Ideal and Reality Bitcoin’s ‘Wild West’ and Legal Challenges

Bitcoin's 'Wild West' and Legal ChallengesAuthor: Web3 Xiaolv, Waibo’s Three Views

In 2008, a person claiming to be Satoshi Nakamoto published a paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” proposing a decentralized peer-to-peer electronic cash payment system, which opened the door to the Web3 blockchain industry.

The Economist published an article about Bitcoin in 2015 titled “The Trust Machine,” telling us that the technology behind Bitcoin will change the way the economy operates. Indeed, early Bitcoin has been notorious for its illegal uses, but we cannot ignore the extraordinary potential of blockchain technology behind Bitcoin. The significance of this technological innovation goes far beyond cryptocurrency itself.

This article will start with the Bitcoin whitepaper to explore the innovations behind Bitcoin and blockchain technology – decentralization, anonymity, privacy protection – and the social impact and legal challenges they bring to the real world. Then, we will discuss the immense wealth this innovative mechanism brings us – decentralized trust mechanism and how it will evolve in the future.

- Analysis of Filecoin’s Staking Economics Building a Trustless Market and FIL Lending Ecosystem

- NFT Weekly Review Milady vs. BAYC’s August Showdown, new speculations on Yuga Labs’ trading market, the continuous surge of art-related NFTs?

- Arweave’s Composability Experiment Exploring a Better NFT Market

1. A decentralized peer-to-peer electronic cash payment network

In the real world, transactions rely on financial intermediaries as trusted third parties to endorse them. However, these trusted third parties often have many flaws, such as unnecessary transaction costs, reversible transactions, centralized malice, etc. The most realistic and brutal lesson is the financial crisis in 2008. So, is it possible to invent a new medium of exchange that allows two parties to trade directly without the need for a trusted third party, just like cash transactions?

This is exactly what the Bitcoin network aims to achieve – a decentralized peer-to-peer electronic cash payment system that aims to solve the centralized trust issues in the current financial system and provide users with a more secure, convenient, and low-cost payment method (a peer-to-peer version of electronic cash (system) would allow online payments to be sent directly from one party to another without going through a financial institution).

2. Achieved through technologies such as blockchain, cryptography, and distributed ledgers

Blockchain technology ensures the achievement of decentralization. It timestamps the transaction information within a certain time period, combines them into an information block (block), and then links the information blocks together to form a chain, verifying each other, thus forming a blockchain.

Since the code under the blockchain is distributedly stored on various nodes of the network without a central server, the network will collectively verify and maintain transaction information based on the longest chain principle through a consensus mechanism (PoW). At the same time, the network uses asymmetric encryption technology (public and private keys) to verify and validate transaction information across the network, making double spending no longer possible.

An open ledger model based on blockchain technology for mutual verification can not only facilitate transactions without intermediaries but also record all transactions in a complete and transparent manner. Through cryptographic hash functions and digital signature technology, blockchain ensures the integrity and immutability of data to a certain extent, thereby establishing a trust mechanism for network ledgers without the need for trusted third parties.

III. Innovative Governance Incentive Mechanism

The Bitcoin whitepaper designed a business model based on mining and transaction fees, where Bitcoin miners are rewarded with Bitcoin by calculating the hash value of blocks using computing power, and they can also earn transaction fees. In a decentralized context, this model provides economic incentives for participants in the Bitcoin network while ensuring the stable operation of the network.

An important challenge is how to protect personal privacy while ensuring the openness and transparency of the ledger. To enhance the privacy of on-chain transactions, some privacy protection tools have been developed. For example, privacy coins like Zcash and mixers like Tornado Cash use additional technical means to make on-chain interactions and transaction activities invisible, thereby providing a higher level of privacy protection.

Therefore, the privacy of Web3 should include the anonymity of identity data and the confidentiality of behavioral data, where all user data, including identity, behavior, activities, etc., are invisible.

The privacy of Web3 = Anonymity (Identity Data) + Confidentiality (Behavioral Data).

-

Anonymity refers to the invisibility of users’ identity information, including the sender and recipient of transactions. However, due to the emergence of on-chain analysis tools, maintaining user anonymity has become difficult, as demonstrated by the exposure of the founder’s off-chain identity information in BAYC.

-

Confidentiality refers to the invisibility of user interaction and activity information, including the amount of on-chain transactions. This can be achieved through technologies such as zero-knowledge proofs and mixers, which provide privacy protection for transaction inputs, outputs, amounts, and other information.

(Image from Manta Lianchuang’s Polkadot Decoded Talk 2022)

(Image from Manta Lianchuang’s Polkadot Decoded Talk 2022)

Although user privacy in Web3 can be protected through technical means, it has raised concerns from regulators. While users enjoy the benefits (no one can see that I lost money due to trading dog coins), regulators are worried about criminal activities (criminals laundering 7 billion to fund terrorist countries to buy bombs).

Most jurisdictions require encrypted trading platforms to comply with regulations such as Know Your Customer (KYC), Anti-Money Laundering (AML), and Countering the Financing of Terrorism (CFT) to ensure the compliance of transactions and prevent illegal activities. These regulations may require trading platforms to collect and verify user identity information, thereby reducing transaction privacy. The sanctions imposed by US regulators on the mixer Tornado Cash precisely illustrate the conflict between privacy protection and security in Web3.

IV. Tornado Cash Used for Illegal Activities on the Internet

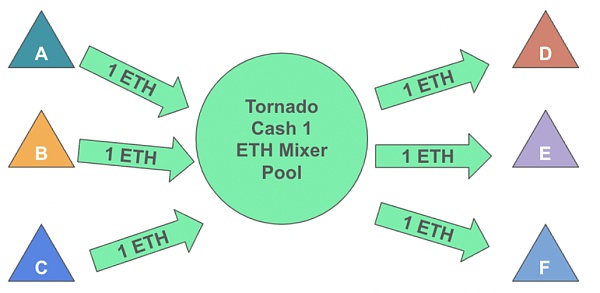

Tornado Cash is a well-known coin mixing application on Ethereum, aiming to provide users with privacy protection for their transaction behaviors. It achieves privacy and anonymity in transactions by obfuscating the source, destination, and counterparty of cryptocurrency transactions. Tornado Cash accepts transactions (user deposits) with different types of tokens. Through innovative application of smart contracts and zero-knowledge proof technology, it mixes various transactions together to sever the public link between deposit addresses and withdrawal addresses, and then transfers them to counterparties (user withdrawals), thus achieving transaction privacy. Users no longer need to worry about their transactions being monitored on the blockchain.

(Image source: https://news.bitcoin.com/bitcoin-core-developer-appeals-to-sec-regarding-bit/)

Therefore, when discussing personal data sovereignty, it is not only about the possibility of a technological implementation, but also about the expectation and challenge of building a future social trust system. In these worlds driven by personal data sovereignty, it is expected that independent individuals can maintain their own free will, form a new trust system, challenge the narratives of capital religion and mechanical universe, and criticize and break the existing solidified trust systems.

Decentralized trust mechanisms are powerful tools and ideas that can promote the formation of new consensus communities, and ultimately create a future world of peace, fairness, connection, and mutual understanding.

V. Conclusion

Crypto-punks initially believed that the internet was the greatest liberation tool, until they realized that the internet had turned into an unprecedented tool for centralization. The once digital utopia has become a digital prison, so crypto-punks had to create a path to utopia – Bitcoin and blockchain technology. Thus, Julian Assange wrote in “Cypherpunks”: “In crypto we trust!” and “Cryptography is the ultimate form of non-violent direct action.”

Although Bitcoin and blockchain technology can liberate personal data sovereignty from the digital cage of centralized institutions, government regulation of crypto-assets still hangs like the sword of Damocles. Gary Gensler once said that the current period is the “Wild West” of the crypto world, but we should not neglect the pioneering spirit, autonomy, adventure, and innovation brought by the “Manifest Destiny” just because there were many outlaws in the West. Just like Bitcoin emerged in 2008, it is bringing various changes to the world.

The concept of blockchain and distributed ledger may not sound revolutionary or attractive, just like double-entry bookkeeping and joint-stock companies. However, like these great innovations, blockchain, this seemingly ordinary technology, may improve processes and have the potential to change trust relationships and modes of cooperation between people.

Bitcoin believers are fascinated by this libertarian ideal – a purely electronic cash that transcends any central bank. But the real innovation is not the electronic cash itself, but the trust machine that creates it and the greater changes it can bring to society.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Should Polkadot’s market positioning and narrative be adjusted?

- The first debate of the Republican primary ended. Which candidates are friendly towards encryption?

- Wu’s Weekly Selection Tornado Cash Co-founder Arrested, HashKey to Open Retail Investors Next Week, and Top 10 News (0819-0825)

- Market Analysis There will be a sharp decline before the next rise, a bear market is approaching.

- The former secretary of the Fuzhou Municipal Party Committee, who supported mining, has been sentenced to life imprisonment, but it has also left us with many questions.

- The first debate of the Republican primary ended. Which candidates are friendly to cryptocurrencies?

- Is there really market manipulation by crypto market makers?