Are cryptocurrencies, as legal assets, subject to taxation in mainland China?

Are cryptocurrencies taxable in mainland China?The China People’s Court published an article on September 1st titled “Recognition of the Property Nature of Virtual Currency and Issues Related to the Disposal of Involved Property”. The article compares and analyzes the criminal law attributes of virtual currencies such as Bitcoin and concludes that virtual currencies like Bitcoin have economic attributes and can be regarded as property. The current relevant regulations clearly define Bitcoin and other virtual currencies as virtual commodities, and administrative laws and policies do not completely prohibit virtual currency transactions. Under the current legal and policy framework, virtual currencies held by relevant entities in our country still constitute legal property and are protected by law.

Is the income from the transfer of personally held cryptocurrencies subject to taxation?

Regarding the tax issues related to virtual currencies such as Bitcoin, major countries or regions have issued relevant tax regulations internationally, specifying matters related to the holding and transfer of virtual currencies such as Bitcoin. For example, US tax laws stipulate that the capital gains tax should be paid for individual income from the transfer of personally held Bitcoin, with the tax rate varying depending on the length of holding. In Japan, personal income from the transfer of Bitcoin and other virtual currencies is subject to miscellaneous income tax, and so on.

In our country, on one hand, because the current policy stipulates that virtual currency-related business activities are illegal financial activities, any legal or natural persons participating in virtual currency investment and trading activities face legal risks. On the other hand, there is currently no specific regulation on the tax supervision of income from the transfer of Bitcoin and other virtual currencies. This has led to many misunderstandings among practitioners, believing that income from the transfer of Bitcoin and other virtual currencies does not involve tax issues and does not need to be taxed.

- Can Bitcoin miners successfully transition to artificial intelligence and perfectly catch the next wave?

- August Cryptocurrency Market Summary Most indicators further corrected, and the total on-chain transaction volume decreased by 6.3% after adjustment.

- LianGuai Daily | The US SEC has postponed its decision on the Bitcoin spot ETF; UK cryptocurrency travel rules come into effect today.

However, first of all, the current regulations in our country do not prohibit individuals from holding Bitcoin and other cryptocurrencies. As mentioned in the beginning of this article from the China People’s Court, based on the existing legal framework, personally held virtual currencies are legal property and are protected by law. Secondly, the current tax laws in our country have not specifically issued regulations on Bitcoin and other virtual currencies, which does not mean that income from the transfer of Bitcoin and other virtual currencies is not subject to tax. On the contrary, the current tax laws in our country already cover matters related to the income from the transfer of cryptocurrencies such as Bitcoin.

Through which channels can the tax authorities obtain information on the transfer of individual cryptocurrencies?

Currently, the tax authorities in mainland China may obtain information on the transfer of individual cryptocurrencies through centralized cryptocurrency exchanges and service providers, information obtained through the CRS (Common Reporting Standard) exchange, information provided by blockchain transaction tracking technology teams, information provided by public security departments, and other channels.

What tax items may be involved in the transfer of personal cryptocurrencies?

According to the current tax laws in our country, the income generated from the transfer of Bitcoin and other virtual currencies by individuals may be subject to the payment of personal income tax.

Currently, the existing regulations in our country define Bitcoin and other virtual currencies as specific virtual commodities, and personally held virtual currencies belong to individuals’ property. When there is income from the transfer, it falls under taxable income for personal income tax calculation based on property transfer income items.

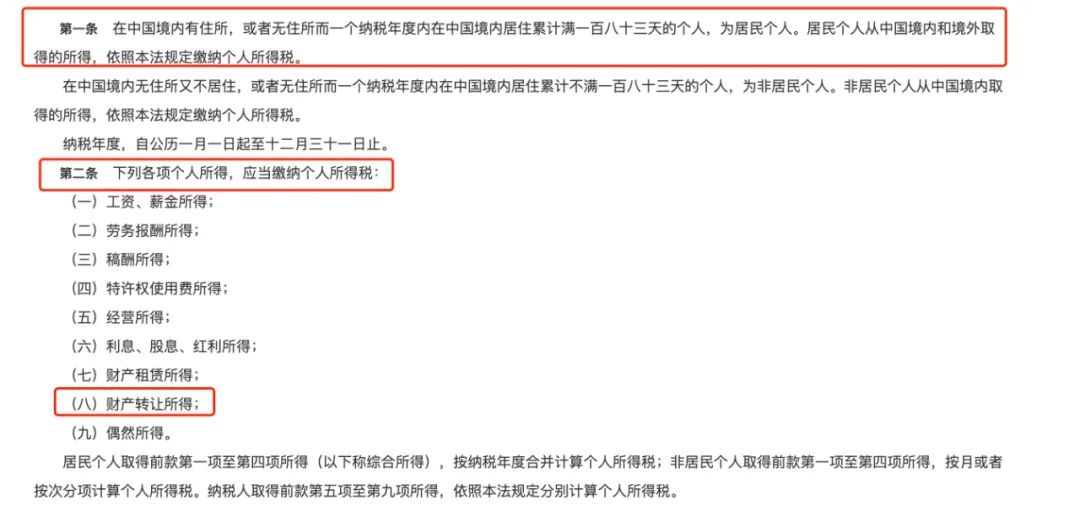

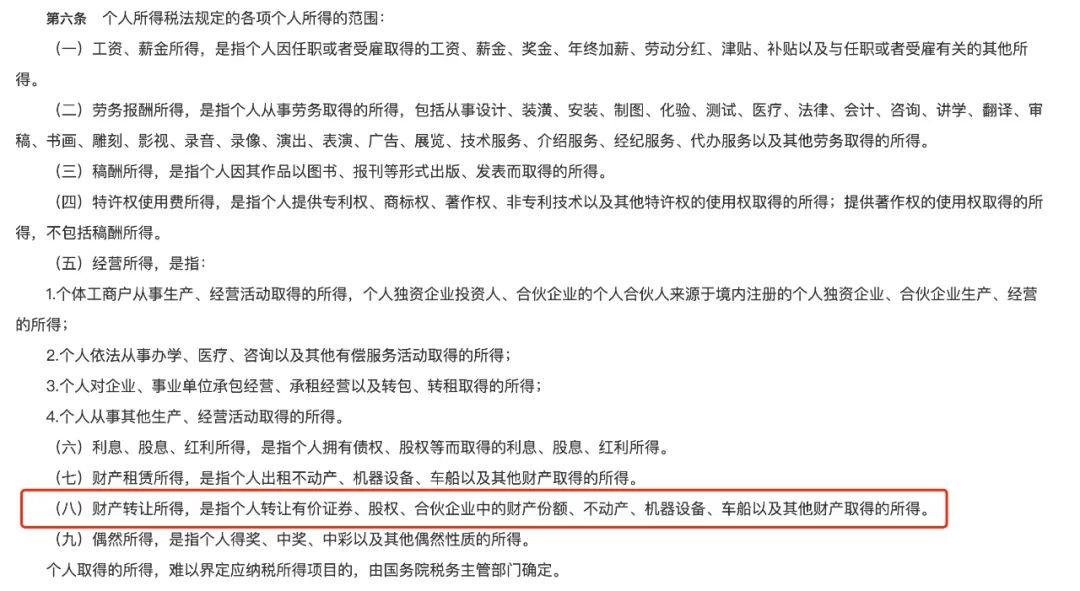

According to the “Individual Income Tax Law of the People’s Republic of China” of our country, “Article 1, …, residents individuals shall pay individual income tax on income obtained from within and outside China according to the provisions of this law”, “Article 2, the following personal income shall be subject to individual income tax: …, (8) income from property transfer, etc.”, “Article 6 of the Implementation Regulations of the Individual Income Tax Law of the People’s Republic of China, the scope of various personal income specified in the Individual Income Tax Law: …, (8) income from property transfer refers to income obtained from the transfer of securities, equity, interests in partnership enterprises, immovable property, machinery and equipment, vehicles and ships, and other property by individuals.”

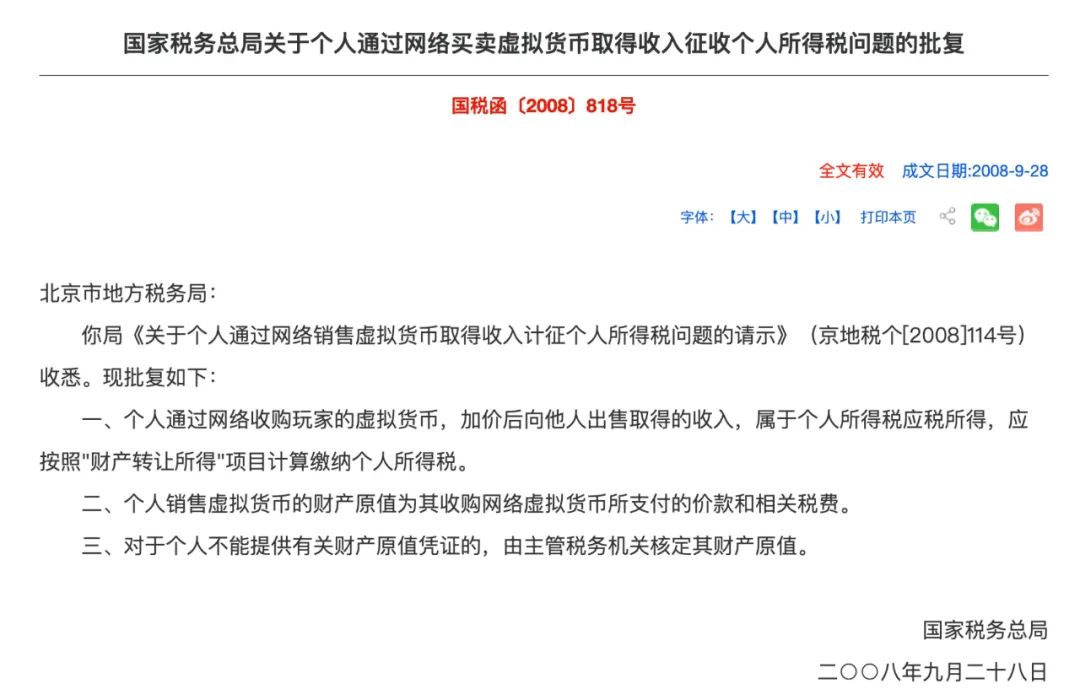

Prior to this, the State Administration of Taxation had made special replies on the collection of individual income tax in virtual currency transactions. According to the provisions of the State Taxation Letter [2008] No. 818: Individuals who acquire virtual currency from players through the Internet, and then sell it to others at a higher price to obtain income, are subject to individual income tax, which should be calculated and paid in accordance with the “income from property transfer” item.

Although this provision mainly targets virtual currencies such as game coins and Q coins, which are different from blockchain-based virtual currencies such as Bitcoin, according to existing laws in our country, both types of virtual currencies are considered virtual commodities. Therefore, this provision has certain reference value for the transfer of Bitcoin and other virtual currencies concerning individual income tax.

What happens if taxes are not paid when cryptocurrency transfer income occurs?

Taxes should be paid when income is obtained. If taxes are not declared and paid on time, when verified by the tax authorities, not only will the tax payable need to be paid, but also a late payment interest of 0.05% per day and relevant fines. If tax evasion occurs, it may also involve corresponding criminal liability. The cost of dealing with it afterwards is very high.

How should individuals consider tax matters when they have income from cryptocurrency transfer?

If individuals have income from cryptocurrency transfer, they can consider tax matters from the perspective of personal tax resident status, tax types, tax amount, and eligibility for tax benefits.

However, tax-related regulations are relatively complex, and tax matters themselves are more professional. In addition, the calculation of income from cryptocurrency transfer, such as Bitcoin, is more complex, resulting in more complex and uncertain tax matters related to cryptocurrency transfer. Therefore, if individuals are involved in income from cryptocurrency transfer such as Bitcoin, it is recommended to communicate in advance with tax professionals or institutions to understand whether there are any relevant tax matters involved, how to declare and pay taxes in practice, and make advance plans. This will avoid unnecessary tax risks or tax costs caused by failure to timely declare taxes or the formation of tax obligations in multiple locations.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Steady profit from rebound? An article lists 4 volatile tokens with the best performance.

- Binance Research Emerging Stablecoins and an Overview of Market Competition

- LianGuai Morning News | SEC decides to postpone the registration of 7 Bitcoin ETFs including BlackRock

- Binance Research Report Emergence of New Types of Stablecoins, Overview of Market Competition Pattern

- Review of the Cryptocurrency Market Summer Trends Mixed Bullish and Bearish News, Doubts about the Sustainability of the Rise.

- Bitcoin Spot ETF Application Inventory When will it be approved?

- Interpreting the lending platform Fuji Money unlocking the financial potential of Bitcoin Layer2