BFX Storm: Any war is a game of power

Recently, I saw "The Right to Tour". A very deep experience is that any war is a game of power. It is a good opportunity to re-divide the power map. The real benefit is always a few people at the top of the food chain, while ordinary people can only Being harvested, receiving lunch, and suffering from innocent disasters. The king has been defeated and has always been like this.

The recent BFX storm is also a game of power. In order to be famous, it is necessary to use the name of justice, for the sake of the people, for the rights of consumers, for the benefit of users, so that the New York Attorney General's play will appear tall. But there are always secrets of ulterior power behind the incident.

The real victims of this game are undoubtedly BFX and Tether. Crypto Capital had an accident and they became "back pot man." As a victim of the Crypto Captital funding freeze, we seem to be sympathetic to it. But the poor man must have hateful things. The USDT has long been undisclosed, opaque, unaudited, and black-box operated, and people have seized the handle. "The 850 million US dollars of funds have been frozen" is just a matter of the New Tests. Even if there is no problem this time, it will come back next time.

New York is the financial center of the world, and the prosecution action of the New York State Attorney General is filled with "the taste of Wall Street."

- Bitfinex will burst new melons: Can "issuing coins" become a good medicine?

- Behind the scenes of the USDT, the dealer's Bitfinex cat and mouse game

- Aside from Staking, talk about the true value of Cosmos

1. Stabilizing the currency dispute

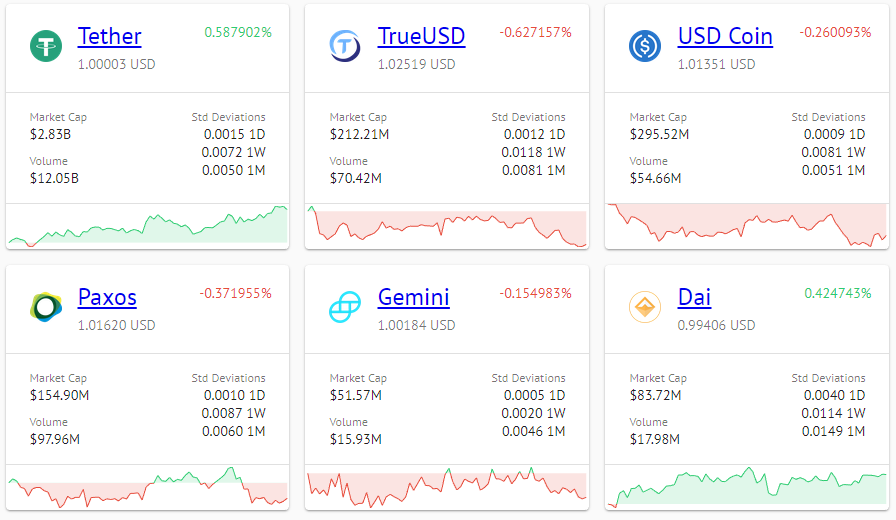

At present, there are a large number of stable coins in the market, and there are roughly three modes: a currency-backed stable currency, a digital asset-backed stable currency, and an algorithmic central bank model stable currency. The implementation of the central bank of the algorithm is very difficult. There are no successful examples. At present, it mainly focuses on the legal currency mortgage and the digital asset mortgage stable currency. It is yet to be proved whether the digital asset-backed currency can meet market demand because of the total cap and design flaws. Currently, the main transactions on the market are the legal currency-backed stable currencies, mainly USDT, USDC, PAX, TUSD, and GUSD.

Any enemy black swan is an opportunity for you to grow and develop. USDT has a credit crisis. The biggest beneficiary is other compliance stable coins. A few days ago, we also posted a picture. When the storm broke out, USDT fell more than 3 points, and the competition coins such as PAX rose 2-3 points.

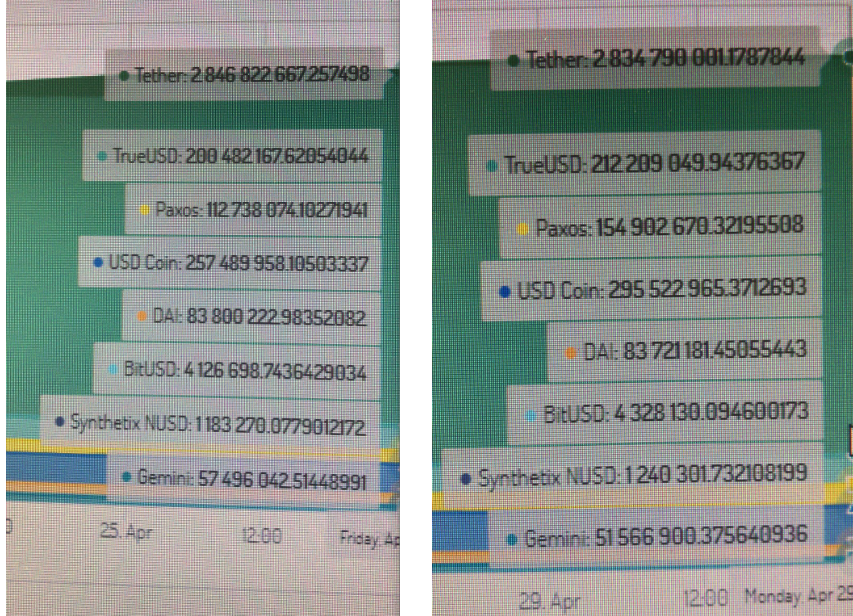

The picture shows the scale of each stable currency market on April 25 and April 29, the data comes from stablecoinindex, and the mapping ability is limited 🙂

We compared the market size of several stable coins before and after the BFX storm. As you can see from the above chart, the total amount of USDT issued in the five-day period fell by 10 million US dollars, TUSD issued 10 million US dollars, and PAX issued 4 more. Tens of millions of dollars, USDC issued an additional 40 million US dollars. GUSD has fallen by $6 million. I don’t know if this guy is playing with Mao?

In general, the competition coins are constantly increasing, expanding their circulation, and occupying the market share overflowed by the USDT trust crisis. They are the biggest beneficiaries.

2. Wall Street Harvester

Since the April 1st April Fools joke, the BTC has briefly entered the ascending channel, rising from $4,200 to $5,500. At the same time, the USDT "printing machine" opened, and this year's cumulative increase of more than 1 billion.

Since April, according to blockchain data and security service provider PeckShield, the largest stable currency issuer, Tether, has accumulated “printing and issuing additional shares” on Omni, ERC20 and TRC20 for 10 times, with a total amount of US$745.9 million. The total market capitalization of various USDTs exceeds $3 billion.

If there is no dollar support behind the issued USDT, this huge amount of money is over-received. This wave of BTC rises, probably related to the USDT overshoot during this time.

At present, it is still at the end of the bear market. The BTC caused by the USDT overshoot has not risen, and it has not attracted the extensive follow-up of over-the-counter funds. The upward trend is not sustainable. If there is a super-issue, there must be a repurchase, and there will be cash, and the market will naturally usher in an inflection point. The method that directly causes the inflection point is the USDT thunder, which has been tried and tested.

According to a news report on April 23, Bitwise's data shows that Wall Street CME bitcoin futures trading volume is nearly $90 million higher than the daily trading volume of the largest bitcoin spot exchange currency.

When the New Test incident broke out on April 26, CME Bitcoin futures trading accounted for half of the entire market, and this part of the funds was mainly short.

(Look at the deep V groove in the picture above)

Subsequently, USDT exploded, BFX suffered a huge loss of 850 million US dollars, the market fell as expected, Wall Street short-selling strength to take advantage of the opportunity to harvest.

3. The dispute over the currency

When the metal currency appears, the coinage rights are basically owned by the state. The unified coinage right refers to the state monopoly currency casting rights, prohibiting local governments and private private casting coins. Metal currency has new casting and recasting. Ordinary people own money and need to take gold to the state-owned mint to cast or recast, providing 100g of gold. Maybe only 50g is minted into the currency, and the excess is collected as state-owned. It was the early coinage tax.

Why is the uniform coinage so important, the French economist Andre Fu has said that printing money is the most profitable business. Former US Secretary of State Kissinger once said: "Whoever controls oil, who controls all countries; who controls food, who controls human beings; whoever masters the currency casting right, will master the world."

Former Federal Reserve Chairman Alan Greenspan said that there is no need to worry too much that the United States can't afford national debt. The United States can start printing money to pay US dollars at any time. This is tantamount to the fact that the red fruit is declared to the world, and the United States imposes a coinage tax on the world by issuing US dollars. This is a typical economic hegemonism.

In the digital currency market, the stable currency is the common currency. At present, any company or individual can issue it, as if it has returned to the era of the early British coinage. The future of the digital currency market is a huge market, and the market size of stable currencies may reach the scale of several trillions of dollars. This is a huge cake. It does not rule out the possibility of the US government intervening. It does not rule out the possibility of Wall Street intervening.

On February 14 this year, JP Morgan, one of the largest banks in the United States, announced that it had completed the development and testing of its own digital currency, JPM Coin. On March 19th, IBM official news: IBM's World Wire blockchain began to open services to 72 countries and 47 currency payments, supporting stable currency and cryptocurrency. In addition, there is news that FACEBOOK will issue stable currency and Samsung will issue stable currency.

Traditional banks, traditional companies, and Internet companies must all enter the stable currency market. In the current digital currency stable currency market, USDT is the king, accounting for 80% of the market. The thief first smashes the king, kills the king, and takes the opportunity to take the position. This is the best way. Moreover, the current king is also a problem, giving competitors the possibility of attack.

What may be hidden behind the BFX storm is the battle for digital currency distribution rights, which is a cut in the US government's involvement in the digital currency market.

Stabilizing coins is a very, very big cake. As the former and current boss, the USDT market is being eroded step by step, but currently there are many users and many fans, still occupying nearly 80% market share. However, the background of many competitors is strong, and they are not in danger. They are complacent in the history of the book. Perhaps the building is overturned and only needs a "black swan".

All kinds of signs indicate that Wall Street is involved in the digital currency market, and the US government has begun to intervene in the digital currency market. In the short term, it may be bearish, and it must be positive in the long run. The right to issue digital currency is a huge power. The Americans have already taken a fancy. Does China continue to choose to turn a blind eye?

(Author: Allin Block Chaining)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- 4D long text speaks through the Polkadot architecture

- Twitter Featured: Bitfinex plans IEO to issue platform coins, raising $1 billion

- Multi-space Discrimination Method of Digital Currency: Cross Judging Method of MA7 and MA30 of Day K

- Broken value creation chain: the value leakage of the securities pass agreement

- Is it a vast galaxy or a black hole? Galaxy Digital's investment loss expanded to $272 million

- DeFi, the current difficulties, the future can be expected!

- The top ten characteristics of the amaranth in the currency circle, how many of you?