Babbitt Column | Open Finance – Explore Bitcoin's Clearing System and Payment Process

Dear readers, everyone, because I have been busy with graduate thesis recently, I haven’t updated the article for a long time. On May 17th, I was very pleased to receive an invitation from Babbitt to participate in the blockchain summit forum in Hangzhou. Among them, the open financial system mentioned in the "Three Main Directions of the General Economics" published by Meng Yan teacher has resonated with me. So this article I will continue to explore Bitcoin's clearing system and payment process, give a model of several existing solutions, and add a lot of personal opinions.

Clearing system

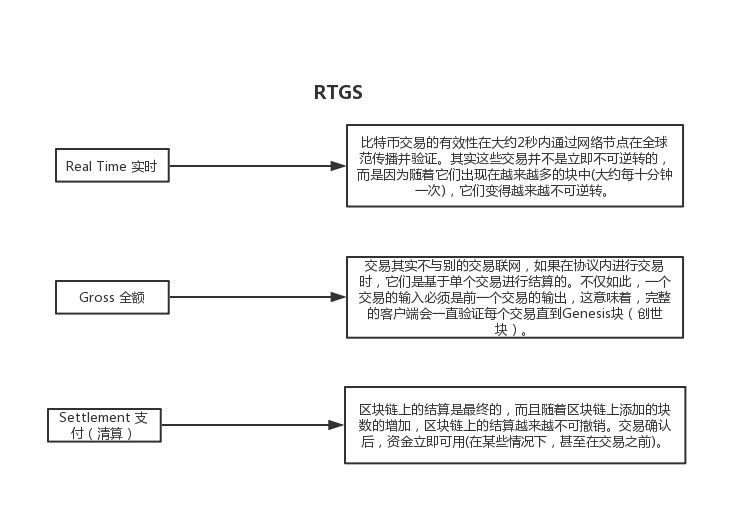

First of all, I would like to introduce a concept to you first – RTGS, according to Baidu Encyclopedia, RTGS is called Real Time Gross Settlement, Chinese is "real-time full payment system". It is an interbank electronic transfer system established in accordance with international standards, which specifically handles the cross-bank transfer business initiated by the payer's bank.

So is Bitcoin RTGS?

- Quotes Daily: BTC continues to fall in volume, short-term rebound brings wheezing

- BlockCenter – the core engine of Bystack

- Staking economic year to earn millions? With the Amino Network

Let me introduce another settlement system, Net Settlement Systems. According to Baidu Encyclopedia – Netting, the payment system will subtract the total amount of the transfer amount received from each financial institution received at a certain time point to obtain a net balance.

Below I compare Bitcoin with these two settlement systems:

| RTGS | Netting system | Bitcoin | |

| Billing type | Full amount | Net balance | Full amount |

| Liquidity management | no | Manageable | no |

| Can you overdraw? | Generally can | Different countries | No |

| Liquidation time | < 5 minutes | 1-30 days | According to network conditions (>10 minutes) |

| Business hours | Working day | Workday + weekend overtime | 24/7/365 |

| Book | Centralization | Centralization | Decentralization |

| Responsible person or organization | Central bank or consortium | Central bank or consortium | nobody |

| Participant | Examined financial institutions | Examined financial institutions | Everyone |

Through this form, we can find that the centralization of the bank or financial institutions that are generally involved in liquidation and settlement, the discussion of centralization and decentralization is not much to say here. However, if there is a problem with the bank's liquidation, there will be a central bank or a consortium to take responsibility. Who is responsible for the Bitcoin network clearing system? If this responsibility is shirked to the miners who consume electricity and power, it is the most unreliable result. Interested readers can read my previous "Evaluation of Bitcoin Mining Mechanism" ( click to read ).

Closer to home, RTGS's clearing efficiency is the highest, but it also brings a lot of costs, but also limited by business hours. Most financial organizations are not good at developing new products (or venture capital). If we assume that Bitcoin is RTGS, what are its main advantages or disadvantages compared to traditional RTGS? From the above table, compared to traditional RTGS Bitcoin's clearing system has an advantage in "business hours." In terms of participants, if Bitcoin is used as a clearing system, participants will be open to everyone. In addition, the Bitcoin system can also program more complex clearing systems, which is uniquely advantageous over ordinary RTGS. However, the slow settlement time, the degree of network congestion, and the fact that Bitcoin has not been widely used in many real economies have also contributed to Bitcoin's pain point as RTGS. So is there no future for Bitcoin on the settlement system? Next, let's explore some of the existing solutions at the settlement level – “Lightning Network” and “Atomic Swaps”.

Lightning Network – the future of Bitcoin?

Lightning Networks is an open source payment protocol based on blockchains (such as bitcoin networks) that allows anonymous payment channels to make millions of transactions per second. In addition, it is a decentralized network that uses smart contracting capabilities in the blockchain to facilitate instant payment on the network. This is probably the answer to the "Bitcoin scalability issue." The vision determines the state, and the pattern determines the outcome. Due to the ability of the Bitcoin network to process transactions, it is limited by the size and frequency of the block. If the lightning network works as expected, Bitcoin can theoretically be extended to infinity [1].

Possible solutions to the "Bitcoin scalability problem" have been discussed more than once in the community. In my opinion, it is not so much a technical debate as it is an "ideology war." There are currently two models in the community.

Cash model (on the chain)

As the name suggests, the cash model (or unlimited bitcoin) is about increasing the size of the block. As long as the miners voted to do so, the deal will remain on the blockchain, but the miners will control the transaction costs, which is the only reward and incentive for them to process the deal, after the 21 million bitcoin limit is reached. Transaction costs will remain.

Core model (under the chain)

It can be understood as a chain expansion, using SegWit or sidechain, "Lightning Network" and other technologies to keep the cryptocurrency more dispersed and decentralized. Compared to advanced models, the core model does not involve additional control over the miners, so many transactions are carried out under the chain.

Atomic interchange

Cryptographic currency transactions usually take place on exchanges, and it is basically known that these exchanges are centralized. The shortcomings of the centralized exchange I don't want to talk about it here (Mt. Gox). Centralized exchanges also charge transaction fees. In addition, they may collapse when the market is active. Atomic swapping, the “revolutionary development” – considered to be the future of cryptocurrency trading – is to “make the prospect of decentralization to a completely different level”.

Atomic interchange does not require any third party by allowing peer-to-peer (P2P) transactions in a way that does not require any trust.

More specifically, let's assume that two people, I and Babbitt's Daxiong, want to exchange Bitcoin with BTM. The exchange rate is directly negotiated between us and does not require any third party. What will happen next? [2]

I am the initiator of this scenario, I will first create something like a "safe" (contract address) to save money during the swap.

In order to open the "safe" and get the funds inside, you need to do two things:

1. The signature of Nobita.

2. A secret number I generated myself.

The important thing is that I can't tell Daxiong this number, because if Daxiong knows this secret number, he is very likely to open the safe and take away the funds before the atom exchange. Next, I used my own secret number to create a hash value (the lock of the safe). At this point, the secret number is the "key" of the safe. This hash value is the lock of the safe. I can use the key to generate the corresponding lock, but if someone knows the hash value, it can't generate the corresponding secret number, which is the "key". Even now that I have the lock and the key, I still can't open the safe. As you remember, this safe also requires the signature of Nobita.

Then Daxiong will check the safe (contract address) I created and make sure everything is working before creating my own safe. After that, I will send the hash value I generated to Daxiong so that Daxiong can create an identical safe based on my hash value. In the same way, Daxiong wants to open this safe that he created and needs my signature.

After doing this, Daxiong especially wanted to broadcast the known secret numbers to everyone. Then Daxiong can hold the secret number, open my safe, and take the funds inside. This atomic swap has been completed!

From this point of view, I have both the key and the ability to sign the Daxiong safe, and can redeem the funds related to the address, the initiative of the transaction is in the hands of the initiator. So what happens if I or Daxiong quit the atomic exchange midway?

Both safes are made in such a way that if there is no exchange, all funds will be returned to the owner according to the specific time period set by both parties. That is, atomic swaps can completely complete transactions on the blockchain without registration (no charge); transactions are made between two different chains (for example, swapping BTCs to LTC); atomic swaps have only two possible outcomes : Both parties successfully exchanged assets, or nothing happened. In this way, you no longer have to worry about the fact that some exchanges suddenly change your address, resulting in your credit not being accounted for! Since the exchange of cryptocurrencies will be easier, the use of cryptocurrencies will increase, and atomic exchange will also result in a significant reduction (or complete elimination) of the "switching cost" between cryptocurrencies. And in the process of the entire atomic exchange, does not provide any private key, security is guaranteed.

Whether it is a technical update such as atomic exchange or lightning network, it needs the recognition and wide acceptance of the community or users. There is still half of the time in 2019. I don't know how many projects will be carried out in an endless stream of propaganda to over-promote the emerging blockchain technology. ICO has played a revolutionary transformation in the open financial system, but many project parties have no choice but to breed more relevant industries in order to maintain their initial “promise”, from media, advertising, software production, overseas services, and certain capital. Meetings, etc. In the end, all this bubble will eventually be destroyed. My humble personal opinion is here – the ultimate cause of the devastating disaster in the blockchain industry is not the rise and fall of Bitcoin against the US dollar, but the popularity of free social media. In China, there is still a long way to go.

Back to the topic, I want to continue to talk about the payment process of Bitcoin and the comparison with the traditional economy. Unlike many articles, I rarely write about the changes that blockchain technology will bring to the present, blockchain insurance, medical care, certification, or earth-shaking changes throughout the financial industry. To tell the truth, even if you haven't read a college student, you can use your imagination to write it out, copy it and paste it, and then buy it with a small white. I hope that readers will be able to grasp the ability to distinguish between right and wrong and analyze information. Now, I will point out some of the pain points and areas for improvement in the current bitcoin system. Again, I told you before, don't trust me, verify me.

| Traditional payment system | Bitcoin | |

| user | consumer | consumer |

| storage | Issuing bank (according to currency) | Managed wallet, hardware, exchange |

| The internet | Visa/Mastercard UnionPay, etc. | Bitcoin network |

| deal with | The merchant receives the corresponding legal currency | Convert with bitpay and the like |

Compared with traditional payment systems, Bitcoin has significant differences in storage methods. For the simplest example, Bank of China’s mobile app is linked to your Chinese bank account, while Bitcoin’s wallet is your own account.

Payment process

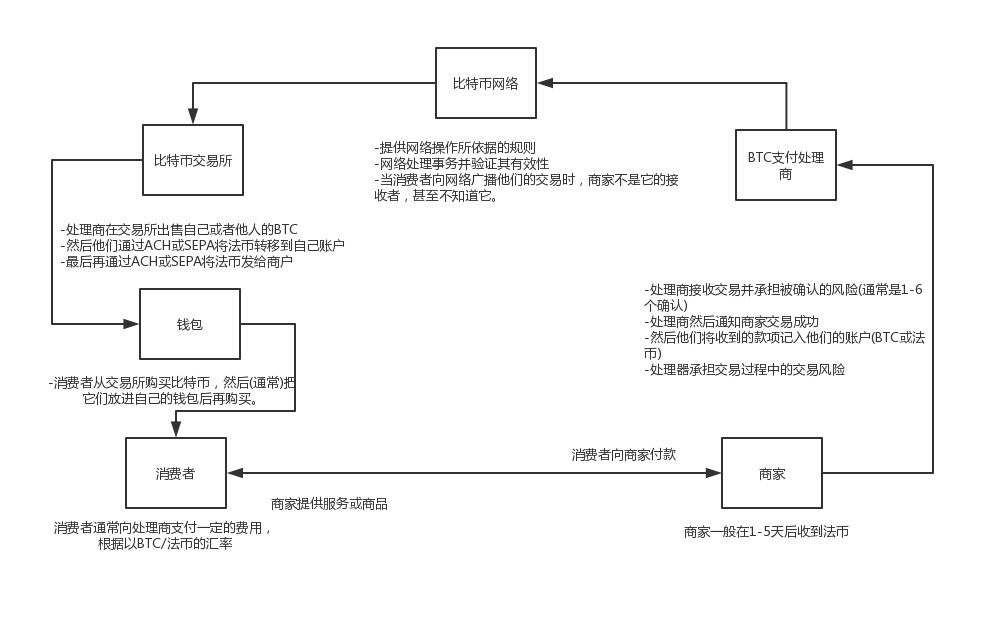

I have compiled a flow chart to illustrate the existing bitcoin payment system.

The above diagram (payment on the chain) outlines the process that would be encountered if consumers used Bitcoin for consumption and payment methods. Under the Bitcoin exchange, ACH and SEPA are similar to RTGS and are another way of bank clearing. ACH is based on US dollar clearing, and SEPA is basically the euro version of ACH. We can see that there are still some traditional clearing systems in the system. As early as 2014, Goldman Sachs published a research report on Bitcoin [3], which shows that from the perspective of merchants, Bitcoin costs are lower, but from the consumer's point of view, Bitcoin The cost is different. First of all, Bitcoin itself stores complexity, making it impossible for many newcomers to start. Secondly, there is no recourse to the merchants, and the convenience of obtaining the bitcoin is not high, resulting in a high level of consumer costs. In addition, the exchange rate of the processor is lower than the average price, which has led to the stagnation of the development of this system.

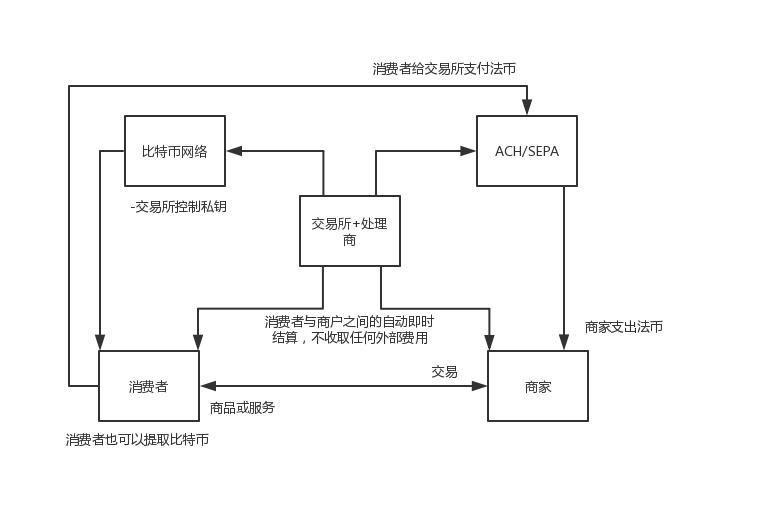

However, if it is also the processor of the exchange, it can be effectively circulated internally (such as Coinbase). In this way, because they are a vertical structure, Coinbase can drop the bitcoin network and directly carry out "chain" transactions. Then you can provide timely confirmation of real-time transactions, and exchange risk. The miner or bitcoin network does not have to pay for the transaction. The liquidity of both French and BTC has increased. Then the entire settlement system can only be formed using the net balance settlement system. Because only the net balance settlement system can exchange unlimited transactions of any size, including micropayments. In such a system, transactions are reversible to some extent, which means they are a centralized payment center, provide payment instruments (BTC) for legal currency, execute payments, and provide redemption tools for legal currency again. (But no credit is currently available).

The model is shown below (payment under the chain):

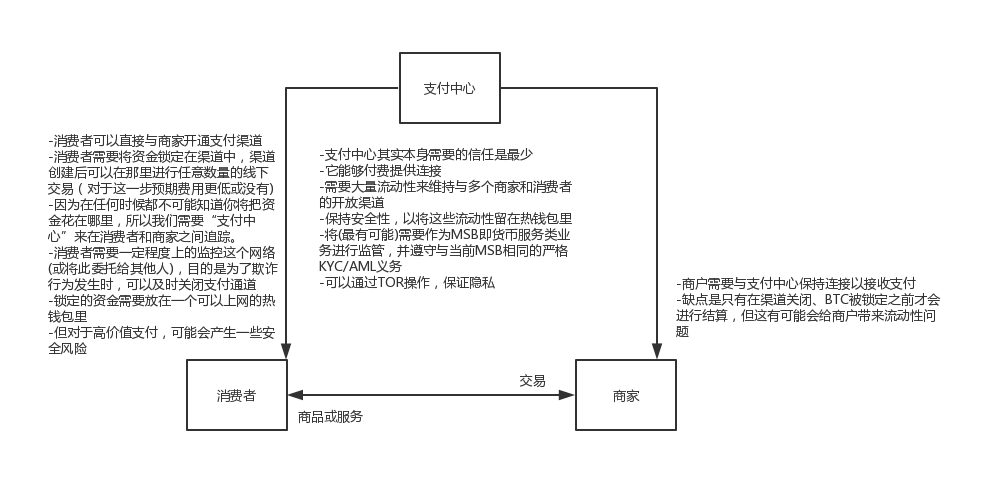

The model is the closest to American Express [4] and Discover [5] as the publisher and acquirer. To date, Coinbase has millions of wallets and thousands of merchants, and for many users, managing third bites to manage your bitcoin and process payments is a risk exchange (accounts) Safety, personal responsibility, etc.). So is there a model that can solve the above pain points? The model provided by Lightning Network or a similar solution is shown below:

We can see that on three models, the “payment center” provided by Lightning Network or similar solutions simplifies a large number of settlement layers, but let's think about it again, does the payment center really need it? Of course, for merchants, the payment of these three models is irreversible, even for high-risk transactions, the possibility of fraud is minimal, no matter where they come from (high-risk countries such as Iran, politically unstable regions, etc.). We can also clearly see that all foreign exchange risks are borne by the processor, and these processors usually do not involve transaction costs (a fee of $100 is charged for $100). And now with many e-commerce platforms to integrate such features, the cost of use is greatly reduced, the subscription fee for this service is low or no. Such payment means never prepay the deposit to the acquirer as a reserve to prevent a refund.

So from a business perspective, why not? They face a new open financial market that they have not been able to reach before, and they can accept payments on a global scale.

Of course, for consumers, the credit/debit card company has put forward a more attractive suggestion: no fraud risk, and the unknown transaction can always be verified by the relevant bank, reflecting the reversibility of the transaction. Brushing a flower or a credit card will give you some discounts and offers. Points can also be redeemed for rewards. The most important point is that the entire bank card system has been accepted by consumers. On the other hand, if bitcoin payments are used, the consumer's bitcoin balance will be subject to fluctuations, and the merchant's choice is much smaller than the credit card network. Moreover, the exchange rate difference must be paid to the processor at each transaction. For consumers, there is no refund protection, irreversible transactions, and usually no discount reward program is a huge disadvantage. However, the situation is gradually getting better. Just like the digital currency major that I am studying at Nicosia University, I use BTC to pay, and the tuition can be discounted.

In general, the current bitcoin payment processing system is “better” for merchants. For the average consumer in developed countries, the current bitcoin payment process is “worse”.

Rome is not built in one day. Credit cards have the advantage of network coverage through an extended global licensee. They use the operations of multiple partners around the world to achieve operational advantages. Credit card issuers give consumers more spending power and increase the amount of concessions. Incentive advantage. Looking at the development of credit cards, what can we learn from?

– Existing systems require better customer support/protection, such as decentralized hosting and arbitration systems?

– Existing systems need to provide more purchase incentives to BTC consumers, such as more discounts or points redemption?

– Provide channels for easier access to purchase and use of Bitcoin, such as more supply and demand providers?

– Provide credit? Or is it another way?

Throughout China's blockchain conferences, some of the project parties have been sensational and publicized. The "big coffee" has emerged in an endless stream. Some Wall Streets have been waiting for more than ten years. Some blockchain technologies are in full swing, and some analyze the market, predict the price of coins, and compare All are. Of course, this is undoubtedly a greenhouse for avid investors or speculators, and it is a blow to good project parties or solution providers. The speculators are only concerned about thousands of coins, ten thousand coins, and prices have risen and fallen. Personally, the BTC/USD trading pair is just a simple price information exchange, there is no other connection. The magnitude of this price change is unprecedented in the financial market. From a fundamental perspective, $18,000 is reasonable and $1 is reasonable.

Back to the payment system, the simplest truth is that the payment network is only useful when the consumer needs it. In a reversible system, if the buyer is considered too risky, they may not be allowed to make the purchase, and the cost of other fraud is Apportioned to the entire issuer, acquirer, merchant and end customer chain. In other words, consumers may not use an irreversible system. However, please note that the vast majority of transactions around the world are still using irreversible systems, and cash is the simplest example. Irreversibility is a process that is specific to the transaction itself (A gives cash to B, B gets cash). Cash is often used for smaller, less risky transactions, so if Bitcoin is still irreversible, then it may Will play this role in retail payments. As a push payment system, Bitcoin provides us with a long-distance trading method of “intentional unknowing”. In other words, it is only untrustworthy to the liquidating third party (network), not to the recipient of the above transaction.

In addition to centralized payment networks such as Visa and MasterCard, there are actually other ways to reduce the risk of irreversible transactions. For example, eBay has established its own reputation and arbitration system, Taobao's "five-star praise" and so on. As mentioned in the previous article "Disperse the Market" ( click to read ), Open Bazaar also tried to establish a decentralized arbitration system similar to eBay. In this way, the payment process of Bitcoin is not much different from the traditional payment process, and it may be more cost-effective in terms of structure. The value proposition of existing bitcoin retail payments is currently beneficial to merchants. We may imagine several overlapping scenarios: the payment process maintains the current model, primarily targeting specific retail niche markets, providing consumers with similar payments to current payment networks. Benefits, and compete in terms of discounts, prices, and offers to create truly decentralized solutions and word-of-mouth systems that reduce fraud. Not only for Bitcoin, is it useful for other project parties to do this work than a meeting?

Citation data

[1] https://www.investinblockchain.com/lightning-network-effect/

[2] Matthew Hrones, 2017. “Atomic Swaps: What They Are, How They Work, And What They Mean For Digital Currencies” http://bitcoinist.com/atomic-swaps-what-they-are-how-they- Work-and-what-they-mean-for-digital-currencies/

[3] https://www.dwt.com/files/paymentlawadvisor/2014/01/GoldmanSachs-Bit-Coin.pdf

[4] https://www.americanexpress.com.cn

[5]https://www.discover.com

This article was published by Babbitt columnist "Rickkk", and it is strictly forbidden to reprint without permission.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Epic litigation! For the first time, the SEC sued KIK for illegal ICO sales on the grounds of “unregistered”. What does the lawyer think?

- Monthly News | May Blockchain Application Landing Projects China Ranks Global

- The SEC filed a lawsuit against Kik, which may be a war between the cryptocurrency world and US regulators.

- Market Analysis: Mainstream currencies are dominated by high-altitude, and the trend is linked to Bitcoin

- Blockchain Getting Started | Security Getting Started Notes (1)

- Interview with Lu Yifan: How does the valuation of the $7.5 billion unicorn be a blockchain?

- BTC crashed, is black box operation or lack of power