Base and Optimism reach a ‘shared revenue’ agreement, pioneering the ‘Layer2 Economic Alliance’.

Base and Optimism reach a 'shared revenue' agreement, pioneering the 'Layer2 Economic Alliance'.Original | Odaily Planet Daily

Author | Azuma

On August 25th, Optimism and Base jointly announced a governance and revenue sharing agreement, which stipulates the different governance collaboration modes between Optimism and Base in the short term and long term states, as well as the economic interaction between the two parties.

If before this, the relationship between Optimism and Base was limited to the latter using the technology stack (OPStack) of the former, which was a kind of soft cooperation, then from today onwards, the two parties will be deeply bound in terms of governance and revenue, and can even be considered as “family” under the same ecosystem.

- An Analysis of the ‘Nintendo’ of the Cryptocurrency World Treasure DAO

- PEPE plummeted by 16%, and the founder behind it was exposed a 97-year-old photographer who used the money from selling coins to buy a Lamborghini.

- Deep analysis of governance risks, capital risks, and protocol risks of LSD.

Governance

First, let’s talk about governance. Since Optimism has designed a relatively complete governance system when issuing OP, this part mainly concerns Base, which does not have governance tokens (it has been mentioned before that it will not issue tokens).

In terms of specific governance forms, there will also be different collaboration modes between the two parties in the short term and long term states.

First, in the short term, the upgrade of the current Base network relies on a 2/2 multisignature contract, with the signing authority of the contract being controlled by Optimism and Base. The two parties will take control in case of emergencies, or Base will execute it after Optimism completes the governance decision regarding the upgrade.

In simple terms, although this form also appears to be a joint decision between the two parties, it will rely more on the willingness to cooperate between the two parties. Assuming that the two parties are not in harmony (although the possibility is very low), the 2/2 multisignature cannot be unified, and the upgrade of Base will be stalled.

In the long term, as one of the “superchains” that adopts OP Stack, Base will be more tightly bound to Optimism through the “Law of Chains” governance framework proposed by Optimism.

The so-called “Law of Chains” refers to a governance framework that hopes to unify the management of all “superchains” (including OP Mainnet, Base, and other OP Stack blockchains), which is planned to be implemented in early 2024.

According to the agreement between Optimism and Base, after the “Law of Chains” is implemented, the two parties will transfer the multisignature governance authority to a security council composed of independent community members distributed around the world (Security Council). The council will not only be responsible for the upgrade of Base, but also for the upgrade of OP Mainnet and other OP Stack blockchains.

On the other hand, because the governance of Base will depend entirely on Optimism in the future, it will also have a part of the authority in the governance of the entire council. In this regard, Optimism will give Base a certain amount of OP shares (the revenue aspect will be discussed later), allowing Base to participate in the governance of the council. However, due to restrictions, it is also stipulated that this voting authority should not exceed 9% of the total voting authority.

Revenue

Compared to the abstract governance aspect, the collaboration between the two parties in terms of revenue is more intuitive.

According to the agreement, Base will pay 2.5% of the revenue from the sequencer to Optimism (the total revenue on Layer2) or 15% of the profit (total revenue minus the cost of submitting data to Layer1), whichever is higher. In return, Base can receive “up to 118 million OP tokens” (about 2.75% of the total supply) in the next six years, enabling it to exercise some of the permissions mentioned in the governance layer in the previous text.

In simple terms, there will be a direct economic exchange between the two parties. Optimism will need to pay Base up to 118 million OP tokens over six years, and in return, Base will permanently provide revenue sharing to Optimism.

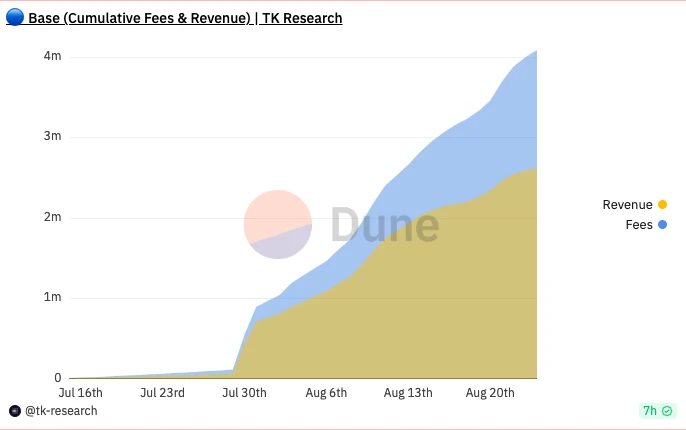

To calculate who pays more or less, let’s do some simple calculations. 118 million OP tokens are currently worth about $183 million. According to data from Dune, Base’s sequencer revenue since its launch (including the pre-launch period) is about $2.6 million. Since there is no profit data, let’s estimate that Base needs to share $780,000 per year with Optimism (2.5% of $2.6 million multiplied by 12).

However, it should be noted that due to the early stage of Base’s ecosystem and the fact that the network currently only has sequencers operated by the team, both factors will have a certain impact on Base’s future revenue situation.

From Optimism’s perspective, although the number of OP tokens it pays is much higher than the revenue sharing feedback it receives from Base in absolute terms, based on the positive expectations that Base will continue to expand in the future, there is still considerable room for increase in the returns from this “transaction” in the long run.

I personally tend to recognize the forward-looking nature of this “transaction”. To give an inappropriate example, before the income sharing agreement was finalized, the relationship between Optimism and Base was similar to the relationship between Cosmos and Terra. Terra adopted the Cosmos SDK issuance (here it is OP Stack), and before 2022, it made a lot of money by using UST “magic”, but this value capture could not be fed back to Cosmos or ATOM.

With the revenue from Base, Optimism will receive a continuous stream of income, which is obviously beneficial to the project’s fundamentals.

Some OP token holders may have concerns about the potential selling pressure of 118 million OP tokens, but this does not seem to be a major concern.

-

First, Base has mentioned that this portion of OP tokens will be mainly used for governance purposes (but there is no mention of hard constraints);

-

Second, these OP tokens will be paid over six years, not all at once;

-

Third, these OP tokens will be spent by the Optimism Foundation to incentivize the development of the Optimism ecosystem. In other words, these tokens are meant to be spent, and what OP token holders should be concerned about is not whether this money will be spent, but whether it is worth it. I tend to believe that it is worth exchanging the highest 2.75% of the OP token supply for a permanent strong support.

As for Base, this OP income also helps to solve the financial issues of Base operations (including developer rewards, ecological incentives, business expansion, etc.). Previously, the operation of Base relied largely on implicit support from Coinbase, but due to compliance considerations (recently there have been voices claiming that the relationship between Coinbase and Base may involve violations), Coinbase will probably make a clear separation from Base at the operational level in the future, and Base will also need to have its own financial sources.

From this perspective, this “transaction” may be a win-win choice that meets the needs of both parties.

“Super Chain” Blueprint, Unveiling the Veil

Overall, the cooperation agreement announced today by Optimism and Base signifies that their cooperation has entered a whole new level. The closeness of this partnership is even hard to find similar cases in the industry’s history.

Looking towards the longer-term future, by completing a deep integration with one of the most important “super chains” Base, Optimism’s “super chain” blueprint finally unveils itself: “Law of Chains” coordinated governance – Optimism expands the ecosystem and promotes decentralization through distributing OP – the ecological entities will continuously contribute back to the mother body with the benefits of the mother body’s fundamental strength – attracting more entities… This positive cycle may become a flywheel to accelerate the expansion of the Optimism ecosystem.

Today’s Base is just the beginning, Zora, Celo, PGN, Debank… In the future, we may see more projects joining this process.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- AI FOMO sweeps the world profits surge 8 times, NVIDIA emerges as the biggest winner.

- Experience the Tu Dog hype type SocialFi platform friend.tech it may be boring and even ridiculous at times, but it has unlimited potential.

- What is the security foundation of the post-POS era? A quick look at the newly proposed theory in the Ethereum community, Proof of Validator

- An Overview of Scroll’s Early Ecosystem What Opportunities Exist for Leading Players in zkEVM?

- The wave of Layer1&Layer2 has arrived, taking stock of the token bridging steps and potential opportunities of various new chains.

- How much selling pressure remains after the hacker account has liquidated 300,000 BNB?

- a16z Partner 4 Theories Driving the Creator Economy