Review of the Cryptocurrency Market Summer Trends Mixed Bullish and Bearish News, Doubts about the Sustainability of the Rise.

Cryptocurrency Market Summer Trends Review Mixed Bullish and Bearish News, Doubts on Rise's Sustainability.Source: Coindesk, Bloomberg

Compiled by: Felix, LianGuaiNews

Earlier this summer, BTC rose due to several positive news. The most notable is a series of institutions, led by BlackRock, applying to launch Bitcoin spot ETFs. The decision of the regional court in the legal lawsuit between Ripple Labs and the US SEC also boosted the entire market. However, the effect of the “confidence booster” was not long-lasting.

Correction

The market sentiment surrounding the positive news is fading, and BTC prices are experiencing a correction. The market is waiting for the decision on the approval of Bitcoin spot ETFs, and the SEC is preparing to appeal against Ripple, with analysts predicting that the case “will not have a result until next year”. This brings “a new round of legal uncertainty” to the crypto market.

- Bitcoin Spot ETF Application Inventory When will it be approved?

- Interpreting the lending platform Fuji Money unlocking the financial potential of Bitcoin Layer2

- Messari Founder Most Bullish on Cryptocurrency Job Market

In addition, part of the reason for the correction is also due to a broader correction in risky assets such as stocks, triggered by “positioning of the tech sector bubble, rising US yields, and concerns about Chinese growth.” Federal Reserve Chairman Jerome Powell hinted that the Fed is prepared to further raise interest rates when necessary and intends to keep borrowing costs high until inflation reaches the target.

End of the Correction

On August 25th, a research report from JPMorgan Chase stated that the sell-off in the crypto market may be nearing its end, and the liquidation of long positions has “basically passed.” Analysts, including JPMorgan strategist Nikolaos LianGuainigirtzoglou, wrote that in recent weeks, some negative legal and regulatory news has gradually dissipated. Although the sell-off wave is still having an impact, according to the open interest of CME Bitcoin futures contracts (the number of outstanding and active futures contracts traded on the exchange), this wave of sell-off seems to be in the ending stage. Because the decline in open interest usually indicates a weakening price trend. Therefore, analysts believe that the downside potential in the crypto market in the short term is limited.

Resumption of the Rise

On August 29th, US court documents showed that Grayscale’s motion for reconsideration was approved, and the SEC’s order was revoked. Grayscale filed a lawsuit against the SEC last year after the SEC rejected its proposal to convert GBTC into a Bitcoin spot ETF. This ruling means that Grayscale has won the lawsuit against the US SEC. Bloomberg ETF analyst James Seyffart said that this does not mean that GBTC will automatically convert into an ETF, but it does bring the approval of Bitcoin spot ETFs closer.

After the news of Grayscale’s victory, BTC prices rose more than 7% at one point, breaking through $28,000. Since then, the price has risen to slightly above $27,900.

It is worth mentioning that, according to data tracked by analytics firm Santiment, nearly 30,000 BTC (valued at $822 million based on the current market price of $2.74) were transferred to addresses related to centralized exchanges before Grayscale’s victory. Perhaps some traders anticipated the price increase and prepared in advance by transferring tokens to exchanges.

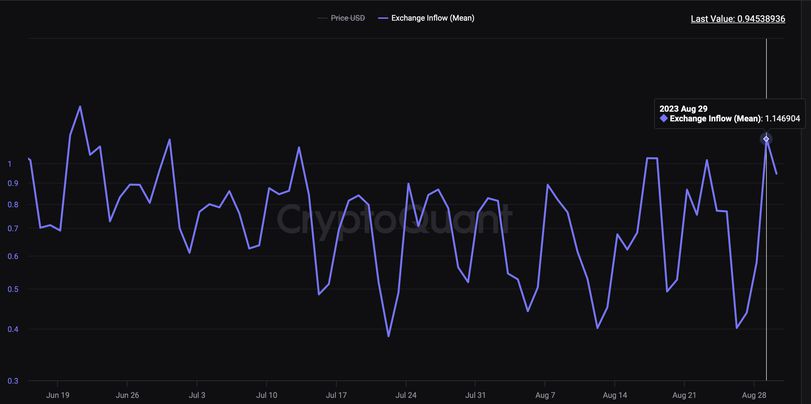

As the price of BTC rose to $28,000, data tracked by CryptoQuant showed that the average amount of BTC flowing into or transferred to exchanges per transaction rose to 1.146, the highest level since June 21.

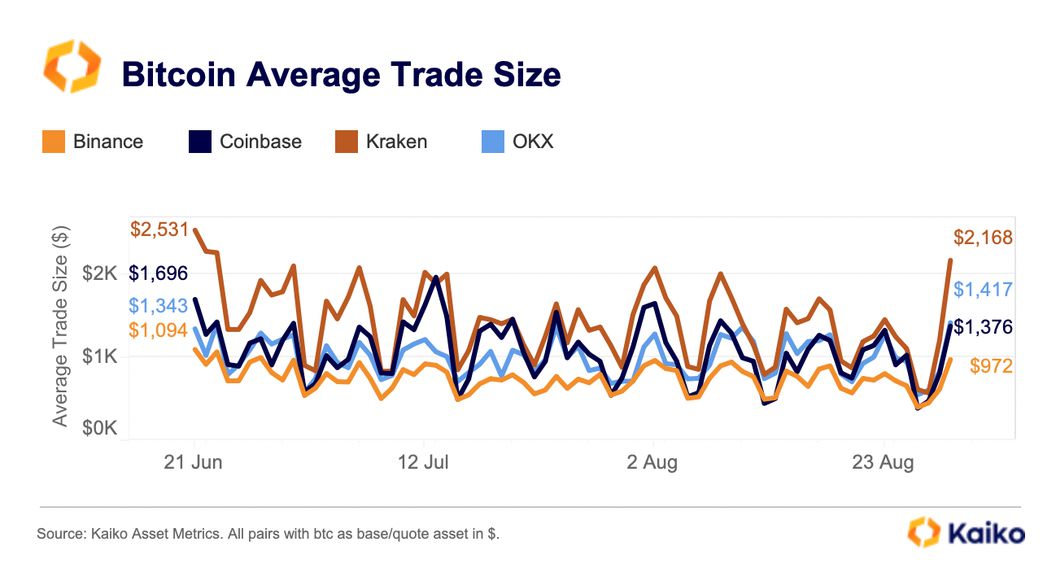

In addition, the average transaction size of BTC has reached its highest point since June. According to Kaiko, after the ruling, the average transaction size of BTC on the cryptocurrency exchange Kraken increased from around $850 to over $2,000. Research firm Kaiko said the last time the average bitcoin transaction size was higher than $2,168 was in June. The average transaction size of bitcoin on most other exchanges has also increased significantly.

How sustainable is it?

Clara Medalie, research director at Kaiko, said in an interview that while it is still too early to judge the sustainability of the price increase, “there are some small signs that we may see a slight reversal”.

It is worth noting that compared to other “mini bull markets”, the trading volume on exchanges has only reached a two-week high in this surge. Medalie explained that trading volume represents the degree of market participants’ involvement in the market, so the low trading volume data may indicate some weaknesses behind this trend.

Although the average transaction size of BTC has reached its highest level since June, indicating the activity of large investors, Medalie said, “The approval of ETFs will definitely be a bullish catalyst for the crypto market. But the market is still in a turbulent period, with a considerable number of bankruptcies and lawsuits underway.”

Garreth Soloway, Chief Market Strategist at IntheMoneyStocks.com, predicts that if Bitcoin fails to break through the $28,000 level before the mid-August sell-off, the price of Bitcoin will further decline.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin Smart Contract Evolution RGB-Driven Web3 Revolution

- Changtui The NFT market will recover, and we will usher in another epic, anti-gravity NFT bull market.

- Grayscale won, but not completely SEC can still reject BTC ETF

- Interview with Circle CEO by Fortune What role does stablecoin play in the cryptocurrency market?

- Two levels of reversal, friend.tech still agreed to be friends with you and the imitation plate.

- Can the decentralized vision still be achieved when cryptocurrencies become politicized?

- 60 sets of data reveal the global changes in the Bitcoin mining landscape, market size, and energy consumption statistics.