Blockchain Industry Weekly | Total market capitalization rose by 14.73%, China accelerated blockchain technology innovation

The report produced by the Institute of Fire currency block chain, reports Published October 28, 2019, Author: Yuan Yuming, Rui

Summary:

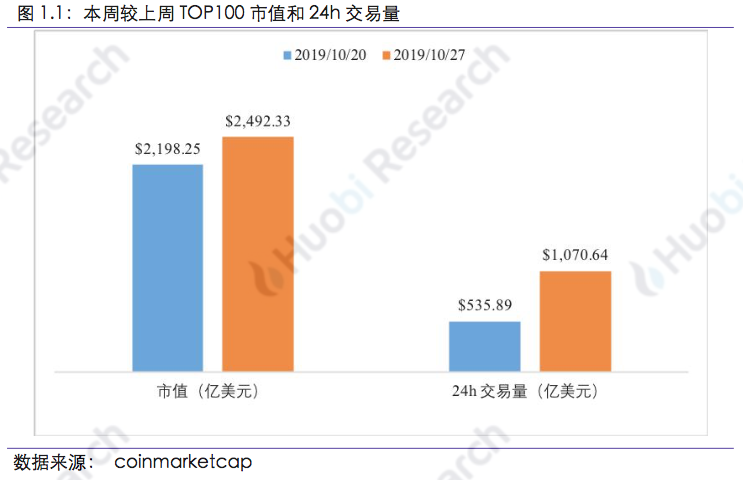

The total market value of blockchain assets this week increased by 14.73 % compared with last week , and the market value of 78 projects in the TOP100 project increased to varying degrees. According to the coinmarketcap data, as of October 27, 2019, the total market value of global blockchain assets reached 255.66 billion US dollars, up 14.73% from the previous week. The total market value of the top 100 projects was 249.233 billion US dollars, up 13.38%. Four new projects entered TOP100 this week, namely Cryptonex, RIF Token, aelf, and Enjin Coin. On October 27th, the price of Bitcoin was $9551.71, up 16.17% from last week, and the price of Ethereum was $184.24, up 4.96% from last week. The turnover of 24h this week was up 99.79% compared with the same period of last week; the total market value and average market value of the TOP100 project were the largest, and the global blockchain asset TOP100 project was stable.

- Zhou Hongyi strongly recommended | New Yorker 16000 words heavyweight article: blockchain is the only hope to return to the essence of the Internet

- Jiang Zhuoer: How much does it cost for Bitcoin to rise to $100,000?

- Popular Science | Introduction to Cryptography (Part-1)

This week, bitcoin computing power is rising , Ethereum's computing power is declining , bitcoin mining difficulty is increasing this week , and Ethereum mining difficulty is decreasing . The average size of bitcoin block is rising this week , the average number of transactions in the block is decreasing , ether. The average size of the block increased , and the average number of transactions in the block increased . This week, the bitcoin miner fee increased , and the Ethereum miner fee remained basically unchanged ; INS is still the most active code item.

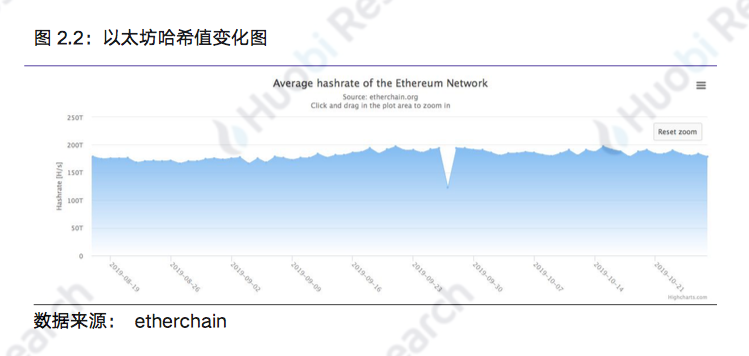

The average value of bitcoin net hash value is 100.1EH/s, which is 5.71% higher than last week. The average value of the Ethereine network's hash value this week was 178.844 TH/s, down 6.41% from last week. The difficulty of mining bitcoin this week is 13.309T, up 2.31%. The average mining difficulty of Ethereum this week is 2416.398T, which is down by 2.95%. The data of Bitcoin is 1020, which is lower than last week. 0.58%; Ethereum's total network data for this week was 46,48 blocks, up 0.53% from the previous month.

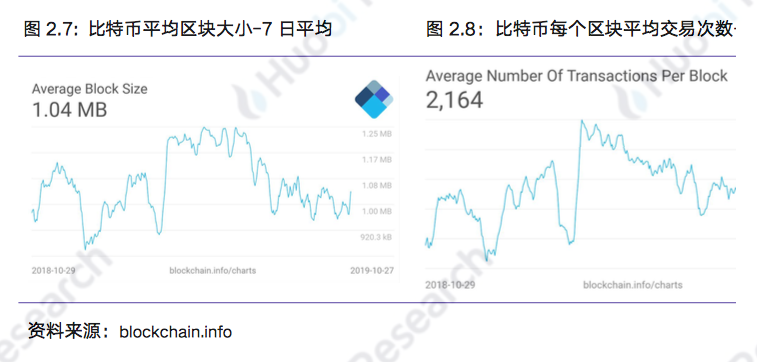

According to blockchain.info data, from October 21st to October 27th, 2019, Bitcoin averaged 1.04MB per block this week, up 4.1% from the previous month, and the average number of transactions per block was 2164. The chain fell by 1.01%. According to the calculation of the erasescan data, the average size of the Ethereum network in this week is 20,478 bytes, which is 9.13% higher than last week. According to the etherchain statistics, the average number of transactions per block this week was 113.1, up 6.15% from the previous month. This week, bitcoin miners’ fees have risen and Ethereum’s miners’ fees have fallen. As of October 27, 2019, Bitcoin's average miner's fee was 1.246USD on the day, up 183.83% from the previous quarter, and each miner's fee in Ethereum was 0.126USD, which was basically unchanged from last week. According to the blockchain.info data, as of October 27, the total number of blockchain wallet users reached 42,863,183, an increase of 0.38%, adding 162,448. According to the calculation of etherchain data, as of October 27, the total number of Ethereum addresses was 76,422,535, up 0.69%, and the number of new addresses was 520,910.

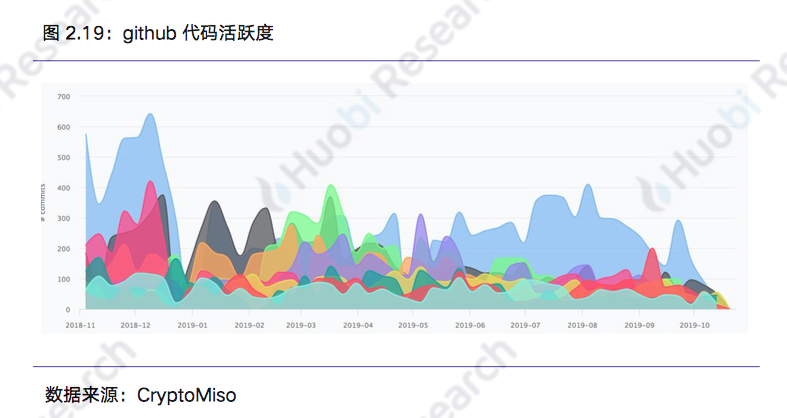

INS is the most active github code for this week. From October 21st to October 27th, 2019, INS was the most active in the github code, with a total of 34commits this week.

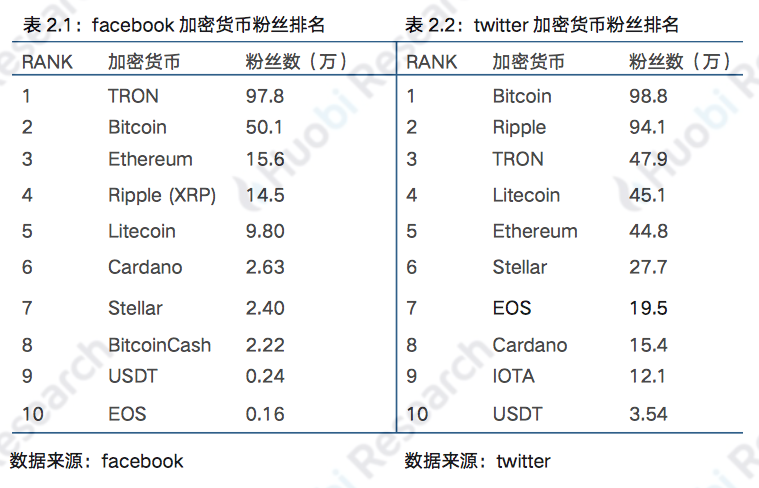

In terms of community activity, Facebook's Tron, Bitcoin, and Ethereum's public homepages are ranked in the top three; in Twitter, the top three fans are Bitcoin, Ripple, and Tron.

This week, a total of three investment and financing projects in the blockchain industry were counted . PhonePe received a strategic investment of Rs. 40.5 billion , Coinplug received a strategic investment of USD 6.4 million , and Mars Finance received a strategic investment from Blueport Interactive.

Report body

1. One week market review

1.1 Overall overview of the industry

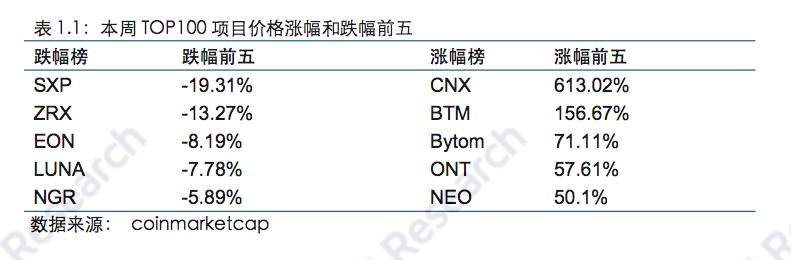

The total market value of blockchain assets this week increased by 14.73 % compared with last week , and the market value of 78 projects in the TOP100 project increased to varying degrees . According to the coinmarketcap data, as of October 27, 2019, the total market value of global blockchain assets reached 255.56 billion US dollars, up 14.73% from the previous week. The total market value of the top 100 projects was 249.233 billion US dollars, up 13.38%. Among them, Cryptonex market value rose the most, the market value rose by 613.02% from last week, the market value rose from 240th to 55th; Swipe market value fell the most, down 19.31% from last week, the market value ranking dropped from 52 to 59th. Four new projects entered TOP100 this week, including Cryptonex (CNX market value rose by 613.02%, ranking from 240 to 55), RIF Token (RIF, market value rose by 4.85%, ranking from 103 to 99), aelf ( The market value of RIF rose by 40.66%, ranking from 106 to 85), and Enjin Coin (ENJ's market value rose by 12.63% from 104 to 100). The biggest increase in the price of the TOP100 project this week was CNX, which increased by 613.02%; the biggest price decline was Swipe, which fell by 19.31%. On October 27th, the price of Bitcoin was $9551.71, up 16.17% from last week, and the price of Ethereum was $184.24, up 4.96% from last week.

The 24h trading volume increased this week . On October 27, 2019, on the whole, the turnover of 24h increased by 99.79% compared with the same period of last week. In this week, 79 projects in the TOP100 project increased in 24h, and the 24h transaction volume of 64 projects increased by more than 20% this week. 48 projects rose more than 50%, the largest increase was BTM, an increase of 2396.41%. This week, 21 projects in the TOP100 project fell in 24h trading volume. The 24h trading volume of 11 projects fell more than 20% this week, and the 7 projects fell more than 50%, the biggest drop was SXP, with a drop of 95.28%.

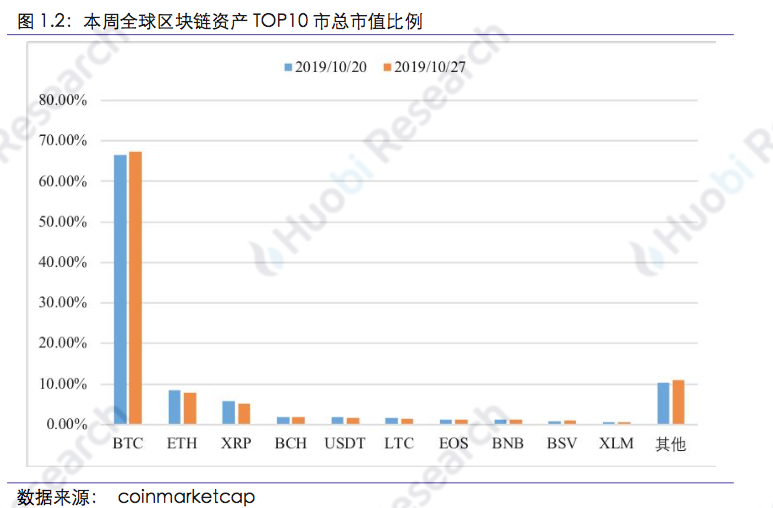

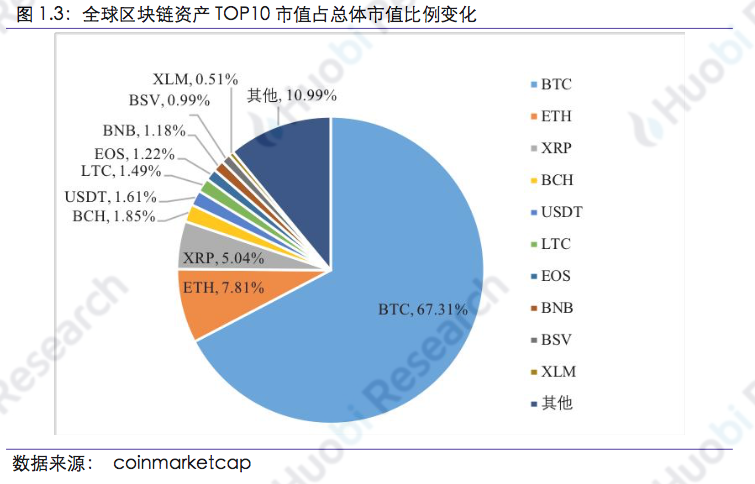

The market value of the TOP10 project rose and the proportion remained stable . On October 27, the market value of the TOP10 asset project was 227.564 billion US dollars, up 13.79% from last week, accounting for 89.01% of the total market capitalization of the blockchain assets, down 0.82 percentage points from the previous month. The market value of the TOP10 project is basically stable. The market value of BTC this week accounted for 67.31%, which was 0.88 percentage points higher than last week.

1.2 Performance of different types of projects

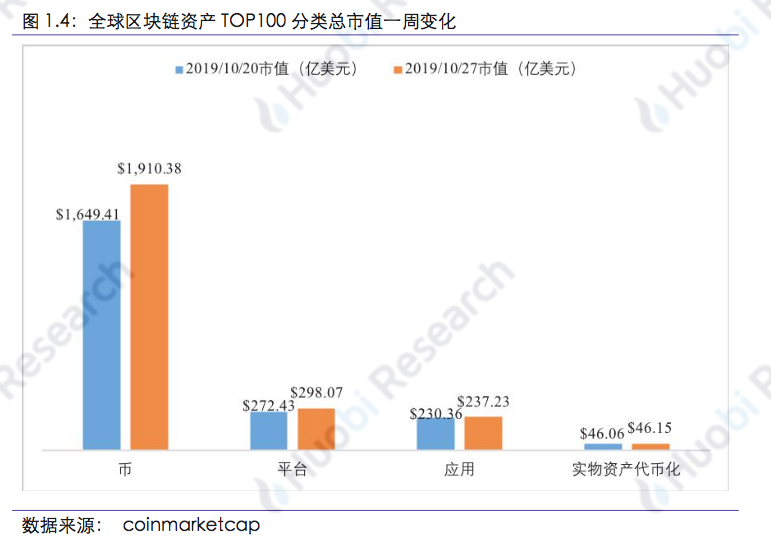

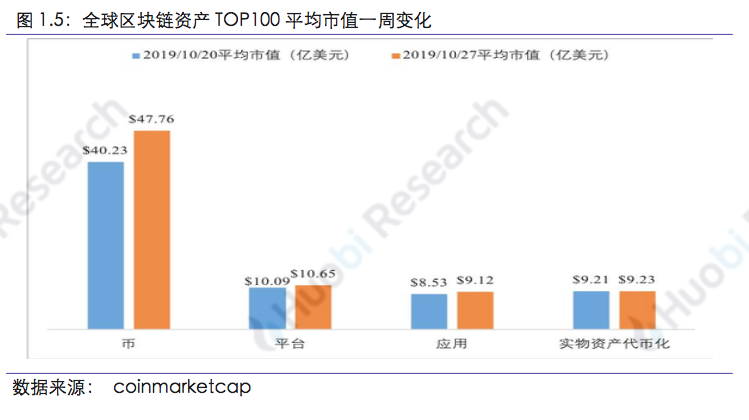

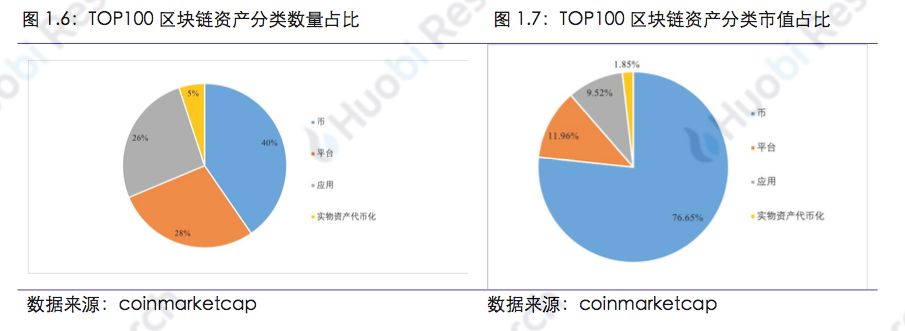

The total market capitalization and average market value of the TOP100 project are the largest . On October 27, 2019, in the global blockchain asset TOP100 project, the total market value of the currency project was 191.038 billion US dollars, up 15.82% from the previous month, the average market value was 4.776 billion US dollars, up 18.72% from the previous month; the total market value of the platform projects was 298.07. Billion US dollars, up 9.41%, the average market value was 1.065 billion US dollars, up 5.5% from the previous month; the total market value of applied projects was 23.723 billion US dollars, up 2.98% from the previous month, the average market value was 912 million US dollars, up 6.94% from the previous month; The total market value of the certification project was 4.615 billion US dollars, up 0.2% from the previous month, and the average market value was 923 million US dollars, up 0.2% from the previous month.

This week, the global blockchain asset TOP100 project classification is stable. On October 27, 2019, among the top 100 projects in the market capitalization, the number of currency projects and application projects decreased by one, the number of platform projects increased by one, and the number of physical token asset classes remained unchanged. The market value accounted for the largest proportion of coins, accounting for 75.03%.

Note: The Firecoin Blockchain Application Research Institute divides it into four categories: “coin”, “platform”, “application” and “physical assets pass” according to the different attributes of the blockchain assets.

Coin: refers to a type of asset developed based on blockchain technology that does not correspond to a specific usage scenario and whose main function is only the transaction target. The asset value is mainly reflected by liquidity;

Platform: refers to a class of assets that are related to the underlying technology development of the blockchain and supported by the use rights or participation rights of such platforms;

Application: refers to a type of asset that is associated with a specific application scenario and is supported by certain usage rights, participation rights, or dividends;

Pass-through of physical assets: refers to a class of assets that are linked to actual assets such as gold and the US dollar and supported by the value of physical assets.

2. Technical ability analysis

2.1 Analysis of the difficulty and benefit of cryptocurrency production

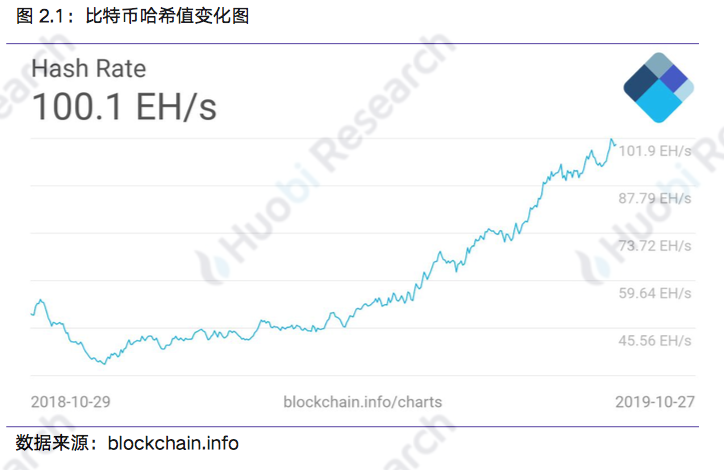

This week, bitcoin computing power has risen, and Ethereum’s computing power has declined. From October 21st to October 27th, 2019, the average value of the bitcoin net hash value was 100.1EH/s, which was 5.71% higher than last week. The average value of the Ethereine network's hash value this week was 178.84 TH/s, down 6.4% from last week.

The difficulty of mining bitcoin this week has increased , and the difficulty of mining in Ethereum has decreased . As of October 27, Bitcoin's mining difficulty remained at 13.309T this week, up 2.31% from last week. The average difficulty of mining in the Ethereum network this week was 2,486.46 T, a decrease of 2.59% from the previous month.

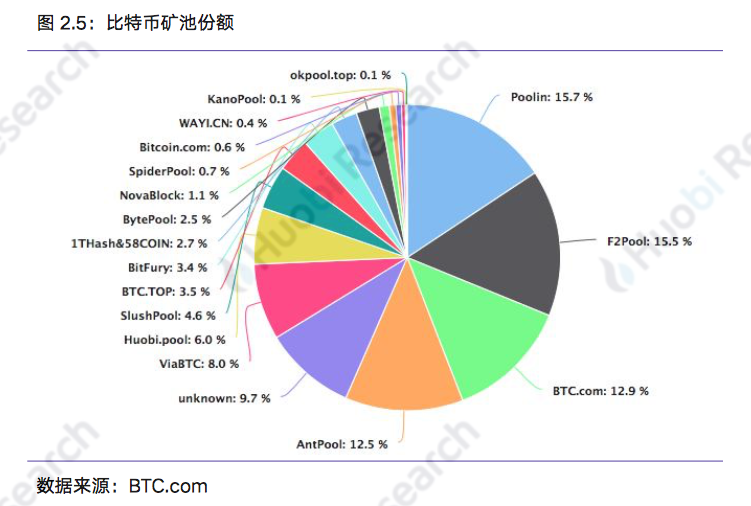

Bitcoin's weekly net outsions fell by 0.58 %, BTC.com and Poolin ranked higher, ViaBTC ranked lower, Unknown ranked higher ; Ethereum mining pools, the number of blocks rose by 0.53 %, the top five ranked last week No change . In the past week, the data of Bitcoin's entire network was 1020, which was 0.58% lower than last week. The top five were Poolin, F2Pool, BTC.com, AntPool and Unknown, respectively, 160, 158, 132, 127, 99. The ratios were 15.69%, 15.49%, 12.94%, 12.45%, and 9.71%, and the computational powers were 15.29EH/s, 15.1EH/s, 12.94EH/s, 12.45EH/s, and 9.71EH/s, respectively.

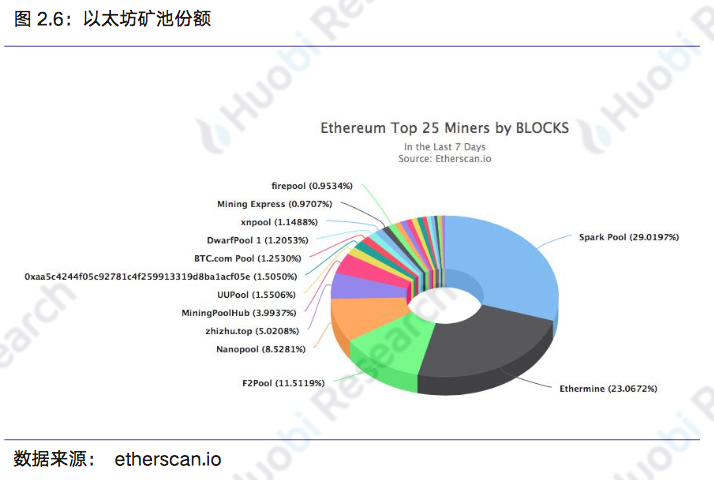

In the past week, the total data of Ethereum's entire network was 46,048 units, up 0.53% from the previous month. Among them, the top five mining pools are SparkPool, Ethermine, F2pool_2, Nanopool and zhizhu.top, with blocks 13363, 10622, 5301, 3927 and 2312, respectively, accounting for 29.019%, 23.067%, 11.51%, 8.52% and 5.02%.

2 . 2 activity statistics

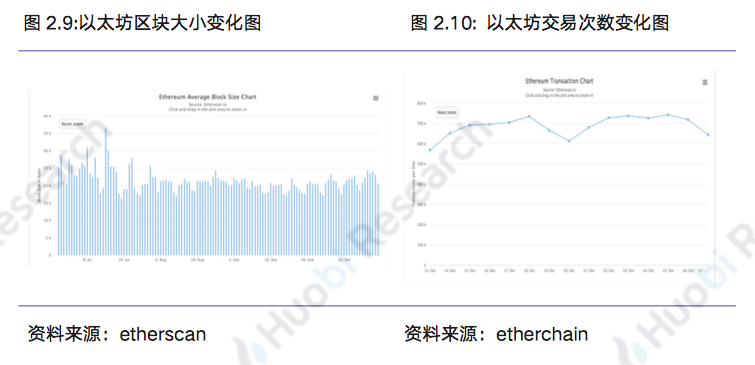

This week, the average size of the Bitcoin block increased , and the average number of transactions in the block fell . The average size of the block in Ethereum increased, and the average number of transactions in the block increased . According to blockchain.info data, from October 21st to October 27th, 2019, Bitcoin has an average size of 1.1MB per block this week, up 4.1% from the previous month, and the average number of transactions per block is 2164 times. , the chain fell by 1.01%.

According to the calculation of the erasescan data, the average size of the Ethereum network in this week is 20,478 bytes, which is 9.13% higher than last week. According to the etherchain statistics, the average number of transactions per block this week was 113.1, up 6.15% from the previous month.

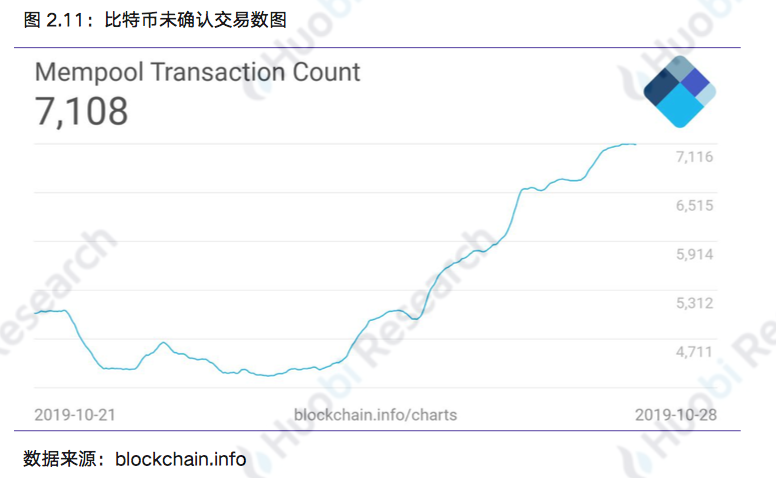

The average number of unconfirmed transactions in Bitcoin increased by 40.64 % this week, and the average number of unconfirmed transactions in Ethereum increased by 25.29 %. As of October 27, the average number of unconfirmed transactions in Bitcoin for 7 days was 7108, up 40.64% from the previous quarter. The average number of 7-day unconfirmed transactions in Ethereum was 40,702.11, up 25.29% from the previous month, with the lowest value being 17,504 and the highest value reaching 48,009.

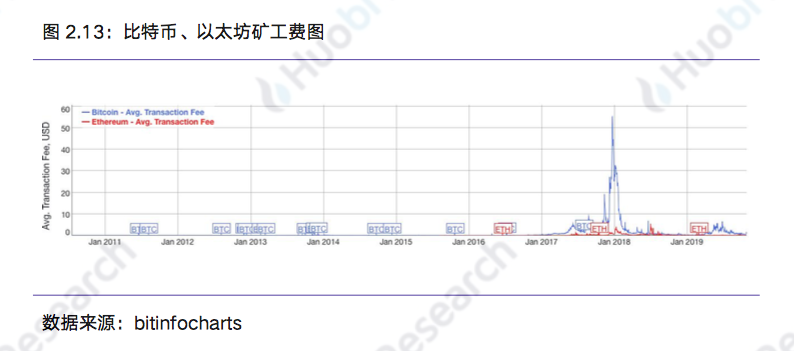

This week, bitcoin miners’ fees have risen and Ethereum’s miners’ fees have remained basically unchanged . As of October 27, 2019, Bitcoin's average miner's fee was 1.246USD on the day, up 183.83% from the previous quarter, and each miner's fee in Ethereum was 0.126USD, which remained unchanged.

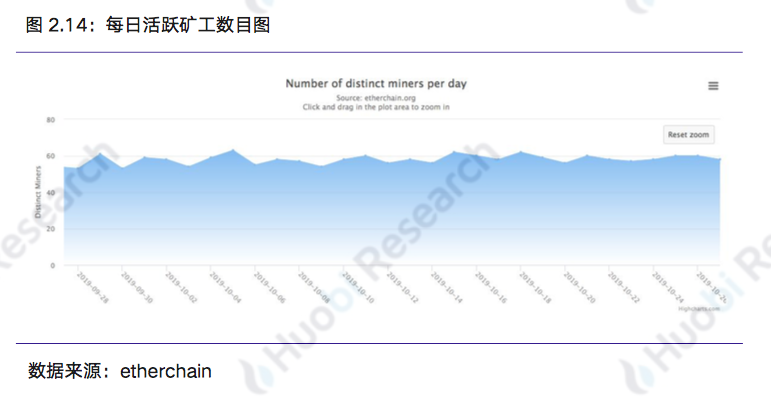

The average number of active miners in Ethereum fell by 1.46 percent from last week . From October 21 to October 27, 2019, the average number of active miners in Ethereum was 58.14, a decrease of 1.46% from last week.

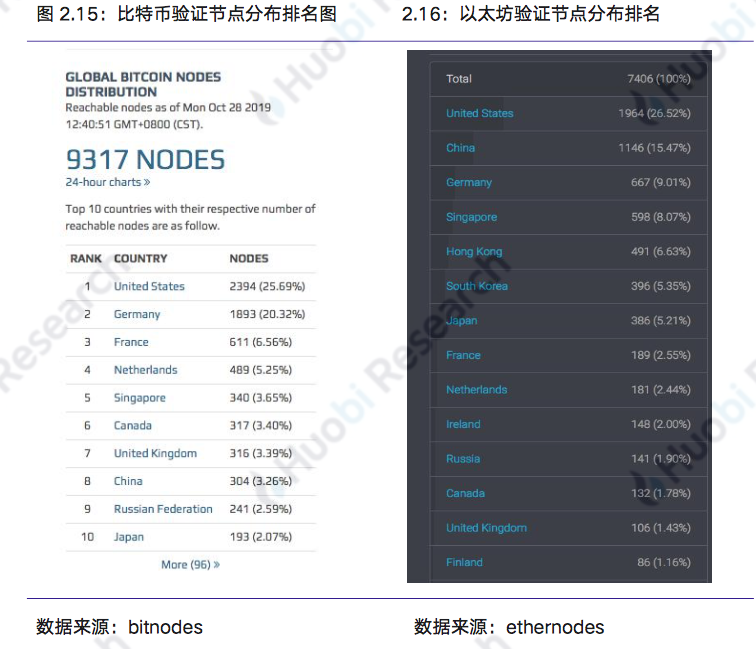

The number of Bitcoin verification nodes decreased , and the number of Ethereum verification nodes decreased . As of October 27, 2019, the number of Bitcoin verification nodes reached 9,317, a decrease of 0.11% from the previous month, of which 2,394 nodes in the United States accounted for 25.69%; Germany had 1,893 nodes, accounting for 20.32%; China ranked eighth, with 304 nodes, accounting for 2.07%.

On October 27, the Ethereum global verification node reached 7,406, down 13.55% from the previous month, including 1964 nodes in the United States, accounting for 26.52%, China with 1146 nodes, accounting for 15.47%, Germany with 667 nodes, accounting for 9.01. %.

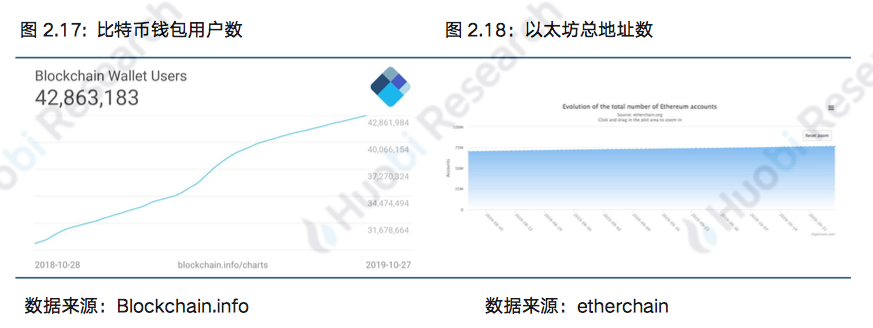

The total number of Bitcoin users and Ethereum addresses increased this week. According to the blockchain.info data, as of October 27, the total number of blockchain wallet users reached 42,863,183, an increase of 0.38%, adding 162,448.

According to the calculation of etherchain data, as of October 27, the total number of Ethereum addresses was 76,422,535, up 0.69%, and the number of new addresses was 520,910.

INS is the most active github code for this week. From October 21st to October 27th, 2019, INS was the most active in the github code, with a total of 34commits this week.

2.3 Community activity statistics

As of October 27, 2019, Facebook's Tron, Bitcoin, and Ethereum 's public homepages ranked the top three, with 978,000 , 501,000, and 156,000 fans respectively. Among Twitter, the top three fans are Bitcoin, Ripple (XRP) and TRON , with a total of 988,000 fans, 941,000 and 479,000.

3. Blockchain Weekly News

3.1 Industry Applications

1. ConsenSys launches satellite tracker based on Ethereum

Blockchain software technology company ConsenSys has released Trusat, a satellite tracking application based on the Ethereum (ETH) network. According to a tweet issued by the company on October 22, Trusat aims to solve the problem of space debris that could damage the Earth's space infrastructure. The program wants users of its app to track satellites in the night sky and record their location to help create records. It is worth noting that this is not the first blockchain-based project involving space. On December 18, 2018, blockchain development company Blockstream expanded its satellite services and is now broadcasting bitcoin (BTC) blockchains to all major land on the planet.

2. Coin's CEO said that WeChat pays using blockchain to track payments

Chan Chan’s CEO, Zhao Changpeng (CZ), tweeted on October 25, saying that he “knows” that WeChat pays the receipt on the blockchain, as well as the screen capture of the receipt and the link to the blockchain browser. . Globally, companies in almost every industry are implementing blockchain solutions, so why does CZ feel it necessary to comment on this? Perhaps this is related to a story at the beginning of this month, when CZ announced the use of WeChat payment and Alipay payment services to launch related services for Binance in China. Alipay quickly dismissed, saying that any payment related to cryptocurrency by Alipay was banned. WeChat also confirmed its anti-encryption position. There is no suggestion that WeChat payment is not a centralized payment system, but the use of blockchain to develop invoices. As Cointelegraph reported in March, China's first block-based subway electronic invoice was issued at the Futian Station of the Shenzhen Metro. The technology was jointly developed by the Shenzhen Taxation Bureau, the parent company of WeChat and the Chinese technology giant Tencent.

3. Publicly traded software company Splunk uses xDai Chain sidechain payment at the conference

Publicly traded software company Splunk is using the Ethereum sidechain xDai Chain to provide payment services for its 2019 Las Vegas SplunkConf conference. According to a report shared with Cointelegraph on October 24th, participants had the opportunity to use a modified version of xDai's proprietary version of Burnerwallet (known as PonyPurse). Splunk's blockchain leader and DLT Nate McKervey explained in a tweet on October 21 that more than 10,000 event participants were able to use Buttercup Bucks (BCB).

4. The encryption application Revolut confirms that MasterCard will expand in the US in 2019

The company confirmed that Revolut, a cryptocurrency-friendly Internet banking application, is scheduled to be launched in the US later this year. In a press release on October 22, Revolut said that expanding its partnership with MasterCard will enable it to enter the US market by the end of 2019. Since its launch in 2015, Revolut, based in the UK, has been providing consumers with Visa and Mastercard consumption. In 2017, it began offering exchanges of three cryptocurrencies: Bitcoin (BTC), Ethereum (ETH) and Litecoin (LTC). Later, five more were added, adding Bitcoin Cash (BCH) and XRP. However, unlike its legal products, the cryptocurrency exchange facility is not supported by UK financial regulators.

5. China's research on blockchain and artificial intelligence cross-border financing

Reuters reported on October 27 that China is studying the application of blockchain and artificial intelligence (AI) in cross-border financing. According to reports, Lu Lei, deputy director of the State Administration of Foreign Exchange (SAFE), a Chinese regulator, said it plans to use blockchain and AI in cross-border financing, with a particular focus on risk management applications. Lu Lei pointed out that the State Administration of Foreign Exchange promotes the application of financial technology and artificial intelligence in international financial and macro-prudential management. His desire for innovation is consistent with the speech of Chinese President Xi Jinping. President Xi Jinping recently called on China to accelerate the adoption of blockchain technology as the core of innovation

3.2 International policy

1. US financial regulators join the UK's global financial innovation network

The Global Financial Innovation Network (GFIN) consists of a coalition of 50 organizations that support financial innovation and has joined a number of US regulators. Press release issued by the Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), the Federal Deposit Insurance Corporation (FDIC), the Office of the Currency Auditor General (OCC) and the US Securities and Exchange Commission (OCC) on October 24, SEC It has joined GFIN itself. Regulatory participation in the program is designed to further enhance their expertise in the US and abroad, helping financial regulators represent the interests and needs of the US and its financial services stakeholders.

2. UK government: FCA will make a final decision on banned encryption derivatives

The UK government emphasizes that regulators, not executives, decide whether to continue to recommend proposals for certain cryptocurrency derivatives to be banned by retail investors. According to Finance Feeds, on October 21st, US Treasury Secretary of State John Glen responded to a series of questions about the development of the UK's cryptographic assets approach, including the UK Financial Conduct Authority's ongoing review of the ban. Glenn did not give a definitive answer. He stressed: "The final decision is the responsibility of the Financial Conduct Authority (FCA), which is operationally independent of the government."

3. President Xi Jinping emphasized the importance of using blockchain as an important breakthrough for independent innovation of core technologies.

The Political Bureau of the CPC Central Committee conducted the 18th collective study on the status quo and trends of blockchain technology development on the afternoon of October 24. Xi Jinping, general secretary of the CPC Central Committee, emphasized that the integrated application of blockchain technology plays an important role in new technological innovation and industrial transformation. We must take the blockchain as an important breakthrough for independent innovation of core technologies, clarify the main direction, increase investment, focus on a number of key core technologies, and accelerate the development of blockchain technology and industrial innovation.

4. The Indian Finance Minister stated that India, like other countries, is extremely cautious about Libra.

Finance Minister Nirmala Sitharaman said that India, like many others, is wary of Facebook's Libra. In last week's 2019 annual meeting of the International Monetary Fund and the World Bank in Washington, DC – including a discussion of the Libra project – Sitharaman told reporters from the New India Express that: "On our side, the Governor of the Reserve Bank is speaking in our turn. I talked about this. I feel that many countries are warning not to rush to do this. Before that, any country must show extreme caution."

3.3 Technical progress

1. Bitcoin hash rate record high shows miners long-term bullish

Bitcoin (BTC) continued to create new records for its network hash rate this month, indicating that miners have shaken off weak price performance. Data from the monitoring resource Blockchain confirmed that the hash rate reached 11.4 billion hashes per second on October 23. This is the largest reading ever, and it has also been echoed by other companies such as BitInfoCharts, which also recorded 11 billion megabytes. A new high in history. The hash rate refers to the overall computing power involved in verifying transactions on the Bitcoin blockchain. Powerful features indicate greater network security and an interest in the potential for bitcoin mining. In other words, miners expect higher bitcoin prices in the future.

4. Primary market investment and financing dynamics

This week, a total of three investment and financing projects in the blockchain industry were counted . PhonePe received a strategic investment of Rs. 40.5 billion, Coinplug received a strategic investment of USD 6.4 million, and Mars Finance received a strategic investment from Blueport Interactive.

Firecoin Blockchain Application Research Institute

The weekly report of the Firecoin Blockchain Industry is a weekly report of the blockchain industry launched by the Fire Coin Research Institute. The report mainly includes technical review of the overall market review, performance of large-scale projects, digital asset production and code update status, as well as detailed analysis and review of blockchain industry news and progress of primary market projects. Investors grasp the overall pulse of the market in a timely and rapid manner, keep up with development trends, and understand the latest developments in the industry with diverse analytical dimensions.

contact us:

Consultation email:

Brief book public number:

Firecoin Block Chain Research Institute

Website:

Http://research.huobi.com/

Disclaimer

1. The Firecoin Blockchain Research Institute does not have any relationship with the digital assets or other third parties involved in this report that affects the objectivity, independence and impartiality of the report.

2. The information and data cited in this report are from the compliance channel. The source of the data and data is considered reliable by the Firecoin Blockchain Research Institute and has been verified for its authenticity, accuracy and completeness. However, the Firecoin Blockchain Institute does not guarantee any authenticity, accuracy or completeness.

3. The contents of the report are for reference only, and the facts and opinions in the report do not constitute any investment advice for the relevant digital assets. The Firecoin Blockchain Institute shall not be liable for any damages resulting from the use of this report, except as required by laws and regulations. Readers should not make investment decisions based solely on this report, nor should they rely on the ability of this report to lose independent judgment.

4. The information, opinions and speculations contained in this report only reflect the judgment of the researcher on the date of the final report. In the future, based on industry changes and the updating of data information, there is the possibility of updating opinions and judgments.

5. The copyright of this report is only owned by the Firecoin Blockchain Research Institute. If you want to quote the contents of this report, please indicate the source. If you need a large reference, please inform in advance and use it within the allowable range. Under no circumstances may any reference, abridgement or modification of this report be made in any way.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bakkt Bitcoin contract rose by 257% in a single day, exceeding 1100 copies

- Read the current situation and development trend of cryptocurrency wallet products

- Extreme market challenges major contract exchanges, BTCC contract performance is outstanding

- Paxos is approved to launch blockchain stock settlement platform, Credit Suisse and Societe Generale will participate in the first batch

- Large-scale shock consolidation, callback or boarding opportunities

- Weekly | China's blockchain industry is welcoming new opportunities, Libra has entered the crisis

- What do you feel after entering the blockchain?