Babbitt column | The most complete analysis: a clear view of Libra panorama

This article has been included in the first monograph on Libra, "Libra: The New Carrier of the Digital Economy." As a review of Libra's analysis, the book refers to a total of 32 articles selected in the book and selected on the Internet. It is true that "About Libra, reading this one is enough."

I would like to thank Teacher Zhu Jiaming for his many valuable suggestions on this article. I would like to thank Hong Qi public and the editor for editing this article. The author specially wrote this article, and through the framework of the "Hundred Schools of Contention", the readers have a more stereoscopic, more global, and more realistic perspective on Libra's social impact on Libra. Such sorting can also better show that the analysis and understanding of the current industry is relatively blank, and the limitations of the industry discussion are.

At the same time, due to the rush of compilation time, in the selection and selection of many contents, it is inevitable that some content will deviate from the original author. I also hope that readers and authors will understand and discuss the discussion of any issues.

Plato's classic philosophy three questions "Who am I? Where do I come from? Where do I go?" It is also suitable for Libra. Around these three questions, this article will dismantle Libra mainly from five aspects:

- Ba Shusong, chief Chinese economist at the Hong Kong Stock Exchange: Blockchain is a cure for the problem of the credit market

- Market Analysis: BTC pulls the line again, is the adjustment finished?

- The digital currency in the eyes of economists – price articles: ups and downs in the bubble

1. Why should I start Libra?

From the logical point of view, there are fruits and conditions, and the understanding of the seeds can better predict the growth of the fruit.

And understand where Libra comes from to better understand what Libra is and where it will go.

1.1 Time coordinates of Libra

As for the origin of Libra, we must first look at the time coordinates of the two dimensions in one outer and one inner dimensions.

The outer dimension is the timeline for other big companies to issue coins. We will find that Facebook is not the first person to eat crabs. The mainstream US economy is gradually embracing the blockchain and digital currency.

In July 2018, ICE, the actual owner of the New York Stock Exchange, partnered with Microsoft, Boston Consulting Group and Starbucks to form Bakkt, an encrypted digital asset service; [1]

Beginning in July 2018, IBM introduced the Stabilization Coin Program, a stable currency supported by the US government's FDIC;

In February 2019, JPMorgan Chase released the digital currency Morgan Coin for inter-agency liquidation;

On June 5, 2019, 14 banks also launched stable currency for settlement (Utility Settlement Coins USC). These 14 banks include Switzerland, Canada, the United States, the United Kingdom, Japan, and Spain. 【2】

On June 12, 2019, Visa announced B2B Connect, a cross-border payment blockchain network;

The internal dimension is the timeline of Facebook's own development. We will find two points. One is that Facebook's contact and exploration with the blockchain started in 17 years. One is that Facebook and Zuckerberg are deeply invaded by user privacy. "The troubles of the problem:

Around the end of 2017, Facebook sought to acquire Coinbase, the largest trading platform in the United States. David Marcus, vice president of messaging products at Facebook, also joined the board of Coinbase (exited in August 2018), and Marcus is currently appointed to blockchain technology. [3]

As early as January 2018, Zuckerberg revealed plans to enter the cryptocurrency market in his New Year's summary; [4]

In March 2018, an internal line was revealed to the US media. Facebook violated the user agreement and provided privacy data of more than 50 million users to a big data analysis company, which may affect public opinion and political voting.

In May 2018, the General Data Protection Act, the GDPR, entered into force in the EU. At the same time, Zuckerberg attended two hearings in the European Parliament and was questioned.

In the first half of 2018, Facebook tried to acquire blockchain projects such as Algorand, Basis, and Keybase to speed up the development process. But it hit the wall again and the acquisition failed.

In February 2019, it acquired the British blockchain consensus Chainspace and opened the recruitment of blockchain.

In April 2019, Zuckerberg proposed "I believe that Facebook should be as easy to pay as sending a photo."

In May 2019, the New York Times reporter broke the news that Facebook was seeking funding for projects in the field of payments, and subsequently ran away from the Coinbase two experts responsible for financial compliance. At the same time, encryption economist Christian Catalini joined Facebook.

On June 14, the Wall Street Journal reported that Facebook had gathered a bunch of big companies to run its cryptocurrency projects.

1.2 Several possible reasons for Facebook launching Libra

Based on the time coordinates of Libra, there are several main analyses in the industry about Libra:

1.2.1 Privacy issues, have to find new business models, and improve the public's negative image of Facebook

In 2018, Zuckerberg was greatly opposed by the United States and Europe regarding Facebook’s infringement of user privacy data. Zuckerberg was almost arrested for refusing to go to the UK for questioning.

Behind the invasion of privacy data is the business model that Facebook has created and relied on to survive – to capture user data through unpaid or low-cost, to accurately characterize user characteristics and preferences through high-level big data analysis, to accurately push advertisements and earn advertising fees. With the increasing awareness of data privacy and the further improvement of the law, Facebook must analyze the data after the user explicitly authorizes and pays the consideration, which means that the cost and risk of its original business model will be greatly improved. It may even become unprofitable in the future. [5]

And Facebook's revenue is basically 100% from advertising, when the changes in the environment make the advertising revenue face a sharp decline, forcing Zuckerberg to lead the Fcaebook to find a new business model. And privacy issues have a big impact on Facebook's stock price, Zuckerberg is very necessary to take action to improve the public's negative image of Facebook.

1.2.2 Development of the payment field

Payment is one of the largest businesses in the global financial system. In a sound ecology, payment is the most frequently used and most important infrastructure. Facebook currently has enough user base, but can't effectively realize it. The introduction of payment system will provide more possibilities for Facebook to realize the value of games, e-commerce, news and other scenarios, and build a complete Closed loop ecology. [6]

Prior to this, Facebook has already made many attempts in this field. Some people say that it is difficult to give up this track after feeling the light assets, large volume and high profits of the payment industry.

Table: Facebook's attempt in the payment field (Source: Zero Financial)

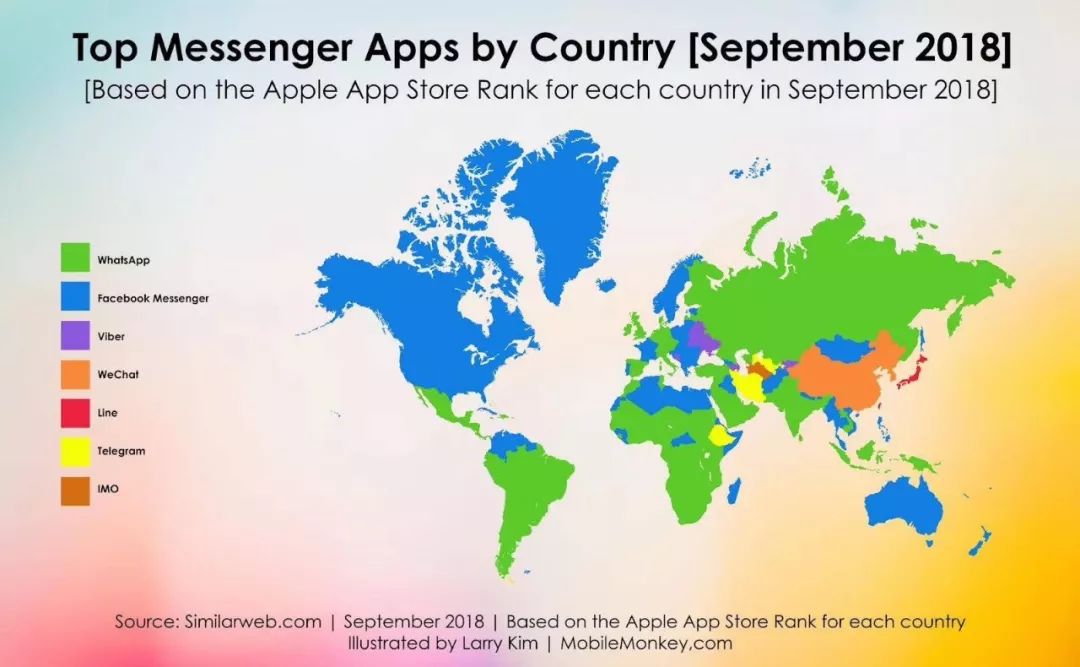

China's mobile payment has always been the world leader. After the WeChat of social products turned to the "social + payment" composite product, the number of payments has far exceeded that of Alipay, and the successful experience can also be fully referenced by Facebook. In contrast, Facebook has a huge advantage in the cross-border payment field, because the number of WeChat users is large, but mainly Chinese, Facebook users are all over the world, there is no need to re-cultivate the user base.

Therefore, it has a natural advantage for paying Facebook and has been continuously exploring and advancing.

1.2.3 Actively challenge the block target first goal

Blockchain and digital currency are no longer a small circle. The front has already introduced to large companies such as IBM and JPMorgan, and Zuckerberg, the head of the $100 billion technology field, will not pay attention to the new Technology, how can you not understand the future of blockchain and digital currency.

And since its inception, Facebook has been invincible in the Internet world, and its success has also contributed to Zuckerberg’s ambition. As the monopolist of the Internet, naturally understand the Matthew effect of the digital world, so Zuckerberg must follow the preemptive and one-stop strategy in the blockchain world, and quickly become the world's number one, making it difficult for latecomers to challenge. [7]

Therefore, at this time, he wants to go from the Internet one step at a time, directly to the blockchain, and become the leader of the blockchain world.

1.2.4 The reason may be compound

It is true that the above three reasons have their own reasons. One is the existing internal worry, the other is the only way to normal development, and the other is Zuckerberg's personality and ambition.

It's hard to say that Zuckerberg doesn't consider any of the above three when making a decision. Libra is criticized by many as eclecticism, perhaps because it wants to satisfy three reasons at the same time.

If there are three reasons at the same time, we should realize that Libra's existence has to meet two goals, and one lacks:

a. The interests of Facebook.

b. Zuckerberg's feelings.

Some people say that Libra is not innovative, it is a bunch of existing technology and thinking. This kind of statement reminds me of Bitcoin. Before Bitcoin, password punks carried out a lot of digital currency experiments. The POW consensus mechanism that people are familiar with today is all invented by the predecessors. Some technologies have made a combination. Isn't Bitcoin innovative?

And to study Libra, we need to know which combination of technology and thinking, and why the Libra sponsor team will select the appropriate components in a particular module.

In this chapter, I split Libra into four parts for disassembly: Value + Libra Currency + Libra Association + Libra Blockchain.

2.1 Libra's values

Many big economists have different opinions on policy formulation, not because of the level of economic theory or the bias of reality judgment, but because of values. Differences in values lead to different normative views on what the policy should strive to achieve.

Differences in values can also lead to projects moving in different directions. So, I will separate the values that Libra conveys through the white paper.

Libra's values can be summed up in three words, and we'll find that these three words run through almost all of the mechanism design discussed below, and at the outset they set Libra's moral high ground.

a. Open. It is open to any individual subject, is open to the choice of reserve assets, is open to members of the association, and is open to technology.

b. Equality. It is equal to the status of the identity, regardless of the region, regardless of occupation, regardless of the rich and the poor, regardless of the investment, regardless of the equality of voting rights, all currencies are eligible for inclusion in the reserve.

c. Sharing. It is the sharing of management power, the sharing of value returns, and the sharing of the old and new worlds.

In the big vernacular, Libra can come in any aspect, and it is equally involved, and can share rights.

The three values of openness, equality, and sharing interact with each other and create the soul of Libra.

There are also many people who question whether Zuckerberg will follow this value. On the one hand, we have seen that all of its mechanisms are designed to match (even if there are many ways that have to be compromised, it is reasonable from the perspective of landing) On the other hand, at least it dares to reveal a problem: the development of science and technology has not brought about the benign development of the global economy, and even created a greater imbalance, resulting in social problems, [8] the gap between rich and poor Problems, as well as the serious irrationality of the allocation of monetary and financial resources that exacerbate the gap between rich and poor.

In this sense, Libra's white paper is the most proclamation of monetary and financial equality, justice and inclusiveness since the 21st century. 【9】

2.2 Libra Currency

There are actually two kinds of coins in the Libra system, one is Libra Investment Token, which is held after the investment of the founder of Libra Association, mainly used for voting and dividends; the other is the Libar currency in the mouth of everyone, Libar mentioned in this article. The coins are all referring to Libar coins.

2.2.1 The currency mechanism of Libar coins

Libra's goal is to be a stable digital cryptocurrency that will be backed by a full use of real asset reserves (called “Libra Reserves”) and supported by a network of trading platforms that buy and sell Libra and compete.

Anchored assets (reserves): A series of low-volatility assets, including cash and government currency securities provided by a stable and reputable central bank, issued for 100% reserve.

Price: Libra's price is not anchored to a certain currency, but is determined by the assets in its reserve pool. Libra does not have its own monetary policy. Any appreciation or depreciation of Libra depends only on fluctuations in the foreign exchange market. The mechanism in this regard will be similar to the Special Drawing Rights (SDR).

Asset Custody: Assets in Libra's reserves will be held by custodians with investment-grade credit ratings across the globe to ensure asset security and dispersion. [10]

Seigniorage tax: For the coinage of the mortgaged asset, the coinage tax should come from its various business income based on Libra. [11]

2.2.2 Why did Libra choose a stable currency that uses a basket of assets as a reserve?

Although Libra is based on the digital currency issued by the blockchain, it is very different from digital currency such as Bitcoin. Libra is an innovative stable currency.

The goal of the Bitcoin white paper is to become electronic cash, but because of the deflation mechanism and other reasons, the currency price fluctuates greatly, and people almost do not have to pay for it, but become a consensus-based digital asset. After several years of attempts at various digital currencies such as Ethereum, it was basically declared that the currency with large price fluctuations was used to make payment failure.

For daily payments, people hope that the prices of items today and tomorrow will remain basically the same, so stable coins with less fluctuations in currency prices become an inevitable choice for landing applications. The top ten digital currency in terms of currency value, except for USDT, has a maximum daily turnover rate of no more than 35%, while USDT's daily turnover rate is as high as 425%.

But it must be stated here that the name of the stable currency is easily misleading to everyone because there is no stable currency at all. For example, the renminbi will fluctuate against the US dollar, and the dollar will always fluctuate relative to gold Therefore, stability is a relative stability, not an absolute stability. When we talk about stable coins, we must know what is relatively stable , this object is very important. [12]

The stable currency in the mouth of everyone now usually refers to the digital currency issued with the anchor currency anchored, such as USDT. Libra differs in that it chooses to use a basket of assets as a reserve. Because most of the current stable currencies are collateralized by the US dollar, many also emphasize 100% reserve, which brings simple and strong credit support to the stable currency, but also wastes liquidity and limits the profitability of the operators. Libra collateralizes a basket of low-risk assets, not limited to dollar assets, so that it can circumvent the risks posed by single-dollar assets, has more open financial characteristics, and has more profit margins, at the cost of large financial risks, and requires Higher asset management capabilities. [13]

Regarding whether Libra is likely to be decoupled from the currency and national debt in the future, and transition to other assets, everyone can only speculate at present.

Some experts believe that after a few years, people have been familiar enough and widely accepted Libra, and the cost of migration is also high. Therefore, it is not mindful whether Libra has enough low-risk assets to anchor. For example, USDT has now changed to not with USD 1 :1, when the adjustment started, it caused turmoil, but the time was not long and it returned to normal. USDT is still the most used stable currency. Therefore, they believe that there will be decoupling in the future, and even after decoupling, they will not only use assets as reserves, but also issue their own credits as reserves.

Some experts believe that decoupling is a difficult thing. The RMB has not yet been decoupled from the US dollar. Libra cannot be stronger than the RMB. [14]

2.2.3 Nature of Libra Currency: Super Sovereign Currency

A large part of the controversy over digital currency such as Bitcoin is whether Bitcoin can be called currency. It can be said that the mainstream economics circle has not yet reached a consensus. But this time, almost no one has ever questioned whether Libra is a currency issue. Everyone has defaulted, and more is discussing whether Libra is a non-state of currency.

Libra has no currency creation function because it represents a basket of currencies that already exist. Libra's 100% is based on the French currency reserve pool and does not generate a coinage tax. Libra has no real monetary policy. Therefore, Libra is far from being a non-state of currency. According to Zhou Xiaochuan's elaboration of super-sovereign currency, Libra is a super-sovereign currency . [15]

2.2.4 Libra is the central bank of the digital economy

The issuance of currency is divided into basic issuance and derivative issuance. The currency issued by the former is called the base currency, and the latter is called the derived currency.

The issuance of the base currency is based on two types of anchoring, sovereign credit and physical assets, all of which are 100%, usually by the central bank. In the case of supporting derivative currency, there is a type of franchise in the economy, usually called a commercial bank, that can lend in ways that are not fully reserved. [16]

Libra buys government bonds directly from the Ministry of Finance, or the bond directly accepts Libra. Libra is equivalent to the central bank; Libra does not accept, users can only accept through the secondary market, and there is a stronger central bank taste. So for now, Libra is more like a central bank than a commercial bank. [17]

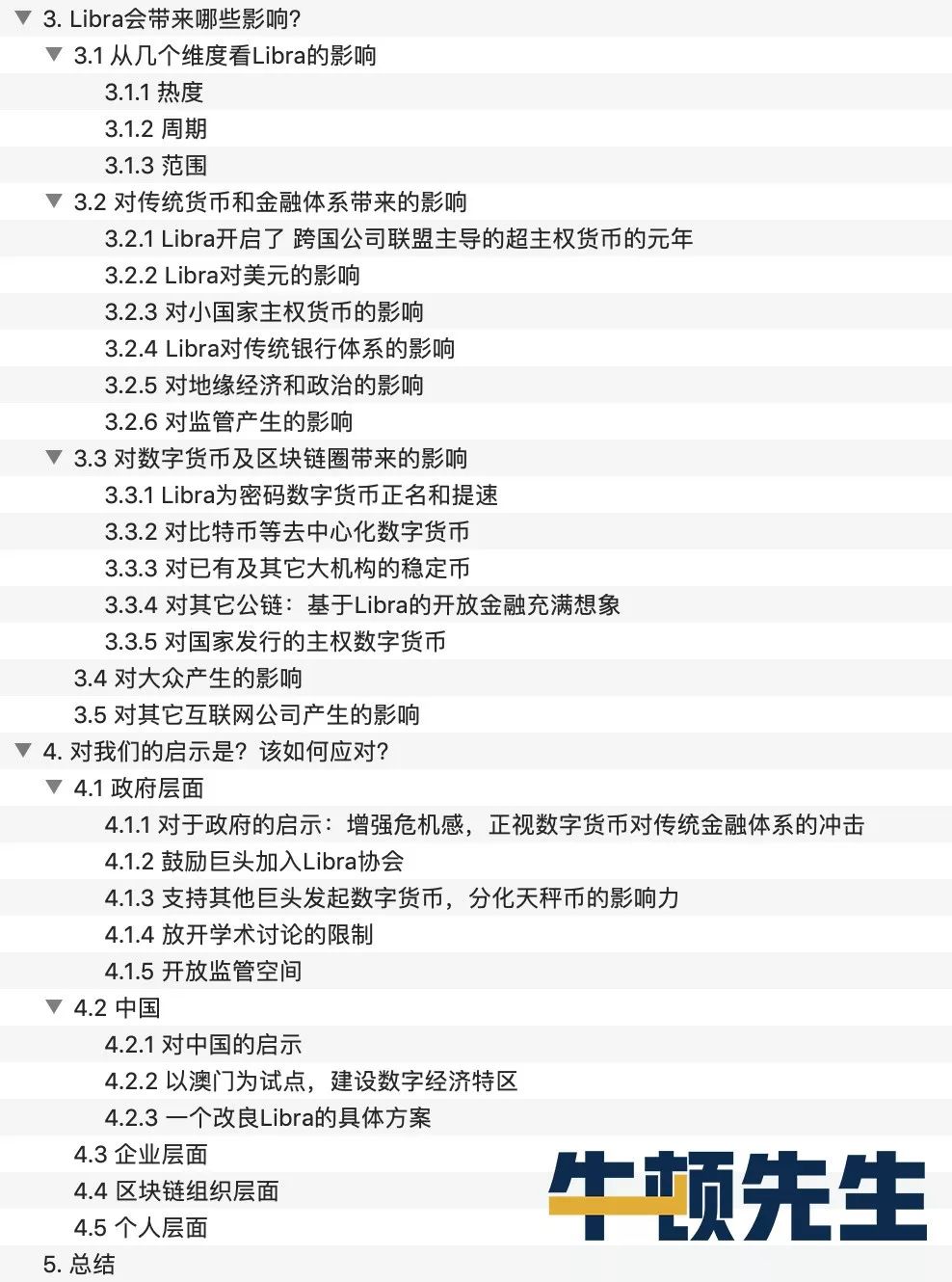

2.2.5 Differences from Q coins, Alipay, Bitcoin

[18]

2.2.6 Questions to be answered

Regarding which currencies and bonds are specifically selected in Libra, there is not enough discussion in the current white paper. This is also a point that some economists are more criticized because it is a core content but it is left blank. Therefore, this issue needs to be publicized by the Libra team's next step:

Which assets are selected? How to solve the problem of proportional distribution of a basket of assets?

2.3 Libra Association

2.3.1 Introduction

The Libra Association is an independent Swiss non-profit organization whose mission is to build a simple global monetary and financial infrastructure that serves billions of people. The members of the association are composed of the verifier nodes of the Libra network, which were originally formed by the founders of the Libra Association and later open to all entities. An important point that Libra has drawn attention from all over the world is the luxury lineup of founders of previous associations such as Facebook, VISA, and PayPal.

Libra's values mentioned in 2.1 of this article run through all the rules and regulations of the Libra Association. The Libra Association's opening is beyond everyone's expectations. Unfortunately, this part is not enough for everyone to discuss.

Independence: In the context of current media communication, many people mistakenly believe that Libra is a coin issued by Facebook, which is a great understanding of the bias. Facebook was only responsible for launching Libra in the early days, but before the end of 2019, the decision-making power will be given to the Libra Association. And Libra's white papers are all based on the Libra Association's perspective and try to describe the association's own independence. Not much mention of Facebook is also an emphasis on Facebook and other members are equal.

Open and Equitable: All the details of the Libra Association are in principle to ensure the openness of members while limiting the concentration of power. In the case of “inequality of starting points” such as the amount of capital contribution, the voting rights are guaranteed as much as possible. "Equality of the end point." Facebook’s voting rights at the Libra Association will not exceed 1%. [19]

Decentralization : Many people criticize Libra as a product of centralization. Although Libra is still central to Bitcoin and Ethereum, it is decentralized compared to traditional Internet companies such as Facebook. The world is not black or white, Libra is the transition between centralization and decentralization.

Among them, many people mistakenly believe that Calibra (a subsidiary of Facebook, responsible for the development of Libra wallet) is a privilege that Facebook has left for itself to ensure the return of Facebook's benefits. But in fact, the wallet service is also open, just like bitcoin, all organizations can develop bitcoin wallets.

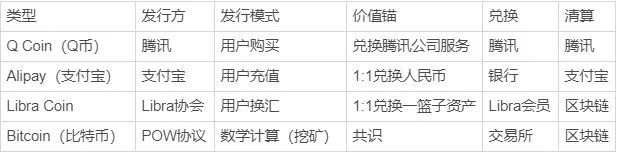

2.3.2 A similar organizational structure has been successful

When I read the description of the organizational structure in the white paper, I have a familiar feeling, because this is almost the same as the organizational structure of VISA in the 1970s.

VISA's predecessor was the credit card department of Bank of America. The business was centered on the credit card of Bank of America and authorized to cooperate with many banks, but the promotion has not been smooth. Until Dee Hock called for the divestiture of VISA from the US banking system, the establishment of the above organizational structure, and the alliance for all banks, fully considering the interests of all member banks, VISA officially developed and became the world's number one.

Libra is similar to VISA and faces the same collaboration between multiple giants, so this organizational structure is applicable.

The organizational structure of VISA (1966) can be compared with the organizational structure of the Libra Association.

member

The ownership of assets of organizations such as trademarks belongs to members; members are open, no one can prevent qualified members from joining, and no one can allow unqualified members to join; members can enter and leave at will;

director

The directors are elected by voting. The number of votes is determined according to the total transaction volume in previous years. One ticket per 1,000 US dollars; one bank can only have one director; each director has only one vote; each district can elect one director, only the headquarters. Only eligible to participate in the vote in the district;

The directors are re-elected each year, and the candidates are selected by the nomination team by the board of directors; they can also be nominated by the members, and more than two members can also join the list of candidates;

Board of Directors

A number of rules and regulations may be amended; however, amendments to the organizational principles that govern the basis of the rules and regulations must be approved by the board of directors by more than 80%; the key clauses require 80% of the directors and 80% of the members to agree;

The chairman of the board of directors is elected by the board of directors; the chairman presides over all board meetings to ensure fair and equitable representation, and does not violate the principles and laws of the organization, but must not prohibit others from speaking;

President

The board of directors appoints the president, and the president will be the CEO and director, but not the chairman of the board; the president prepares the board of directors agenda, each director has the right to propose any bill to be included in the agenda; the president is responsible for day-to-day operations and execution;

funds

Each member pays 0.25% of the sales fee for the service fee; if there is a dividend or other income distribution, it will be paid according to the ratio of the service fee paid by the respective bank to the total service fee; [20]

2.3.3 Can Libra be decentralized?

The author believes that in the process of decentralization, Libra faces two insurmountable problems:

a. Many assets are difficult to decentralize themselves. Therefore, Libra is difficult to decentralize due to restrictions from asset issuers and management parties.

As mentioned earlier, Libra is an anchor asset for distribution. So we have to have a deeper understanding of assets, assets can be divided into atomic assets, bit assets, composite assets. And when we trade, the property is not an asset. Therefore, there are two aspects that need to be guaranteed. One is to guarantee the one-to-one correspondence between property rights and things, and the other is to ensure that property rights can completely control the articles.

Based on this principle, we can draw a conclusion that for atomic assets, there is no way to completely decentralize and must rely on centralized institutions.

Only a part of the bit assets can be decentralized. For example, "Game of Thrones" is particularly hot. The show itself is an asset, but fans may download pirated copies. When using pirated copies, there is no reduction. There is no difference between the acquisition of product value and the viewing of genuine products. Such assets are useless even if they are placed on the chain, or they need a centralized organization to safeguard their rights.

To determine whether an asset can be completely decentralized, it is important to see if the user must be in the network to get the full value of it. Bitcoin is a special case. Copying a bitcoin from a blockchain network is just a number that cannot be consumed, so bitcoin can be completely de-neutralized. If it is not available on the Internet, then it can't be completely decentralized. It must rely on a centralized organization to supervise it, just like the current patent, the current copyright.

From the current point of view, most of the assets used in life, even if the proportion of bit assets is already high, but the vast majority of bit assets are still not decentralized, so most assets can not be done. Centralized, must rely on centralized management.

b. Values are difficult to resist the profitability of capital.

Libra was almost identical in its organizational structure when VISA was first created in the 1970s, but after VISA's founder Dee Hock left VISA to retreat, VISA became a company and went public. Although it is difficult to say that it is unsuccessful from the stock price level, the original vision similar to Libra has not been realized, so it is also a failure.

Libra's founding team must have left in the future, and will face the problem of capital gains. Whether through the structure of Libra, how much of the fees, interest and other benefits will be distributed to the founders of the Libra Association. It is difficult to compare the leverage of 15 times and 20 times. This is the charm of capital that is completely in line with the demands of rational economic people. 【twenty one】

2.3.4 The long-term difficulty Libra faces is the internal interest game

Money is the most important commodity or business in a market economy. The larger the size and circulation of money, the greater the economic benefits involved. The greater the economic benefits, the more intense the struggle or game. As the system expands, the difficulty of coordination will become greater and greater.

If Libra becomes a world currency, its every move, such as the composition of its basket of currencies, the selection and disposal of a basket of mortgage assets, etc., will affect the currency stability, balance of payments, national income, etc. of different countries. It even involves complex social issues such as race, religion, and terrorism. Libra as an alliance, in this complex social environment, the game and struggle will become so fierce that its currency is difficult to maintain stable and continuous operation.

Thinking about the operation of the United Nations and why the United Nations did not launch a world currency may help to understand the difficulties that Libra will face in the long run. 【twenty two】

2.3.5 Everyone's concern: Why are the founders of the association mostly American members?

Although Libra has set up a very democratic voting mechanism, the current 27 founders of the association are basically American companies, which is close to one-third. Many non-US business organizations say that even if they join Libra, voting rights have been monopolized, and it is difficult to obtain the true value of voting, just formal democracy.

Therefore, the author suggests that before a non-permitted network is reached, can it limit the voting power of a country to no more than 30%? This is more in line with Libra's values.

2.4 Libra blockchain

2.4.1 Introduction

The Libra blockchain is a coalition chain based on the LibraBFT consensus mechanism and will move towards the public chain of the POS mechanism in the future.

Three requirements during the alliance chain:

a. Ability to scale to billions of accounts, high transaction throughput and low latency, and an efficient and high-capacity storage system.

b. Highly secure and secure to secure financial and financial data.

c. Flexible enough to support the management of the Libra ecosystem and innovation in the future of financial services.

2.4.2 Move is a smart contract platform language for "digital assets"

"Move" is a new programming language for implementing custom trading logic and "smart contracts" in the Libra blockchain. Named the only innovation and two points in the Libra white paper, this new language is also rated as "this may be what the future smart contract language should look like."

First-class Resources concept

Traditional programming languages, including the Ethereum smart contract language, have a lot of smart contracts for miscounting, and even once lost confidence in the future of smart contracts.

The Move contract uses a type that absorbs the traditional theory of "linear logic," called a resource type. Digital assets can be defined by "resource types", so that digital assets, like resources, satisfy some of the characteristics of linear logic:

Digital assets cannot be copied;

Digital assets cannot disappear out of thin air.

The true meaning of First-class Resources is that digital assets are first-class citizens. This sentence can be derived. Move is a smart contract language for operating digital assets. From a technical point of view, a digital asset can be used as a contract variable, a digital asset can be stored, can be assigned, can be used as a function/procedure parameter, or as a function/process return value.

Bottom-up static type system

Move uses a static type system, essentially a logical constraint, which is much stricter than Ethereum's smart contract language. Modern programming languages such as Rust and Golang all use static type systems. The advantage is that many low-level programming errors can be found at compile time, rather than dragging them to the runtime. 【twenty three】

2.5 Application Scenario

The application scenarios of Libra are mainly as follows, and it is likely that they will also advance in the following order:

2.5.1 Cross-border remittance

The poor people mentioned in the Libra white paper did not have equal access to financial services, and the first thing was the issue of cross-border remittances.

Because Libra uses a blockchain-based algorithmic ledger, which only contains a single ledger, eliminating the management of the hook relationship between sub-books, the settlement efficiency should be greatly improved. This is especially true for efficiency gains in cross-border remittances. [24] This is a big market and pain point: the annual cross-border remittances have at least trillions of dollars in transfers, the average is 7% of the handling fee, and the light handling fee is $70 billion. [25] According to Bloomberg, Facebook's WhatsApp users can use Libra to send money to India.

The landing of cross-border remittances is relatively easy and widely accepted.

2.5.2 Payment based on Facebook and digital economy

Facebook itself has a huge volume of products, and Libra's first step in purchasing products is more controllable and easy to push in its own system. According to the New York Times, Facebook plans to use Libra to pay for Facebook advertising. [26]

Furthermore, Facebook itself is in the digital world, and there are many online eco-partners in which Libra will be unimpeded. Imagine that if we buy members online, listen to music, buy game props, and reward, we use Libra as the unit to calculate the price. What impact will it have in the long run? In the subtle, people will accept Libra as a value scale in the digital economy, that is, the local currency.

As mentioned above, the section on stabilizing coins states that the stability of stable currencies is relatively stable, and the relative objects that people usually use are closely related to life and consumption. We use some everyday items to make judgments. The currency is relatively stable compared to most items, and it is considered to be stable. For example, people do not use the house to make monetary stability judgments. Even if the house accounts for the amount of money he has earned for 20 years of work, he will usually choose a higher frequency such as clothing, food, housing and transportation.

Nowadays, China and the United States have used mobile phones for more than 4 hours a day. It can be expected that the future will only grow longer and longer, and the frequency and proportion of consumption in the digital world will only gradually increase. If this part of the consumption is the majority and is paid through Libra, Libra will not only be the value scale of the digital economy, but will become the value scale of the entire human economy.

2.5.3 Investment

In the future, there will be digital financial products based on Libra. These assets will be anchored by Libra, and Libra is the most suitable currency for investing in investment, just like the Token Fund, which has previously raised BTC and USDT in the digital currency field. .

2.5.4 offline payment

When Libra forms consensus and influence on the line, it is easy to expand to the offline without guidance. The main problem facing this part is the supervision of sovereign countries.

2.6 Libra's compliance

2.6.1 Attitude: Embracing supervision

First, it must be clear that Libra's attitude is initially to embrace regulation. Libra has communicated with several authorities before various news reports indicate that the white paper was released.

This attitude is very straightforward in the white paper: we believe that working with the financial sector (including regulators and experts in various industries) to collaborate and innovate is to ensure sustainable, safe and credible support for this new system. The only way to frame.

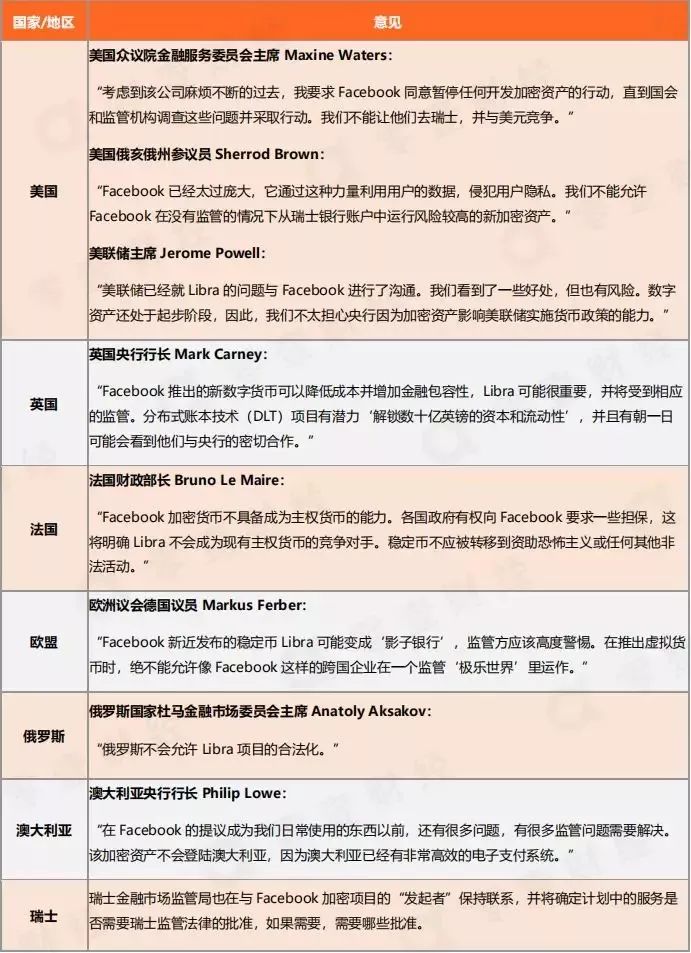

2.6.2 Responses from government agencies in various countries

Two days after the release of the Libra project white paper, politicians from various countries and regions expressed their attitudes. Overall, there is more opposition to or demand for Libra regulation. How to face the different types of regulation that may arise in various countries in the future and survive and develop in the current powerful and complex sovereign currency system is a major challenge for Libra.

Source: Zero 壹 Finance · Zero 壹 think tank according to public information

2.6.3 Supervision is a major problem in the short term, but it is not unsolvable

Libra is currently facing the situation that technology is once again in front of the regulatory system. This time is not irreconcilable, but everyone still does not know how to deal with it.

The regulatory system represented by the United States is not the first time this has happened. They have their own inclusiveness. The early involvement of US regulatory experts in the supervision system, which is based on the development of social balance and the well-being of the people, gives the gold medals for financial innovation and illegal gold medals, so that innovators will not bear the burden of accounting after the fall. In the process of innovation, you can start a business in the process of innovation, and you can make bold attempts in the boundary where the law is not clear, and you don't have to worry about your own personal threat. Such a light-loaded entrepreneurial model has given American innovators a basic protection. Companies such as Uber and Coinbase in the Libra Association have grown up in such a regulatory environment. [27]

It can be expected that Libra has a lot of regulatory details to consider and improve in terms of currency, asset collateral, stable currency circulation, anti-terrorism and anti-money laundering. But on the other hand, Libra is not the first person to eat crabs from the law of stabilizing coins. The USDC/TUSD/PAX on the market are all compliant stable coins. Libra's design structure is not fundamentally different from them. It can be carried out in full accordance with the laws of the country where it is implemented, and the corresponding KYC, ALM, license application, etc. And Libra has a stronger team and financial resources, and can fully afford the best lawyers and lobbyists to help them clear the relationship and settle the incident.

In some small countries where legal infrastructure is not in place, it may be opposed by populism because Libra hits the local currency. However, these countries often have a characteristic, and even if they are supervised, they cannot be implemented well. When they really announced that Libra was illegal, it could not hinder Libra's circulation in the country unless it was completely cut off from the Internet. [28]

2.7 Libra is dynamic and constantly evolving

Finally, I hope that everyone will pay attention to the Libra that people are discussing today, based on its white paper, not Libra's ultimate solution, and not the way Libra will eventually implement it.

The Libra white paper, which is now published, should be said to be a document with a sneak peek, or a consultation paper sent to the world. The white paper will definitely be upgraded. I believe that the Libra team will make corresponding adjustments and revisions based on feedback from the whole world.

Therefore, we need to understand Libra as a dynamic, evolving and evolving historical event. To avoid a slap in the face, Libra needs to be a long-term economic and monetary financial innovation and observation and reflection that affects the world and history. [29]

3.1 See the impact of Libra from several dimensions

3.1.1 Heat

On June 19th, the second day of the Libra white paper, Facebook's WeChat index reached 6.64 million. As a highly professional financial and technical vocabulary, Libra's WeChat index on June 27 overshadowed the popular vocabulary facebook and bitcoin, reaching 3.95 million, which also directly highlights Libra's popularity: although everyone is not Facebook users, but Libra is really concerned about it.

Source: WeChat Index

3.1.2 cycle

In today's communication environment where most topics are hot for less than three days, Libra has been covering the news, brewing hotspots, detonating after the release of the white paper, and now continuing fermentation, the topic has lasted longer than most economic topics. The last event that had such heat and continuity was a trade war.

As the first super-sovereign currency initiated by a multinational alliance, Libra has to face the most complicated supervision and challenges in history. It is not necessarily successful, and even the probability of failure is not small. But Pandora’s door has been opened for profit, and the number is not The transnational corporations in the Qing Dynasty will also inevitably follow suit.

3.1.3 Scope

The Libra incident has a wide range of influences, from officials of government agencies to civil media practitioners, from academia to business, from financial predators to the Internet, from the pass to the currency circle to the chain, from the United States to From Europe to China, from the industry to the general public, Libra's actual influence has far exceeded the general economic events and technological events.

In the context of Facebook's own users, at least 2.7 billion people will be affected; even if it is calculated according to the monthly activity of 2.38 billion, or 1.56 billion daily, the scope of its impact is extremely amazing.

3.2 Impact on traditional monetary and financial systems

Uncovering the appearance, Libra is actually just an attempt by Facebook to solve the payment problem. The breakthrough innovation in the blockchain field that most followers expect is now more imagined.

Since the choice of traditional French currency and national debt as the stable currency form of anchorage, it has chosen to stand with financial traditional enterprises rather than become the opponents of the financial industry in the digital economy. [30]

3.2.1 Libra opens the first year of a super-sovereign currency led by a multinational corporation

Since the emergence of the currency, it has always had both economic and political functions. Therefore, competition between currencies has been given a strong political significance. However, with the advancement of globalization, the scale of international trade has expanded rapidly, and people need a unified world currency. Today, this role undoubtedly belongs to the US dollar, although it also brings many problems. Under the current situation of political fragmentation, big country game, and civilized conflict, under the traditional financial structure, the ideal world currency is difficult to achieve.

Based on blockchain-based Libra, this cross-border, coalition super-sovereign digital currency will effectively reduce transaction costs and greatly improve collaboration efficiency, which is what multinational companies can't ask for. Will have a great impact on the traditional financial system. [31]

And Facebook is only the first rebels in the Roman legion. Multinational giants such as Twitter, google, whatsapp and Instagram, and JP Mogan certainly smell the taste of super-sovereign currency. They have already secretly prepared for it, just waiting for the right time.

The super-sovereign currency led by the alliance of multinational corporations will completely break and reconstruct the stable symbiotic relationship between the current economy and politics. The super-sovereign currency is based on the governance mechanism of distributed open values, and will bring capitalism to a new stage.

3.2.2 Libra's impact on the US dollar

Libra is still an extension of the legal currency system. Libra is essentially a credit currency. It anchors legal currency and mortgaged currency-denominated assets. It is the use of legal currency credit to support private credit. The problems and challenges faced by the legal currency system will also affect Libra's stability. Facebook gives Libra the direction of decentralization in the future, but a complicated and large alliance credit currency system is very difficult to turn to decentralized currency. [32]

Libra will only help the dollar, not the dollar. If the US government wants Libra to go out of the market, it will be off the market in two minutes. It can be done by making a phone call, so it is impossible to replace the dollar, and it is only a tool of the dollar. [33] Even if Libra replaced the US dollar one day, for the United States, it was nothing more than the financial center moved from New York to Silicon Valley. The influence of the United States on global finance was not declining, but it was greatly enhanced. [34] However, it should be noted that Libra is not 1:1 anchored to the US dollar, so its impact on the status of the US dollar remains to be seen. [35]

In general, the support of the US dollar is the national credit of the United States, and the violent machine is a key part of the national credit; for the ability to physically and physically destroy itself, Libra, which is highly centralized, cannot feel it. To threats; therefore, its desire to replace the dollar is much different than the decentralized digital currency, at least at this stage.

So will Libra become the embarrassment of the dollar and fall into the tragedy of dollar pricing?

It is widely believed that the USDT or other so-called dollar-denominated digital currency deviates from the dollar as a sign of failure; while Libra allows for a range of fluctuations, the so-called volatility must be based on the dollar. [36] Just as the SDR is calculated based on the dollar exchange rate of the currency in the basket, it is equivalent to its anchor or the dollar. If Libra is very similar in nature to SDR in terms of currency, will its fate be the same as SDR? (The result of the US dollar system is denominated in US dollars…) [37]

The author believes that the proximity to SDR in currency design does not mean that the use of SDR will be repeated in the use and ultimate fate. The most critical question is whether the ultimate decision maker accepting a currency is the consumer, that is, us. Often said "C-side users."

SDR is built on top of traditional banks and old clearing systems, and cannot reach the end consumer, so it can only last a lifetime in the basket.

Libra is born with billions of C-side users, and it is entirely possible to change the user's consensus by subtly changing. For C-end users, whether a currency fails, not only the most powerful US dollar, but also more intuitive is the emotional judgment of their daily contact and consumption. The US dollar exchange rate is not as good as a meal and a game prop in the eyes of ordinary consumers. When the exchange rate between the US dollar and Libra is seriously deviated, but ordinary Libra users eat, consume, play games, watch videos in the facebook ecosystem, when using Libra to pay the price, the price does not fluctuate, then the user generally thinks that "the US dollar does not Reliable." (See 2.5 above) and the exchange rate between the US dollar and Libra deviates. Only when it uses Libra cross-border exchange services, will there be more intuitive judgment.

Finally, combined with the analysis of the possible future changes of Libra anchors in the end of the previous 2.2.2, we can consider the following two questions:

1. Is it the best solution for facebook to be friends with the traditional financial system rather than being an enemy?

2. At this stage, it will not challenge the traditional financial order. Does it mean that it will never be challenged?

3.2.3 Impact on sovereign currency of small countries

Wang Xing made a remark in the meal. The world should not have more than 200 independent countries as it is now, because it is impossible to find two hundred teams capable of issuing money. When the Libra white paper was released, he commented that Facebook’s strategy is clear, and the persimmons are soft, and the currency system of the weak countries in 200 countries is gradually replaced. It is of course to be a low-powered country. Bowing down, the conspiracy is a conspiracy.

Undoubtedly, between the small national sovereign currency that is arbitrarily issued and the world stable currency anchored by a basket of high-quality legal currency bonds, people will definitely choose the latter, so Libra’s circulation will definitely have a great impact on the sovereign currency of small countries, and even Replace .

Regarding the impact that Libra will have on the original economic system, there is a very appropriate case to refer to, namely the “dual currency system” of Cambodia and its impact.

After the coup in Cambodia in 1997, Professor Zhu Jiaming had proposed systematically for the Cambodian government to rebuild the economy, especially the monetary system. That is to use the US dollar as the main currency and the Cambodian currency as the auxiliary currency. Because the war-torn Cambodian people, through the era of non-monetary economy, only believe in the dollar, because the Cambodian government cannot freely issue additional dollars. The dollar can achieve price stability and avoid hyperinflation. With the relative stability of prices, political stability and social stability can be achieved. Professor Zhu Jiaming’s opinion was accepted and practice proved that this choice is correct. [38]

In fact, the US dollar is no longer the American dollar, but the world currency. There is no conspiracy here. This is the result of history.

Therefore, in combination with Professor Zhu Jiaming's design of the Cambodian dual currency system , the US dollar and the Cambodian Riel dual currency system are obviously more advanced and better.

But small national governments may not accept it. For most non-elected authoritarian governments, Libra weakens the government's ability to control the economy and reduce the government's coinage tax. Although it may be good for the economy and the public, it is very likely to trigger a strong rebound.

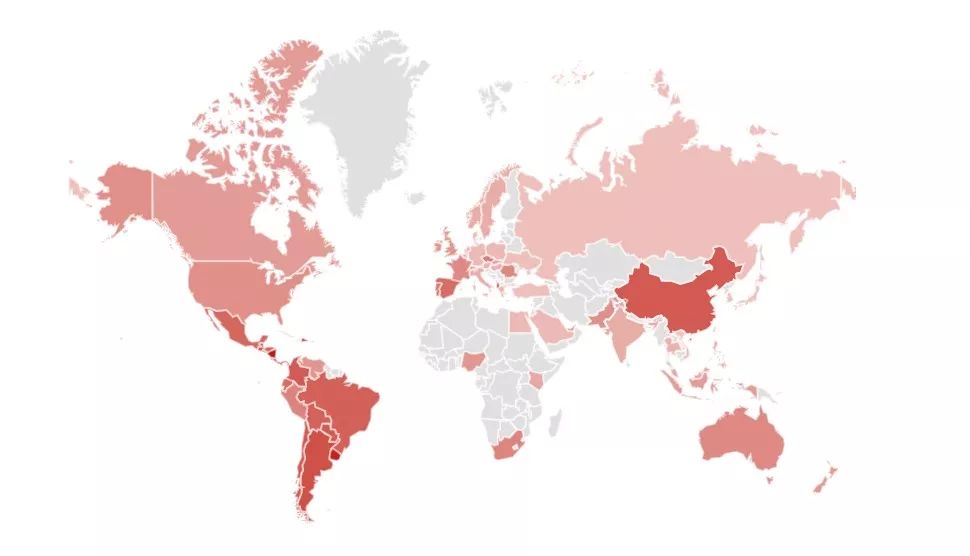

Libra's search heat by region. Source: Google Trends

The darker the color in the picture, the higher the heat. The top five countries in the heat are the Dominican Republic, Nicaragua, Uruguay, Paraguay, and Argentina. This time, the Libra white paper also clearly stated that the main service target is the people of small countries. From the picture, it can be basically understood as the precise target audience.

Interestingly, China's heat ranks 10th.

3.2.4 Libra's impact on the traditional banking system

Libra tries to snatch the bulk of the bank's monetary system: the coinage tax and the inflation tax: With the gradual establishment of Libra credit, it will gradually become detached from the legal currency and become the base currency, which will have a great impact on the legal currency system and the traditional banking system. Shock, this also brings a lot of suspense to its prospects. [39]

The foregoing expresses the possibility that Libra is only an extension of the US dollar, and also analyzes its direct access to C-end consumers, so there is an opportunity to change the principle of consumer pricing consensus (3.2.2). At the same time, we also want to see that the design does have the potential to have existing cakes for traditional legal currency and banking systems.

3.2.5 Impact on geo-economic and political

New technology brings a new game battlefield, which is an important issue that all economic powers must face seriously.

The dominance of the US dollar is mainly reflected in international trade, investment and foreign exchange reserves. It cannot be unimpeded in the daily payments of various countries and inter-firm trade, especially in the digital economy. However, Libra can do things that the dollar can't do. Facebook users can create, hire, shop, travel, consume, buy insurance, and more around Libra. More importantly, Libra is a “folk” currency that does not have the strong political color of the dollar.

Therefore, Libra and the US dollar are more complementary. The alliance between the US dollar and Libra is a high probability event when the two sides need each other. Once Libra's alliance with the US dollar is formed, in the long run, it is difficult for the government, especially the democratic government, to effectively deter Libra's penetration of its digital economy. A more reasonable choice can only be to cooperate with Facebook and its allies. [40]

Economy and politics have never been separated. When the dollar + Libra is unimpeded in the world, the existing geopolitical and economic structure will inevitably be broken, and the world pattern will face a new round of reshuffle.

How to deal with the new situation of the United States and the United States + Libra joint promotion of the old and new world? For policy makers in other economic powers, I am afraid that we must abandon the old brain, seriously study and analyze, and combine our own advantages and characteristics to formulate countermeasures.

3.2.6 Impact on regulation

When we consider and discuss Facebook's regulatory issues, we should note that its regulation is not just regulated, but it is likely to change the traditional thinking of regulation and change the regulatory system. [41]

Regulatory is by no means static, but it will certainly change with the emergence of new species. Since the Hama Rabbi Code, human laws have undergone numerous changes. So Libra, which is embracing the regulatory attitude, will eventually lead to changes in regulatory regulations. The author is optimistic about this matter.

3.3 Impact on digital currency and blockchain

3.3.1 Libra is the name and speed of the password digital currency

As a form of generalized cryptocurrency, Libra is connected to other cryptocurrencies in terms of ideas, concepts, logic, technology, and infrastructure. [42] Libra's release will undoubtedly bring huge promotion and popularization to the field of cryptocurrency. In addition to the direct users of facebook, there are potential indirect users brought by its powerful demonstration effect, such as twitter, google and other giants to follow up. The resulting user, with this alone, could bring billions of potential new users to the entire cryptocurrency industry, which will undoubtedly be the best dividend in the cryptocurrency industry.

The emergence of Libra, which represents the top commercial force's promotion of digital currency, has begun to mark the rise of digital currency, which has finally passed through the infancy and began to enter the growth period. At the same time, Facebook's strong brand influence has also brought the opportunity to “redress” the entire digital currency industry.

3.3.2 Decentralized digital currency for Bitcoin, etc.

First, Libra cannot replace the decentralized digital currency such as BTC.

The decentralized framework designed by Nakamoto for Bitcoin, especially the pow mechanism that is simple and has no personal preference, greatly abstracts the various social relationships that may affect the operation of the currency, and avoids the politics that Libra will face for Bitcoin. The economic game has laid a solid foundation for the world currency. This framework also provides a strong vitality for the bitcoin in the weak hour.

As a private credit currency that uses the French currency system to improve credit, Libra has rooted in the problem of centralized currency, which is fundamentally different from the central cryptocurrency. [43]

Second, from a secular point of view, Libra will push for a sharp rise in decentralized digital currencies such as BTC. (In the week after the Libra white paper was released, bitcoin prices did rise sharply) for two reasons:

a. Libra brings unprecedented exposure to digital currency and BTC, which greatly enhances the visibility and consensus strength of BTC.

b. Among the large number of new users Libra expects to bring, the proportion of users with investment attributes and preferences is certain, that is, the investment demand of new users will be released centrally. Libra itself is a stable currency. Due to various regulatory issues, most of the follow-up giants can only issue stable coins. The investment value-added property of the stable currency itself is weak and cannot meet the huge investment demand. Therefore, these new investment demand will greatly increase the price of digital currencies such as BTC and related industries.

3.3.3 Stabilizing coins for existing and other large institutions

In the long run, it is definitely a big impact on the USDT, because the USDT is mainly used as a stable intermediary in the trading market, the secondary market, and the speculative speculation market. This function can be completely replaced by Libra, not to mention Libra's liquidity. It should be better.

However, in the short term, USDT will certainly respond. The most likely situation is that Libra is the mainstream, and USDT can still find its own living space. In particular, Libra's account system is not as anonymized as USDT, so for some users who are particularly concerned about privacy, USDT still has its important value. [44]

At the same time, the impact on the Ripco coin is relatively large. The Ripple system was actually discovered as a centralized system two years ago, and it is an independent report issued by many third parties after many studies.

The 14 traditional banks are similar to the "little tigers" and are united against Facebook as the "big tiger." They are currently clustered together, but they still do not reach Facebook users covering more than 130 countries and regions around the world. [45]

Libra is obviously a big threat to the stable coins issued by other institutions, but at the same time, the threat itself will promote other institutions to conduct more in-depth research and thinking, which will lead to better new solutions.

In short, there will be progress if you are competitive.

3.3.4 For other public chains: Libra-based open finance is full of imagination

For other public chains, Libra is a competition and a push.

The Libra blockchain will probably be the biggest competitor in Ethereum. The main reason is that the Libra project has great potential to push it to its customers through existing channels; it is built by organizations with large-scale development teams; and ideas are copied and improved from Ethereum (state rent, account abstraction…) .

The Ethereum promoter Vitalik believes that Facebook Libra is a big plus for Ethereum and the industry. Its influence, the connected 2 billion users, the existing funds and the developer resources all have huge opportunities. Vitalik said that if Ethereum applications can build bridges connecting Libra and Ethereum, it will bring millions of users.

However, Vitalik also admits that Libra "will definitely" compete with the decentralized blockchain public chain, but will not replace them. Because the decentralized value created by the blockchain company cannot be replaced by the corporate consortium behind Libra. A closer look at the organization behind Libra reveals that many are commercial companies located in the United States. Many people in the world feel uncomfortable with the blockchain projects, decentralized applications and cryptocurrencies managed by these organizations. So there are many opportunities for both systems today. [46]

3.3.5 Sovereign digital currency issued to the state

For governments, the issuance of national sovereign digital currency is now one of the highest priority issues for senior officials. We can make a simple reasoning about this matter, and we can draw the following inference:

a. The national sovereign digital currency was accelerated.

In order not to be left behind, a group of national sovereign digital currencies may be launched, but for historical reasons, sovereign digital currencies are different. In terms of "openness or not" and "degree of strength and weakness", we can roughly divide them into four situations: "open, closed, strong, and not strong enough". The following inferences can be drawn:

Open and strong sovereign currency: long-term parallel existence, each line is.

Open weak sovereign currency: weakening or even replacing sovereign currency.

Closed strong sovereign currency: short-term closed operation is not disturbed, but it cannot prevent escape and long-term weakness.

Close weak sovereign currency: ibid.

Whether it is a strong sovereign currency or a weak sovereign currency, it is impossible to completely sever the link with the outside world in the current convenient and developed information flow; therefore, it is impossible to completely prevent capital flight. Therefore, closure and escaping are undoubtedly the lock-up countries of the new era. Inserting the head in the sand will not change the situation in which the butt is beaten outside. Over time, it will cause irreversible consequences.

b. Instead of issuing a single sovereign currency, it is better to initiate or participate in the initiation of a super-sovereign currency.

3.4 Impact on the public

Libra raises public awareness of open finance. Before the financial system was shelved, it was far from the life of ordinary people, but Libra pulled it down the altar and made people feel real about finance and open finance. This kind of contact will promote them to continue to learn relevant knowledge.

It is difficult to make practical progress in terms of privacy protection. When you use Clibra to use KYC, when you use libra, your identity on the chain is tied to the real identity. And Facebook can have access to know your information. Calibra is a subsidiary of Facebook and “Promise” will not share your account information or financial data. However, aggregated data may be shared. This means that calibra always has a reason to reach out to the user's financial data, both businessally and legally. [47]

Whether it can be done, and not going to do is two concepts. What's more, Facebook has a black history of contempt for privacy from the beginning.

3.5 Impact on other Internet companies

Since Libra itself is a cryptographic digital currency, it is an uncompromising financial product, so the impact on Internet companies can also be analyzed from a financial perspective.

First, Libra, in the form of super-sovereign currency, is a reduction in the impact of all stock financial institutions and Internet companies; secondly, it will have a direct impact on the financial services of financial Internet companies or Internet companies; Internet companies, because Libra plays a more plug-in role, which is equivalent to perfecting the underlying financial payment infrastructure, so more will be promoted; only those Internet companies that are iteratively slow and do not respond Will be more negatively affected.

The world is interactive. On the one hand, the new era of Libra will affect the world; on the other hand, the world's response will in turn affect Libra. This chapter, mainly to discuss the various aspects of the body's response to Libra.

4.1 Government level

4.1.1 Implications for the government: to enhance the sense of crisis and face the impact of digital currency on the traditional financial system

For digital currencies such as Bitcoin, it has been widely ignored by monetary authorities, bank executives, government departments, and economists for quite some time. Many people wanted to bury their heads in the sand before, when this thing did not exist. Some people think that they can resist the enemy outside the country through administrative and technical means, and they are lagging behind the world trend. Some people have luck in this, and hope that other governments will collectively act to block the digital currency and reverse the historical trend. [48]

But from the bitcoin, the competition currency, to the expansion of the digital currency such as token, USDT, GUSD, the impact of the new way on the traditional financial system based on legal currency has never stopped. After Bitcoin was used for anonymous transactions and cross-border remittances, the ERC20 token brought a low-cost, high-liquidity securities issuance and circulation system that challenged the existing securities system. The emergence of the USDT broke the well-defined sovereignty boundary of the legal currency, and penetrated the dollar supply deeper into countries with foreign exchange controls. As the latest digital currency form, Libra will bring a huge impact on the traditional monetary banking system with its huge commercial system in the forefront of modern economy, such as social, payment, exchange, and Internet. [49]

The impact of the digital currency can be ignored, but the trend of the world will not change, and the transformation of the digital currency to the world is irreversible. At this time, the closure of the country will not bring prosperity, but will only bring behind beatings. Just like a sharp sword is not as good as a gun. This is a new paradigm to reduce the dimensionality of the old paradigm. No matter how great the achievements are in the old paradigm, if you choose to escape, it will soon be surpassed.

4.1.2 Encourage giants to join the Libra Association

Libra outlines a beautiful belief and organizational structure in the white paper. This unique openness makes Libra not belong to anyone or any organization. But this belief and framework is a verbal scorpion, or it will be really enforced. We are not aware of it.

The best way to detect it is to apply to join Libra.

First of all, the cost of testing is not high. If non-US organizations apply unsuccessfully, it proves that Libra is different, and Libra is dismantled from the lowest level of consensus;

If a large number of non-US organizations apply successfully and achieve the diversity of their members, then everyone will take the helm at Libra and will not lose the voice of cyberspace. The above mentioned concerns about the unreasonable allocation of various currencies in a basket of currencies, and some unreasonable rules, can be directly optimized by themselves, and those problems are no longer problems. [50] At the same time relying on the Libra platform, many companies are able to go abroad and become global applications. [51]

This is not much different from rebuilding a Libra, even saving costs, and making better use of existing consensus and network advantages.

4.1.3 Support other giant hairs to start digital currency and differentiate the influence of Libra

Many governments are worried that their country has insufficient voice in the Libra Association, and Libra is likely to abuse market dominance after gradually forming a monopoly. For this kind of problem, in addition to the rigid means of supervision, encouraging competition is also a desirable strategy. [52]

The world has never been a big one, there are VISA and MasterCard, Alipay and WeChat payment. Libra can be used as a template to improve the inadequacies, and other giants not joined Libra, to create a new digital currency and Libra to form a balance.

4.1.4 Restrictions on academic discussion

The topic of digital currency is extremely easy to use for illegal financial activities, so it is usually suppressed by the government, which is a realistic need for financial stability. But releasing relevant discussions in the academic and technical fields is not only necessary, but also does not conflict with the big goal of financial stability. The key to the global digital economy competition that has arrived is the financial thinking, the incentive model, the governance mechanism, and the experience of regulatory compliance and international operations. These things are not widely exchanged and fully discussed. Come.

Therefore, within a certain controllable range, academic and technical discussions on encrypted digital currency will be released, and relevant conferences and exchanges will be held to promptly raise the level of understanding of this topic among relevant industry professionals. [53]

4.1.5 Open regulatory space

Developed countries and developed countries have held hearings and seminars to allow digital currency projects to be tested in the sandbox of supervision. However, the open discussion and experimentation of digital assets and digital currencies is a restricted area in some countries, which greatly limits the development of the industry.

Therefore, a reasonable risk aversion mechanism should be established to allow enterprises to try within a certain scope, such as considering trial operation outside the country or setting up a regulatory sandbox in the enclave. [54]

In addition, because of the inclusiveness of the United States for financial innovation supervision, enterprises are allowed to try in the gray area when the law is not perfect, and they are not held liable for such attempts after the law is perfected.

4.2 China

In all countries, China has its own unique cultural, institutional and economic environment. In addition to the above revelations and responses, there are the following specific strategies.

4.2.1 Implications for China

Reflect on past regulatory issues

The emergence of Libra coins, on the one hand, benefited from the active role of American private companies, and on the other hand benefited from the prudent tolerance of the US government. The lessons of financial technology and inclusive finance should be re-examined to give market space for financial technology innovation.

The financial technology industry represented by blockchain technology has sprouted in China not later than the United States, and even China has led the world in blockchain technology and applications. Due to the tightening of post-regulatory policies, China's blockchain ecology is shrinking and it is now lagging behind the United States. The one-size-fits-all or open-hand approach to governance has not been able to adapt to the fast-growing financial technology industry. It is not only detrimental to financial stability and defuse financial risks, but also causes innovation to stagnate, and thus lags behind other countries, causing asymmetry risks.

Inferred from the profoundness of the blockchain digital assets, the stagnation and backwardness in this area may cause the overall backwardness of the intergenerational level, and even repeat the mistakes of lagging beatings a hundred years ago is not alarmist.

Therefore, it is imperative for China to establish a prudent and inclusive financial technology regulatory system, which will promote the healthy and orderly development of financial technology innovation. In order to achieve inclusive and prudent supervision, it is necessary to achieve “supervised technology plus negative list” to achieve a prudent and bottom-line inclusive basis. [55]

Open mind and dare to participate in competition.

China has the conditions to participate in this competition and gain a place. China has a group of powerful Internet companies, a large and young and creative group of engineers, and a large-scale real economy. If digital currency is used as a new tool, it will rapidly develop overseas business, sell Chinese products, and occupy international The market, effective support for the "Digital Belt and Road" strategy, can fully dominate the new global digital economy competition.

The Chinese market is bigger and it is also a single market.

Although Alibaba and Tencent are among the top five Internet companies in the world, their main user groups are mainly domestic or Chinese, and Facebook accounts for no more than 10% of users in the US. This is why Facebook is able to launch Libra. .

How to establish an international market is a problem that we have to face in front of us. This also requires China to achieve more openness.

4.2.2 Building a Digital Special Economic Zone with Macao as a Pilot

As a big country with a population of 1.4 billion, China is often cautious in the formulation and promotion of many policies. It is also necessary to balance the overall situation. But this will lead to a wave of easy-to-miss technology, some of the country's high-quality talent project resources are lost, and even behind other countries. Under such circumstances, it is most appropriate to carry out reforms based on a region that belongs to China but is relatively isolated. Under the system of one country, two systems, Macao just meets the demands.

Macao can be regarded as the special zone for the reform of China's digital currency. All new policies and new projects of digital currency will be given priority in Macao. This can effectively isolate the risks that may be brought to the whole country. After the experiment is successful, it can naturally be pushed to the world through the window of Macao.

The digital monetary policy is not only local, but from the moment the policy is born, it is globally oriented. The implementation of such a good policy will bring about a whirlpool effect, bringing in all the resources of the world. For example, many Chinese blockchain project foundations are registered in Singapore, and many digital currency exchanges are registered in Malta.

4.2.3 A specific solution for improving Libra

Imitated with Libra as a model and improved on Libra's shortcomings. Improvements include:

First, improve the Libra coin tax allocation mechanism, from minority monopoly to a wider group, such as Libra users can participate in the distribution of the coinage tax, to stimulate the wider use of people and promote Libra's enthusiasm;

Second, increase the participation of the Libra system, allowing a wider range of sovereign governments/institutions/people to participate in the Libra infrastructure (ie Libra tokens are more dispersed and longer tails);

Third, the reserve pool is mainly based on bonds, which reduces the legal currency. This can reduce the cost of user funds and transfer the real benefits to the public, but there is a risk of capital arbitrage between the legal currency system and the Libra system (though considering the Chinese government’s foreign exchange and The effectiveness of monetary management, this risk can be controlled, which is an advantage that the United States, Britain and Europe do not have);

Fourth, increase non-debt assets into reserve pools, such as gold and bitcoin, to reduce the color dominated by Libra sovereign countries;

Fifth, strengthen the Libra reserve pool risk management mechanism, such as restricting the commercial bank/shadow banking leveraged funds into the Libra system arbitrage, more specifically, if the reserve pool is a bond, restrict Libra Association to only benefit from bond interest (not allowed to enter The result of the shadow banking system is that Libra becomes a truly independent central bank and a more stable class-like reserve bank (stocks that limit leveraged debt rather than non-debt assets) and can effectively reduce financial system risks;

Sixth, restricting the free flow of international capital in the Libra system and maintaining a certain degree of division of the financial system between different economies within the Libra ecosystem (this is in line with China's existing RMB and foreign exchange management policies). Reducing the free flow of international capital brought about by Libra facilitates disrupting the financial stability of relevant economies, ensuring the effectiveness of existing monetary policy implementation and liquidity management, and preventing unsustainable debt creation. [56]

4.3 Enterprise level

For enterprises in the non-blockchain industry, blockchain and digital currency are challenges and opportunities. In this big transformation, they are not sure, and it is easy to go down. If they are right, they may usher in the second growth of enterprises. curve.

In addition to the above-mentioned government-level strategy, joining Libra and other activities, companies have the following paths to embrace the new era brought by Libra:

a. Find a combination of your own industry, blockchain, and digital currency to conduct business, or find industry leaders to form alliances;

b. Use Libra to manage thinking and build alliances in the industry, similar to VISA to banks;

c. Learn the self-organized management methods such as Libra and VISA to upgrade the company management structure;

d. Use a digital currency such as Libra for trading in overseas operations.

4.4 Blockchain organization level

Libra's blockchain-based architecture allows applications based on it to connect blockchain circles with traditional Internet users just like bridges. Other blockchain organizations should seize the opportunity to share the dividends of this new aircraft carrier:

a. Translate the developed application onto the Libra;

b. Cross-chain, establish bridges to connect Libra and other public chains, making information data interaction and asset replacement possible;

c. Introduce the stable currency Libra within its own system.

4.5 Personal level

Participation at the individual level is mainly divided into four dimensions:

Learning: Focus on the future of the government and domestic large companies (especially Ali, Tencent and headlines) in digital finance, while at the same time supplementing financial common sense, even through small-scale digital currency management, to obtain some of the initial experience of digital finance;

Use: By next year, overseas users will enjoy digital financial services quietly and experience instant, open and low-cost payment experiences;

Investment: buy stocks of 27~100 node companies and enjoy dividends;

Work: Caring about your own industry, companies, products, how to transform with blockchain, digital currency, join top teams or start a business; programmers can also learn the move language, there should be a wave of high salary next year. [57]