and creating new demands, satisfying the mobile smart life of more than 1 billion people, changing the rules of the industry, and promoting the prosperous development of the mobile Internet.

It can be seen that supply innovation here is a technology, a tool, a product, a reform and breakthrough on the supply side, while satisfying real needs is its fundamental demand. So what is the real demand of the blockchain industry, and what kind of supply-side innovation can satisfy it and sustain its development?

2.2.2 Supply-side Innovation Activates DeFi Again

What kind of supply-side innovation will activate DeFi again?

After the DeFi Summer and NFT Summer between 2020 and 2021, DeFi has been dormant for a long time, and most of the innovations have disappeared. However, DeFi applications such as lending and DEX, such as Uniswap, Compound, and Curve, have achieved stable development by meeting people’s real financial needs and have become industry-recognized infrastructure. Now, the entire DeFi industry has long lost its glory and is stumbling in a bear market. Can DeFi make a comeback?

● The impact of underlying assets on the upper-level finance and even the entire economic system is fundamental and global. The so-called “success or failure depends on the underlying assets”. The category, characteristics, and capabilities of underlying encrypted digital assets will determine the construction of upper-level smart contracts and the operation of financial businesses, and even determine the feasibility, robustness, and sustainability of the encrypted economic system.

● As a major asset innovation, ERC20 and FT bring DeFi innovation and meet the needs of homogeneous finance; while ERC721 and NFT meet differentiated needs and bring about a wave of NFT and NFT-Fi innovation.

● The limitations of FT and NFT as asset categories restrict the ability boundaries of Fi, making it difficult for certain applications to be implemented or achieving low efficiency and utility. Therefore, blindly pursuing innovation in Fi may be overlooking the essentials or ultimately proving false.

● To address the above issues, innovation in application products should not only focus on FT and NFT, because products can solve a specific problem or demand, while standard and asset category innovation can solve a class of problems and demands, achieving breakthroughs and realizing application enhancement, opening up greater development space.

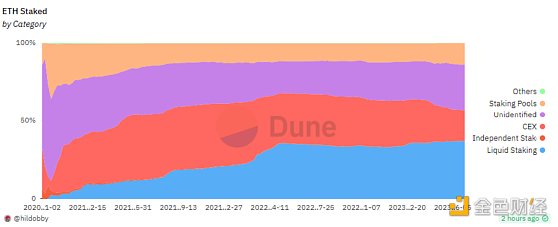

Based on the above analysis, we believe that FT (fungible tokens), NFT (non-fungible tokens), and SFT (semi-fungible tokens) cover all asset categories in terms of asset performance, and can support the development of universal applications for corresponding asset categories.However, future breakthroughs and explosive innovations may occur in a specific niche, so it is necessary to further delve into specific application scenarios under these three types of assets to create new asset classes based on specific scenarios and application functions, thereby reactivating DeFi, achieving supply-demand matching and balance, and promoting ecosystem explosion and sustainable development. As shown in Figure 2-1.

LSD is exactly such a new type of asset, which focuses on the derivative assets in the liquidity staking sub-scene and has real and long-term application scenarios (POS chains require token staking to build a long-term, stable, decentralized, and secure node network), forming a long-term and sustainable supply-side asset supply.Therefore, LSD is an innovation in the supply-side asset class, which will stimulate demand-side innovation and create more possibilities.

A long-term and sustainable supply-side asset needs an outlet for demand matching, which is precisely where DeFi comes in. Through DeFi, financial operations such as re-staking, borrowing, trading, currency creation, credit expansion, and liquidity provision can be carried out with LSD, meeting investors’ demands for asset allocation efficiency and flexibility, asset liquidity, asset income strategies, and asset risk management. This opens up space for demand-side innovation.

Looking back now, the Shanghai upgrade is an important opportunity, as ETH can be redeemed and staked for liquidity (LS), effectively opening the supply gate for LSD. And as ETH, as a strong consensus underlying asset, transfers its consensus and credit to LSD, LSD is endowed with strong consensus income-generating assets and becomes an incremental resource that various DeFi protocols compete for on the supply side.

From a technical implementation perspective, LSD is a protocol asset implemented in code, with programmability, permissionless, and composability features. It can flexibly realize combined innovation with various Fi, namely LSDFi. As a result, LSD flows freely into various sub-sectors, activating various types of DeFi and igniting the LSDFi market.

2.2.3 Achieving sustainable development through supply-demand balance

The matching of supply and demand achieved by LSD and LSDFi is a good start and brings feasibility to sustainable development. However, it is still necessary to emphasize the balance of supply and demand, which contributes to long-term and sustainable ecological prosperity.

Let’s recall the past ICO and DeFi Summer. ICO created a large number of cryptocurrencies, leading to a speculative bubble. However, more than 90% disappeared because of the lack of real value and use cases. This was a case of oversupply and mismatch between supply and real demand. DeFi Summer had its highlights but gradually faded due to lack of innovation on the asset side and limited expansion capability of DeFi. This was a case of insufficient supply and demand being greater than supply. It can be seen that in the case of supply-demand imbalance, there may be temporary glory but it is difficult to sustain.

Therefore, we need to consider supply-demand balance, from supply-demand matching to supply-demand balance, and transform sustainable development from possibility to reality. The focus of supply-demand matching is on the generation of underlying assets in specific real-world scenarios, forming a supply of new asset classes, and matching and realizing their value demands by Fi. Supply-demand balance is a dynamic process that is ongoing. The focus is on the development of Fi, which needs to follow the fundamentals of demand and the dynamic changes in supply, pursue real value implementation and efficiency, rather than transiently satisfying speculative needs, and guard against potential risks.

3. LSD: The Liquidity Staking Ecological Pattern

3.1. LS Leading ETH Staking

From the analysis in Section 1 of this article, it can be seen that after the Shanghai upgrade, ETH can be redeemed, meaning that ETH staked on the local validator node can be withdrawn, and ETH liquidity is released. However, the overall staking amount has not decreased but increased. At the same time, the staking amount of mining pools and CEX has decreased, while liquidity staking has continued to grow, indicating a clear preference for liquidity staking among holders.

Why is this the case? There are four main reasons:

● Universality: Running independent nodes has technical challenges and requires high capital demand, which is not suitable for everyone. Liquidity staking lowers the entry barrier and maintains the liquidity of staked assets, making it more suitable for participants with different capital scales and non-professional abilities.

● Capital Demand: For large capital, the pursuit is not high returns initially, but stable returns in a controllable risk situation, and capital with strong liquidity. This will be further analyzed based on data in the later part of this article.

● Diverse Choices: Based on LSDFi, LSD holders have diverse options to meet different demands in liquidity, utilization, value, and risk, such as staking, LP formation, stablecoin issuance, lending, interest rate swaps, risk hedging, etc.

● Expected Returns: Compared to native staking on validator nodes, LSDFi provides higher expected returns. In addition to the base staking yield of approximately 4-7% APR, users will also receive additional yield from LSDFi. Overall returns are significantly increased, for example, Lybra has an APY of 7.2-8.5% on stablecoin eUSD, while Farming can go up to 140%; Pendle’s Pool APY can reach 43%.

After the Shanghai upgrade, liquidity staking has driven rapid growth in Ethereum staking. The current total Ethereum staked is 23.7 million, distributed across various staking platforms. According to Defillama’s data, the staked Ethereum on liquidity platforms is approximately 10.2 million, with a TVL of $19.5 billion, accounting for 43% of the total. The advantage of liquidity staking is evident.

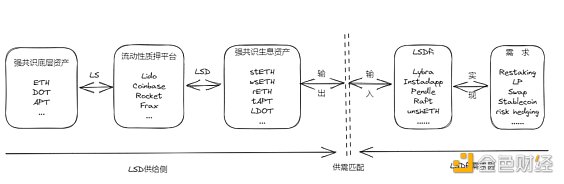

Looking at the distribution of the top 10 ETH staking platforms, liquidity staking platforms occupy the majority, but CEX and mining pools still have a certain proportion, as shown in Figure 3-1.

3.2 LS Market Structure: Dominance of a Few Strong Players

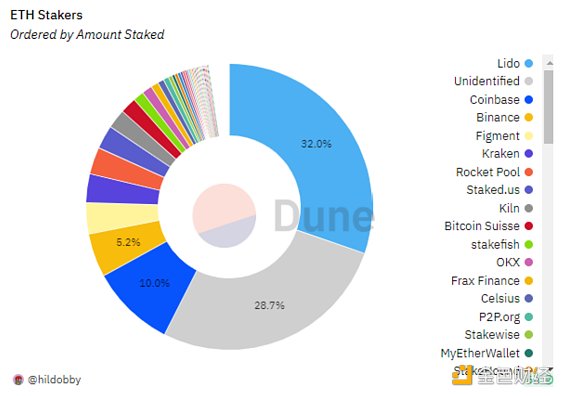

In terms of market structure, a situation of dominance by a few strong players has emerged, as shown in the market share displayed by Dune in Figure 3-2.

According to Dune@LidoAnalytical, the total amount of ETH staked through Lido has reached 7.61 million, distributed across six ecological networks: Ethereum, Polygon, Solana, Polkadot/KSM, and Referral Program. They account for 32.0% of the total ETH staking market share.

Lido has become the largest liquidity staking platform, followed by centralized exchanges such as Coinbase, Binance, and Kraken, accounting for 10.0%, 5.2%, and 3.35% respectively. There are also some smaller liquidity staking providers, but their staked ETH amounts are relatively small.

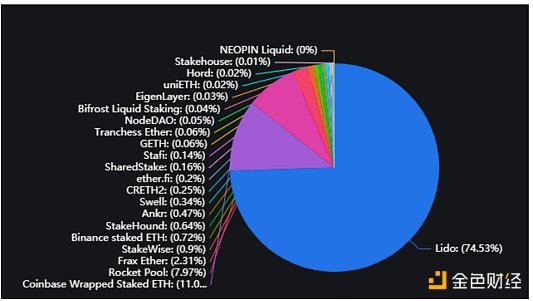

In addition, within the liquidity staking platforms, Lido’s TVL stands out, accounting for 74.53%, as shown in Figure 3-3.

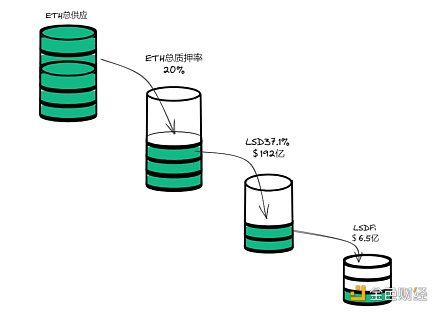

From ETH supply to ETH staking, we have compiled Figure 3-4 to visually present the overall to specific focus.

Based on the above analysis, in this round of liquidity staking competition, Lido has achieved extraordinary success and become a dominant force in the staking market. The large number of derivative products stETH generated by Lido will also have a wide-ranging impact on LSDFi.

3.3 Opportunities for LS in Various Public Chains

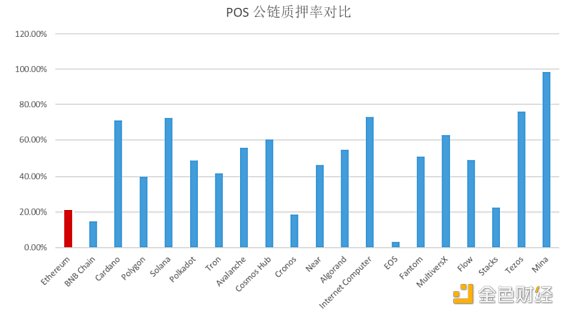

Above, we mainly analyzed the overall and local staking liquidity of the Ethereum ecosystem. In fact, staking liquidity also has the feasibility of prosperous development on other POS public chains, and this trend is forming.

According to Staking Rewards data (Figure 3-5), the average staking rate of mainstream POS public chains is around 60%. For example, Solana is 69.53%, Cardano is 63.04%, Avalanche is 62.1%, and Polkadot is 43.32%.

The high local staking rate of each public chain provides the basic supply-side resources for staking liquidity. Once conditions are ripe, these local stakings can be transferred to staking liquidity through the LSD staking platform, thereby replicating the highlight moments that are happening in the Ethereum ecosystem.

For example, Lido has already launched staking liquidity on Aptos and Polkadot, and both Aptos and Polkadot have developed native staking liquidity protocols, such as Aptos’ Tortuga, Ditto, and Polkadot ecosystem’s Bifrost. Based on Polkadot’s shared security, cross-chain interoperability, infinite scalability, and the trend of leading Web3 development, we believe that Bifrost will have greater development space.

Bifrost is a scalable, non-custodial decentralized full-chain staking-specific parallel chain built on Polkadot. Bifrost’s vision is to aggregate more than 80% of the Staking liquidity of PoS consensus chains through cross-chain derivatives, and provide standardized and cross-chain interest-bearing derivatives for Polkadot relay chains, parallel chains, and heterogeneous public chains bridged with Polkadot; reduce the user’s staking threshold, increase the proportion of multi-chain staking, improve the ecological application income foundation, and create a stakeFi ecosystem of three-party empowerment between users, multi-chains, and ecological applications in a positive cycle.

Currently, Bifrost has provided standardized staking liquidity derivatives (Ominichan LSD) for multiple blockchain networks. Since its launch on the Kusama parallel chain in October 2021, a total of $137M derivatives have been minted, providing $11.04M liquidity, with 81,297 on-chain holding addresses and a total of 333,921 signed transactions completed. With the development of the Polkadot ecosystem and the narrative of LSD/LSDFi, Bifrost is expected to gain more development space.

The above is just an example. We will provide specific introductions to the development of LSD & LSDFi on other public chains in separate sections, so we will not go into detail here.

3.4 LSD Supported by Mainstream DeFi

As mentioned earlier, according to the data provided by @LidoAnalytical on Dune, the current amount of ETH staked through Lido exceeds 7.61 million, and through 1:1 minting, this means that more than 7.61 million stETH will be generated (including a certain amount of stETH being wrapped as wstETH). The cumulative staking income generated currently exceeds $650 million.

stETH and wstETH are two ways of tokenizing staking rewards. The difference between the two is that stETH is the native staking certificate of Lido, which is a rebasing token. The amount of stETH in the user’s address will increase with the daily staking rewards from Lido. On the other hand, wstETH is an encapsulated version of stETH that automatically tracks interest earnings. The quantity of wstETH in the user’s address remains fixed, but the rewards will accumulate on wstETH (the programmability of digital assets). This means that the value of wstETH will increase over time, and the exchange rate of wstETH to stETH will continue to rise. The differences between stETH and wstETH bring different asset attributes to each.

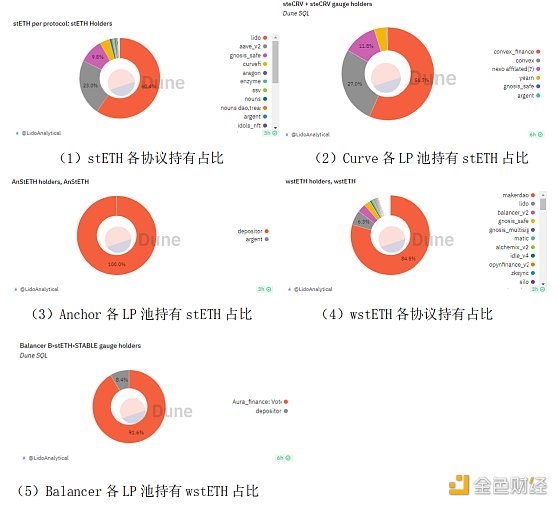

These stETH and wstETH tokens are distributed among various DeFi protocols, LP pools, DEX/CEX, wallets, and DAO treasuries, as shown in Figure 3-6 (1)-(5).

Based on Figure (1)-(5), it can be estimated that the total amount of stETH/wstETH held by various DeFi protocols, wallets, liquidity pools, and DAO treasuries is approximately 5.57 million tokens, accounting for 73.2% of the total LSD generated by Lido. It can be seen that these well-established DeFi protocols such as AAVE, Uniswap, Compound, MakerDAO, etc. have become the main destinations and use cases for the mainstream LSD assets.

The stETH-ETH liquidity pool holds a total of 640,000 ETH, with Convex_finance on Curve being the largest liquidity pool, accounting for 56.7%. The Anchor LP pool holds a total of 3,000 ETH, which can be considered negligible.

As for the distribution of wstETH, MakerDAO has an absolute advantage, holding 930,000 tokens, accounting for 84.5% of the protocol’s holdings. In terms of wstETH liquidity pools, Aura_finance on Balancer is the largest, holding over 44,000 wstETH, accounting for 91.6%.

From the above analysis, it can be seen that stETH/wstETH, as the mainstream interest-bearing assets on the supply side, have received strong support from mainstream DEXs and have been applied in various scenarios such as DEX, lending/CDP, yield aggregators, fixed-income, risk grading management, and leveraged staking. This injects vitality into DeFi in bear markets and also promotes the development of the LSDFi ecosystem that is currently receiving attention.

4. LSDFi: Who will play a good hand

As a derivative asset, LSD has characteristics such as programmability, composability, and free flow, which can be applied to various existing DeFi scenarios. At the same time, the emergence of LSD has brought about innovation in DeFi protocols, which are built on LSD-like derivative assets. These DeFi protocols are called LSDFi, and they bring liquidity, capital efficiency, yield strategies, risk management, and other innovations to LSD holders. After the upgrade in Shanghai, LSDFi has experienced rapid development.

4.1 Overview of the LSDFi ecosystem

First, let’s analyze the current development status of these LSD interest-bearing assets in the LSDFi ecosystem from an asset perspective.

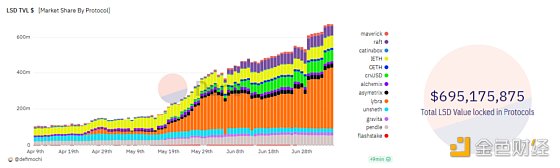

Currently, various liquidity staking platforms have derived their own interest-earning assets LSD using ETH as the underlying asset, such as Lido’s stETH/wstETH, Frax’s sfrxETH, Rocket’s rETH, Swell’s swETH, etc. Since April, the TVL contributed by all LSDs has been growing rapidly, increasing from $60 million to the current $695 million in three months, an increase of approximately 12 times. As shown in Figure 4-1.

Among these LSDs, the market share of the top 5 blue-chip LSDs is shown in Figure 4-2, with Lido’s stETH and wstETH accounting for 88.8%, basically dominating the market and becoming the absolute leading force in the supply of interest-earning assets on the LSDFi supply side.

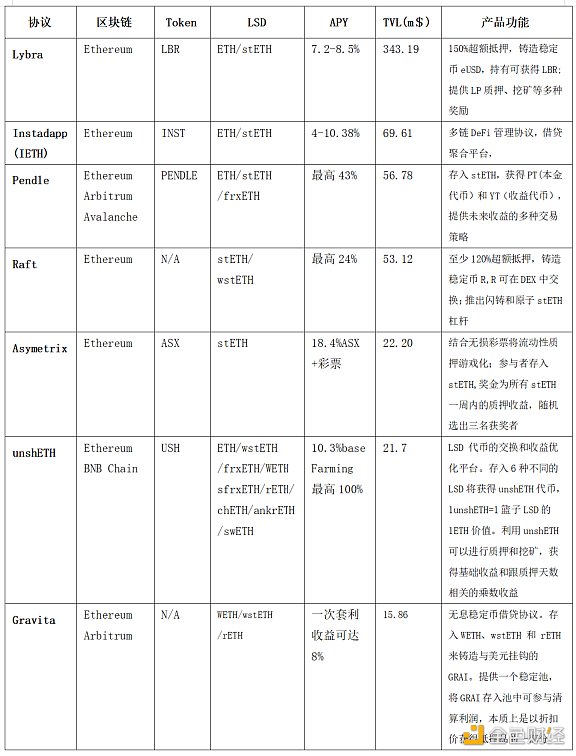

Next, let’s take a look at the overall development of these protocols from the perspective of LSDFi protocols. Figure 4-3 shows the top 10 LSDFi protocols.

Figure 4-3 Market Share of LSDFi Protocols

Figure 4-3 Market Share of LSDFi Protocols It can be seen that Lybra far surpasses other protocols, accounting for 48.77%, which is almost equal to the sum of the market share of other protocols. The market share of crvUSD, IETH, Pendle, and Raft, ranked 2nd to 5th, is between 10.19% and 7.61%, relatively average.

4.2, Mainstream LSDFi Protocols

We have organized the current top TVL LSDFi in Figure 4-4 to establish a preliminary understanding quickly. However, a deep understanding still needs to be specific to each protocol, which we will present in the next research report.

4.3, Empowerment and Risks of LSDFi

Through the above mainstream LSDFi protocol analysis, we found that LSDFi mainly empowers LSD in terms of liquidity, high yields, capital efficiency, risk hedging, and asset issuance.

● High Liquidity: Provides specific scenarios for the segmented market of LSD assets, such as aggregated trading, collateralized borrowing and lending, margin swapping, and principal and interest separation, to increase and create liquidity in the market.

● Yield Strategies: LSDFi provides diversified yield strategies for LSD, supporting liquidity mining, re-staking, collateralized borrowing and lending, creating credit through leveraged borrowing, etc., to obtain mining rewards, re-staking rewards, protocol dividends, fee income, leverage income, etc.

● Capital Efficiency: Supports high leverage on LSD, flash minting, atomic stETH leverage, loop lending, principal and interest separation, etc., to enhance the flexibility of capital utilization and capital efficiency.

● Risk Management: By utilizing the asset attributes of interest-bearing assets containing principal and interest, the interest rate of LSD is discounted to the present for sale, or future assets can be directly purchased. The essence is to hedge the risk of spot price fluctuations through derivatives, thus achieving active risk management.

● Asset Issuance: By over-collateralizing LSD or anchoring a basket of LSD to create interest-bearing stablecoins, participate in DeFi activities to gain more profits.

In terms of risk, LSDFi is in the early stage of development and has various potential risks, such as the risk of diminution caused by pledging, the risk of collateral liquidation caused by LSD price fluctuations, and the risk of smart contract vulnerabilities, etc.

At the same time, we also see that the current liquidity is created based on the pledging derivatives of native tokens on the blockchain, which is still internal liquidity. Its sustainability is subject to the influence of external energy injection and the outflow of internal liquidity to the external. If internal liquidity accelerates its outflow after making profits, this will have an adverse impact on LSDFi.

5. Outlook: Growth Potential of LSDFi

Before analyzing the potential growth space of LSDFi in the future, we need to know which factors are related to its growth and what constraints or limitations exist.

5.1 Growth Drivers and Limiting Factors

From Figures 1-4, we can see that since Ethereum switched from POW to POS in December 2020, the staking volume of ETH has been steadily increasing. However, after the Shanghai upgrade was completed on April 13, the staking volume quickly increased by 30% and ignited the LSDFi market. What is the logic behind this?

Let’s first analyze why the staking volume of ETH has grown rapidly:

● First, the switch from POW to POS provides holders with stable risk-free returns, which leads to a continuous increase in the total staked ETH. However, staked ETH loses its liquidity, resulting in higher opportunity costs, and most stakers are in a loss-making state.

● Second, the Shanghai upgrade enables the free withdrawal of ETH, releasing liquidity. These released ETH need to find a destination that combines returns and liquidity.

● Furthermore, liquidity staking simultaneously meets the demand for risk-free stable returns (the POS returns of public chains are a stable risk-free return) and liquidity needs, resulting in rapid growth of liquidity staking. Think about it, Lido timely released its V2 version on May 15, and stETH can be redeemed for ETH at any time. It is telling holders that not only can they get stable risk-free staking returns from Lido, but their capital also remains highly liquid. Lido has essentially become a “paradise” for large funds.

It needs to be emphasized that for large-volume funds, their primary consideration is not to obtain higher returns. Their basic requirement is to obtain safe, stable risk-free returns and maintain good liquidity. Liquidity staking precisely combines these two fundamental advantages.

● Therefore, after the upgrade, Shanghai’s liquidity collateral squeezed CEX and mining pool shares, achieving rapid growth and becoming a leading force in driving up the ETH collateral rate. This is mainly because large-volume funds have obtained satisfaction in both income and liquidity.

Next, let’s analyze the logic behind the LSDFi market explosion and make deductions using Figure 5-1.

● First, the current market belongs to the primary stage where the growth of innovative asset supply activates demand growth.

The growth of liquidity collateral has brought about rapid growth of LSD derivatives such as stETH, rETH, swETH, etc. LSD first activated existing DeFi protocols such as Curve, MakerDAO, Uniswap, etc., providing a large amount of liquidity and bringing about market fundamentals. At the same time, some LSD flowed into innovative LSDFi protocols, stimulating investor enthusiasm through the creation of liquidity and diversified income strategies, resulting in the first wave of LSDFi market growth.

● Secondly, the growth of LSDFi has not completely matched the growth of supply, and there are still some factors to be considered.

The current LSDs asset TVL created by liquidity collateral is around $19.2 billion, while LSDFi only has $695 million. It is obvious that there is still a large amount of LSD that has not entered LSDFi, and LSDFi itself does not seem to be ready to accommodate such a large-scale derivative asset. The potential of LSDFi has not been fully released, and the current growth space is limited. Why?

As for the first point, why hasn’t a large amount of LSD entered LSDFi? There are two important factors. First, a large amount of ETH is still concentrated in the hands of whales. Data from NonFungible shows that the top 10 holding addresses account for 32.12% of the total flow, with the top 1 accounting for 21.98%. These are large-volume funds that hold market dominance and have initiative. However, the current volume of LSDFi is still small, and there are obstacles to the inflow and outflow of funds. It can be tested, but it is not suitable for large-scale operations, especially in a bear market. Second, as mentioned earlier, the basic demand of large funds is to obtain stable risk-free returns while also having good liquidity. The process from ETH to LSD has already met their core demands. They are not interested in participating in LSDFi at the moment to pursue high returns but also bear high risks. These large-volume funds need to wait for the maturity of timing and conditions.

As for the second point, the potential of LSDFi itself has not been fully released. Because LSDFi is still in the early stage, it seems that neither users, applications, nor infrastructure are fully prepared. It takes time to popularize education, validate concepts, expand and improve infrastructure and supporting facilities, enhance user experience, and validate risks. These are limiting factors for the current continuous growth of LSDFi, resulting in demand growth not matching the supply of assets on the supply side. However, as conditions and timing mature, these limiting factors will become the foundation and driving force for growth, propelling LSDFi to a new level.

5.2 Outlook for LSDFi

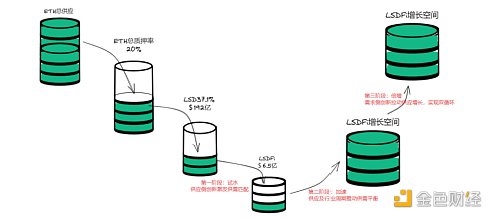

We divide the development of LSDFi into three stages, each with its own typical characteristics, as shown in Figure 5-2.

Phase 1: Pilot stage, supply-side dominance, supply-side innovation stimulates supply-demand matching, bringing the first wave of LSDFi market trends. The distance between the 19.2 billion LSD TVL and the 695 million LSDFi TVL may be a limitation, but it is also a potential for future growth.

Phase 2: Acceleration stage, supply overlays industry cycles, driving demand-side innovation to achieve supply-demand balance, bringing the second wave of LSDFi growth trends. If the ETH collateralization ratio increases from 20% to the average collateralization ratio of 60% on POS chains, it will definitely bring a large increase in LSD on the supply side. Combined with the possible bull market industry cycle in the next 2-3 years, it is expected to open up industry space. With large-scale funds carrying LSD entering LSDFi, industry expectations will be strengthened, driving accelerated growth of LSDFi TVL and taking it to a higher level.

Phase 3: Multiplication stage, in this stage, whether it is users, developers, applications, or infrastructure, they all improve, validate, and perfect. Some LSDFi on the demand side become mature and refined, gradually becoming infrastructure and innovation soil, capable of attracting scaled funds and users. At the same time, improved infrastructure and innovation soil will accelerate LSDFi innovation, further driving supply-side growth, achieving supply-demand incentive compatibility, and realizing a dual circulation of supply and demand.

Finally, we would like to say that true innovation always brings change to the industry. Whether it is asset category innovation, protocol or standard innovation, such as ERC3525, ERC6551, Uniswap V4, LSD & LSDFi, they are like pebbles thrown into a lake, causing ripples that spread in circles, until every corner, covering the entire lake.

Although in a bear market, Builders are still constantly innovating. This is the driving force and hope for the continuous development of the industry. LSDFi is becoming the grand narrative of the next cycle. Please allow us to be optimistic. LSDFi may bring more than 50 times the growth potential.

However, the content of this article is not investment advice. DYOR, Do Your Own Research!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The Bitcoin greed and fear index of Matrixport indicates that BTC will rise in the future.

- Rebound equals sell-off? What happened to Bitcoin?

- Opinion Bitcoin ETF may push Bitcoin to new historical highs.

- Grayscale Trends are Your Friends – Managing Bitcoin Volatility with Momentum Signals

- Will MicroStrategy stop buying Bitcoin?

- Crypto is building a rule-based order and gradually allowing Old Money and retail investors to enter the market.

- Crypto+AI The Cryptocurrency Narrative of the Next Bull Market