A paper on how cryptocurrency reforms the traditional derivatives exchange clearing mechanism

Author: Hasu, Arthur

Source: Chain smell

This paper analyzes the various clearing mechanisms used in different cryptocurrency derivatives exchanges and their differences from traditional derivatives exchanges. Finally, it concludes that cryptocurrency is a breakthrough technology that has rapidly changed the trading environment. Compared with traditional financial market exchanges, it reduces the barriers to entry for a larger customer base.

We analyzed the various clearing mechanisms used in different local cryptocurrency derivatives transactions and their differences from traditional derivatives exchanges. We believe that cryptocurrency derivatives exchanges have introduced long-awaited trading innovations that have created tremendous user freedom. However, they are not without special risks.

- Digital currency of Chinese listed companies (middle)

- Ten experts took turns to accept Meng Yan's sharp question: How many points do you give to the development of the current blockchain?

- What is the SEC thinking about Crypto compliance?

Clearing in traditional markets

The Chicago Mercantile Exchange (CME) is the world's largest derivatives exchange. It also offers BTC futures contracts in various types of traditional financial instruments. However, the trading specifications for these contracts are completely different from those in the local cryptocurrency derivatives exchange.

CME's BTC futures contract requires approximately 40% initial margin and the transaction is only open Monday through Friday. The contract size is 5 BTC and is currently around $40,000. Users need to establish good relationships with futures brokers who are allowed to trade on CME and who can liquidate products on the CME.

why is it like this?

Brokers must be selective to the customers they accept because all of the transactions their customers make in the market pose a potential risk to their capital. When the trader's net asset value falls below the maintenance margin, the trader will receive a margin call and be required to raise the account's initial margin level to the highest level. This amount is called a change deposit.

If the change deposit is not paid in time, the broker will begin to manually liquidate the trader's position. However, if the account reaches a negative asset before the liquidation is completed, the trader will still bear additional losses.

Failure to pay will result in bankruptcy proceedings. If the bankruptcy fails, the broker must use his own funds to cover the amount of the debt.

Clearing in the cryptocurrency market

Cryptographic currency derivatives are a new class of financial instruments with unique market dynamics. Therefore, exchanges established specifically for cryptocurrency transactions have redesigned many of the processes and specifications typically used in traditional exchanges.

These differences are very obvious. Unlike CME, there are no brokers on the local cryptocurrency derivatives exchange, margin requirements are between 1% and 10%, and are ranked according to the trader's position size. Trading 7 * 24 hours a day, 7 days a week, and the minimum contract size can be as low as $1. Users are also not required to have a certain identity or credit in the real world, and the KYC policy (that is, to fully understand your customers) is mainly for regulatory reasons. Margin collateral is cryptocurrency.

These changes have eliminated many entry barriers and made the cryptocurrency derivatives market more attractive to a broader customer base.

How to achieve these improvements?

Currently, the total market capitalization of all cryptocurrencies exceeds $250 billion. It is still relatively small compared to other asset classes. However, the volatility of cryptocurrencies makes cryptocurrency holders increasingly in need of management risk, and derivatives are an ideal tool to solve this problem. The demand for cryptocurrency transactions has continued to grow and has led to huge liquidity in the cryptocurrency market, which in turn has reduced costs. The simple registration process also makes acquiring customers cheaper than traditional financial markets. However, the lack of user credit and a small contract size means that the exchange must automatically process the liquidation.

How does automatic clearing work?

If the market exceeds the bankruptcy level of the account, the loss of the trader's position may be greater than the total margin collateral. This often occurs in the cryptocurrency market due to high volatility.

As you can see from the example above, if the BTC price falls below Alice's clearing price before the position can be liquidated, Alice loses not only the transaction collateral ($7,500). If Alice and Bob contract directly with each other, Bob's profit will be less than he expected.

We define liquidation as the following event: When the account's margin balance is lower than the maintenance margin, the risk engine automatically lowers the trader's position.

If the price reached by the engine is higher than the bankruptcy price, we believe that the liquidation is successful. Otherwise, we think it is unsuccessful. Exchanges also don't want to liquidate positions prematurely because they can frustrate their traders and may cause them to suffer unnecessary losses.

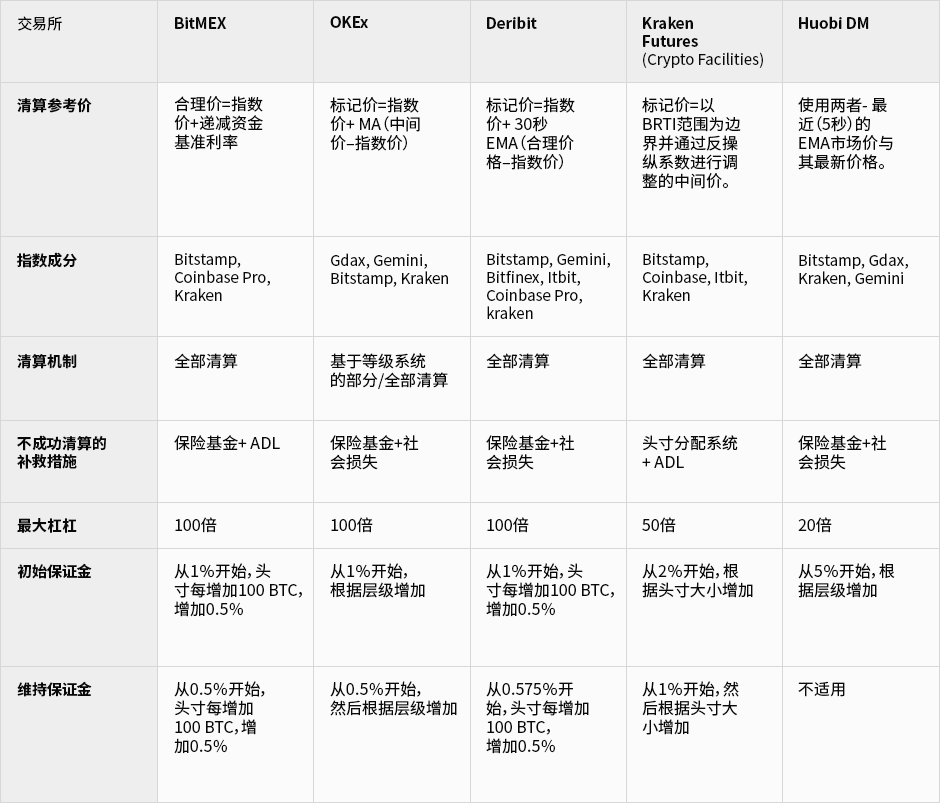

The following is a comparison table of all transactions related to clearing treatment:

Incremental clearing, also known as partial liquidation. In the case where partial liquidation can ensure that the margin balance is higher than the required maintenance margin level, the position will be liquidated in stages to avoid unnecessary losses.

Once the trader's margin balance is lower than the maintenance margin, all will be liquidated and the trader's position will automatically fall to zero equity.

ADL stands for Automated De-Leverage, which occurs when a trader's opponent closes a position at the bankruptcy of the liquidated trader.

Social loss is also known as recovery. Refers to the loss of position of a trader who has not successfully liquidated to all profit traders of the contract.

Position allocation, also known as liquidity support. The designated liquidity supplier takes over the position close to bankruptcy.

An insurance fund is a designated reserve fund used to cover the negative assets of a trader's position that has not been successfully liquidated.

Currently, most cryptocurrency derivatives exchanges use adjusted index prices as clearing reference prices. Both the index and the liquidation reference must be calculated to be resistant, so that high amplitude outliers do not trigger bad liquidation. For example, Deribit calculates its index by continuously retrieving intermediate prices from seven index components and excludes the highest and lowest values. In addition, the mark price is used as the clearing reference price. The mark price is the index price adjusted by the 30 second EMA of the difference between the reasonable price and the index. This mechanism is used to avoid price collapse, and there are often price breaks in other exchanges that only use future prices as reference prices. In a special case at Okex, a large trader only fired a market order during a very liquid day of the day, triggering a series of liquidation, which fell from $7,000 to $4,600. At the same time, the BTC price in the spot market never fell below $6,300.

Does the adjustment of the liquidation reference price solve the problem of false triggering liquidation?

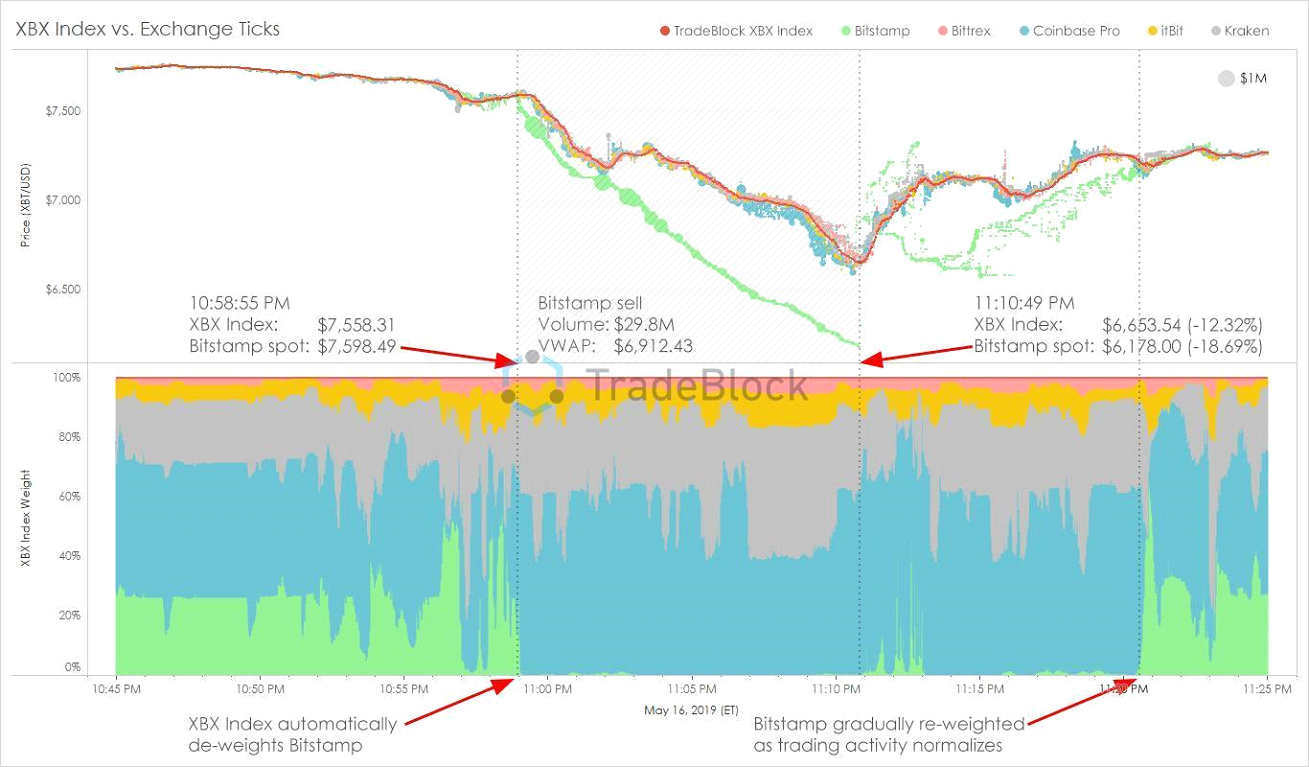

May 17, 2019: 20% of lightning plummeted

On May 17, at 2:30 am GMT, Bitstamp suddenly suffered selling pressure of 4,300 BTC. This is about one-third of Bitstamp's average daily trading volume in previous weeks.

Source: Clark Moody & Lowstrife

Source: Clark Moody & Lowstrife

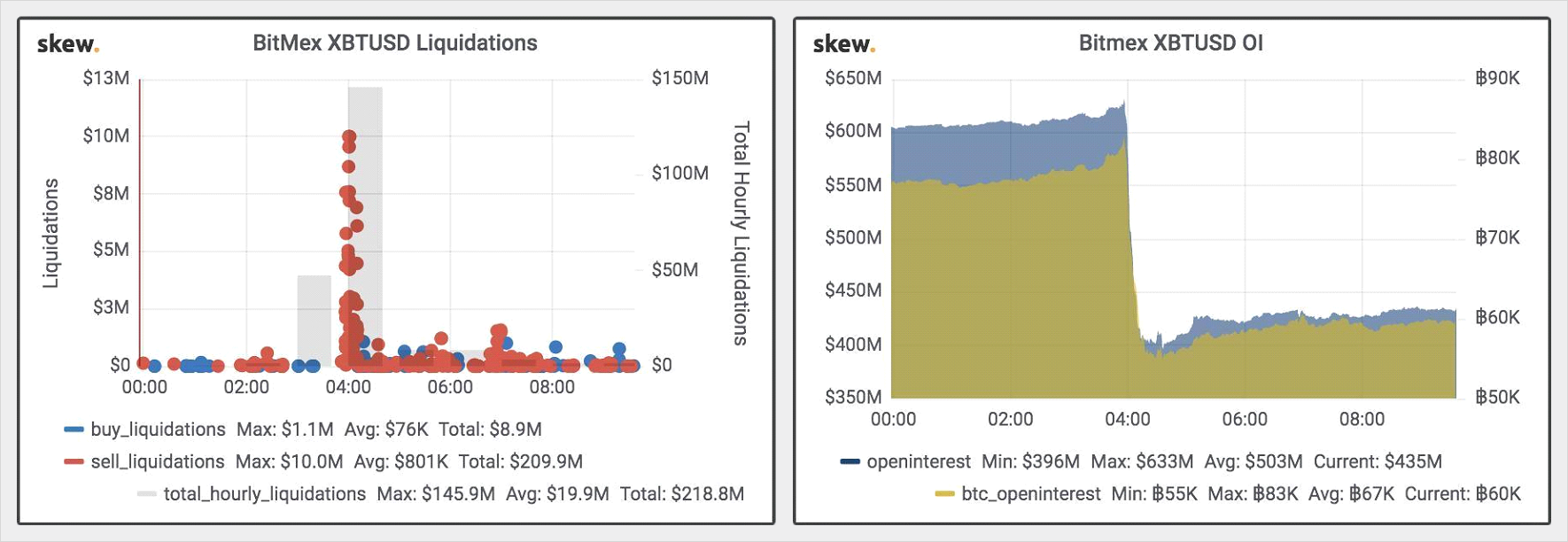

On BitMEX, more than $230 million in positions were closed, resulting in a reduction in open positions from $630 million to $400 million.

At the time, Bitstamp accounted for half of the BitMEX index. However, BitMEX's own trading volume and open interest are much higher than their underlying spot exchanges.

Traders noticed this and established a large short position on Bitstamp, and then the price drop on BitMEX triggered the liquidation of other people's long positions.

A local $30 million BTC sell-off triggered another $230 million in liquidation. This shows the profitable nature of such triggering events.

Source: Skew

Source: Skew

What is a defense mechanism and why do they fail?

In the absence of trading restrictions, arbitrageurs can buy on Bitstamp and sell at higher prices on other exchanges (such as Coinbase Pro, Kraken and Bitfinex). By redistributing asset flows between unaffected exchanges, the impact of large-scale selling on the price of an exchange will diminish.

In fact, no one can get enough balance of the currency on Bitstamp to absorb the selling pressure. The arbitrage of cryptocurrency is a strategy that depends mainly on the effective management of working capital. Arbitrage traders do not hold a large amount of fiat money in the exchange to wait for a sudden collapse. In addition, the average confirmation time for BTC transactions has been increasing, limiting the ability of arbitrageurs to transfer tokens from Bitstamp to other trades for quick sale. And even if they do, they can't transfer the dollar back to Bitstamp fast enough to make a new loop.

The cryptocurrency derivatives market is affected by the fact that strong brokerage products are not readily available and arbitrageurs are unable to trade in mispricing. Two solutions that already exist today may be helpful: leveraged spot trading and cross-exchange joint transfer of BTC.

If the second BitMEX index component is Bitfinex (a spot exchange that offers up to 3 times leverage), arbitrageurs will be able to quickly offset the selling pressure by using their token collateral, and such an attack will be ineffective. In addition, if there are more exchanges on the Liquid Network, arbitrageurs will be able to immediately transfer BTCs between their different exchange accounts.

Arbitrage plays a vital role in ensuring market efficiency. Therefore, the design system that the exchange optimizes according to their needs is crucial.

Potential improvement of the clearing mechanism

Cryptographic currency transactions are rapidly evolving, and major exchanges have implemented some meaningful liquidation adjustments.

Build a more robust price index

We compared the minimum price of a BTC permanent contract reached on different exchanges during a flash crash:

In contrast, the lowest price reached by the major Bitcoin index price providers:

During the power outage, the minimum price for a BitMEX XBT permanent contract is:

- Lower than the average minimum price of the other four sample derivatives exchanges by $251 or 3.78%

- $267 or 4.01% lower than the average minimum price of the institutional sample Bitcoin index for 3 samples

This suggests that more adjustments in exponential components and outliers can significantly improve the exchange's ability to defend against market manipulation. In addition, third-party index providers continue to implement more advanced index calculations to ensure they are less susceptible to manipulation.

As the number of index components increases, outliers can be determined and excluded. This is a relatively simple method. However, this greatly increases the cost of market manipulation. In our example, this is done by Deribit and OKEx. It can be seen that all exchanges that do not include Bitstamp or incorporate counter-measures into their index calculations have significantly reduced the number of liquidation, thus protecting the user's funds.

The table below shows the difference between the lowest price of the TradeBlock XBX index on May 17, 2019 and the price of Bitstamp.

Source: TradeBlock

Source: TradeBlock

Incremental clearing VS all clearing

Compared with all liquidation, users benefit from incremental clearing. In the case of gradual liquidation, the probability of another liquidation after a liquidation trigger is drastically reduced. This makes the rewards of triggered attacks much lower, because the $30 million sell order on Bitstamp now only triggers a small portion of the total liquidation of $230 million.

There are many forms of incremental clearing. When the margin balance is higher than the maintenance margin, Deribit will gradually liquidate the position with a step of 12.5% of the position and stop the clearing agreement. This prevents the trader's position from being fully liquidated in the event of a price anomaly, after which the market resumes immediately. As a result, Deribit has never socialized its losses during its three years of operation.

OKEx has also turned to a partial clearing mechanism that has shown pleasing results. Depending on the size and level of the position, the position is either reduced to the lowest level or all cleared. Since the introduction of this liquidation mechanism, they have not suffered social losses despite the large fluctuations in the platform.

It is important to note that there is no concept of full liquidation in traditional financial markets. The broker manually reduces the client's position to a level above which the balance exceeds the maintenance margin, but does not close the position. We believe that there is currently no sufficient reason for the Exchange to continue to use all liquidation and that incremental clearing should be the industry standard.

Trading restrictions and circuit breakers

In many stock and futures markets, sudden and sharp increases in prices may trigger trading restrictions. Each exchange calculates an acceptable price change and sets a price limit that should stop trading. These limits are called circuit breakers and if the price suddenly exceeds these limits, the transaction will be stopped. During this period, the transaction is in a cool-down period, and users can release and cancel orders as needed. After this period ends, the transaction will resume. These restrictions were introduced to avoid a lot of selling.

If Bitstamp or BitMex uses a circuit breaker mechanism, the trade will be suspended and the trader will have more time to process the market information and cancel or place the order accordingly, thus reducing the impact of the sell-off on Bitstamp.

Insurance fund

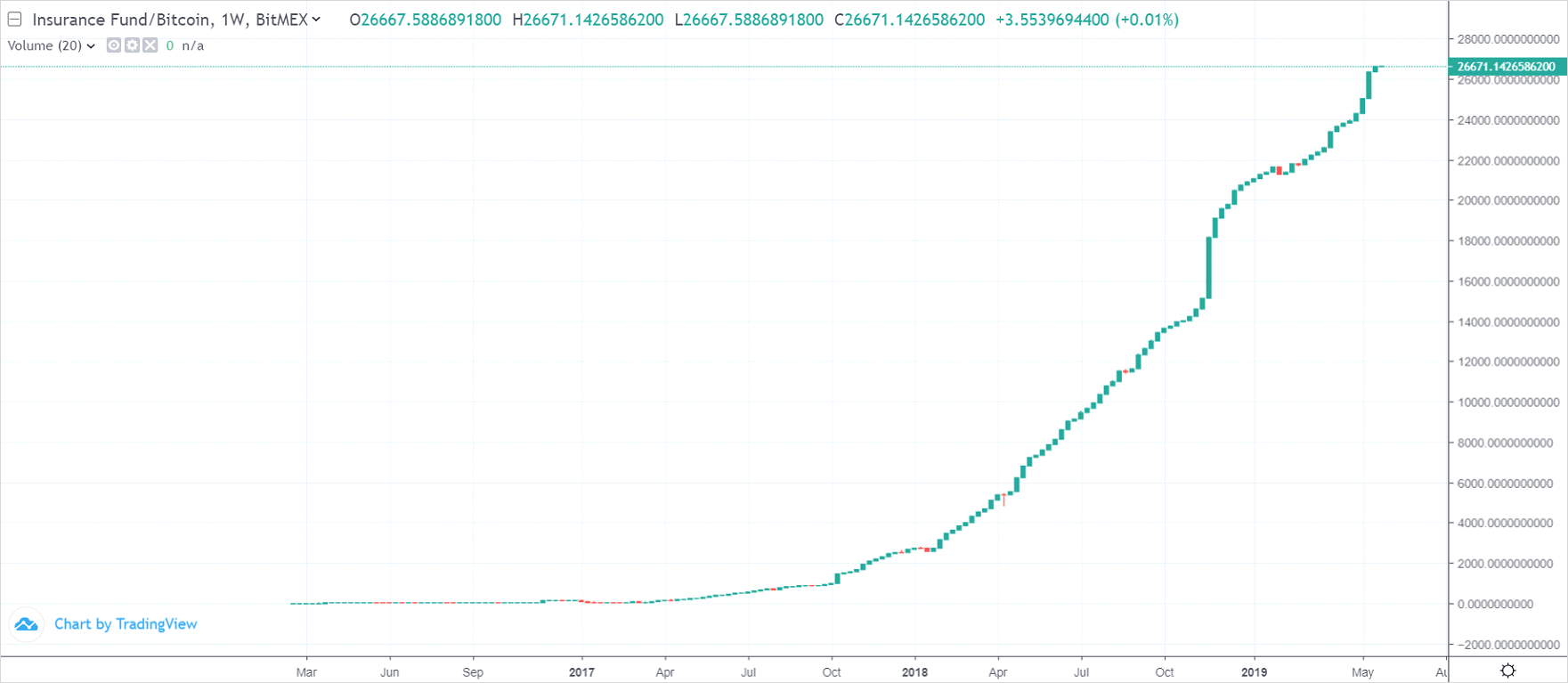

Insurance funds account for a certain amount of expenses for large position holders. However, how to manage these funds is uncertain. Since insurance funds are owned by exchanges, they may be used as another source of income rather than as a trader's insurance mechanism. An example is the BitMEX Insurance Fund. Its large amount is considered to be a necessary condition for achieving the necessary expenditures during periods of high volatility. Despite this, on May 17, the BitMEX Insurance Fund increased by 750 BTC, one of the highest and best days of its history.

However, there are other options for the insurance fund system, such as position allocation systems, also known as liquidity support systems. In this case, the designated market maker will take over the position of the liquidated trader at the bankruptcy price. Even though this strategy is not as safe as an insurance fund, and its success rate varies by market conditions, it can also be used as an additional layer in the liquidation process to make it more customer-friendly.

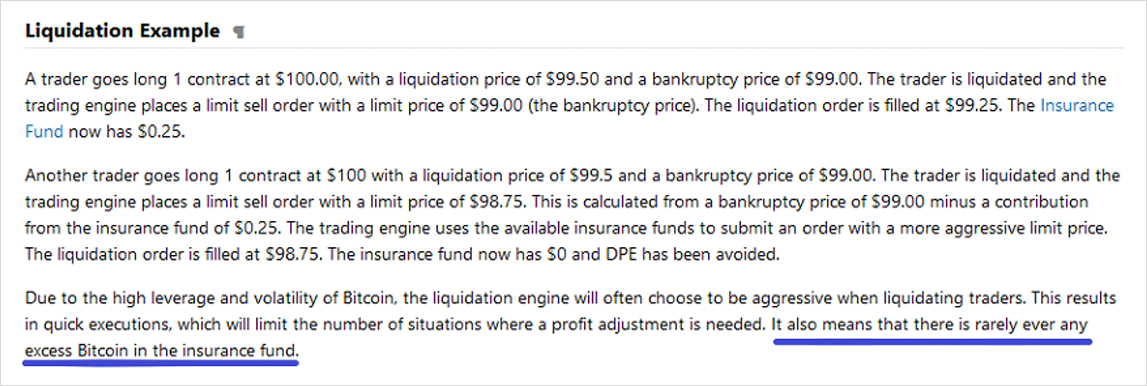

Even if a large-scale insurance fund adds a layer of security, too many insurance funds may indicate that the clearing mechanism is too radical. Under an exchange-owned insurance fund, an exchange may no longer be motivated to innovate, such as a partial liquidation or a more resistant price index. When BitMex first invented the insurance fund, it predicted that "there is almost no excess bitcoin in the insurance fund." Looking at the chart of the insurance fund, we can say clearly that there is excess bitcoin today.

Liquidation example

The trader buys a long contract at $100.00. The liquidation price is $99.50 and the bankruptcy price is $99.00. The trader is liquidated and the trading engine places a limit sell order with a price of $99.00 (bankrupt price) and the clearing order is made at a price of $99.25. There is now an insurance fund of $0.25.

Another trader sold a long contract at $100, with a clearing price of $99.5 and a bankruptcy price of $99.00. The trader is liquidated and the trading engine has a limit sell order with a price of $98.75. This is derived from the bankrupt price of $99.0 minus the insurance fund's increment of $0.25. The trading engine submitted a more aggressive price limit using the available insurance funds. The clearing list is executed at a price of $98.75. The insurance fund now has $0, avoiding DPE.

Due to the high leverage and volatility of Bitcoin, the clearing engine usually chooses a more aggressive approach when liquidating traders. This will result in a quick execution, which will result in limiting the amount of profit that needs to be adjusted. This also means that there is almost no excess bitcoin in the insurance fund.

Source: BitMEX

in conclusion

Cryptographic currency is a breakthrough technology that has rapidly changed the trading environment. Some highly innovative and successful companies have been established. These exchanges have successfully met the needs of users and have reduced entry barriers for larger customer segments compared to traditional financial market exchanges. Derivative transactions can now be seamless, global and uninterrupted.

Market participants are becoming more sophisticated and demanding service levels are getting higher and higher. In cryptocurrencies, as in traditional financial markets, customers vote with money. Exchanges that can make users more interested or more relevant to the user's interests will thrive.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- He lost 4 bitcoins due to operational errors. Is the lightning network rule too strict?

- Read the cryptocurrency wallet pattern and future development

- The future of credit, currency and digital currency

- Gartner: Blockchain is listed in the top ten strategic technology trends of 2020, against one of the highlights of deepfake

- 2019 Will it be the "year of DAO"? A text on the past and present of the centralized autonomous organization

- Google claims to achieve "quantum hegemony", IBM, V God, Bitcoin developers have come to refute

- Dutch International Group (ING) Releases White Paper: Corda Blockchain Security and Privacy Improvement Solution