Suning Financial Research Institute: Libra Ruocheng, Bitcoin will be extinguished

It has been quiet for a long time, and the currency circle is boiling again. One bitcoin regained its uptrend and reproduces the money-making effect; the second giant entered the game, and Libra attracted much attention.

These two things seem to help each other, but in fact they compete. Libra, who ignores Bitcoin as a competitor, has inadvertently ringed the death knell for Bitcoin.

Soaring again

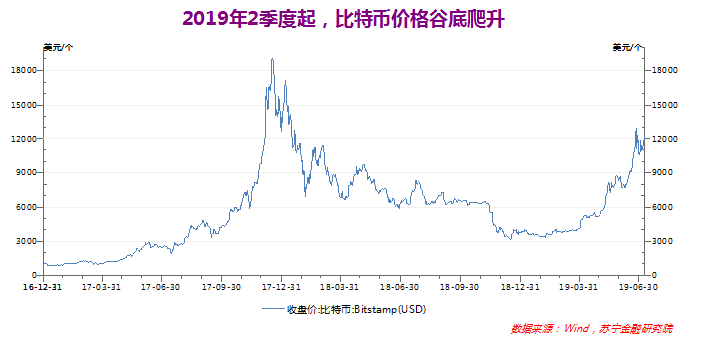

The bitcoin that has been quiet for nearly a year has returned to public opinion because of the skyrocketing. Since the second quarter of 2019, bitcoin prices have climbed from the bottom of the market and out of the rising channel. In just three months, the increase was 2.15 times, which was close to 13,000 US dollars per share (equivalent to nearly 90,000 yuan per piece).

- BCH and ETC are married to ETH? V God said that they can be used as ETH data layer in a short period of time.

- Viewpoint | Ethereum plunged, it is time to throw away the illusion that Ethereum has skyrocketed again

- Bitcoin fell below 10,000, the price of a number of mainstream currencies, and who fell in the pot?

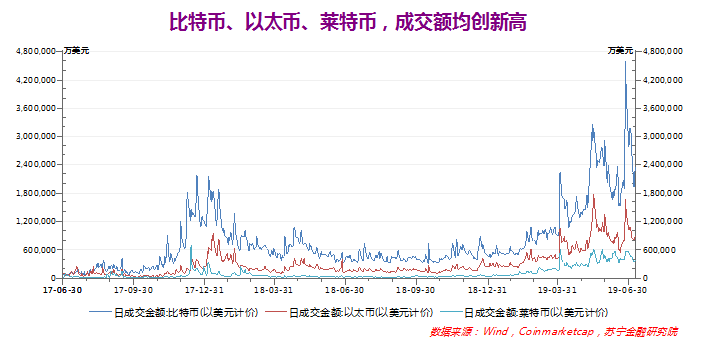

The price has risen fiercely and the volume has been solid. From the daily transaction data, Bitcoin has skyrocketed this time, and the amount of money spurred is much larger.

According to Coinmarketcap data, the daily trading volume of mainstream payment tokens such as Bitcoin, Ethereum and Litecoin all reached new highs. In the case of Bitcoin, the recent daily turnover peaked at US$46 billion (2019.6.27), more than double the peak of the previous bubble period of US$21.8 billion (2017.12.21).

Some people say that the memory of speculators is only a few days, and a big increase is enough to put the pain of the crash behind and re-energize. One year after the plunge, virtual currency reproduces the skyrocketing picture, allowing disheartened speculators to see the dawn. From the Baidu index, in late June 2019, the average daily search volume of “Bitcoin” reached 97,500 times, approaching the 2017 high, and the excitement of investors is evident.

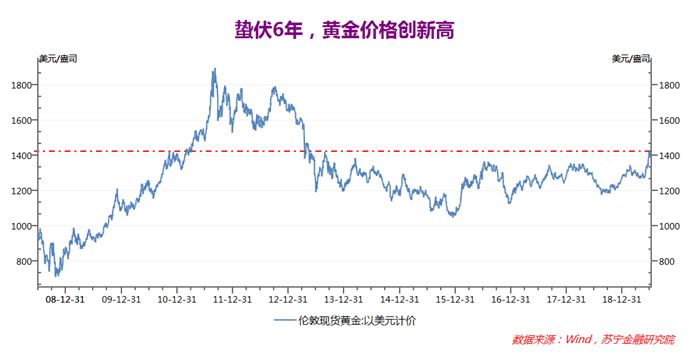

Regarding this price increase, there are different opinions. The more mainstream view is the safe-haven property . The international situation is increasingly complicated, and gold is rising, hitting a new high in six years. Bitcoin, as a virtual asset with limited supply, naturally rises.

From the rhythm point of view, both gold and bitcoin started a steep rise mode in mid-May 2019. When the 5G event heated up and fermented, the hedging was established.

Another driving factor is that Facebook intends to unite a group of giants to launch virtual currency – Libra.

Libra's mission is to create a simple, borderless currency and financial infrastructure for billions of people, sparking global regulatory attention. Facebook has 2.7 billion users worldwide, more than one-third of the world's population, opening up a huge space for Libra's global reach.

After Libra appeared, there were different opinions. For example, some people said that the 28 members of the Libra Alliance are basically American companies and are regulated by the US government. Therefore, Libra is an extension of the United States' scramble for global currency dominance, opening up a new battlefield outside the sovereign currency. In the future, the global currency pattern will occupy a position.

The conspiracy theory does not believe, but Libra does not allow it. Libra is positioned in a stable currency, linked to a basket of sovereign currencies, eliminating the speculative nature of Bitcoin, and its value is stable enough. It also inherits the characteristics of virtual currency crossing national borders and surpassing sovereignty, supplemented by Facebook’s 2.7 billion users. Bringing significant changes to the global currency landscape.

Of course, Libra still faces a lot of difficulties on the landing level, so a Libra may not be enough, but ten Libra? Twenty? With Facebook as an example, there will inevitably be more multinational giants "dying" virtual currency, and many Libras are coming to us and coming to the global central bank.

In this case, the delay is invalid and it is the best policy. For example, the People's Bank of China has recently stated its position – with the approval of the State Council, the central bank is organizing market institutions to jointly carry out research and development of DC/EP (payment instruments with digital currency characteristics). Once the defensive mentality of the global monetary regulatory layer is broken, it is a tonic for Bitcoin.

What really makes Bitcoin sluggish is the intentional neglect of the global regulatory authorities. Once the global central bank runs and promotes digital currency, there will be room for speculation in virtual currency such as Bitcoin.

The hedging effect superimposes the Libra innovation effect, and Bitcoin runs on the rising channel.

Bad foundation

Under the tuyere, garbage can rush to the sky. If you look at the long-term, you have to see if the foundation is solid. For Bitcoin, is the status of its payment-type tokens stable? Is there a strong challenger?

Virtual tokens are broadly classified into three categories: payment tokens, securities tokens, and utility tokens.

In the virtual asset world, the responsibility of the payment instrument belongs to the payment type token, which is represented by the stable currency such as Bitcoin, Ethereum, Litecoin and USDT.

A virtual token that is considered to have a security token offering (STO) is a securities token. Such tokens represent assets, usually in the form of token holders who can claim debts or equity from the issuer. Currently, most ICO tokens are securities tokens.

In addition to payment-type tokens and securities-type tokens, it is a practical token. In general, utility tokens do not have an appreciation feature and are only used to obtain services within the blockchain. At the beginning of 2018, the so-called "virtual points" issued by many Internet companies in China were the practical tokens.

As a payment token, the value base of Bitcoin depends on three points:

One is physical performance. Calculated by block size 1M, Bitcoin processes up to 7 transactions per second, which is actually about 4.2 pens/second. Compared with the peak capacity of tens of thousands of pens and hundreds of thousands of pens per second, the gap is too large. The ability to undertake real trading. Around the improvement of physical performance, the Bitcoin community has proposed a series of ideas such as increasing block size, isolation witness, sidechain, lightning network, and fragmentation. Basically, every attempt to break through the physical performance bottleneck has turned into a driving force for bitcoin price increases.

The second is the blockchain ecology. Analogous stock prices, stock price rises and falls in the short term depends on speculation, medium and long-term depends on the operating conditions of listed companies, sustainable profit margins, the increase is large. The blockchain ecology has the same supporting role as virtual currency. The more scenarios of blockchain ecological access, the more stable the virtual currency value base. Ethereum can be a latecomer (compared to the earlier currency such as Litecoin), thanks in large part to the ecological power of Ethereum.

The third is the payment attribute. Virtual currency is just a series of virtual characters. Without the support of the central bank, its value is based on user trust, and the basis of user trust is full decentralization, that is, the algorithm determines everything, and no one can manipulate it (just an idealized state, Can be infinitely close, can't actually do it). Among the virtual tokens, Bitcoin has the highest degree of decentralization and the most market trust. Of course, the price is the huge consumption of electricity. In addition to the trust issue, the value of the payment is also stable. Considering that all virtual tokens (except stable currency) are unstable, everyone is half-pounded. This factor is no longer important.

Among the three foundations, the payment attribute is the core. Bitcoin is used for payment, the high cost of physical performance (about $2.5/per pen) and high latency (about 4.2 pens/sec) are widely criticized, and the blockchain ecology can't be compared with Ethereum, but with no Comparable decentralization, Bitcoin is able to stand out in the currency circle and rank first in virtual currency.

However, the emergence of Libra, or the death knell for Bitcoin.

The core strength of Bitcoin is decentralization, which solves the problem of trust. There is a giant support behind Libra, which naturally captures the trust of the vast majority of people and does not lose bitcoin in terms of security. In addition, Libra is linked to a basket of official currencies, eliminating the drawbacks of currency fluctuations, and physical performance is the second bitcoin. The emergence of Libra and Libra will replace Bitcoin in most payment scenarios.

Once the payment attributes are weakened, Bitcoin, in addition to acting as a payment tool in various anonymous trading scenarios (which will continue to face anti-money laundering regulatory pressures), can only quietly make an investment. The problem is, if you lose your payment plan and retreat to pure investment, what is the imagination of Bitcoin?

Uncertainty

The emergence of Libra has become a strong booster for Bitcoin's rise in the short term. As a competing product, it may be a bit of a bit of money in the medium and long term. Also Libra, also Libra.

The question is, can Libra's own vision be realized? Libra's goal is not to replace Bitcoin, but to "build a simple, borderless currency and financial infrastructure that serves billions of people." Since it is a currency and an infrastructure, it is bound to face resistance from all sides. If Libra is difficult to produce under pressure from all sides, it will sound a warning to Bitcoin and it will not be established.

Resistance 1: Can't land in countries that ban virtual currency

Libra is a virtual currency that is subject to national virtual currency regulatory policies.

At present, the attitude of national regulators to virtual currency is still unclear. Taking Bitcoin as an example, according to incomplete statistics, there are 99 countries that do not impose restrictions on the trading and use of Bitcoin. 130 countries have not issued clear opinions. More than a dozen countries have defined bitcoin as illegal, and some countries only Accept restricted use.

Due to the issue of monetary sovereignty, many countries that are friendly to virtual currency only accept their asset attributes and prohibit their payment attributes. For example, the existence of a virtual currency exchange is allowed, but ICO (or STO) is prohibited, and virtual currency is also prohibited for daily payment.

Some countries, such as China, recognize Bitcoin as a kind of private financial asset, but prohibit the existence of virtual currency exchanges, and do not allow virtual currency to be used for daily payments. In India, holding bitcoin is even illegal.

For Libra, positioning in payment transactions is the exclusive privilege of national currency, and in most countries there will be legal resistance.

Resistance 2: Competitive pressure of the traditional financial system

Libra intends to remove the shortcomings of the current financial system, such as high transaction costs, inconvenient cross-border payments, and the threshold is too high to exclude more than one billion people. Libra's efforts to improve the global payment system are similar to recreating an Alipay or WeChat payment on a global scale, with the goal of “regarding where you live, what work or income you are doing, transferring money globally should be like sending text messages or Sharing photos is as easy, cost-effective, and even safer."

In terms of this experience alone, Libra has limited appeal to Chinese people who already enjoy the free and convenient payment experience, but there is a market at the global level. Major developed countries still have to pay higher fees for transfer transactions, and cross-border payments are inconvenient; in the vastly underdeveloped areas, billions of people still do not have access to basic financial services, as described in the White Paper on Understanding Libra. "There are still 1.7 billion adults in the world who are not exposed to the financial system and cannot enjoy the financial services provided by traditional banks. Among them, 1 billion people have mobile phones and nearly 500 million people have access to the Internet."

The traditional financial system chooses to face the challenge. In terms of domestic payments, in theory, as long as China's third-party payment model is copied, it can effectively resist the impact of Libra; for cross-border payments, SWIFT has taken action – June 20, 2019, SWIFT released The SWIFT Payments: Looking to the Future white paper, announcing the launch of gpi payments for trading platforms based on distributed ledger technology (DLT).

With the traditional financial system moving in, coupled with the regulatory support of regulators, Libra has a long way to go to overthrow the existing financial system.

Resistance 3: Financial risk prevention pressure

The Libra Association emphasizes that “anyone with Libra can get a high degree of assurance that they can exchange this digital currency they hold in their local currency at the exchange rate, just like changing one currency to another when traveling. same."

Standing on a global scale, Libra has established a super direct connection system for different currencies, taking on the role of partial clearing. Within this ecosystem, the Libra Association is the central counterparty in all method currency exchange transactions and the ultimate source of credit risk, liquidity risk, operational risk and business risk throughout the clearing system.

The risk is born in the Libra ecosystem, but it spreads beyond the Libra ecosystem through Libra holders around the world. The higher the Libra's popularity, the more terrible the risk spillover effect. Global central banks and international organizations have been exhausted and can not stop the financial crisis. Who can count on the Libra Association to effectively control these risks?

Therefore, based on concerns about the uncontrollable potential risks, Libra's risk control pressure and consequent regulatory resistance will only become heavier and heavier.

Prospect

In the short term, Libra's landing will still face various unknowable resistances, and its influence and role may be exaggerated. However, the sudden winds began in Ping, new things have emerged, and new trends have taken shape.

"The road is tangible, and it is in the midst of a change." Many times, the interrelationships between things far outweigh people's perceptions. Libra is in Bitcoin, Libra is in the current financial ecology, and how the interaction and reaction between them evolves is inexhaustible.

It is the natural way to adjust the trend and dance in the wind. Where does Libra, Bitcoin and the current financial system go? We will continue to pay attention.

Author: Xue Hong Yan

Source: Suning Financial Research Institute

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Tether's 5 billion USDT has been destroyed

- BTC fell below $10,000 again, can the bull market hold on?

- Babbitt column | Xiao Wei: Blockchain project legal red line, you know?

- Starting from the "Father of Libra" Marcus: Interested in Bitcoin 7 years ago, personally texting and convincing Zuckerberg to issue coins

- QKL123 market analysis | The market is falling, when will it be closed? (0715)

- Bitcoin halving effect: What effect will it have on price?

- Interview with pure white matrix CEO Wu Xiao: Blockchain Magic of "Secondary Disease" Youth | Babbitt Venture +