Aiming for the opportunity of the next bull market Ordinals ecosystem

Aiming for the next bull market opportunity Ordinals ecosystemBitcoin is the first cryptocurrency project that has designed a secure, decentralized, and censorship-resistant network. It has gained widespread trust from the public and has become the most important blockchain project. However, the Bitcoin base layer is very simple, which makes it lack additional functionality while being the most secure, decentralized, and censorship-resistant blockchain. Until the release of the Ordinals protocol, it became possible to create NFTs on the Bitcoin chain, gradually breaking the current situation of Bitcoin’s lack of scalability, and immediately attracted public attention. The innovation of BRC20 also provides greater possibilities and imagination for Bitcoin. Since the launch of this protocol, more than 27 million Ordinals have been recorded, and the price of Bitcoin has also risen because users need to find trading platforms to buy Bitcoin so that they can invest in the latest digital assets introduced in the crypto world. On August 31, Binance Mining Pool also officially launched the Ordinals engraving service, allowing users to register “satoshis” and store ownership records, etc.

So what is the principle of Ordinals? What developments have been made in the past six months? Why are major institutions starting to layout Bitcoin Ordinals? Are there any participation values and how to participate? This article will comprehensively sort out the Bitcoin Ordinals ecosystem for readers.

The Origin of Ordinals: Bitcoin NFTs

In the current blockchain network, NFTs are mainly minted and verified through tokenization standards built on blockchain protocols (such as ERC-721 on Ethereum) and traded on centralized markets such as OpenSea, Rarible, and Nifty Gateway. Transactions that meet these standards will require wallets that support them, but they will be affected by the speed and cost of network congestion, and they will inherently be sensitive to third-party risks due to reliance on centralized markets. However, is there a way to mint, buy, and sell NFTs directly on the base layer of the blockchain and imprint them on its smallest monetary unit?

The non-Turing completeness of the Bitcoin network means that it does not support smart contracts, so NFTs cannot be issued through contracts. Rodarmor’s solution is to engrave NFTs on BTC. Since the total supply of Bitcoin is limited to 21 million, and its price is high, Bitcoin has a smallest unit called a “satoshi” (sat), and 1 Bitcoin can be divided into 100 million satoshis. Rodarmor’s idea is: can we arrange these “satoshis” in a certain order and assign them an ordinal number between 0 and 2,100,000,000,000,000, and then connect them to other information: images, text, videos, or even a piece of code. This makes each “satoshi” unique and irreplaceable. This is equivalent to giving Bitcoin the native ability to create NFTs. Rodarmor wanted to create a system to number the satoshis and assign a unique sequence number (Ordinals) to each satoshi, resulting in integers from 1 to 100 million, where each ordinal represents one “satoshi” Bitcoin that cannot be further divided. This unique identifier will allow users to track each “satoshi” on the blockchain. Rodarmor hopes to achieve this in a thoroughly Bitcoin-native way, without using sidechains or separate tokens.

In early 2023, Rodarmor officially launched the NFT protocol Ordinals built on the Bitcoin mainnet. It allows the identification and tracking of each individual “sat” (satoshi) in time and space based on their mining order. This protocol allows unparalleled on-chain asset verification, ensuring that the ordinal number remains unchanged if anyone transfers from one wallet to another. Ordinals also allows for the engraving of various types of content, such as images, text, videos, and music, on individual “sats” on the Bitcoin network.

- LianGuaiWeb3.0 Daily | CZ Binance Leads the Way in Regulatory Compliance

- Who profited from the Federal Reserve’s nearly $100 billion loss due to interest rate hikes?

- Four financing events worth paying attention to last week DeForm, FirstMate, Stroom Network, BuidlerDAO.

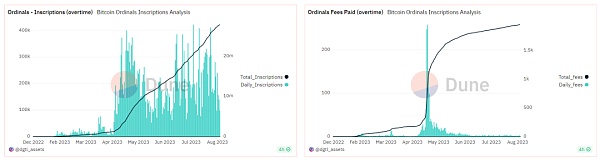

Since its launch, Ordinals has completely reignited the discussion around Bitcoin NFTs, with transaction volume exploding and new markets for Ordinal NFTs emerging rapidly. According to the latest data from Dune Analytics, the cumulative minting volume of the Bitcoin NFT protocol Ordinals has reached 27,819,966, generating a total cost of 1949 BTC.

The main reason is that creating and trading Ordinal NFTs through the engraving service is much easier than traditional minting methods. Ordinal engravings eliminate the need for higher-level smart contracts, reducing the entry barriers for potential creators, buyers, and sellers. It also helps offset the higher transaction fees associated with larger block sizes due to engravings, which is key to attracting users to use ordinal engravings.

Exploring Ordinals: BRC20

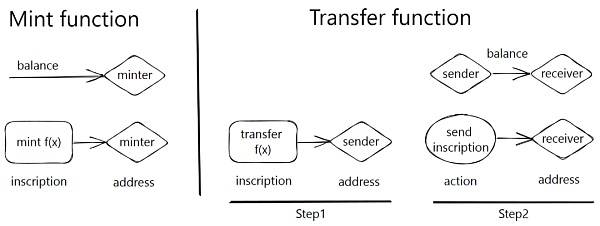

Like most novel projects in the cryptocurrency field, Ordinals has attracted interest and hype. Two months after the release of the Ordinals protocol, Twitter user @domodata proposed a token standard on Bitcoin called BRC20, using the Ordinals engravings of JSON data to deploy token contracts, mint tokens, and transfer tokens. The BRC20 standard can be seen as an application-like NFT of Ordinals, similar to a check, but BRC20 does not have smart contracts.

BRC20 Core: Deploying tokens, minting tokens, and transferring tokens

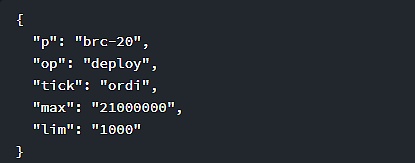

He tweeted, “I have started an experiment in issuing homogenized tokens on BTC based on the Ordinals protocol, and I call it BRC20. At the same time, the experimental token $ordi based on the BRC20 standard also emerged, designed to pay tribute to BTC, with a total supply of 21 million, and anyone can mint it for free.”

The first BRC-20 token “Ordi” deployed by @domodata

The BRC20 standard limits the development of tokens by setting the token supply and maximum minting amount as unchangeable, and the token naming is limited to 4 digits. To address these issues, the ORC20 standard was introduced, which removes the token naming restrictions and adds upgradability to tokens, allowing project teams to empower tokens further. It also adds advanced features such as setting royalties and whitelisting. However, due to the incomplete development of the infrastructure for ORC20 and the continued concentration of wealth in BRC20, ORC20 currently receives limited attention.

The market for BRC20 is rapidly expanding. There are already 37,554 different tokens made using the BRC20 standard in the crypto world, with a total market value of $260 million and this number is constantly increasing. BRC20 is becoming a new revolution, and most importantly, the team behind BRC20 is developing rapidly, promising to improve the functionality of BRC-20, which will make it easier for developers to create tokens using BRC20. With the development of the DeFi field, we should expect to see more tokens and financial products using BRC20.

The Ordinals Protocol is reshaping the future of Bitcoin

The release of the Ordinals Protocol has attracted the attention and imagination of thousands of Bitcoin users. Unlike Ethereum’s NFTs, with Ordinals, assets can be directly represented on the Bitcoin base layer without the need for separate sidechains or tokens. This means that existing Bitcoin infrastructure can be used to seamlessly create, transfer, and manage assets within the Bitcoin network. In addition, compared to Ethereum NFTs, Ordinals provides greater flexibility and customization options. The protocol allows for the creation of more complex and customizable content types and the ability to inscribe “satoshis” with arbitrary content, meaning that Ordinals can be used for a wide range of digital assets.

The Ordinals Protocol has changed the paradigm of Bitcoin and improved the versatility of asset creation and management tools on the Bitcoin network. The introduction of the Ordinals Protocol adds uniqueness to each “satoshi” and marks the beginning of the era of valuation for “satoshis”. Bitcoin is no longer just a store of value, it now allows for the creation of unique digital assets similar to NFTs.

The Ordinals Protocol has changed the Bitcoin ecosystem in various ways and contributed to the development of the Web3 asset market and the entire Bitcoin ecosystem.

The Ordinals Protocol provides artists and creators with a secure and decentralized way to store their works on the blockchain, while also contributing to the security and incentives of the Bitcoin network. Inscribing content leads to increased transaction fees and block size, incentivizing miners to protect the network. It is also possible that more and more users will join the network and run nodes, making the Bitcoin network more sustainable in the future.

At the same time, the Ordinals Protocol helps promote the mass adoption of Bitcoin and brings more value to the ecosystem. It can be seen that digital assets on the Bitcoin chain will be more valuable than NFTs on other chains, and the tools being built will support the new generation of Bitcoin dApps and infrastructure. The success of Bitcoin is crucial for the success of Layer2 chains like RSK and Stacks, and high demand will provide a stronger reason for the development of scaling solutions, thereby improving their efficiency.

The Ordinals Project and Current Status

The proposal of the Ordinals Protocol has expanded the scope of Bitcoin beyond just being a store of value and payment functionality, breaking the limitations of the Bitcoin ecosystem. In just six months, multiple branch protocols and projects have emerged around Ordinals, bringing new possibilities to the Bitcoin network.

Inscription (BTC NFT)

1. Sub 10K: Sub10K refers to the top 10,000 inscriptions ranked by inscription number, which have early value and are loved by veteran players. It is currently the strongest consensus in the entire Ordinals ecosystem, and the most popular are the collection series, such as Ordinals Punks, which is one of the series in Sub10k. It consists of 100 pixelated avatars, which have been minted on the Bitcoin blockchain in the form of inscriptions through the Ordinals protocol and can be traded.

2. Bitcoin Punks: The first project inspired by CryptoPunks on Ethereum using the Ordinals protocol, where all assets have been minted for free by collectors. The NFT project Bitcoin Punks based on the Bitcoin mainnet Ordinals protocol has completed minting, with a total of 10,000. They are mostly held by veteran players and have the endorsement of OKX, similar to Ordinals Punks, they also have a strong consensus.

3. Taproot Wizard: Taproot Wizard is an NFT project created on the Bitcoin blockchain, initiated by Udi Wertheimer, a cryptocurrency asset developer, to commemorate the Taproot upgrade of Bitcoin, as well as the classic image of the Bitcoin wizard in the Bitcoin community. Therefore, many people in the community support Taproot Wizard because they believe that this meme and the rise of Bitcoin are inseparable, and it is the most original and authentic meme of Bitcoin.

BRC20 (fungible tokens)

1. ordi: Ordi is the first token contract of Brc20, and it became the first meme token on the BTC chain. It has strong speculation value and has been fully minted. Although its market value is currently only 70 million US dollars, it cannot change its status and influence in the Brc20.

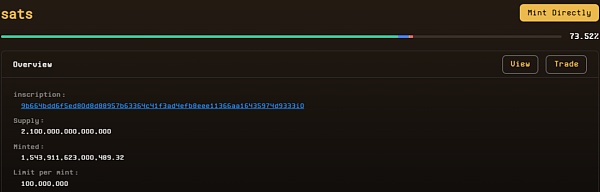

2. sats: Sats is the ninth inscription token on the Brc-20 protocol, with the full name of satoshis, which is the smallest unit of Bitcoin, abbreviated as sat or bitcoin satoshi. 1 BTC = 100 million sats. The total supply is 21 trillion, corresponding to 21 million BTC. Sats has currently minted 73% and has over 30,000 holders. Its market popularity has far exceeded similar Brc20 tokens, even surpassing the veteran-level ordi, making it the most potential BRC20 token at present.

In response to this, the official Sats community has given the following reasons: 1. Sats is of extraordinary significance as the smallest unit of Bitcoin. 2. There are enough holders, high recognition and wide adoption in the community. 3. It has strong interest drive for miners and mining farms. After the Bitcoin halving in 2024, mining farms must find new profit points, otherwise their income will be halved. Therefore, sats with a large total supply and strong consensus becomes their hundredfold and thousandfold reason for choice. 4. The total market value of BRC20 tokens is very small, making it easy to erupt, and sats is the leading coin of BRC-20, so it will inevitably have a high increase. 5. Fair distribution, large total supply, sufficient time for minting, fair to everyone.

Proxy Platform

1. UniSat Wallet: UniSat Wallet was officially launched on April 23rd and is the earliest wallet to support BRC20. UniSat has made significant contributions to the success of BRC-20, and while everyone is enthusiastic about Bitcoin image NFTs, UniSat is committed to integrating BRC-20. UniSat Wallet is the official wallet for Ordinal Protocol, supporting storage, minting, and trading of Ordinals NFTs and BRC20 tokens.

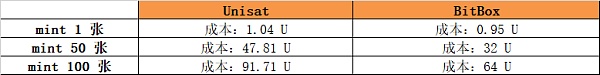

2. BitBox: BitBox is currently the most cost-effective engraving tool on the entire network. Currently, BitBox has eliminated platform fees, and the total fees mainly include engraving fees and network fees. The engraving fees will be automatically returned to the user, so compared with Unisat, BitBox is cheaper. Taking mint sats (gas fee: 12 satoshis) as an example:

So, under normal network conditions, we can use BitBox’s low transaction fees to mint sats, and then sell them on Unisat to make a profit from the price difference.

Where is Bitcoin Ordinals heading?

Bitcoin is currently the largest cryptocurrency by market capitalization, and Ordinals has opened up new directions for the Bitcoin ecosystem. Whenever Bitcoin funds flow in, it opens up a huge ceiling for the Ordinals ecosystem.

The Ordinals protocol has introduced new features to Bitcoin that have never been implemented before, including smart contracts and token creation. As the underlying technology of Bitcoin continues to develop, we can expect new features to make engraving more efficient, secure, and universal. Future upgrades to Bitcoin may introduce new mechanisms to embed data into “sats” or allow for more complex engravings. At the same time, advances in blockchain scalability and data storage can enable larger engravings and more complex Bitcoin Ordinals protocols.

First, the value and utility of BTC Ordinals largely depend on market adoption. As more and more artists, creators, businesses, and consumers become aware of and use BTC Ordinals, their value and utility may significantly increase. The development of BTC Ordinals trading markets and platforms may also play a crucial role in its adoption.

Second, the interoperability of BTC Ordinals with other blockchain systems and digital assets also brings exciting possibilities. For example, future developments may allow BTC Ordinals to interact with Ethereum smart contracts, serving as collateral for DeFi platforms or integrating into dApps. Large blockchain institutions are also actively entering the market, with OKX, Element NFT Marketplace, and Binance pool all preparing to launch Ordinals engraving services and BRC20 trading markets, providing broad application scenarios for the Ordinals protocol and BRC20 tokens.

The emergence of BTC Ordinals opens a new chapter in the development of the Bitcoin network and blockchain technology. Although still in its early stages, the protocol unlocks the immense potential of digital ownership, creativity, and data verification in a new era. BTC Ordinals will become more mature in the future, and its use cases will expand. Despite the challenges and uncertainties, the innovation and adaptability of the Bitcoin community give us reason to be optimistic about the future of BTC Ordinals.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Multichain has fallen, what can save the cross-chain bridge?

- Ethereum SAAS Staking One-Week Data Record

- DeFi Regulatory Woes Uniswap in Heaven, Tornado Cash in Hell

- MEKE public beta countdown ends, focusing on derivative trading in the DeFi sector.

- Hubei Court rules that the virtual currency mining contract is invalid due to the purchase of IPFS storage servers for mining Filecoin.

- NGC Ventures Is the AI track still worth starting a business now?

- Why is identity verification so important for Web3?