2020 "Yield Reduction" Year, Surprise or Fright?

Text | 嚯 嚯

Edit | Sword

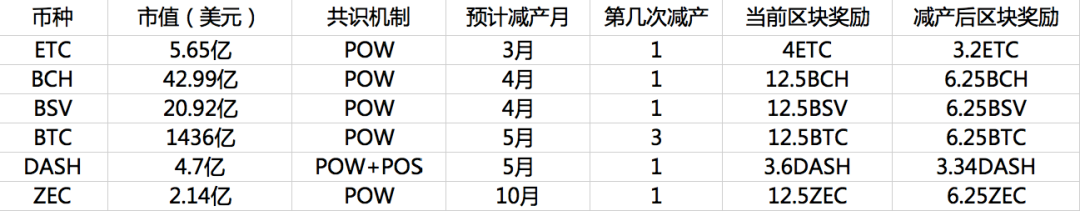

2020 is a year of concentrated outbreaks of "reduction in production" of the cryptocurrency native network. In March and April, ETC, BCH and BSV will enter a halving cycle; in May, the highly anticipated coin king BTC cuts production, and DASH also cuts production this month; in October, the production reduction will continue to ZEC.

- "Secret" in the Cloud: Building Non-Interactive Zero-Knowledge Proofs — Exploring Zero-Knowledge Proofs Series (5)

- Perspectives | Re-analysis of Private Chain and Alliance Chain Concepts

- European Securities and Markets Authority to introduce digital currency legal framework to address growing cyber threats to retail customers

Except for Bitcoin, several other mainstream crypto networks have halved their mining rewards for the first time. From the past price trend of BTC, after each halving, its price will rise. However, if the current currency price is estimated, the cost of BTC miners will double in a short time after the reduction in production. On the eve of the cut, each miner will face a "gamble", and the key to winning is the rise of Bitcoin.

The founder of Tiger Wallet Wang Ruixi believes that the reduction in production does not constitute a sufficient reason for a certain currency to rise. He told Hive Finance, "One of the factors affecting the price of bitcoin is supply. In fact, in a fully free market, it is difficult for us to judge the change in the relationship between supply and demand."

"After all, it takes four years to catch up to a bitcoin reduction of half a year. I plan to adjust the monthly pocket money from 3,000 yuan to 6,000 yuan." On January 9, Weibo user "Bitpie Wallet" increased the number of bitcoins. The currency investment has resonated with many commenters.

There is still about 4 months before the third block reward of Bitcoin is halved. According to the estimate of Bitcoinblockhalf.com website, as of 18:00 on January 9, there are 124 days before the third half of Bitcoin is halved. Half-time is expected to be at 6:30 on May 13, 2020. On Huobi Global, the current BTC quote is $ 7,900.

In simple terms, "halving" refers to "block reward reduction", and Bitcoin has cut production twice in history. The first occurred on November 28, 2012. The block reward was reduced from 50 BTC to 25 BTC, and the BTC quote was halved at $ 12.22 on the day. One year later, on November 30, 2013, the price of BTC reached its highest point of $ 1,175 after the first halving for 367 days.

The second halving took place on July 10, 2016. The block reward was reduced from 25 BTC to 12.5 BTC, and the BTC quote was $ 648 on the day of the halving. On December 16, 2017, BTC set a new all-time high of 19,891 US dollars for 525 days.

Looking at the long-term trend, after each halving, the price will rise, and the cycle to reach the peak is also lengthening. Generally, prices are determined by market supply and demand. Halving the reward once every four years will undoubtedly break the original supply and demand balance of the currency and stimulate the rise of the currency price. In August last year, Litecoin took the lead in reducing the production of mainstream currencies. From the low of 22 US dollars at the beginning of 2019, it soared to a high of 145 US dollars on June 22, an increase of more than 500%, which temporarily led the currency market.

Much like the Football World Cup, which is held every four years, bitcoin's production reduction is also a major event in the currency circle, awakening fanaticism and shouts. Unlike previous sessions, in addition to Bitcoin this year, other mainstream crypto-asset networks such as BCH and ETC will also embark on a journey of reducing production, all of which are halving for the first time.

Among them, the block rewards of Ethereum Classic (ETC) in March will be reduced from 4 to 3.2; in April, the block rewards of BCH and BSV will be reduced from 12.5 to 6.25; in May, the block rewards of DASH will be reduced from 3.6 Reduced production to 3.34; in October, ZEC's block rewards will be reduced from 12.5 to 6.25.

Therefore, some people refer to 2020 as the "outbreak year" of halving crypto assets.

Six major currencies that are about to reduce production in 2020

Guo Hongcai, an investor who has twice experienced Bitcoin halving, told Hive Finance that among the digital currencies that are about to reduce production this year, he is still looking forward to Bitcoin. "Only the price of Bitcoin will be halved, and other altcoins will be reduced It may not go up, but for Bitcoin, my idea is simple: just go up and go up. "

Liu Changyong, director of the Blockchain Economic Research Center of Chongqing Technology and Business University, also held the same view. He told Hive Finance that the reduction in production of currencies with smaller market capitalization had little effect on prices, because the substitution was too strong, the price rose slightly, and the capital May flow to other currencies, "The key is that Bitcoin is halved."

Although the industry is generally optimistic about the market outlook for reduced production, no one can guarantee the rise. If the current currency price is estimated, the cost of miners will double in a short period of time.

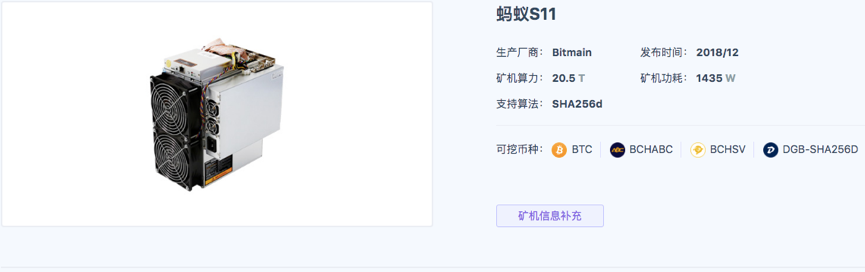

Based on the calculation of the ant mining machine S11, the theoretical return of S11 at 20.5 T is 0.00037351 BTC per day, which is 21 yuan per day (BTC is calculated at 7900 USD). Assuming that the electricity cost is 0.5 yuan per degree and the power of the S11 miner is 1435W, then the electricity cost of S11 is 17.22 yuan per day. This means that the current daily income of the Ant S11 miner is 3.78 yuan.

If the price of bitcoin remains at $ 7,900 after reducing production, miners using the Ant S11 miner will lose 6.72 yuan a day while the mining difficulty remains unchanged.

Therefore, some media have predicted that in May, after the reduction of Bitcoin production, "an unprecedented mining disaster" will occur, and even 2020 will be regarded as the "year of life and death" of mining.

On December 23, 2019, LongHash, an encrypted data analysis platform, stated in the article "How Bitcoin halving leads to mining disasters". Because people generally expect "Bitcoin halving to drive prices up", many people have joined the mining industry and bought Mining by mining equipment, this will cause Bitcoin's hashrate to continue to grow. According to the article, according to historical records, there is no direct correlation between the price of bitcoin and halving, but the continued increase in computing power has increased the cost of mining for miners.

On January 6, this year, the mining machine giant Bitmain lay off workers on a large scale. Some media said that "1/3 of the staff will be optimized." A person familiar with the matter revealed that one of the reasons for Bitmain's layoffs was related to the halving of Bitcoin in May this year. The founder Wu Jihan was not optimistic about the halving this time, and the company streamlined "winter."

In the anxiety, some miners were optimistic. "As long as the price of coins rises, don't worry."

In addition, many people in the industry have previously expressed predictions about the price of Bitcoin. PlanB, a well-known Twitter crypto analyst, speculated based on a macroeconomic model that when Bitcoin is halved in 2020, its price is expected to exceed $ 10,000, and may even exceed $ 100,000.

On March 1, 2019, Ethereum completed the "Fort Constantinople" and "St. Petersburg" hard forks. The upgrade involved five different improvement plans (EIPs). The block reward is reduced by 33%, from 3ETH to 2 ETH. On the day of the production reduction, Ethereum quoted USD 135.33. Three months later, it reached the highest value of USD 366.5 in 2019, a 170% increase from the price of the day of production reduction. Later, a downward trend was started. As of now, 9 months have passed since the first production reduction. It was stable around 138 USD, close to the currency price on March 1.

In 9 months, Ethereum after production reduction shows a downward V trend

According to Wang Ruixi, founder of Hufu Wallet, one of the factors affecting the price of Bitcoin is supply. With constant demand, a reduction in supply will naturally increase prices. He told Hive Finance that a halving in 2020 would be a small percentage of the market's supply reduction. "In fact, in a fully free market, it is also difficult for us to judge the change in the relationship between supply and demand." He believes that the halving does not constitute a sufficient factor for Bitcoin to "must rise."

"Based on the characteristics of Bitcoin, the demand will become stronger and stronger, and the bubble will continue." Wang Ruixi believes that 2020 may be the "darkness before dawn". On the whole, the advantages for practitioners outweigh the disadvantages.

Expectations and worries are like two sides of a coin. The same is true for Bitcoin halving. It is the judgment of many industry veterans to treat the halving event cautiously and rationally.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- People's Daily: Guangdong Financial High-tech Zone-Introducing "Blockchain" and Strengthening "Jinkechuang"

- How are overseas blockchain developments? We analyzed 34 blockchain companies at the 2020 CES show

- Review | Digital currency DCEP is about to test why central bank issues digital currency

- Perspective | Why is 2020 so important to digital currencies?

- Is there any chance here? A true blockchain startup story

- Zuckerberg releases 10-year vision, talks about "decentralization", without mentioning Libra

- Exclusive interpretation: frequent high-level voices, what is the IMF's attitude towards central banks' digital currencies?