Zou Chuanwei, Chief Economist of Wanxiang Blockchain: A Preliminary Analysis of the People's Bank of China DC/EP

Author: Zou Zhuanwei

Source: Universal Blockchain

Summary

On October 24, 2019, in the 18th collective study of the government, it was pointed out that "the application of blockchain technology has been extended to digital finance." The key to understanding digital finance is to understand the People's Bank of China DC/EP (Digital Currency/Electronic Payment).

- Analysis: Why is Lava's "Flint Mechanism" an upgraded version of staking?

- Dry goods | Financial contracts and smart contracts

- Babbitt Column | Dusk of the Ethereum Empire

This paper analyzes the PBOC DC/EP in five parts. The first part combs the DC/EP core features based on DC/EP information obtained from public sources and speculates on the DC/EP design. The second part analyzes the third-party payment before and after the “broken direct connection”. Because you want to understand DC / EP, it is best to compare it with the third-party payment before and after the "breaking directly connected". The third part analyzes the impact of DC/EP on payments. The fourth part analyzes the impact of DC/EP on currency. The fifth part analyzes the opportunities for private companies to participate in DC/EP infrastructure construction and application promotion.

This paper believes that the People's Bank of China DC / EP should be the most implementable Central Bank Digital Currency (CBDC) program in the world . The specific conclusions are as follows:

· DC/EP does not use a true blockchain like Libra, but may use a centralized ledger based on UTXO (Unspent Transaction Output) mode, but still belongs to the Token paradigm. This centralized account book is embodied in the digital currency issuance registration system maintained by the central bank. It does not need to run a consensus algorithm and is not subject to the performance bottleneck of the blockchain. The blockchain may be used for the registration of the identification of digital currencies and is in an auxiliary position.

· Users need to use DC/EP wallet. The core of the wallet is a pair of public and private keys. The public key is also the address, and the address contains the RMB digital certificate. This digital certificate is not a blockchain Token in the full sense, but it is consistent with Token on many key features and is based on 100% RMB. The user can initiate an inter-address transfer transaction through the wallet private key. The transfer transaction is recorded directly in the centralized ledger by the central bank. DC/EP uses this to loosely couple accounts and control anonymity.

· Although DC/EP is a currency tool, third-party payments are mainly payment instruments after “disconnected”, but there are many similarities between the two. If DC/EP is doing well enough in terms of technical efficiency and business development, from the perspective of users, third-party payment can bring the same experience after DC/EP and “disconnected”. Therefore, after the DC/EP is disconnected, the third-party payment has an alternative relationship with the application.

· DC/EP will have a tightening effect on M2, and M2 contraction reflects the contraction of the banking system to some extent. The digital currency does not pay interest, and the PBOC does not have a plan to completely replace cash with DC/EP, so DC/EP will not constitute a new monetary policy tool. DC/EP has a strong policy implications for central bank monitoring of capital flows and anti-money laundering, anti-terrorist financing and anti-evasion taxes. Therefore, the regulatory function of DC/EP exceeds the monetary policy function.

· The impact of DC/EP on RMB internationalization is mainly reflected in cross-border payments based on digital currency. Although cross-border payments, including DC/EP, can promote the internationalization of the renminbi, cross-border payments are only a necessary condition, not a sufficient condition, for the internationalization of the renminbi. The internationalization of the RMB is inseparable from a series of institutional arrangements.

• In DC/EP, the People's Bank of China is unlikely to open its balance sheet to the private sector, and the private sector's participation in digital currency is unlikely. In other words, the private sector is unlikely to exchange digital funds in direct payments to the People’s Bank.

· If the public/private key application relied on by the DC/EP wallet is not significantly improved in terms of popularity, user experience, and private key security management, a dedicated digital currency hosting and payment institution will appear. This is a major opportunity for the private sector to participate in DC/EP. The digital currency custody and payment agency will fully integrate the acquiring system established by the current third-party payment institution.

Introduction to DC/EP

DC/EP core features

So far, the People's Bank of China has not published a file system to explain the DC/EP design. The introduction of DC/EP is scattered in Zhou Xiaochuan, Yi Gang, Fan Yifei, Vice President, Yao Qian, and Mu Changchun. Speech and papers by the deputy director and others. After combing and comparing these public channel information, DC/EP should have the following core features:

Instead of M0, based on 100% preparation for the blonde. Digital currency does not pay interest, and does not assume other social and administrative functions besides the currency's four functions (value scale, means of circulation, means of payment, and value storage). In order to ensure that the issuance and withdrawal of digital currency does not change the total amount of central bank currency issuance, there is an equal exchange mechanism between the commercial bank deposit reserve and the digital currency: in the issuance phase, the central bank deducts the commercial bank deposit reserve and issues the same amount of digital currency; In the return phase, the central bank increased the deposit reserve of commercial banks in equal amounts.

Follow the traditional central bank-commercial bank binary model operation framework. The central bank issues digital currency to the commercial banking business library. The commercial bank is entrusted by the central bank to provide digital currency access services to the public, and together with the central bank to maintain the normal operation of the digital currency issuance and circulation system.

The expression of digital currency. The digital currency is in the form of an encrypted number string representing the specific amount of the central bank guarantee and signature issued, including the most basic number, amount, owner and issuer signature. Among them, the number is a unique identifier of the digital currency, the number can not be repeated, and can be used as an index of the digital currency. The digital currency is programmable and can be attached to a user-defined executable script > Digital Currency Registration Center and Certification Authority. The registration center records both the digital currency and the corresponding user identity, completes the registration of ownership, and also records the flow of water, completes the digital currency generation, circulation, inventory check and registration of the entire process of demise. The registration center is built on the traditional centralized method and is a digital coinage center with a new concept. The certification center is an important part of the controllable anonymous design of digital currency. The certification of financial institutions or high-end users can use Public Key Infrastructure (PKI), and the authentication of low-end users can use identity-based cryptography ( IBC, Identity Based Cryptography).

The account is loosely coupled and served in a centralized management mode. Digital currency is less dependent on accounts in the trading session, and can be as easy to circulate as cash, and can achieve controllable anonymity. The meaning of controllable anonymity is that digital currency only discloses transaction data to the third party, but if it is not the holder's will, even if the commercial bank and the merchant cooperate, it cannot track the transaction history and use of the digital currency. Digital currency holders can directly apply it to various scenarios, which is conducive to the circulation and internationalization of the RMB. In contrast, bank cards and Internet payments are based on tightly coupled accounts.

Application to distributed ledgers. The Digital Currency Registration Center does not use distributed ledgers. In DC/EP, the distributed ledger is used for the registration of the confirmation of digital currency, providing a website for external digital currency confirmation through the Internet, and realizing the function of the digital currency online money detector. There are two advantages to doing this. On the one hand, the core issuance and registration system is isolated and protected from the outside world, and the advantages of distributed ledgers are utilized to improve the data and system security of the right query. On the other hand, since the distributed ledger is only used to provide query access to the outside, the transaction processing is still completed by the issuance registration system, thus effectively avoiding the bottleneck problem of the existing distributed ledger in transaction processing.

System independent. Digital currency is universal and ubiquitous, capable of completing transactions on a variety of trading media and payment channels, and leveraging existing financial infrastructure. In theory, the bank's deposit currency, electronic money can reach the payment network boundary, digital currency can also be reached.

Speculation on DC/EP design

From the public disclosure of information by the People's Bank, DC/EP does not use the real blockchain like Libra. Although the digital currency is not a Token in the blockchain, it can not be "double-flowered", anonymity, unforgeability, security, transitivity, separability and programmability, and the Token in the blockchain. It is similar. Therefore, DC/EP still belongs to the Token paradigm, not the account paradigm. The DC/EP issuance registration subsystem is maintained by the central bank and is centralized. It does not need to run a consensus algorithm, so it will not be subject to the performance bottleneck of the blockchain. In DC/EP, the blockchain is used for the registration of the confirmation of digital currency and is in an auxiliary position.

The speculations for the DC/EP design are as follows:

The DC/EP uses a centralized ledger based on the UTXO model. This centralized ledger is embodied in the digital currency issuance registration system and is maintained by the Central Bank. Centralized ledgers can be organized by hash functions and Merck trees, but because they are maintained by the central bank, it does not make much difference. The central bank's credit is significantly higher than that of commercial banks and other private institutions. There is no need to introduce a distributed trust mechanism represented by the blockchain in DC/EP, so DC/EP uses a centralized account book to make sense. Of course, it is also possible to treat a centralized ledger based on the UTXO model as a "degraded" blockchain (or a blockchain with only one node).

DC/EP wallet. Users need to use a DC/EP wallet. The core of the wallet is a pair of public and private keys. The public key is also the address, and the address contains the digital certificate of RMB. This digital certificate is based on 100% RMB to prepare for the blonde. Users can see the addresses of other users, but not necessarily the identity of the address owner. The central bank knows the correspondence between the address and the user's identity through the managed digital currency registration center, but it is not necessarily a strong real name system.

DC/EP trading. The user can initiate an inter-address transfer transaction through the wallet private key. The DC/EP transfer transaction is not broadcast to the peer-to-peer network like the Token transaction in the public chain. The miner packs it into the block and runs the consensus algorithm, but the central bank directly records it in the centralized book.

Third-party payment before and after "broken direct connection"

This part of the analysis of the third-party payment before and after the "broken direct connection" will be a comprehensive view of the flow of funds analysis and balance sheet analysis. The former is more intuitive, the latter is more rigorous and forms a good complement.

Third-party payment before "broken straight"

Before the “broken direct connection”, third-party payment institutions can directly connect to commercial banks around the supervision, often opening a reserve account in multiple commercial banks. The reserve fund is the advance receipt of funds to be received by the third-party payment institution to handle the payment business entrusted by the customer. These funds belong to the user and are deposited in the commercial bank in the name of a third-party payment institution, and the third-party payment institution initiates a fund transfer instruction to the commercial bank. The provisioning interest should theoretically be owned by the user, but in practice is generally owned by a third-party payment institution and constitutes an important source of income for third-party payment institutions. In particular, a considerable portion of the provision is deposited in commercial banks in the form of interbank agreements, and the interest rate is relatively high. Third-party payment institutions use these reserve accounts to handle cross-bank fund clearing, over-range operations, and disguise the cross-bank clearing functions of central banks or clearing organizations.

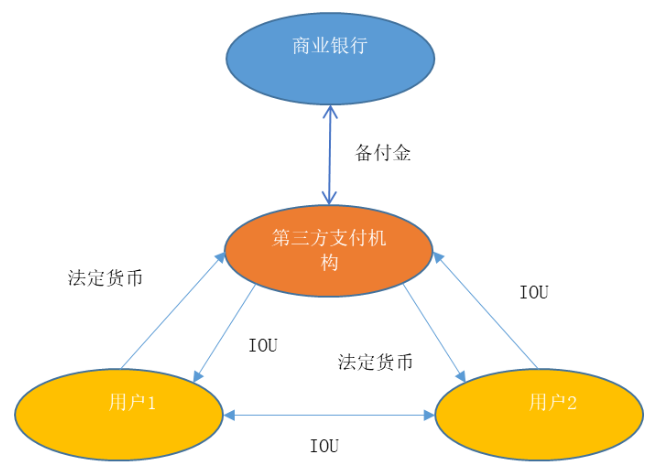

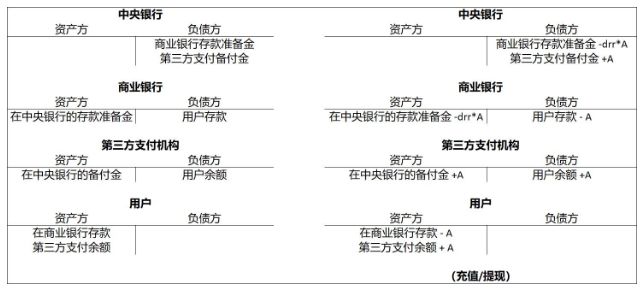

Figure 1 shows the flow of funds in third-party payments before “broken straight”. Among them, the balance of the user in the third-party payment institution is essentially IOU (I Owe You), and no interest is paid; the legal currency involved in the recharging and withdrawal of the user by the third-party payment institution is actually their deposit in the commercial bank.

Figure 1: Flow of funds in third-party payments before “broken straight”

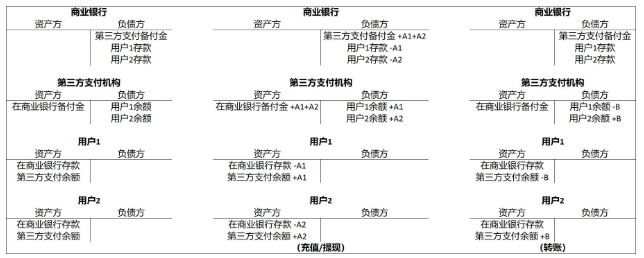

Figure 2 shows the balance sheets of the parties involved in the third-party payment before the “broken direct connection” and their changes in the scenarios of recharge, withdrawal and transfer. For the sake of simplicity, assume that there are two users who use the same deposit bank and the same third-party payment institution. Of course, it can also be assumed that the two users use different deposit banks and different third-party payment institutions. This analysis will be more complicated, but the core logic will not change. For ease of understanding, the provision is treated as an asset of a third-party payment institution, and the user balance is treated as a liability of a third-party payment institution. The following assumptions and perspectives are used for the analysis of third-party payments and DC/EP after “broken direct connection”.

Figure 2: Balance sheet analysis of third-party payments before “broken direct connection”

The user recharges and withdraws at the third-party payment institution (in the middle of Figure 2, user 1 recharges A1, user 2 recharges A2; if A1 or A2 is less than 0, it indicates withdrawal), their deposits at commercial banks and (pay by third party) The reserve funds deposited in the name of the institution are converted to each other. This conversion occurs inside the debt side of the commercial bank. Transfers or payments between users (on the right side of Figure 2, user 1 pays B to user 2; if B is less than 0, it means that user 2 pays user 1), which will trigger their adjustment in the balance of the third-party payment institution.

A phenomenon-level product before the "broken straight" is Yu'ebao. The balance treasure products are the products of third-party payment institutions selling money market funds. Third-party payment institutions collect idle funds from users and invest in money market funds. In China, a considerable portion of the money market funds invest in long-term interbank agreements deposits and certificates of deposit, earning interest rates higher than individual demand deposits. The user obtains the money market fund share, and the third-party payment institution conducts the T+0 quick redemption withdrawal service for the user through the advance payment.

Third party payment after "broken direct connection"

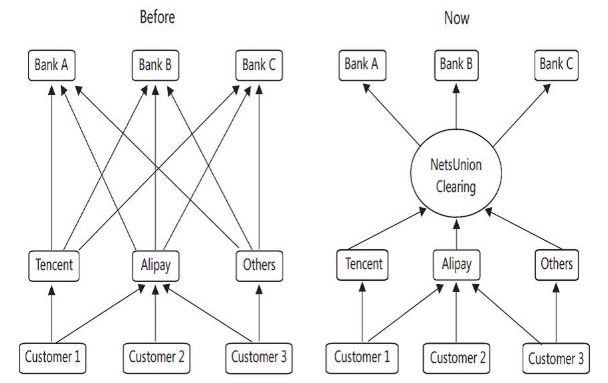

There are three main points in the "broken straight". First, the third-party payment institution's reserve fund account in the commercial bank is revoked, and the third-party payment institution is cut off from the direct connection of the commercial bank. Second, a network connection (ie, a non-bank payment institution network payment clearing platform) is introduced between a third-party payment institution and a commercial bank to establish a common transfer clearing platform under the supervision of the central bank (Figure 3). Third, 100% of the third-party payment provisions are centrally deposited at the central bank. The provision is reflected in the “non-financial institution deposit” account of the central bank’s liability party, which belongs to M0 and does not pay interest. According to President Zhou Xiaochuan's statement, this is mainly to motivate third-party payment institutions to obtain income by providing services instead of reserve interest.

Figure 3: The role of network association in "broken direct connection"

Figure 4 shows the flow of funds in third-party payments after “broken straight”. As in Figure 1, the legal currency involved in the replenishment and withdrawal of the user at a third-party payment institution is actually their deposit at the commercial bank. But for the sake of simplicity, Figure 4 does not present commercial banks and their deposit reserve at the central bank.

Figure 4: Analysis of the flow of funds in third-party payment after “broken direct connection”

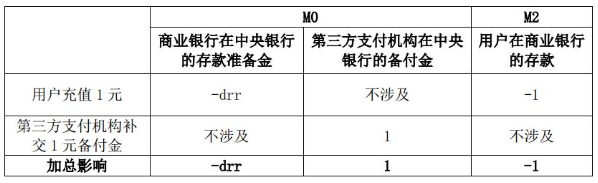

Figure 5 shows the balance sheet of the parties involved in the third-party payment after the “broken direct connection” and their changes in the scenarios of recharge and withdrawal, where drr (abbreviation of Deposit Reserve Ratio) indicates the deposit reserve ratio. The right side of Figure 5 shows the scenario where User 1 recharges A (if A is less than 0, it means withdrawal). The transfer scenario is similar to the right side of Figure 2 and will not be repeated.

After “disconnected directly”, the operation of third-party payment cannot be separated from the central bank’s balance sheet, and user recharge and withdrawal will have a complicated impact on the money supply and money multiplier. For example, when users recharge, their deposits in commercial banks (belonging to M2) are reduced, thereby indirectly reducing the deposit reserve of commercial banks in the central bank (belonging to M0), and (stored in the name of a third-party payment institution) at the central bank. The provision (subject to M0) is increased. Conversely, when users raise money, their deposits in commercial banks increase, which indirectly increases the deposit reserve of commercial banks in the central bank, but the reserve in the central bank decreases.

Figure 5: Balance sheet analysis of third-party payments after “broken direct connection”

DC/EP impact on payments

This part of the DC/EP analysis is similar to the second part, and is also a comprehensive use of capital flow analysis and balance sheet analysis.

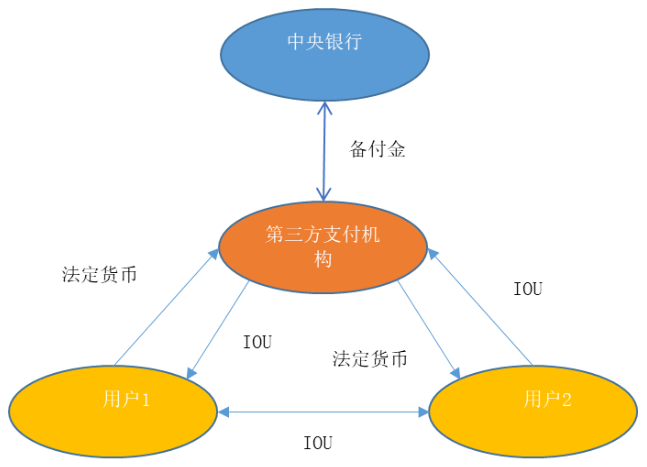

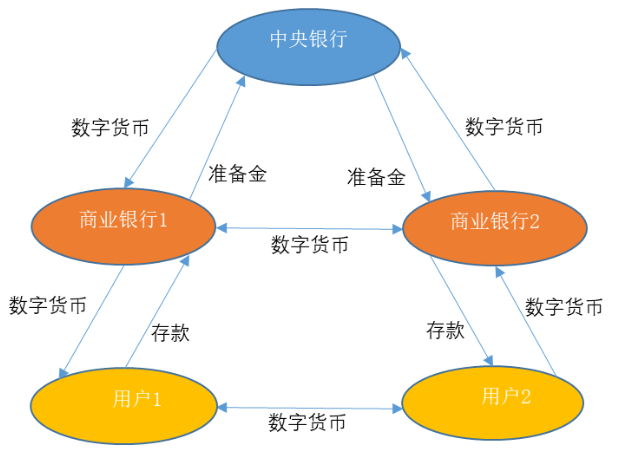

Figure 6 shows the flow of funds in DC/EP:

Figure 6: Analysis of the flow of funds in DC/EP

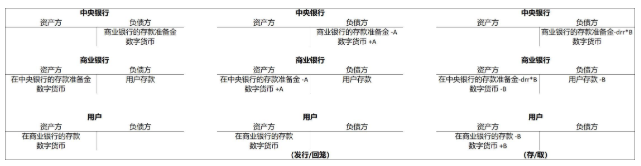

Figure 7 shows the balance sheets of the DC/EP parties and their changes in the digital currency issuance/return and deposit/extract scenarios, where drr represents the deposit reserve ratio. The middle of Figure 7 shows the scenario where the central bank issues a digital currency of A to the commercial bank. The deposit reserve of the commercial bank at the central bank is reduced by A (A is less than 0 to indicate the return). The right side of Figure 7 shows the scenario where the user withdraws the number B of digital currency from the commercial bank, and the user's deposit at the commercial bank is reduced by B (B is less than 0 to store the digital currency).

As can be seen from Figure 7, the issuance/return of digital currency is reflected in the internal structure adjustment of the central bank M0, but the total amount of M0 remains unchanged. The deposit/withdrawal of digital currency is also reflected in the mutual conversion between the user's deposit in the commercial bank (belonging to M2) and the digital currency (belonging to M0), but the increase or decrease of the user's deposit in the commercial bank will cause the commercial bank to deposit at the central bank. The reserve will increase or decrease accordingly.

If the digital currency in Figures 6 and 7 is replaced with cash, they will describe the cash issue/return and deposit/save scenarios. This shows that DC/EP uses the traditional central bank-commercial bank binary model operation framework to minimize the impact on existing currency distribution channels and commercial banking business models.

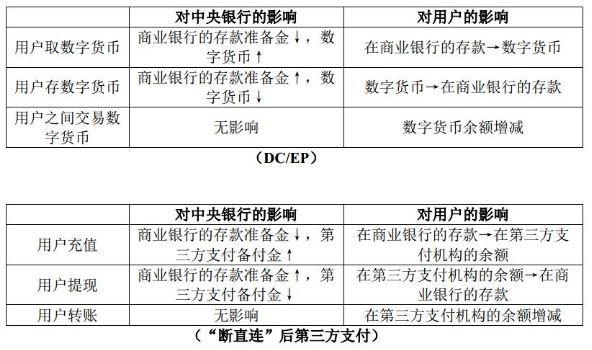

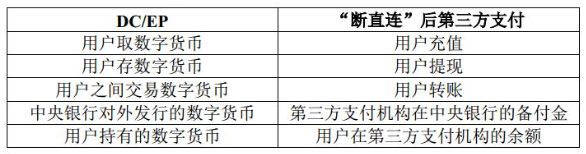

From Figure 4 vs. Figure 6 and Figure 5 vs. Figure 7, it can be seen that there are many similarities between DC/EP and third-party payments after “disconnected” (Table 1). Table 1 considers the impact of digital currency withdrawal/issuance operations associated with the user's deposit/acquisition of digital currency on the central bank.

Table 1: Comparison of third-party payments after DC/EP and “broken direct connection”

Table 1 shows that DC/EP has a homomorphic relationship with third-party payments in a certain sense (Table 2). If DC/EP is doing well enough in terms of technical efficiency and business development, from the user's point of view, DC/EP and “disconnected” third-party payment theory should bring the same experience. This shows that for users, there is a mutual substitution relationship between DC/EP and third-party payment after “disconnected”.

Table 2: The isomorphism of DC/EP and third-party payment after “disconnected”

In addition, there are the following similarities between DC/EP and third-party payments after “disconnected”:

• Both are for general users, especially retail users, and are therefore called “General Purpose”.

• All are centralized, based on the central bank-commercial bank dual model.

• The digital currency does not pay interest, and the balance of the user in the third-party payment institution does not pay interest (the balance treasure product does not apply to this situation, see above).

The difference between DC/EP and third-party payments after “disconnected” is also obvious:

• After the “broken direct connection”, the third party payment is based on the third party payment institution account and the third party payment institution's reserve fund account at the central bank, which is the account tight coupling mode. The digital currency is based on the digital currency issuance registration system managed by the central bank and is a loosely coupled model of accounts.

• Third-party payments are based on accounts, and accounts are associated with identity and are therefore not anonymous. Digital currency is controllable and anonymous. This will cause a difference in privacy protection between the two.

• The balance of the user at a third party payment agency is a payment instrument. Third-party payment transfers are limited to users who use the same third-party payment institution. For example, there is no direct transfer transaction between WeChat payment users and Alipay users. Digital currency belongs to M0 and is legal in any scenario.

• DC/EP's substitution effect on cash is very obvious, and it has strong policy implications for the central bank to monitor the flow of funds and anti-money laundering, anti-terrorism financing and anti-evasion taxes. The programmability of DC/EP brings space for intelligent macro-control, such as the “forward guidance” of monetary policy. Director Yao Qian has a special analysis of this issue. It should be said that the application of digital currency programmability is an important part of digital finance. Third-party payment mainly replaces payment instruments such as bank cards and checks, and has no strong policy tools.

DC/EP impact on currency

This part analyzes the impact of DC/EP on currency from two perspectives: one is the monetary policy significance of DC/EP, and the other is the impact of DC/EP on RMB internationalization.

Monetary policy implications of DC/EP

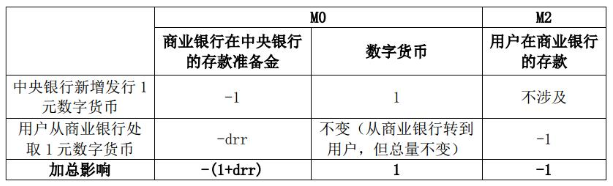

Second, the effect of DC/EP on M0, M2 and the currency multiplier M2/M0. The third part has already covered this issue, and Table 3 gives a rigorous analysis. Table 3 assumes that the user takes a $1 digital currency from a commercial bank, and this one-digit currency comes from a new issuance by the central bank. Table 3 shows that from the central bank, a new digital currency is issued to the user, M0 is reduced by drr, and M2 is reduced by one.

Table 3: Impact of digital currency issuance on money supply

For comparison, Table 4 shows the impact of user recharge on the money supply in the third-party payment after “broken direct connection”: the user recharges 1 yuan, M0 increases 1-drr yuan, and M2 decreases 1 yuan.

Table 4: Impact of user recharge on money supply in third-party payment after “broken direct connection”

Tables 3 and 4, in addition to revealing a key difference between third-party payments after DC/EP and “disconnected”, also indicate:

• The development of third-party payment after DC/EP and “disconnected” will have a tightening effect on M2, and M2 tightening reflects the contraction of the banking system to a certain extent.

• DC/EP has little effect on the currency multiplier M2/M0. The development of third-party payment after "broken direct connection" will cause M0 to increase and M2 decrease simultaneously, which will reduce the currency multiplier M2/M0.

The impact of DC/EP on RMB internationalization

The impact of DC/EP on RMB internationalization is mainly reflected in cross-border payments based on digital currency.

Before 2015, RMB cross-border settlement mainly consisted of two modes: agency bank and clearing bank. Under the agent bank mode, commercial banks with domestic settlement business capabilities have signed RMB agency settlement agreements with overseas banks, opened RMB inter-bank current accounts, and represented overseas banks in cross-border RMB receipt and payment, settlement and other services. In the clearing bank mode, the overseas clearing bank signs a RMB agency settlement agreement with other overseas banks, opens a RMB inter-bank current account, and acts as an agent for other cross-border RMB receipts and payments.

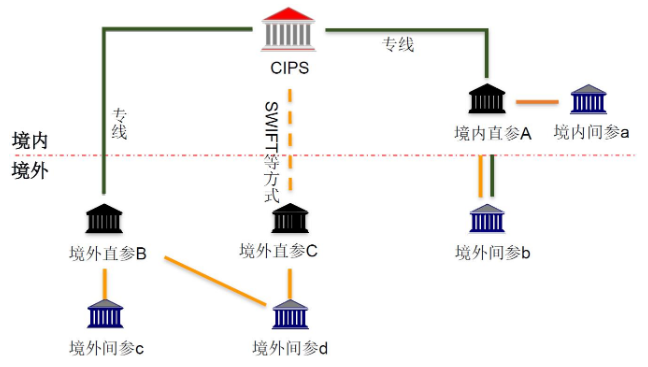

In 2015, the Cross-border Interbank Payment System (CIPS) was launched as a “highway” for the internationalization of RMB, providing cross-border fund clearing and settlement services for RMB cross-border and offshore businesses (Figure 8). . CIPS's business processing mainly includes one-stop payment service for customer remittance and position transfer, bulk payment service for bulk remittance, and payment settlement settlement and CCP (Central Counterparty) for SSS (Security Settlement System). ) Centralized liquidation of financial market operations, etc. CIPS can handle the settlement of RMB cross-border trade, investment and financing, financial market business, etc. It is conducive to supporting the use of RMB on a global scale, providing liquidity to overseas banks and local markets, and preventing offshore funds from impacting onshore markets. In addition, Figure 8 shows the relationship between CIPS and SWIFT, the global interbank financial telecommunications association.

Figure 8: RMB Cross-Border Payment System (CIPS) Architecture

The above cross-border payments are based on bank accounts. To this end, offshore banks need to have renminbi business, and overseas companies and individuals need to open renminbi deposit accounts. The DC/EP only requires the user to have a DC/EP wallet, which is much lower than opening a RMB deposit account. Digital RMB transactions are naturally cross-border, and DC/EP can effectively expand the use of RMB outside the country. At this point, DC/EP has similar logic to Libra.

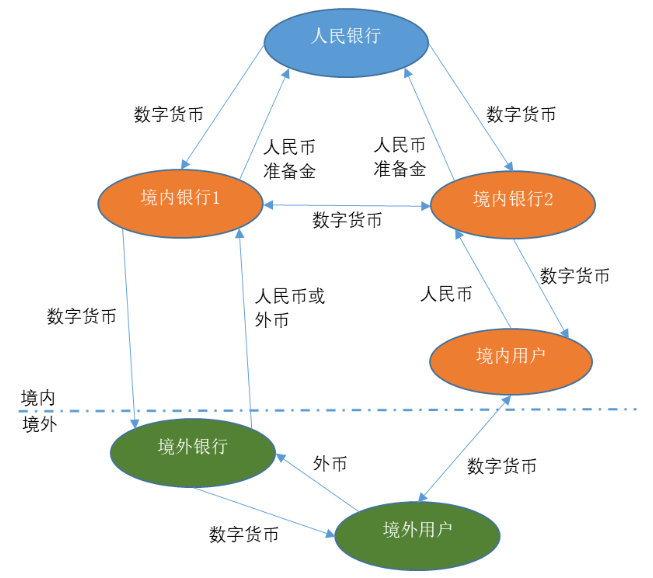

Foreign banks, companies and individuals can obtain digital renminbi in two ways. First, redeem it to domestic banks, businesses or individuals through the RMB it holds. This is essentially a digital currency issuance and circulation system that extends overseas through a cross-border payment network. Second, exchange foreign currency for the digital renminbi. This implies a requirement for the convertibility of the renminbi. The digital renminbi obtained by overseas banks, enterprises and individuals will be repatriated to the territory through cross-border trade, investment and financing, and financial market operations (Figure 9).

Figure 9: DC/EP and cross-border payments

Although cross-border payments, including DC/EP, can promote the internationalization of the renminbi, cross-border payments are only a necessary condition, not a sufficient condition, for the internationalization of the renminbi. The internationalization of the RMB is inseparable from a series of institutional arrangements. There are three dimensions to currency internationalization: trade settlement currency, investment currency, and reserve currency. The international currency should be satisfied: 1. Freely convertible; 2. The currency value is stable, the internal inflation is low, the foreign exchange rate is stable; 3. The deep cross-border trade scenario is supported; 4. The foreign acceptance is high; The domestic financial market is mature and open; 6. The domestic legal environment is perfect, especially in the protection of property rights. These requirements exceed the scope of cross-border payments.

Private companies participate in DC/EP infrastructure construction and application promotion opportunities

According to the statement of the People's Bank of China, based on the technical standards and application specifications, the payment path, payment terms and commercial applications should be given to the market as much as possible.

The opportunities for private sector participation in digital currency issuance should be small. The People's Bank of China has made it clear that digital currency follows the traditional central bank-commercial bank binary model operating framework. In this way, it is impossible for the PBOC to open its balance sheet to the private sector in the DC/EP, and the private sector is unlikely to exchange digital money for the payment of the reserve fund to the PBOC. It should be noted that in the third-party payment after the “broken direct connection”, the People’s Bank of China opened the balance sheet to the third-party payment institution, and the reserve fund was centrally stored in the central bank, which was a product of special industry and regulatory background, and this It has a complex impact on money supply and currency multipliers.

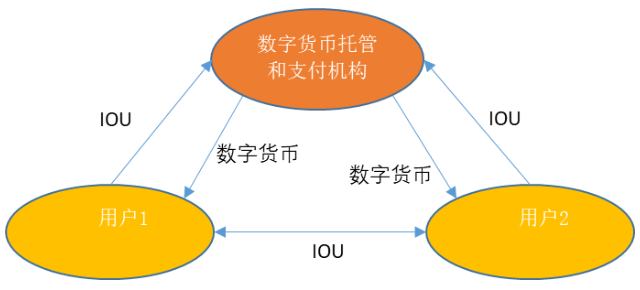

If the public/private key application relied on by the DC/EP wallet does not significantly improve in terms of popularity, user experience and private key security management, then the status of digital currency custody will be very important and will be integrated with digital currency payments. This should be a major opportunity for the private sector to participate in DC/EP, with the possibility of a dedicated digital currency custody and payment agency (Figure 10). After the user recharges the digital currency to the address of the digital currency hosting and payment institution, the host obtains the escrow certificate (similar to the payment account balance or IOU concept) granted by the digital currency escrow and payment institution. Transfer transactions between users through IOUs, and IOU transfer transactions can be fully integrated with the third-party payment receipts.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Viewpoint | The value of Ethereum as a payment platform

- urgent! BitMEX "accidentally" leaked a large number of user email addresses, please replace them immediately

- Investor Perspectives | System, Order and Privacy Protection: Another Perspective on Blockchain

- The private key is handed over to relatives and friends for safekeeping. Are you assured of such a deposit?

- Preparing for the main online line: a quick overview of Libra node operation guide

- Jianan past events: floating up and down eight years, or become the first mining machine stocks

- Take Ripple Coin (XRP) as an example to understand how big the international cross-border remittance of blockchain is.