Banana Gun Research Report How did this sniper rifle make its way to the top of the TG BOT queue?

Banana Gun Research Report How did this sniper rifle rise to the top of the TG BOT queue?Project Introduction

Currently, Telegram Bot has developed rapidly in terms of iteration, and Banana Gun is one of the emerging forces. It has successfully captured one-third of the market share and formed a three-way competition with the major competitors in the market. Compared with other trading bots, Banana Gun has little difference in functionality and mainly focuses on sniping newly listed or issued tokens.

However, in addition to the functionality of the trading bot, Banana Gun has a more important vision, which is to create a sustainable ecosystem project using its economic model. In this ecosystem, robot users become token holders, and token holders also become robot users, forming a virtuous cycle. This design aims to create value for token holders over time and make Banana Gun a long-term project.

Author

Elma Ruan, Senior Researcher at Shi Lian Investment Research, holds dual master’s degrees in marketing/finance from Ivy League schools and has 5 years of WEB3 experience. She is proficient in multiple tracks such as DeFi and NFT. Before entering the crypto industry, she worked as an investment manager at a large securities company.

1. Research Focus

1.1 Core Investment Logic

Using tools to snipe new projects requires a certain technical threshold, and trading bots serve as a link between ordinary cryptocurrency users and high-tech personnel. Banana Gun is a Telegram Bot that has recently been highly sought after. Its simple and user-friendly interface and powerful features have gained a certain reputation. This project has quickly risen and provided various functions such as sniping new project listings, copy trading, and selling tokens, bringing a lot of heat to the current market. Trading bot projects mainly focus on sniping new listings for buying and selling trades, attracting attention due to their potential profit opportunities. In terms of product, it mainly guides users through its economic model.

- A comprehensive inventory of the top ten on-chain Rug Pull projects in the crypto community, mainly from the previous bull market.

- Big Brother Ma Ji Huang Licheng to Launch New Project? Overview of its Organizational Structure and Token Economics

- Token2049 Review Lack of Innovation in Projects, Institutional Focus on Regulation

As of 2023, Telegram has 700 million monthly active users and 55.2 million daily active users, ranking among the top 5 in global downloads. Banana Gun, like other trading bots, chooses Telegram as its platform mainly because of its large user base and the ability to create bots using its API. Telegram values privacy and security, aligning with the values of the cryptocurrency community. The Telegram platform allows Banana Gun to stay connected with users, automate user services, and optimize processes to reduce manual work. By providing an API, Telegram allows Banana Gun to create programmatic bots on the platform for socializing, trading, and attracting user interactions. Overall, the functionality and large user base of Telegram make it an ideal platform for Banana Gun to engage and interact with its target audience.

Following the success of Unibot, Banana Gun entered the field of Telegram bot trading. DEX (Decentralized Exchange) trading bots are becoming increasingly popular among aggressive traders. Banana Gun highlights the feature of sniping new tokens and is sought after by users who like to chase new projects. This convenient feature for users is also one of the reasons why Telegram Bots similar to Unibot have experienced rapid growth. Users can easily execute trades on mobile devices or PCs, making it a one-stop solution. At the time of launch, Banana Gun had a relatively low market value, making its token highly attractive to investors seeking high returns. This attractiveness comes from the token’s economic model, where Banana Gun’s token rewards and burning mechanism are relatively well-developed. The project’s economic model is a positive flywheel mechanism that allows users holding $Banana tokens to receive rewards. Another positive factor is that the project maintains strong data and an active user community after its launch, laying the foundation for long-term success.

Unibot has been rising rapidly, triggering FOMO sentiment among retail investors in the BOT sector and increasing attention to similar projects. With the strong launch of Banana Gun, another competitor, Unibot, has also announced plans to adjust fees in order to maintain market competitiveness. Unibot and Maestro are the main competitors of Banana Gun and have strong followers in the cryptocurrency community. The iteration speed in the robot field is rapid, and Banana Gun occupies one-third of the market share, indicating that it is a critical moment for competition in the Bot market. Since the project announced its token issuance, its momentum has become even more fierce, and it is expected to seize a leading position in the market. This intense competitive environment requires Banana Gun to maintain innovation and steady development in order to maintain its leading position in fierce competition.

However, Banana Gun’s smart contract has undergone two audits and still has vulnerabilities, which is a serious technical issue that needs to be highly vigilant. Anonymous programmers have discovered these vulnerabilities using ChatGPT, highlighting the need for further enhancement of security in the project. In addition, after the launch, Unibot holders may engage in FUD, perhaps because Unibot is a competitor of Banana Gun and its holders may attempt to weaken the success of Banana Gun by spreading fear, uncertainty, and doubt. The negative impact of such competitors requires the project party to have a response strategy. In terms of functionality, Banana Gun still has some shortcomings and has not yet reached the level of functionality similar to Unibot, although the project team is working hard to improve. This may cause some investors to lose interest in the project, especially those who value comprehensive functionality. Finally, the high FDV (Fully Diluted Valuation FDV = Price * Total Token Supply) of Banana Gun’s token after its launch may deter some investors seeking low-risk investments. Taking a comprehensive view, these shortcomings require the project team to think deeply and resolve them in order to ensure the long-term and steady development of the project.

In the current bear market and volatile market conditions, investors are turning their attention to sniper attacks on newly listed tokens because it has lower costs and lower risks than the secondary market. This strategy is particularly popular among retail investors. In addition, the core demand for on-chain innovative projects is still buying and selling, and projects that can attract traffic and generate profits will receive more attention. In the future, the industry may develop into various application models such as web versions or applications, relying on platforms with high traffic to achieve profitability. Profitability will become an important factor affecting the position of the project. Overall, Banana Gun has tremendous potential in the market, but investors should always be aware of market risks and conduct proper due diligence.

1.2 Valuation

Currently, Banana Gun’s FDV has exceeded 84 million US dollars, which is about 12 times the valuation before its launch. For details, please refer to section 4.2.

2. Project Overview

2.1 Project Introduction

Banana Gun is a Telegram-based trading bot, with its main products being Sniper bot and Sell bot. Compared to other copy trading bots, Banana Gun’s advantage lies in its focus on sniper trading during the opening of a token. It allows users to snipe upcoming tokens or trade already issued tokens. The goal of Banana Gun is to become the preferred sniper/manual buying bot on the Ethereum network and consider expanding to more blockchain networks in the future.

2.2 Past Development and Roadmap

Date Event

2023-07-04 Developers release MEV backend update, Dashboard goes live

2023-07-14 Official announcement of development roadmap

2023-07-19 Announcement of collaboration with Ottobots

2023-07-21 Announcement of collaboration with Defirobot

2023-07-31 Announcement of Miner tip as direct transfer to builders

2023-08-01 Official launch of Telegram sniper bot

2023-08-13 Official announcement of partnership with Hype Notifier Bot

2023-08-18 Upgrade FoF’s slippage and sell bundled packages; release Banana Gun whitelist eligibility announcement

2023-08-25 Update development roadmap

2023-09-05 Disclosure of tokenomics distribution; announcement of airdrop for social task completers and NFT holders

2023-09-09 Banana token presale

2023-09-12 Banana token, a bug that cannot be fixed in the contract is discovered. Official announcement of re-auditing the vulnerability and plans to upgrade and restart the airdrop; snapshot in progress

Future Roadmap:

The future roadmap includes the following goals:

· Promote Banana Gun’s services to more users and increase user adoption.

· Continuously increase the size of the fund pool and revenue share.

· Capture a larger market share to leverage economies of scale.

In terms of specific features, Banana Gun plans to:

1) Expand the trading application of the bot to other blockchains, currently limited to the Ethereum chain.

2) Develop a web version of the bot trading application, allowing users to use these features on the web, not just limited to the Telegram platform.

2.3 Team Situation

Overall Situation

Due to the lack of official information about the team, the specific situation is currently unclear.

2.4 Financing Situation

Venture capitalists and incubators have had contact with the Banana Gun project and have a preliminary understanding of it, but ultimately decided not to invest. Currently, Banana Gun’s development relies mainly on funds raised from the community to drive progress.

3. Business Analysis

3.1 Target Audience

The target audience of Banana Gun primarily consists of individuals interested in cryptocurrencies who wish to participate in token trading in a fast and efficient manner. The following are several categories of users who may benefit from Banana Gun’s services:

1) Investors and traders: Banana Gun can assist investors and traders in sniper buying before a project goes live or in safely purchasing tokens after a project goes live. It provides a convenient trading channel to meet their investment needs.

2) Novice users: For novice users in the field of cryptocurrencies, Banana Gun provides a simple and user-friendly platform that allows them to easily participate in token trading and seize profit opportunities.

3) Users enthusiastic about new projects: The flagship feature of Banana Gun is sniper buying of new coins, which provides convenience for users who enjoy participating in new projects and obtaining early investment opportunities. They can use Banana Gun to purchase newly issued tokens in advance to achieve greater potential returns.

3.2 Business Description (Function Description)

1. Configurations

To use Banana Gun, users must follow the following steps in order.

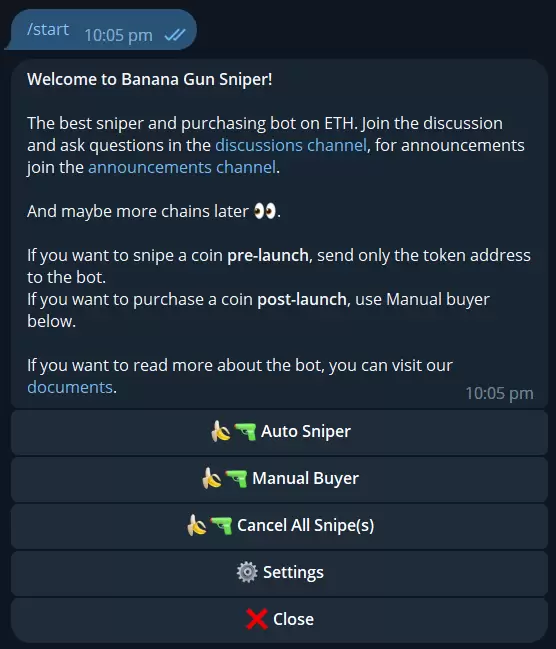

To get started, enter /start in the Banana Gun Sniper Bot, and the main panel will pop up.

Click “Settings” to configure Banana Gun / add wallets based on user preferences.

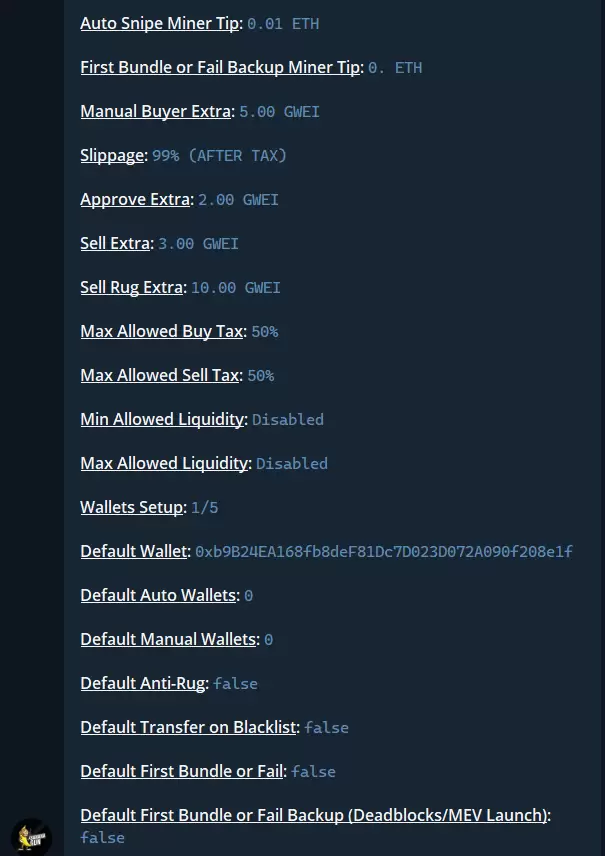

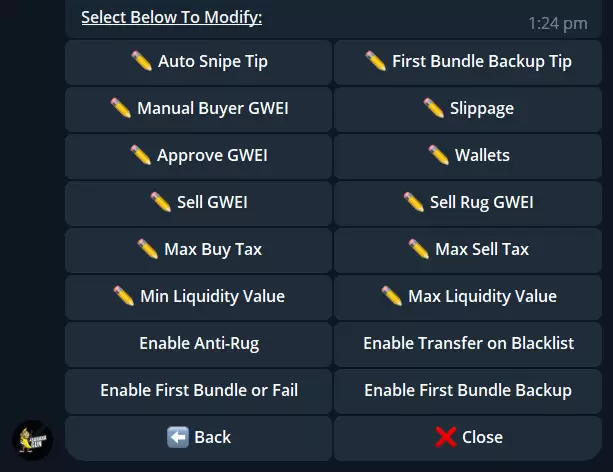

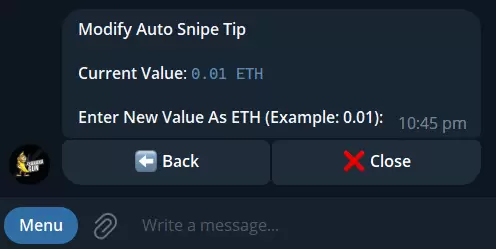

Auto Snipe Tip

Auto Snipe Tip is a feature applicable to tokens that are planned for snatch buying before going live. It allows users to set an additional amount of Ether they are willing to pay as a bribe in order to have a better chance of snatching earlier than other buyers. In other words, by paying more tips, users can improve their position in the transaction block and increase their chances of successful snatching. Note: Banana Bot uses Ether as a bribe, not Gwei. Therefore, users do not need to calculate how much ETH to bribe. Additionally, Banana will use 100% of the input amount.

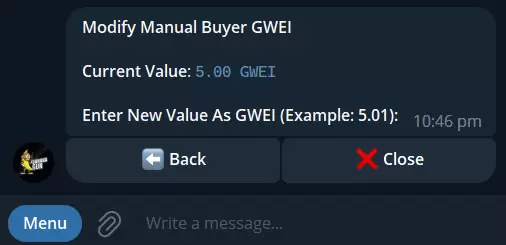

Manual Buyer Gwei

This feature is applicable to the purchase of tokens that have already gone live. It allows users to set an additional amount of Gwei they are willing to pay in order to enter the purchase transaction at an earlier time than other manual buyers. Using more Gwei can allow users to obtain an earlier position in the transaction block, thereby increasing their chances of purchasing tokens.

In simple terms, the core of this feature is to allow users to use a higher transaction fee (Gwei) to purchase tokens as early as possible in order to gain priority in the transaction block. This can increase the chances of successfully purchasing tokens and improve the efficiency of user snatching.

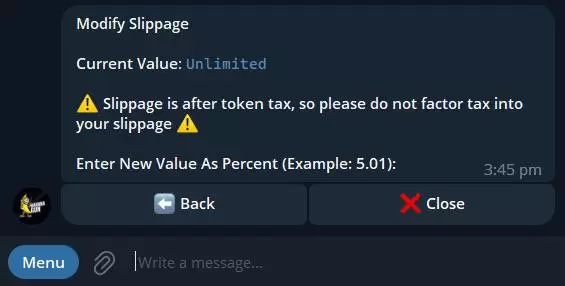

SlipLianGuaige

SlipLianGuaige is a concept involving price fluctuations, typically ranging from 0-100%. It is applicable to projects that do not have a maximum trading quantity limit. The purpose of slip is to allow for price fluctuations or failures during the trading process.

In simple terms, slip refers to the possibility of price fluctuations or transaction failures during a trade due to market conditions or other factors. The percentage of slip determines the extent of allowed price fluctuations. A higher slip percentage means that larger price changes may be accepted, while a lower slip percentage indicates a lower tolerance for price fluctuations.

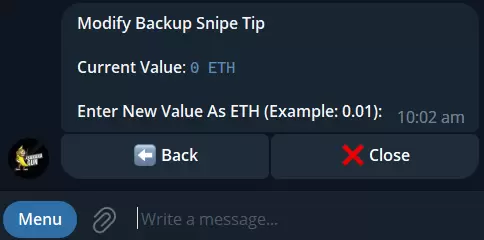

First Bundle Backup TIP

When a cryptocurrency encounters transaction congestion or engages in MEV, the “First Bundle or Fail” feature becomes ineffective, and the “First Bundle Backup” feature is activated. First Bundle Backup is like a disabled sniping method, where users pay additional Ether as a bribe to block builders, giving them priority purchasing rights over other snipers.

Note: This option is only applicable to MEV launches and tokens with Deadblocks.

Approve Gwei

Set how much additional Gwei the user is willing to use to ensure the approval of token sales. Using more Gwei can prioritize the user’s transaction processing and complete it faster.

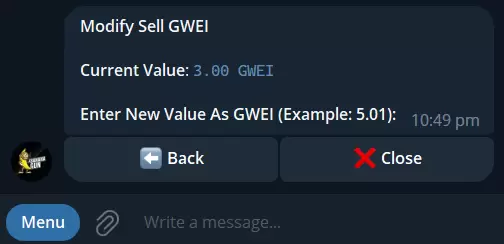

Sell Gwei

Set how much additional Gwei the user is willing to use to sell the required tokens. Using more Gwei can prioritize the user’s transaction processing and complete it faster.

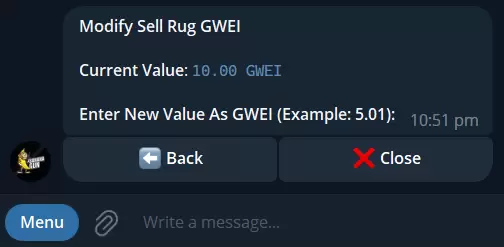

Sell Rug GWEI

Before the Rug, there will be a broadcast of DEV’s remove, which will be monitored by a bot. The bot will activate a defense mechanism. If the user’s Gwei setting is higher than DEV’s remove operation, the token can be successfully sold before the project is Rug, avoiding financial losses.

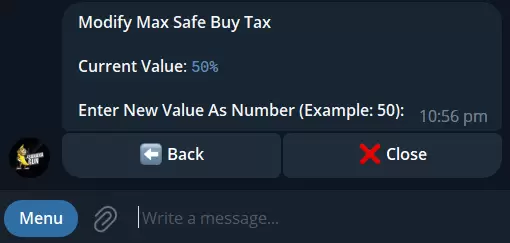

Max Buy Tax

When the purchase tax rate of the selected token is equal to or below this amount, the sniping bot/manual buyer will be triggered. For example, if the purchase tax rate of XYZ token is 99% upon launch, the bot will not be activated and the sniping will remain in “pending mode”. If the developer reduces the purchase tax rate to 75%, the bot will be activated in the same block. This ensures that high tax rates do not affect the purchase efficiency and cost.

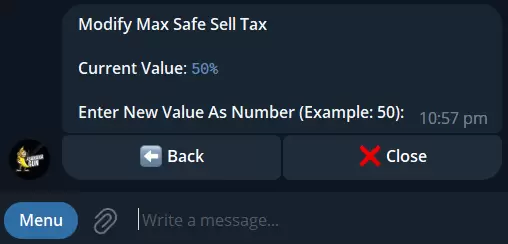

Max Sell Tax

When the sell tax rate of the selected token is equal to or lower than this amount, the snipe bot/manual buyer will be triggered.

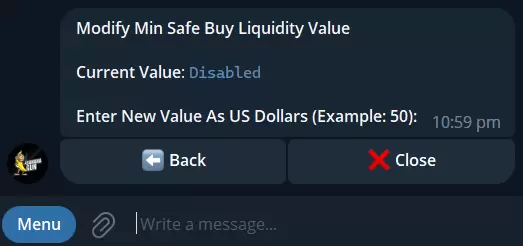

Min Liquidity Value

The snipe bot/manual buyer will only be triggered when the market liquidity of the token reaches or exceeds the amount set by the user. This ensures that there is sufficient market liquidity during the purchase to avoid issues or high costs.

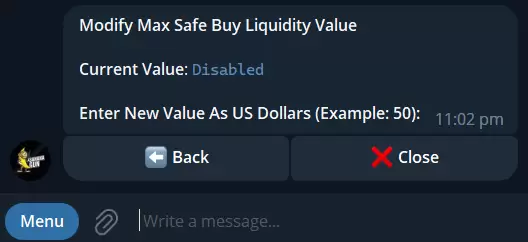

Max Liquidity Value

The snipe bot/manual buyer will only be triggered when the market liquidity of the token reaches or falls below the amount set by the user.

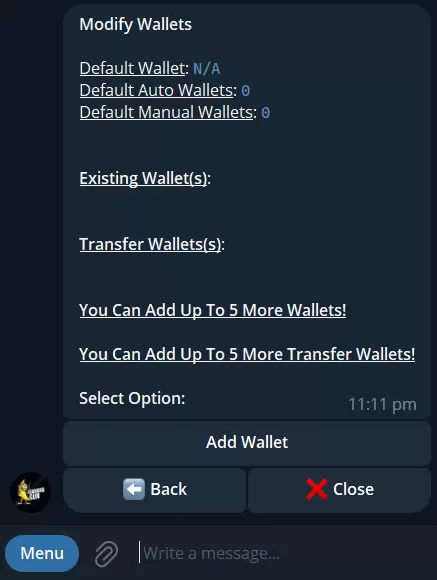

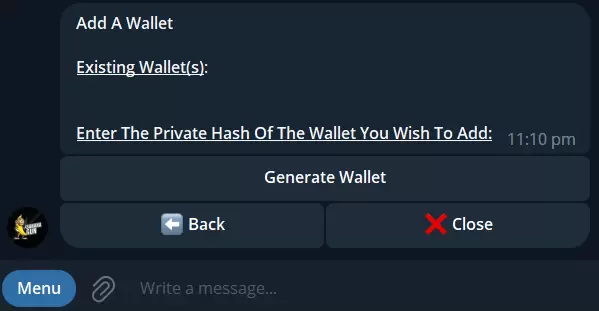

Wallets Setup

In Banana Bot, users can connect up to 5 wallets. Users can choose to import existing wallets or generate new wallets by Banana Bot.

2. How to snipe

By following the steps below, users will be able to use Banana Gun to snipe unreleased tokens on the Ethereum network.

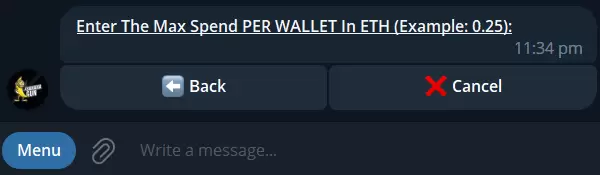

1) Paste the token contract address (CA) that the user wants to snipe into BananaGun Sniper bot, and a question will pop up asking how much Ether to spend.

Example: The Prelaunch data tells the user that the maximum allowable purchase amount will be 0.02 WETH (a form of Ethereum) as the maximum wallet. If the user enters 0.1 WETH, Banana Gun will spend as much WETH as possible to obtain the maximum wallet, but not exceeding 0.1 WETH. If the price of the maximum wallet is higher than 0.1 WETH, it will purchase tokens worth 0.1 WETH.

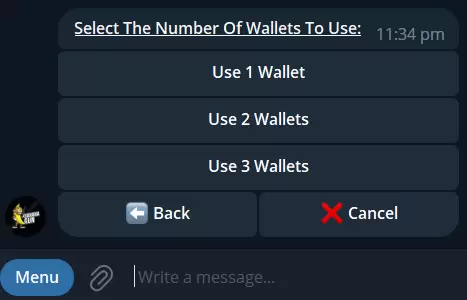

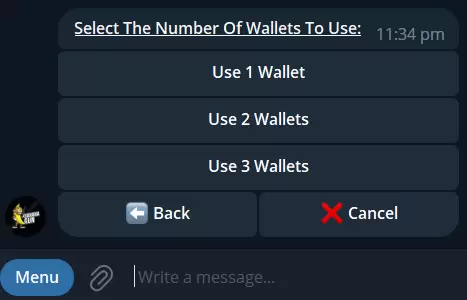

2) Select the number of wallets the user wants to buy.

If the user has set a default wallet (automatic), Banana will skip this step.

3) User initiates the snipe, if Banana Gun is triggered and successfully enters, the token will be loaded into Banana Gun Sell Bot.

3. Pending Snipes

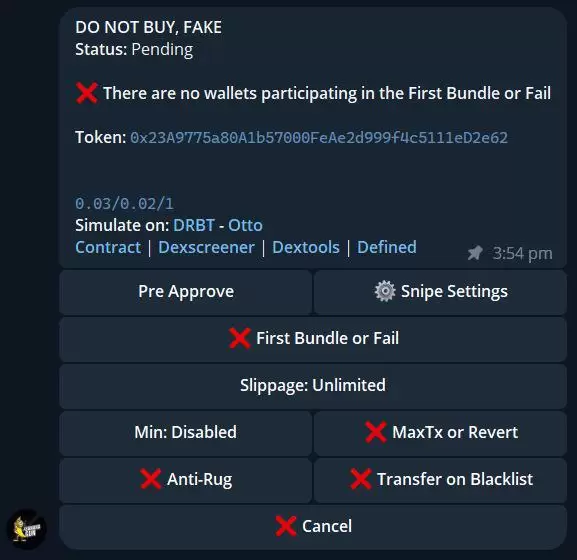

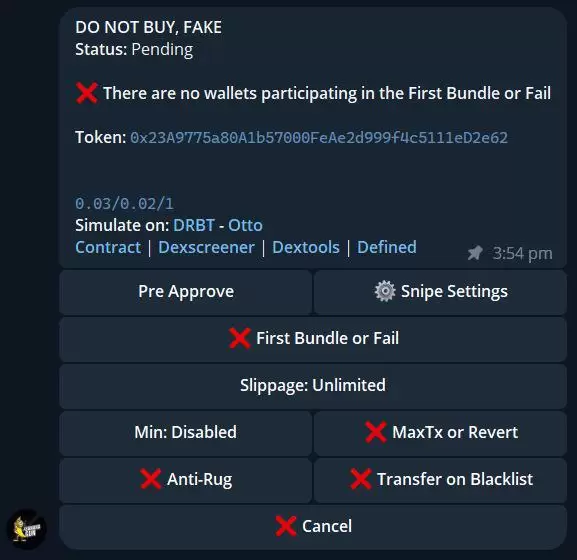

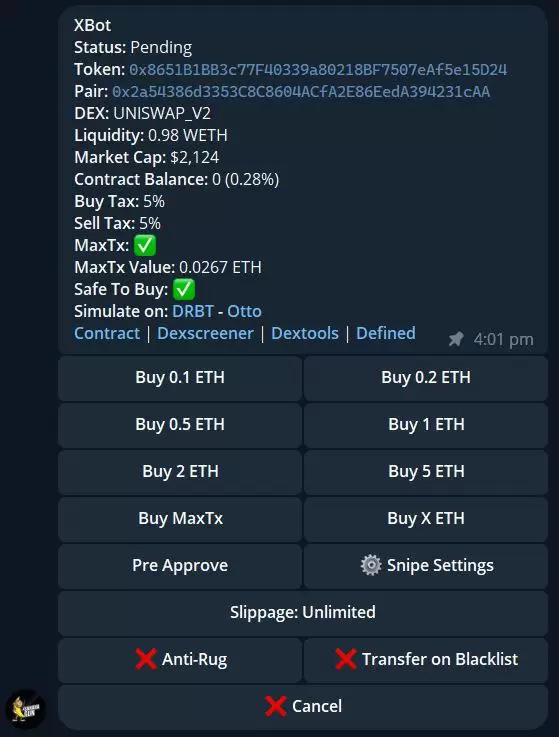

When the user successfully sets up a snipe, the user will see a pop-up window displaying the detailed information of the activated snipe and the following buttons.

Pre Approve

The default setting is to approve the purchase of tokens after sniping. If the user wants to complete the transaction as soon as possible, the user can pre-approve the token.

Snipe Settings

If the user wants to change the settings when starting the snipe, click this button.

Important reminder: Changing any settings here will only change the settings for this snipe. The settings for other pending snipes will not be changed, and new snipes will adopt the settings of the primary settings.

MaxTx or Revert

Automatically set the maximum transaction amount (MaxTx), and if the amount spent exceeds the maximum amount, it will be reverted (if the robot detects that no maximum transaction amount is set, the snipe cannot be performed).

For example: The maximum transaction volume of the token is 2%, and the user sets the maximum expenditure to 0.1 ETH. If the value of 2% exceeds 0.1 ETH when the user makes a purchase, the user’s transaction will be rolled back (the user’s current gas fee will be spent, and the tax will be applied when the snipe is executed).

SlipLianGuaige

The normal range is 0-100%, applicable to trading releases without setting a maximum transaction limit. This range allows for greater price fluctuations or possible failures.

Min (Mintoken)

The user can set the minimum percentage or quantity of tokens to be purchased.

For example: If the user sets the minimum token quantity to 1% and the maximum expenditure to 0.1 ETH. If 0.1 ETH is only equivalent to 0.5% of the tokens when the user makes a purchase, the purchase will fail (this will incur the current gas fee, and the corresponding tax will be applied when the snipe is executed).

First Bundle or Fail Backup

If the user sees a check mark, it means it has been turned on. If the user wants to turn off the “First Bundle or Fail Backup” function, the user can turn it off.

Anti-Rug

If the user sees a check mark, it means the “Anti-Rug” function has been turned on. If the user wants to snipe without enabling the anti-rug function, the user can turn it off.

Transfer on Blacklist

If the user sees a check mark, it means this option has been enabled. If the user wants to snipe without enabling transfer on the blacklist, the user can turn it off.

First Bundle or Fail

If the user sees a check mark, it means it is enabled. If the user wants to snipe without the first bundle or fail, the user can turn it off.

Cancel

The user can cancel the snipe.

4. Manual Buying

1) First, paste the CA (contract address) that the user wants to buy. It will automatically detect whether the token has been listed and whether it has passed the security tax and security liquidity details set by the user. If the token has been listed, the Banana bot will ask the user how many wallets to purchase with.

Note: If the user has set a default wallet (manually), Banana will skip this step.

2) Banana Bot will send detailed information about the token, and the user will have various options to determine how much Ether they want to spend.

Important note: If the user chooses to purchase an amount of Ether that exceeds the maximum wallet amount, the system will use the maximum wallet share to make the purchase and deduct the required amount from the user’s Ether. The excess Ether will be returned to the user’s wallet. In other words, the system will try to meet the user’s purchase needs with the maximum wallet amount, and any excess money will be refunded to the user.

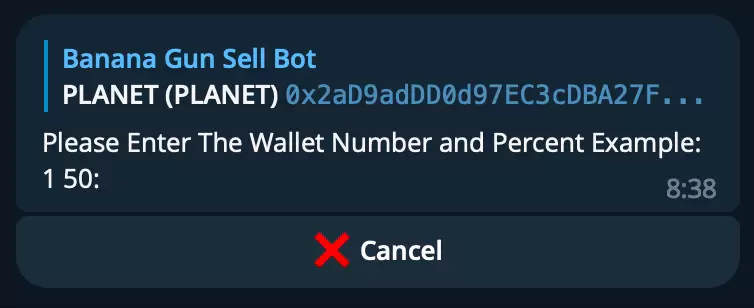

Figure 23

If Banana Gun successfully purchases the token, the token will automatically be loaded into the Banana Gun Sell bot.

5. How to handle active tokens

The Banana Gun Sell Bot is responsible for handling active tokens purchased through the Banana Gun Sniper Bot.

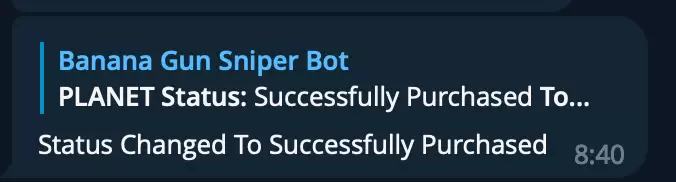

When a user successfully purchases a token, they will receive the following notification on the Banana Gun Sniper Bot:

After receiving this message, the token will automatically be loaded into the Banana Gun Sell Bot.

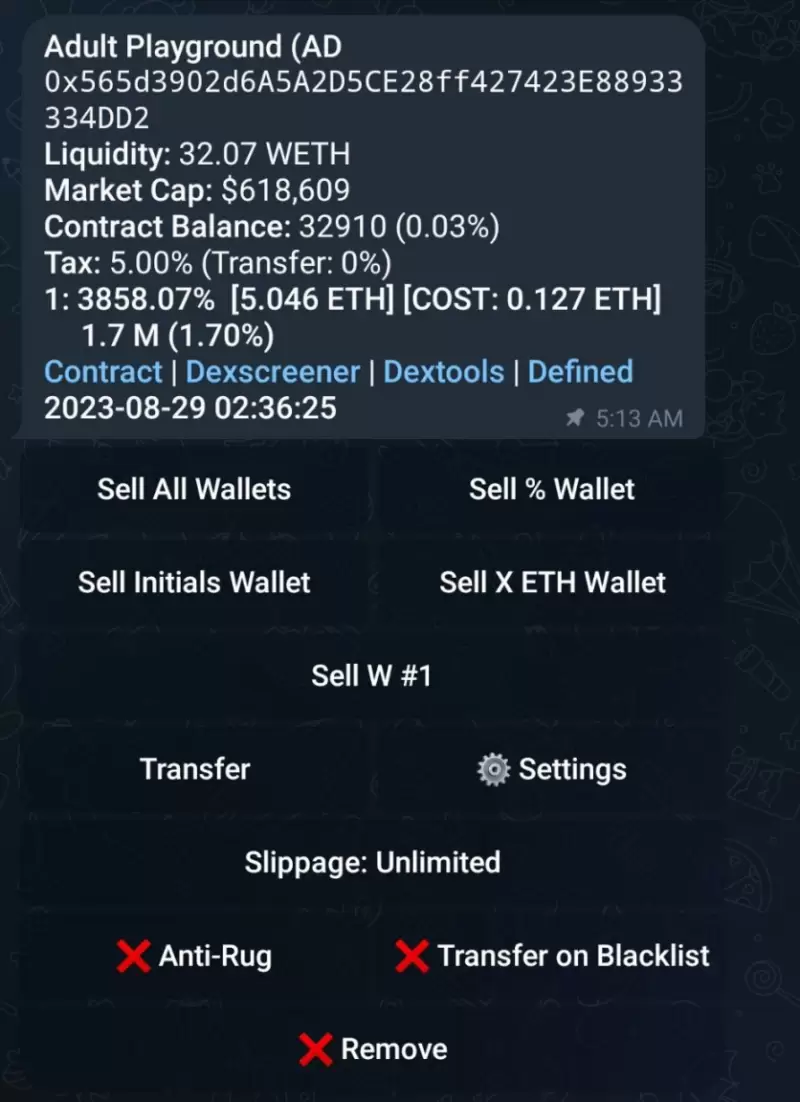

Figure 25

Liquidity – WETH in the liquidity pool.

Market Cap – The market value of the token.

Contract Balance – The remaining token supply in the contract address.

Tax – Sales tax for the token.

Transfer – Transfer tax for the token if the user wants to transfer it to another wallet.

Timestamp – The last time this window was updated.

All Sell Wallets

If the user clicks this button, the token will be sold on each wallet (if the user used multiple wallets for the purchase).

Sell% Wallets – Sell a certain percentage of tokens in the sell wallet

When the user clicks this button, they can choose to sell a certain percentage of tokens on each wallet (if the user used multiple wallets for the purchase). For example, “1 50” means the system will sell 50% of the tokens in wallet 1. In other words, the user can choose to sell a portion of the tokens in the wallet at a certain percentage.

Sell W # – Sell

If the user clicks this button, 100% of the tokens will be sold in wallet #1.

SlipLianGuaige – Slippage

Slippage refers to the range of price fluctuations allowed during execution of a transaction, usually between 0% and 100%. Slippage is applicable in cases where no maximum trade limit is set, allowing for a certain degree of price fluctuation or failure.

Transfer on Blacklist

When users click this button, the system will automatically transfer the tokens in their purchased wallets to their transfer wallets. This way, users can avoid being blacklisted. Developers may blacklist early buyers, which means they cannot participate in certain activities or enjoy specific benefits. By clicking the button and transferring the tokens to their transfer wallets, users can avoid the risk of being blacklisted.

Settings

Users can configure specific tokens. These configurations are the same as the settings mentioned in the overall configuration. However, it should be noted that any changes made here will only affect the settings of the current purchase activity, not the settings of other pending purchase activities. New purchase activities will adopt the settings in the main settings, not the changes made by users here. So be careful to ensure your intentions and expectations when making settings.

Anti-Rug Protection

If users see a checkmark, it means that this option has been enabled. If users want to snipe without enabling the anti-rug protection, they can turn it off.

Core Idea:

The core idea of this operation is to ensure that when purchasing tokens, a measure of anti-rug protection is enabled to avoid losses in token value caused by malicious operations. If users do not want to use this protection, they can choose to turn off this option.

Remove

Users can remove tokens from the Banana Gun Sell Bot by clicking this button. If users find that the window is not updating, it means there is a problem with the TG API. Users can remove it and reload it to resolve the issue. If users remove tokens from the Banana Gun Sell Bot, they will lose the anti-snipe protection, which means they cannot sell the token temporarily until they reload it.

3.4 Industry Space and Potential

3.4.1 Classification

Telegram Bots have performed well in attracting investors, thanks to their precise audience, which consists of native users in the cryptocurrency field, making it relatively easy to attract customers. However, this approach may overlook potential users outside the cryptocurrency field.

In the current market situation, Telegram bots operate based on the “chasing small coins” model, and the rising cycle of most tokens is short, with the possibility of skyrocketing or plummeting within a few hours. Users continuously use bots to find new breakout points. As the market overall leans towards a bearish trend, mainstream cryptocurrencies such as Bitcoin and Ethereum no longer attract more attention from native users, which may affect the attention and liquidity of altcoin markets. In addition, the security issues of user wallets are also a major obstacle to long-term development. Nonetheless, Telegram Bots’ outstanding performance has brought new vitality to the market.

Common cryptocurrency trading bots are classified according to their main functions and categories, providing various functions in different cryptocurrency trading and analysis fields:

DeFi Category Robots:

Unibot – DeFi robot for trading.

WagieBot – DeFi robot for trading and tracking.

Boltbot – DeFi robot for trading.

0xSniper – DeFi robot for trading.

NitroBot – DeFi robot for trading.

Xbot – DeFi robot with customizable trading.

ASAP – DeFi robot dedicated to Discord.

SwipeBot – DeFi robot supporting AI trading with $ETH, $ARB, $BSC.

Bridge Bot – DeFi robot for cross-chain operations.

AI DEV – DeFi robot supporting AI trading and token issuance.

All In – DeFi robot supporting AI trading.

Data Analysis Category Robots:

Cipher Protocol – Robot for data analysis.

NeoBot – Robot for data analysis and tracking.

Meowl – Robot providing data analysis and toolkits.

TokenBot – Robot for social trading.

Trace AI – Robot supporting AI data analysis.

Scarab Tools – Robot for data analysis.

BlackSmith – Robot supporting AI data analysis.

TrackerPepeBot – Robot supporting AI data analysis and contract security testing.

DAGMI – Robot for tracking.

First Sirius – Robot for data analysis.

The DIG – Robot for token and NFT data analysis.

WallyBot – Robot for wallet analysis.

Airdrop Ambush Trading:

Farmer Friends

LootBot

alfa.society (provides airdrop tips)

Others:

EnigmaAI – Robot supporting custom AI trading on centralized exchanges.

NexAI – Robot providing various AI tools.

0x1 – Multi-functional cryptocurrency trading robot.

MagiBot – Robot for privacy trading.

3.4.2 Market Size

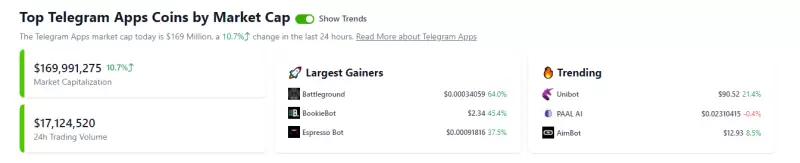

Although Telegram Bots have gained recent attention, the fact is that plugin-like robots have long existed and are not limited to Telegram and Discord platforms. However, in the recent market environment, TG trading robots have shown outstanding performances and attracted widespread attention. According to Coingecko’s data (2023.09.14), the total market value of the Bot sector is currently about $169 million, with a trading volume of approximately $17 million in the past 24 hours.

From the enthusiastic response of the market to TG trading robots, it can be observed that the demand for such robots is growing rapidly and may continue to expand in the future. This trend may be driven by the rapid development of the cryptocurrency and blockchain market and the demand from investors for automated trading and auxiliary tools.

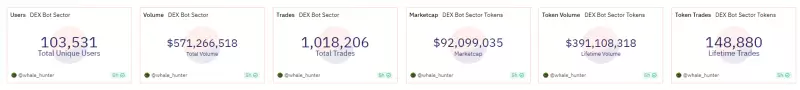

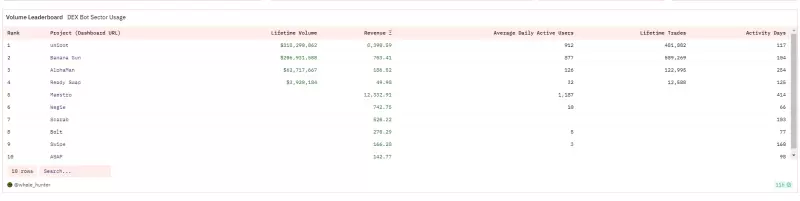

According to Dune data, the Bot sector currently has over 100,000 users, with a total trading volume of $570 million and over 1.01 million transactions. The total market value of projects that have launched and issued tokens in the Bot sector is approximately $92 million, with a total trading volume of the BOT token reaching $390 million. From the data, the Bot sector demonstrates high market activity and user participation, showing great potential.

This trend reflects the growing trust and demand from investors for robot trading tools. With the continuous development of the cryptocurrency market and the popularity of automated trading, the Bot sector is expected to continue to thrive.

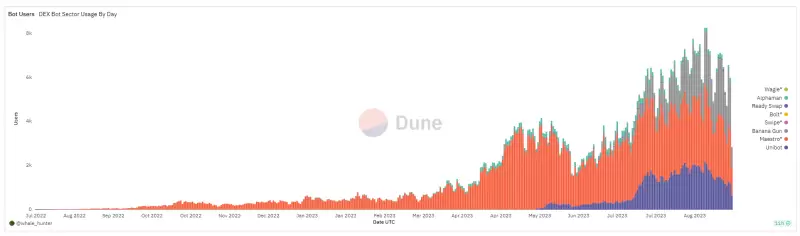

In terms of user numbers, Unibot, Banana Gun, and Maestro are currently in a competitive position. In the past, Maestro held the dominant position and had the majority of user share. However, with the entry of Unibot and Banana Gun into the market, they have gradually eroded Maestro’s advantage in terms of users. This shows a fierce competition.

In terms of trading volume, Unibot, Banana Gun, and AlphaMan rank in the top three (data on Maestro’s trading volume is not clear yet). However, AlphaMan’s total trading volume is only one-third of Banana Gun’s. This indicates that AlphaMan is relatively weak in terms of trading volume.

Looking at the development trend of the market, as competition intensifies, these platforms may further enhance user experience and functionality to attract more users and trading volume.

3.5 Business Data

•Operational Data

User Situation

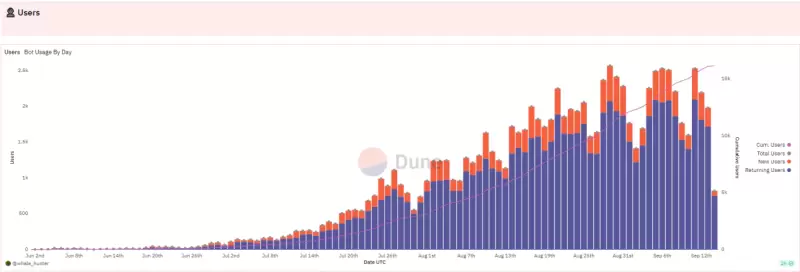

According to Dune data, the project currently has a total of 16,195 users, with the number of daily active users fluctuating between 1,700 and 2,300. The proportion of new users per day is about 15% of the total number of users. The project’s user growth trend started in mid-July and has reached a relatively high and stable level by mid-August. It is worth noting that there was no significant increase in new users observed after the project token was launched.

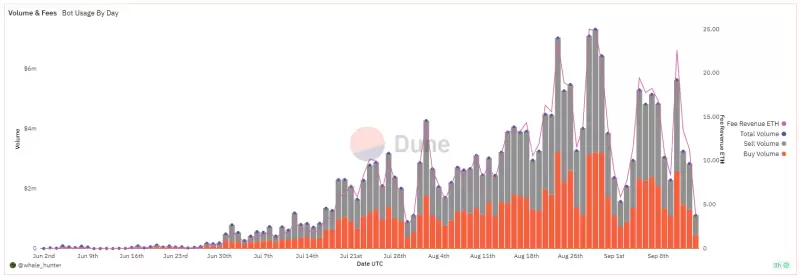

Trading Volume and Revenue

According to the data, as of now, Banana Gun robot has achieved a total trading volume of $210 million since its inception, with nearly 600,000 transactions and an average of 32 transactions per user. The average transaction amount per user is $12,000. It is worth noting that from the chart data, it can be observed that the proportion of buy and sell used by the Banana Gun robot is relatively balanced. There was a small peak in trading volume in early August and early September, and the latest data shows a slight decline in trading volume, which may be influenced by the contract vulnerability risk.

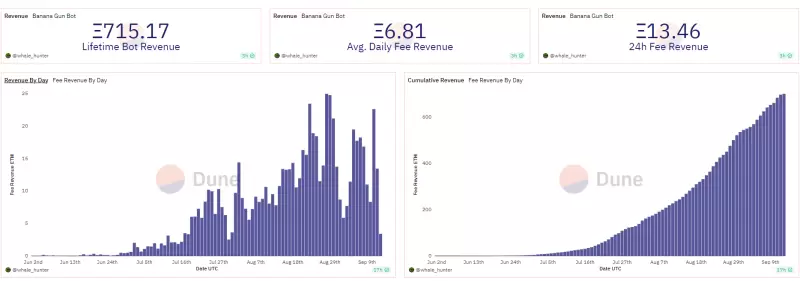

Profit

From a profit perspective, the total profit of the Banana Gun project is 715 Ether, which, based on the current price (as of September 14, 2023), amounts to a total revenue of $1.13 million. The average daily profit is approximately 6.81 Ether, with the highest daily profit reaching 25 Ether and the lowest daily profit being 2.3 Ether in the past two months. It should be noted that the profit level corresponds to the peak trading volume, but there has been a certain degree of decline recently. This may be influenced by market fluctuations and project operation strategies.

• Social Media Data:

Twitter: 22,000 subscribers

Telegram: 7,491 subscribers

3.6 Project Competitive Landscape

User data is one of the important indicators for project comparison. It reflects the popularity of the tools in the market and the level of user engagement. In this project comparison, the focus will be on the user data rankings of the top three bot tools: Maestro, Unibot, and Banana Gun.

3.6.1 Project Introduction

Maestro

Maestro Sniper Bot was launched in 2022 and is one of the earliest sniper bots in the market. It is mainly used to quickly snipe new contract positions on decentralized exchanges (DEX). With the development of DEFI, there are more and more user experience issues, and Maestro Bot is one of the best tools to solve these problems. It currently supports three chains: BNB Chain, Ethereum, and Arbitrum.

Although the use of Maestro Bot is free, a 1% transaction fee is charged for each successful trade. In addition, Maestro also provides a paid premium subscription service that offers a higher version called “Maestro Pro Bot” for a monthly fee of $200. Subscribers will enjoy privileges such as faster speed, more concurrent trades, and exclusive access to token metrics.

Unibot

Unibot is a bot that provides DeFi trading tools on Telegram. It can execute various commands such as token exchange, copy-trading, cross-chain asset transfers, etc. Unibot aims to build a user-friendly wallet and integrate closely with DEX to provide users with a convenient cryptocurrency interaction experience. With advanced algorithms and powerful infrastructure, Unibot can provide high-speed functions, including private nodes for sniping, private transaction options, wallet monitoring, and token tracking.

3.6.2 Project Comparison

1) User Data (as of September 14, 2023): Banana Gun has 2,741 daily users, Unibot has 1,340 daily users, and Maestro has 2,661 daily users. According to recent data, Banana Gun accounts for 39.3% of the user market, Maestro accounts for 38.2%, and Unibot accounts for 19.2%. Overall, Banana Gun and Maestro have a larger user market share, while Unibot has less momentum.

2) Transaction Data (2023.09.14): In terms of total trading volume, the trading volume of Banana Gun is 210 million USD, while the trading volume of Unibot is 320 million USD. The data for Maestro has not been recorded yet. Given that Unibot was launched earlier than Banana Gun, this may partially explain the higher trading volume. Overall, although Banana Gun is relatively new, its trading volume also shows market attention and recognition.

3) Transaction Fees:

– Banana Gun: Charges a fee of 0.5% for manual trades and 1% for sniper trades;

– Unibot charges users a default transaction fee of 1%. If users hold at least 10 $Unibot and connect their wallet to the robot, they will enjoy a 20% fee discount. In addition, users will receive an additional 10% fee discount by interacting with the robot through a referral link.

When buying and selling $Unibot, a one-time tax of 5% will be charged, with 1% going to liquidity providers, 2% distributed to token holders, and the remaining 2% used for team and project operating costs.

– Maestro charges a 1% transaction fee for all trades.

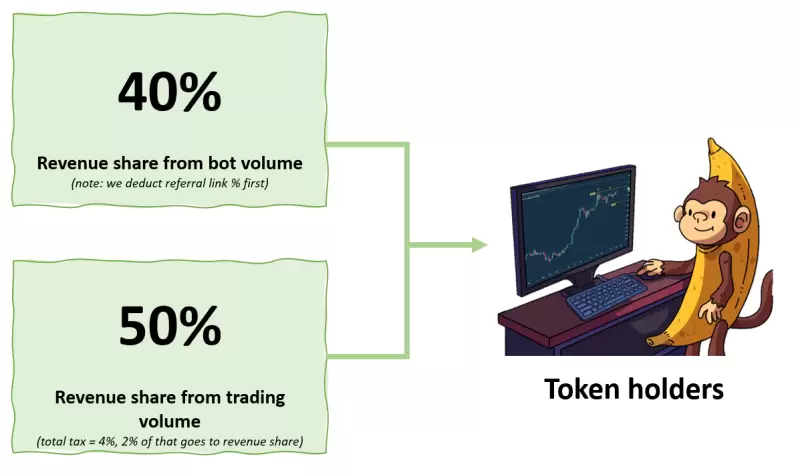

4) Income Distribution to Holders:

– Banana Gun comes from robot trading revenue (40% after referral) and 50% of tax revenue.

– The distribution mechanism for Unibot is to allocate 40% of all robot transaction fees to token holders. This distribution mechanism does not require staking, but users must hold at least 10 $Unibot tokens. Profit rewards are distributed in ETH.

– Maestro currently has no income sharing or referral rewards.

5) Key Products:

– Unibot: A referral system with profit sharing functionality.

– Banana Gun: Its main feature is the separation of buyer and seller robots.

– Maestro: Currently applicable to Ethereum, BSC, and Arbitrum chains. It has some special features, such as Presale Snipe, TG Group Mirroring, and Bribes+Bundle Snipes (only available in the advanced version).

6) Future Development:

– Maestro plans to launch more features and tools to meet user needs.

– Unibot plans to introduce more trading strategies and custom options to improve the flexibility and adaptability of the robot.

– Banana Gun plans to launch a web version of the robot and expand to other chains.

3.7 Token Model Analysis

3.7.1 Token Total Supply and Allocation:

Token Name: $Banana

Applicable Blockchain: Ethereum

Token Unlocking Status: Please refer to the following image

• There are a total of 2.5 million tokens available for circulation in the presale and liquidity pool.

The token will have a 4% buy tax and a 4% sell tax (this tax will gradually decrease as the market value significantly increases).

– 2% will be allocated to token holders.

– 1% will be allocated to the team.

– 1% will be allocated to the treasury.

• The project will provide initial liquidity with 500,000 $Banana tokens and $325,000 worth of liquidity funds, totaling $650,000. This will give Banana an initial market value of $1.63 million, so the initial price will be $0.65, the same as the presale price.

This liquidity ratio is relatively healthy, about 40% relative to the circulating market value. This ratio is an ideal balance point in terms of market volatility and trading depth. In simple terms, this configuration provides sufficient liquidity to the market while reducing the risk of extreme fluctuations.

3.7.2 Presale and Airdrop Details

Presale

Duration: 3 weeks

Rules: Users can accumulate bound NFTs by completing various tasks in the robot.

Purpose: To identify users who are loyal to the robot.

Rewards: These NFTs will be used to determine who will be whitelisted and participate in the launch.

Details:

· Maximum fundraising: 800E

· Maximum holding per address: 1E

· Presale price: $0.65

· Listing price: $0.65

· Initial market value: $1.56M

· Initial FDV: $6.5M

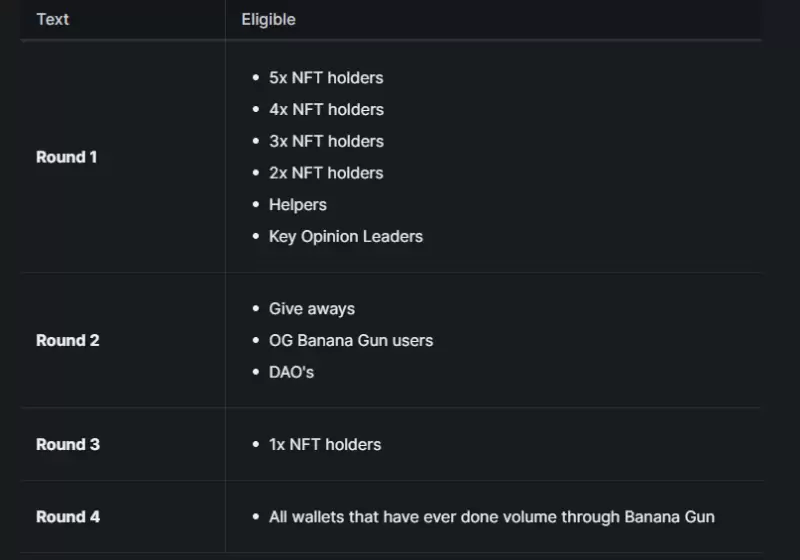

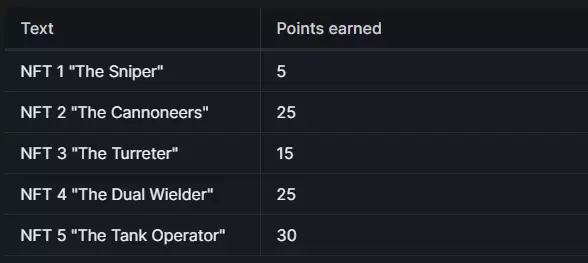

(These quotas will be opened in different rounds on a first-come, first-served basis. After each round, the remaining quotas will be moved to the next round.)

Airdrop

The project will conduct two airdrops, one for NFT holders and one for social task completers:

1) Airdrop A Total allocation: 100,000 $Banana

Target: NFT holders

Details: NFT holders can receive different amounts of points based on the requirements and difficulty of each NFT. The airdrop will be released linearly in stages for 2 months.

Calculation rules:

– Determine the total quantity of each NFT.

– Calculate the total points by multiplying these quantities with the points of each NFT.

– Divide the total airdrop amount of $100,000 by the total number of points.

– Get the dollar amount per point multiplied by the number of points.

2) Airdrop B Total allocation: 20,000 $Banana

This airdrop is mainly targeted at those who complete social tasks, such as community members, KOLs, etc. Specific details have not been announced yet.

3.7.3 Token Holder Benefits

1) Holder Benefits Sharing

Source of Income: From robot trading revenue (40% after referral) and 50% of tax revenue.

Significance: Aimed at incentivizing token holders to hold tokens and providing a stable foundation for token prices in conjunction with the project’s future growth potential.

Note: Only unlocked tokens can accumulate income shares (50% of tokens held by the team will be locked for long-term holding and will not be included). This income only applies to users who own $Banana tokens. If tokens are sold before the snapshot, no income will be obtained. Users can claim income at any time on the Banana Gun dApp.

2) User Rewards

Now, users can trade with robots and receive a small amount of Banana tokens as rewards (these tokens will also enjoy income sharing). Over time, this ratio will grow rapidly. In this way, robot users become token holders, and token holders become investors.

The project rewards users who use robots with Banana tokens. When trading with Banana Gun’s robots, users will pay transaction fees (common practice among all robots).

The fees are as follows:

Manual Purchase = 0.5%

Automatic Purchase = 1%

To incentivize loyal robot users, the project will partially refund the fees in the form of Banana tokens to encourage trading with Banana Gun. The refund ratio will be calculated according to the following formula:

Banana Cashback = Paid Fees (in USD) * Adjustment Coefficient X

(The Adjustment Coefficient X is a adjustable multiplier that ranges between 0.05 and 1)

Example: Short-term trader John likes to engage in speculative and buying transactions through Banana Gun. Within a week, he bought and sold tokens worth a total of $10,000 at an average fee of 0.75%. Meanwhile, the trading price of Banana was $10, and the multiplier was 0.2.

He paid a fee of $75 in ETH

He received a cashback of $75 * 0.2 = $15, which is equivalent to receiving 1.5 Banana tokens

This means that he can obtain the reward he originally intended when purchasing the tokens.

3.7.4 Token Model Value Capture

The goal of the token model is to promote a positive cycle of the token economy and maintain a low inflation pattern. Through repurchase mechanisms, adjustable coefficients, and income sharing with investors, it aims to balance supply and demand, control inflation rates, and ensure the sustainability of the token economy. This can minimize the impact of selling pressure on token prices, promote active participation and investment from token holders, as follows:

1) Repurchase through a 1% treasury tax: In all cases, this can offset most of the inflation.

2) Adjustable coefficient: The project party can use this leverage to precisely balance the issuance.

3) Ape-to-earn will bring higher robot trading volume, forming a virtuous cycle.

4) High proportion of token revenue sharing, so investors will be more inclined to hold tokens.

The contraction/inflation range will be between -30% / +30% and will be influenced by the following three main factors:

Token price

Robot trading volume

Total trading volume

4. Preliminary valuation

4.1 Core question

Does the project have a reliable competitive advantage? Where does this competitive advantage come from?

The Banana Gun project has a reliable competitive advantage, which is mainly attributed to the following factors:

1) Resource advantage: Banana Gun has successfully attracted a large number of users to participate and use in the early stages, thereby establishing a large and active user base. This creates economies of scale and network effects for Banana Gun, making it difficult for other non-head competitors to catch up in a considerable amount of time.

2) Marketing strategy: The Banana Gun project has implemented successful strategies in market promotion. By adopting effective marketing strategies and channels, Banana Gun has successfully attracted more user attention and participation. This excellent marketing capability helps improve brand awareness and user recognition, giving it a competitive advantage.

3) Market share: Banana Gun has already gained a certain market share, indicating that it has established a certain influence in the market. Compared to new competitors entering the market, they have a relatively stable position, which increases user loyalty and market share.

However, it is important to note that the market competition is a constantly changing environment, and competitors are also constantly developing and improving. In order to maintain a competitive advantage, the Banana Gun project needs to continuously innovate, enhance user experience, and maintain close interaction and feedback mechanisms with users. This can continuously meet user needs and sustain the growth of competitive advantage.

What are the main variable factors in the project’s operations? Are these factors easy to quantify and measure?

The main variable factors in the operation of the Banana Gun project can include the following aspects:

1) User growth: User growth is a key variable factor that can be measured by statistics such as the number of registered users, active users, and paying users.

2) User retention: User retention rate is an indicator of user loyalty and stickiness, which can be quantified by tracking user activity and repeat purchase rate.

3) Revenue and profitability: Revenue and profitability are important indicators of project sustainability. Sales revenue, net profit, etc. can be tracked to measure revenue and profitability.

4) User Satisfaction: User satisfaction is a key indicator for understanding the satisfaction level of users towards products and services. User satisfaction can be quantitatively or qualitatively measured through methods such as surveys, user feedback, and evaluations.

5) Market Share: Market share is an indicator that measures the position and influence of a project in the overall market. Market share can be measured through methods such as market research and competitive comparisons.

These variable factors can be quantified and measured to some extent. By collecting and analyzing relevant data, these factors can be evaluated and compared. However, certain factors (such as user satisfaction) may be more subjective and require qualitative methods for measurement and understanding. In addition, appropriate measurement standards and indicators need to be set based on the specific circumstances and goals of the project to ensure accuracy and comparability.

4.2 Valuation Level

1) Before Token Listing:

Since the pre-sale accounts for 20% and the maximum pre-sale amount is 800E, as of September 14, 2023, with the Ethereum price at $1621, the valuation of Banana Gun can be calculated as follows:

Maximum pre-sale amount: 800E

Ethereum price: $1621 (September 14, 2023)

Pre-sale percentage: 20%

Valuation = Maximum pre-sale amount x Ethereum price / Pre-sale percentage

Valuation = 800E x $1621 / 20% = $6,484,000

Therefore, based on these parameters, the valuation of Banana Gun is approximately $6,484,000. This is an estimated value based on the provided data and calculation method, and the actual valuation may be influenced by various factors.

2) After Token Listing:

As of September 17, 2023, the current token price is $8.493, and the FDV (Fully Diluted Valuation) is $84,929,995. Therefore, the current FDV of the project has exceeded $84 million, which is approximately 12 times the pre-listing valuation.

4.3 Main Risks

1) Security Risk: The project requires users to provide private keys, which may pose security risks despite not requiring mnemonic phrases. Private keys are sensitive information of user wallets, and once leaked or mishandled, it may lead to asset loss. Therefore, users need to pay special attention to protecting private keys and ensure necessary security measures when interacting with the project.

2) Token Economic Model Risk: The project’s token pre-sale accounts for 20% of the total supply, which may result in significant selling pressure. If a large number of token holders sell in the market, it may have a negative impact on token prices. Investors need to carefully consider this factor and understand the token supply and distribution situation.

3) Professionalism of the Development Team: The project’s development team may have issues, including code errors. The occurrence of vulnerabilities in tokens during the initial listing stage indicates certain deficiencies in the technical competence and professionalism of the development team. Users need to conduct due diligence on the team behind the project and evaluate their development and management capabilities.

5. References

1. https://docs.Bananagun.io/ Official website

2. https://twitter.com/BananaGunBot Official Twitter

3. https://www.coingecko.com/en Coingecko

4. https://Unibot.app/ Unibot official website

5. https://docs.maestrobots.com/faq/smart-rug-auto-sell Maestro official website

6. https://www-telegram.org/318 Telegram Usage Report

7. https://www.web3sj.com/news/81503/ Unibot and Telegram Bot Track After Going Viral

8. https://dune.com/whale_hunter/dex-trading-bot-wars Dune data

9. https://dune.com/whale_hunter/banana-gun-bot Dune data

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Topping the list with a 15.4% airdrop ratio, taking stock of 19 potential projects invested by Binance Labs that have not yet issued their own tokens.

- Robinhood Bot Comprehensive and Fast New Trading Robot

- Bear market forces on-chain innovation. Are these newly popular projects worth paying attention to?

- ABCDE Why Should We Invest in GRVT (Gravity)

- Interpreting the Future Path and Star Projects of LayerZero’s Cross-chain Innovation

- Analysis of 10 Tips for Web3 Entrepreneurship The period of bonanza for bottom-up project development has passed, and marketing is becoming more important.

- Overview of the first six investment projects of the Base Ecosystem Fund