Industry Weekly | Facebook currency is yellow? – Waiting for the official hearing in July

Summary

In our previous communication, we believe that Facebook has taken the first step to embrace the blockchain, but Libra, as a global stable currency anchoring a basket of assets, has a long way to go in terms of technology and supervision. From a regulatory point of view, a letter from a member is only expressing willingness. It is not the final ruling. Regardless of success or failure, Facebook still needs to face some hearings in the future. We will also closely follow the event and look forward to more details of Libra. .

LedgerX was approved as a Bitcoin physical delivery futures exchange. Recently, the US Commodity Futures Trading Commission (CFTC) has approved the Bitcoin derivatives provider LedgerX to provide physical settlement of the Bitcoin futures contract, which is the second company approved to provide physical delivery of bitcoin futures contracts; Bakkt, Seed CX and ErisX of the exchange are also planning to enter the market. Unlike the cash-settled bitcoin futures offered by the Chicago Mercantile Exchange Group and the previous Chicago Board Options Exchange, customers will receive actual bitcoin after the contract expires instead of the equivalent dollar. LedgerX can not only trade Bitcoin futures contracts, but also provide such products to retail investors. It is not limited to institutional clients. Bitcoin officially enters the traditional financial market, and Bitcoin has begun to become like gold and stocks. a vast market.

- Mid-term inventory in 2019 (next part): What happened to the encryption industry in the past six months?

- Facebook Libra Supervisor: Users don't have to trust us, they will attend the hearing this month.

- The 1 billion fund disk "wave field super community" running out of cash, why is Sun Yuchen always worried?

Goldman Sachs and JP Morgan Chase are eager to stabilize the currency. Plustoken is suspected of running, involving 20 billion yuan. All this shows that the blockchain industry has had an indiscriminate impact in all areas. On the one hand, the industry is waiting for a verifiable innovation. The role model, on the other hand, is how regulation regulates chaos in the industry. We believe that Bitcoin brings the creation of blockchain from 0 to 1. The industry looks forward to the next 1 to 2 or even 1 to 10 re-innovation, using the actual landing to change the world. At the same time, regulation will be impossible for the development of the industry. A lack of a link to avoid illegal chaos.

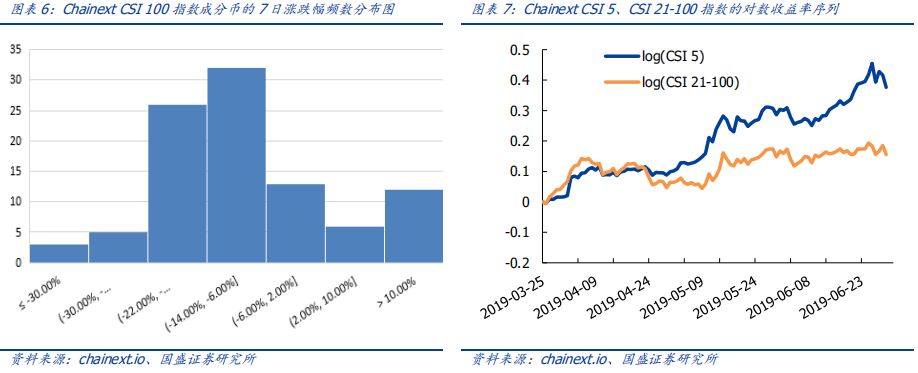

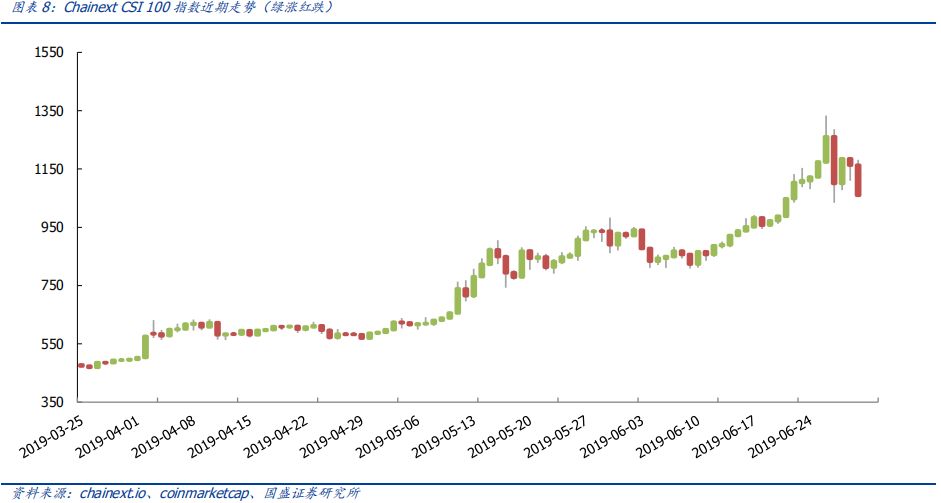

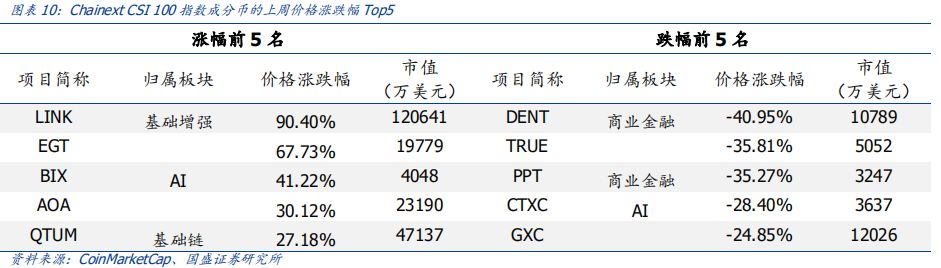

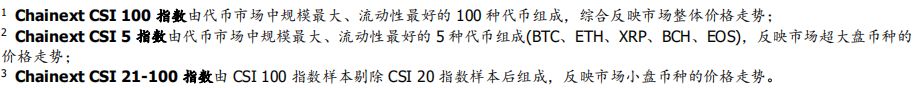

Last week's market review: Chainext CSI 100 fell 4.57%, and the basic enhancements in the segmentation sector performed best. From the perspective of the sub-segment, the basic enhancement, the Internet of Things & Traceability section outperformed the Chainext CSI 100 average, which was +24.58, +10.83%, pure currency, storage & computing, AI, basic chain, entertainment social, Payment transactions and commercial finance sectors underperformed Chainext CSI 100 averages of -1.6%, -2.64%, -6.91%, -8.38%, -13.16%, -13.8%, -16.87%, respectively.

Risk warning: regulatory policy uncertainty, project technology progress and application landings are not as expected, and cryptocurrency-related risk events occur.

1. Hotspot tracking: G20 summit promotes global coordination of digital currency regulation, LedgerX becomes Bitcoin physical delivery futures exchange

Event: Recently, the US Commodity Futures Trading Commission (CFTC) has approved LedgerX, a New York-based bitcoin derivatives provider, to provide physical settlement of bitcoin futures contracts; the G20 summit is concerned with digital currency regulation, and global coordinated regulation continues to deepen. The media blasted Plustoken suspected of running, Goldman Sachs, JP Morgan Chase issued the "arrow on the string."

The G20 summit focused on digital currencies, and global coordinated regulation continued to deepen. At the Chinese and foreign media briefings held by the Ministry of Foreign Affairs, the G20 Chinese spokesperson said that the G20 is also concerned about the application of new technologies in the financial sector, including digital currency, encrypted assets, etc. China should say that it is doing a good job in this regard. From June 28th to 29th, the V20 Virtual Asset Service Providers Summit was held at the G20 Summit. According to the V20 official website, the conference will convene G20 representatives, as well as cryptocurrency exchanges such as Circle, Coinbase, bitFlyer, Kraken, and Huobi, to jointly explore feasible technical solutions to achieve the FATF's Financial Action Task Force (FATF). The latest cryptographic asset monitoring guidelines. The cryptocurrency industry representatives and regulators discussed FATF's latest cryptographic asset monitoring guidelines. After two days of discussions, I agreed to establish an international regulatory agency for the Virtual Money Service Provider (VASP). However, the name of the institution is currently undetermined. In addition, the V20 meeting has not yet agreed on the technical solutions and regulatory framework of the FATF regulations.

LedgerX was approved as a Bitcoin physical delivery futures exchange. Recently, the US Commodity Futures Trading Commission (CFTC) has approved that New York-based Bitcoin derivatives provider LedgerX can provide physical settlement of bitcoin futures contracts, and LedgerX is the second company approved to provide physical delivery of bitcoin futures contracts. Other companies, such as the Intercontinental Exchange's Bakkt, Seed CX and ErisX, are also planning to enter the market (although Bakkt's own futures contract is self-certified, the company is still waiting for the New York Financial Services Department to issue a license for its warehouse). Unlike the cash-settled bitcoin futures offered by the CME Group and the previous Chicago Board Options Exchange (Cboe), customers will receive the actual bitcoin after the contract expires instead of the equivalent dollar. . LedgerX can not only trade Bitcoin futures contracts, but more importantly, it can also provide such products to retail investors, rather than institutional customers, whereby Bitcoin officially enters the traditional financial market, and Bitcoin also begins to become like gold. Like stocks, it has opened up a broader market.

Goldman Sachs and JP Morgan Chase are eager to stabilize the currency. Plustoken is suspected of running, involving 20 billion yuan. All this shows that the blockchain industry has had an indiscriminate impact in all areas. On the one hand, the industry is waiting for a verifiable innovation. The role model, on the other hand, is how regulation regulates chaos in the industry. We believe that Bitcoin brings the creation of blockchain from 0 to 1. The industry looks forward to the next 1 to 2 or even 1 to 10 re-innovation, using the actual landing to change the world. At the same time, regulation will be impossible for the development of the industry. A lack of a link to avoid illegal chaos.

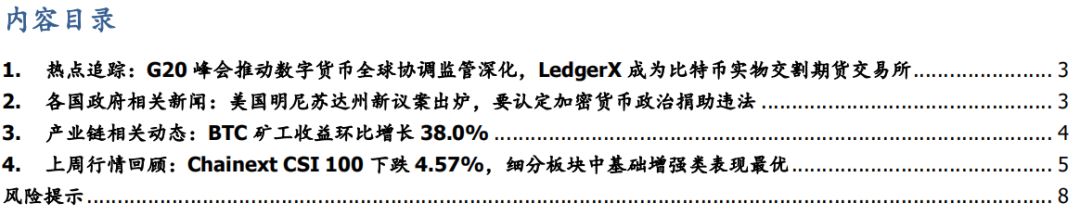

2. Relevant news from various governments: The US Minnesota new bill determines that cryptocurrency political donations are illegal

The Abkhaz government drafted a regulatory law requiring cryptocurrency mining licenses. In response to domestic cryptocurrency mining activities, the Ministry of Economic Affairs of Abkhazia, the autonomous republic of Georgia, drafted a bill that has been approved by the department and presented to the cabinet. The regulatory bill establishes mining regulations from a legal, economic, organizational, and technical perspective, requiring mining operators to register as legal entities or businesses plus, and register as taxpayers, obtain licenses for mining activities, and Temporary restrictions on mining power are available in crisis situations such as failures.

3. Industry chain related dynamics: BTC miners' revenue increased by 38.0% from the previous month

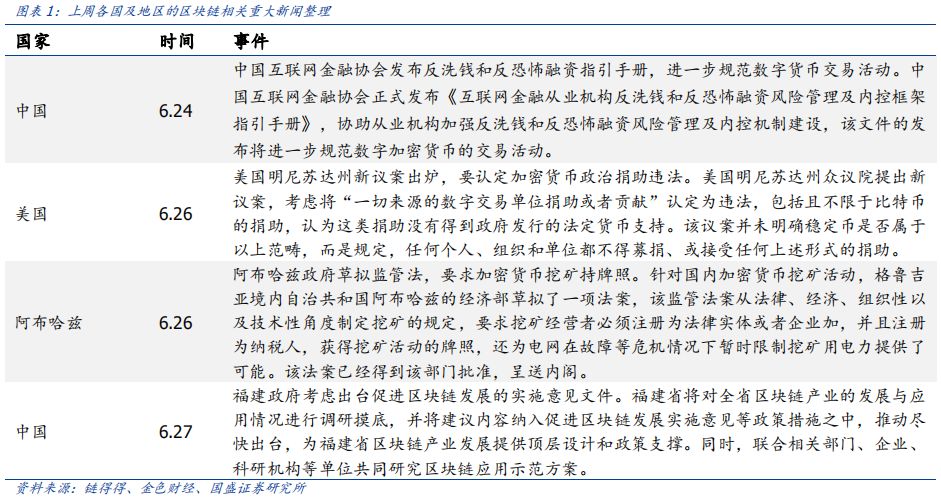

Last week, BTC added 2.654 million new transactions, an increase of 9.04% from the previous month; ETH added transactions of 5,915,600, down 2.86% from the previous month. Last week, the average daily income of BTC miners was 25.32 million US dollars, an increase of 38% from the previous month; the average daily income of ETH miners was 4.369 million US dollars, an increase of 11.65%.

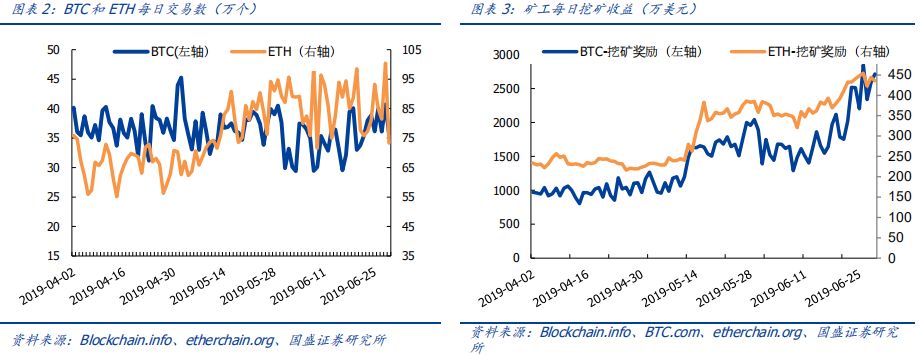

Last week, BTC's average daily computing power reached 62.19EH/s, an increase of 15.77% from the previous month; the average daily computing power of ETH's entire network reached 169.6TH/s, an increase of 5.36% from the previous month.

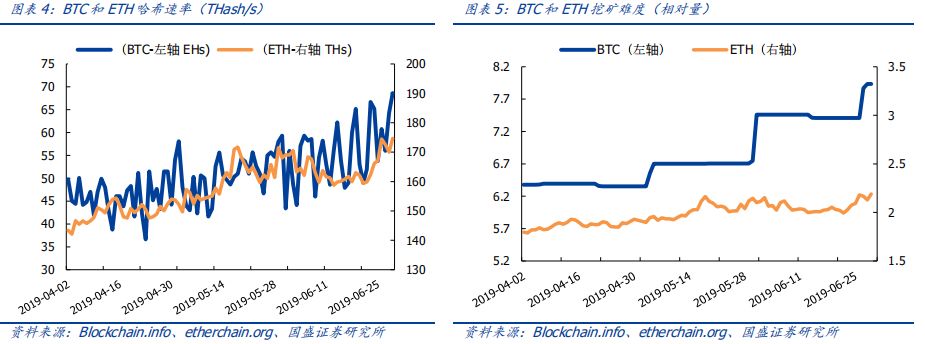

Last week, the difficulty of mining the whole network of BTC was 7.63T, an increase of 2.91% from the previous month; the next difficulty adjustment day was on July 10, the estimated difficulty value was 8.73T, and the difficulty increased by 9.99%; the average mining difficulty of ETH whole network last week was 2.12T, an increase of 4.96% from the previous month.

From the perspective of the sub-segment, the basic enhancement, the Internet of Things & Traceability section outperformed the Chainext CSI 100 average, which was +24.58, +10.83%, pure currency, storage & computing, AI, basic chain, entertainment social, Payment transactions and commercial finance sectors underperformed Chainext CSI 100 averages of -1.6%, -2.64%, -6.91%, -8.38%, -13.16%, -13.8%, and -16.87%, respectively.

2. The technical progress and application of the project fell below expectations;

3. A cryptocurrency-related risk event occurs.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Opinion: How to seize the opportunity of Facebook Libra

- Market Analysis: BTC has a V-shaped rebound, and the risk of short-term chasing increases

- Top No. Funds Plustoken Dreams Apocalypse

- In the first half of the year, it surged 220%, but there are still 60% bitcoin transactions that have not occurred…

- Libra wants to cool? Congress stops! After the fever, the rational look can reach the core of value.

- Why is Bitcoin a better stored value tool than gold and Van Gogh?

- 72 hours before the 30 billion MLM crash: Why are investors most panicked about media reports?