Steady profit from rebound? An article lists 4 volatile tokens with the best performance.

4 volatile tokens with best performance listed for steady profit from rebound.Original Author | Cryptocurrency Researcher Ann

Original Translation | Baize Research Institute

By observing the market trends in the first half of 2023, I have compiled a list of volatile tokens that have performed well.

The key criterion for inclusion on this list is naturally volatility. Just like other parts of the market, if the market crashes, these tokens will also experience a decline, just not as much as other tokens. However, what sets them apart is their strong rebound, which often allows traders to make daily profits of 10% or more, providing excellent opportunities for traders.

- Binance Research Emerging Stablecoins and an Overview of Market Competition

- LianGuai Morning News | SEC decides to postpone the registration of 7 Bitcoin ETFs including BlackRock

- Binance Research Report Emergence of New Types of Stablecoins, Overview of Market Competition Pattern

In addition, the price volatility of these tokens is also beneficial for traders who use the DCA (Dollar Cost Averaging) strategy, as it provides immediate gratification. Don’t you like assets that rise after buying at the bottom (support line)? Don’t you like assets that have a clear bottom, as opposed to those that may not have one?

Arbitrum (ARB)

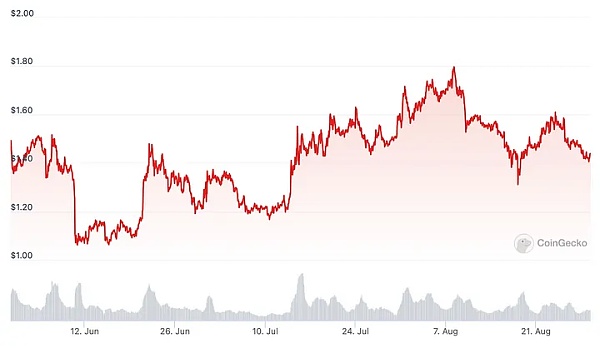

ARB, the native token of the leading Ethereum Layer 2 solution Arbitrum, is a relatively young token that was launched less than a year ago (in March 2023). Since ARB was launched during a bear market, it has yet to experience a true “boom moment”.

If you carefully examine the chart below (sourced from Coingecko), you can easily see how this token differs from others. Overall, ARB’s performance this year has not been particularly impressive. However, compared to most tokens that have plummeted by 90% since the peak of the bull market in 2021, ARB’s price chart is not as dismal.

This year, ARB has experienced several price surges, but there have been very few fundamental reasons behind them. The most recent surge occurred during the ETHCC event, with rumors that the project team was about to make some major announcements (which ultimately did not leave a lasting impression).

In addition to some technical analysis predictions, I also have some theories about the reasons behind these surges.

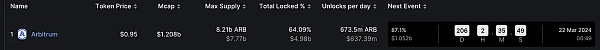

ARB still has a long way to go before the investor token unlock. According to DeFillama data, the first unlock of ARB will begin 200 days from now, which is on March 22, 2024.

Therefore, since the token was launched, there hasn’t been a large-scale sell-off of ARB, and assuming that most people who received ARB through airdrops have already sold, this has caused some volatility and created profit opportunities for traders.

As the unlock date approaches, we can be certain that the price of ARB will decline. However, having spent enough time in the cryptocurrency market, I know that token prices tend to rise before the unlock. I know this logic may seem strange, but if you understand the game theory of the cryptocurrency market, you would know that investors will definitely not sell their tokens cheaply. The rebound “helps” create FOMO (Fear Of Missing Out) and provides liquidity for the massive sell-off by these investors. Although this theory is just an urban legend, it still makes sense to think about it.

Fundamentally, even during a bear market, Arbitrum has successfully solidified its position as one of the successful projects. It has found a niche market, which is to become the No.1 DeFi L2. Moreover, GMX, built on top of it, has become the “mascot” protocol, attracting new users and increasing fee revenue.

In conclusion, the combination of token status and fundamental value makes ARB a good volatile asset.

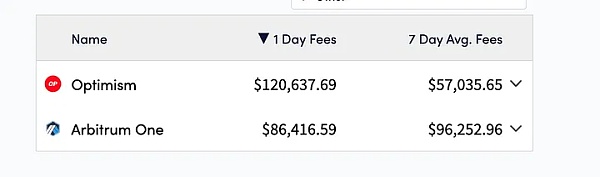

Optisium (OP)

At the time of writing this article, OP is experiencing token unlocking time, and the price has fluctuated. (August 30, 2023)

OP, another leading L2 token on Ethereum Optimism, is an example of how the token has risen before the unlocking event.

Over the course of two months, OP rose from $0.89 to $1.8. In the recent meme coin frenzy, OP was also one of the relatively “prosperous” tokens, rising along with tokens such as BALD or UNIBOT.

The reason for the rise (excluding any market irrational factors) is the recent improvement in Optimism’s reputation. Coinbase built their Base chain on top of Optimism’s OP Stack and signed a revenue-sharing agreement beneficial to both teams. Not to mention, the launch of OP Stack and the OP Stack chain ecosystem itself during the ETHCC event also contributed to the excitement in the market and the rise in prices.

The establishment of the partnership between Coinbase and Optimism proves the top L2 status of Optimism and challenges Arbitrum.

From my personal experience trading OP, this particular token has a strong demand. Reversals always happen quickly and fiercely during a downturn. On Binance, the trading volume of OP is considerable, making it one of the tokens with the highest trading volume, and the trading volume of its perpetual contract is even larger.

Solana (SOL)

After the catastrophic moment of FTX last year, Solana is embarking on a path of self-redemption. After a year of setbacks, the community seems to be improving.

Due to the “SBF effect,” I may be biased towards Solana. (I dislike SBF, so I find everything he promotes intimidating, including Solana.)

However, I have to admit that Solana is very resilient. Solana has its loyal user and developer community.

Since February, Solana has achieved zero downtime, setting a record for the longest continuous normal operation time. This is something they can rightfully boast about. In comparison, Arbitrum has experienced several interruptions just this year. For example, in June, the network was interrupted due to sorter errors.

In addition to SBF, Solana also has a major “group” supporting them – Jump Crypto. It is worth noting that Jump Crypto is on par with Wintermute and Alameda in terms of “market-making”. Therefore, when SOL decides to make a comeback, I expect the price of SOL to rise unexpectedly.

This year, the price of SOL has often stayed within a certain range. As can be seen from the chart, whenever SOL reaches the lower area, it quickly rebounds.

Ethereum (ETH)

Speaking of prices not staying low for long, no token can compare to Ethereum.

Cheap ETH is always in demand. For example, in the recent crash, while Bitcoin dropped from $29,000 to $26,000, the price of Ethereum fell to around $1,400-$1,500, but only for a moment, and then quickly rebounded to $1,600.

In addition, whenever there is a new “traffic explosion point” on the chain, the ETH price will quickly rebound along with the rise in gas fees.

Ethereum has some liquidity issues because most of the circulating ETH is pledged or locked in DeFi instead of being on the open market. Therefore, recently ETH has not shown much fluctuation, which is a bit annoying for traders and hodlers.

Conclusion

August is one of the most disliked months in the crypto market in recent years. Now that August is over, what comes next?

You need to understand that things won’t stay at the bottom or the top forever.

Usually, the end of the year is a good time to accumulate positions. That’s why I believe it’s a good idea to share this list of volatile tokens. Because when the big market comes, you don’t want to miss out on (crazy) gains, but you will also miss out on (crazy) drops.

<END>

Note:

The above projects and opinions should not be considered investment advice. DYOR. According to the notice issued by the central bank and other departments on “further preventing and disposing of the risks of virtual currency trading speculation”, the content of this article is only for information sharing and does not promote or endorse any business or investment activities. Readers are strictly required to comply with local laws and regulations and not to participate in any illegal financial activities.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Review of the Cryptocurrency Market Summer Trends Mixed Bullish and Bearish News, Doubts about the Sustainability of the Rise.

- Bitcoin Spot ETF Application Inventory When will it be approved?

- Interpreting the lending platform Fuji Money unlocking the financial potential of Bitcoin Layer2

- Messari Founder Most Bullish on Cryptocurrency Job Market

- Bitcoin Smart Contract Evolution RGB-Driven Web3 Revolution

- Changtui The NFT market will recover, and we will usher in another epic, anti-gravity NFT bull market.

- Grayscale won, but not completely SEC can still reject BTC ETF