Why has Bitcoin returned to $30,000 and its market share soared?

Why did Bitcoin reach $30,000 and its dominance increase?Author | Hei Mi, White Zhe Research Institute

At the time of writing, Bitcoin has risen by more than 6% in the past 24 hours, briefly touching $29,000 (editor’s note: the price has surpassed $30,000 at the time of publication). At the same time, Bitcoin has regained 50% of the entire cryptocurrency market. It is worth noting that since May 2021, Bitcoin’s market dominance has never exceeded 50%.

I believe that the current Bitcoin bull market and the rise in market dominance can mainly be attributed to three factors: the entry of financial giants into cryptocurrency trading, the resurgence of competition for Bitcoin spot ETFs, and the upcoming fourth Bitcoin halving.

- Is it good or bad that Wall Street giants are taking over cryptocurrency with ETF and EDX?

- Ethereum Inscriptions: Continuation of Bitcoin’s Order or Regression of History?

- Bitcoin returns to $29,000, can the old narrative of institutional entry ignite a new bull market?

Under regulatory crackdown, financial giants enter cryptocurrency trading

EDX Markets is an institution-specific exchange supported by three of the largest asset management companies in the United States, Charles Schwab, Fidelity Digital Assets, and Citadel Securities. It was announced in September 2022 and was officially launched yesterday, causing a stir in the cryptocurrency community.

As for the core leadership, EDX Markets’ CEO will be Jamil Nazarali, former global business development director of Citadel Securities, and the CTO and general counsel will be Tony Acuña-Rohter, former chief technology officer of ErisX, and David Forman, former general counsel of Fidelity Digital Assets, respectively.

As a well-backed exchange newcomer, EDX takes a cautious approach to SEC regulation, with security and compliance as its focus.

On the one hand, EDX differs from other exchanges in that it is a “non-custodial” exchange, meaning that it does not directly hold customers’ cryptocurrency assets, but ensures the safety of customers’ funds through trusted intermediaries.

On the other hand, recently, two major cryptocurrency exchanges, Coinbase and Binance, have been sued by the SEC.

In the Binance case, the SEC has classified ten tokens as securities, including SOL, ADA, MATIC, FIL, ATOM, SAND, MANA, ALGO, AXS, and COTI. In the Coinbase case, the SEC has classified seven additional tokens as securities, including CHZ, FLOW, ICP, NEAR, VGX, DASH, and NEXO.

The aforementioned token EDX is not available for trading, and customers can only trade four cryptocurrencies: BTC, ETH, LTC, and BCH – SEC claims that they are not securities.

Therefore, EDX has refocused institutional interest on established cryptocurrencies including Bitcoin.

While some Twitter users are concerned about the timing of the SEC’s recent lawsuits against Binance and Coinbase, many view EDX’s launch as good news for Bitcoin’s price.

In addition, industry insiders speculate that after SEC’s enforcement action, these financial giants launched their exchanges not by coincidence, suddenly “these Wall Street behemoths entered the cryptocurrency market after the runway was cleared.” Regulatory agencies may be more inclined to have established firms enter the cryptocurrency market, rather than supporting native companies in the market from the beginning.

Bitcoin spot ETF competition reignites

Despite the SEC’s crackdown on the cryptocurrency industry, traditional financial giants and institutional investors are still interested in Bitcoin, and have accelerated their entry into the market.

BlackRock, the world’s largest asset management company, has applied for a Bitcoin spot ETF. If approved, it will open up a regulated investment channel for a wider range of investors without actually buying Bitcoin, and eventually lead to an increase in Bitcoin demand and value.

Markus Thielen, head of cryptocurrency research at digital asset service platform Matrixport, believes: “The likelihood of the SEC approving BlackRock’s Bitcoin ETF is high…The ETF may be approved in September or October 2023 and will attract $10 billion within three months and $20 billion within six months-this will greatly support Bitcoin’s price.”

Since BlackRock submitted its ETF application, Bitcoin’s price has risen by 12%, and Coinbase stock Coin has also risen by 12%.

WisdomTree followed closely. Less than a week after BlackRock’s application was submitted, the asset management company, which manages $87 billion in assets, once again applied for a Bitcoin spot ETF. WisdomTree stated in the filing: “The Bitcoin market has matured, and its operational efficiency and scale are substantially similar to those of mature stock, fixed income, and commodity markets.”

This is not WisdomTree’s first application. In December 2021, the US SEC rejected it for lack of “regulatory sharing agreements” and concerns about market manipulation.

In recent years, many ETF issuers have attempted Bitcoin spot ETFs, but have been rejected by the SEC, including WisdomTree, VanEck, ProShares, Invesco, Valkyrie, and ARK.

There are rumors that the third largest asset management company, Fidelity, is planning to cause an “earthquake” in the crypto market, applying for its spot Bitcoin ETF and may acquire the struggling Grayscale. However, Fidelity has not confirmed this rumor, and whether the company will really enter the crypto market remains to be seen.

However, BlackRock’s actions may indeed attract traditional financial giants to follow suit, triggering another round of “Bitcoin spot ETF competition” after 2021, and Bitcoin may soon usher in its “golden moment”-the first gold spot ETF in 2004 After obtaining approval in the United States, its price exploded in the following years.

Upcoming Bitcoin Halving

The upcoming fourth Bitcoin halving will occur in 10 months (May 9, 2024), and the block rewards will be reduced to only 3.125 bitcoins. Bitcoin halving is an important narrative of Bitcoin and a catalyst for the recent three bull market growths. It will reduce the block rewards issued to miners by half every four years. The number of bitcoins mined at the same energy cost after each halving will decrease, so this often causes strong guesses and expectations about Bitcoin prices in the Bitcoin community.

Historically, this narrative has often led to record highs in the Bitcoin and broader crypto markets.

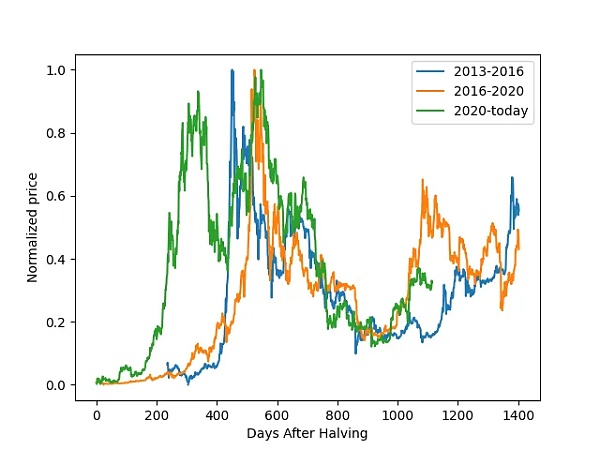

As shown in the figure below, the blue line, orange line, and green line represent the Bitcoin price trend for the three halving cycles from 2012 to 2016, 2016 to 2020, and 2020 to the present.

It can be seen that all lines reached the maximum price between day 400 and day 600.

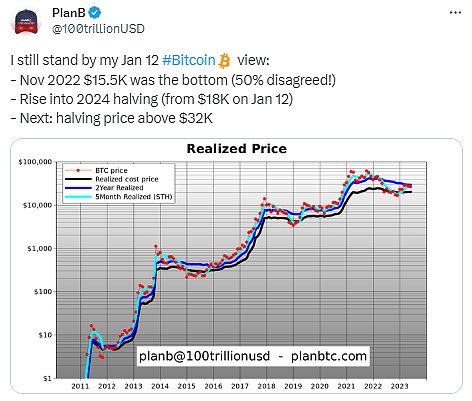

The most popular Bitcoin analyst Plan B believes that through the fourth halving, the Bitcoin price is expected to rise to more than 32,000 US dollars and start a new round of bull market cycle in 2025.

Lastly, DYOR and dig deep into any event.

Risk warning:

According to the “Notice on Further Preventing and Dealing with the Risk of Virtual Currency Trading Speculation” issued by the central bank and other departments, the content of this article is only for information sharing and does not promote or endorse any business and investment activities. Readers are strictly required to abide by local laws and regulations and not participate in any illegal financial activities.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Understanding EDX Markets: 10 questions about behind-the-scenes investors, compliance, and more after a night on the headlines

- Research: Which cryptocurrencies are included in the recognized token index in Hong Kong? An industrial analysis of the indexing economy.

- EDX Markets, a trading platform supported by Wall Street, has arrived! It is designed for institutional use and operates on a non-custodial model.

- Asset management companies WisdomTree and Invesco have resubmitted their application for a physically-backed Bitcoin ETF.

- Why is the US government reluctant to sell its 5 billion dollars worth of Bitcoin?

- Encryption exchange “moving tide”: US SEC “strongly pushed away”, Middle East and Hong Kong “welcoming with a smile”

- BlackRock boosts the market but Bitcoin “looks fragile”