Understanding Two RWA Asset Issuance Models in One Article

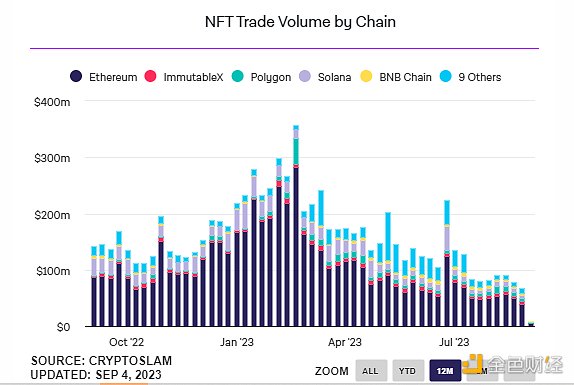

Understanding Two RWA Asset Issuance Models in One ArticleRWA assets have attracted widespread attention in the world of cryptocurrencies. Since they are RWAs, so-called “real-world assets,” they are inevitably subject to the framework of the real world, especially the legal system and asset ownership structure of the real world. Therefore, to solve related problems, compared to token issuance directly on the blockchain, the issuance framework and process of RWA tokens are more complex.

It is crucial to differentiate asset issuance models. For example, there are nearly ten similar projects offering almost the same returns for the same type of government bond tokens. How to distinguish their advantages and disadvantages? Especially for fixed-income products like government bond-like tokens, which are often investment products, the allocation ratio is often significant. How to differentiate the risk points of similar products?

Using government bond-type tokens as an example, the asset issuance model and related legal documents determine what underlying assets investors are buying: whether it is the corporate debt of a company investing in government bonds, the fund shares of a fund investing in government bonds, a government bond ETF repackaged and purchased by a certain entity, or a genuine government bond token that can ultimately be redeemed by the US Department of the Treasury. Different types of underlying assets correspond to different types of risks, and these risks may be difficult to perceive for the vast majority of the time until a black swan event occurs.

This article will organize and analyze common types of RWA token issuance in the market, hoping that readers can further understand the RWA asset issuance framework and effectively identify risks in the process of further integration between the crypto world and the real world.

- Exclusive Interview with Solv Co-founder Meng Yan DeFi and Public Chains Still Have Huge Development Potential, Perfecting Infrastructure is the Key to Mainstream Adoption

- Hive Digital CEO Blockchain and AI can mutually benefit each other

- Why is Ethereum’s position as the king of public blockchains difficult to shake?

Classification of Asset Issuance Models

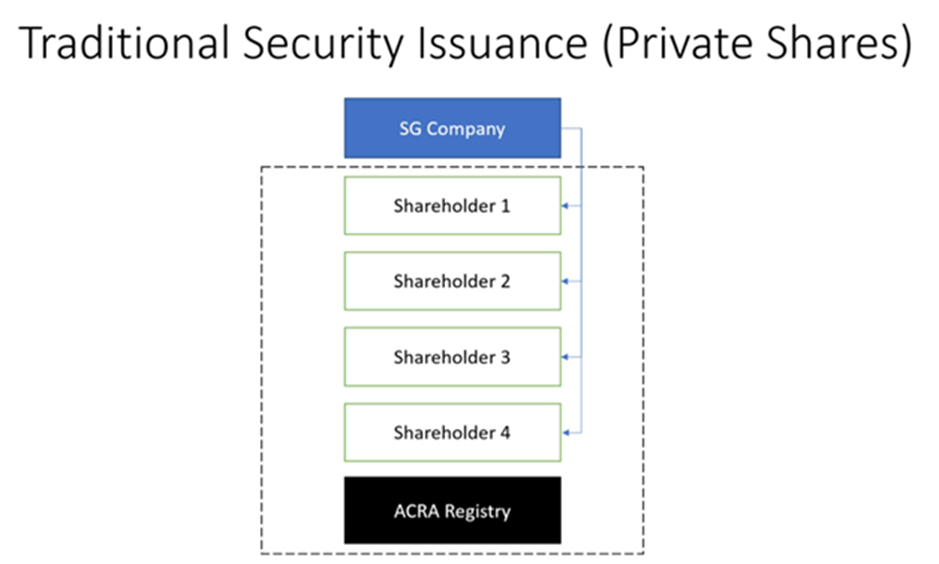

To understand the RWA token issuance models, let’s first take a look back at the traditional asset issuance models. Taking securities as an example, the figure below shows the typical issuance model for Singapore company equities.

Figure 1: Traditional stock issuance model, source: DigiFT

A company may have multiple equity holders, and the ownership of these equities will be registered with ACRA, and their transaction and transfer records will also need to be registered with ACRA.

Among them, ACRA is the securities registration institution in Singapore. Corresponding institutions may exist in other countries’ markets or involve different market mechanisms, such as transfer agents in the United States. Their function here is to register and record securities holders.

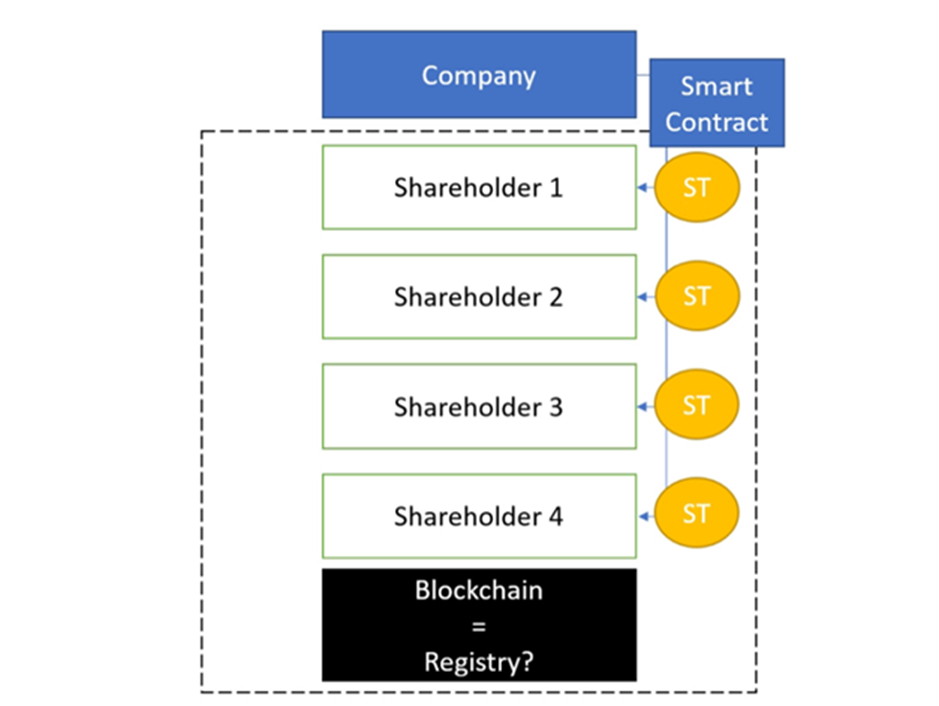

Figure 2: Direct issuance model, source: DigiFT

If tokens are to be issued on the blockchain, it is actually using the blockchain as a ledger to register and record equity ownership and record each transfer process.

In a few countries and regions at the forefront of financial innovation, they support direct registration of securities on the blockchain, such as Switzerland’s DLT Act. Therefore, in these regions and countries, securities can be directly issued using the blockchain as a ledger through authorized organizations. However, in other major financial markets such as the United States, Singapore, Hong Kong, etc., the relevant laws temporarily do not support direct registration of securities on the blockchain. Therefore, most assets need to take a “detour.”

Currently, the mainstream issuance models in the market can be classified into two categories: direct issuance model and asset-backed model. Essentially, both issuance models involve issuing relevant bonds on the blockchain, but the form of issuance and corresponding rights are completely different.

It should be noted that if private securities meet certain conditions, such as a limited amount of sales and a limited type of investors, their impact on the financial market is very limited and they can also be issued under regulatory compliance. This is also the reason why most RWA projects currently only target qualified investors.

Direct Issuance Model

The direct issuance model involves the asset issuer using the blockchain as a tool for registration and issuance of corresponding tokens on the chain. The tokens represent the underlying assets themselves. Investors who purchase and hold such assets can directly obtain various related rights belonging to the assets, such as voting rights for stocks and repayment rights for bonds.

However, the direct issuance model still has many limitations in the current market environment. For example, such securities are tokenized and incompatible with the current mainstream securities exchange structures (such as Nasdaq, SGX), or there are certain friction costs. Currently, the relevant legal structures are also incomplete, and there are no sufficient legal cases that can serve as precedents for the future.

Case Study

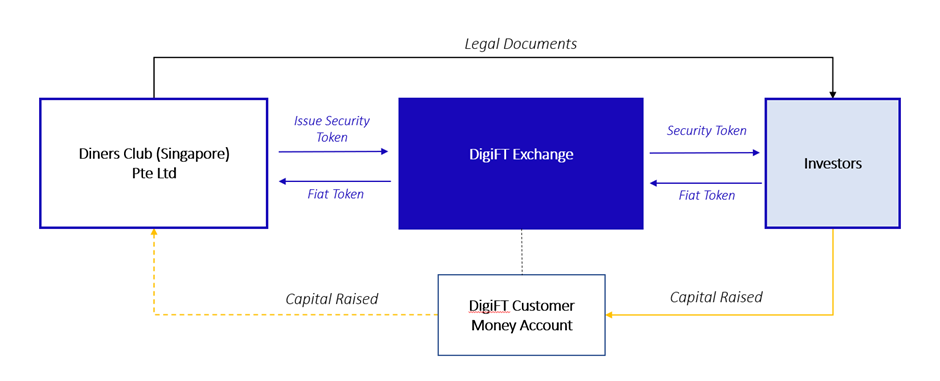

Many RWA projects currently adopt the direct issuance model, such as using bonds to introduce real-world economic rights onto the chain. One example is the Diners Club Debt Security Token issued by DigiFT. The issuance structure is as follows:

Figure 3: Diners Club Debt Security Token Issuance Structure, Source: DigiFT

Diners Club International Ltd. is a direct banking and payment services company under Discover Financial Services and is one of the most well-known brands in the US financial services industry.

Diners Club (Singapore) Pte Ltd. (DCS) is the franchised operating entity of Diners Club International Ltd., established in 1973. It is a limited liability private company registered in Singapore and its main business is to provide credit card and debit card services in Singapore under the name “Diners Club”. DCS issued tokenized notes for a one-month period on DigiFT as a trial for its financial management plan, using the direct issuance model.

In this case, DCS is the asset issuer and the tokens issued represent the company’s notes. Any user holding the token can redeem the corresponding assets from DCS after the expiration.

Asset-Backed Model

Due to the current legal imperfections and the limited availability of on-chain assets, many projects choose to use the asset-backed model for issuance. Essentially, this type of token is a new security that represents the economic rights of the underlying assets. The asset issuer registers and issues the assets outside the blockchain system, and after a third party purchases the assets, tokens are issued according to the corresponding proportional relationship, with the risks borne by the asset issuer and the asset-backed token issuer.

The asset-backed model is currently a common RWA model that can bring real-world returns into the chain, but it introduces additional risks, and although the issued tokens can contain the economic value of the underlying securities assets, there may be differences in rights and real securities rights.

Case Analysis

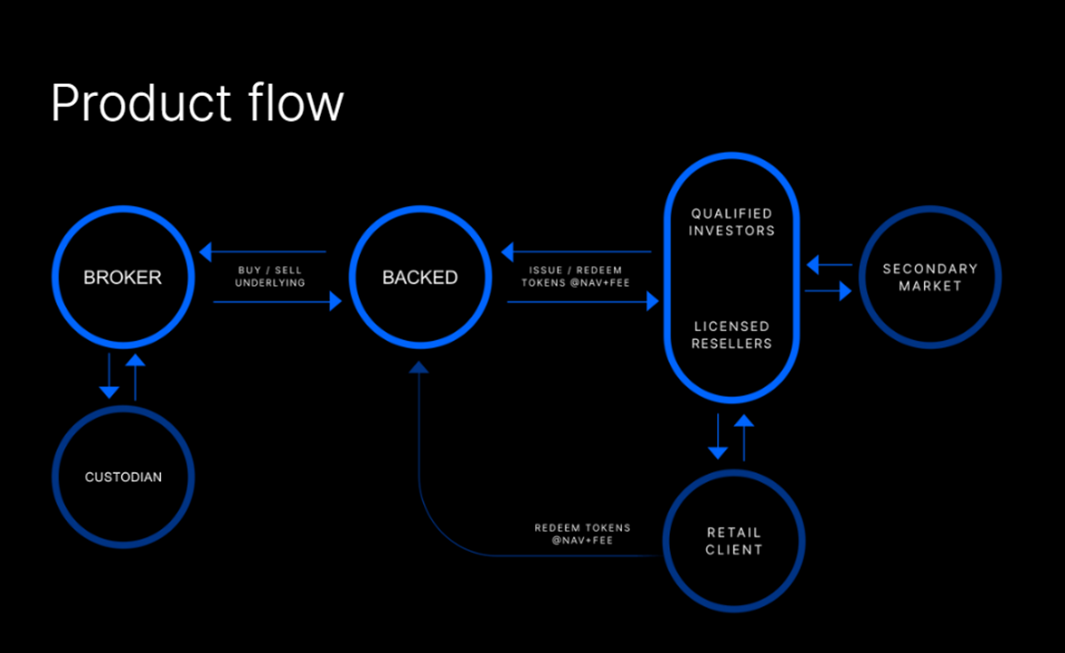

Backed Finance is a regulated institution headquartered in Switzerland that, under Switzerland’s DLT Act, can bring real-world securities onto the chain in packaged form, giving tokens economic rights. Under the asset-backed model, purchasing its tokens only provides economic rights corresponding to the tokens. Backed Finance also states in its legal documents that its tokenized assets are only tokens that track the underlying asset prices and do not include a range of traditional securities rights such as voting rights. Its issuance structure is as follows:

Figure 4: Backed Finance product operation process, Source: Backed Finance

Backed Finance buys corresponding assets through third-party institutions, which are then held in custody by licensed custodians. Backed Finance then issues corresponding tokens, with each token tracking the prices of the underlying assets through on-chain and off-chain data, but not involving other rights such as stock voting rights. Currently, the assets issued include assets such as Coinbase stocks and Blackrock iShares ETFs. The issuer of the assets is the issuer corresponding to the underlying assets, such as Coinbase for its stocks, and the token issuer is Backed Finance. This introduces at least two layers of counterparty risk, respectively from Coinbase and Backed Finance. Backed Finance is a typical project that issues corresponding tokens using the asset-backed model. It also explicitly states in its legal documents that the token only tracks the prices of the underlying assets (tracker of the underlying) and does not hold any other rights of the securities.

Summary

Tokens issued through the direct issuance model are the underlying assets themselves and can provide investors with direct related rights, making it a healthier issuance model. Due to the current incomplete legal framework and a lack of sufficient court cases as reference, there are higher legal risks for RWA assets issued through direct issuance. The asset-backed model is a trust mapping of the asset token issuer. This model has a very high trust cost, and project parties improve their trustworthiness through various means, such as obtaining licenses, using oracles for reserve proof, and regularly disclosing bank accounts, etc. With complete legal documents, a well-established operational process, and sufficient information disclosure, tokens issued through the asset-backed model can also provide investors with relatively complete rights and have relatively high flexibility. However, the asset packaging model is a “detour” within the existing framework, and we look forward to the large-scale application of the direct issuance model.

Over the past hundreds of years, financial securities have evolved from paper securities to electronic securities. However, as a new financial accounting tool, we believe that blockchain will have more complete laws and related infrastructure in the future to tokenize securities, further improving efficiency and reducing costs.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- a16z AI combined with blockchain creates four new business models

- Interview with Sui’s Vice Chief Information Security Officer at Mysten Labs Considerations, Design, and Practice of Sui Blockchain Security

- Sei’s ultimate marketing rule Make headlines through news, and use sunshine airdrops to sweep the cryptocurrency community.

- 10 Ways NFTs are Boosting the African Tourism Industry

- Insights and Reflections Why is it difficult to hear the voices of female entrepreneurs in Web3?

- Exploring the Concept and Function of Layer 3 in Modular Blockchain

- Inventory of Seven Bills that Could Determine the Future of Cryptocurrency in the United States