Zhu Jiaming: The Super Experiment of Currency Internet——Libra Analysis

What attitude should I face the impact of Libra?

In the past week, the most impactful event on the global scale was the publication of the Libra white paper and the vision, implementation and path of Libra as reflected in the white paper. In the Chinese world, in the past few days, the climax of Libra's thoughts, comments, and discussions was quickly formed.

Such a climax will soon pass, but Libra's influence on world politics, the economy, especially the monetary and financial system, geopolitics, and the just transformation of world society has just begun. This is undoubtedly a long-term historical process that always needs attention.

Therefore, the impact on Libra should be: rational rather than perceptual; open rather than conservative; scientific rather than delusional; prudent rather than rash.

- Cross-border payment, three countries

- Roller coaster market, Algorand really played a "funds disk"?

- Bitcoin hit $12,000, and this crazy situation is reminiscent of 2017…

To this end, the most important thing is to have a comprehensive grasp of Libra-related information, materials and the formation of the correct analytical framework and methods. Super Experiment of Money Internet released by “Zero Finance and Zero·Thinking Think Tank” and “Digital Assets Research Institute” : Facebook Libra Analysis is a serious and practical attempt.

Zhu Jiaming June 25, 2019

Summary

- Libra hopes to “build a simple, borderless digital currency and a financial infrastructure that serves billions of people.” “Our world really needs a solid digital currency and financial infrastructure, and the combination of the two must deliver on the promise of the 'money internet'.”

- Libra breaks the traditional boundaries of sovereignty, is not subject to independent supervision by any sovereign state, and is not repellent to users. Facebook hopes to use Libra to establish a new global payment system to achieve greater and deeper inclusive finance.

- Libra adopts a “currency-like currency + a basket of currencies” system to maintain the stability of the currency, while the distributed governance structure formed by members of the Libra Association reduces the monopoly that one party may form while ensuring the security and stability of the reserve assets.

- The efficiency and security of the Libra blockchain comes from two core technologies, one is the optimized Byzantine fault-tolerant consensus mechanism, and the other is the Move language specifically designed for the trading and management of digital assets.

- Although technical analysis, Libra may make substantial progress in promoting the application of digital currency and raising the public's digital currency awareness, but this digital currency transcending national borders may encounter obstacles in the future promotion process. .

In 1999, Friedman predicted in an interview that "the Internet will develop a reliable electronic currency in the near future, through which people can realize the transfer of assets without knowing each other."

In 2019, Facebook's digital currency project Libra (also known as Libra) officially released a white paper and went online to test the network. Facebook tried to “build a simple, borderless digital currency and financial infrastructure for billions of people”, “ The combination of the two must be able to fulfill the promise of the 'money internet', and Friedman’s original prophecy seems to be becoming a reality.

In May 2018, it was reported that Facebook established a department specializing in blockchain and digital currency, which was led by David Marcus; at the end of 2018, Bloomberg reported that Facebook's digital currency project would be applied on WhatsApp, but Mainly facing India's cross-border transfer market; in May 2019, the BBC reported that Facebook's digital currency "GlobalCoin" will be released in the first quarter of 2020.

On June 18, 2019, Libra's white paper on Facebook's leading digital currency project was officially released. On the same day, the blockchain test network of the project was officially launched. Libra's plans are different from previous reports.

Bitcoin-marked digital currencies have been under development for decades and have spawned thousands of variants, but the value of instability is one of the important reasons why these digital currencies cannot be widely used. Libra currency is essentially a stable currency whose value will be determined by a combination of low-volatility assets, including cash and government currency securities provided by a stable and reputable central bank. Thus, even if the exchange rate of a currency fluctuates, Libra's value will remain stable. In the case of the exchange of dollars and Libra, when the user exchanges $1 for Libra, the $1 will be reincorporated into Libra's reserve assets and exchanged for exchange rate and exchanged for Libra equivalent to $1.

Libra reserves are not controlled by Facebook, but are controlled by the Libra Association of several member institutions. Facebook plans to increase the number of member institutions of the association from the current 28 to 100 by 2020, and each member institution will pay $10 million in exchange for voting rights within the association to determine the reserve portfolio behind Libra and Libra's exchange rate.

1. New experiment of "world currency"?

“Why can't we use mobile phones to transfer money as easily and quickly as we send messages to friends?”

“Why can't we create a currency that is stable, safe, and usable worldwide?”

“Can we let everyone involved in the global economy enjoy financial services on an equal basis?”

Libra first raised three questions at the beginning of an introductory video whose mission was to “build a simple global currency and financial infrastructure” to create a “world currency” for everyone.

Can Libra carry the mission of establishing a “global currency” or “world currency”? Let us first review the brief history of the development of "world currency" for more than 200 years:

World Currency 1.0 – Gold

The famous scientist Newton had spared no effort to explain the importance of gold to the cabinet during his later years as the director of the British Mint and asked for uniform pricing of gold. In 1717, the British Parliament passed a resolution to set the price of gold at £3 per ounce, 17 shillings and 10 pence. In 1817, the British formal legislation confirmed the gold standard system. Since then, other countries have followed the British practice. By the middle and late 19th century, the gold standard has been widely adopted around the world, so gold has become the world currency.

However, with the continuous development of the commodity economy and the increasing frequency of international trade, gold is increasingly unable to meet the increasing demand for commodity circulation. In 1914, when the First World War broke out, the participating countries concentrated gold on raising military expenditures and issued bank vouchers that could not be cashed as gold, while strictly prohibiting the free export of gold. The gold standard gradually collapsed with the outbreak of World War I, and the world currency 1.0 era ended.

World Currency 2.0 – US Dollar

In the latter part of the Second World War, the United States dominated the establishment of the Bretton Woods system with three-quarters of the world's gold reserves and strong military power. In July 1944, representatives of 44 countries held the famous Bretton Woods Conference in Bretton Woods, New Hampshire, USA, and adopted the US proposal to reach the International Monetary Fund Agreement. According to the agreement, gold is pegged to the US dollar, and gold per ounce is equal to 35 US dollars. The currencies of various countries are linked to the US dollar. Thus, a fixed exchange rate between the US dollar and the currencies of other member states is established, and the US dollar-centered international monetary system is established. World currency.

From the 1960s to the 1970s, contrary to the gradual recovery of the economies of the post-war world, the United States was deeply mired in the Vietnam War. The increase in overseas military spending has reduced the US gold reserves, coupled with the impact of two oil crises, the US currency. The expansion has intensified and the dollar crisis has exploded several times. In July 1971, the seventh US dollar crisis broke out. The Nixon government announced the implementation of the new economic policy on August 15 of that year. The United States announced that the US dollar will stop redeeming gold. So far, the system linked to the dollar and gold has survived. In December of the same year, the Smithsonian Institution. The signing of the agreement marks the depreciation of the US dollar against gold; with the further depreciation of the US dollar in February 1973, the major developed countries have successively turned to the floating exchange rate system, the Bretton Woods system began to collapse, and the US dollar changed from the only reserve currency to the main reserve currency. However, it is still at the center of international trade.

In 1974, the United States and Saudi Arabia signed an agreement to sell weapons to Saudi Arabia and guarantee their homeland security. In return, Saudi Arabia accepted the US dollar as the sole denomination and settlement currency for oil exports. In December of the same year, the United States and other OPEC member states also signed agreements one by one. The "oil dollar system" was established and consolidated the dominant position of the dollar in the international monetary system. Today, to some extent, the dollar is still the "world currency."

From credit currency to digital currency

The new pattern of the international monetary system, the Jamaican system, formed after the 1976 Jamaica Agreement, completely cut off the free exchange of the dollar and gold, and the credit monetary system was established on a global scale. Although the credit currency system has increased the flexibility of the money supply, its fatal flaw is that the government's currency issuance is easily out of control after being freed from the constraints of gold reserves. Since credit currency (banknotes) relies on government credit, once the government has a fiscal or currency crisis, the credit currency will become worthless.

Since credit money (banknotes) can be printed in large quantities quickly and at low cost, and the market lacks effective supervision of currency issuers, credit currency may be over-issued, and this over-issuance will increase inflation and financial order. The risk of imbalance. Although the US dollar is currently the most important foreign exchange reserve in the world, the centralized US dollar as a world currency actually contains certain risks. The United States can use the US dollar to obtain the resources of other countries in a super low-cost manner, or it can target any country. Launch sanctions in US dollars.

In 2008, the mysterious password geek named "Zhongben Cong" brought Bitcoin into the public's field of vision for the first time. People often associate Bitcoin with the 2008 financial crisis. This digital currency, which has no specific issuer and is decentralized, is considered to be a new form of currency that is not controlled by any government or financial institution, and even has the basic conditions for becoming a world currency. In the economic model of Bitcoin, a distributed database of nodes in the entire Bitcoin network confirms and records all trading behaviors, and uses cryptography to ensure the security of all aspects of Bitcoin circulation. But bitcoin is not perfect. First, the price of Bitcoin often fluctuates drastically; secondly, in the impossible triangle of the blockchain (decentralization, security, and efficiency), Bitcoin gives up efficiency, resulting in high transfer fees for Bitcoin and slow transfer rates. These factors make Bitcoin unsuitable for everyday micropayment scenarios.

In order to solve various problems in the development of blockchain and digital currency, various blockchain projects have emerged in an endless stream, and the types of digital currencies have also exceeded 2,000. Although blockchain or digital currency has certain potential to address the availability and credit of financial services, as the Libra white paper states, “the existing blockchain system has not yet been widely adopted. Existing blockchains Lack of scalability and the volatility of digital currencies, these factors have so far caused existing digital currencies to perform poorly in terms of hedging and exchange media, thus hindering their widespread use in the market."

Second, three ideals

From the white paper, at least Libra's three ideals can be seen: improving the existing monetary system, implementing inclusive finance, and creating a new global payment system. Of course, the breakthrough in Facebook's own business model may also be the driving force behind its launch of Libra.

As a major component of the world monetary system, sovereign credit currencies issued by central banks have obvious sovereign boundaries, and users have many restrictions in their use. Libra's vision is to become a simple, borderless, low-volatility digital currency.

After the disintegration of the Bretton Woods system, the world monetary system entered the era of a dollar-dominated floating exchange rate. In 2009, the beginning of the first bitcoin created by Satoshi Nakamoto, the existing monetary system has gradually suffered a certain impact. Bitcoin de-states the currency that Hayek advocates, and in the true sense has changed from ideological theory to a huge social practice, proving the possibility of non-sovereign currency.

Bitcoin was born under the background of the global financial tsunami in 2008. While improving the shortcomings of the existing "double flower" of electronic money, it also got rid of the shortcomings caused by the monopoly of centralized institutions and the control of currency.

Within the existing monetary system, efforts to promote super-sovereign currencies have also emerged. At the 2009 G20 meeting, Zhou Xiaochuan, then president of the People's Bank of China, proposed "creating an international reserve currency that is decoupled from sovereign states and can maintain long-term stability of the currency, thus avoiding the inherent defects of sovereign credit currency as a reserve currency."

Based on the blockchain release, Libra breaks the traditional sovereignty boundary, is not subject to independent supervision by any sovereign country, and is not repellent to users. In this respect, Libra has many similarities with super-sovereign currencies. The economist Zhu Jiaming believes that for the first time, Libra clearly stated that the super-sovereign currency is quite clear from theory, technology to implementation. In 2019, it will probably be remembered as the super-sovereign currency year by history due to the emergence of Libra. .

Libra will build on a secure, scalable and reliable blockchain backed by an asset pool that is endowed with its intrinsic value and managed by an independent Libra association to promote financial eco-development and create a more inclusive financial system.

Inclusive Finance refers to the promotion of appropriate and effective financial services to all sectors and groups of society with financial services needs at an affordable cost.

Libra said: Through joint efforts, technology companies and financial institutions have also developed solutions to help enhance global economic empowerment. Despite these advances, there are still many people in the world who are free. There are still 1.7 billion adults in the world who are not exposed to the financial system and cannot enjoy the financial services provided by traditional banks. Among them, 1 billion people have mobile phones and nearly 500 million people have access to the Internet.

The most obvious manifestation of inclusive finance is the reduced operating costs of the financial business itself. Traditional financial services are provided and operated by specialized financial institutions such as banks. The complicated operational processes bring high costs, and these costs will eventually spread to each end user, increasing the cost of using the currency itself. At the same time, inclusive finance means pursuing equality and non-discrimination, so that more people can enjoy financial services. At present, there is a significant inversion of financial services costs, that is, the less money, the higher the cost of actually paying. For third-party financial institutions such as banks, large customers are more profitable, although the cost of a single business may be lower. This is also mentioned in the Libra white paper “The poor pay more for financial services”.

Libra and the financial services it can provide, due to the blockchain network, rely on decentralized, borderless, non-tamperable and other technical features, can eliminate the existence of third-party financial intermediaries to some extent, simplify the entire financial service process. Objectively creates a new possibility: financial services do not need to be independent of financial services, and the business itself carries financial services, namely: business is finance.

Libra enables users around the world to choose to trust and be willing to join the Libra network to enter at a very low threshold and enjoy the convenience of Libra. At the same time, financial operations no longer require a separate financial institution to bear the cost and ultimately pass it on to users. Libra can use P2P transactions to let all participating users directly share the cost without paying third-party fees, thereby reducing user fees and realizing the original intention of inclusive finance.

The Libra white paper says:

“Whether you live where you work, what your work or income is, transferring money globally should be as easy, cost-effective, and even safer as sending text messages or sharing photos. New product innovations and new players in the financial ecosystem will help To reduce the difficulty of getting everyone's access to capital while providing a smooth and seamless payment experience for more people."

Payment is one of the largest businesses in the global financial system. China is currently the most developed and leading country in global mobile payments. The latest data shows that the scale of China's mobile payment market in the first quarter of 2019 was as high as 47.7 trillion yuan. But regardless of Alipay or WeChat, the existing payment system is built on the bank clearing network. In other words, the existing payment system is essentially the payment port of the banking financial system. Today, when the Internet and financial networks are still separated, payment information needs to be passed between the two networks. While Alipay and WeChat Pay just provide a payment gateway service between the two networks, and do not essentially change the payment model. Alipay's underlying clearing network is still an interbank clearing system.

Libra's payment network is a blockchain-based clearing system that is not restricted by traditional financial networks. Because Libra's underlying clearing network is global, Libra users can make peer-to-peer direct transactions with each other anywhere in the world. Of course, the Libra underlying network based on distributed accounting technology has advantages over the existing centralized mode clearing network in terms of security and protection of users' personal wealth.

In terms of cross-border payments, Libra may be equally promising. According to World Bank data, the current global cross-border payment market continues to grow at a rate of no less than 5% of the US dollar. According to a report released last year by Accenture Consulting, the number of cross-border payment transactions through banks alone reached 10 billion to 15 billion, and the scale exceeded 25 trillion US dollars.

If the current SWIFT model is used for cross-border payment, it usually takes more than 24 hours to complete due to the complicated processes such as interbank reconciliation. In terms of cost, the handling fee and service fee will generally exceed 5% of the total amount of the remittance.

Previous projects such as Ripple have practiced blockchain cross-border payments and have achieved some success. But compared to Libra, Ripple can't make daily payments, only to improve the efficiency of cross-border payments. That is to say, after the user can complete the cross-border payment through Ripple, he still needs to convert the encrypted digital currency such as Ripple he holds into legal tender to be applied in the real scene. Libra doesn't need to be like this, because it is the currency that exists for the daily payment scenario, and can be used directly after completing cross-border payments. This is one of Libra's advantages over other blockchain cross-border payment projects.

Libra is another revolutionary experiment in the payments field. Prior to this, Facebook has already made many attempts in this field.

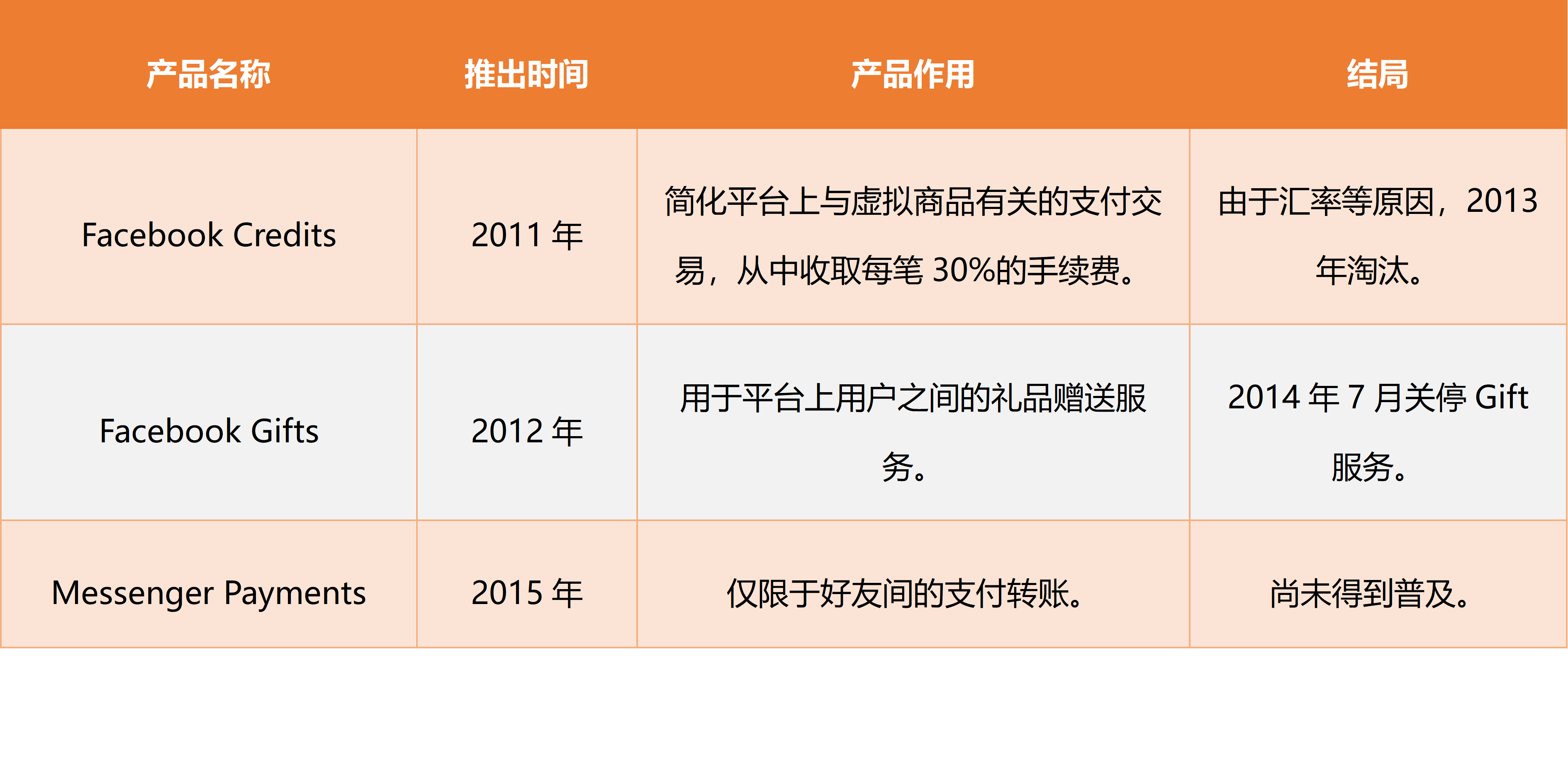

Table: Facebook's attempt in the payment field

Source: Zero 壹 Finance · Zero 壹 think tank according to public information

Facebook is so persistent about paying, perhaps because it wants to build a complete closed-loop ecosystem and get rid of the current revenue model that relies too much on a single business. In a sound ecology, payment is the most high-frequency use and the most important infrastructure.

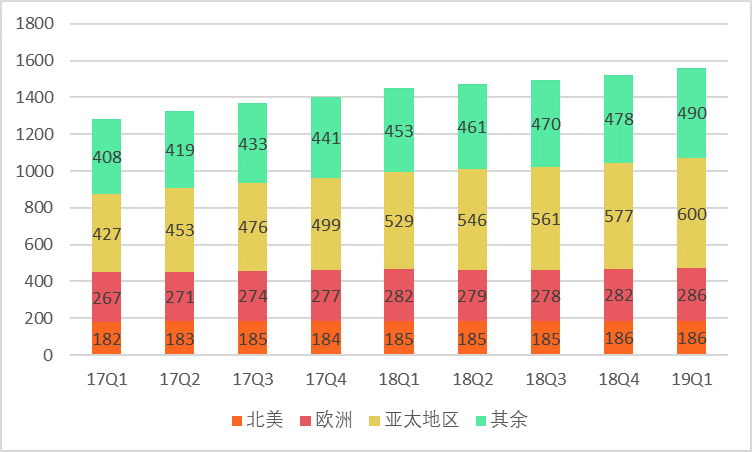

The basic attribute of Facebook is "social." With its strong social attributes, Facebook has accumulated a huge amount of users and data. According to the financial report data for the first quarter of 2019, Facebook's daily active users in the first quarter exceeded 1.56 billion, an increase of 8% year-on-year; the number of active users per month was 2.38 billion, which also achieved an increase of 8%.

Figure: Facebook daily user growth (in millions)

Source: Zero Financial and Zero·Think Tanks are organized according to Facebook’s financial report data

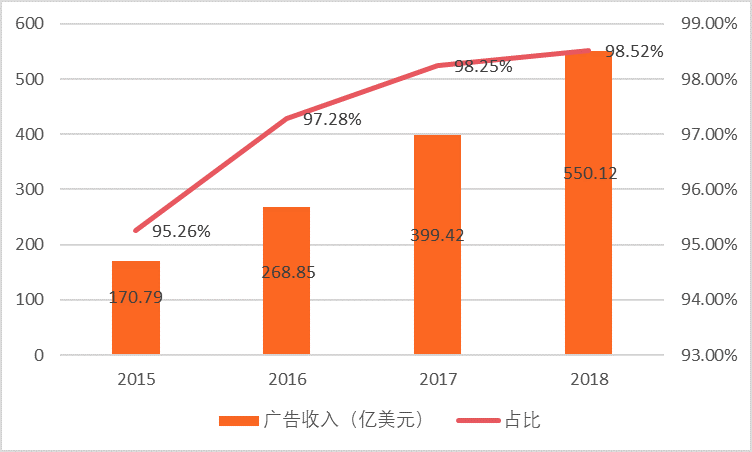

And advertising is currently the most important monetization channel and source of income for Facebook. According to financial report data, Facebook's revenue in the first quarter of 2019 was US$15.08 billion, of which advertising revenue was US$14.912 billion, accounting for 98.9% of the company's total revenue. Mobile advertising revenue accounted for 93% of overall advertising revenue, up from 91% in the same period last year.

Figure: Facebook advertising revenue and share change

Source: Zero Financial and Zero·Think Tanks are organized according to Facebook’s financial report data

A revenue model that is highly dependent on advertising revenue is also becoming a potential risk for Facebook. At present, almost all of Facebook's revenue comes from advertising. The revenue share of other businesses such as online games is decreasing year by year, and emerging businesses such as Oculus are unable to generate huge revenue in the short term. Although Facebook's advertising business performance is still bright in the first quarter of 2019, as the company said in an analyst conference call, "the company will face huge resistance in advertising in the second half of the year."

This kind of resistance comes from both internal and external aspects: from the internal point of view, due to frequent data security and privacy issues, it has gradually led to the loss of user trust, affecting the effectiveness of advertising; external Google, Amazon and other strong enemies, especially Amazon In recent years, digital advertising has sprung up everywhere. With high conversion rate and accurate delivery, it is increasingly favored by advertisers.

Facebook, which lacks payment scenarios, cannot effectively realize the huge users and data it owns, and many business attempts are limited. Taking the game business as an example, the mode of driving game business development based on social attributes has been proved to be feasible and effective by Tencent. According to the data of Tencent Financial Report in 2018, the revenue of Tencent's mobile game business in 2018 was 77.8 billion yuan, a year-on-year increase of 24%, accounting for 41% of the annual revenue, which is an important source of Tencent's revenue. According to Metcalfe's rule, the network value is equal to the square of the number of network nodes. Facebook with billions of users is obviously very valuable and dependent on each user node in the Facebook network. In theory, based on such a powerful social gene development game business, Facebook should be more able to promote user engagement and drive potential players than the AppStore lacking social elements, but why the game business has not become an important part of Facebook revenue. ?

Experts believe that the obstacle to Facebook's expansion of the game business is the lack of payment channels. Bloomberg has reported that the lack of payment tools will become a key obstacle for Facebook to generate revenue through mobile games. Only relying on Apple and Google's payment channels will reduce its profit in the game business.

And Libra gave Facebook an opportunity to gain new business growth. Libra's greatest significance for Facebook is that it is expected to help Facebook enter the payment field, making it a more robust and diverse Facebook ecosystem. Facebook already has enough user bases, and the introduction of Libra's payment system will provide more possibilities for Facebook to realize the value of games, e-commerce, news and other scenarios. At the same time, the presence of many giants in the Libra Association will also give Facebook a new opportunity in terms of users and expansion partners.

Third, how to stabilize: a basket of currency + class currency bureau system + distributed governance

As a currency for daily payments, you first need to be stable. The original vision of Bitcoin was the trading scenario for peer-to-peer payments, but today it has become a value storage tool that has become the “digital gold” in people's mouths. Among them, in addition to the shortcomings of the underlying blockchain network transaction performance, the sharp fluctuation of prices is also one of the key factors limiting the encryption of digital currency such as Bitcoin into the daily payment currency.

Some scholars believe that the essence of money is trust. In order to gain the user's extensive trust, the currency is inseparable from stable anchors. Before the Bretton Woods system, the currency was generally anchored by precious metals such as gold and silver. After the Bretton Woods system, the currencies of other countries in the world were basically anchored by the US dollar, while the US dollar was first anchored by gold, and then directly used the national strength as a guarantee. Take sovereign credit as an anchor. The economist Zhang Wuchang also repeatedly said that "the currency has an anchor is a good thing."

Libra hopes to be a stable digital currency asset and use it for a variety of everyday payment scenarios worldwide. In order to accomplish this goal, gaining user trust and maintaining value stability is a problem that Libra must address.

According to the white paper, Libra adopted a “currency-like currency + a basket of currencies” system to maintain the stability of the currency. That is: Libra's value is effectively linked to a basket of fiat currencies, and each Libra currency issued is backed by real reserve assets. To create a new Libra currency, users must purchase Libra in a 1:1 ratio using fiat money and transfer the fiat money into the reserve, with redemption support from many competitive exchanges and other liquidity providers around the world.

When it comes to "a basket of currencies," the most famous is the SDR (Special Drawing Rights) of the National Monetary Fund. Through a "basket of currencies" approach, SDR combines various currencies in a certain way to form new synthetic currency units (or pricing standards) and maintains relative stability through exchange rates between various currencies. As an important international reserve asset other than gold and the US dollar, SDR is not a real currency. In a way, it is more like a white paper issued by the International Monetary Fund, so that countries with SDR quotas can purchase the required “single” from other countries through SDR when they need foreign exchange or solve the problem of international trade deficit. All kinds of foreign exchange in the basket currency.

Unlike SDR, Libra is tied to the “a basket of currencies” value to ensure that the value of the anchor is stable and reduces dependence on a single currency and a single economy. Libra's vision is to be a global currency without borders, so it is unwilling and unable to anchor the dollar directly. Although anchoring the US dollar is the easiest for Libra, it will make Libra a US dollar stable currency like the USDT, turning it into another manifestation of the US dollar in the digital currency world, and will cause its future development to be greatly constrained by The dollar and the US government. Moreover, linking with a single legal currency is not conducive to the promotion and use of Libra in other countries around the world, and limits the possible imagination in the future.

In addition, anchoring with a single currency will increase the risk of Libra's own value stability. Even if it is as strong as the US dollar, it is no longer very stable today. Linked to a basket of currencies, the impact of single-currency price fluctuations on Libra can be reduced by the hedging relationship between currencies.

Similar to SDR, the Libra Association will change the composition of the basket in a timely manner according to changes in the market situation. This has further maintained the stability of the "a basket of currencies."

The currency board system is a system in which the exchange rate system and the currency issuance system are combined. The main features include: the local currency is linked to the anchor currency, maintains a fixed exchange rate, and can be fully exchanged; in legal form, the currency issuance must have foreign exchange reserves or The full support of hard currency; the currency issuer does not have an independent monetary policy, can not control the currency issuance, and the operation in the financial market is completely passive, which is the most obvious difference between the currency bureau and the central bank.

The "linked exchange rate system" currently implemented in Hong Kong, China is essentially a currency board system linked to the US dollar. HSBC, Standard Chartered Bank and Bank of China, the three major note-issuing banks of Hong Kong dollar, are required to pay a full US dollar reserve at the exchange rate of HK$7.8 when issuing HKD, in exchange for the Hong Kong Monetary Authority’s proof of interest-free liabilities, in order to issue equivalents. Hong Kong dollar. When the Hong Kong Government issues coins, it must also use the full amount of Hong Kong dollars or foreign exchange as a reserve to obtain a distribution permit.

Libra works in a similar way to the currency board system. The release of each Libra currency requires a real full asset reserve. These reserves currently include a series of low-volatility assets such as cash and government currency securities provided by a stable and reputable central bank.

In order to improve efficiency, users will not directly access the reserve, but the authorized dealers will participate in a large number of legal currency transactions with Libra, and the reserve funds will increase or decrease. To create a new Libra currency, users must purchase Libra from a authorized dealer in a 1:1 ratio and deposit it in storage, and vice versa.

Compared with the currency board system, it is not difficult to find that these authorized dealers have similar roles in the Libra system as banknotes, and many of the world's regulated electronic exchanges and dealers that can be publicly traded are similar to general commercial banks.

Libra's asset-backed issuance model using this currency-based system has not only been verified in reality, but has also become mainstream in the stable currency market for encrypted digital currencies.

Stabilizing coins are the product of the encrypted digital currency market. As mentioned above, the current price of encrypted digital currency represented by Bitcoin and Ethereum is fluctuating violently, and it is impossible to carry out daily transaction payments. In addition, the strict regulation of digital currency by some countries including China has led to the lack of digital currency market. The legal currency was put into the gold channel, so the stable currency came into being.

At present, the distribution models of stable currencies can be roughly divided into three categories:

a. The legal currency reserve mortgage model, that is, the stable digital currency anchored by the value of the legal currency through the mortgage of the legal currency;

b. The digital asset collateral model, in which digital assets are anchored at the price of the legal currency by pleasing digital assets on smart bonds in the blockchain. However, due to the current price fluctuations of digital assets, it is generally necessary to ensure that there is sufficient collateral behind each stable currency through risk control mechanisms such as excess pledge and compulsory liquidation;

c. Algorithm central bank mode (also known as “coin coin” mode), that is, no collateral is required, and the central bank’s open market operation is carried out through a pre-set algorithm mechanism to adjust the amount of stable currency supply, thereby making the stable currency price and the legal currency anchor set.

The current stable currency market is dominated by the French currency reserve mortgage model. Although this model runs counter to the decentralization of blockchain, and its representative project USDT has been questioned and trusted, it still cannot change the reality that more than 95% of the stable coins are issued through this model.

Therefore, Libra's idea of issuing a full reserve mortgage is not the most innovative, but it is the most secure and most acceptable method for users. But compared to the general stable currency, Libra has several important innovations:

a.Libra is anchored in a basket of currencies rather than a single currency such as the US dollar;

b. Mortgage low-risk asset portfolios without being limited to US dollars;

c. Issued by an association of 100 (currently 28) senior financial entities.

In addition, the Libra Association stated that it will not actively develop monetary policy, but will only “manufacture” and “destroy” Libra coins according to market demand, and maintain stability by adjusting Libra supply and demand. This is also very similar to the passive monetary policy of the currency board system, which can largely guarantee the stability of its policies.

At the same time, in order to maintain exchange stability, Libra will work with many competitive exchanges and other liquidity providers around the world to enable users to be confident that Libra will be sold at any time at an equivalent or close to the value of the reserve. The stability of the exchange channel.

Above, a basket of currencies guarantees stable asset anchorage, effectively linking a basket of currencies to ensure Libra's value is stable, full reserves maintain the true value of Libra, and work with numerous exchanges and liquidity providers to ensure a stable acceptance channel, plus passive Sexual monetary policy avoids users' concerns about inflation and arbitrary issuance, thus achieving Libra's relative stability.

Facebook has been plagued by issues such as data security and user privacy leaks. The "Cambridge Analysis Incident" that occurred in the first half of last year has left Facebook still in the vortex of the crisis of confidence.

In order to avoid the impact, the white paper clearly stated that Libra will be operated by a Libra Association, an independent non-profit membership organization based in Geneva, Switzerland. Members of the Association will be comprised of the Validator nodes of the Libra Association Network, which will coordinate and provide a management framework for the network and asset reserves, and will lead the development of social impact support to support inclusive finance.

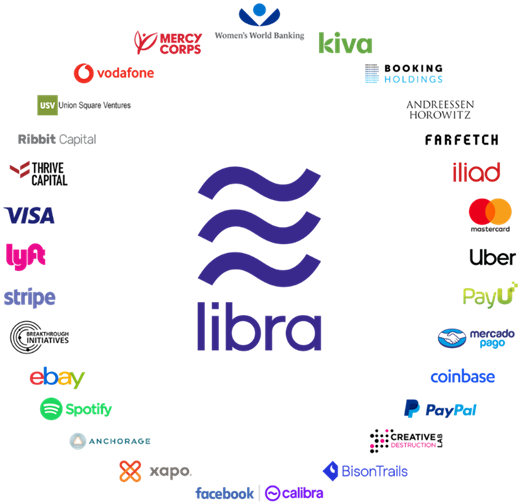

The Libra Association will be a regulatory entity consisting of 100 independent members. It currently includes 28 founding members including Uber, Paypal, Visa, Coinbase, etc., covering payments, telecommunications, venture capital, blockchain, etc. Many fields.

Figure: Libra Association's current 28 member institutions

Source: Libra.org

Facebook will remain a leader in the Libra Association before the end of 2019 and will become an ordinary founding member in the future. The white paper emphasizes that all decisions will be made by the Council of the Association, and that more than two-thirds of the members of the Association will be required to vote in order to pass important policy or technical decisions. At the same time, the reserve will be decentralized in a custody network with investment-grade credit ratings to limit counterparty risk.

Fourth, the technical core: mechanism and language

In addition to the white paper, the Libra blockchain provides several technical documents detailing more technical details, such as consensus mechanisms and new programming languages. Libra's source code has been published on Github, and a test network has been officially provided. online.

From the white paper, the Libra blockchain will be officially launched in 2020, and the membership of the Libra Association will be expanded from the current 28 to 100, and each initial member institution will be responsible for running a verification node, all member nodes will jointly maintain Libra blockchain network. The consensus between these nodes is coordinated by the optimized Byzantine Fault Tolerance (BFT) mechanism called LibraBFT. Each node will repeatedly exchange and verify information with other nodes to ensure correct confirmation between trusted nodes. Information and identify the node in question. Similar to all blockchain networks that use the BFT consensus algorithm, nodes within the Libra blockchain network can reach consensus faster and guarantee higher throughput across the network, but can only accommodate up to one-third of the problem. The node exists, that is, when the number of malicious nodes reaches 34%, the attack can be launched.

The current Libra blockchain design can be viewed as a “chain of alliances”, a “licensed blockchain” in the white paper, and Libra’s development team calls the current “non-licensed blockchain” (ie The “public chain” model is not the best choice for a blockchain that needs to support billions of people. However, Libra's development team did not abandon the public chain model. Instead, it plans to consider the transition to the public chain model five years after Libra goes live. That is to say, everyone in the future can access the Libra blockchain as a node for transaction verification. From this point of view, the future Libra blockchain consensus mechanism is likely to choose Proof of Stake (POS).

Among the technical documents published by Libra, the most attractive one is the new programming language called "Move", which the development team said "can be customized in the Libra blockchain." Trading logic and 'smart contracts'. After reading the relevant documentation of the Move programming language, we believe that the Move language is a programming language designed for digital assets. According to the technical documentation, this language has three uses, namely the issuance of digital assets such as digital currency, processing blocks. Chain trading and management verification nodes.

Move is a statically typed language, and in essence it is a programming logic constraint, so it is much stricter than Ethereum's smart contract language. Modern programming languages like Rust, Golang, Typescript, Haskell, or Scala are statically typed languages because many simple bugs can be detected during compilation rather than waiting until the program is executed.

Another feature in the Move language is the "First-class Resources" mentioned in the technical documentation, which is "first-class resources". The "resources" here and the "Value" (value) in the Ethereum programming language are corresponding concepts. The difference is that "values" can be copied at will, while "resources" can only be consumed. For example, “resources” are like the water in a bottle will decrease as we drink, and “value” is like a sentence on a notebook, we can remember them in the brain but they never disappear. . Smart contracts written in the Move language combine "resource types" with traditional linear logic, so the "resource types" of digital assets on the Libra blockchain also conform to some of the characteristics of linear logic, such as digital assets cannot be copied or out of thin air. disappear.

The Move language's "first-class resources" concept also includes a basic principle that "digital assets are first-class citizens," so we say that the Move language is a programming language designed for digital assets. In fact, digital assets can be stored and allocated as variables in smart contracts, as parameters or return values for functions and processes, while the static type of Move allows the compiler to check during compilation and before smart contract deployment. Most errors in resources, thus enhancing the security of smart contracts.

Currently, the Move language can only be used in built-in smart contracts, such as Libra, Libra-related transactions, and management verification nodes. "It is expected that developers will be given permission to create contracts after a period of time."

V. Future: More than just technology needs to be broken

To complete its own ideals, Libra needs to break through not only technology, but also many problems at the institutional and commercial levels.

The digital currency and asset reserve design in the Libra white paper has led some to believe that Libra is not only expected to be a “world currency,” but that the Libra Association will also have some of the functions of a central bank. The Libra Association buys government bonds directly from the Ministry of Finance, or the bond seller directly accepts Libra, which is equivalent to playing the role of the central bank. In addition, users do not directly access the reserves, which means that the Libra Association does not accept users, users It can only be exchanged in the secondary market, which gives Libra a stronger central bank taste. For now, Libra is more like a central bank than a commercial bank. But in the long run, Libra may become a super bank that combines the functions of a central bank and a commercial bank as Libra is widely accepted and used.

But the Libra Association does not set its own monetary policy, but “manufactures” and “destroys” Libra coins based solely on the needs of authorized dealers. This is in contrast to the central bank's ability to formulate its own monetary policy, created by the Libra Association. Perhaps a new type of central bank.

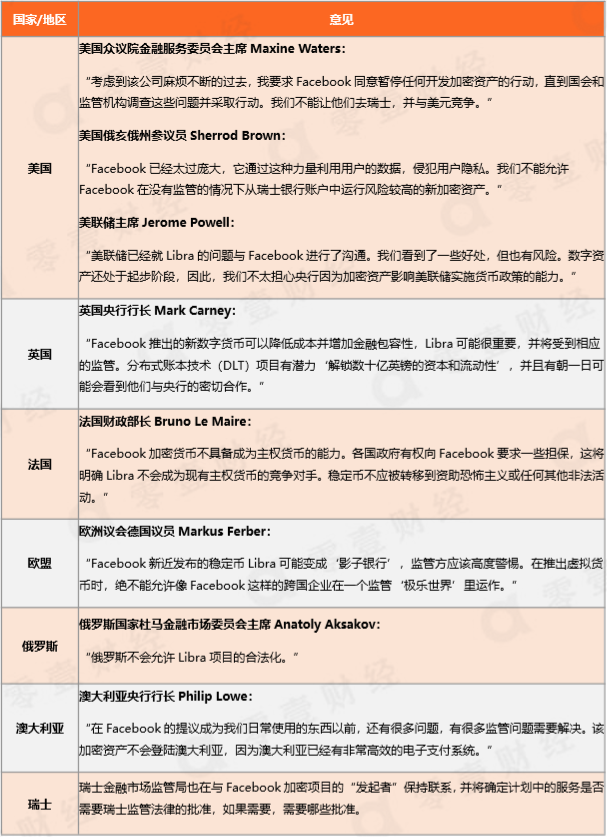

However, two days after the release of the Libra project white paper, politicians from various countries and regions expressed their attitudes. Overall, there is more opposition to or demand for Libra regulation. How to face the different types of regulation that may arise in various countries in the future and survive and develop in the current powerful and complex sovereign currency system is a major challenge for Libra.

Table: Voices of politicians in major economies

Source: Zero 壹 Finance · Zero 壹 think tank according to public information

First of all, from the perspective of payment, Libra's payment process based on blockchain is very different from Internet-based mobile payment. The mobile payment surface represented by Alipay looks very fast, but actually needs a series of behind it. Support for financial infrastructure.

Figure: Basic process of cross-border payment

Drawing: Zero Financial and Zero·Thinking Think Tank

Although there are reports that Alipay's Hong Kong version has used blockchain technology to achieve real-time cross-border transfers between Hong Kong and the Philippines, the cross-border payment service of WeChat payment has been accessed in more than 49 countries and regions. Support 16 currencies for direct transactions, but they still need to rely on third-party agencies to clear the settlement, while Libra does not rely on third-party payment settlement agencies, all transactions are directly completed in the blockchain, and can achieve transaction records. Transparent and permanent retention and non-tamperable, as well as easy to monitor and track.

Libra's payment (or cross-border payment) has certain advantages in theory, but the reality is in countries with relatively perfect monetary systems (such as Alipay and WeChat payment widely used in China), convincing people to pay from a habit. It’s difficult to switch to another payment method, and if you allow a basket of currency reserves, if people convert Libra to Libra, but convert Libra to US dollars, it will bring currency mismatch and exchange rate. Risks, as well as financial regulatory issues, and regulation is still a loop that cannot be bypassed.

The Libra Association plans to increase the number of member institutions from the current 28 to 100 by 2020. According to the Libra white paper, the more members join, the more the Libra ecosystem will be robust and the application scenarios will be rich. But how to attract more potential member institutions to join the entire ecological construction and how to balance the internal interests of member institutions, these white papers are not clearly stated.

In addition, one of the most common dilemmas facing payment blockchain projects is the disconnection from mainstream consumer groups. It is also unknown how much Facebook can convert users on its social networks into Libra users.

Finally, Libra's ultimate goal is to transform into a “non-licensed blockchain network” that we generally understand as a “public chain,” but as the Libra white paper says, “There is no mature solution yet. A licensed network that provides the scale, stability and security needed to support billions of people around the world and transactions.” Plus the Libra blockchain is still in the early stages of development, such as chain governance contracts, market design, networks Technical, economic and governance issues such as emergency need to be addressed, and Libra's development will not be smooth in both the short and long term.

–/ END /–

Source: Zero Think Tank

Author: Zero One digital asset Institute think tank

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Fragile Libra Association: Regulators are eyeing, no one pays for nodes inside

- Anonymous Angrim Grin: Regaining Zhongben Cong Electronic Cash Dream

- Financial Watch | Bitcoin continues to skyrocket and speculative risk rises

- Is it worth looking forward to halving the Litecoin in August? One article says throughlite

- India’s regulation is counterproductive, with a local BTC premium of over $800

- How to catch the big bull market? Demystifying the 3 rules of BTC bull and bear cycle

- Why at this stage of the bull market, most altcoins do not run bitcoin