Why is DOT considered software while multiple well-known public chain tokens are recognized as securities by the SEC?

Why is DOT considered software, while some public chain tokens are seen as securities by the SEC?Author: Polkadot Labs

Background

Due to a series of Crypto black swan events triggered by FTX last year, various countries have strengthened their regulation. This can be seen intuitively from the recent discussions and policies related to regulation in various countries, which often mention the need to avoid financial events like FTX.

Since this year, US regulation has also changed its previous style and frequently launched attacks on the Crypto industry. Previously, it had already targeted Kraken Exchange, BUSD/USDC and other stablecoins.

The frequency of regulatory policies and conferences has also been increasing, and it is no longer just a wait-and-see or discussion atmosphere, but tends to be more direct regulation.

- Former SEC official: Why is the US Department of Justice reportedly filing criminal charges against Binance?

- From Productivity Boosts to Nightmare Scenarios: 10 Areas Where Cryptocurrency and Artificial Intelligence Could Overlap

- Explaining the Maverick protocol mechanism, which entered the top five in DEX after three months of release.

In addition to this trend in policies, it is also reflected in Crypto practitioners in the United States. We have also had exchanges with some American teams before in Hong Kong, and many local teams are leaving the United States one after another. The United States is no longer a regulatory-friendly environment for the Crypto industry.

What has the SEC done

Returning to the most concerned issue recently, it is the SEC’s lawsuit against Binance.US and Changpeng Zhao (CZ).

According to public information and analysis in the Crypto field, the US Securities and Exchange Commission (SEC) has the following key points in the lawsuit against Binance and its CEO CZ:

The defendants named in the complaint by the SEC are three subsidiaries of Binance (BAM MANAGEMENT US HOLDINGS INC., BAM TRADING SERVICES LIMITED, BINANCE HOLDINGS LIMITED) and CZ himself.

The SEC accused Binance of providing three core services involving securities under the command of CZ: trading platform, broker and clearinghouse. Binance knowingly avoided registration required by US law to engage in these businesses to evade regulation.

The SEC accused Binance and BAM Trading of illegally providing and selling unregistered securities, including products such as BNB Vault, Staking, Simple Earn, etc. Users did not receive sufficient disclosure, including potential risk factors.

The SEC accused Binance and BAM Trading of making false statements about the situation of Binance US. And attracted about $200 million in investment and billions of dollars in transaction volume.

The SEC accused the defendants of earning billions of dollars in profits through illegal means while exposing investors to risks.

SEC’s demands include:

- Permanently enjoin the defendants from further violating the law;

- Disgorge the defendants’ ill-gotten gains;

- Deprive CZ and related entities of the ability to engage in related unlawful business through interstate commerce channels and means (i.e., commercial rights);

- Impose civil fines on the defendants;

- Provide appropriate compensation to investors.

The SEC’s lawsuit against Binance is a civil lawsuit, not a criminal lawsuit.

In the United States, the SEC is a federal government agency responsible for enforcing federal securities laws, protecting investors, maintaining fair, orderly, and efficient markets, and facilitating capital formation.

SEC lawsuits are typically civil in nature, aimed at correcting illegal behavior, preventing its recurrence, and seeking compensation for investors.

Criminal litigation involves violations of criminal law, brought by the government against individuals or entities, and may result in fines, imprisonment, or other criminal penalties.

In the securities law field, criminal litigation is typically handled by the United States Department of Justice, not the SEC. Therefore, the SEC’s lawsuit against Binance is a civil lawsuit aimed at seeking compensation, preventing future illegal behavior, and potentially requiring Binance to pay fines.

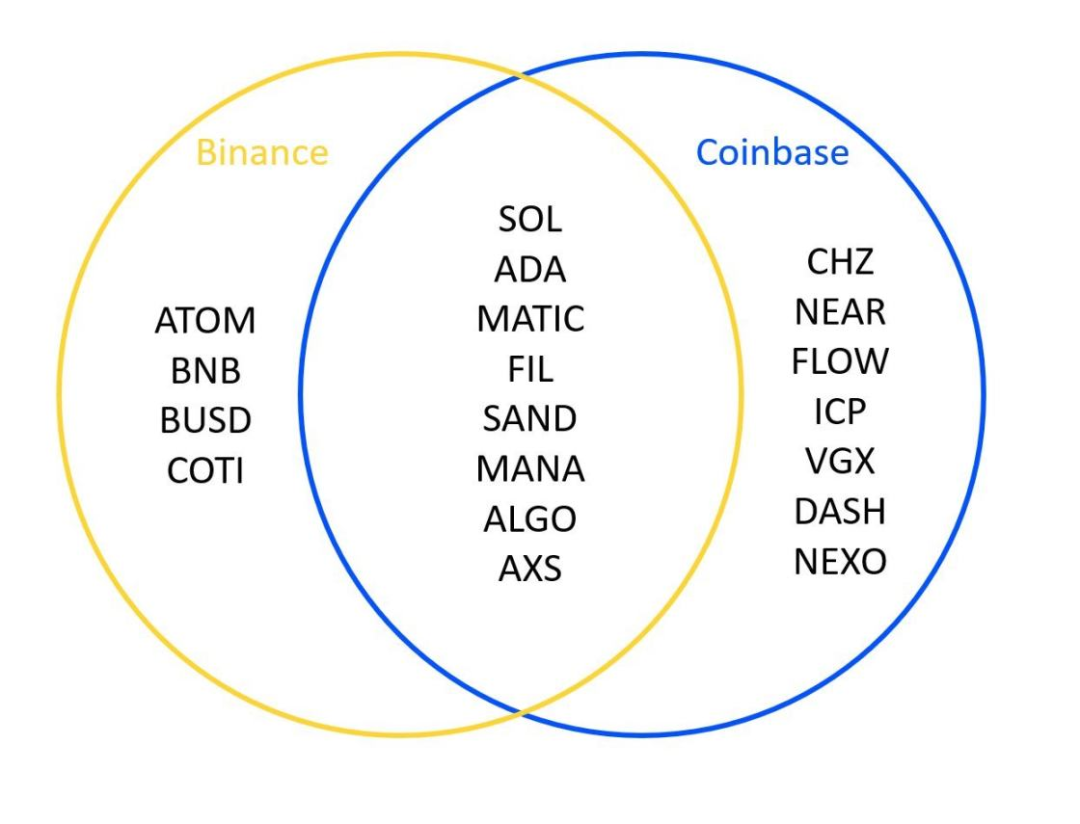

One of the key points worth noting is that the lawsuit mentions the sale of unregistered securities, and the lawsuit documents show that SOL, ADA, MATIC, FIL, ATOM, SAND, MANA, ALGO, AXS, and COTI are identified as securities.

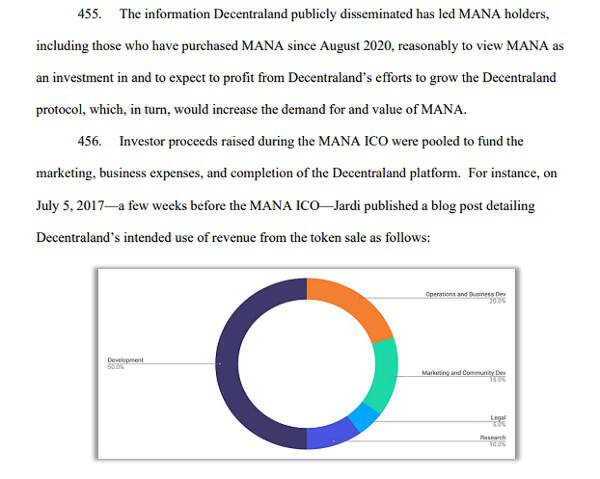

In the lawsuit documents, the SEC analyzed the above tokens one by one, and it is obvious that they have similar patterns: the process of first coin issuance (1C0), token ownership, distribution of the core team, and the promotion of profit generation through owning these tokens.

On the other hand, the SEC also sued Coinbase, the largest cryptocurrency exchange in the United States and the first company to go public on Nasdaq, which also identified that Coinbase sold unregistered securities, including multiple tokens. In summary, there are a total of 19 tokens mentioned:

- Binance: ATOM, BNB, BUSD, COTI

- Coinbase: CHZ, NEAR, FLOW, ICP, VGX, DASH, NEXO

- Both: SOL, ADA, MATIC, FIL, SAND, MANA, ALGO, AXS

Previously, the SEC only made judgments on individual projects and only claimed in propaganda that many tokens were actually securities. However, this large-scale recognition that tokens of multiple projects belong to securities may have a huge impact on the entire crypto industry.

What impact would it have if they were considered securities?

- These tokens will not be able to trade on US exchanges.

- They may be delisted from US exchanges. (Some delisting precedents have been set before.)

- The simultaneous judgment of so many projects will affect the normal development of many existing projects.

- The policy risks that practitioners or projects will face will be greater, which will curb the talents who originally wanted to enter the industry.

- It seriously undermines confidence in traditional funds entering Web3, which will be reflected at both the primary and secondary levels.

As for how to judge whether a token belongs to securities, it is necessary to mention a standard with a sense of age-the Howie test.

The Howie test is a standard used by the US Supreme Court to judge whether a particular transaction constitutes a securities issuance in a judgment (SEC v. Howey) in 1946.

If it is recognized as a security, it is necessary to comply with the provisions of the US Securities Act of 1933 and the Securities Exchange Act of 1934. The standard includes four major conditions:

- It is an investment of money;

- The investment is expected to generate profits;

- The investment is for a specific enterprise;

- The source of the profits is the issuer or a third party’s efforts.

The concept of “money” in this definition has been continuously expanded and can be extended to investments in assets. The definition of a specific enterprise is relatively vague and different judges have different understandings. Most federal courts believe that it can be an investment in the project.

As for the last point, if the investor’s own behavior will determine whether the profit is generated, the investment will not constitute a security.

The SEC stated that the 19 tokens mentioned above meet the requirements of the Howie test due to the three common factors mentioned earlier, thus generating a “profit expectation”.

Many of these 19 tokens are tokens of public chain projects, but DOT of Polkadot is missing.

Why was Polkadot able to avoid trouble?

Actually, Polkadot had been preparing for this since 2019.

In April 2019, staff members from the Securities and Exchange Commission’s Innovation and Financial Technology Strategy Center (FinHub) released the “Framework for Digital Asset ‘Investment Contracts’ Analysis.”

The framework’s elements indicate that almost all digital assets provided and sold for fundraising purposes are likely to constitute securities in the hands of initial purchasers.

However, the framework’s other elements also indicate that there is a compliance path – allowing digital assets initially offered and sold as securities to be re-evaluated later.

This path indicates that, under certain circumstances, digital assets can no longer be securities under the U.S. federal securities laws. In other words, a change in nature can occur.

This provided a compliance path to explore. In November 2019, the Web3 Foundation behind Polkadot made a decision that changed its development trajectory and caused changes in business processes, personnel management, and public communication methods.

They chose to accept the Securities and Exchange Commission’s (“SEC”) “come in and chat” proposal.

And after three years of continuous communication with SEC officials and adjustments to themselves, the Web3 Foundation finally explored a feasible theory.

That is, how to achieve the tokenization of increasingly decentralized projects (such as Polkadot) and a digital asset, which, apart from being provided and sold for fundraising purposes, does not have security-like attributes.

And in November 2022, nearly a year after completing the Polkadot launch process, including a truly decentralized governance mechanism and an on-chain treasury.

The Web3 Foundation also excitedly announced that their views, which were jointly held with SEC staff, were consistent, and the native digital asset DOT of the Polkadot blockchain had completed a change in nature.

Currently, the provision and sale of DOT are not securities transactions, and DOT is not a security. It is just software.

So DOT is software, not what it claims to be. This is a path that the Web3 Foundation and regulators have jointly explored, and Polkadot is a successful practitioner on this path.

In fact, although regulators seem to have a relatively broad impact, their vision is only to control chaos (after all, the impact of FTX is too great), but they are not completely banning the crypto industry. On the contrary, they hope that it will support new technologies in an orderly environment.

However, regulations often lag behind technological developments, which requires both project parties and regulatory parties to communicate and find a balance.

It is great to see that the Web3 Foundation has explored this path, after all, it was Dr. Gavin Wood, founder of the Web3 Foundation and Polkadot, who proposed the concept of Web3.

The success of this path is not only a milestone for Polkadot, but also for the entire Web3.

Visually, thanks to this, the regulatory risk of DOT of Polkadot is relatively lower than that of other public chains.

In addition, Polkadot’s low regulatory risk and practical experience can help address many regulatory issues in the Polkadot ecosystem, which will become a reason why many projects or companies are more willing to choose Polkadot as infrastructure.

Of course, the more important thing is that for the entire Web3 industry, Polkadot’s move is equivalent to opening up a new path, and the Web3 Foundation is very happy to share such advanced experience.

Based on the regulatory process and success of Polkadot, they will launch a content related to relevant experience, which is the Polkadot Purple Paper.

For more information about the Purple Paper, please refer to the official Polkadot forum:

https://forum.polkadot.network/t/polkadot-purple-Blockingper-token-morphism-guidelines/2023/4

Although regulations are very strict now, even the United States, which previously called for “how to make Web3 happen in the United States,” has entered such strict regulation. But regulation will not regulate for the sake of regulation, and will always explore a way to balance development and regulation.

During this process, the crypto industry will encounter some difficulties, but when the regulation becomes more standardized, it will definitely usher in a new spring.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Binance US hires former chief of the US SEC enforcement division to lead defense

- Sequoia Capital leads investment, testnet goes live, Quick Guide to Taiko’s Layer2 Network Interaction

- Combining “Privacy Pools” and “Innocence Proofs”: How to effectively curb illegal activities while protecting privacy?

- ArkStream Capital: Nintendo or Steam? Analyzing the Development Path of Decentralized Gaming Platforms

- Rare sats: A system overview of rare sats. What are the types of rare sats and the search tools available?

- Overview of Flood architecture and use cases: How to solve the problems existing in current RPC system testing?

- What is the next step for the whales who have made more than 10x profit in Pendle?