What is the next step for Ethereum after The Merge?

What's next for Ethereum after The Merge?Author: JOEL JOHN, SAURABH; Translation: QDD, Cointime.com

We have been tracking gaming, Web3 social, and payment infrastructure in this newsletter. Part of the reason for implementing these applications is improvements at the protocol level. We have introduced some improvements in previous articles, such as account abstraction and ordinality. But sometimes, when the protocol has made enough progress, it is worth writing an article about upcoming improvements.

If you try to trade volatility, you may be affected by two upcoming factors. One is the continuous repricing of the probability of a Bitcoin ETF. The other is the rapid decline in private market activity. We will discuss these two factors at another time, but for now, let’s take a look at the technological advancements Ethereum is making as a protocol.

Why pay attention to these? As of the end of June this year, the market value of all cryptocurrencies is about $1.2 trillion. Among them, about $590 billion is Bitcoin, and about $130 billion is stablecoins, which have made slow progress in innovation. Excluding stablecoins and Bitcoin, Ethereum accounts for 47% of the industry’s market value. In the smart contract platform (with a total market value of about $340 billion), two-thirds are Ethereum. Without considering Ethereum, it is impossible to establish a comprehensive understanding of the industry.

- Exploring the StarkNet ecosystem AGLD soaring, whole-chain gaming brewing

- MKR Drives DeFi Recovery Are RWA and Endgame Sustainable Narratives?

- Opinion The launch of the dYdX chain will effectively test the network effects of Ethereum and Layer 2.

The discussion of ordinality and ETFs has generated great interest in Bitcoin, but the fact is that Ethereum has the strongest momentum. We see the Ethereum protocol evolving from a smart contract protocol used only by DeFi hackers and NFT enthusiasts to other uses, such as real-world assets (RWAs) and central bank digital currencies (CBDCs).

We have shifted from “Rollups will be launched” to “We need to reduce the cost of Rollups publishing data on Ethereum.” This article will introduce the most important recent upgrades of Ethereum and share future prospects. Ethereum’s roadmap has changed over the years and is likely to continue to change as technology matures and we gain new information.

Before we start, let’s make a small editorial note. Most articles involve storytelling and broader implications. I also hope to write this article in this way to a large extent. However, the roadmap of a technical product cannot be creatively interpreted. Therefore, we try to provide a very objective explanation of what might happen in the future. We try to explain concepts, but you may notice that this article is more complex than what you usually read.

What’s new today?

In the past month, you may have seen a lot of content about “The Merge” on your timeline. This is the transition of Ethereum from Proof of Work (PoW) to Proof of Stake (PoS). In the case of the PoW chain, external computers compete to determine who has the ability to find a specific number that meets predefined conditions to create a block. In the past, the energy consumption of PoW Ethereum has been a point of controversy for artists and the public in accepting Ethereum as a protocol building platform.

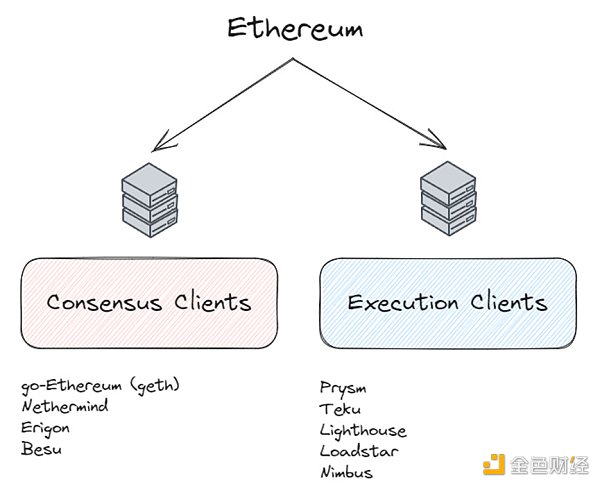

Merge is a parallel chain running on the Proof of Stake (PoS) chain. Most of Ethereum’s functionalities continue to exist on the Proof of Work (PoW) chain, and thereafter, transaction, smart contract instructions, and balance functionalities are also moved to the PoS chain. Earlier this year, the merge merged Ethereum’s execution and consensus functions into a PoS-based system. Instead of rewarding miners, rewards are given to individuals who stake their assets on the network.

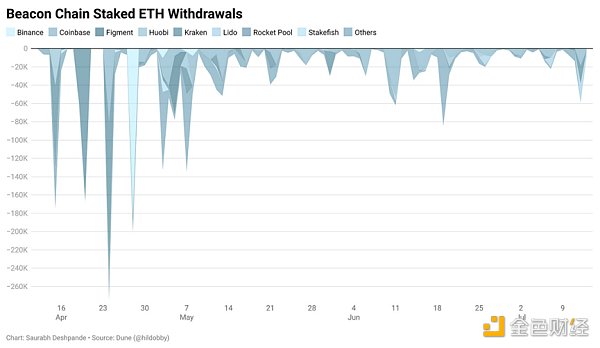

As of April 2023, the network started allowing users to withdraw their staked Ether on the network. Previously, if you staked Ether, you couldn’t withdraw those tokens in case of emergencies. Now you can, after waiting for a certain period of time. These changes also come with some other notable variations. Here are a few worth mentioning:

-

EIP 3651 reduces the gas cost associated with accessing the coinbase address (the address related to receiving block rewards) for MEV payments.

-

EIP 6049 warns against using the SELFDESTRUCT opcode as developers intend to change its usage. These changes are mentioned in the subsequent sections.

-

EIP 3855 introduces a new instruction to reduce gas costs.

-

EIP 3860 makes changes to Initcode (the code executed when creating a contract), limits its usage, and introduces gas fees to prevent abuse.

Although Ethereum’s current roadmap takes several years, the Cancun-Deneb upgrade is scheduled for later this year. The long-term roadmap is divided into four sections: scalability, security, user experience, and future adaptability. We will provide a detailed overview of each section below.

Scaling 200x

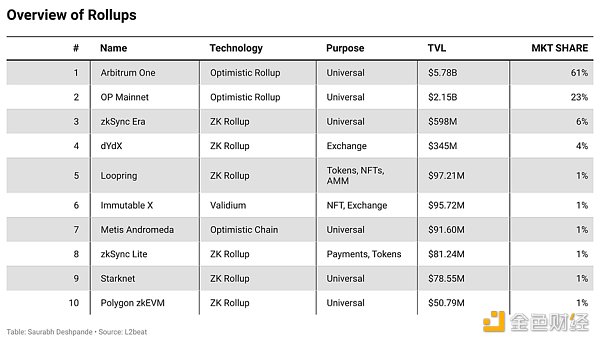

Scalability is the Achilles’ heel of all decentralized public blockchains. Ethereum’s initial idea was to achieve scalability through sharding (dividing the network into multiple networks for parallel execution). However, with the emergence of Rollups, the idea of sharding was put on hold, and Ethereum’s roadmap became centered around Rollups.

When it comes to Ethereum’s scalability, you will hear two new terms – Danksharding and Proto-Danksharding. We will gradually explain these terms, but know that Danksharding is the ultimate form, and Proto-Danksharding is the intermediate step to achieve it. The idea of Ethereum centered around Rollups is that it should shape itself in a way to accommodate multiple Rollups.

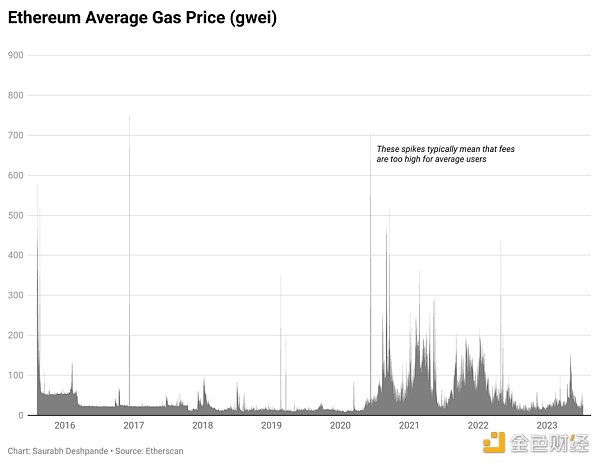

Before delving into the aforementioned daunting terms, let’s briefly recap the basics of Rollups. As demand increases, Ethereum becomes slower and more expensive. Here, demand refers to the demand for Ethereum’s block space and virtual machine (VM). Therefore, by offloading computations elsewhere, we can relieve the burden on the EVM.

Based on where they publish transaction data (whether on Ethereum or elsewhere) and how they prove that the executed computations comply with Ethereum’s rules, different types of Rollups (optimistic, validity, zero-knowledge) are created. If you want to learn more about Rollups, you can refer to Vitalik’s explanation of Rollups in 2021.

Rollups submit the input data of transactions in batches (compressed) to Ethereum. These inputs are called calldata. Calldata has two main issues:

-

There is a limit to the amount of calldata that can be included in a block (937,000 bytes). You may wonder why this limit exists. The reason is the same as the size limit of each block in Ethereum and Bitcoin – to ensure that the system requirements of running nodes and validators remain within a controllable range to protect decentralization.

-

For the same reason, we cannot arbitrarily increase the limit of calldata. This limit also restricts the scalability of Rollups as a solution.

-

Calldata is expensive because every node on the Ethereum network has to process it and store it permanently, but Rollups do not need to permanently store this data.

Proto-Dankesharding, or EIP-4844, is a method to improve the calldata limit. This EIP proposes the introduction of a binary large object (BLOB) space attached to a block. Being attached to the block means that the EVM or executing clients cannot see this space (which means that the EVM does not need to store or process it). This blob space is visible to consensus clients. When Rollups publish data to the blob, consensus clients will prove that they have seen this data.

These data will be available for everyone to view and verify whether Rollups have indeed published the correct data for a long enough period of time (1-3 months). After this deadline, consensus clients will delete the data and only leave their proofs. This way, consensus clients ensure that they are not affected by data inflation. Additionally, the EIP also proposes simplified methods for verifying this data, so that validators do not need complex devices to challenge Rollups.

Rollups help reduce the cost of transactions on Ethereum L1 to about 12% to 33% of the original cost. The changes brought by EIP-4844 are expected to further reduce the cost associated with L1 transactions of Rollups to 5% of the current fees. The goal is to reduce Ethereum transaction fees to less than $0.001.

Improving Validator Management

There are two solutions in the research phase that are expected to improve security: proposer boost and view merge. Discussions are underway to replace proposer boost with view merge. Below is a brief explanation of these two terms, and if you want to learn more, you can start from here and here. Proposer boost means giving block producers additional temporary weight to make chain reorganization and block replacement more difficult.

In view merge, validators need to merge their views of the state of the chain (the complete view of addresses and contract balances, etc.) before confirming new blocks. This helps prevent attacks that rely on validators not having temporary consensus on the state of the chain.

One way to attack Ethereum is to control a large validator. The keys to control the validator are scattered across multiple devices to make it difficult for such threats to gain access. Distributed Validator Technology (DVT) ensures that there are no single points of failure in the validator stack.

It can be seen as a multi-signature for nodes. Validators can disperse their private keys across multiple computers. This achieves two key objectives. First, attackers now have to invade multiple computers to gain access to the validator’s private keys. If Ronin uses DVT, attackers may need greater effort to obtain control of the bridged funds (worth over 600 million USD). Second, a hardware failure in one of the systems will not affect the validator’s node. This avoids penalties caused by downtime.

In addition to controlling keys, attackers can also determine the next validator and attempt to send a large number of requests through denial-of-service attacks (DoS). Secret Selection of Leader Election (SSLE) only allows the selected validators to know that they have been chosen to produce blocks. This ensures that attackers do not know who will produce the next block.

In addition to block rewards, Maximum Extractable Value (MEV) is one of the important sources of income for Ethereum validators or block producers. They typically profit from reordering transactions (and introducing their own transactions) in the process.

Ethereum proposes to distribute this value more fairly to validators by introducing Proposal-Builders Separation (PBS). Currently, the same validator creates and broadcasts blocks. Proposal-makers (or builders) and broadcasters (or proposers) are separated through PBS. The latter can choose a block from the market of block builders.

Simpler Transactions and Lightweight Nodes

When designing the user experience for clients, the company optimizes for the number of clicks. There are two reasons for this:

-

Less clicks result in lower cognitive load for users.

-

More clicks mean more time. When competing for a user’s time and attention, it’s best to ensure that they are engaged with your application. If a task takes too long to execute and others have reduced their execution time before you, you may lose the user.

While this is true for almost all Web2 companies, there is still a long way to go for cryptocurrencies in terms of optimizing user experience. If we want users to use our applications because they are excellent in themselves, and not just because they are decentralized, we have a lot of work to do.

In fact, we already have some innovators using our products. Selling them on the basic principles of blockchain technology will not help us achieve “mass adoption”. DApps must stand shoulder to shoulder with traditional applications to attract the masses. This means that protocols like Ethereum need to make several changes in terms of user experience. This article will discuss transactions and accounts through the forms of account abstraction and improved node infrastructure. This way, ordinary users can experience the feeling of running a node without relying on any centralized institution to verify if they have received their funds.

Account Abstraction

The most important upcoming upgrade to improve user experience is account abstraction. We have already outlined the reasons for it in this article. To recap, EIP 4337 (or Alt Mempool for account abstraction) will be deployed to the mainnet in March 2023, marking the first step towards account abstraction.

It introduces elements of account abstraction without changing the existing protocol. 4337 can be seen as a new layer where existing wallets can act as smart contracts, not just addresses. It introduces a special type of transaction called a user operation for interacting with smart contracts.

These user operations are stored in a separate mempool. Miners or block builders package these transactions and submit them to the network. But what does this mean and what will it achieve? B1C0nomy explores the possibilities of short-term gasless transactions, social logins, batch transactions, gas payment with tokens other than Ether, and more.

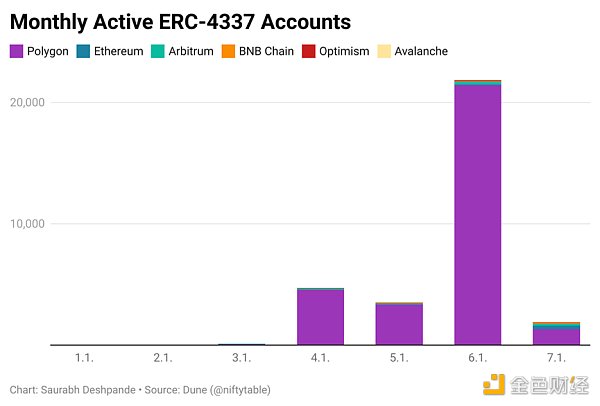

We have discussed how it works in the past, so we will use it as a revision of the adoption of AAs. As of June, over 20,000 wallets have interacted by enabling AA functionality. It is likely that this standard will drive the next wave of gaming, media, and Web3 social applications. If you want to try it yourself, we recommend downloading the Vybe wallet.

Better Node Infrastructure

Are you running an Ethereum node? Most likely not. It requires significant hardware with high memory, storage, CPU, and technical knowledge. To help decentralized nodes, our goal should be to reach a hardware requirement that does not hinder those interested in running nodes. How do we achieve this? Ethereum introduces a concept called “statelessness.” It does not eliminate the need for nodes but changes how they handle data.

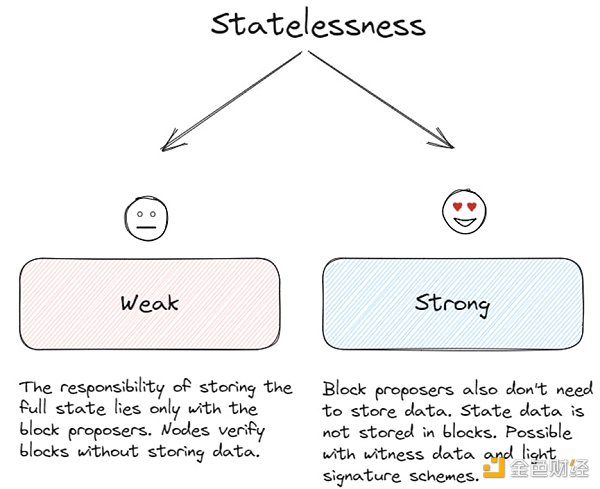

To understand this concept, we first need to understand what weak state and strong state mean. Weak state means that only block proposers have the responsibility of storing the complete state, and other nodes do not store any data when validating blocks. Strong state means that state data is not stored in blocks. But do we not need state data to confirm the validity of blocks? In fact, there is something called “witness.”

Before diving into how witnesses work, let’s briefly review the process of validating blocks. Using the state data in the blocks, nodes calculate the state root (by hashing the transactions together until a single hash is found). When the calculated root matches the one provided in the block, the block is validated.

Witnesses contain fragments of state data required for calculating the root hash. With this witness, nodes can verify if the block producer correctly executed the transactions and updated the state.

Alright, now that we understand that we need witness data to replace the state data in blocks for nodes to determine the validity of proposed blocks. But this also means that witness data needs to propagate quickly to all nodes. If the size of this data is large, only nodes with high-bandwidth connections can validate blocks. This is where the problem of centralization lies.

Currently, Ethereum uses Merkle trees to find the state root of a block. The problem is that the witness data obtained from the Merkle trees is huge and cannot support stateless clients. As a step towards strong statelessness, we have something called Verkle trees. Compared to Merkle trees, they are only 1/23 the size and can provide witness data that can be quickly propagated across the network.

Verkle trees are currently running on the testnet. In the next stage, as clients update to support them, they will be running on private and public clients. With faster propagation and less storage requirements, we may see low-cost node providers entering the market. (If you are building such a provider, let us know).

All these changes are happening simultaneously. Some of them may evolve into other forms when they are put into practical applications. We do not have a definitive view on the evolution of the roadmap. But what is certain for now is that the current price may not reflect the intellectual density of the Ethereum team. Of course, there may be other L1 (or L2), but it may be difficult to replicate the contributor network that these developers are releasing at this speed.

We may see technological changes brought about by the Cancun-Deneb upgrade by the end of this year. We won’t delve into every detail, but for those inclined towards technology, here’s a quick overview. Please note – there is a lot of jargon involved.

-

EIP 1153 – Interacts with transient storage by introducing new opcodes. Transient storage is simply temporary storage created and destroyed within a single transaction. Since this storage does not require disk access, its gas consumption is much lower.

-

EIP 4788 – While this is still ongoing, it aims to enable smart contracts to access the beacon chain from within the EVM. Well, I know this sounds meaningless. Currently, smart contracts access the state of the beacon chain through different oracles. With this EIP, smart contracts can read the state of the beacon chain without relying on oracles, making smart contracts more trustless.

-

EIP 5656 – Introduces a new instruction called MCOPY, which allows smart contracts to copy data from one place to another. The gas consumption of the currently used instructions, MLOAD and MSTORE, is higher.

EIP 6780 – Restricts the use of the SELFDESTRUCT instruction.

Its current use is to destroy a smart contract and transfer its ETH to a specified address. It is a response to the 2016 DAO hack. However, smart contracts rarely use it. To make contracts more predictable, 6780 limits the instruction to only two cases – applications that use it to retrieve funds will continue to work, and applications that use SELFDESTRUCT to create contracts will continue to work within the same transaction.

The above-mentioned EIP 4788 and 4844 also apply to the consensus layer.

-

EIP 7044 – Voluntary validator exits (validators unlocking their ETH in the custody contract) are only valid in two network upgrades. This EIP proposes to make voluntary exits permanent. This will simplify the staking experience and improve the overall staking experience.

-

EIP 7045 – Allows proofs to include the last slot of the next epoch. Let’s explain. Messages sent by validators claim that they have seen a block. An epoch is a time period consisting of 32 slots, with each slot lasting 12 seconds. Ethereum reshuffles the validator committee every epoch. The aforementioned proofs are only valid in certain slots. This EIP increases the number of slots where the proofs are valid, thereby improving the security of Ethereum.

What’s Next

We have been debating the issue of protocol economics internally. People often raise the old argument that SMTP, HTTPS, and RSS have changed the world without requiring users to pay high fees. Can Ethereum have a similar impact? We are considering the answer in the next article, but what is certain now is that Ethereum is a knowledge black hole that attracts some of the smartest people of our time and has achieved application scenarios that we couldn’t imagine a few years ago.

These applications are still in their early stages, just like Netflix before the widespread adoption of broadband. The protocol changes in the form of EIPs require massive coordination to develop and deploy the code, ensuring that no failures occur. When we look at price charts, we often think that nothing is happening. But if this article has anything to convey, it is that a distributed developer team is doing a lot of work, which is often taken for granted.

Entering a Linux IRC server ten years ago and seeking help to download different operating systems was an interesting experience. Developers in the 1990s contributed to these systems. We are no longer excitedly discussing changes in Linux distributions as many of them are stable and used on various devices. Ethereum may also have a similar moment. Users may think that the protocol is constantly evolving and they don’t need to worry about anything. But that is the ultimate state. We haven’t reached there yet.

Chains in our industry often experience failures. The frequency of reorganization in some chains is even as frequent as the anxiety attacks of a young professional. There is still a lot of work to be done.

Before we reach that stage, it is time to build now.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- IOSG Ventures In-depth Exploration of New DeFi Unleashing the Potential of Data

- Opinion Transitioning from SNARK to STARK is the inevitable path to zkSync’s multi-chain vision.

- Opinion 5 Reasons Why UniswapX Will Change the Rules of DEX, MEV, and Interoperability Games

- Chainlink Cross-Chain Interoperability Protocol (CCIP) goes live on the mainnet, how does it bring security to cross-chain?

- Who is Tom Emmer? Majority Whip in the US House of Representatives active in the cryptocurrency field.

- Official Interpretation of UniswapX and How Does UniswapX Work

- The growth of RWA is driven by US Treasury Bonds.