Interpreting the lending platform Fuji Money unlocking the financial potential of Bitcoin Layer2

Fuji Money Unlocking Bitcoin Layer2's Financial Potential

Original Article | https://blog.blockstream.com/

Translation | [email protected]

Introduction

Welcome to the Layer-2 Report, a comprehensive overview of Bitcoin’s second layer, covering new innovations, projects, protocol updates, and discussions in this field.

- Messari Founder Most Bullish on Cryptocurrency Job Market

- Bitcoin Smart Contract Evolution RGB-Driven Web3 Revolution

- Changtui The NFT market will recover, and we will usher in another epic, anti-gravity NFT bull market.

In this issue, we will focus on Fuji Money, a non-custodial lending platform exclusively for Bitcoin that is currently under development. We will also take a closer look at the development of the Lightning Network and the Liquid protocol to see how these two protocols have progressed in recent years.

Note: This article is the last one in the BlockChain Layer2 series. Due to timeliness issues, the other articles are not translated. If Blockstream releases new reports in the future, Web3CN will continue to bring you the latest and cutting-edge content related to BTCLayer2.

Tracking the Growth of Layer-2

*Please note that the data was extracted as of July 1, 2022.

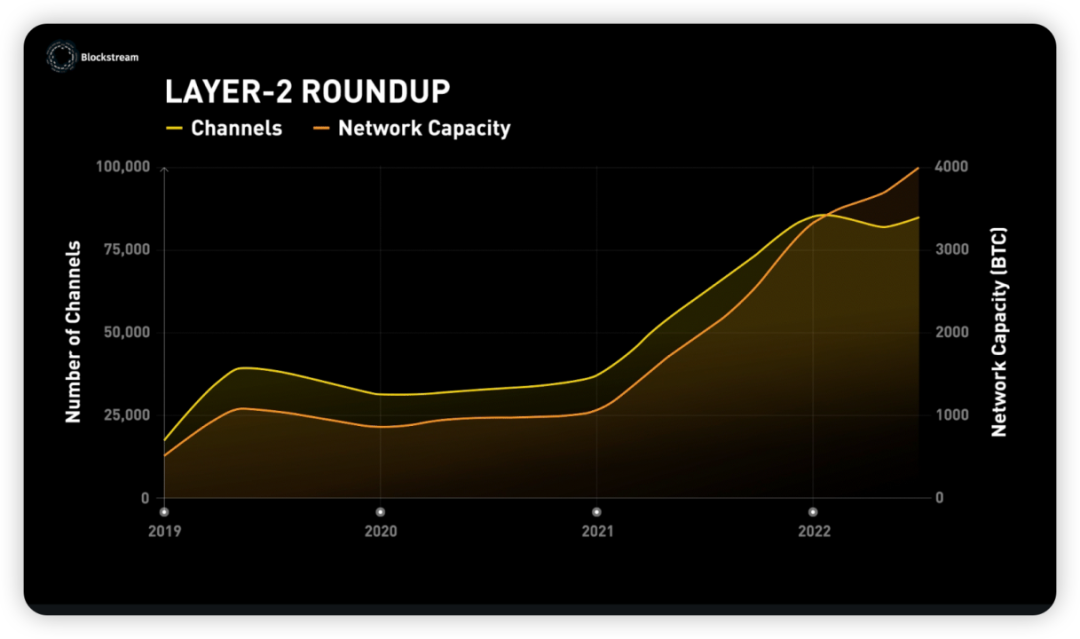

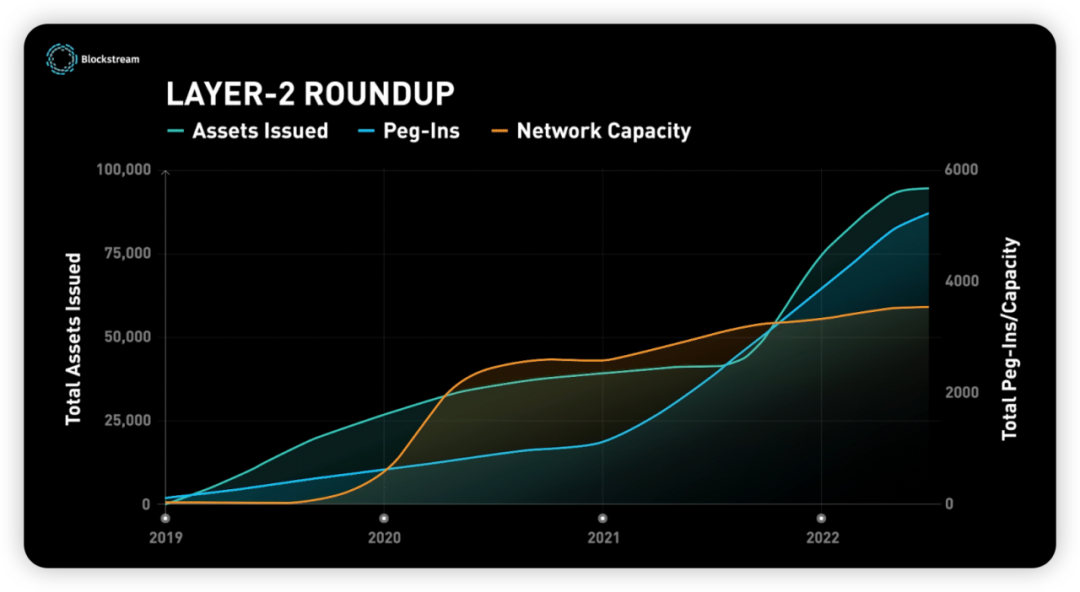

As the Lightning Network and Liquid Network have experienced rapid growth, network usage has significantly increased since 2021. As of July 1, 2022, the total capacity of both networks reached 7,563 bitcoins, setting a new high despite the price correction of Bitcoin this year.

Since 2019, the number of channels (channels used to send or receive payments between parties) on the Lightning Network has quadrupled to over 85,000. The network capacity, or the amount of bitcoins circulating on the Lightning Network, closely follows, surpassing 4,000 bitcoins.

*Please note: As of August 30, 2023, according to data from 1ML, the current number of channels is 68,106, which has decreased since the publication on July 1, 2022.

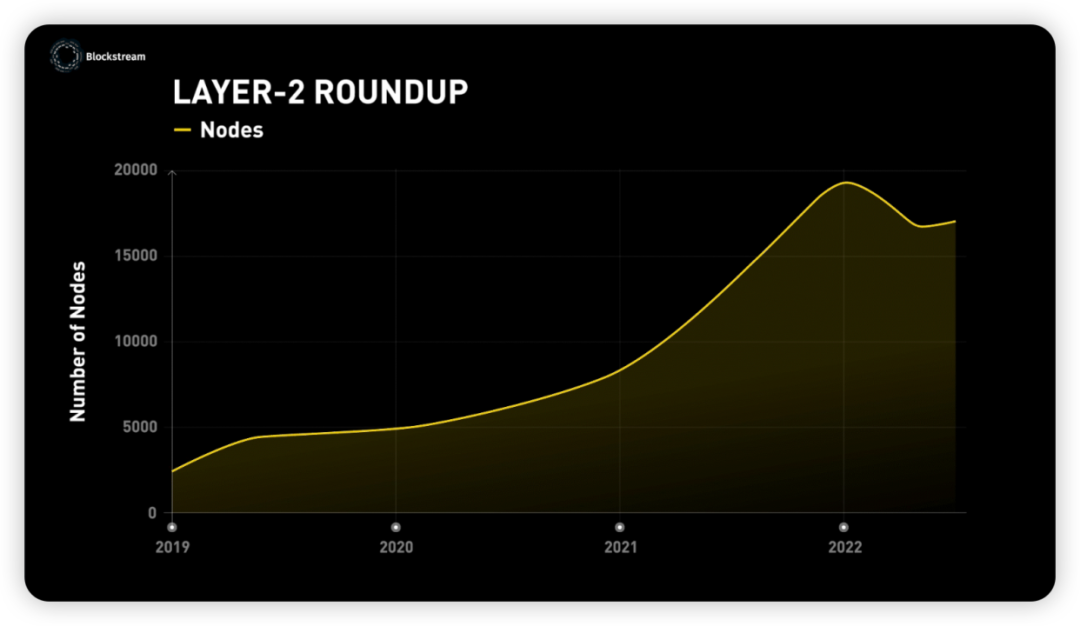

At the same time, the number of Lightning Network nodes has grown nearly 600%, doubling on average each year. If this trend continues, there could be over 40,000 Lightning Network nodes in operation by 2023.

Building the Financial Layer for BTC

Fuji, which has recently attracted attention, is a synthetic asset protocol built on Liquid that is compatible with the Lightning Network. It allows users to borrow stablecoins and synthetic assets without the need for trust and to engage in peer-to-peer transactions (as briefly introduced in the previous article in the Bitcoin Layer-2 Series 2).

According to the research paper by Marco Argentieri, Andrew Camilleri, and Dmitry Petukhov (link provided in the references), Fuji combines the characteristics of Bitcoin and Layer-2 technologies, such as Liquid opcodes, Taproot, and Lightning Network submarine swaps, to enable lending in the case of over-collateralization.

Planning

The support for assets will be determined based on community feedback and demand, asset liquidity, and the availability of reliable oracles. If you would like to participate in these discussions or recommend a certain type of asset, please join Fuji’s Telegram channel.

The first available Fuji asset will be FUJI USD (FUSD), a stablecoin backed by Bitcoin and pegged to the US dollar. Users can borrow FUSD by depositing Bitcoin into the Liquid smart contract (i.e., contract address), or by using the Lightning Network submarine swap or directly using L-BTC.

The team has plans to expand the protocol to other asset categories, such as collateral-backed synthetic stocks, whose prices will be determined by referencing indexes through oracles.

Synthetic Assets

Synthetic assets are assets verified by oracles and can be anything that oracles can confirm, including regulated security tokens (such as Blockstream Mining Note) or a portion of Apple stocks, to entire index funds (such as the S&P 500 Index) or specific exchange-traded funds (ETFs).

In the Fuji protocol, users (borrowers) borrow synthetic assets by locking collateral in the Liquid smart contract. This synthetic asset acts as a digital holder asset on Liquid, which users can store and transact privately with other users.

In the future, users may also be able to create their own baskets of assets, i.e., a group of different asset combinations, as long as trusted oracles are available. The Fuji protocol will initially use Blockstream’s cryptocurrency data source as the source of price data and plans to expand the number of oracles as more oracles become available to improve price data resilience and accuracy. This helps ensure reliable references for synthetic asset prices to support various operations and transactions on the Fuji platform.

DYOR

After the project announcement, preliminary questions about the risk profile of Fuji arose due to significant volatility in Terra Luna and bankruptcy of Celsius. Both projects were affected by the drastic price fluctuations in the crypto market, resulting in overleveraged assets facing difficulties.

Before delving deeper into the protocol, it is important to DYOR (Do Your Own Research) and understand that the Fuji project is still in the development stage (at the time of this article’s publication), and certain aspects of the trading infrastructure or terms may change over time. The research report embedded earlier in the blog provided a good explanation of some of the risks involved in lending, such as real-world attacks or poor oracle performance. The report also touched on potential solutions to these issues. Fortunately, the Fuji team seems to adopt a cautious risk management strategy and is committed to building a reliable and robust protocol.

Protocol

Let’s delve into some details of the Fuji protocol, particularly in terms of risk reduction.

Firstly, the minimum Collateral Coverage Ratio (CCR) in the Fuji protocol is 150%, which is significantly higher than the industry standard of 110%. This is done to reduce the risk for borrowers. Users can also increase their collateral at any time by “recharging collateral” to enhance their margin.

Note that the minimum collateral coverage ratio refers to the ratio between the value of the collateral provided by the borrower and the loan amount. In the Fuji protocol, the minimum collateral coverage ratio is set at 150%. This means that the borrower needs to provide collateral worth at least 150% of the loan amount. The purpose of this is to ensure that even in the event of a decrease in the value of the collateral, the collateral is still sufficient to cover the loan amount and protect the interests of the lender.

When the collateral of a contract approaches a dangerous level (such as during a decline in the price of Bitcoin), the borrower will receive a notification of a price reduction and will be advised to close or top up the position. If the value of the collateral falls below the minimum requirement (<150%) and is verified by an oracle, the liquidator (Fuji) can intervene and seize the collateral, but they must destroy an equivalent amount of Fuji assets.

Furthermore, users can custody their funds autonomously, which means that they can not only keep their assets in a Liquid wallet of their choice but can also custody them externally to the Fuji platform. If Fuji goes bankrupt, users can still unlock their collateral assets. Currently, there is a redemption fee of 0.25% when unlocking collateral assets. There is no interest or other fees charged for borrowing, but this may change as the platform develops. In addition to autonomous custody of assets, users can also choose various parameters of the contract, such as collateral assets and CCR (≥150%). Fuji will verify if the collateral meets the required amount and use the reissue tokens for new issuances.

Third, unlike the aggregation mechanism used by other projects, the issuance of each asset in Fuji is based on UTXO model contracts, which helps reduce system risks and avoid domino effects. Additionally, contract rules can be individually customized, providing greater flexibility and adjustments. Potential vulnerabilities or attacks are effectively isolated within the model, providing additional protection in certain scenarios, such as when upgrading contracts.

Fourth, the issuance and destruction of assets on the Liquid blockchain are not confidential to achieve permanent verifiability. Once the issuance is completed, Liquid’s privacy transaction method becomes the default, hiding the asset type and quantity. Due to the Taproot addresses of the contracts, the liquidation target price is also kept confidential, further protecting investor privacy and reducing liquidation risks.

On some other platforms, the liquidation price is publicly disclosed on the chain, allowing attackers to accurately know how much to push the price down to force liquidation. However, Fuji prevents this from happening through Taproot.

In the age of digital authoritarianism, decentralized and trust-minimized finance is the infrastructure needed for a free society. This remains true even if Bitcoin becomes the primary global store of wealth in the future. Modern financial products and services need to find their place on the Bitcoin standard, and leveraging Layer-2 applications such as the Lightning Network and Liquid will be at the forefront of capital market reform.

References

1. Synthetic asset smart contract for the Liquid network article link:

https://vulpem.com/synthetic-asset-smart-contract.pdf?ref=blog.blockstream.com

2. Original article link: https://blog.blockstream.com/layer-2-roundup-july-22/

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Grayscale won, but not completely SEC can still reject BTC ETF

- Interview with Circle CEO by Fortune What role does stablecoin play in the cryptocurrency market?

- Two levels of reversal, friend.tech still agreed to be friends with you and the imitation plate.

- Can the decentralized vision still be achieved when cryptocurrencies become politicized?

- 60 sets of data reveal the global changes in the Bitcoin mining landscape, market size, and energy consumption statistics.

- Ideal and Reality Bitcoin’s ‘Wild West’ and Legal Challenges

- Analysis of Filecoin’s Staking Economics Building a Trustless Market and FIL Lending Ecosystem