Comprehensive Analysis of Opportunities and Challenges in the RWA Track

Analysis of RWA Track Opportunities and ChallengesAuthor: Institute of Everything

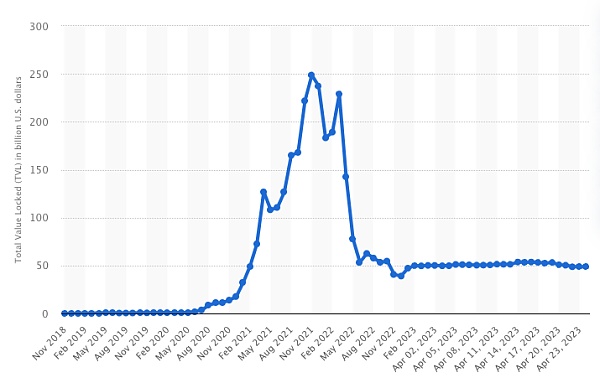

In the past five years, DeFi has experienced rapid development, especially in 2020-2021, when DeFi TVL grew from hundreds of millions of dollars to trillions of dollars, known as DeFi Summer. During this process, a large amount of funds poured into DeFi, various innovative DeFi applications continued to emerge, airdrops and subsidies prevailed, creating waves of wealth myths for early participants. During the bear market, DeFi TVL remained stable at around $50 billion.

- Vitalik EthCC Speech Summary Account Abstraction Will Completely Change Wallet Interaction Methods

- A SNARK player actually announced that they will follow STARK?

- CME Executive Why Are People Interested in Our Cryptocurrency Products

TVL (total value locked) across multiple Decentralized Finance (DeFi) blockchains from November 2018 to April 24, 2023 (in billion U.S. dollars) Data source: www.statista.com

The recent discussion of the RWA track has allowed practitioners in the crypto industry to see opportunities for further expanding the DeFi territory. Some crypto-friendly jurisdictions are actively promoting the implementation of RWAs, and many well-known traditional institutions, such as Goldman Sachs, Siemens, Hamilton Lane, Bank of China International, and Amazon, are also exploring RWAs. In the past three months, almost all RWA-related tokens have seen price increases, some of which have increased by 10 times. Citibank predicts in its research report “Money, Tokens, and Games” that by 2030, RWAs may bring $50 trillion in assets to the chain.

Events related to the embrace of blockchain by TradFi in the first half of 2022-2023

|

Date |

Event |

|

2022/5/31 |

The Monetary Authority of Singapore (MAS) announced the launch of Project Guardian, an initiative in collaboration with the financial industry aimed at exploring the economic potential and value propositions of asset tokenization. The pilot will be led by DBS Bank Limited, J.P. Morgan, and Marketnode. |

|

2022/9/24 |

Private equity giant KKR tokenized a portion of its $4 billion Health Care Strategic Growth Fund II (“HCSG II”) on the Avalanche blockchain, allowing on-chain investors to invest in this asset class. |

|

2022/12 |

UBS issued $50 million tokenized fixed-rate notes on a blockchain licensed under UK and Swiss law, setting a precedent for regulatory compliance in blockchain finance. |

|

2023/1/11 |

Goldman Sachs announced the official launch of its digital asset platform GS DAP, which is developed on the privacy-supporting Canton blockchain using the Daml smart contract language developed by Digital Asset. In November 2022, the European Investment Bank (EIB) used the platform to issue €100 million two-year digital bonds. |

|

2023/2/1 |

According to the Polygon official blog, global asset management company Hamilton Lane opened a portion of its $2.1 billion Equity Opportunities Fund V to individual investors through the Securitize tokenization platform on the Polygon network. |

|

2023/2/14 |

German electrical engineering giant Siemens issued €60 million of digital bonds on the Polygon network, which were issued under the German Electronic Securities Act, which came into effect in June 2021, allowing for blockchain-based debt sales. |

|

2023/6/12 |

Bank of China International (BOCI), a wholly-owned investment bank of Bank of China Limited, recently announced a partnership with UBS to issue RMB 200 million worth of tokenized notes, becoming the first Chinese financial institution to issue tokenized securities in Hong Kong. |

In fact, what RWA brings to DeFi is not only a huge asset scale, but also a rich variety of asset types, including stocks, bonds, real estate, artwork, luxury goods, precious metals, and even carbon credits. There are already projects exploring and experimenting with almost every type of asset. Some are well-established DeFi protocols such as Maker DAO, AAVE, Compound, Maple, and Centrifuge, while many others are emerging early-stage projects that have been extensively researched and documented.

Assets are the lifeblood of finance, and as larger and more diverse assets become the underlying assets of DeFi, more innovative use cases will be inspired. Some crypto industry participants believe that RWA will be the main driving force behind the next bull market.

However, some analysts adopt a cautious attitude towards RWA. Bringing real-world assets onto the blockchain is not a new concept. Since the birth of DeFi, there have been efforts to bring real-world assets (RWA) onto the chain. However, apart from stablecoins, these efforts have seemed to make more noise than actual progress. Similar concepts that were once hotly debated, such as “blockchain transformation,” “synthetic assets,” “tokenization,” and “STO,” have all disappeared in the ever-changing narrative. As a result, DeFi and TradFi have long been two parallel worlds, with the vast majority of assets that DeFi relies on being native to the blockchain.

So how should we objectively view the RWA trend? What is the significance and value of RWA? Is the time ripe for the mass adoption of RWA on the blockchain? What are its challenges?

What is the significance and value of RWA?

As mentioned earlier, RWA will bring a huge asset scale and a diverse range of asset types to DeFi, promoting its development. However, in our opinion, the empowerment of TradFi by blockchain technology far outweighs the empowerment of DeFi by RWA. Blockchain has some very superior characteristics that can address some major shortcomings in traditional finance:

First, it reduces commercial friction. Traditional finance can be considered a labor-intensive industry, with many important transactions involving multiple intermediaries and a large amount of paperwork. Property rights need to be verified and the process of property transfer needs to be documented. On the other hand, blockchain is essentially a shared ledger, where all relevant parties can access a unique and tamper-proof record of ownership and transaction history. On the blockchain, transactions are settlement, and purchases are rights confirmation. Therefore, blockchain can significantly reduce transaction costs, improve transaction efficiency, and eliminate counterparty risk in the transaction process. The International Monetary Fund (IMF) mentioned in its 2022 Global Financial Stability Report that compared to the TradFi system, DeFi’s approach to the financial market brings significant cost savings, mainly in terms of labor. This is because TradFi often involves complex intermediary systems with high operating costs.

Secondly, flexibility and composability. With the programmability of blockchain, on-chain assets can be easily split, combined, and transformed into new asset types. For example, indivisible assets can be divided, allowing traders with smaller funds to participate in transactions. Multiple assets can also be combined into one asset, similar to index funds. Moreover, options, futures, and more complex structured financial transactions can be realized. Although off-chain flexibility and composability can be achieved through legal contracts, it is not as convenient as on-chain. Compared to legal contracts, smart contracts have the feature of automatic execution. The original rights represented by derivative assets created by smart contracts are guaranteed by code. Complex transactions created by smart contracts can be automatically completed under agreed conditions, without default risks, legal document costs, litigation costs, and execution costs. What’s more attractive is that all data on the chain is open, allowing for completely permissionless composability. Anyone can freely develop their own products and protocols based on existing products and protocols, which would require a lot of business processes in off-chain finance.

Thirdly, transparency and traceability. Asset tokenization and asset securitization have similarities. Asset securitization has long existed in traditional finance, with common securitized products such as MBS and ABS. MBS is a security backed by mortgage loans, while ABS is a security backed by credit card loans and car loans. MBS and ABS are essentially financial derivatives packaged from mortgage loans. By selling MBS and ABS, banks can earn spread income while transferring risks completely. After the success of MBS and ABS, more complex financial products were created, such as CDO, which was then packaged and resold layer by layer until it reached investors. Investors may no longer understand the underlying assets, only various selling points offered by securities dealers. However, after asset tokenization, regardless of how they are packaged or derived, the processes are transparent. Investors can trace the underlying assets and make transactions based on a full understanding of the risks. DeFi will be more transparent than TradFi. Traders can have access to more complete information and better prevent risks accumulation and systemic crises like the “subprime mortgage crisis”.

In conclusion, we believe that blockchain will be an excellent platform for financial services. The automatic execution feature of smart contracts will significantly reduce commercial frictions in the financial industry, eliminate reconciliation costs, and improve the liquidity and composability of assets. In the joint report “It’s Time to Explore Institutional DeFi” written by Oliver Wyman Forum, DBS Bank, JPMorgan Onyx, and SBI, it is mentioned that traditional financial institutions embracing DeFi will have significant benefits (see the figure below).

Source: Oliver Wyman Forum, DBS, Onyx by J.P. Morgan, SBI Digital Asset Holdings

From various perspectives, embracing blockchain technology is the inevitable endgame for the development and evolution of the financial industry. Time will prove that DeFi is an advanced form of the financial system, and asset holders will increasingly want to hold and trade assets in the form of RWA.

Is the time for massive on-chain RWA here?

The previous attempts to put real assets on the chain have not been successful mainly due to two factors: unclear or one-size-fits-all regulatory policies and immature blockchain infrastructure. However, what we see is that these two barriers to the implementation of RWA are disappearing.

Firstly, some regions have realized the tremendous improvement power of Web3 technology in the financial industry and have started to actively embrace Web3 technology, especially in areas where the financial industry is a pillar industry, such as Singapore, Switzerland, Hong Kong, and even some regions where central bank digital currencies (CBDCs) are being launched, providing a more reliable value anchor for the development of RWA than stablecoins.

Secondly, the infrastructure in the crypto field has developed for many years and is now fully capable of supporting the development of RWA, including public chain and cross-chain infrastructure, token standards, DID technology, ZK technology, and so on.

Regulation

Compared with on-chain native assets, RWA has an unavoidable centralized link, which is the custody of off-chain assets. If off-chain assets are lost, damaged, or stolen, the on-chain RWA tokens will become worthless. In addition, lending protocols also involve operations on off-chain assets of liquidation entities, which cannot be executed by on-chain smart contracts and must rely on off-chain legal procedures.

Code is law, but code cannot replace all laws.

In an era without regulation, DeFi can experience a period of wild growth, but to achieve the massive on-chainization of off-chain assets, it must be accompanied by regulation. The process of putting assets on the chain must be recognized by regulators to receive legal protection and minimize the moral risks of custodians. At the same time, the transfer of assets on-chain must also be recognized by regulators for the transfer to be meaningful.

With the rapid development of the cryptocurrency industry, authorities around the world have gradually paid attention to and committed to regulating the cryptocurrency market. They have issued licenses and implemented supervision on entities providing cryptocurrency-related services. Some countries or regions, such as South Korea, Switzerland, Japan, the European Union, the United Arab Emirates, and the United Kingdom, have formulated or launched laws and regulations covering cryptocurrency assets and their related services. Although in most cases, the objectives of these regulatory policies are mainly to prevent money laundering and systemic financial risks, they objectively provide clear rules for cryptocurrency practitioners and create a space for compliant operations of cryptocurrency-related services, as well as protection for the holding and transfer of cryptocurrency assets. This is a huge benefit for the development of the RWA field.

Public Chains and Cross-chain Infrastructure

With years of scalability efforts, public chains have made qualitative leaps in performance, and related development tools are becoming more and more refined. With the development of Layer2, parallel chains, and other technologies, “one-click chain deployment” has become a reality. Moreover, under the empowerment of shared security, new chains do not need to invest huge costs and time to incentivize node participation in order to enhance their decentralization. Cross-chain technology allows any asset to circulate in multiple ecosystems and be combined and integrated into different scenarios. This allows RWA assets to achieve full-chainization without having to choose a specific ecosystem.

Token Standards

FT (Fungible Token) and NFT (Non-Fungible Token) are the most basic token standards, represented by ERC20 and ERC721, respectively. FT represents fluid assets that are homogeneous and can be infinitely divided, while NFT represents solid assets with specific forms and boundaries that are unique and indivisible. ERC20 once sparked the ICO craze, and the emergence of ERC721 also ignited the NFT Summer. Token standards continue to evolve, giving rise to more derivative standards. Now, they can almost map everything in the real world and the relationships between things. Among them, ERC3525 is particularly suitable for expressing financial instruments and will facilitate the on-chainization of RWA.

Image source: Bo Cai Bo Cai – “From ERC20, 721, 1155 to 3525: A Detailed Description of RWA’s Road to Web3 Mass Adoption”

DID Technology

Various public chains, represented by Ethereum, have always been anonymous systems with a certain degree of resistance to regulation. Some encryption technology believers believe that the gene of the encryption industry is anarchism, and the crypto world and government regulation are incompatible.

However, we believe that in order to make the encryption industry more sustainable, a certain degree of regulatory compliance needs to be achieved. We are not advocating for consortium chains nor do we believe that public chain systems should be completely transformed into real-name permissioned systems in order to be compatible with regulation.

In fact, through DID technology, regulatory compliance can be achieved on public chains, and it can be presented as an autonomous option for encrypted users while protecting user privacy.

According to the Web3 DID solution proposed by W3C, users can register with regulatory authorities using their DID to obtain a Verifiable Credential (VC). If certain on-chain services are required by regulatory policies to perform KYC on users, when providing the service, the service provider can use the user’s VC to request verification from the issuer of the VC, which is the regulatory authority. The regulatory authority only needs to return a message: “Is this user allowed to use the current service?” with a simple “yes” or “no” answer, without disclosing the user’s complete registration information. Of course, in the W3C DID solution, institutions qualified to issue VCs are not limited to regulatory authorities. They can be any issuing organization, including schools, industry associations, on-chain DAO organizations, etc.

Please note that during this process, users have the autonomy to choose. Users can choose not to obtain the corresponding VC. However, if a certain on-chain service requires users to have a certain VC and users happen to not have it, then they cannot use that service. Users can choose to use other services.

This approach gives users the choice and allows the entities providing on-chain services to accept the regulation of a certain jurisdiction. Regulations implemented by certain jurisdictions such as foreign exchange controls, sanction lists, and restrictions on personal information leaving the country can all be enforced on-chain.

ZK Technology

ZK technology refers to Zero-Knowledge related technologies. As a public ledger, transactions on the blockchain are publicly queryable and permanently visible to anyone.

Data privacy is crucial for customers in certain areas of traditional finance. They are unwilling to expose their positions and transaction history on a public network. Sometimes experienced data analysts can infer investors’ orders and even off-chain identities from public data. (The author has previously used tools such as Zerion and LianGuairsiq to track whale account positions, analyze the market, and profit from it.) This situation is unacceptable for many traditional institutions, as their transaction records and customer information are confidential business data. However, when ZK technology is applied to the blockchain, controllable privacy can be achieved on the basis of a public ledger. Users can selectively disclose partial information to authorized entities or declare a certain assertion to be true without revealing any information.

You can prove to a certain entity that your assets meet a certain threshold without disclosing the specific amount. You can also prove that you have made a transaction without revealing the counterparty and amount. This ensures privacy without compromising the openness and composability of the blockchain. The application of ZK technology to privacy has made good progress in the Web3 field and is being increasingly adopted.

In summary, clear regulatory policies and improved infrastructure are unlocking the development of the RWA track, and the opportunity for large-scale RWA on-chain has matured.

What are the challenges of RWA?

Above, we discussed why traditional finance needs to embrace blockchain and why the timing is right for the development of RWA. Now, we need to objectively analyze the challenges that RWA still faces.

One challenge is the uncertainty and complexity of regulatory policies. Although the global trend of regulatory policies towards the crypto industry is gradually becoming stricter and clearer, it is a gradual process that cannot be achieved overnight. In the meantime, there may be detours and setbacks. In addition, regulatory efforts worldwide are still in the exploration stage, and there is no unified standard, classification, or definition. Although international regulatory bodies such as the Financial Action Task Force (FATF) and the International Organization of Securities Commissions (IOSCO) are making efforts, it is difficult to achieve unity in the short term. This will hinder the ambitions of RWA service providers in the global market and prevent the full potential of blockchain technology in facilitating global liquidity.

The second is the inertia and historical burden of the traditional financial system. Traditional finance is a self-contained system with established rules, orders, and concepts. It also involves a large number of interest entities and complex interest relationships. It is difficult to switch to a new system all at once. For example, for countries like China and the United States, the first consideration is inevitably the stability of the financial order rather than exploration and innovation. The enthusiasm for embracing DeFi in regulatory policies will not be high. Mainland China adopts a suppressive attitude towards the cryptocurrency industry, while opening the window in Hong Kong, which is in line with China’s consistent policy of “crossing the river by feeling the stones”. The United States still tends to regulate cryptocurrency assets within the framework of the traditional financial system and is unlikely to give a green light to the cryptocurrency industry. We believe that in addition to regions such as Singapore, Hong Kong, and Switzerland that actively embrace the cryptocurrency industry, regions with relatively weak traditional financial systems, such as Africa, Southeast Asia, Latin America, and the Arab world, may have greater opportunities.

The third is the problem of DeFi itself. So far, the DeFi field still faces serious security issues such as code vulnerabilities, price manipulation, MEV, and private key leaks. The financial field directly deals with money, so the tolerance for security will be very low. Many DeFi protocols adopt decentralized governance mechanisms, resulting in no responsible entity to claim compensation. The losses caused by these security issues may end up being borne by no one.

The fourth is the account system problem of Web3. If a large number of RWAs are put on the chain, but the number of players on the chain is insufficient, the development of RWA will still be limited. The user experience of blockchain has always been criticized, not to mention the complex and difficult-to-understand account and password management process that has discouraged many beginners who do not understand the industry. Even many experts have experienced the painful experience of forgetting, losing, or even being stolen of private keys. The existing blockchain account system greatly hinders the entry of a large number of users into Web3. Currently, new account technologies such as MPC wallets and contract wallets are under development, but it also takes time. If the prediction of Citibank that 1 billion users will enter the blockchain is to become a reality, the user experience of Web3 accounts needs to be close to that of Web2.

Conclusion

Overall, we are optimistic about the long-term development of RWA and believe that it is an inevitable trend. Blockchain is a better financial carrier. But we must also be aware of the short-term challenges faced by RWA.

In the short term, we may still see the following situations:

-

Traditional financial institutions may not temporarily move their existing businesses onto the blockchain, but use the blockchain as an incremental business channel;

-

Some low-quality assets, and even assets with significant custody risks, will attempt to be dumped on the chain, creating a mixed situation in the RWA field;

-

Given that regulatory policies are easier to implement on permissioned chains, RWAs will first appear on permissioned chains rather than public chains.

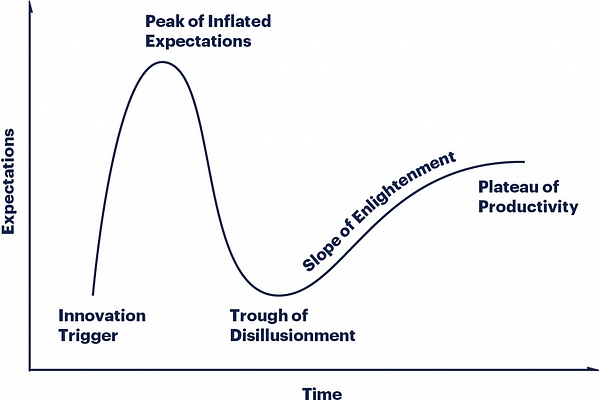

We expect the development of RWA to go through a Gartner Hype Cycle, from the short-term outbreak phase to the bubble phase, regression phase, and ultimately steady growth.

Gartner Hype Cycle

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Hubei police crack the first nationwide ‘virtual currency case’, with a transaction volume of 400 billion.

- LianGuaiWeb3.0 Daily | Chainlink Launches Cross-Chain Interoperability Protocol on Ethereum and other Networks

- Tokenizing Everything Institutional Betting on the RWA Track Enters the ‘Golden Age

- Opepen Threadition has been online for 2 days and has minted over 37,000 tokens. Why is Jack Butcher always able to create NFTs with phenomenal popularity?

- Foresight X To define, what is Crypto Native

- In-depth Explanation of Boojum Upgrade Why zkSync Era Chooses the STARK Proof System

- What is the next step for Ethereum after The Merge?