16 cases from the bottom of the Chinese blockchain platform: the application layer is clearly differentiated

Source: Mutual chain pulse, author: Liangshan Huarong

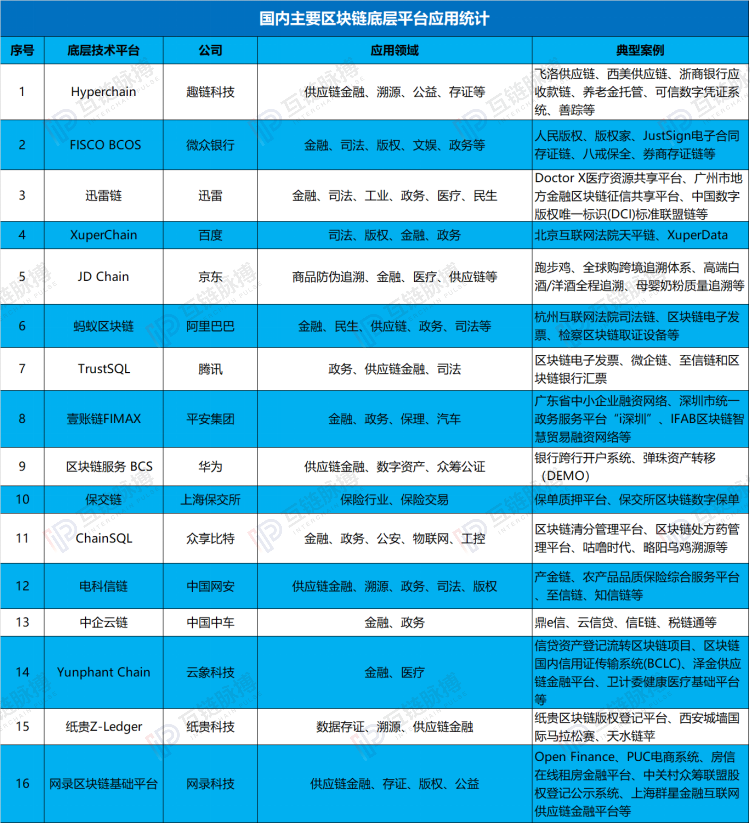

The inter-chain pulse combed the application of 16 major domestic blockchain underlying platforms and found that more than 70% of the underlying platforms began to focus on their respective subdivisions and tried to find breakthroughs, while the remaining 30% of the underlying platforms were still exploring multiple areas. application.

On the track of the underlying technology platform of the blockchain, the direction of landing many enterprise applications is diverging.

Before this year, both large-scale technology companies such as BAT, Huawei, and Ping An Group, as well as native blockchain companies such as Yunxiang Technology, Wanglu Technology, Zhigui Technology, etc., have fully tested the application of the underlying blockchain platform. water. But now, as the application exploration gradually enters the deep water area, the major blockchain bottom platforms have their own emphasis on the application landing.

- Mining Monthly Report: The market plunged and the computing power was lowered. Where should miners go?

- Opinion | The evolution of money in the New Crown epidemic: Cryptocurrencies are becoming more attractive

- The three death spirals of mining: two pictures to understand what happened to Jianan?

The inter-chain pulse combed the application of 16 major domestic blockchain underlying platforms and found that more than 70% of the underlying platforms began to focus on their respective subdivisions and tried to find breakthroughs, while the remaining 30% of the underlying platforms were still exploring multiple areas. application. The two constitute the two camps that promote the development of the underlying technology platform of China's blockchain.

Seventy percent of the underlying platforms target the financial scenarios in the subdivided fields and become a hot spot

The main entities of the current layout of the underlying technology platform of the blockchain can be roughly divided into three categories: native blockchain companies, large technology companies and central and state-owned enterprises.

The native blockchain company has a first-mover advantage in technology R & D precipitation and application exploration due to its early entry time, so it has achieved initial results in the field of deep cultivation.

The most representative company in China is FunChain Technology, and its application and exploration in the financial field is progressing rapidly. Typical application cases include the Filo supply chain platform in cooperation with Fosun Financial Services, the receivable chain platform in cooperation with Zheshang Bank, and the pension custody platform constructed in cooperation with Agricultural Bank, Taiping Insurance, Insurance Exchange, etc. .

In addition, two native blockchain companies, Yunxiang Technology and Zhigui Technology, have also made great breakthroughs in the subdivided fields.

For example, the exploration of Yunxiang Technology in the financial field has covered many subdivided scenarios such as trade finance, supply chain finance, equity trading, financial product trading, and asset securitization. Typical cases include the launch of Blockchain Forfeiting Trading Platform (BCFT), Blockchain Domestic Letter of Credit Transmission System (BCLC) with Minsheng Bank, China CITIC Bank, etc., as well as the cooperation with Zhejiang Financial Asset Trading Center Chain financial product issuance review system, capital depository blockchain, etc.

After launching application cases such as the paper registration platform for copyright registration in the field of copyright registration, Zhigui Technology has also started to target the financial sector. At the beginning of this year, it completed the formation of the East China team, and plans to accurately apply financial technology, regulatory technology and other application scenarios.

(Watchmaking: Inter-Chain Pulse)

In addition to native blockchain companies, some large-scale technology companies also focus on deep-seated subdivisions in terms of breaking the underlying blockchain platform.

For example, JD Chain of JD.com's application mainly focuses on the traceability of various commodities on its e-commerce platform. Typical cases include the global purchase cross-border traceability system, the traceability of maternal and infant milk powder quality, and the full trace of high-end liquor / foreign wine.

The current application of TrustSQL, the underlying platform of Tencent, mainly focuses on government affairs and finance. Typical applications include blockchain electronic invoices, micro-enterprise chains, Zhixin chain and blockchain bank drafts.

In addition, Ping An Group's application of One Account Chain is mainly based on financial scenarios. Representative cases include Guangdong SME financing network, IFAB blockchain smart trade financing network, Hong Kong Monetary Authority International Trade Finance Network and so on.

Finally, some state-owned enterprises and state-owned enterprises also chose to make a single point of breakthrough in combination with the original main business in the application breakthrough of the underlying platform.

For example, the China Enterprise Cloud Chain led by CRRC is mainly focused on finance, factoring and other fields. Typical applications include Dingxin, Cloud Credit, and E-chain. The Shanghai Insurance Exchange launched the insurance exchange chain also to serve its insurance transaction business, the main application cases include policy pledge platform, the insurance exchange blockchain digital insurance policy.

The application differentiation trend is obvious. The underlying platform has formed two camps

However, a small number of powerful blockchain underlying platforms are still trying to implement multi-domain and multi-scenario applications. Among them, the landing progress is faster than Ant Blockchain, Thunder Chain and FISCO BCOS.

For example, the Ant blockchain, the current application scenarios covering finance, government affairs, justice, retail, public welfare, traceability and other fields, the underlying platform of the blockchain has been Tmall, Hangzhou Internet Court, Zhejiang Provincial Department of Finance, Several institutions or platforms such as Zhejiang Taizhou Central Hospital, Ant Financial Public Welfare Platform provide technical support.

According to Shi Yuelang, the business director of Ant Financial's blockchain, introduced at the end of 2019, there are more than 40 application scenarios of Ant blockchain landing.

So far, ThunderChain has completed more than 50 application projects in six fields including finance, justice, industry, government affairs, medical treatment, and people's livelihood. Typical cases include Doctor X medical resource sharing platform, Guangzhou local financial blockchain credit sharing platform, China Digital Copyright Unique Identification (DCI) standard alliance chain, etc.

Although FISCO BCOS, the underlying platform of Wezhong Bank, carries a financial label, the actual landing scene includes nine major areas such as copyright, justice, government affairs, finance, public welfare, and game entertainment.

In addition to large technology companies, there are also a few native blockchain companies whose underlying platforms are trying to implement applications in multiple fields.

For example, Zhongxiang Bit, whose ground platform landing scenario covers six major fields including finance, government affairs, public security, Internet of Things, industrial control, and agriculture, currently has more than 20 application solutions. Typical application cases include blockchain asset transaction management system, blockchain inventory management platform, blockchain prescription drug management platform, Gulu era, Luoyang black chicken traceability and so on.

From the perspective of the current situation, the current trend of differentiation of domestic blockchain bottom technology platforms has become very obvious, and two major camps are being formed: the first camp is enterprises represented by FunChain Technology and Yunxiang Technology. The platform application is focused on the subdivided fields that they are good at, and has achieved initial results; while the other big camp is the underlying technology platform represented by Ant Financial, Thunder Chain, FISCO BCOS, etc., relying on its own strong strength to try Promote application in multiple fields.

Whether focusing on their respective subdivisions or advancing in multiple fields, the formation of the two camps is a natural product of domestic blockchain applications exploring into deep water areas.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Contribution takes "credit currency", a town in Hangzhou explores a new way of blockchain rural governance

- Viewpoint | The birth of blockchain has financial attributes and is a frontier in the investment field

- Mining companies: Bitcoin mining is basically not affected by the epidemic, and the price is the most worrying

- The central government issued the first element market-oriented configuration file: accelerating the cultivation of the data element market

- Cognitive disruption of front-line practitioners of blockchain: Bitcoin, token economy and DeFi

- Popular Science | State transition in the Ethereum 2.0 beacon chain

- Jianan Yunzhi released 2019 financial report: full year net loss of 148.6 million US dollars