20,000 words to understand the risk management framework of MakerDAO

first part

Foreword

No matter what you think of JP Morgan, the designer called the Robber Noble or the "Currency Trust" is still known as the savior of the financial system and the founder of the Federal Reserve. People can't deny JP Morgan's claim that character and trust are the foundation of all transactions. In contrast to the past, the financial system has a new meaning in the form of blockchain.

Even in the so-called "Trustless" system, the concept of trust has not disappeared, only more diversified. This kind of diversification has never been realized before. We can allocate some resources to a group of people to establish character and trust in a new sense. Even if a participant or a group of people fails, we can still rely on most of the participants to maintain our trust.

In this three-part series, we will examine the risk governance framework adopted by MakerDAO. In this first part, we will introduce the different types of stable coins. Next we will introduce the concept of “decentralized risk management”. The second part will discuss how Maker's risk team, modeling team, and internal risk control team initiate and implement decentralized risk management. The final section describes how MKR holders can participate in voting systems and manage risk. The goal of this series of articles is to let people understand the framework of Maker risk governance and the process of voting by MKR holders.

- The fourth exploration of the valuation of the certificate: looking for the Holy Grail, scientific valuation guide

- India has negotiated a total ban on cryptocurrencies, and cryptocurrencies are worrisome in India

- USDT used the reserve fund to help Bitfinex cover 850 million US dollars of losses, misappropriation of funds or bridge loans?

Trust and stabilize the currency

Stabilizing coins are formed through the monetary mechanism and the tokens have similar stable value. This stable value is generally anchored by some existing reference point, most of which is in US dollars but can also be extended to Euros or other assets.

In general, there are three types of stable currency implementations:

- Custodian

- Coinage tax

- Collateral

The custodian is in the form of centralized trust, where the user stores an asset (usually one dollar) and gets an equivalent token. If the user wants to retrieve the asset, the token needs to be returned. The custodian will return the assets to the user. Users expect that the custodian will protect their assets.

The coinage tax or “algorithm central bank” model requires users to trust an institution. If the price of the token is too high, the institution will increase the supply. If the token price is too low, the agency will reduce supply. Users need to trust the algorithm used by this organization or organization to act as a camera and keep the token stable.

The collateral model allows users to trust trust based on assets on the blockchain. At the same time, with the economic growth and expansion of the blockchain, the types and value of assets on the chain will also increase.

It can be said that each mode has its pros and cons. The different modes you choose determine where you trust trust and your definition of stable currency.

Decentralized Stabilization Coin for Collateral Guarantee – Dai

Maker believes that for users on the blockchain, decentralized stable coins are the first choice. If the user is already using the blockchain, this means that the user already has some trust in the assets on the blockchain. Instead of placing trust in an offline or centralized organization, it is most natural to trust a decentralized chain to stabilize the currency.

The stable currency of Maker is called Dai. Anyone can borrow Dai from their chain of crypto assets (currently Ethereum), which also generates Dai's supply, so Dai's money supply is completely decentralized. To achieve such a currency lending (creation) function, Maker has developed a series of smart contracts called Collateralized Debt Position (CDP). CDP creates Dai's liquidity, and because of the nature of its overcollateralization, the risk of collateral can always be controlled.

Secured debt warehouse – the engine of money supply

The previously mentioned secured debt warehouse (CDP) can control credit risk. How is this achieved?

Credit risk refers to the default risk of the borrower's debt. If this happens, the lender will pursue the borrower's repayment of the loan. The easiest way to resolve the risk of default is a mortgage guarantee. Guarantees are a common tool for controlling credit risk in traditional finance. The process of guarantee is generally that the borrower pledges an asset and the lender can claim the asset in the event of a default. There are two concepts that need to be clarified – "asset pledge" and "default event".

The first concept is “asset pledge”. The pledge asset as a guarantee needs to be debt free and available to the lender. Traditionally, this means that the lender has access to the asset and if the movable lender can save the asset somewhere. For pledge assets, there are specialized companies and industries to ensure that assets are debt free and well preserved. However, all of this can be done on time in CDP.

The second important concept is the event of default. Anyone with legal awareness will agree that there is no clear definition of this. In fact, in traditional industries, the definition of events, the time of definition, and the appropriate actions are equally an industry-wide matter. CDP allows this series of events to be handled automatically and in a timely manner.

CDP perfectly solves these two problems and provides Dai's supply through this credit creation.

At this point, we should know more about CDP, but there are still two problems. What kind of collateral should we choose and how do we define the default event? These two issues are a subset of the broader risk issues. Maker's risk team built a risk framework for this.

Maker's risk team not only builds a risk framework but goes one step further. Different risk teams build a competitive risk framework and improve the framework through a decentralized voting mechanism. MKR holders will be involved in the management and decision of these risk frameworks. In the next section we will detail the content of this framework and how MKR holders can vote. The third part of this series will be elaborated on governance issues.

Governance and decentralized risk management

1. The goal of risk management

The goal of risk governance is to ensure the stability and sustainability of the Maker system through an effective system. We currently form a decentralized, open, and scientific risk management community. The community will manage the risk of the system and choose the collateral behind it by adopting a scientific model. Initially, the risk governance community will be guided by a foundation and will ultimately be led by different risk teams selected by MKR holders to work with third-party independent risk assessors.

The significance of decentralized risk management is that it helps to reduce bias and existing fixed paradigms and make better decisions. The stability of the Maker system is likely to be severely affected by internal bias. For example, MKR holders may vote for their own tokens as collateral. Decentralized risk management needs to ensure that rigorous and fact-based theories are higher than individual opinions or group biases.

The stability of the Maker system inevitably faces systemic and non-systematic risks. Risk requires verification, quantification and management of the model. The decentralized risk management function will openly contain various models, continuously improve the model by studying the potential threats of the system, and apply the best model to be tested.

2. Decentralized risk management function formation

Our vision is that the community will conduct a rigorous scientific debate on the risk management models available to the system. These debates will be based on different risk frameworks introduced by existing risk teams. In other words, a risk team can challenge the current framework and introduce a new framework. The new framework will have a starting weight and determine its impact on the overall risk function.

The risk framework will include not only the model but also the data sources and results. The data can be exogenous data, such as price data, or endogenous data, such as qualitative analysis that determines a parameter.

It is important to note that the community debates the risk framework rather than the final parameter results. In other words, the consensus on the framework determines the consensus on its processes and outputs.

3. Risk team and its functions

When we adopt a more decentralized risk management function, the risk team voted by the MKR holders needs to put their risk framework in the system. The results of the framework will consist of system analysis and risk parameters. The risk framework has different settings for different collaterals and their assessment models. At the same time, there may be a mixed risk framework, such as a framework that only evaluates asset-based tokens. There may be an evaluation model for the overall collateral.

The governance debate will involve the form, structure, and accuracy of the choice risk framework. After the risk framework has been debated, understood, and adopted (through the risk team), the transparency of the framework will also affect its initial weight. The higher the transparency, the higher the initial weight of the framework. The choice of the governance team will be voted on and its weight will change with accuracy.

Eventually, the MKR holder will manage the system's risk function through a voting mechanism, which will include two sets of functions and two sets of voting forms.

Governance mechanism framework

The governance mechanism has two sets of functions. The first group is active and the second group is responsive. Active governance includes debate, solutions, and automation. Responsive includes procedural interventions. The choice of tokens for collateral and its risk parameters (discount rate, etc.) are all active governance. Conversely, risk adjustments due to changes in collateral flows and market capitalization are responsive governance.

There are two forms of voting, the first requires a solution and the second is to activate the solution into the system. The first type of vote for governance voting is to provide a solution, such as introducing a new predictor or a new risk team. The second is to execute a vote, the purpose is to change the state of the system, such as changing the risk parameters of a certain collateral.

In this series of processes, the time nodes and frequencies of voting are important. When we successfully develop a vote, we need to consider the frequency and timing of responsive governance needs. The frequency of these events depends on the power of the MKR holder to manage the risk function. Complete decentralization will ensure that there are only a few reactive governance, and more decisions come from active governance.

1. The time of active governance voting

There are three subtypes for voting. One-off or initial voting, intermittent voting, and regular voting.

A one-time vote or initial vote means the start of a certain program. The first risk framework vote below will be a good example. The risk management function starts with an internal team proposal and serves as a template for the future team.

Intermittent voting will be unconventional, with no fixed-time voting, such as choosing a new oracle.

Regular voting will be a regular vote, such as the implementation of new collateral risk parameters. This requires MKR holders to participate step by step, such as every quarter.

2. The point in time of responsive voting

Some inputs may need to change for a risk framework or a series of risk frameworks. These inputs are related to a function that is implemented, such as a predictor. If we need to exclude a oracle, the responsive vote needs to be activated. Similarly, if the market value of a collateral changes, the risk parameters for it also need to change responsively.

3. Add a new collateral type

In the selection and evaluation of collateral, the first step is to analyze certain tokens from the fundamentals by risk teams and independent research institutions, and propose them to MKR holders. The MKR holder passed the governance vote to pass or oppose the outcome of the proposal. Proposals to vote through the community will go to the next round of executive voting. Governance voting can happen at any time and before voting is executed.

For the type of collateral voted through governance, we will add its risk parameters to prepare for the next round of voting. In each quarter, the risk parameters are updated in the system by executing a vote. This means that the contract needs to be deployed to the system and change the state of the system.

The state of the collateral changes over time, so responsive governance decisions are adjusted to match the value of the collateral. These adjustments are intermittent but are in line with the risk framework.

First risk framework

How to initiate decentralized risk management functions? The risk function will be activated by the Maker Foundation's internal risk team. The internal risk team provides references and templates for future risk teams. The goal is to delegate the risk management implementation to the decentralized team in the future, while the internal team serves as a guide for the creation and deployment of the framework. The internal risk team first plans the types of risks inherent in the system and the models for managing risks, including how to quantify the management of CDP and the supply of Dai. The specific framework content will be detailed in the second part of this series.

summary

In the first part of the risk governance framework, we introduced Dai's position in the stable currency industry and explained Dai's supply mechanism and risk management process. We briefly describe the framework for decentralized risk management functions and how MKR holders can participate in management and decision making processes.

the second part

Introduction

In the first part of the trilogy, we briefly introduced the world of stable coins, defined decentralized risk management, and summarized the governance structure around risk functions. So in this article, the second part of the trilogy, we will have a deeper understanding of the risks in the system—describe how the various parameters in the MakerDAO system represent these risks. Finally, we will outline the models that are best suited to measure and manage the risks. So as the beginning of this article, let's first hit the core of the system, CDP mortgage system, and explore the risks we face in the supply side of Dai.

Inherent risks when using CDP to supply Dai

Traditionally, the loan process is usually adequately funded to minimize the risk of default. Then the question is coming, how is the mortgage fund sufficient? Mortgage can only be considered ample if it can completely cover the loan balance when the default occurs. Then things are very simple. If I mortgage $100 worth of gold, would you like to lend me $100? Then you will tell me immediately, “NO” — because the volatility of gold prices may make the value of repayment less than the time of borrowing. If the default occurs at this dangerous moment, then you will not be able to fully cover the loan amount. So the solution is obvious, we can ask lenders to mortgage more gold to cover volatility. So the risk factor we first consider is the volatility of the value of the collateral.

We deliberately use gold as an example because it has many of our default assumptions. The first assumption is that gold is always gold. What does that mean? This means that the industrial use and value storage function of gold may be replaced by something else (in which case gold will become quite volatile and may depreciate significantly), but this possibility is extremely low. We must recognize the basic attributes of gold. The second hypothesis is based on the main attribute of gold, and the market has a trading market with good liquidity against the law. Without sufficient liquidity, the price of gold will not reflect its true value. In other words, the price is just an advertisement, and the value is what you really get. So there are two risk factors derived from this, one is the change in the quality of the token, and the other is the change in the liquidity of the token.

Gold has another property that we take for granted by default, which is not directly related to its liquidity. At present, the world's gold is worth about 7.5 trillion US dollars, so it is difficult for any individual to monopolize most of the world's gold. When the MakerDAO system uses certain tokens as collateral, it will inevitably face the problem of excessive concentration, and gold does not have such risks.

For example, if an encrypted token has a supply of $100 million in the market, and a significant portion of the holder uses the currency as a collateral, MakerDAO will therefore face a huge Risk exposure. Assuming that 40 million of this currency is used as collateral, then when the currency price drops sharply, we have to liquidate the position that accounts for 40% of the total supply. Then even in a market with abundant liquidity, this dumping behavior will have a devastating impact on the currency price, causing the currency price to collapse. Therefore, the fourth risk factor is the centralized exposure.

So now that we understand the risk of holding a high exposure on a single collateral, let's look at another issue of exposure, that is, to have a high exposure to a single type of collateral, and this is What really needs to be diversified. We know that deploying multiple high-volatility assets in a portfolio can create diversified returns. Simply put, the lower the degree of association between tokens (as collateral), the higher the diversified benefits that can be harvested. When Dai enters the multi-mortgage phase, it tries to use more types of tokens. Therefore, our fifth risk factor is the risk of association, or the risk of diversification.

The risk we will talk about in the end is also the kind of risk that is most relevant to the world of cryptocurrency, which we call the risk of feeding. In the US market, we have a very fragmented securities trading structure. An individual can complete a stock transaction at multiple venues. So in the United States there is a "securities information processor", also known as SIP.

The function of this institution is to integrate the best bid and ask prices from all exchanges and disseminate this best bid price to a number of licensed data providers.

In other words, this is the regulation of publicly released information. The world of cryptocurrencies is fragmented in itself, but because there is no SIP-like presence to monitor data sent to the public – there is a need for self-regulation of prices. The quality of the feed price is the value of the collateral. If we can't rely on the feed price, we can't rely on the price of the feed, so we can't have confidence in the value of the collateral.

In general, Dai's supply-side risks are mainly:

- Volatility risk: The higher the volatility of the collateral value, the more difficult it is to recover the full amount of the loan in the event of default.

- Qualitative risk: The more unstable the fundamentals of the institution, the more confidence holders will have, and the more volatile the currency price.

- Liquidity risk: The lower the effective liquidity in the market, the easier it is for the currency price to deviate from the actual value.

- Exposure risk: The greater the total proportion of total supply, the greater the risk exposure.

- Relevance risks: The higher the correlation (between mortgage assets), the lower the benefits from diversification.

- Feeding risk: A low quality feed will result in insufficient information on the value of the collateral.

Obviously, there is an intrinsic link between the above risks. Solving any one risk can reduce the impact of other risks.

We need to understand how to identify, measure, and manage the above exposures and the information we will need when making decisions. In the following sections we will outline the risks, the proposed risk management model, and the extent to which each risk parameter represents these risks.

Further, we will outline the responsibilities that internal risk teams and Maker holders need to shoulder.

We will outline the various risks in order. First we start with qualitative risks, then exposure risk, liquidity risk and volatility risk, correlation risk, and finally feed risk.

Explore inherent risks and how to manage them

Qualitative risk

Outline

In order to assess whether a token will always retain its nature (as in gold), we need to understand and evaluate the institutions behind it. This includes a comprehensive investment evaluation, institutional due diligence for financial analysis. The significance of financial analysis is to derive the true value of tokens – due diligence is to understand the potential volatility based on their operational and commercial risks.

For MakerDAO, we are clearly more interested in the inherent instability caused by operational and commercial risks. The price advice and price information are left to the market to decide. In order to identify the business risks of the institution, we need to extract all the qualities of the institution – and then streamline it until we can clearly understand the risks surrounding the token.

Risk management function

An essential feature here is to facilitate the compilation of information to assess the qualitative characteristics of tokens used as collateral and subsequent institutions. This data compilation process, completed through due diligence, is a three-step process that is performed in order to make the most of the resources.

These three steps are:

- The initial collateral on-line link: including the transaction support structure, currency allocation, and available time series data.

- Operational assessment: including the functionality of the token, from the institution itself to the governance mechanism, to the rights of the holder.

- Technical assessment: including the robustness and security of related technologies.

The information compiled by the Due Diligence Service will be used to evaluate the characteristics of potential mortgages. The features that will be included are:

- Team: Core team and consultant

- Community: Market sentiment survey

- Technology: Safety and Integrity Review

- Market Competitiveness: SWOT Analysis

- Business Model: Structure and Legal Analysis

The scores for each feature will be combined to a general review. Tokens below the passing score will be deprecated, and qualified scores will be used in the future to adjust the risk parameters in the system. We will detail the features and system risk parameters in future releases. For now, what we have to do is to inform everyone about these processes.

Responsibilities of Maker Holders and Maker Internal Risk Team

MRT will create a qualitative risk template and assign each score to it.

The model and the information in it will help MTH and other teams. The final risk program will consist of multiple groups, and finally a unified weighted rating for the token will be generated.

MTH will use the available information, along with multiple evaluation results, to decide whether to place a token into the collateral portfolio. As mentioned earlier, rejected tokens will be placed at the end of the queue and temporarily discarded, while tokens that pass the evaluation are classified as "reviewed." The “review” means that there is no result, either because it has not passed, or because it lacks some necessary decision information.

Exposure risk: debt ceiling

Outline

How much risk are we willing to bear on the debt of a single species?

When will this risk be too great? What does “too big” mean?

Then the concept of “too big” here represents the magnitude of the risk exposure based on effective supply values. If we break this magnitude, then the risk exposure we focus on in the collateral category will be unbearably high. In the future, liquidation of defaults on this category of assets will be difficult to sustain, as it will have a huge impact on the market itself (even in a highly liquid market), which in turn will cause the currency price to fall further, so that we cannot fully recover the mortgage category. The corresponding loan amount.

We refer to the magnitude of the collateral risk exposure as the maximum exposure level and assign a liquidation ratio (see the next section for details). We can calculate Dai’s exposure level in the form of a debt ceiling, ie The maximum amount of Dai that can be lent under the door of the collateral type. This magnitude is not absolute and its value is based on the effective supply of (Dai).

Further, we should also consider the relationship between liquidity and free circulation (tokens). Free circulation (the token) refers to the part of the token that is actively traded in the effective token supply on the market – the part that is not held by the founders and large institutions for a long time. That is to say, any real liquidity in the market is the result of the free circulation (tokens) of the part.

We have a top-down and bottom-up approach to calculate the debt ceiling. The top-down approach begins with free circulation of tokens, which leads to a problem.

“What is the largest debt we are willing to hold?”

The bottom-up approach starts with the price impact and leads to a problem.

“How much price shock can the market bear in a given cycle?”

In general, from top to bottom or bottom to top, these two approaches are not compromises. In fact, top to bottom should be seen as a bottom-up boundary. In other words, if the bottom-up approach is used, the market has sufficient liquidity to absorb a large amount of tokens, but finds that the risk exposure of tokens of this magnitude is too large, then use top-down the way.

Risk management function

The calculation of the debt ceiling for a single token includes three practical issues. The first is the calculation of the maximum debt ceiling for a hypothetical token when it has sufficient liquidity. The calculation is based on a top-down approach, and the value we will derive is called the upper limit of the debt theory. The second question is to consider the maximum allowable ceiling for the current trading environment and portfolio—this is the bottom-up approach—we call it the actual upper limit of the debt. The risk combination of the current trading environment and the current collateral asset portfolio is a factor to consider.

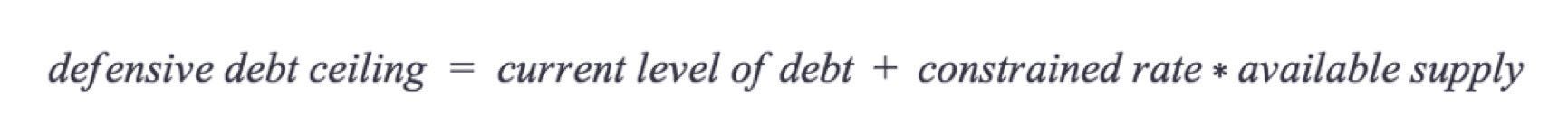

The last issue is the consideration of the current rate of increase in the debt ceiling. If the debt ceiling grows too quickly, it could be due to increased speculation and even an aggressive attack. Simply put, an excessively high rate of growth is likely to mean a volatility in which an attacker moves or rises abnormally. Both mean that there is something wrong with the system. Therefore, what kind of debt ceiling growth rate will trigger the limit from the defensive debt ceiling, for example, we can carry out the following formula:

Defensive debt ceiling = current debt level + constraint rate * available supply

The "constraint rate" here is the maximum growth rate in a certain period.

In general, the theoretical debt ceiling is the maximum Dai supply that can be allowed when a token is collateralized. The actual debt ceiling is the upper limit that the current market for the token can handle. The defensive debt ceiling will maintain the entire system as the debt level grows.

In a recent article, we will show the model used by our internal risk team to calculate the above various debt ceilings.

Responsibilities of Maker Holders and Maker Internal Risk Teams

The Internal Risk Team (MRT) creates a debt ceiling model as a template to open to other teams and Maker Holders (MTH). After that, MRT will continue to educate the money holders and other teams interested in the model through various channels. Each collateral that has passed a qualitative assessment will be accompanied by a debt ceiling derived from the decentralized risk calculation equation, which is initially provided by the internal risk team, but will ultimately be based on the individual risk model. Contribution weights are decided together.

The debt cap model is part of the risk structure established by a single risk team. As mentioned earlier, this risk framework is an integration of multiple risk models intended to calculate single or multiple risk parameters for the entire system. Once the MRK holder has voted for a risk team, this also means that the holder accepts the risk framework proposed by the team and the values derived from the model. The holders will have a deep understanding of the different architectures and models under the different risk teams through various channels. In addition, the currency holder will also participate in the debate between the various risk teams.

Liquidity and Volatility Risk – Liquidation Ratio

Outline

The existence of the debt ceiling can effectively regulate the risk of market liquidity loss caused by the system. This kind of risk can be caused by excessive holding of a single token, or by liquidating too much money in a certain period of time. Liquidity risk is a test of market liquidity at this stage, while volatility risk is a test of price risk (market risk) in the case of known market liquidity magnitude.

The specific amount of the minimum mortgage for a particular token will depend on both volatility and liquidity risk. We will detail the volatility risk through the example of gold. Then, if the gold price volatility is 10% daily, you can expect a float of $125. Assuming you are conservative, you will most likely expect the collateral's asset-debt difference to be more than twice the daily volatility. Because 20% of the day's plunging is very rare, of course, there is still the possibility, but very rare. We return to the original case, we need a collateral worth $100/0.8=$125: then if the value of the collateral falls by 20%, it is equivalent to a loss of $25, but we still have a collateral worth $100 to prepare for the outstanding loan. .

Now we discuss liquidity risk. We have assumed that $125 is enough to make a $100 loan, then what if it is $1 million? Ok, then we can conclude that we need $1.25 million in collateral. But obviously, it is much more complicated to liquidate $1.25 million in gold than $100. So we have to consider the market liquidity at this time again. Then what we need at this time is to make an adjustment to the value of the collateral to compensate for the liquidity risk. Going back to the original example, assume that the liquidity adjustment value is 1.15, which means that the original value is increased by 15%. Then the total amount of collateral needed is $1.435 million.

Then we know the volatility risk and the homogenization adjustment for liquidity risk, we conclude that a $143.5 collateral is required for every $100 loan.

Another outstanding issue is the length of the loan. If there is a lot of time, then it is clear that the demand for mortgages will be higher. Or you need to add collateral. Considering that the loan period in the MakerDAO system is open, does this mean that we need an astronomical total mortgage value? No, unlike in traditional configurations, loans are liquidated immediately when default occurs.

The length of the loan is the time when the position is cleared. That is to say, we will predetermine a maximum period for the liquidation of the position, and calculate the adjustment to the total value of the mortgage based on this.

Summary, based on the volatility risk, we can calculate an initial mortgage amount; and based on liquidity risk, we can add a liquidity adjustment to the calculation. Based on the length of time the collateral is known to be liquidated, the final adjustment will be the liquidation expectation period.

Risk management function

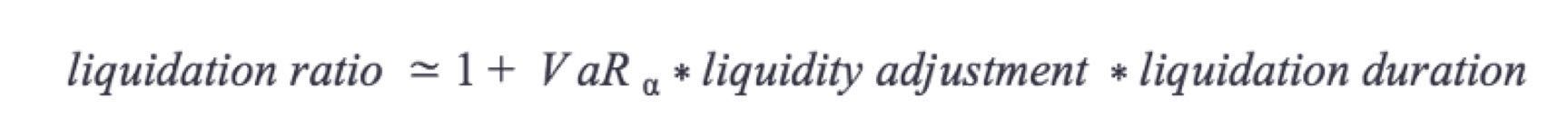

How are the above related to the liquidation ratio? The liquidation ratio is the ratio of the required mortgage amount to the loan amount. In the previous example, when considering the risk of volatility, the gold mortgage amount we requested was $125, and then the liquidity risk was added to get $143.5. Then we considered the liquidation period expectation and finally got $175. So the clearing ratio here is $175/$100 = 175%.

So the liquidation ratio can be roughly estimated as:

The liquidation ratio is approximately equal to 1+VaR* liquidity adjustment* liquidation period

Here VaR is the value of risk under a known confidence interval. This concept and related calculations will continue to be detailed in future articles.

When the mortgage-to-debt ratio is below a predetermined level, the system will liquidate the mortgage. Under a specific confidence interval, the collateral at the time of liquidation should be sufficient

Redeem the remaining loan. Any collateral balance after liquidation shall be returned to the borrower. If the balance of the collateral is insufficient, the MKR holder will supplement the missing part by inflation. As mentioned earlier, more details of the model will be detailed in future articles.

Responsibilities of Maker Holders and Maker Internal Risk Teams

Similar to the debt cap model, the Internal Risk Team (MRT) creates a clearing scale model as a template to open to other teams and Maker Holders (MTH). After that, MRT will continue to educate the money holders and other teams interested in the model through various channels. Each collateral that has passed a qualitative assessment will be accompanied by a debt ceiling derived from the decentralized risk calculation equation, which is initially provided by the internal risk team, but will ultimately be based on the individual risk model. Contribution weights are decided together.

The clearing ratio model is part of the risk structure established by a single risk team. As mentioned earlier, this risk framework is an integration of multiple risk models intended to calculate single or multiple risk parameters for the entire system. Once the MRK holder has voted for a risk team, this also means that the holder accepts the risk framework proposed by the team and the values derived from the model. The holders will have a deep understanding of the different architectures and models under the different risk teams through various channels. In addition, the currency holder will also participate in the debate between the various risk teams.

Relevant risk

Outline

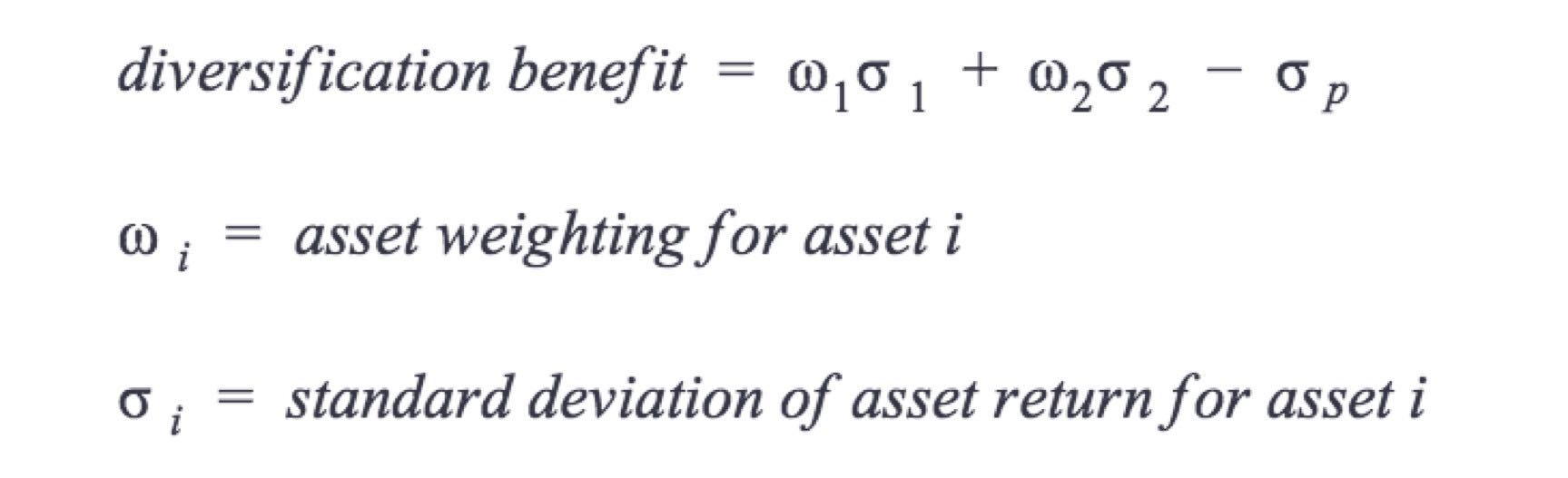

If you create a portfolio of two financial assets, the risk you face will almost always be less than the sum of the risks faced by the two separate assets. The reason is that the return correlation between two different assets is often imperfect. This brings diversified benefits to the portfolio. We can express this benefit in the following program:

The above program shows that the return is the sum of the weighted volatility of each of the two independent assets minus the volatility of the combination. The combined volatility here includes diversity, while the sum of the two weighted volatility is assumed to exclude pluralism. So in this subtraction we can get a diversified return value.

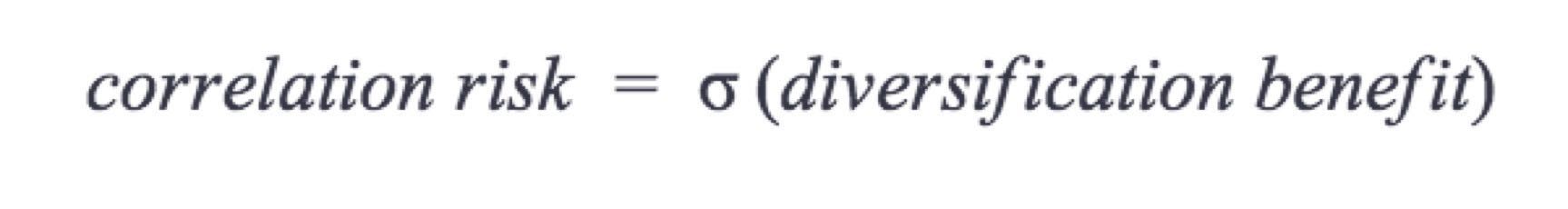

If the correlation between the two assets is always constant, then we will come to a constant diversification. However, the degree of relevance will change, resulting in changes in diversified returns. This then poses a risk to the portfolio or, more specifically, increases the risk of association.

We manage the correlation analysis by increasing the type of collateral. These new collaterals are either uncorrelated or negatively correlated. Our goal is to stabilize our diversified returns once we have enough unrelated collateral in our portfolio.

The MakerDAO system will use a variety of tokens as collateral. Or, the system will include as many unrelated tokens as possible. Unfortunately, it is easier said than done. We will continue to elaborate on this in the next step.

Risk management function

To understand how to manage the risk of association, we need to define the concept of bookkeeping and risk capital once. Bookkeeping documentation is a way to add assets to a portfolio. It has a variety of techniques to implement, but in general it requires you to keep your portfolio in a risk/reward framework until the final form is completed. Venture capital is the amount of loss that an organization is willing to tolerate in adventuring for the pursuit of expected returns. Venture capital is also known as economic capital. This will be detailed in the last article of this series.

The above concepts can be combined here. If you document a mortgage portfolio under a defined risk/reward framework, you will sacrifice your venture capital efficiency. Each collateral variety has its own stabilizing cost, which represents the return portion of the institution. For this stable fee, if the collateral variety contributes to the diversification of the portfolio and does not significantly affect the overall return, then it will be included in the portfolio. That is, whether it is included or not depends on the amount of risk capital it sacrifices.

Suppose an established level of risk capital, if we start with a small group of highly correlated tokens – this quickly depletes venture capital due to low diversification gains.

Ideally, you can build your mortgage portfolio smoothly, but the reality is cruel. Unlike the traditional stock market, we don't have many options, so we have to take advantage of the resources available at hand. At the current start-up stage, the asset correlation will be higher than the general asset portfolio level.

Responsibilities of Maker Holders and Maker Internal Risk Teams

Similar to the debt cap and clearing ratio model, the Internal Risk Team (MRT) creates a correlation model as a template to open to other teams and Maker Holders (MTH).

Feeding risk

Outline

Simply put, price and value are actually two different things. Price is the result of advertising, but its specific value is rarely reflected. This feature is particularly noticeable in the world of cryptocurrencies, and its decentralized trading system generates a large source of price information.

We have a number of techniques that can be used to identify a more representative representation of value from a wide range of price information. Despite this, the inherent or hidden risks attached to many of these techniques are yet to be assessed.

So how do we identify the quality of a source of information and its content? How long can this information source last?

The quality of the information obtained from a price source does not depend entirely on the accuracy of the visible transaction records in the market, as some transaction records may be misleading due to fraudulent transactions. If it is known that a transaction record is real and the source of information spreads the message in an appropriate manner – does this mean that the main function of the entity is to provide the source? If not, then this source will soon dissipate. Imagine if Bloomberg News suddenly disappeared tomorrow, what kind of situation the current financial world will fall into. Strictly speaking, this is actually a technical problem, but because of the huge load it carries, it is so large that it spreads out to every corner of the entire business system, including the financial and economic risk management part of the system.

Risk management function

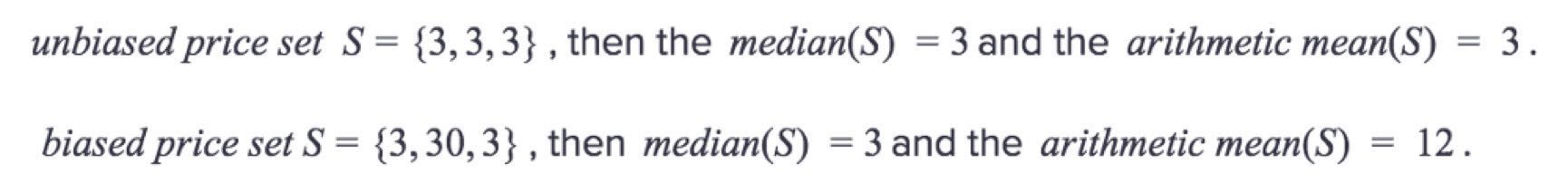

At present, the implementation of risk management is mainly through the review of multiple price sources, based on a delay mechanism to take the price median. The way in which the median is extracted from multiple sources ensures that when the price difference is too large, the results will not be too different. This is impossible to do with the average. The following set of deviations and the set of unbiased can prove this fact:

On the other hand, the delay mechanism mentioned only allows us to compare real-time prices with delayed prices. Based on this, we can have sufficient time to discover the attack behavior in the price and deal with it before actually using each delay price.

Responsibilities of Maker Holders and Maker Internal Risk Teams

The Maker internal risk team will first show the parameters and processes for managing the risk of feeding. They will continue to research and update methods and educate Maker holders through various channels.

Maker holders can vote on new predictors and feed options.

Economic capital and stability costs

Outline

What is economic capital? From the perspective of financial risk management, this is the capital risk that an entity is willing to undertake when seeking a return on capital, or how much it is willing to bear. Economic capital is also known as venture capital. That involves a decision-making process in this place, which is essentially related to the risk aversion of the agency's decision-making. The higher the risk aversion of an institution, the smaller the economic capital it will allocate.

The main design idea of the MakerDAO system is to try to prevent the liquidation of collateral enough to cover the remaining loans. Please note that the mortgage act itself is committed to the lender from the beginning, and the possibility of defaulting on the insolvency of the liquidation is extremely weak. Here, the so-called venture capital is involved. So the question is, how much capital do we have to place in order to maintain the operation of the entire system when the value of the mortgage is insufficient?

The events we are talking about here are tail events or stress events. These events are usually defaulted to be extremely difficult to happen, and to some extent can represent events that have never occurred before. The specific way to obtain economic capital is to calculate the expected loss value of the corresponding tail event. There was no absolute commitment during this period. All we did was to use collateral for risk coverage and then cover the long tail risk with economic capital.

Risk management function

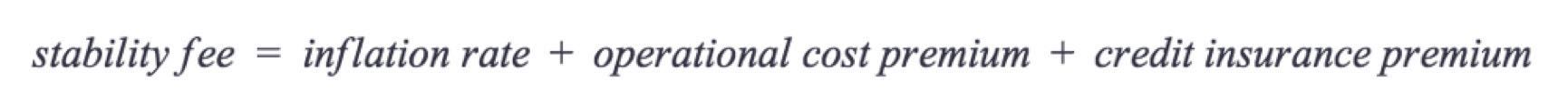

Economic capital represents the amount of risk an organization is prepared to bear, so what is its expected return? Each loan in MakerDAO includes a stabilization fee. The purpose of this fee is to help MakerDAO operate and maintain the stability of the entire system. The stabilization fee is like an interest rate, and an interest rate is generally composed of several components. To put it simply, an interest rate must be the purchasing power used by the compensatory party, so first it has to pay for inflation. The second component is the organization's operating expenses and some policy spending. The third is to compensate the insurance provided by the Maker holders previously mentioned for the system.

Traditionally, this should be a credit risk premium based on the credit quality of the lender. But in this system, credit risk has completely migrated to the collateral. Further, the traditional form also includes a liquidity preference fee to compensate for the extended loan with a high amount. However, this fee does not appear in the MakerDAO system because the period of the loan in the system is open.

In summary, credit stability fees can be simply viewed as the sum of inflation, operating expenses, and credit premiums.

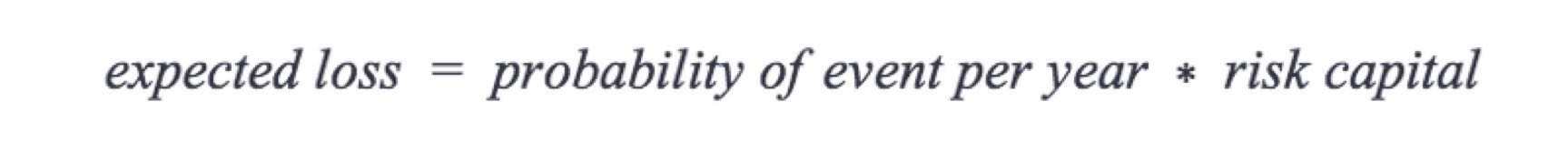

The credit insurance premium component is actually more applicable in the current context of this article. To put it simply, let's assume that inflation and institutional operating expenses are zero. Then we simply consider the stabilizing fee as a premium that provides insurance for the system when the collateral is insufficient. One of the ways to understand the stability fee is to consider it as the possibility of MakerDAO's own venture capital (based on several hypothetical scenarios that we will not elaborate). Another simpler way to understand it is to think of it as an expected loss. Assuming all risk capital is exhausted, then we can express the expected loss as:

So if we set a face value for venture capital – assuming $100, then the expected loss is $2.5 when the probability of a (loss) event is 2.5%. This $2.5 or 2.5% is the reasonable risk compensation for this part of the risk each year.

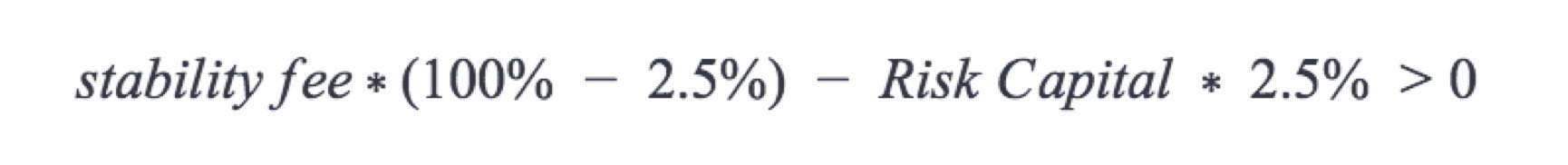

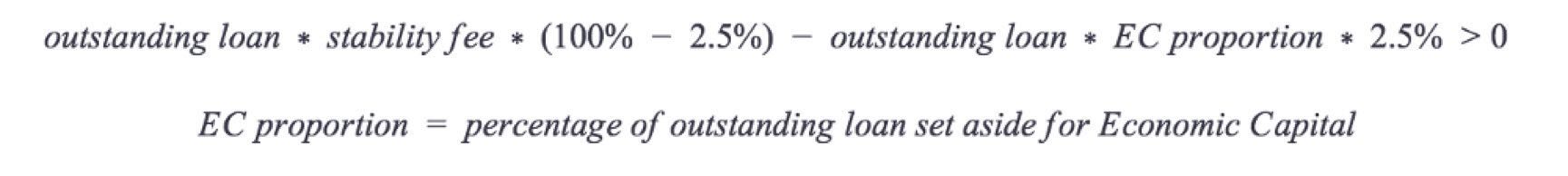

In this regard, we have well interlinked economic capital and stability fees through the above interpretation of probability. Remember, if we consider the stabilization fee to be a derivative of the probability of exhausting all venture capital, then we must also hope that our sale has a positive expectation, that is:

The upper inequality represents two events. The first is that if the default does not occur within a year, we earn a stabilization fee. The second is that a default occurs within a year, and we are therefore consuming all of the venture capital. Note that these two events in this scenario are logically mutually exclusive. Either default occurs when we use venture capital or it does not happen.

Assuming that the stabilization fee (ie, the probability of default) is 2.5% of the risk capital per year, then the equation can be solved:

Venture capital should be 97.5% / 2.5% = 39 times higher than the stability fee. The quick calculation (counting down) shows that the adjusted minimum risk return is 2.56% (2.5%/97.5%), which does not seem to be very attractive. In fact, there is still one missing item in the calculation here. Let's reshape the previous inequality and add an addition to it:

So our venture capital can be defined as:

The above shows that venture capital represents the portion of the loan that is not covered by the collateral. The previous inequality (Risk Capital < 97.5%) can be directly understood as risk capital must be less than 97.5% of the loan. Because what we have been pursuing is to let the collateral cover most of the risks. We hope that venture capital should represent a relatively small proportion of loan balances. Conservatively, this ratio should not exceed 8% to 10% of mortgages, and is far below the requirement of < 97.5% for venture capital. In fact, if we choose 10% and reverse the return value, then the risk capital adjustment return will be (2.5%/10%) 25% – a fairly attractive return ratio.

The economic capital formula is a top-down tool for calculating the corresponding stability fee for each mortgage. Further, it can also be used to assess the minimum stability fee for the entire portfolio. So far, the relationship between the diversified benefits and the associated risk factors we introduced earlier is clear. In fact, from the debt ceiling to the liquidation ratio, the correlation factor, and the economic capital, they are based on the important components of the MakerDAO system, and play a very important role in the continuous construction, management and analysis of the collateral combination in the system.

to sum up

All institutions in the market actually face a series of risks, or multiple levels of risk. As the second in a series of risk management frameworks, we focus our attention on the various inherent risks involved in the Dai supply side of the CDP system. That is to say, the risk of this level is directly linked to the power core of the MakerDAO system.

Responsibilities of Maker Holders and Maker Internal Risk Teams

Similar to other risk models, the Internal Risk Team (MRT) creates an economic capital and stability cost model as a template to open to other teams and Maker Holders (MTH).

So far, we have expressed these known risks through the system's risk parameters. The internal risk team and the responsibilities of the majority of Maker holders have also been listed above. We will publish more details on the system's primary risk parameter model in future articles.

The third part of the series, the Ultimate, will focus on some of the choices that Maker holders face. This article will detail the types of choices, from initial choices involving internal risk teams to general collateral category selection. The article will also explain the different voting content, as well as the expected voting time. The end of the article will explain how the entire risk program will operate under careful deployment and scientific risk management process management. All of this will be done through the donor community.

the third part

Introduction

In the final part of the governance risk framework, we will outline and introduce the responsibilities of MakerDAO system governance, and will combine the entire content to understand the actual governance cases using governance voting and execution voting.

The purpose of the governance system is to provide the best framework to ensure the stability of Dai. I hope to create something better than what Milton Friedman imagined, showing the truly decentralized e-cash in the computer bytes. Before we put the various parts together, we need to consider the concept of governance from the perspective of MKR token holders.

Governance describes how an organization should be controlled and describes who is accountable to the organization's stakeholders. Governance is the balancing of the most appropriate governance methods in theory and the most effective governance methods for organizations in different governance teams. The other difficulty is that not many people can clearly present the "best fit" model, let alone agree.

In fact, the complexity of governance depends on the level of understanding of the definition of “best” in the organization. The less obvious the definition, the more likely the group is to define it according to its own interpretation.

It is precisely because of the existence of these groups that a new trend has emerged. From seeking the best explanation in the competition to the "winners take all" mentality. The consequence of this trip is that people begin to pursue some support around the popular subjective interpretation, rather than open and critically objective debates. Begin to form special interest groups through lobbying activities to support their views. Lobbying seems to be the built-in function of such a system, and its appearance is not surprising.

It is not the emergence of a special interest group that is a bad thing. The danger is that the group may value “victory” rather than share an effective explanation of the situation and its impact. Therefore, the collective may be governed by the group with the most resources, not necessarily the one with the best direction.

These are not new issues, but there are no new solutions. Instead of circumventing these issues, MakerDAO re-architects the best way to solve these problems because it allows for a governance-scientific governance with the greatest chance of success.

Proposal and scientific rigor

As mentioned in the first part of this series, the proposal takes two forms: active and responsive. The positive proposal creates something new for the system, and the responsive proposal changes the proposal that the system has implemented.

Positive proposals are accompanied by time elements. This time reminds the cycle of the proposal and also suggests the law of the expected changes in the system. Positive proposals can be one-off and are usually related to the initiation of a governance system. Intermittent proposals are more relevant to the system's service providers, and the introduction of new oracles or risk teams is an example. The conventional proposal involves the structural maintenance of the system, which provides direct assistance to the stability and integrity of the system.

In addition, there are responsive proposals whose function is to respond to state changes in the system. The type of collateral in the system may have changed in terms of liquidity, so a specific debt ceiling needs to be changed. For mortgage types or the entire encryption system, volatility may have shifted to a different mechanism and the clearing rate may need to be changed as well. Basically, responsive proposals respond to changes in the system.

Regardless of the type of proposal, the content of the proposal is usually reviewed or based on scientific rigor. This ensures that voters who are governing need to decide “what is” rather than “how to do it”. A good example is the risk team. MKR token holders vote in the risk team through governance voting, agree with the model used by the risk team, and further agree with the products under the model.

The proposal was introduced into the community, then discussed, and finally placed on the governance level for discussion and voted on as necessary. This process is to ensure the maximum possible adoption of the proposal. This process is elaborated in the next section.

Proposal to vote through governance and vote

Both responsive and positive proposals need to go through a process of enhancing confidence. The review, digestion and resolution of the proposal are necessary for the system. The resolution was obtained through a successful governance vote, which indicated the general intent of MKR token holders. The resolution shows that the community that is governing is interested in passing the proposal in the vote to reduce the debate as much as possible before the proposal is actually deployed to the system.

If voting is a one-time positive proposal, such as adding a new oracle, you only need to vote for governance. There are two options for voting: yes or no. In the future, more graded votes and different hierarchical voting mechanisms may be added. There are also two options for executing a vote. This decision will determine if the state of the system has changed. Given that a resolution was reached through a governance vote in advance, we assume that the resolution will also be added to the execution vote – thereby increasing confidence in the success of the vote.

Time-based governance voting

Proposals that are open for governance voting will be reviewed for a period of time after submission. If a change is required during this time, the change will be made after resubmitting the proposal and resetting the review period. Vote after the review, accept the vote in favor or decline for a period of time, and the results of the vote will be recorded in the governance system. If the case does not receive enough positive votes, it will not pass, but will still be visible in the system and show the percentage of negatives. If for some reason the proposal cannot be voted, it may be returned. Either way, you can submit a new proposal and start the process again. In short, there are time limits for deliberation and voting. At the end of the voting period, the result with the most votes (yes or no) wins.

Executive voting is ongoing

The execution of the voting extension is to represent the state of the system. No matter what it is, the state of the system always exists. This means that the state of the system is continuously active and therefore requires continuous governance. In detail, assume that the MKR token holder has accepted the previous proposal, such as implementing a set of risk parameters that reflect the current state of the system. A competitive proposal for the system can be introduced at any time. If the MKR token holder disagrees with the competition proposal, they need to vote for the current state of the system, meaning they do not want any changes.

Since MKR token holders can submit new proposals at any time, the system needs to have strong continuity. The system needs continuous monitoring and governance, so it also needs a voting structure that reflects this need. The structure that MakerDAO deploys to meet this need is called a continuous approval voting system.

Continuous approval voting

One point to consider in governance is where MKR holders wish to store tokens. Tokens can be placed in three places: the first is a wallet, the second is a voting structure, and the third is a flow pool structure.

It is worth repeating that the MKR token is the governing token. Therefore, MKR tokens should always be in the voting structure, at least in theory. So the remaining question is, if the MKR tokens are not in the voting structure, where will they exist? Why is there there? This section will focus only on the voting structure, and the rest will discuss when tokens are not in the voting structure.

Let us use a thought experiment to clarify the process behind it. MKR token holders need to manage the system, establish the status of the system, and prevent any proposals that are contrary to the overall governance objectives. Imagine that all MKR tokens are in the voting structure, and one proposal contains most of the tokens—that is, this reflects the current state of the system. Therefore, the remaining tokens are distributed to a new set of proposals that will challenge the state of the system. Based on the overall distribution of tokens, it is clear that the current state of the system will remain the same as most token holders support the current state.

If the proposed proposal is clearly beneficial, its inherent value will be realized in the system. If the MKR token holder is aware of its value, most tokens will be transferred to this new proposal and selected as the new state of the system.

At this point, it is necessary to step back and think about how the new proposal represents the new state of the entire system. The first thing to remember is that if the proposal is supported by a majority, the changes described in the proposal will only be executed once. After that, the proposal became a "system status" proposal. Therefore, the new state of the system is presented in a way that changes it, and most of the MKR token holders in the new proposal represent the current state of the system and the changes required in the new proposal. In addition, in order to protect the current state of the system, MKR token holders must vote in this latest proposal that reflects the current state of the system.

We continue our thinking experiments, assuming that there are constant proposals to introduce the system. In order to properly manage the system, MKR token holders need to put tokens into the voting structure, either constantly representing the status quo or turning to new proposals to unlock their potential value. . This is a continuous approval vote. Persistence represents the current state of the system, which challenges and strengthens itself as it moves through the majority of votes between the new proposals required and the most recent successful proposal.

Responsibility value

The main feature of MKR as a token for managing tokens is that the holder is responsible for the operation of the system and is also responsible for his actions. The difference is that you are responsible for your actions. The motivation for motivating participants is to give them a say in the development and growth of the organization. If the governance is implemented correctly, it will increase the value of the token. If not, its value will shrink. Therefore, the system will pay attention to governance and further increase the value of tokens through good governance.

The previous section cites a thought experiment, and we assume that all MKR tokens are in the voting structure – the continuous approval voting system. In addition, it infers why all tokens in the voting structure are needed by using the case of submitting a continuous proposal.

Back to the case of no continuous submission to the system proposal, what does this mean for MKR token holders? Assuming that the balance has been reached, the system will not accept the new proposal. This means that the MKR token has extracted all the value from the proposal, and since no new proposal is submitted, its value to the system should remain the same. In terms of allocating capital for optimal use, MKR token holders may wish to transfer value to Dai in order to maintain maximum value from all proposals.

Transferring value to Dai is a specific clearing event and an instance of what happens in the liquidity pool structure. The liquidity pool represents all of the clearing carriers available to MKR token holders who believe that the MakerDAO system needs to be reallocated because it is in a state of balance and does not feel the system is further threatened. If the new proposal re-enters the system, the previous holders may enter the liquidity pool, regain their position in MKR and participate in the vote, either to help get value from the new proposal or to oppose it.

The MKR that the user deposits in the wallet reflects the maturity of the system. If the voting structure is not fully developed, unsafe, has no adequate liquidity, or is not liquid enough, the only remaining option is to place the token in a separate wallet.

In short, a perfectly developed, secure voting structure and a liquid MKR market should have only two options: deposit MKR tokens in the voting structure, or turn them into Dai. But the governance structure will never perfectly meet the standards of all holders, and a certain MKR will be stored in the wallet.

Core responsibilities of MKR token holders

The most important aspect that may be kept in mind in the voting system is that the passage of a vote does not limit the minimum number of people. In combination with the principle of minority majority, it should be clear that the primary responsibility of MKR token holders is to review all proposals entering the voting structure. In fact, the lack of a minimum number of people will motivate all MKR token holders to participate. A potential threat is that a opposing proposal can be passed when there are very few participants. In this case, it may be because the governance proposal is not clear or the holder is too indifferent. Either way, if a harmful proposal is passed, the governance security module must be started. If it proves that the proposal is indeed harmful or has caused a significant attack on the system, an emergency shutdown will be implemented before the proposal takes effect.

Now let's explore what the governance security module is, what to do, and understand the system's emergency shutdown feature.

Governance security module

Once the voting is passed, a delay period is established. The delay period is a major component of the governance security module. The code passed by the new vote is packaged by the module before being deployed to the system and enters the 24-hour final review period. During this time, all token holders can review the code, especially for token holders responsible for emergency closures. The purpose of the review is to ensure the integrity of the system, and if the code is considered to be harmful to the system, the system will close the code before deployment.

Emergency shutdown

If attacked, the system will shut down. An emergency shutdown is the ultimate protection of any intentional or unintentional behavior of a harmful system. The Governance Security module is an example of built-in security measures to protect your system from attacks. The predictive machine security module works in the same way, and currently combines multiple prices into one price to improve authenticity, but there is still no guarantee that the price offered is valid. In this case, the oracle security module will use the same measures as the governance security module and provide the system with the opportunity to shut down before the adverse price is enabled.

The main purpose of the emergency shutdown is to unify all incentives. As with anything, there will be an abnormal incentive. In these cases, if the abnormal stimulus is inconsistent with the main purpose of the system, the emergency shutdown function will start.

Responsibility of MKR token holders

The main purpose of MakerDAO system governance is to align the interests of all token holders:

- Governance needs to be aware of the trade-off between liquidity structure and voting structure incentives. MakerDAO will be a better system, if the value of a series of proposals in the voting structure is higher than the liquidity value of the token.

- Governance requires constant community involvement. Since there is no minimum number of requirements, the governance structure needs to be always involved to prevent non-representative votes that change the state of the system. It seems to be a better idea to set the minimum number of people from the beginning, but it has injected central authority. Specifying the minimum number of passers is a way of expressing the importance of voting. This is subjective. Any predetermined minimum number of people can only represent what is important to a person or group of people.

- Governance needs to be iterated. The system of stable currency Dai is based on scientific governance. The basic component of the scientific approach is empiricism, and empiricism states that we should always use data to verify or question hypotheses. In the end, the system will get better by constantly challenging and changing. Changes may first have significant marginal benefits and then gradually reduce to negligible marginal benefits. In the ideal case, the system is now in a stable equilibrium state. Structural adjustments will continue to occur, and this structural shift should be expected.

Governance in practice

Governance voting process: voting in new risk teams

The risk team builds a tool or set of tools to assess the risks inherent in MakerDAO. Tools created can focus on the entire risk process or one of its components. The team then demonstrates the functionality of the tool under a certain data set given a data set that is verifiable and easy to access.

In turn, the risk team provides this set of tools to the MKR token holder for evaluation. These tools can be accessed through advanced interactive web pages or simply by downloadable worksheets. It is important that the toolset includes all the necessary documentation.

The procedures required to vote in a new risk team are as follows:

- The risk team describes and displays the toolset, including interactions with MKR token holders and other risk teams.

- When the risk team is convinced that its tools are understood by the public, they should formally submit their tools.

- Sending the proposal to the voting structure means that the risk team should have some MKR tokens to submit such a proposal. The proposal will be submitted to the governance vote.

- The proposal enters the review period (two weeks) and can be discussed through the Maker social channel (Reddit, Rocketchat or an internally created board).

- After the review period, the proposal entered the voting period (two weeks).

- At the end of the voting period, if the proposal receives a majority of support, it means that the risk team will be accepted.

- Thereafter, the value of the risk parameter generated by the risk team will default to the parameter for performing the vote. This means that people do not vote directly on the parameters, but vote on the tool, and the parameters are introduced into the state of the system by the tool.

- If the MKR token holder finds that the value submitted to the execution vote is different from the data introduced by the tool: the vote will be rejected and the risk team may be removed from MakerDAO.

Execute the voting process: Vote on new collateral types and risk parameters

Adding a new collateral type to the system means that a new Dai may be generated. The new collateral type should be considered from two perspectives. The first is the potential it generates to create a new Dai, and the second is the stability it brings to the system. A qualitative assessment of the organization of the collateral token can indicate the robustness of the collateral and provide insight into the level of stability it may contribute to the system. A quantitative assessment of the tokens shows the risks faced by the secondary market trading tokens and the amount of collateral tokens that should be available in the system. Such an assessment will indicate the potential amount of Dai that may be generated by the token and the market risk of the token.

There is a governance vote before each execution of the vote. The order in which governance votes are:

- The type of collateral will be submitted in the form of an individual or a group of risk teams, including qualitative and quantitative assessments of the type of collateral.

- The risk team or team that submitted the submission will formally submit a proposal to accept the mortgage type into the system.

- The proposal will go through a general review period (two weeks) and will enter the voting period (two weeks) if there is no obvious dispute.

- At the end of the vote, if a majority vote is obtained, the proposal will be passed.

The order in which votes are executed is as follows:

- Update information on the qualitative and quantitative assessment of collateral types and publish them again.

- The risk team submitting will submit a proposal containing the nominal value of the collateral type on the quarterly voting date.

- Since the proposal is a continuous approval voting system, the proposal requires a majority vote.

- Once the proposal becomes the dominant proposal with a majority vote, it will be launched immediately.

- The governance security module will start with a 24-hour delay before the code is deployed to the blockchain. This is the last security structure to determine code security.

- Deploy the code to the blockchain and change the state of MakerDAO.

At this point, the new collateral type can be used freely as a collateral for the issuance of Dai, a process involving different types of voting structures.

At the end of this article, I will discuss the expected governance decisions to launch the multi-collateral Dai system.

Summary: Next Steps

Governing a MakerDAO system is similar to managing a large ecosystem. Some inherent features help to govern the system, and some need to rely on the governing body. In any case, the system-related information will be smooth and continuous, requiring constant evaluation and governance. MKR token holders must fully understand their responsibilities and the benefits of managing the MakerDAO system.

Launching multi-mortgage Dai is the focus of the Next Steps, including:

- The internal risk team is approved through a governance vote to vote in the collateral type and risk parameters. (Implemented before the main network is released)

- Realization before the main network release: Approve the initial list of collateral types through governance vote to vote for and deploy risk parameter values. (Implemented before the main network is released)

- Realization before the main network is released: By performing a vote, the value of the risk parameter of the approved collateral type is voted. (Implemented before the main network is released)

As far as actual governance is concerned, we still need to understand other aspects. The first is the actual tool for calculating risk data and the way to build a collateral portfolio as a whole. Second, how to aggregate the risk data of the risk team and deploy it to the system. We'll cover this separately in two other documents. At present, the risk data has been deployed and the necessary approvals are in place, and the complete system deployment will be initiated rigorously, which will be a new chapter for the governance system.

Compilation: Guan (Part 1)

Proofreading: Pan Chao (Part 1)

Compile: First Class App (Part 2)

Source: MakerDAO

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Looking at the gold content of blockchain stocks through the annual report: None of the business revenues disclosed, nearly 50% stayed in the study

- Analysis: Why does the DAI target interest rate feedback mechanism fail?

- Bitfinex black box operation "wearing", BTC slams and detonates panic

- Bitfinex and Tether colluded to use the USDT reserve to cover $850 million in losses? New York Attorney General’s Office has something to say

- Popular Science | 7 Steps Getting Started Blockchain

- Quote analysis: Are you in a hurry to leave? May be a trap

- Market Analysis: Mainstream currencies are retreating across the board. Can BTC hold the $5,000 mark?