Cryptocurrency market value soars, is a wild bull market imminent?

A. Market Point of ViewI. Macro Liquidity

Monetary liquidity is tightening. Faced with macro and geopolitical uncertainties, market risk aversion is increasing, and the yield on the 10-year U.S. Treasury bonds is approaching the 5% threshold. The U.S. dollar index is on the rise, and the Federal Reserve’s interest rate cut cycle is still far away. It is expected that there will be no interest rate hike in November, but there is a higher probability of an interest rate hike in January next year. U.S. stocks have been continuously declining, reaching the lowest level in six months. The cryptocurrency market is soaring, with a weakened correlation with the U.S. stock market, showing an independent trend from the annual high.

II. Overall Market Trend

- German Brands Embrace NFTs: Revolutionizing Tradition with a Digital Twist

- Judge Rules in Favor of Yuga Labs: NFT Copycats Get the Hammer!

- Unveiling the Humorous Side of Solana Incubator: Get Ready to Launch Your Rocket!

Top 100 market cap gainers:

This week, BTC has skyrocketed, and the market has become more optimistic about the approval of spot ETFs. Altcoins are rising across the board, with hotspots surrounding public chains and meme concepts. The market has automatically chosen the path of least resistance, mainly non-ETH related public chains such as SOL, MINA, CFX, KUJI, etc. These chains have less hidden funds and are easier for market makers to drive up. On the other hand, ETH-related Layer 2 projects such as ARB, OP, etc., have more accumulated funds due to the previous upgrade of the Canungra watershed and are being avoided by speculative funds. At the same time, there is a revival in on-chain activity, and many new meme coins are emerging. The season of meme coins is approaching. Value investors like to invest in public chains, while retail investors prefer emotionally driven meme coins. Everyone has a bright future.

1. PEPE: The team recently burned $7 million worth of tokens, indicating that there may be subsequent actions. PEPE’s weekly chart has broken through, with large trading volume and high market recognition. Meme coins have the characteristic of being 10 times below current levels and then being 10 times above, making them suitable for buying at new highs and whole numbers. Other memes such as Harry Potterbitcon, joe coin, etc., have also seen several-fold increases. 2. MINA: A lightweight ZK public chain listed on the Korean exchange upbit. Recently, there has been an obvious expectation effect for coins listed on Korean exchanges, with several-fold speculative price increases, such as POLYX, CYBER, etc. 3. TRB: A domestically produced oracle project with no significant fundamentals. The price recently broke through $100, and speculative trading caused it to increase more than 10 times. A few major addresses control 30% of the tokens, making it a typical stock manipulated by market makers. Similar tokens include BLZ, INJ, etc. Watch out for short squeeze risks.

III. BTC Market Trend

1) On-Chain Data

80% of BTC holding addresses have achieved profitability. From the trading volume of Binance, we can see that it has reached the second highest level since the end of fee-free trading in April. As the market approaches its high point for the year, a large portion of holding addresses have recovered from losses to profitability.

The total market value of stablecoins remains stable with a slight increase. In the past week, the market value of USDT, which is the main trading force, has increased by over 630 million dollars, reaching a market value of over 84 billion dollars. As long as the trend can be maintained, the market can recover from the bottom.

The long-term trend indicator MVRV-ZScore is based on the total cost of the market, reflecting the overall profitability of the market. When the indicator is above 6, it is in the top range; when it is below 2, it is in the bottom range. MVRV falling below the critical level of 1 indicates that holders are generally in a loss-making state. The current indicator is 1.03, entering the recovery phase.

Cryptocurrency investment products have seen net inflows for 4 consecutive weeks. The recent influx of funds may be related to the launch of BTC spot ETF in the United States, with a total capital of 66 million dollars. SOL has seen a further inflow of 15 million dollars last week, making it the most popular altcoin so far this year. Concerns about ETH have led to an outflow of 7 million dollars, making it the only altcoin with outflows last week, which is in sharp contrast to SOL.

2) Futures Market

Funding rate: The rate is positive this week, indicating a preference for long positions by major funds. Rates range from 0.05% to 0.1%, indicating a higher leverage for long positions, and is a short-term top for the market; rates range from -0.1% to 0%, indicating a higher leverage for short positions, and is a short-term bottom for the market.

Futures open interest: This week, the total open interest of BTC has significantly increased, synchronized with the price, indicating that major funds have entered and are optimistic about the future market.

Futures long/short ratio: 0.9. Retail investor sentiment leans towards short positions. Retail investor sentiment is often a contrarian indicator, with below 0.7 indicating fear and above 2.0 indicating greed. The fluctuation in the long/short ratio data weakens its significance as a reference.

3) Current Market Situation

BTC breaks annual high. Bears get liquidated one after another, pushing BTC price from $30,000 to $35,000 within a few hours. On the news front, BlackRock’s spot ETF prepares for listing. On the technical front, BTC holds steady above the 28,000 BOLL weekly line, indicating that the uptrend is expected to continue. The RSI indicator is at 85, entering the overbought zone, suggesting short-term market sentiment is greedy, so be cautious of a potential pullback. BTC dominance reaches 53%, with 55% being a crucial level. If it drops below 55% in the future, altcoins may rotate into more opportunities.

B. Market Data1. Total Locked Value (TVL) in Public Chains

2. Proportion of TVL in Each Public Chain

This week, TVL increased by nearly $500 million, with a growth rate of around 13%. After BTC broke through multiple resistance levels last week, it directly reached a price close to $36,000. Although this rebound from the bottom has brought unlimited possibilities and hopes to the market, it is still uncertain whether the bear market is about to end. This week, TVL on the ETH chain increased by nearly 15%, on the ARB chain by 9.2%, on the OP chain by 6.8%, and both TRON and POLYGON chains saw an increase of over 10%. The SOLANA chain saw a staggering increase of more than 20%. Except for a 1.3% decrease in the BASE chain, all other mainstream public chains saw an increase.

3. Locked Value of Various Protocol Chains1) Locked Value of ETH

2) Locked Value of BSC

3) Locked Value of Polygon

4) Locked Value of Arbitrum

5) Locked Value of Optimism

6) Base Lock-up Situation

Four, ETH Gas Fee History

The on-chain transfer fee is about $2.43, the Uniswap transaction fee is about $8.27, and the OpenSea transaction fee is about $3.21. Gas usage and transaction fees have risen sharply this week. From the perspective of Gas consumption, Uniswap occupies the top position, accounting for 12.82% of the entire market. The rebound at the bottom of the market brings signs of recovery and possibilities for on-chain applications.

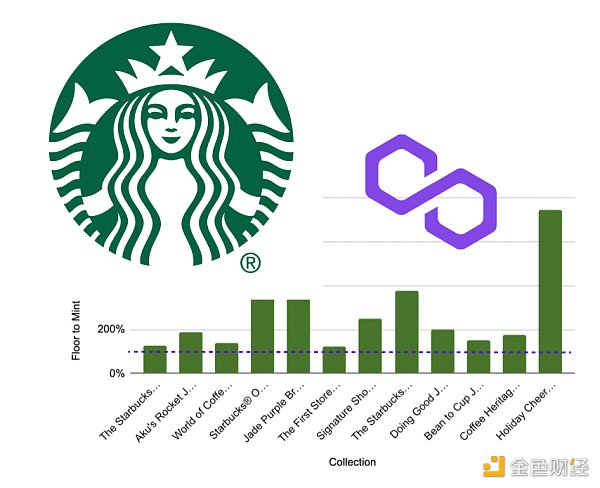

Five, NFT Market Data Changes

1) NFT-500 Index

2) NFT Market Situation

3) NFT Trading Market Share

4) NFT Buyer Analysis

This week, the floor prices of top blue-chip projects have both risen and fallen, with BAYC and MAYC both rising by more than 5%, excluding Azuki, which has risen by 15%, and CloneX and AOI Engine, which have risen by more than 20%. Yawanawa, which rose by more than 50% last week, experienced a decline of more than 30% this week. In the past week, there has been a significant increase in NFT market trading volume, but the number of repeat buyers and the number of first-time NFT buyers are still declining, and there are no obvious signs of recovery in the NFT market brought about by the rebound at the bottom of the market.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Future Trends in the Entertainment Industry How NFTs Shape Asian Fan Culture and Business Models

- Neon Machine Raises $20 Million for Blockchain-infused Game “Shrapnel”

- Get ready for epic mobile dungeon adventures with Immutable’s Guild of Guardians A Game Review

- Peeking into the Flooring Protocol reveals that fragmenting NFTs does not solve the pain points of the NFT market.

- Doge Uprising: Revolutionizing the Crypto World with Manga and Memes! 🚀

- Brawlers Wrestle Their Way to Epic Games Store

- Welcome to the latest edition of Cointelegraph’s Nifty Newsletter! Get ready to dive into the world of nonfungible tokens (NFTs) and enjoy some witty banter along the way. Every Wednesday, our Nifty Newsletter keeps you in the loop with the latest NFT