Block space is a scarce commodity. How can it be objectively evaluated?

Block space scarcity and objective evaluation.Author: Nate; Translation: Deep Tide TechFlow

Trading, storing data, and computing on the blockchain is called block space. Intuitively, the transactions contained in a block are block space.

In various articles, posts, and podcasts, block space is increasingly referred to as the “best product” or the “most important commodity.” Understanding what block space is and how to create and evaluate its value can be confusing, especially as it is constantly evolving.

- Head of SEC’s Division of Encrypted Assets and Network More Charges to be Filed Against Exchanges and DeFi

- LD Capital Storj Short-Term Liquidity Analysis

- ARK Invest acquires European ETF issuer Rize ETF Limited.

Not all block spaces are equal; in fact, they differ greatly. Block space is a type of commodity that can be easily rated based on common features such as security, flexibility, and decentralization. This article will explain each feature in detail, provide examples, and then explore the market participants of the most valuable digital commodities currently available.

First, let’s briefly introduce the consensus mechanism that protects block space:

Proof of Work (PoW) requires miners to solve complex mathematical problems to verify transactions and create new blocks. The first miner to solve the problem will receive newly minted tokens as a reward. The process of solving these problems requires a significant amount of computational power, making it difficult for any miner to control more than 50% of the network’s computing power. If a miner can control more than 50%, they can launch a 51% attack. In a 51% attack, the miner with the majority of computational power can manipulate transactions or even reverse them, potentially allowing them to double-spend coins. Nowadays, almost all PoW production is done through mining pools.

Proof of Stake (PoS) is a newer consensus mechanism that requires users (called validators) to provide a certain amount of cryptocurrency as collateral to verify transactions and create new blocks. Validators are selected based on the amount of tokens they stake and have an incentive to act in the best interest of the network.

Quality

Block space can be constructed and generated in many different ways and can be used for various purposes. Each block space market has different levels of security, decentralization, and guarantees, as well as choices in terms of block space size, quantity, and validation methods. When deciding to participate in the block space economy, you may want to evaluate different qualities.

Security

Perhaps the most important quality is the security of the blockchain. How much resources and effort are required to attack the chain, often referred to as a “51% attack,” but there are also other types of consensus mechanisms that only require 33% agreement from producers.

A common measure of blockchain security is to look at the “attack cost.” How much resources would it take to rent and/or buy computational power/stakes to control 51% of the network?

A complete takeover of a blockchain is very rare and has only happened a few times in history, with one example being Justin Sun’s takeover of the steem blockchain. I often wonder why well-known blockchains like Dash, Bitcoin SV, or even Zcash, haven’t seen more complete takeovers if their security is so poor, as it could be inferred that their other qualities are equally or even more deficient.

The most common attack is a simple blockchain reorganization. This is often seen on blockchains like Polygon, which frequently undergo reorganizations. It should be noted that, given the probabilistic consensus of Polygon, not all reorganizations are necessarily malicious, but they can also be an attack where producers reorganize transactions in previous blocks for their own benefit.

To better understand the issues brought about by reorganizations, consider the following example: a small company bids on a billboard on a popular highway. After fierce competition with their rivals, the company’s boss ends up paying 20% more than originally anticipated. They are satisfied with the billboard and send their design to the billboard company. A few weeks later, the boss drives to the highway to see their advertisement, only to find their competitor’s advertisement on the billboard. This is similar to what happens in a reorganization, where your previously paid transaction is “rolled back” and reorganized.

For users of the blockchain, security is perhaps the most important feature, as they want to ensure that the transactions they make are secure and relatively immutable. This directly affects the value of the blockchain, the willingness of producers to spend resources on producing blocks, and the interest of final users to engage in transactions.

Decentralization

The degree of decentralization of a blockchain is closely tied to its security and is also a very important quality. Decentralization has several equally important components:

-

The Nakamoto coefficient;

-

Different operators;

-

Geographical distribution;

-

Client diversity;

-

Unique hardware.

The Nakamoto coefficient is undoubtedly the most commonly used metric for measuring the degree of decentralization of a blockchain. It is a very simple formula: the number of validators or the percentage of computational power required for an attack, which helps understand the number of validators needed to collude successfully to prevent a blockchain from functioning normally.

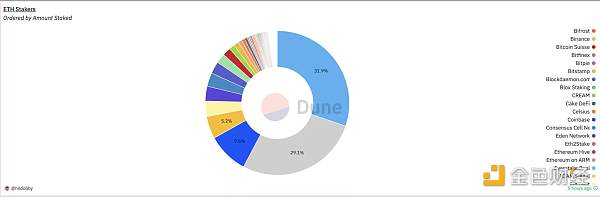

Equally important as the number of participants is the number of different participants required to collude. For example, Coinbase operates around 7% of Ethereum validators. Lido, a liquidity staking provider, currently accounts for around 33% of Ethereum network validators. Lido itself is not a validator but collaborates with trusted operators in the blockchain field like Coinbase. By calculating the share of Lido’s operation together with the number of validators, Coinbase actually controls around 12% of the entire network.

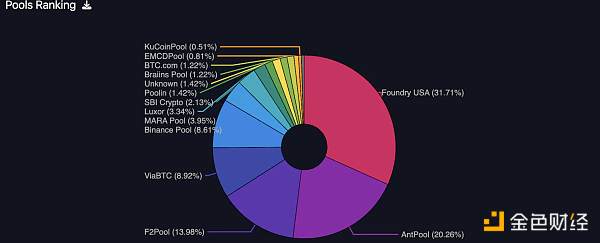

Bitcoin is often considered the leader in decentralization, but its Nakamoto coefficient is only around 5. While there are indeed many unique block producers, Bitcoin mining pools have complete control over the ordering of transactions in blocks (until Stratum V2 is fully implemented and used).

For most of Bitcoin’s history, 1 to 2 mining pools have controlled over 33% of the computational power, thus controlling the order of transactions in a given block.

Some market participants are very concerned about the order of their transactions in specific blocks, and having a single party in complete control of the order greatly diminishes the quality of the block space for them. Note that this is also true for Rollups with a single sequencer.

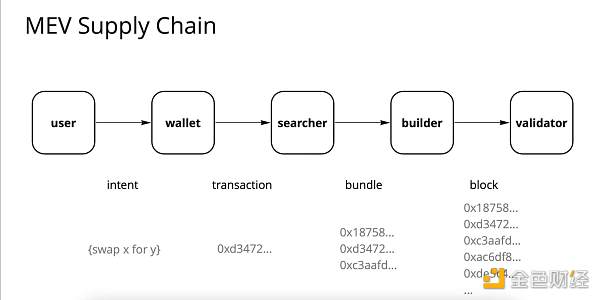

Having a single party sort/build most of the block space is intuitively very detrimental to decentralization, but it can also have significant effects on producers extracting additional value for themselves. This is often referred to as Maximum Extractable Value (MEV), where producers can extract a significant amount of value. It is also important to note that MEV is helpful for the normal functioning of certain applications, such as liquidations, arbitrage to maintain market competitiveness, and even searchers required for Squeeth rebalancing, are good examples.

When discussing block space, MEV is a very large and important concept (MEV supply chain is now a billion-dollar industry itself) that may require a separate article. But here are a few points to know:

Building an independent MEV supply chain is crucial to avoid harming block space consumers. Many protocols are addressing this issue:

-

Flashbots;

-

Solana’s Jito;

-

Cosmos’ Skip;

-

Bitcoin’s Stratum V2;

(Still awaiting MEV solutions from Polkadot and Near)

MEV also exists in Bitcoin, where large mining pools have started extracting it, and the amount of MEV that can be extracted is directly related to the value of the given block space.

Size, Quantity, Verification

The actual specifications of the block space are also important factors in determining quality. These are very simple and clearly defined:

-

How big is a block? How many transactions can a block accommodate? How much data can a block hold?

-

How often are blocks generated? How many blocks are generated in a day?

-

How does the network achieve consensus on blocks?

Questions about the size and quantity of block space are usually quality considerations for consumers or traders. If a consumer wants to complete a transaction within 1 hour, how many blocks can bid for transaction space? As a trader, how scarce is block space?

Evaluating how the network achieves consensus on blocks may be a quality concern for institutional consumers, which may be a fund or trading company, but more likely an application built on top of a given block space, such as an exchange, custody service, or Layer 2. An exchange may evaluate how the network forms consensus, as it may affect user execution. Examples of different network participants forming consensus:

Round-robin/leader election:

-

In round-robin, validators are regularly selected to build, propose, and solely include entire blocks.

-

Examples include Solana, Cosmos, and Polygon.

Common Consensus:

-

In a general consensus network, producers broadcast blocks to the network REST, and if there is consensus, the block is added.

-

Examples include Bitcoin.

Single Sequencer:

-

Most Layer 2 networks implement a single sequencer, which sorts all transactions, forms them into blocks, and publishes them to the Layer 1 or data availability layer.

-

Examples include Arbitrum and Optimism.

The way consensus is reached has slightly different impacts on the execution of related exchanges.

Round-robin leader election is usually very fast, but for networks that have not yet abstracted the block-building layer, transaction validators have the advantage.

General consensus is the most fair for exchange users’ execution, but currently there are difficulties in handling throughput. As of 2023, we have not yet seen a functionally complete and fast order book on a blockchain using general consensus.

Exchanges built on networks that currently use centralized sequencers need to determine the possibility of sequencer operators engaging in front-running or extracting certain types of value from trade orders.

The fourth option for exchanges is to run certain parts of their infrastructure offline, such as their order books. This is also emphasized in the hybrid part of AMM and order book.

Availability

Ensuring the widespread availability and accessibility of block space is important.

Can you easily access block space? Is it always available or are there times when the chain stops or goes offline? How easy is it to run your own RPC node or access publicly available nodes? Are RPCs often overloaded, do they have sustained uptime?

Uptime

As a consumer, it is important that you have access to the block space market at all times. If a blockchain frequently stops or goes offline, you cannot rely on using that blockchain.

For example, if you are a new liquidity provider who wants to provide liquidity to centralized liquidity AMMs and have a choice between Solana and Ethereum blockchains. Evaluating based on availability alone, the choice is simple. In the past year, Solana and almost all Layer 2s have experienced days of downtime, rendering the entire chain completely unavailable.

Chain State and Storage

As a producer (and possibly as a consumer), considering the accessibility of downloading, verifying, and storing the complete chain state may be an important consideration.

As a block space producer, you want to ensure that you have extremely high uptime and minimal dependence on others in case they go offline. Some blockchains like Solana or Near actually require you to download chain data snapshots from AWS S3, Google BigTable, or other validators, while you sync and store chain data very little or not at all.

Chain state and storage are also very important considerations for applications or protocols that require historical data. On Bitcoin or Ethereum, fully syncing a node takes just a few days and you have the complete historical data. On the other hand, Solana’s full chain state is primarily stored in a Google BigTable database and requires PB-level data, making it nearly impossible for an ordinary consumer to sync and store.

Costs and Fees

Block space is valuable and comes with various costs and fees associated with its production and consumption.

As a producer, there are more traditional costs such as upfront purchases and/or ongoing costs for the various hardware and software that enable you to operate on the network. In most cases, initial capital expenditure for token issuance as collateral is also necessary (this is the case in PoS networks). In return, you typically receive block rewards from the network, which may also include fees paid by consumers for the block space you produce.

As a consumer, in order to use block space on a given network, you need to pay fees to the block producers (this does not include any additional fees you may need to pay for interacting with protocols).

The costs and fees vary depending on the implementation of the blockchain and the design of the fee market. Typically, a chain implements one of the following designs:

-

Priority Gas Auction (PGA): Consumers who want to utilize block space submit their transactions with a given fee, and the transactions enter the memory pool. As producers gain fees from the blocks, they (usually) prioritize transactions based on the highest fees. This is a very simple fee market design and the most common one.

-

EIP 1559: Consumers who want to use block space pay a base fee (burned) and a priority fee (or tip) to the block producers. The purpose of this introduction is to have better consistency in estimating the fees consumers need to pay.

The design of the fee market has a significant impact on the amount and willingness of consumers to pay, as well as the expected rewards producers anticipate from block production.

Flexibility

Block space can be highly adaptable or very static. In most cases, consumers may prefer stable and predictable consumption space, but in certain use cases, consumers (usually protocols) may want their space to be highly adaptable and flexible.

Flexible block space means constructing blocks in different ways based on various use cases. This could involve adding pre-processing and post-processing instructions at the validator level, allowing block size fluctuations, or the ability to abstract block construction.

For example, if you are a lending protocol exploring the launch of your own blockchain, you have several options to consider:

-

Application chain based on Cosmos;

-

Rollup based on Optimism or Arbitrum technology stack;

-

Building a parachain on Polkadot.

Each of these has different considerations in terms of security, decentralization, and usage.

-

A Cosmos application chain requires you to build security through an incentivized validator set, but allows you great flexibility in consensus, block construction, and transaction execution.

-

Building a Rollup using the Optimism technology stack is currently more centralized as it has a single sequencer, but it allows you to have very fast EVM-compatible block space.

-

Polkadot parachains allow you to use the shared security model of Polkadot but require a significant bid of DOT in auctions to be included.

In short:

-

Cosmos application chains have ultimate flexibility in creating, controlling, and securing block space.

-

Rollups provide flexible block space creation, but control and security are currently limited to a single centralized sequencer.

-

Parachains bootstrap security from the Polkadot mainnet… but at a cost.

Bitcoin, Ethereum, Polkadot, and others generate general-purpose block space. Osmosis, Aevo, Lyra, Sentential use customized and dedicated block space to improve their products.

In recent months, products like Caldera and Conduit have made launching OpStack, Arbitrum, or other Rollup/application chains easier.

Market Participants

The block space market is complex but can be broadly divided into producers and consumers.

Producers

Block space producers are network participants who receive a set of transactions to be included and construct blocks by sorting them. This is often one of the roles of validators, miners, or mining pools on a given chain. With the rise of MEV protocols, this block construction has largely been outsourced to a separate actor called a builder. The “MEV supply chain” is now very complex, involving many different actors as shown in the figure below.

In proof-of-work, mining pools have complete autonomy over the transaction ordering in the blocks mined by miners in the pool. This will change with the release and adoption of stratum v2, allowing individual miners to express transaction ordering preferences to the mining pool.

Producers aim to produce high-value block space, or expect to do so in the future. Below is a list of major producers in various blockchains:

-

Coinbase Cloud;

-

Chorus One;

-

Jump Crypto;

-

Figment;

-

Marathon ;

-

Galaxy Digital;

-

Riot;

-

Foundry.

Consumers

Consumers are any entity that uses the block space being produced. The actual use cases can be varied, such as transfers, exchanges/trades, other financial transactions, etc.

However, the largest consumers are often overlooked. Asset issuers, exchanges, and protocols built on top of blockchains are typically some of the largest consumers. Below is a list of protocols/companies that are major consumers:

-

Asset issuers such as Circle, Tether, LianGuaixos;

-

Centralized exchanges such as Coinbase, Binance;

-

Layer 2 solutions like Arbitrum, Optimism (this environment is growing as many application teams deploy their own Rollups);

-

And of course, large users/traders.

Valuation

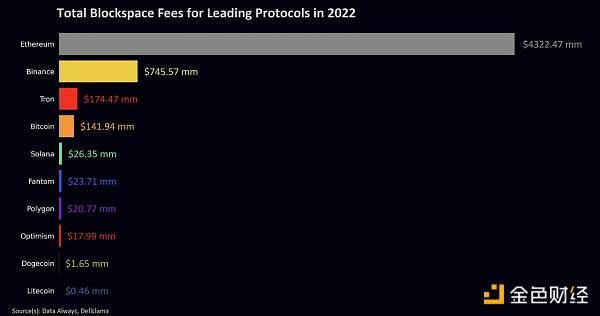

The demand for block space can vary greatly. Data Always has provided a good overview of the block space demand for 2022. Below is a table of block space fees for major protocols:

It is worth noting that most fees paid in native protocols are block subsidies. A valuable indicator to consider when tracking real demand and growth is the percentage of user transaction fees to total block rewards. For example, on Bitcoin, this averages around 2-4%, but on Ethereum, it can be similar during low activity periods but can skyrocket to over 60%. When tracking protocols with mature MEV supply chains, tips should also be included.

Some chains have taken time to develop unique fee markets, one of which is Ethereum’s EIP1559. This upgrade has multiple goals, such as reducing fee volatility, but it also has an important long-term goal of preventing blockchain instability in a world without continuous native token issuance. 1559 results in base fees being burned and priority fees going to validators, reducing the importance/weight of block subsidies in overall block rewards.

To maintain its promise of low-cost fees, Solana has created a native fee market where transaction fees are natively tied to each different contract interaction. If there is high demand for NFT minting on Magic Eden, the transaction fees on Jupiter will not increase. This change is very consumer-centric as it actually reduces the fees validators can expect to receive. However, considering Solana has a well-developed MEV supply chain, native fees may attract more users, thereby earning more fees through MEV tips.

Valuation of block space is still in a very early stage, given that the majority of on-chain block rewards come from predictable block subsidies, rewards, and corresponding valuations have not changed much. However, as halving, increased demand, and the creation of MEV supply chains occur, the proportion of transaction fees/tips to total block rewards will increase, making valuation more unpredictable and introducing unique trading opportunities.

Transactions

Pricing of block space is abysmal. In many cases, blockchains misprice their payment to producers as they continue to mint more inflationary block space of terrible quality. Most block space is cheap and abundant, with only a few instances of expensive block space being valuable.

This is where I expect new implementations of block rewards and fee markets to come in. Currently, most blockchains propose static block subsidies in their whitepapers, perhaps in line with some kind of deflationary schedule. How do they determine the accurate pricing of their block space before their blockchain goes live? I look forward to new implementations that determine block subsidies.

Given that these markets are so nascent, you may just be a producer or consumer and may not have considered that you can trade block space. Currently, these trades are often expressed in the form of swaps, forwards, and futures, but there are also more unique tools such as licensing fees, block inclusion reservations, and gas tokens.

The main places for trading block space currently are:

-

Luxor, where you can trade non-delivery forward contracts for Bitcoin called “Hashprice”.

-

Alkimiya, a more flexible exchange market where you can trade block space for Bitcoin and Ethereum, possibly including gas exchange.

Some promising projects include:

-

Overlay, a perpetual futures platform that allows you to trade native data feeds and explicitly mentions various block space components in its documentation.

-

Oiler, which has multiple products, one of them being Pitchlake where you can trade the base fees of Ethereum.

-

Volmex, a volatility trading platform where I can see something eventually launching a fee or validator reward volatility index.

An interesting product concept is to form a block space quality index based on the above features and create a block space exchange market between blockchains, such as the exchange between Bitcoin and Ethereum block space demands.

In addition to speculative markets being built like Luxor and Alkimiya, these markets are crucial for transferring risk between block space producers and risk-takers. As listed companies and energy companies enter the Bitcoin production field, they will want to reduce their cash flow volatility. As Layer 2 becomes more complex, they will want to hedge their transaction fees on Layer 1. As exchanges and asset issuers seek more efficient operations, hedging their variable transaction costs becomes important.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- When we say institutions are entering cryptocurrencies, what institutions are we actually referring to?

- Starknet’s Volition Analysis The Perfect Interpretation of Data Security and Cost Control

- IOSG founder Token2049 impression Bull market still needs time, the toughest time has come

- Behind the 15 Celebrities Involved in the JPEX Case KOL Cold-blooded Hype Murder, Downtown Cash Throw for Traffic

- RWA in the Eyes of the Fed Tokenization and Financial Stability

- Top Warehouse Research Report Chain Game Guild Yield Guild Games

- Generative Manufacturing Transforming Code into Physical Objects