Opinion: Bitcoin "Fire of May" is burned by Chinese investors?

Although regulators sometimes sounded a supervisory charge on the encryption market, the investment fever of “Digital Gold” bitcoin in China has not diminished. The market view is that the hot speculation of Chinese investors is a major factor in boosting BTC prices.

May Bitcoin Baidu search heats up

In May of this year, the price of BTC was arrogant from the beginning of the month of 5,350 US dollars, once approaching the major threshold of 9,000 US dollars, an increase of over 68%, becoming a well-deserved "rising star."

Economist and cryptocurrency trader Alex Kruger conducted a study on bitcoin price trends and bitcoin heat in the Chinese market and found that Chinese investors are likely to be a positive factor driving the surge in BTC prices in May.

By studying the search heat data of "Bitcoin" in Baidu search, Kruger said that

- Xiao Lei: Bitcoin to the left, entrepreneurs to the right

- Write the virus to the blockchain and never die? We did a bold experiment…

- From atomic swapping to airdropping to forking, the SEC knows more about cryptocurrencies than you think.

“The popularity of Bitcoin in China is definitely rising.”

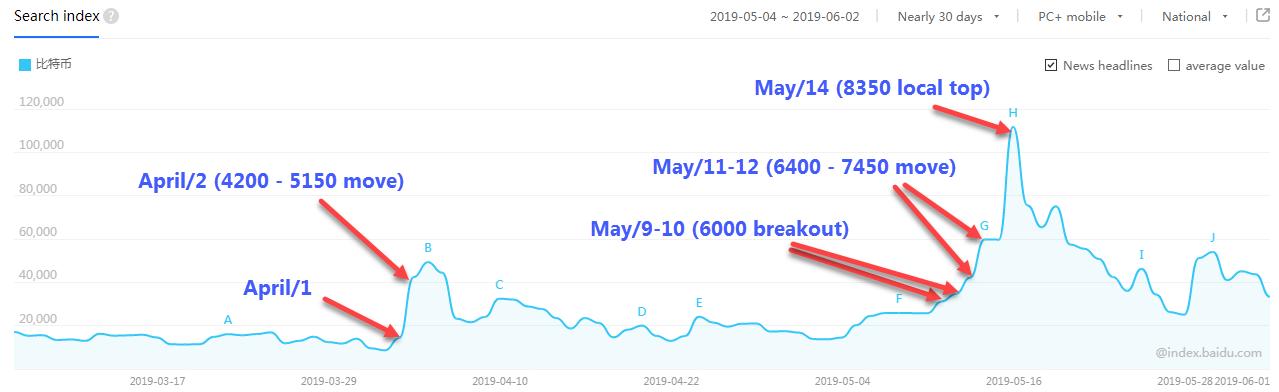

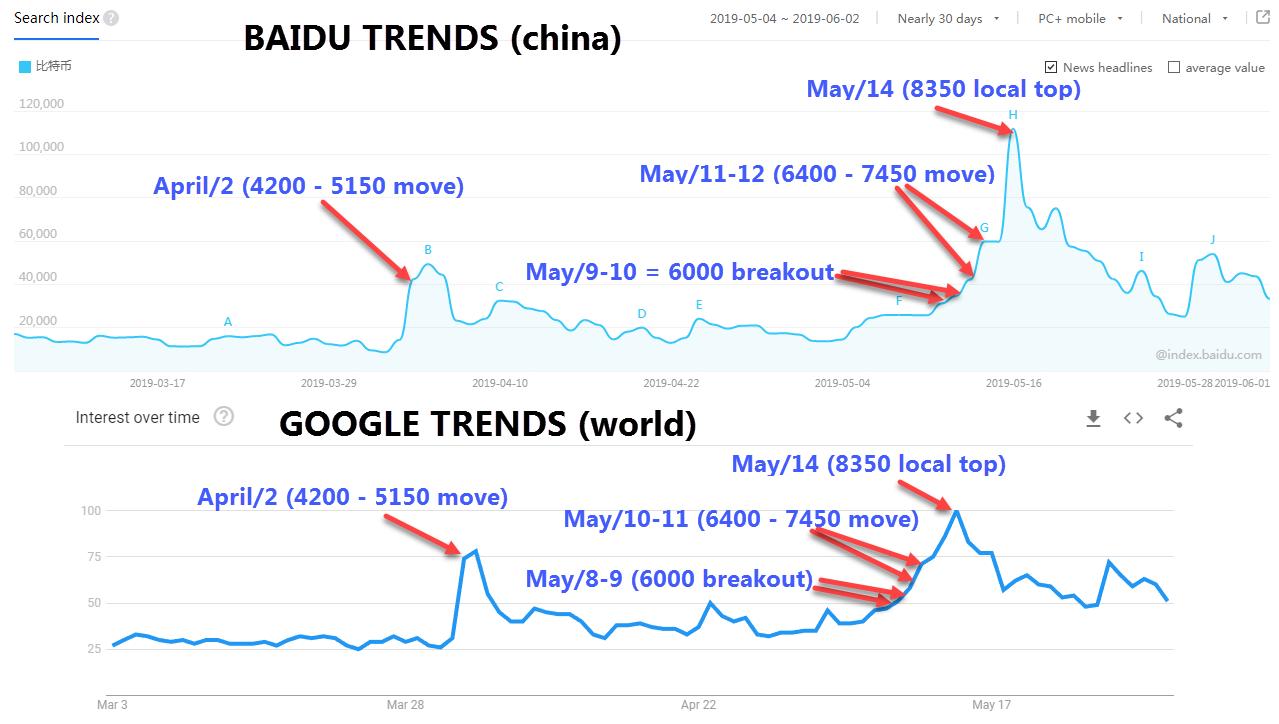

Kruger said that from the market performance from April to May, when the BTC price is in a big break or in a strong rebound, the Baidu search heat of the "bitcoin" keyword tends to soar.

As shown in the chart below, this trend is even more pronounced in May. The BTC price successfully broke through the major psychological barrier of 6,000 US dollars, and then rushed to 7450 US dollars, and then succeeded to stand above the 8350 US dollars by the market FOMO sentiment. In this short period of time, the "Bitcoin" Baidu search fever soared. And peaked at $8,350 at its price point.

In addition, while the price of BTC rose last month, the search for Google on behalf of the global market and the popularity of Baidu search in the Chinese market all showed a simultaneous upward trend.

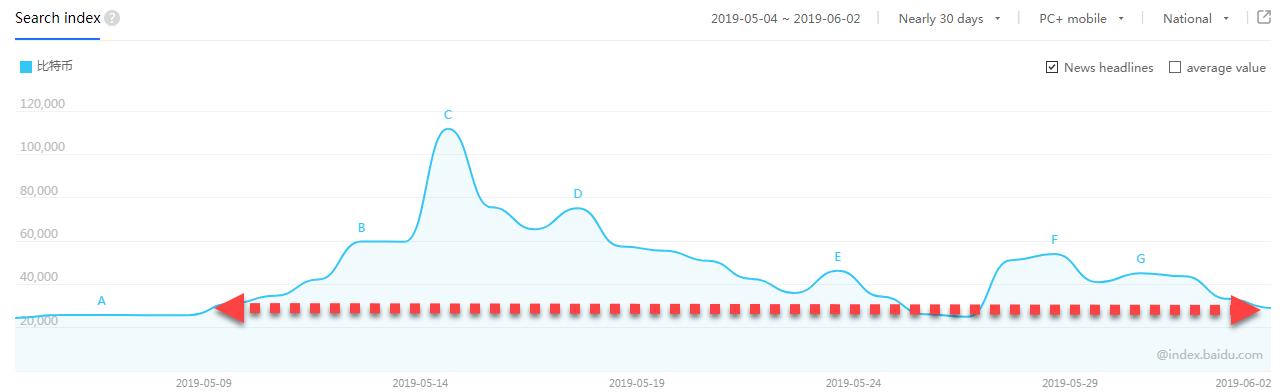

However, Kruger also said that the trend of search heat and BTC price movements appeared to have a bearish divergence after mid-May.

After May 14th, although the price of BTC continued to climb, the search fever of Bitcoin was declining regardless of Baidu search or Google search. However, the popularity of Bitcoin in the Chinese market has picked up recently, and it has risen to the search fever when the BTC reached $6,000 at the beginning of last month.

Bitcoin = new hedging tool?

It may not be a coincidence that BTC price movements and Baidu search trends are highly consistent.

According to market news, starting from the May 26th Trump plus tariffs, the RMB exchange rate against the US dollar has been falling all the way, and it suffered a 11-day losing streak last month. Affected by Sino-US trade frictions, market risk aversion has risen sharply. With the massive influx of funds into the encryption market, Chinese OTC buyers seem to use Bitcoin as a new asset hedging tool.

Wan Hui, the founding partner of Primitive Ventures, said on Twitter earlier that during the market shock, perhaps "bitcoin is the ultimate winner."

Cryptography analyst Joseph Young also said on Twitter that bitcoin has good reason to be a safe-haven asset in the face of increasing geopolitical risks. This reason is not necessarily because of price, but because the infrastructure supporting this asset class is improving rapidly.

However, the encryption market is highly volatile. In the early morning, Bitcoin took a collective divergage in the mainstream currency, and the idea that crypto assets jumped into a safe-haven asset against global financial instability may be difficult to convince.

Source: Shallot APP, copyright belongs to the author.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Party newspaper: the country's first blockchain membership card issued in Hangzhou

- BEPAL officially became a member of the Wanchain Galaxy Consensus Ecology, building a Wanwei Chain PoS node ecosystem

- Media: Don't let "Buffett lunch" become "Buffett curse"

- Gartner's latest forecast: 90% of corporate blockchain technology will be replaced in 2021

- Matrix Element was invited to attend the 2019 International Financial Technology Conference

- The tip of the iceberg: See how domestic listed companies "issue money" through Thunder

- DeFi solved a pain point and brought more pain points.