NFT completely cold? Analyzing the actual transaction data of the past two years

Analyzing 2 years of transaction data to assess NFT's coldnessAuthor: OVERPRICED JPEGS

Translation: Huohuo, Plain Language Blockchain

1. The Demise of NFTs

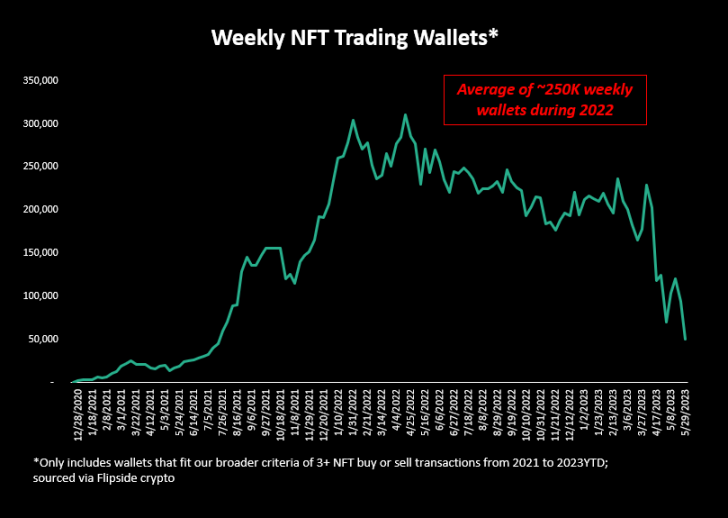

NFTs are dead. It is becoming increasingly difficult to refute this view. This week, only 46,139 wallets bought or sold NFTs. Wallet participation decreased by 73% compared to the same week last year. Similarly, trading volume decreased by 82%. Let’s not even get started on prices.

- Interoperability and Bridging in Blockchain Current Status

- Vice President of the Hong Kong University of Science and Technology, Wang Yang Seizing the opportunity to issue government-backed Hong Kong dollar stablecoin

- Understanding Two RWA Asset Issuance Models in One Article

But are things really as bad as everyone says? And has everyone really left? To look to the future, we must first review the NFT thesis of 2021 and how we got from there to where we are now.

The narrative goes something like this:

We said that as people flocked to this emerging technology for its ability to solve many real-world problems, NFTs would become mainstream.

The promise of blockchain-backed Taylor Swift concert tickets, intellectual property, and exclusive clubs (also known as Discord channels and Telegram chats) was intriguing. Additionally, the prices of Monkey JPEGs skyrocketed.

Well, it turns out that some of those ideas sounded pretty foolish. The bubble defeated us, mainstream consumers rejected our grand vision of web3. The bubble burst, and with it came… a flood of memes, games, scams, passports, and metaverses being rejected, and doubt began to spread:

What if none of this mattered?

What if factors other than the NFT cycle drove adoption?

What if it was primarily us – the crypto natives – who were participating?

How could there be billions of dollars in trading volume?

What if NFTs were actually caught in a death spiral?

It is in this context that I will share some research findings from my collaboration with the excellent data scientist rmas. Specifically, we have been studying NFTs on ETH L1.

I am sharing some important data to provide historical and contextual background for the current NFT landscape and perhaps bring a glimmer of hope in the process.

However, before we dive in, let me make it clear that I’m not here to convince you that NFTs will not die. Many NFTs have already died. But, as I want to say, the market is full of zombies. And we all know zombies are immortal.

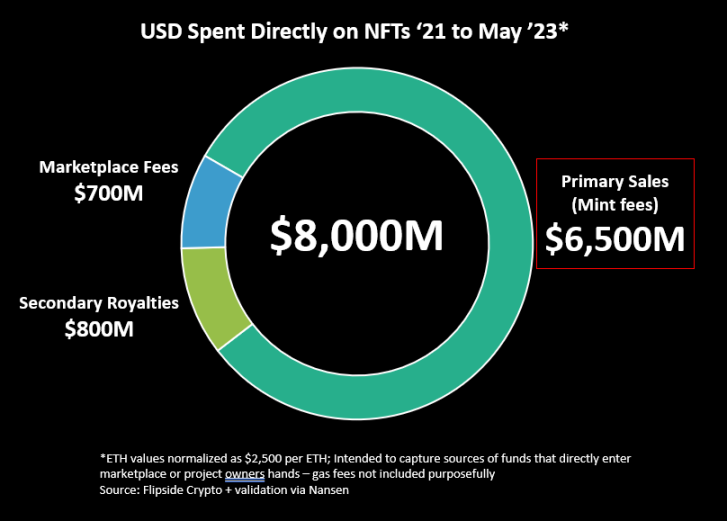

Spent $8 billion buying JPEGs with my 650,000 friends.

We often look at the trading volume or market value of the secondary market to understand the health of the cryptocurrency market. We know that these numbers may be exaggerated, but in general, if the numbers go up, there will definitely be more people participating.

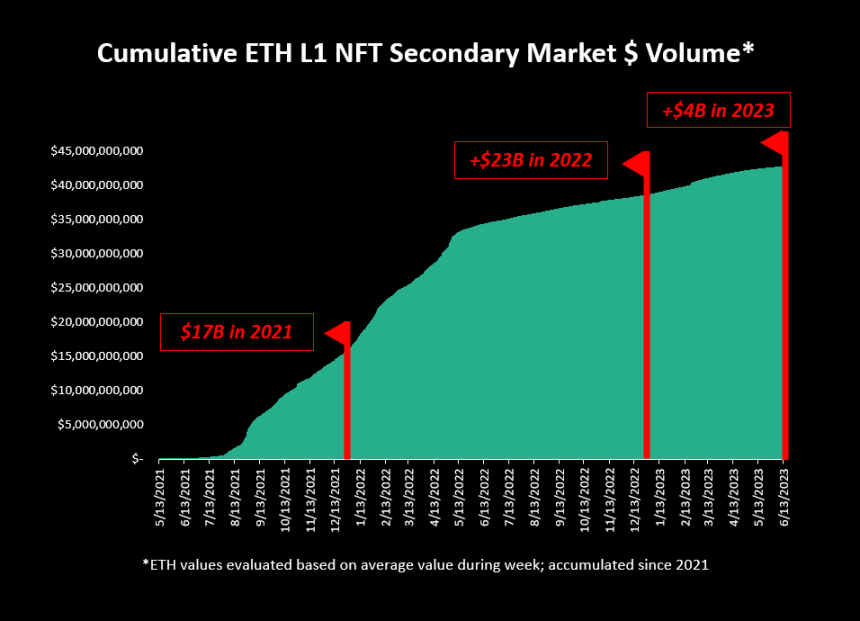

The secondary trading volume of NFTs exceeds $40 billion. Is this true? What are the prices for washing transactions or zero-sum PVP? We can argue endlessly about this question, but the natural inference is that “new consumers” must have participated in driving such large sales.

Let’s take a different approach and see how much money was actually “spent” on minting and secondary licensing fees. Then we’ll consider how many people were involved in spending that money.

Here are the facts.

ETH NFTs worth $6.5 billion were minted from 2021 to 2023.

$1.5 billion was collected during the same period through royalties and marketplace fees. If you think this is surprising, you should take a look at the types of projects that charge more than 1,000 ETH for minting fees. You will be ashamed.

Anyway… during our peak period, spending on NFTs definitely reached $8 billion. Despite some broad adoption, there is still a lot of liquidity entering the market.

2. How many “users” actually bought these things?

“Users” as a measure of cryptocurrency is often a concern. We know that creating new wallets is easy, and the metrics may be exaggerated.

However, the real question is simple: do one million users regularly buy and sell NFTs? Or is it close to five million? Or five hundred thousand?

We have designed a formula to obtain a fairly accurate number. First, we use simple segmentation to understand how many wallets bought or sold (traded) NFTs three or more times from 2021 to 2023.

This number is 2.1 million wallets. How do I know that about 2 million wallets are real users? Intuition tells us that we all have more than 2 wallets.

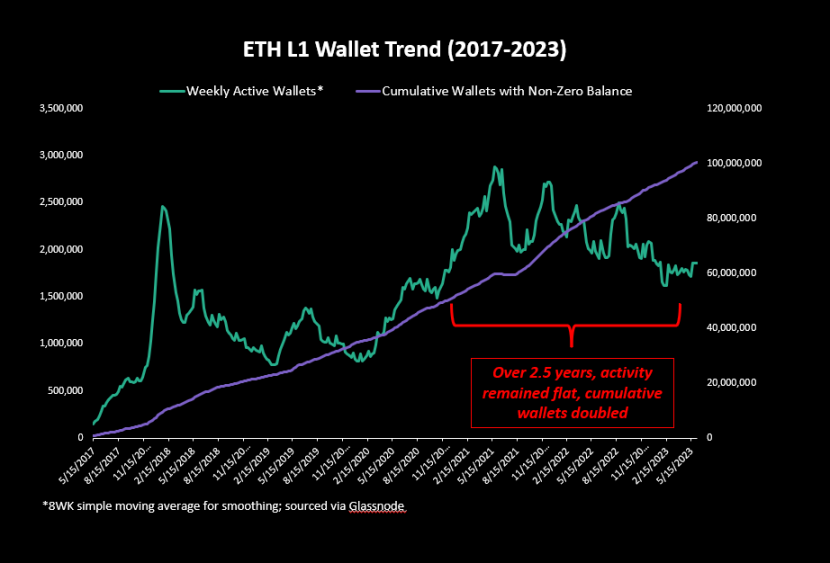

We can look at the monthly average number of wallets on Ethereum and compare it to the number of non-zero wallets. In the past 2.5 years, the cumulative number of non-zero wallets has doubled, while the average number of wallets using the chain per month has remained the same.

If we apply this logic to NFT wallets, we should reduce the number of 2 million NFT wallets by half to roughly understand the “users”. Therefore, now we estimate the upper limit of frequent NFT users in the past 2.5 years to be 1 million.

This brings up more questions: What is a user? What happens when someone exits? Who is active?

There are two important numbers:

1) Total number of independent users reached

2) Weekly active usage

Let’s take a look at the weekly active usage of NFTs.

Unfortunately, our best “usage” metric is the number of NFTs bought or sold last week. For most of 2022, the weekly wallet count has been around 250,000.

The weekly count of 250,000 active wallets sets the “bottom” of our estimate range. The number of users seems unlikely to be less than 250,000. With this, I can assert that there are between 250,000 and 1 million independent users participating in ETH NFTs on a semi-regular basis.

For future shorthand, we’ll cut it somewhere in the middle and say there are about 650,000 users. Or there are 650,000 clowns participating in the NFT circus between 2021 and 2023.

Now, let’s stress test the user based on that spending number and see if it makes sense.

$8 billion divided by 650,000 is $12,000 per person. Seems like a lot, right? Let’s dive deeper into how we view liquidity when it enters the market. And who ultimately gets the money? Where does the minting fee go?

When NFTs are bought and sold, liquidity has multiple opportunities to exit the market:

1) Minting: typically absorbed by the team, usually spent on “operations”

2) Royalties: same as above

3) Marketplace fees: theoretically used for personnel allocation and market operations

4) Gas fees: we will ignore in this exercise

5) Exiting traders: also ignored in this exercise

Let’s dive into #1-3. Since all of these are market-based, we first look at the trading volume timeline of the NFT market.

Over the past 2.5 years, the dollar value of NFT trading volume on ETH L1 has been $44 billion. So, let’s first check if it makes sense for the trading volume to be 6-7 times that if only $8 billion was spent on minting and fees.

We dive in and are surprised by some facts along the way.

3. Putting the money back in the casino

John Bessler's Perpetual Motion Machine

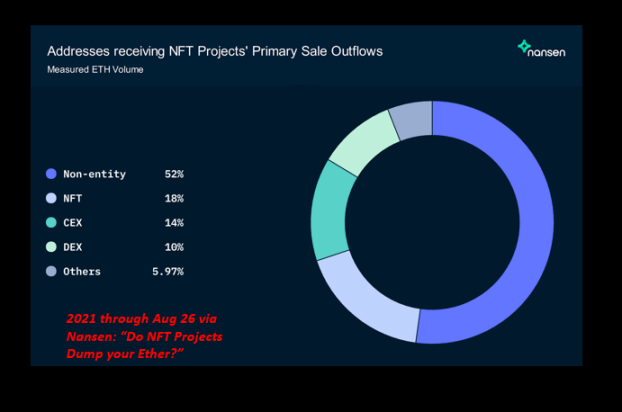

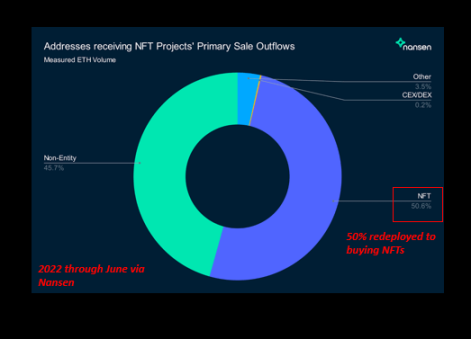

Nansen has done an excellent job in tracking the NFT minting revenue in 2021 and 2022. What we have seen is actually surprising… Here is where the funds went in 2021 (as of August):

In the first half of 2021, 18% of the minting fees were reinvested in purchasing NFTs. Well, that’s true, but take a look at this…

In the second half of 2022, 50% of the minting fees were reinvested in the NFT market.

Let’s take a moment to understand this. 50% of the project’s minting funds were used to buy more NFTs. Of course, some of them may be bad actors, but not all of them. In just six months, 50% of the project’s funds returned to the NFT market. Considering that most projects in this field do very little, this is significant.

So, if the project collected a total of $7.3 billion in minting fees and licensing fees, and 50% was put back into the market, the “loss” of real liquidity withdrawn from the market is about $4.4 billion.

Is this true? Did these people really show up with this money and put it into the NFT vending machine?

Well, let’s take a look at their wallets.

On January 1, 2022, wallets that met our criteria for NFT transactions more than three times had over $3.9 billion in liquid assets in their wallets. This only involves USDC/T and ETH.

So yes, this expenditure is real. And the scale of liquidity suggests that these people are unlikely to be the mythical “mainstream” consumers. They may have been involved in cryptocurrencies for some time.

4. Conclusion

Between 2021 and 2023, there may be 650,000 users who participate in NFTs on ETH on a semi-regular basis. Not 650,000 per week—I’m talking about cumulative users. Compared to the number of users ranging from 50,000 to 200,000 per week, this number is not that many.

Although the fast-paced Discord chats and the bullish market atmosphere make it seem like we have wider adoption, these numbers indicate to me that the core NFT participants have never been the mainstream audience. Most of the trading volume between 2021 and 2023 comes from a small group of crypto natives who spend an average of $7,000.

Because if we had indeed gained mainstream attention and lost it, people might say that the broad thesis of NFTs will never recover.

But if there are 650,000 cryptocurrency natives participating, buying, selling, and trading digital art in a span of two years, then the current level of participation is not declining as sharply as we have revealed, because there weren’t that many people here to begin with.

Yes, people have left. But there are still many cryptocurrency natives and fallen ones here, even though the spending and participation are much lower than a year ago (or damn, even a week ago).

Despite the absurdity of most of the hype cycle, we still learned a lot and gained a lot in the process.

We are the walking dead. Few in number, slow in speed, and mutating every day. You can surpass zombies, but eventually the infection will spread.

So yes, NFTs are dead, but we can continue for a while without a brain until the next cycle begins.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Exclusive Interview with Solv Co-founder Meng Yan DeFi and Public Chains Still Have Huge Development Potential, Perfecting Infrastructure is the Key to Mainstream Adoption

- Hive Digital CEO Blockchain and AI can mutually benefit each other

- Why is Ethereum’s position as the king of public blockchains difficult to shake?

- a16z AI combined with blockchain creates four new business models

- Interview with Sui’s Vice Chief Information Security Officer at Mysten Labs Considerations, Design, and Practice of Sui Blockchain Security

- Sei’s ultimate marketing rule Make headlines through news, and use sunshine airdrops to sweep the cryptocurrency community.

- 10 Ways NFTs are Boosting the African Tourism Industry