Who profited from the Federal Reserve’s nearly $100 billion loss due to interest rate hikes?

Who benefited from the Federal Reserve's $100 billion loss from interest rate hikes?The profits earned by money market fund investors are the result of losses incurred by the Federal Reserve, the Treasury Department, and the American taxpayer.

In order to curb high inflation, the Federal Reserve began raising interest rates in March 2022. 18 months later, this round of interest rate hikes may finally be coming to an end, and now is the time to examine who the winners and losers are under the Federal Reserve’s interest rate hikes.

The winners are naturally the investors who hold money market mutual funds, as their current returns have increased by over 30,000% since February 2022 (the month before the Federal Reserve began raising interest rates), which is equivalent to a 300-fold increase.

The losers are the 12 regional Federal Reserve banks, which have previously generated huge profits but are now facing massive losses due to the interest rate hikes. A few months ago, I wrote an article discussing the topic of the Federal Reserve’s dwindling sources of income, but when the total losses reach the critical level of $100 billion, this issue is sure to receive more attention, which may happen by the end of September.

- Four financing events worth paying attention to last week DeForm, FirstMate, Stroom Network, BuidlerDAO.

- Multichain has fallen, what can save the cross-chain bridge?

- Ethereum SAAS Staking One-Week Data Record

Stepping back, this issue is actually quite interesting. In order to curb high inflation and slow down economic growth, the Federal Reserve has been raising interest rates for 18 months. As a result, money market fund investors have seen significant returns, while the Federal Reserve itself has suffered huge losses.

Prior to the Federal Reserve’s interest rate hikes, the regional Federal Reserve banks were making substantial profits. In 2021, these 12 banks handed over $107.4 billion in profits to the U.S. Treasury Department. However, for some reasons (which I will explain later), the profits of the regional Federal Reserve banks have evaporated due to the Federal Reserve’s interest rate hikes, and the profits they have handed over to the Treasury Department this year have significantly decreased.

Now let’s take a look at the calculations involved.

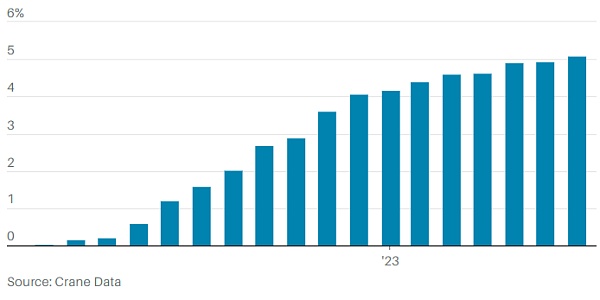

Peter Crane of Crane Data pointed out that as of February 2022, the average yield for investors holding money market funds was 0.02%. The total assets of these funds were $5.009 trillion, resulting in an annual yield of approximately $1 billion.

Significant increase in money market fund returns

Since the Federal Reserve began raising interest rates in March 2022, the yield of money market funds has risen to over 5%.

Average yield

However, as of July 31st this year, the average yield of these funds was 5.08%, with total assets rising to $5.903 trillion. According to Crane’s calculations, the annual yield of these funds is $299.9 billion.

Crane further points out that as of August 18th, the average yield of these funds has risen to 5.15%. Assuming that the total assets remain unchanged (which is a very conservative assumption), these funds will generate over $300 billion in annual returns for investors.

However, Kran emphasized that the $300 billion is an “annualized” return, which means it is inferred based on the current situation as the annual return, not the actual return that investors holding these funds have already obtained.

The reason for the increase in returns for money market fund investors is that these funds purchase short-term securities. In the past 18 months, the Federal Reserve has raised the short-term federal funds rate from near zero to 5.25%-5.50%. The returns obtained by money market fund investors have increased with the Federal Reserve’s interest rate hikes.

Kran said, “5% is a magical number and is a very important number from a psychological perspective. When the yield reaches 5%, funds start pouring into money market funds. This situation occurred in the late 1990s and early 21st century, and it is also happening now.”

However, while money market fund investors have seen their returns increase by 30,000%, ironically, the Federal Reserve itself has suffered losses due to interest rate hikes.

The 12 regional Federal Reserve banks, which used to make a lot of money, are now experiencing huge losses because the interest they pay on the trillions of dollars borrowed from money market funds and other financial institutions exceeds 5%. At the same time, their own investment portfolios still contain a large number of low-yield mortgage loans and US Treasury bonds purchased during the period of near-zero interest rates.

Regional Federal Reserve banks have been borrowing at high interest rates to prevent money market funds and bank assets from “flooding” the financial system, which would cause interest rates to fall. If this were to happen, it would undermine the Federal Reserve’s strategy against inflation.

According to the Federal Reserve’s recent semi-annual financial report, as of June 30, the Federal Reserve’s “deferred assets” – which is what I referred to as “losses” – totaled $74.7 billion.

Stephen Church of Piscataqua Research was the first person to draw my attention to the loss situation of regional Federal Reserve banks. He said that the weekly loss has remained at around $2 billion, totaling $77.1 billion as of the end of August this year. Church expects the loss in September to reach $100 billion, which I believe will be an important figure that will attract more attention.

As of June 30, the total profits contributed by regional Federal Reserve banks to the Treasury Department were only $102 million, a decrease of over 98% from before June 30 of the previous year. Since June 30 of the previous year, the interest rate hikes have had a significant impact on the financial markets and the profits of regional Federal Reserve banks.

According to the operating rules of regional Federal Reserve banks, they must earn enough profits to climb out of the “deferred assets” pit before they can contribute huge profits to the Treasury Department again.

The losses of regional central banks will not increase the federal budget deficit. However, due to the huge profits that were previously handed over to the Department of the Treasury no longer exist, this does help control the deficit. So far this fiscal year, the US fiscal deficit has reached 1.6 trillion US dollars. This could become a matter of concern as taxpayers worry about the continuous rise in government debt, and losses could become a reason for politicians to increase criticism of the Federal Reserve.

In other words, the returns obtained by money market fund investors are, to some extent, losses incurred by the Federal Reserve, the Department of the Treasury, and US taxpayers.

It is still difficult to predict the future investment prospects of money market funds. However, at present, they are greatly benefiting from the Federal Reserve’s interest rate hikes and are likely to remain big winners in the near future.

So, if you have a large number of money market mutual fund accounts, it’s time to feel happy about it and enjoy it while you still can.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- DeFi Regulatory Woes Uniswap in Heaven, Tornado Cash in Hell

- MEKE public beta countdown ends, focusing on derivative trading in the DeFi sector.

- Hubei Court rules that the virtual currency mining contract is invalid due to the purchase of IPFS storage servers for mining Filecoin.

- NGC Ventures Is the AI track still worth starting a business now?

- Why is identity verification so important for Web3?

- NGC Ventures Is the AI track still worth starting a business in?

- Web3 people facing AI replacement anxiety Don’t panic, can’t smash my rice bowl, can’t ruin my job.