Bitcoin's scheduled chip for TSMC may provide 33 million TH/s of computing power in the second quarter of next year.

According to the technology big V "mobile phone chip master" previously broke, Bitcoin has scheduled the production capacity of 30,000 7nm wafers in the third quarter and fourth quarter to TSMC.

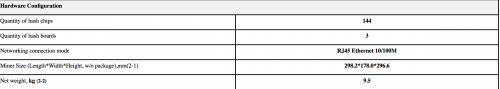

According to the website of the mainland China website, the 7nm mining machine models (currently sold out) are mainly used for the ant mining machine S17-53TH/s, the ant mining machine T17-40TH/s and the ant mining machine S17 Pro-. 56TH/s, each of which has 144 chips for the S17 or S17Pro miners and 90 chips for the T17.

- Libra VS US Congress New Currency War

- Questions that David Marcus avoided at the hearings

- Libra hearings are full of gunpowder: it is difficult for regulators to trust Facebook

According to the difference in IC design skills, a 12-inch wafer can be roughly cut into 2500-5000 ASIC miners. According to industry analysts, a 12-inch 7nm nanowafer can roughly cut 3,000 ASIC miners. chip.

Based on 144 chips per mining machine, it can be roughly calculated that Bitumin's scheduled 30,000 7nm nano wafers will produce about 625,000 7nm miners in two quarters.

Under normal circumstances, the price of a piece of ASIC miner wafer is about 8,000 US dollars. According to the current tight production capacity and repeated price increases, there have been rumors that TSMC's 7-inch process 12-inch wafer cost is raised or raised to 10,000 US dollars. The price of the 30,000-piece wafer order of the mainland may reach 300 million US dollars (about 2.06 billion yuan).

According to previous financial and chain financial reports, some people in the industry revealed that Bitcoin ranked 16th in TSMC's chip supply ranking list (the top ten were occupied by mobile phone manufacturers).

In contrast, TSMC's chips are more likely to be supplied to manufacturers with stable demand for more than 12 months. Because the demand between mining machine manufacturers and the currency price is too close, their demand is highly volatile. The capacity of the mining machine is generally determined when the manufacturer's chip is placed three to six months ago. The response of the manufacturer's production capacity is generally lagging behind, and it is impossible to maintain a stable demand for the chip.

Therefore, it is reported that, unlike the previous order, TSMC may require Bitumin to pay a larger proportion of the deposit, and even need to pay the full amount before production. According to the "mobile phone chip master", for the batch of orders worth 300 million US dollars, Bitcoin has already "paid" to TSMC, which suggests that Bitcoin currently has more cash.

Recently, the demand for mining machines in the market is strong, and the online market has been snapped up, which is in short supply. According to the official website of the mining machine, the ants SHA256 mining machines are all sold out, and the ants S17 (53T) and T17 (40T) delivery dates are in September this year. The order delivery of Shenma mining machine M20s (68T) and M21s (56T) was even scheduled for November. Previously, industry insiders have analyzed that the mining capacity is likely to be loose from September to October (that is, near the end of the flood season).

It is expected that Bitco's scheduled third and fourth quarter wafers will be shipped by the end of 2019 or the first to second quarter of 2020, which can roughly estimate the first bitcoin continent to 2020. It can provide 33 million TH / s of computing power in the second quarter.

Source: Financial Network · Chain Finance

Author: Xi breeze

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Senior Republican Party: Centralized companies have data leakage risks, blockchain is the best alternative to privacy protection

- Quotes Daily: BTC fell below the $10,000 mark, and the short-selling force gradually fermented

- Facebook hearings 丨 yesterday, today, Libra's road to tomorrow is even harder

- Six pictures analyze the status quo of stable coins

- Xiao Lei: The renminbi is absent from the libra currency basket, and the purpose of the United States has been achieved.

- Vitalik: Ethereum 2.0 has no unresolved research challenges

- French digital currency regulations will be approved at the end of the month to approve the first batch of legitimate enterprises