Token investment strategy: Why is momentum trading so successful?

Given the recent volatility in the global market, we would like to spend time reviewing the performance of our investment strategy in the pass and assessing the risks

What have we learned from trading in the last two years?

All returns are calculated based on only the long-term portfolio, which is selected daily for each investment method, as described here. Think of the following important learning content:

1. Momentum is largely superior to all other investment methods because it participates in the market rally but cashes out during the bear market.

2. Due to the risk weight of the index (the weight of which is more equal to the weight of the market value), the momentum tends to favor a small-cap investment style.

- Resumption | The halving is approaching, the recovery after the global plunge, how many points can Bitcoin play in this crisis?

- 6 dimensions explain how the Ethereum network responds to the global market under the impact of coronavirus

- Depth | Panorama of Global Digital Currency Regulatory License

3. Small stocks (overweight altcoins) initially outperformed the market and then underperformed.

Why is momentum trading so successful?

Compared with other investment methods, because momentum is so good, we hope to study its mechanism in depth. Most importantly, momentum is considered to duplicate call options. The idea of call options is to let investors only participate in the high-end market, but not in the low-end market. Ideally, call options will only have upside, but not downside. Unfortunately, call options must be purchased at a fixed price, which is called option margin.

Currently, Bitcoin's call option fees are approximately 20% of the nominal investment per quarter. This means that unless Bitcoin goes up and the call options are cashed out, investors will lose 80% of their investment in one year. Momentum strategies are famous because they can replicate call options at less cost (see Hurst et al., 2013). We estimate that the cost of copying call options with a momentum strategy is about 10% per year, so it is actually eight times cheaper than direct call options (examples below).

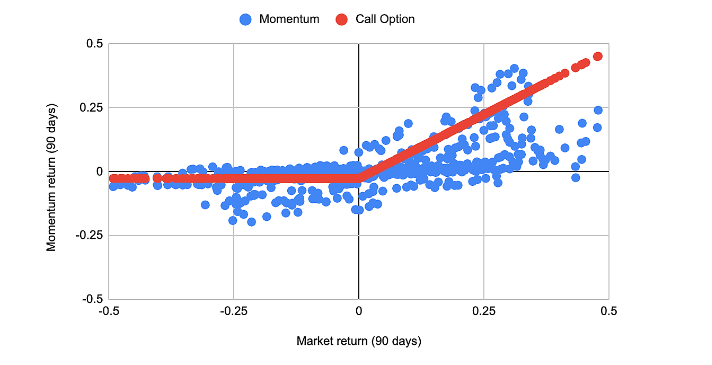

We discussed the 2017 token here, but want to view the results in our real-time transactions. The chart above shows the performance of the momentum investment style relative to 90-day rolling market returns. The figure also shows a suitable call option. As mentioned above, trading only bullish momentum is copying call options. The graph shows that the yield curve of momentum trading is very similar to call options.

However, when the market sold off, investors in this strategy did not fully hedge. Especially if the market sells up to 25% of the stock, the momentum strategy will still be greatly affected, and the risk will only be reduced to about 20%. However, the momentum strategy works well in larger sell-offs and reduces the risk to about 10%. We calculated the average performance of the momentum strategy over 90 days, while the market performance during the same period was negative, it was 2.66%, so it was 10.66% in 1 year.

If the copying of call options works well with the momentum investment style, what about put options or even selling options?

The same principle applies.

The establishment of a put option with momentum is essentially a short signal and has the following return status. Of course, put options have a higher premium because financial markets are risk-averse and can usually protect against downside risks (for an introduction, see Volatility Smile). If you now use long and short trading momentum investment styles, then of course we can copy the so-called long cross positions. Intertemporal options are a simple combination of call options and put options. If the market rises or sells, investors will be rewarded.

However, investors must pay the premiums for both call and put options, so the price of straddle options is even higher. At Protos, we only do long trading momentum, this is simply because the price of put options is even higher, and because we are optimistic about the overall market.

What about selling options?

The return of short-cross stocks is exactly the opposite of that of long-cross stocks, which sell both put and call options. In this case, investors are collecting option premiums. Therefore, if the market is sideways, investors will generate a constant return. However, if the market rises or falls sharply, investors will face unlimited losses. Therefore, we believe that many funds and investors implementing this strategy have gone bankrupt.

If momentum investment is replicating a long-span, then the opposite of momentum investment should be a short-span. What is the opposite of momentum investment?

Therefore, please consider the following market conditions:

If the market has fallen sharply, momentum investors will go into cash (long-term momentum investment replicates call options) or go short (long-term momentum investment replicates straddle riding)).

The opposite strategy is of course to buy this market and think that this market is very cheap and bet on recovery.

Of course, if the market continues to fall, then the investor will face unlimited losses. This strategy is often referred to as the mean regression strategy and is adopted by market makers. Since market makers always quote both parties, they inherently face the risk that the market continues to move in one direction and cannot close positions. Another name for this strategy is "buy", which always has the risk of unlimited losses.

Which strategy is better? Momentum or buy?

Of course, this depends on the risk tolerance of the market and investors. The advantage of momentum investment is that the downside risk is quite limited, but on the other hand, if the market is sideways, a small amount of money will be lost over time.

The advantage of buying and selling is that this strategy usually generates revenue and slowly increases the holdings over time. On the other hand, this strategy faces unlimited losses, especially if you use leverage to buy funds that should be bought on dips. Since market makers adopt this strategy, they usually perform well for a period of time, but then fall into an unexpected market crash like this in the March 2020 stock and crypto markets. In fact, we think this is why there are a lot of large hedge funds without many famous market makers-in the end, they are only occasionally eliminated.

There is a saying that is very appropriate: "Trend is your friend" .

Disclaimer: The author is ProtosFund co-founder and CIO philippkallerhoff, ChaiNext only translates.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- DeFi Review: Beyond the critical DeFi network effect

- Netizens broke the news: Reddit is suspected of developing the reward function of blockchain

- Research | Blockchain technology is expected to restructure the international payment model

- 930 days, witness the blockchain speed of Xiong'an New District

- The Secret History of Bitcoin: Bitcoin and Space Travel

- MOV announces the first list of federal nodes, from open applications to open ecosystem

- Analyst: Bitcoin is picking up steadily and may hit a record high in the coming months