Why do I say that the encryption market is far from cool?

Author: Qin Xiaofeng

Source: Planet Daily

The OKEx market shows that on June 27 this year, BTC hit a high of the year, close to $14,000. Then the price began to decline, and the lowest fell to around $7,700, with the biggest drop of more than 45%.

In the past month, the price of BTC has been hampered by the downtrend line. However, at 20 o'clock last night, the market turned sharply, and BTC briefly fell below $7,300.

- A paper on how cryptocurrency reforms the traditional derivatives exchange clearing mechanism

- Digital currency of Chinese listed companies (middle)

- Ten experts took turns to accept Meng Yan's sharp question: How many points do you give to the development of the current blockchain?

(BTC daily chart from OKEx)

As of press time (about 16:30 pm on October 24), BTC quoted 7450 US dollars, the cumulative increase since this year is only 98%, other mainstream currencies have not performed well this year: LTC (+61%), BCH (+ 34%), ETH (+19%), EOS (+5%), XRP (-22%).

The sluggish market has also caused many people to sigh: Encrypted winter has arrived, it is time to store grain for the winter.

However, the author believes that the following data shows that there is still hope in the market, and the winter is far from coming.

1. Admission of funds, stable currency is still in issue

For the market, the stable currency is an important channel for the deposit of the French currency. The additional issuance and destruction can reflect the flow of funds to a certain extent: the additional issuance means the inflow of funds, and the destruction is the outflow.

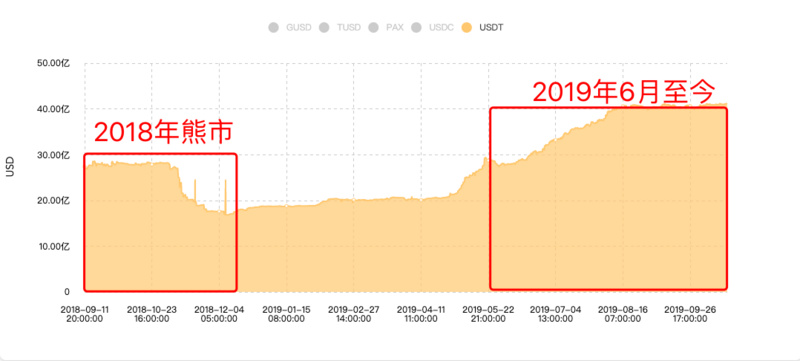

According to Longhash monitoring data, when the cryptocurrency entered the bear market in 2018, the USDT circulation decreased from 2.74 billion (early September 2018) to 1.87 billion (end of December), a drop of more than 30%.

(USDT issuance)

From the beginning of this year to October 23, the number of USDT issuance increased from 1.87 billion to 4.11 billion, an increase of 119%.

It is worth noting that although the market started to decline after June 27 this year, the USDT is still issuing additional shares, with an increase of 1.11 billion from June 27 to the present, an increase of 37%.

In view of the controversy of the USDT, which is often considered to be inflated and opaque, we decided to look at the market liquidity through compliance with stable currencies.

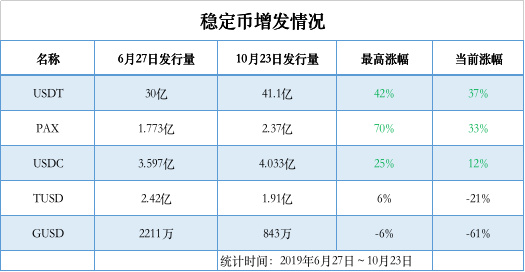

There are currently four mainstream compliance and transparent stable coins on the market: USDC (USD Coin) of Circle Company, GUSD (Gemini Dollar) of Gemini Company, PAX (Paxos Standard) of Paxos Company and TUSD of TrustToken Company. (TrueUSD).

(Stable currency issuance, Odaily Planet Daily statistics)

According to Longhash data, the total issuance of the above four stable currencies on June 27 was 801 million, with a maximum of 892 million, the highest increase of 11%; the current total is 840 million, an increase of 4%.

From the perspective of individual issuance, USDC has the highest increase of 25% during this period, and the current increase is maintained at 12%; PAX has the highest increase of 70%, and the current increase is 33%.

(USDC, PAX increased in the past six months)

From the above data, we can also conclude that despite the downturn in the past few months, the encryption market still has a large amount of capital to enter, and the outflow of funds is not obvious.

The inflow of funds also supports the trading volume of the encryption market.

CoinMarketCap data shows that the average daily trading volume in June this year was about 82 billion US dollars. The average daily trading volume in October this year was 53 billion US dollars, a drop of about 35%.

(2019 transaction amount)

Moreover, the amount of US$53 billion is not small, and the single-day transaction volume in the same period last year was only over US$10 billion. The activity of the encryption market transactions this year is much higher than last winter.

(2018 transaction amount)

In addition, in the bear market in 2018, the single-day trading volume dropped by more than 80%. The current market transactions are far better than the bear market in 2018.

Second, the DEFI market is booming

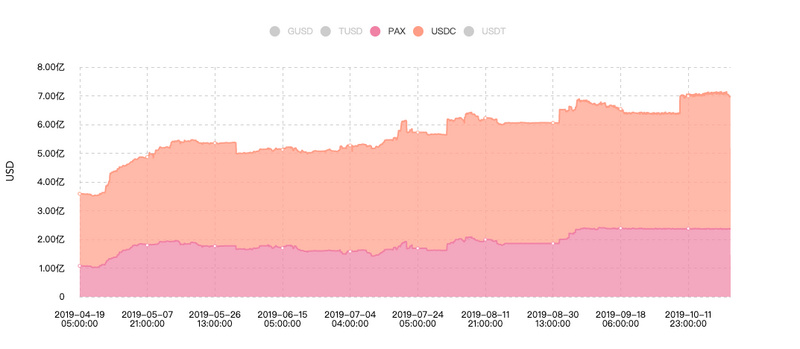

In addition to the spot market, the Decentralized Finance (DEFI) market is also booming.

DeFi Pulse data shows that the total value of tokens currently locked in the DEFI market is $5.446, an increase of more than 87% compared to the beginning of the year.

(Image courtesy of DeFi Pulse)

Although the value of the DEFI market has shrunk by more than 30% since July this year. But since 2 months ago, the market has gradually warmed up and has risen more than 20% in the past two months, showing a bullish momentum.

Third, the volume of CME contracts continues to increase

In addition, there is no big drop in the futures market.

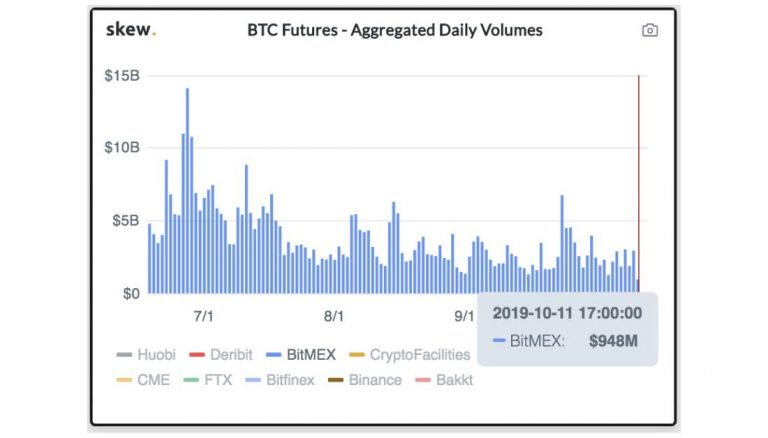

Although BitMex's trading volume has continued to fall in the past few months and hit a new low for several months ($948 million) on October 11, the more important reason for this result is its own non-compliance.

(BitMex transaction amount)

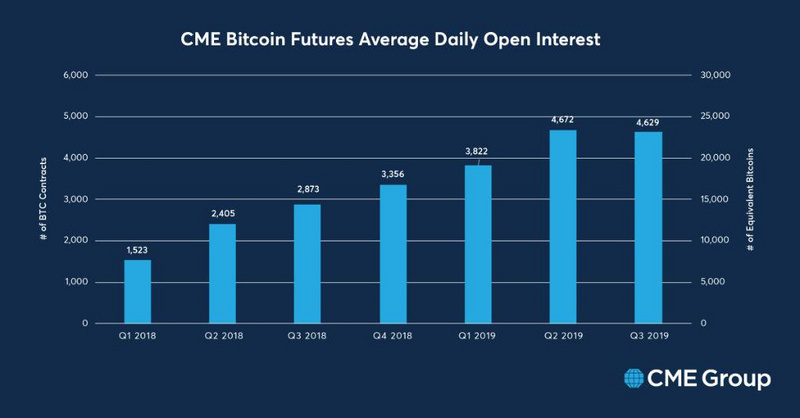

In contrast, the bitcoin futures contract of the CME (Chicago Mercantile Exchange) has been popular in the past few months.

According to CME, the number of open positions in the past few quarters has continued to rise, and the third quarter has only dropped 1% from the second quarter; compared with the third quarter of 2018, the open interest in the third quarter of 2019 has increased by 61% year-on-year. In addition, the average daily contract volume in the third quarter was 5,534, an increase of 10% over the same period last year.

(CME Bitcoin contract data)

CME explained that these transactions are mostly from institutional investors. “Institutional financial flows remain strong, with 454 new accounts added in the third quarter and 231 new accounts in the third quarter of 2018.”

CME added that institutions include pension funds, endowments, insurance companies, mutual funds, and portfolio/investment managers whose clients are primarily institutional investors.

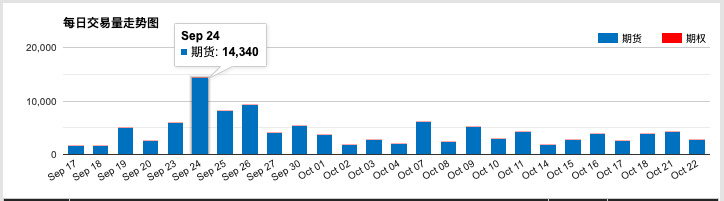

However, it is worth noting that since October of this year, CME's contract transactions have declined slightly, and the average daily trading volume has slipped to 3,376, or 16,880 BTC.

(CME October transaction data)

Fourth, institutional funds continue to flow into the market

According to a report released by Block Fi, a Canadian encryption lending company, institutional investors have become more interested in cryptocurrencies and have entered the market after the bear market in 2018.

According to the report, there are currently 201 private funds involved in cryptocurrency investment in the United States, accounting for 1.3%. Although the ratio is not large, the ratio is not small for emerging assets.

And among the 201 private funds, 18 billionaires are directly investing in cryptocurrencies, and they manage more than $286 billion in funds; assuming that 1% of these funds are invested in cryptocurrencies, then 30 – $5 billion in traditional funds enters the field of encryption.

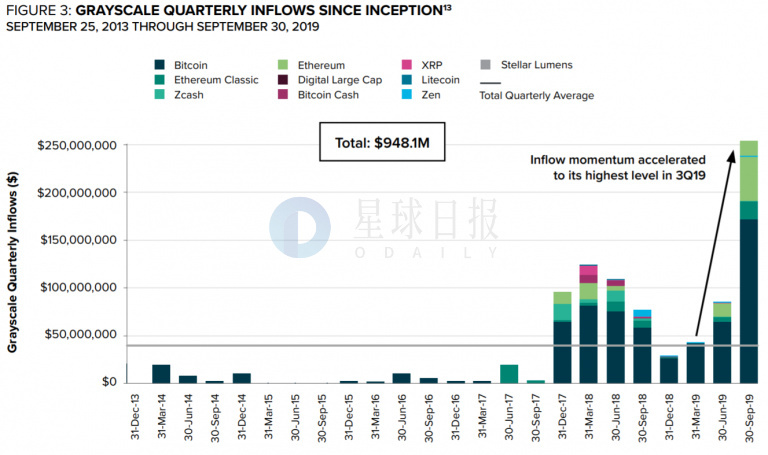

If the above report is still based on speculation, the grayscale company's report confirms that institutional users are accelerating entry.

Recently, the crypto asset management agency Grayscale (Grayscale) announced its third quarter report for 2019 and said it was a record-breaking quarter.

The report said that although the gray-scale trust product returns generally rebounded this quarter, its investment inflows tripled from the previous quarter – from $84.8 million to $254.9 million, an increase of more than 200%.

(grayscale report)

The main source of these funds is still institutional investors represented by hedge funds, accounting for 84%. The grayscale report emphasizes that institutional funding has risen more than 80% compared to a year ago.

Funds from institutional users will directly promote the rise of the encryption market on the one hand, and form a good demonstration effect on the other hand, which will inevitably drive more traditional funds into the market and form a positive positive cycle.

to sum up

Currently, the market is in a correction cycle, and mainstream currencies including BTC and ETH are being suppressed by the 100-day moving average.

Encryption analyst Keith Wareing said that the current BTC must stand firm at $8,120 in order to continue to rise; followed by resistance at $8550, $99,000 and $12,100; once the BTC falls below $7,860, it will fall to $7,600. And around $7,000, which could lead to a larger sell-off at that time, prompting miners to shut down.

Violation of the law will be investigated.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- What is the SEC thinking about Crypto compliance?

- He lost 4 bitcoins due to operational errors. Is the lightning network rule too strict?

- Read the cryptocurrency wallet pattern and future development

- The future of credit, currency and digital currency

- Gartner: Blockchain is listed in the top ten strategic technology trends of 2020, against one of the highlights of deepfake

- 2019 Will it be the "year of DAO"? A text on the past and present of the centralized autonomous organization

- Google claims to achieve "quantum hegemony", IBM, V God, Bitcoin developers have come to refute