Articles about Market - Section 56

Early layout of BRC20, comparing three Bitcoin mnemonic wallets

Source: Coinmonks Translation: BlockingBitpushNews Mary Liu "Not your keys, not your coins," Cryptocurrency veterans ...

Why has Bitcoin returned to $30,000 and its market share soared?

Financial giants enter the field of cryptocurrency trading, reigniting competition for Bitcoin spot ETFs, and the fou...

Is it good or bad that Wall Street giants are taking over cryptocurrency with ETF and EDX?

Within a week, BlackRock's Bitcoin ETF and EDX Markets, a cryptocurrency trading platform backed by Citadel, were bot...

Ethereum Inscriptions: Continuation of Bitcoin’s Order or Regression of History?

Ethscriptions is a new way to create and share digital artworks on Ethereum using transaction calldata. This method i...

Bitcoin returns to $29,000, can the old narrative of institutional entry ignite a new bull market?

Traditional financial giants are starting to lay out their encryption strategies. Written by Qin Xiaofeng from OKX, O...

Understanding EDX Markets: 10 questions about behind-the-scenes investors, compliance, and more after a night on the headlines

Author: BlockingcryptonaitiveCrypto Never Sleeps. In June 2022, the two market-making giants Citadel Securities and V...

Research: Which cryptocurrencies are included in the recognized token index in Hong Kong? An industrial analysis of the indexing economy.

Author | William Wu on Blockchain Authorization Release I. Hong Kong Virtual Asset Index Policy Interpretation Sinc...

EDX Markets, a trading platform supported by Wall Street, has arrived! It is designed for institutional use and operates on a non-custodial model.

Old-school capital entering the market seems to be releasing a new regulatory signal.

Asset management companies WisdomTree and Invesco have resubmitted their application for a physically-backed Bitcoin ETF.

Bloomberg's senior ETF analyst Eric Balchunas tweeted that asset management company WisdomTree has once again submit...

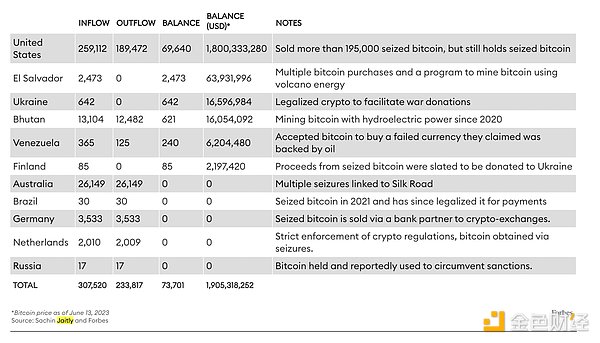

Why is the US government reluctant to sell its 5 billion dollars worth of Bitcoin?

This is more likely to represent an inertia rather than a strategy.

- You may be interested

- Is Bitcoin really important? In fact, ...

- Cryptocurrency market value soars, is a...

- Can Bitcoin replace gold, currency, and...

- Babbitt Column | What Can I Use to Save...

- Google Play delisted the app many times...

- From the market distribution of DAI sta...

- Time stamp capital Zhang: Does the bloc...

- 10 Ways NFTs are Boosting the African T...

- Read Libra in a text: the difference be...

- Chain Travel Weekly (No. 27): "Hyp...

- After Baidu, Netease, and Xiaomi blockc...

- Why is DOT considered software while mu...

- Why does China have to seize the opport...

- Vitalik Buterin’s latest paper Ho...

- The Great Thaw: Bitcoin’s Bullish Sprin...

Find your business way

Globalization of Business, We can all achieve our own Success.