Blockchain weekly report Bitcoin weekly active address +8.17%, BNB affected by the impact of the surge 23.65%

In the 16th week of 2019, we will analyze the development trend of the encrypted digital currency industry in the past week from the data of nine dimensions, and explain a more realistic blockchain for everyone.

Focus:

In the past seven days, the global trend of Bitcoin has remained flat compared with last week, and market sentiment has been greedy. The details are as follows:

Total market value of cryptocurrency: +0.59%

- Market Analysis: Under the market differentiation, where do the funds go?

- Encrypted currency with liar's playing cards

- The Unrecognized Potential of Ethereum: From Prisoner's Dilemma to Cooperative Game

Bitcoin BTC price: +2.38%

Bitcoin weekly trading volume: -3.18%

Weekly new address: -2.78%

Weekly active address: +8.17%

Bitcoin network computing power: -3.99%

In the past 7 days, the mainstream currencies were relatively stable. BNB was affected by the currency's main online line and the 7th BNB quarterly destruction, which led the top ten currencies with a gain of 23.65%. Among the TOP100 currencies, 70 currencies were lost. The new address of Bitcoin has dropped, while the active address has increased, indicating that the number of BTC investors has slightly decreased, while the activity of existing users has increased. At this stage, it is suitable to adopt the “fixed-rated investment method”. In the next week, the cryptocurrency market will continue to fluctuate and do not easily make leveraged futures.

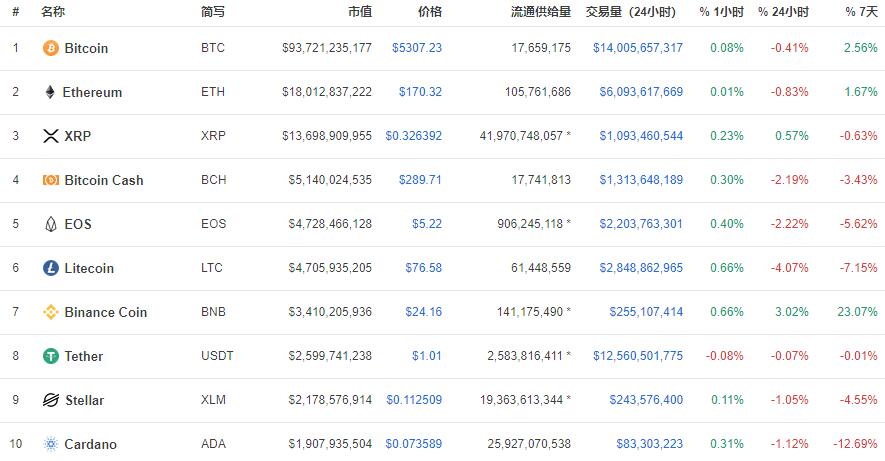

First, the weekly market value trend:

In the past week, the total market value of cryptocurrency has risen from $176.631 billion to $177.67 billion, with a total market capitalization of +0.59%.

Among them, bitcoin BTC price: +2.38%, Ethereum ETH price: +1.67%, Ripple coin XRP price: -0.63%, bitcoin cash BCH price: -3.43%, EOS price: -5.62%, Litecoin LTC price: -7.15%.

(Chart source: coinmarketcap)

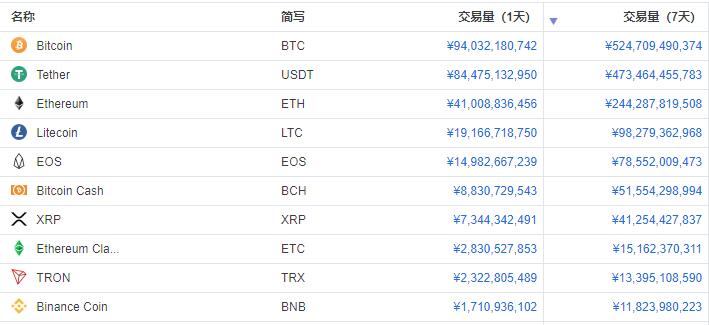

Second, the weekly trading volume list:

Bitcoin weekly trading volume fell from last week's $80.946 billion to $78.17 billion this week, and weekly trading volume: -3.18%.

The top 10 currencies in the past 7 days of digital currency trading volume are: Bitcoin BTC, TEDA USDT, Ethereum ETH, Litecoin LTC, EOS, Bitcoin Cash BCH, Ripple XRP, Ethernet Classic ETC, Wave Field TRX, Coin Ancoin BNB. This week, the Star XLM fell out of the top ten. The specific data is as follows:

(Chart source: coinmarketcap)

Third, the number of new addresses, active addresses: (basic indicators reflecting the internal value of Bitcoin)

In the past seven days, the new address of Bitcoin dropped from 2,623,107 last week to 2,550,438 this week, and the new address was added: -2.78%.

The bitcoin active address in the past seven days rose from 4,810,988 last week to 5,204,207 this week, and the weekly active address: +8.17%.

The new address dropped, while the active address increased, indicating that BTC investors' admissions decreased slightly, while the activity of existing users increased.

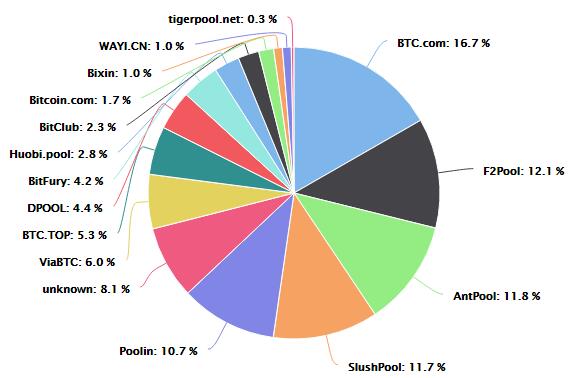

Fourth, the whole network computing power trend:

Bitcoin's total network computing power dropped from 44.91EH/s last week to 46.7EH/s now, and the total network computing power: -3.99%.

At present, each T gains 1T * 24H = 0.00003958 BTC, the next difficulty is predicted to be (+0.05%) 6.36T, the median block volume is 1.2M in the past two weeks, the number of unconfirmed transactions is 12,340, and the predicted output is halved. For May 15, 2020.

Mine pool computing power list:

(Chart source: btc.com)

V. The proportion of the total market capitalization of mainstream currencies:

The current global cryptocurrency market bitcoin BTC market value accounted for 52.61%, Ethereum ETH accounted for 10.12%, Ripple XRP accounted for 7.62%, bitcoin cash BCH accounted for 2.92%, Litecoin LTC accounted for 2.74%.

(Chart source: coinmarketcap)

Sixth, Google Trends:

Google Trends shows how many keywords are searched globally by analyzing Google’s billions of search results worldwide.

Look at the Google Trends keyword "BTC USD", which can be used to measure the growth trend of Bitcoin users:

The top five countries with the highest “bitcoin” in the world are: Nigeria, South Africa, St. Helena, Austria, Switzerland.

The five countries with the highest global “blockchain” are: Benin, Georgia, St. Helena, Ghana, China.

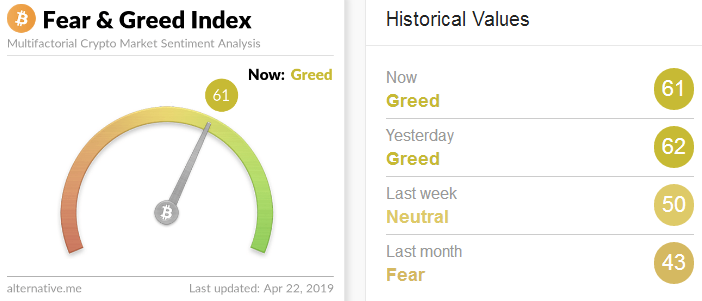

Seven, bitcoin sentiment analysis:

Bitcoin market sentiment changed from last week's neutral to this week's greed, as shown below:

(Chart source: alternative.me)

Note: Bitcoin panic and greed index: 0 means "extreme panic" and 100 means "extreme greed". When investors become too scared, this may be a buying opportunity; when investors become too greedy, this means that the market will adjust, which may be a selling opportunity.

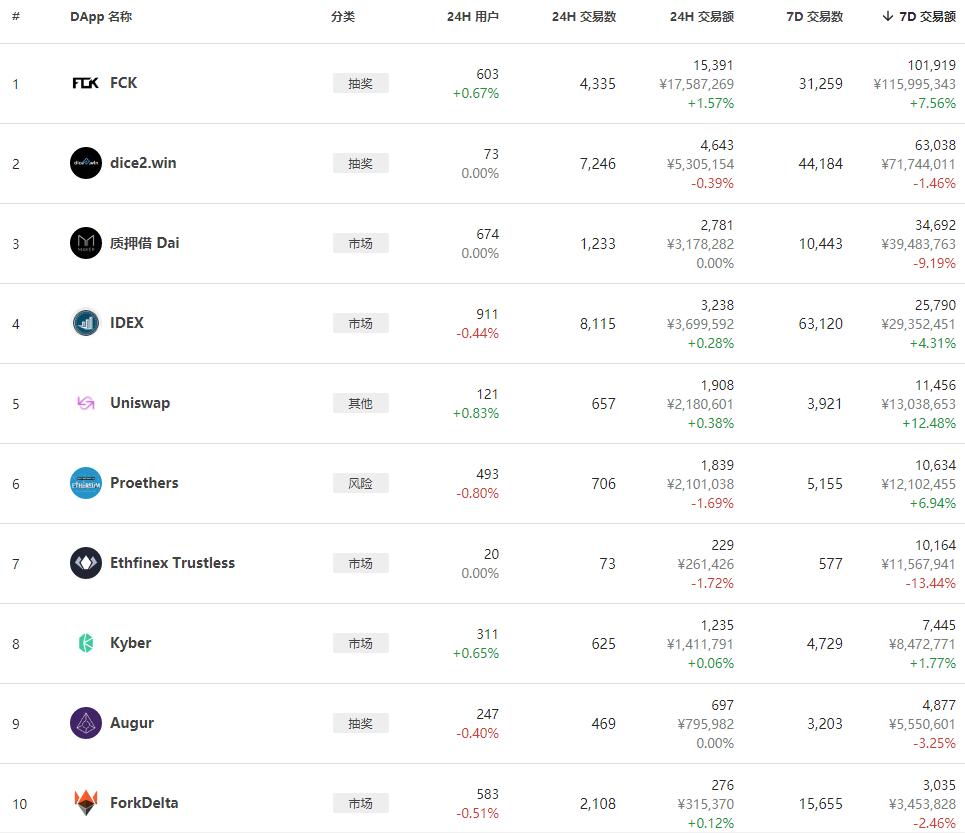

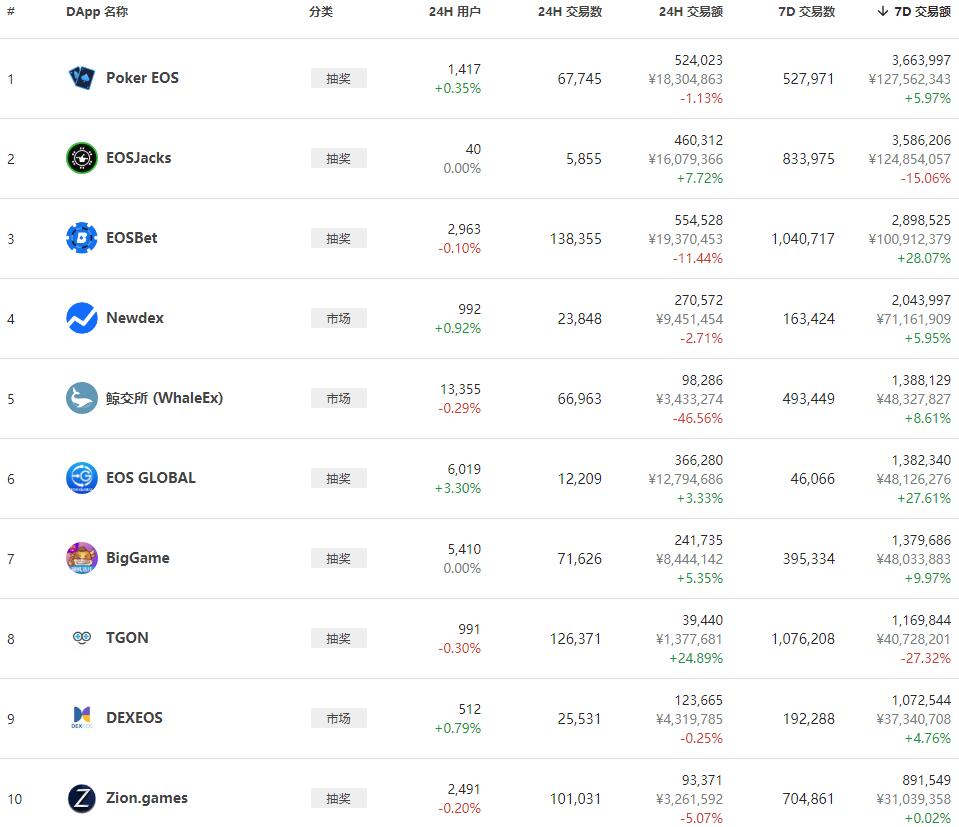

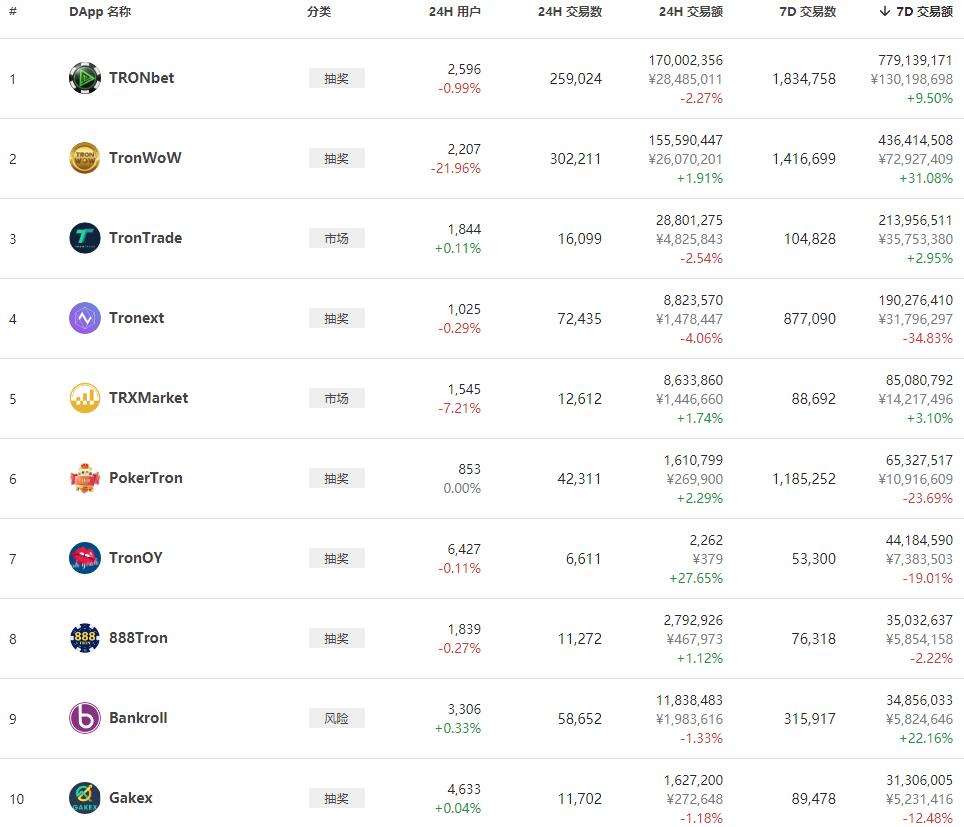

Eight, DApp turnover:

The total transaction volume of the top ten DApps based on the Ethereum blockchain is: 327.6 million yuan.

The total transaction volume of the top ten DApps based on the EOS blockchain is: 929.7 million yuan.

The total trading volume of the top ten DApps based on the wave field blockchain is: 349.8 million yuan.

Ethereum DApp rankings:

EOS DApp leaderboard:

Wave field DApp rankings:

(Chart source: DApp.review)

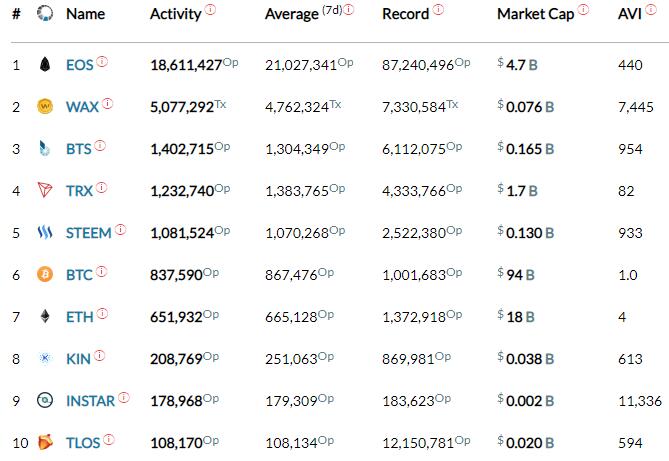

Nine, blockchain activity index:

The current blockchain activity index ranks TOP10 as: EOS, WAX, BTS, TRX, STEEM, BTC, ETH, KIN, INSTAR, TLOS.

[Note]: The copyright of this report is owned by the currency. If you need to reprint or quote, please indicate the source is “Currency”, thank you!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- WikiLeaks Bitcoin Donation Address Retrospection: How much donated? Who is donating?

- Market Analysis: BTC breaks through the morning, the bulls are still building strength

- G20 is near, Japan submits a proposal, wants to be the "big boss" of global supervision

- Exclusive | FT rose nearly 10 times in the year, investors are running next, what does the Fractal public chain want to do?

- Opinion: The future of the blockchain client will be in full bloom

- With 25% layoffs, Messi can't save the world's "first" blockchain phone!

- Do not understand technology? Talking about project investment opportunities from the operational level