Babbitt column | What is the central bank cryptocurrency?

[Editor's Note] The author of this article, Rickkk, refers to the “Central Bank Cryptographic Currency” (CBCC), which is usually expressed as “Central Bank Digital Currency” (CBDC). The reader is reminded to respect the author's original intention to retain the “central bank cryptocurrency”.

The following is the text:

In less than 10 years, Bitcoin has become a household name. As of July 2019, its price has risen from a few cents in the beginning to about $10,000. At the same time, hundreds of other cryptocurrencies have appeared. In my opinion, although bitcoin or other cryptocurrencies are unlikely to replace sovereign currencies, more like the existence of an "electronic gold", but their emergence has proved the underlying blockchain or distributed ledger technology. Feasibility of (DLT). 2017 may be the craziest year of the blockchain. Many large venture capital institutions and financial institutions have injected a lot of money into the industry, not only to provide new financial services, but also to improve the efficiency of old financial services. This article mainly wants to bring you to know the central bank's cryptocurrency Central Bank Crypto Currencies (subsequently replaced by CBCC), which has recently become the focus of the industry. This article will answer this direct question – what is the central bank cryptocurrency?

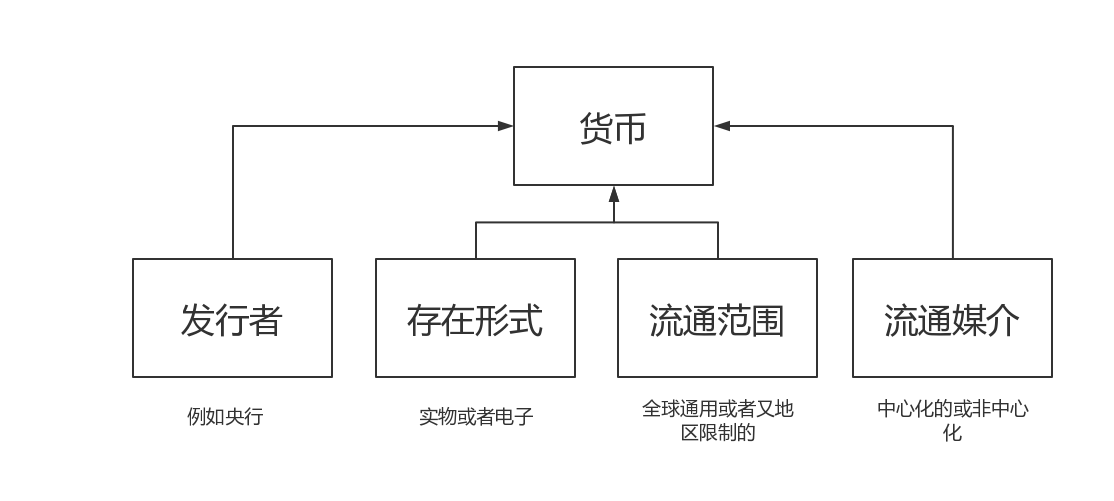

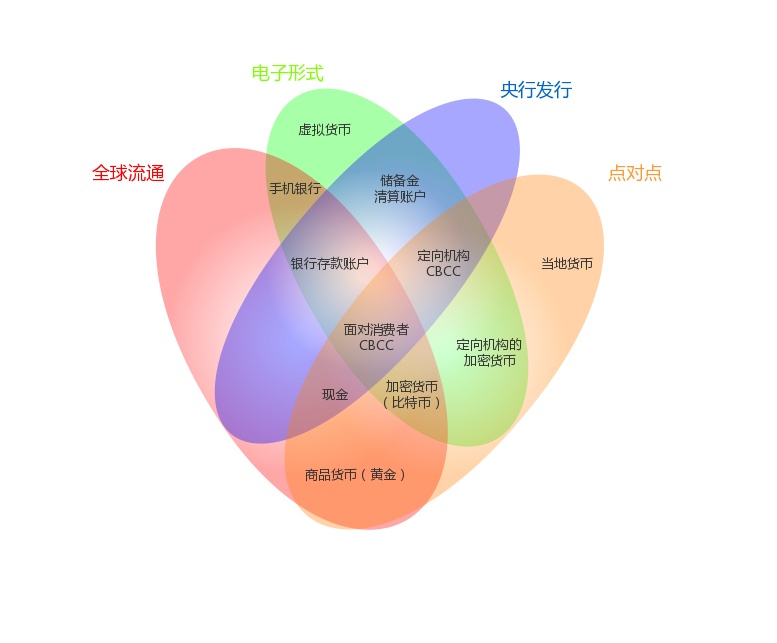

For the answer to this question, readers can't help but think that, as the name suggests, is the central bank's cryptocurrency not a cryptocurrency authorized by the central bank? Indeed, this is the most direct answer to the question. If we read this question carefully, the word "currency" can be too particular. If we classify CBCC from some basic attributes of currency. (see picture 1)

- Bai Shuo: It is recommended that China establish an independent system that can compete with Libra.

- Changdao Iced Tea, which has transformed its blockchain, doubled its share price, and delisted, was exposed to insider trading after a lapse of one year.

- Huawei Ren Zhengfei: China can issue its own Libra

(figure 1)

Then CBCC can be defined as an electronic form of central bank currency that can be circulated through a decentralized approach called peer-to-peer, which means that transactions occur directly at the payer and payee. There is no need for a central intermediary. This distinguishes the CBCC from other forms of electronic money currently available to the central bank, such as reserves.

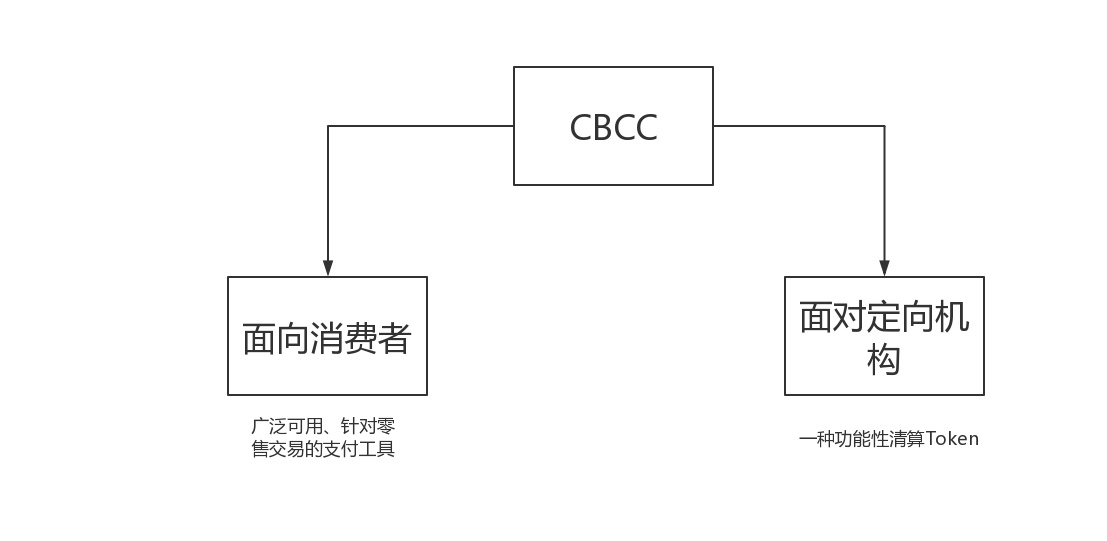

The circulation medium for the reserve [1] is exchanged in a centralized manner between multiple accounts of the central bank. Not only that, but such a classification can also distinguish between two possible forms of CBCC: (see Figure 2)

figure 2

But what advantages do these two types of CBCC have for the currency issued by the existing central bank?

For consumer-oriented CBCC, peer-to-peer payments for new technologies will have the potential to provide anonymous functionality that is similar to cash but exists in digital form. However, if some central banks do not consider anonymity as an important factor, most of the benefits of the so-called face-to-face consumer CBCC can be achieved by getting the public into the central bank's account.

In the face of targeted CBCCs, most of the situation depends on whether they can improve work efficiency and reduce settlement costs (for clearing, read my previous article, "Open Finance – Exploring Bitcoin's Clearing System and Payment Process" ). Here, my answer is mainly based on some technical issues that still need to be resolved. Some central banks have tried large-scale CBCCs, but no central bank has announced plans to adopt the technology.

So below, I will discuss these two CBCCs in more depth with historical examples and ongoing projects, answering the question of what is CBCC.

CBCC – a new central bank currency form

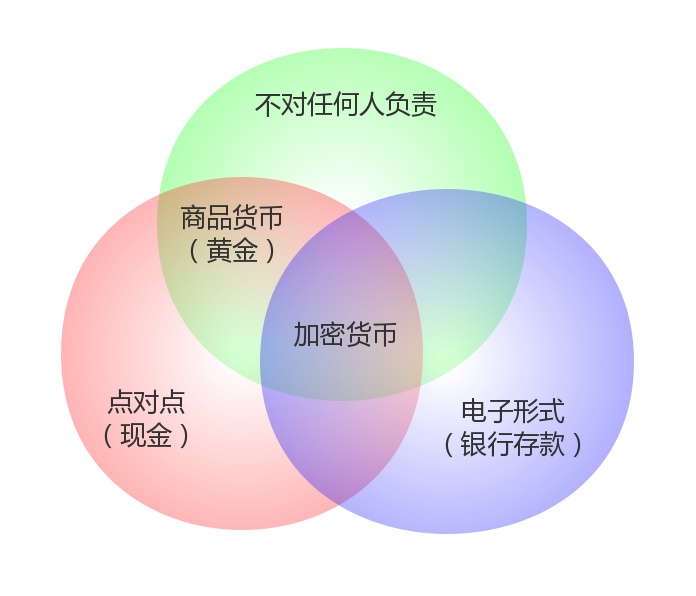

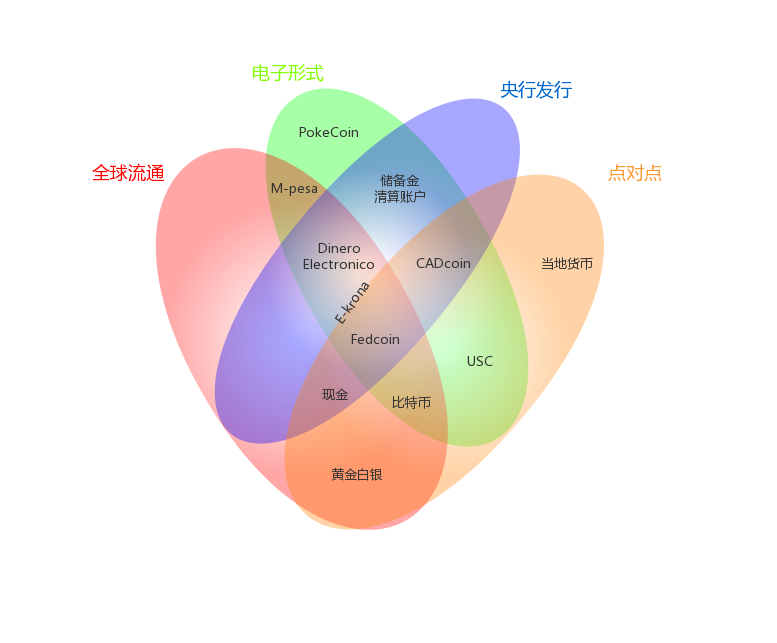

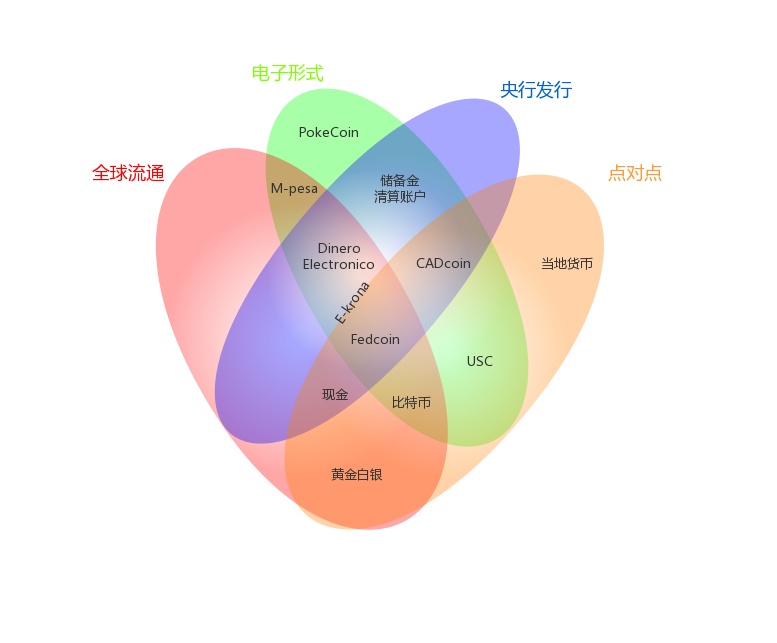

First, if we trace back to the earliest definition of CBCC, it is a report on cryptocurrency published by CPMI in 2015 [2]. The report mainly points out three main characteristics of cryptocurrencies: they are electronic money; they are not responsible for anyone; they provide point-to-point exchange functions. These features are also common in other forms of currency (Figure 3).

image 3

Usually, the electronic representation of money (such as bank deposits, Alipay, WeChat balance) is circulated through a centralized financial infrastructure. Previously, peer-to-peer transactions were limited to money in real money (banknotes, coins). Commodity currency refers to the currency with physical support, gold and silver, the currency under the gold standard, and the dollar under the Bretton Woods system.

Cash is equal, but it is not electronic, and cash belongs to the central bank's liabilities. Similarly, commercial bank deposits are a liability of the issuing bank. Today, they exist electronically in front of our computer screens, on the mobile side, and in a centralized way. Your bank deposits can be circulated on the books of a bank or exchanged between different banks through the central bank.

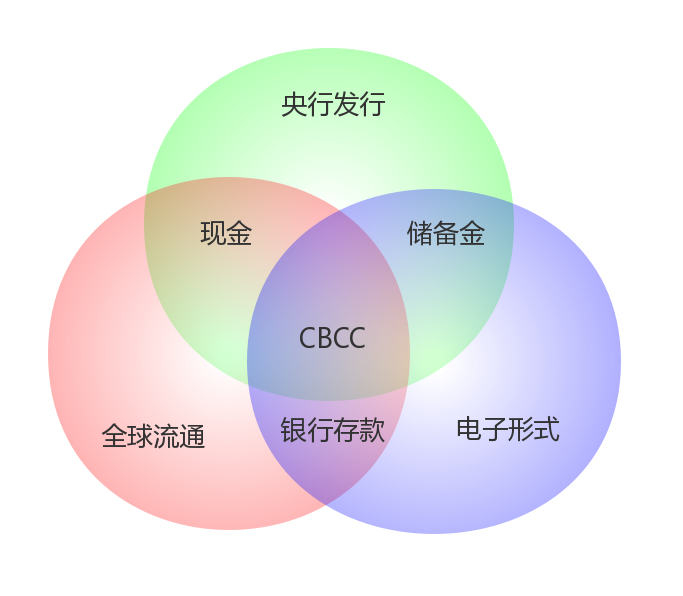

Then, according to the definition given by CPMI, it seems natural to define CBCC as an electronic central bank liability that can be used for peer-to-peer transactions. But this ignores an important feature of the central bank's other forms of money and can be acquired. Currently, one form of currency issued by the central bank, cash, is of course open to everyone. Then we combine the definitions given by CPMI, and then consider the problem of liquidity. Combined with the currency attributes given in (Figure 1), we can divide CBCC more precisely: (see Figure 4)

(Figure 4)

Then, if we look at the two major categories that we just started to give to CBCC, we can finally see: (Figure 5)

(Figure 5)

In principle, the central bank has four different electronic currencies: two CBCCs and two types of central bank deposits. The most common form of central bank deposits is held by commercial banks and is often referred to as a settlement account or reserve. Another form is deposits held by the public and liabilities to the public.

(Image 6)

For example: We are in the middle, consumer-oriented CBCC – Fedcoin as an example. A more accurate definition of Fedcoin should belong to the retail CBCC. This concept has not been recognized by the Fed, it is to let the central bank create its own cryptocurrency. Both currencies can be converted to the dollar equivalent, and the conversion will be managed by the Federal Reserve. Unlike the total amount of Bitcoin, the Fed's money supply will not have a predetermined total amount, but will increase or decrease according to the willingness of consumers, like cash.

Facing the example of the orientation mechanism CBCC – CADcoin [3]. It is a digital asset representing the currency of the central bank. In the case of CADcoin, the targeting agency is the Bank of Canada. CADcoin has been simulated by the Bank of Canada in collaboration with Canadian payment company R3 (a financial technology company) and several other Canadian banks, but has not yet been implemented.

Another project worth mentioning is the E-Krona project planned by Sweden. The Swedish central bank has planned to use E-Krona as a digital currency equivalent to the country's conventional currency for small amounts between consumers, companies and government agencies. transaction. Eva Julin, head of the E-Krona project, said that after negotiating with 19 companies, the central bank finalized IOTA as a partner for the project. At present, Sweden is in the initial stage of the E-Krona project, which is expected to be completed in 2019 [4].

Therefore, E-Krona is located at the boundary between the bank account and the consumer-facing CBCC.

Dinero Electronico is a mobile payment service in Ecuador, mainly based on the central bank of Ecuador providing the public with a basic bank account. Citizens can open an account by downloading the app, registering their ID number, and answering security questions. People can save or withdraw money at a designated trading center. Since Ecuador uses the US dollar as its official currency, the account is denominated in US dollars, and the US dollar can be circulated globally. Therefore, this is a rare electronic bank deposit account and can be circulated globally.

Bitcoin believes that everyone knows more about it. It was officially released as an open source software in 2009. Except that it is not issued by the central bank, Bitcoin should have such attributes as peer-to-peer, global circulation and electronic form.

PokeCoin is the currency used for in-game purchases in Pokemon Go games, so it should fall within the virtual currency range.

USC (Utility Settlement Coin), a public settlement currency is a very good example of a cryptocurrency facing a targeting agency. As a public settlement currency, new participating bank members will include Barclays Bank, Imperial Bank of Canada, Credit Suisse, HSBC, Mitsubishi UFJ Financial Group. Other participating financial institutions include UBS, New York Mellon Bank, Deutsche Bank, Santander, NEX and blockchain startup Clearmatics. This settlement currency will become a collateralized digital currency supported by cash assets issued by the central bank, which allows us to easily transfer ownership through the transaction of the Common Settlement Coin (USC), thereby reducing process complexity and settlement time [ 5].

M-PESA from Kenya has been introduced in my last article. The biggest advantage of M-PESA is that the parent company Safaricom is a telecommunications company, so the grocery stores that can pay for telecommunications in the village are almost all Safaricom agents. These grocery stores are like ATMs in the M-PESA system, but in Kenya. More than 40,000 such grocery stores. According to the World Bank's statistics in 2018, 73% of Kenyans use mobile payments, saying that M-PESA has made Kenya the world leader in mobile payments [6]. This makes M-PESA steadily fall within the mobile banking range.

Image 6

Discussion of two CBCCs

Consumer-oriented CBCC – Anonymous decision

The technology behind CBCC allows central banks to offer an anonymous digital cash alternative like cash. As the issuer, the central bank needs to decide whether it needs customer information (the true identity behind the public address). Then there will be two situations (in the Chinese industry) :

The first type – suppose the People's Bank of China decides that it needs the customer's ID card, passport and other information to get CBCC.

- Third-party anonymous service agencies will provide anonymous services from third parties.

- Third-party anonymous wallet or use this for illegal fundraising

- Comprehensive monitoring of consumer cash flow

- More convenient to collect various income taxes, etc.

Second – no need for any information, completely anonymous CBCC, electronic version of cash

Although it seems that the central bank may issue a cryptocurrency that provides anonymity, it may seem strange, but isn't cash right now? However, a key difference from cash is that for consumer-oriented CBCC, providing anonymity becomes a multiple-choice question, and the anonymity of cash, from the beginning to the present, may be for convenience, not for some central banks. Original intention.

CBCC for Orientation Mechanisms – Jasper and Project Ubin

Although many cases are conceptual, one of the reasons why the central bank is interested in the technology behind it (such as DLT technology) is that many central bank payment and clearing systems are at the end of their technology lifecycle. These systems use a outdated programming language to write programs, or use database designs that are not suitable for the present, resulting in high maintenance costs and gradual lower efficiency.

The Jasper project of the Bank of Canada and the Ubin project of the Singapore Monetary Authority (MAS) are two projects that have to be mentioned, mainly for distributed RTGS. If you don't understand liquidation, you can read my previous article on liquidation – "Open Finance – Exploring Bitcoin's Clearing System and Payment Process."

First, Ubin, the Ubin project is a project with industry partners to explore the use of distributed ledgering technology (DLT) for settlement and settlement of payments and securities. The project aims to help MAS and the industry better understand DLT through practical experiments. DLT has the potential to make financial transactions and processes more transparent, flexible and cost-effective. The ultimate goal is to help develop simpler, more efficient alternatives to replace the current system based on tokens issued by the central bank [7].

Project Jasper is a joint venture between Canadian Payments, Bank of Canada, Financial Innovation Alliance R3 and a number of Canadian financial institutions to understand how distributed ledger technology (DLT) can change the future of Canadian payments. The project was launched in March 2016 [9].

Both projects aim to develop more flexible, efficient and cost-effective alternatives to replace the current financial system based on the digital currency issued by the central bank. Both projects have successfully developed a DLT-based domestic interbank payment prototype, and subsequent experiments have also explored and successfully tested the feasibility of simultaneously switching and finalizing the markup of digital currency and securities assets [10]. Although these experiments have proved the feasibility of the technology, the effects of DLT will be very limited in terms of the efficiency of central political parties and centralized systems in China, and the decision-making nature.

in conclusion

At present, cash is still the only means by which the public holds the central bank's currency. If someone wants to digitize the assets they hold, they must convert the central bank's debt into a commercial bank's debt or convert it into a third-party financial institution's debt. (Save cash in a bank account, or WeChat, Alipay balance)

CBCC will allow consumers to hold central bank debt in digital form. The idea of allowing the public to have a central bank account has been around for a long time and is achievable. The benefit of consumer-oriented or retail CBCC over CBCC for targeting organizations is that the former has the possibility of providing anonymity, thereby holding central bank debt in digital form.

Of particular note is that peer-to-peer anonymous transactions can be targeted to any node. If anonymity is not important to the public, then many of the so-called “benefits” of CBCCs like consumers can be achieved by allowing the public to gain broad access to third-party financial institutions that enter central bank accounts or central bank controls.

As people attach importance to anonymity and privacy protection, if China wants to issue CBCC, it must find a balance between user privacy and regulation.

Reference

- Https://baike.baidu.com/item/Preparation/1993377?fr=aladdin

- Https://www.bis.org/cpmi/publ/d137.pdf

- https://www.r3.com/wp-content/uploads/2017/06/cadcoin-versus-fedcoin_R3.pdf

- Http://www.bitcoin86.com/szb/21088.html

- Http://www.8btc.com/settlement-coin-as-bank-blockchain-test-enters-final-phase

- Http://www.mpaypass.com.cn/news/201811/01200952.htm

- https://www.mas.gov.sg/schemes-and-initiatives/Project-Ubin

- Https://www.payments.ca/industry-info/our-research/project-jasper

- https://www.payments.ca/sites/default/files/29-Sep-17/jasper_report_eng.pdf

- https://www.mas.gov.sg/-/media/Jasper-Ubin-Design-Paper.pdf?la=en&hash=EF5857437C4857373A9287CD86F56D0E7C46E7FF

Recommended reading

Deloitte's analysis report on CBCC

Https://www2.deloitte.com/us/en/pages/consulting/articles/state-sponsored-cryptocurrency-adpating-bitcoin-innovation.html?nc=1#

Ubin detailed project report

https://www.mas.gov.sg/schemes-and-initiatives/Project-Ubin

Jasper and Ubin Cross-Border Payment Design Report

https://www.mas.gov.sg/-/media/Jasper-Ubin-Design-Paper.pdf

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Mykings mine botnet update infrastructure, new wallet revenue exceeds 600,000

- Ren Zhengfei 5G, Libra: China can issue its own Libra | Interview

- 2 million transactions, 10 million BTC, 70 billion US dollars, CME announced bitcoin futures trading data

- Explain why Bitcoin needs lightning network with the example of Bar Judy

- Don't wait! The altcoin spring will not come

- A paper on the cryptocurrency mining industry panorama

- USDT, the invisible sword of Damocles