Blockchain Weekly | Who is the basis of the blockchain: public chain or AWS?

Guide

AWS service failures trigger a chain reaction, and AWS is the most important infrastructure for the blockchain?

Summary

Topic: On August 23, 2019, Binance issued a notice stating that Binance's recharge and withdrawal functions were suspended due to the failure of some network service providers. In addition to Binance, there are a number of general trading platforms that have traded or re-issued business anomalies due to AWS failures, and some small exchanges have pinned. The digital certificate has been in existence for ten years, but it is still at a relatively early stage compared with the traditional financial market. Traditional institutions have not entered this market on a large scale, and the industry infrastructure is far from perfect. In the whole process of the incident, how many problems were caused by AWS failures, and how many of them were caused by the problems of the trading platform itself, but this incident undoubtedly exposed some problems in the trading platform industry. Alarm clocks for market participants, more investors will realize the importance of a safe and stable exchange system, and the exchange only optimizes the technical structure, prepares emergency plans, and enhances the availability of the system to win the trust of users.

- Encrypting the world's largest "net red" Telegram blockchain is coming soon

- Industry Watch | Where is the future of blockchain, the opportunities and challenges of the US Securities Regulatory Commission's STO opening

- QKL123 market analysis | "slow cooking" market will continue (0827)

Quotes: The rebound is weak, waiting for the direction. The total market value of digital certificates this week was 274.87 billion US dollars, up 1.5%; the average daily turnover was 51.59 billion US dollars, down 9.3%; the average daily turnover was 18.8%, down 1.3%. The current price of BTC is 10,408 US dollars, an increase of 0.3%; the average daily turnover of BTC this week is 15.7 billion US dollars, and the average daily turnover rate is 8.5%. The current price of ETH is 194.7 US dollars, an increase of 5.0%; the average daily trading volume of ETH is 6.58 billion US dollars, and the average daily turnover rate is 31.7%. This week, the exchange's BTC balance was 883,600, a decrease of 0.23 million. The exchange's ETH balance was 9.25 million, an increase of 58800. In the BICS secondary industry, the market value of physical assets and supply chain certification increased significantly.

Output and heat: The difficulty of mining has decreased, and the attention of BTC has decreased slightly. The difficulty of mining this week is 10.2T, which is 0.20T lower than last week. The average daily power is 72.14EH/s, down 2.32EH/s from last week. The difficulty of mining this week is 2212, which is 73.58 lower than last week. The average daily power is 178.8TH/S, which is 4.79TH/S lower than last week.

Industry: AWS service failure events sounded an alarm. The central bank said that the development of electronic payment instruments with digital currency characteristics has progressed in stages; Nasdaq added XRP index to its newly launched website; CME announced that it will add data from Gemini Exchange to BTC and Ethereum pricing indices; AWS services are abnormal and multiple exchanges are affected; Binance plans to build a regional version of Libra.

Risk warning: regulatory policy risk, market trend risk

text

1

Topic: The most important infrastructure for the blockchain: AWS?

1.1 "823 Incident"

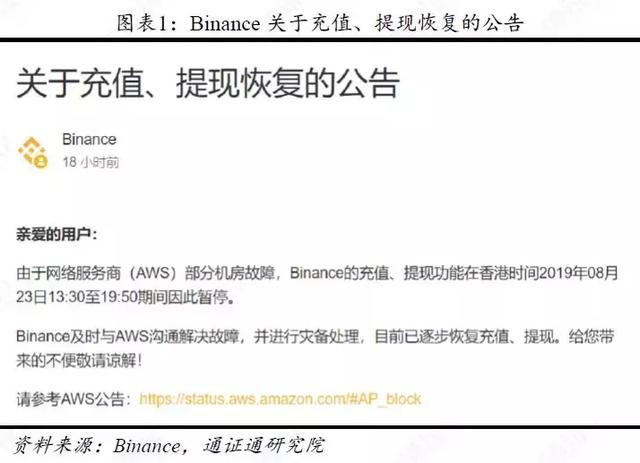

AWS failures have caused multiple digital clearing exchanges to trade or restate business anomalies. August 23, 2019 (there is no special description of Beijing time below), Binance issued a notice saying that because of the network service provider (AWS, Amazon Web Services, Amazon cloud computing service, is a cloud computing platform created by Amazon) In some computer room failures, Binance's recharge and withdrawal functions were suspended during the period from 13:30 to 19:50 on August 23, 2019, Hong Kong time. In addition to Binance, there are a number of general trading platforms that have traded or re-issued business anomalies due to AWS failures, and some small exchanges have pinned.

The AWS Status page shows that at 11:36 on August 23, 2019, a small portion of the EC2 server in the single Availability Zone of the AP-NORTHEAST-1 area was shut down due to overheating, which was caused by a control system failure that caused the failure. Multiple redundant cooling systems fail in a partial area of the affected Availability Zone. The freezer resumed at 14:21 on August 23, and by 17:30, most of the anomalies had recovered.

1.2 AWS is big and not reliable?

AWS currently offers more than 165 services. AWS was launched in July 2002 and offers many remote web services. In 2019, AWS provided more than 165 services including computing, storage, database, networking, analytics, machine learning and artificial intelligence (AI), Internet of Things (IoT), security and application development, deployment and management. The most popular services include Amazon Elastic ComputeCloud (EC2) and Amazon Simple Storage Service (Amazon S3). EC2 allows users to have virtual computer clusters that are readily available over the Internet.

AWS currently operates 69 Availability Zones (a fully isolated partition of AWS's global infrastructure) in 22 geographic regions around the world, and plans to add three regions, Cape Town, Jakarta and Milan, while adding nine more Availability Zones.

The AWS global cloud server market ranks first. In 2010, AWS estimated revenues to be only $1.5 billion. By the end of 2018, AWS annual revenue had grown to $25.62 billion. According to Gartner, AWS ranks first in the global cloud server market, accounting for 51.8% of the global market. AWS has a broad customer base around the world, and the official website says AWS has millions of active customers and tens of thousands of partners worldwide. According to reports, in 2019, more than 80% of DAXs in Germany (the blue chip index launched by Deutsche Börse Group) use AWS.

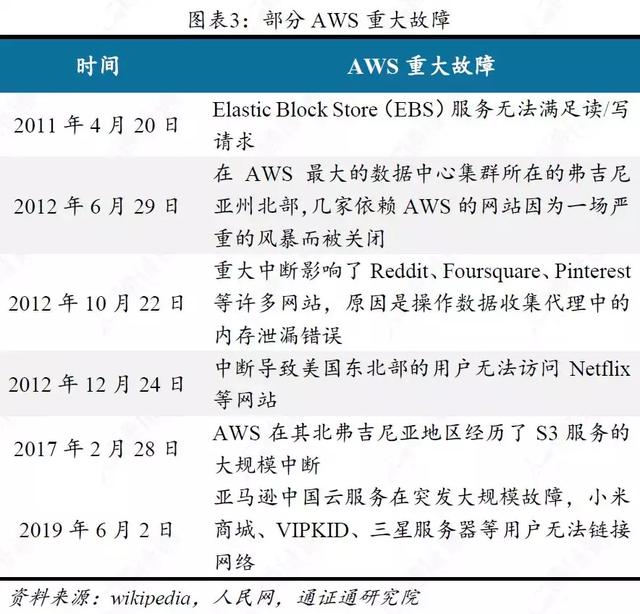

However, there have been many major failures in AWS history.

1.3 Fault ringing alarm

The digital certificate has been in existence for ten years, but it is still at a relatively early stage compared with the traditional financial market. Traditional institutions have not entered this market on a large scale, and the industry infrastructure is far from perfect. In the whole process of the incident, how many problems were caused by AWS failures, and how many of them were caused by the problems of the trading platform itself, but this incident undoubtedly exposed some problems in the trading platform industry. Alarm clocks for market participants, more investors will realize the importance of a safe and stable exchange system, and the exchange only optimizes the technical structure, prepares emergency plans, and enhances the availability of the system to win the trust of users.

2

Quote: The rebound is weak, waiting for the direction

2.1 Overall market: shrinkage slightly increased

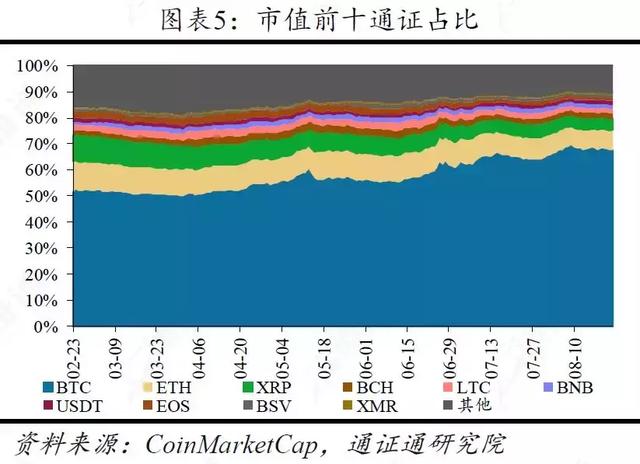

The total market value of digital passes this week was 274.87 billion US dollars, up by about 1.5% compared with last week's increase of 4.13 billion US dollars. After the downward trend of the shock last week, the market has slightly adjusted back this week.

The average daily trading volume of the digital pass market was US$51.59 billion, down 9.3% from last week, and the average daily turnover was 18.8%, down 1.3% from last week.

This week, the exchange's BTC balance was 883,600, down by 0.23 million from last week. The exchange's ETH balance was 9.25 million, an increase of 58800 from last week. The balance of the exchange's BTC decreased slightly, and the ETH balance increased to a certain extent.

The USDT market value was $4.06 billion, an increase of $11.5 million from last week. The enthusiasm for the funds to enter the market has dropped, and the USDT has only a small premium.

2.2 Core Pass: Shanzong Pass is oversold and rebounded

The current price of BTC is $10,408, with a weekly increase of 0.3% and a monthly increase of 6.1%. The average daily turnover of BTC this week was $15.7 billion, with an average daily turnover of 8.5%. The BTC rose slightly this week, and its performance was in line with the main circulation certificate.

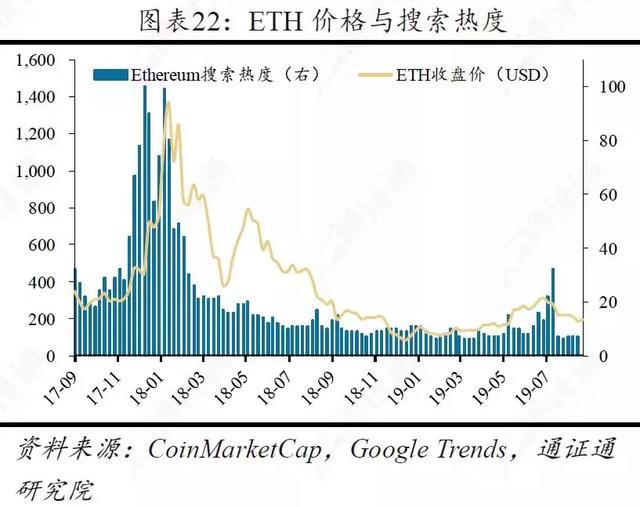

The current price of ETH is 194.7 US dollars, with a weekly increase of 5.0% and a monthly decline of 10.3%. The average daily trading volume of ETH this week was 6.58 billion US dollars, and the average daily turnover rate was 31.7%. ETH had a large decline in the previous period and closed slightly lower this week.

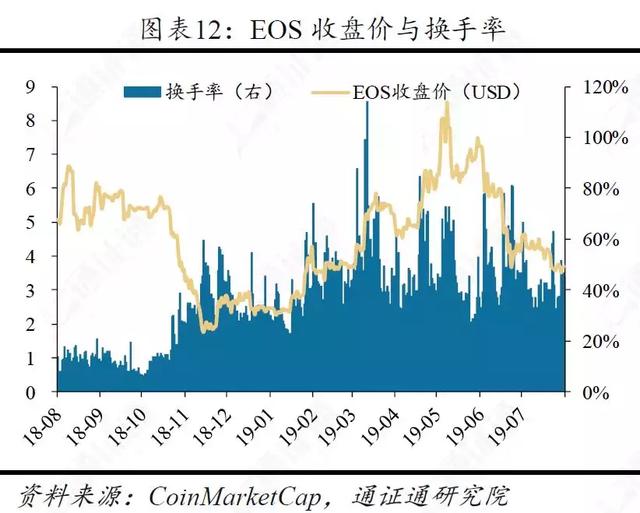

EOS is currently trading at $3.68, a 2.5% increase in the week and a 19.9% drop in the month. This week's EOS average daily trading volume was 1.38 billion US dollars, with an average daily turnover rate of 41%. EOS was oversold in the early period and rebounded slightly this week.

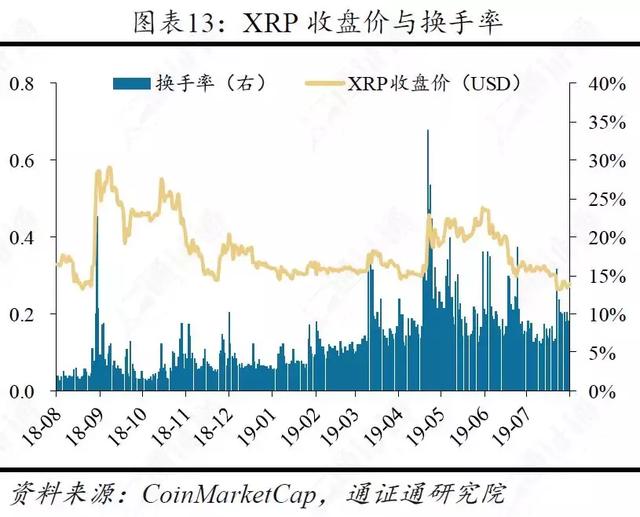

The current price of XRP is 0.28 US dollars, with a weekly increase of 5.6% and a monthly decline of 12.5%. The average daily volume of XRP this week was $1.1 billion, with an average daily turnover of 9.4%.

The monthly volatility of major passes this week fell mostly. The monthly volatility of BTC was 18.5%, down 1.3% from last week. The monthly volatility of ETH was 19.4%, down 0.1% from last week. The EOS monthly volatility was 20.8%. It was down 3.9% from last week; the XRP monthly volatility was 16.9%, up 0.4% from last week. This week, the market's XRP volatility rose slightly, and the volatility of other major circulation certificates declined slightly.

2.3 BICS industry: physical assets and supply chain pass market value increased significantly

In the secondary industry of BICS (Blockchain Industry Classification Standard), the market value of the payment and settlement industry decreased from 75.8% to 75%. From the perspective of the change rate of market capitalization, the market value of physical assets, supply chain and information technology industry accounted for a higher growth rate, up by 195%, 48.6% and 20% respectively compared with last week; other, data & storage and non-bank finance The decline in market share was more pronounced, down 17.37%, 4.47% and 2.49% from last week.

The BICS secondary industry with more obvious increase in the number of passes this week is other, data & storage and public services, which increased by 60%, 14.3 and 12.5% respectively compared with last week; BICS level II with more obvious decline in the number of passes this week The industry is the supply chain and physical assets, respectively, down 33.3% and 20% compared with last week.

2.4 Market view: weak rebound, long-term upward trend has not changed

This week, BTC repeatedly tested the 10,000 USDT support, the market enthusiasm continued to shrink, and the market as a whole was in a state of shock consolidation, and no direction has been chosen. From the perspective of the BTC trend, as the triangle continues to narrow, the distance direction is not far off.

BTC did not perform as well as other major circulation certificates this week. Other major circulation certificates fell by a large margin in the previous period. This week, the performance was relatively strong and the rebound was large.

The callback can be gradually added. In the long run, the quality pass has a large imagination, and it is still in the early stage of the bull market. The callback is a rare opportunity to increase the position. Investors can do a good job of asset allocation based on their own situation.

3

Output and heat: the difficulty of mining has decreased, and the attention of BTC has decreased slightly.

Both BTC calculation and mining difficulty have been reduced. The difficulty of mining this week is 10.2T, which is 0.20T lower than last week. The average daily power is 72.14EH/s, down 2.32EH/s from last week. The difficulty of mining this week is 2212, which is 73.58 lower than last week. The average daily power is 178.8TH/S, which is 4.79TH/S lower than last week.

This week, Google Trends's Bitcoin entry search heat was 12, which was slightly lower than last week. The Ethereum entry search heat was 7, which remained unchanged from last week.

4

Industry News: AWS Service Failure Event Rings Alarm

4.1 The central bank said that the development of electronic payment instruments with digital currency characteristics has progressed in stages.

According to the official website of the People's Bank of China, the central bank recently stated in the "People's Bank of China Annual Report 2018" that it will promote the central bank's digital currency research and development in an orderly manner, closely follow the international dynamics of the central bank's digital currency research, and actively participate in international exchanges. Steadily and orderly organized commercial organizations to jointly develop electronic payment instruments (DC/EP) with digital currency characteristics, and made progress in stages.

4.2 Nasdaq adds XRP index to its new website

According to U.today news, Nasdaq added XRP to the new index of its newly formed website, new.nasdaq.com.

4.3 CME announces that it will add data from Gemini Exchange to BTC and Ethereum pricing indices

CME official Twitter announced that CME CF BTC and Ethereum USD pricing index will join the trading data of Gemini Exchange from 10:30 on August 30th. Gemini became the fifth constituent exchange of the CME BTC pricing index and the fourth constituent exchange of the Ethereum pricing index.

4.4 AWS service is abnormal, multiple exchanges are affected

A bug in Amazon's Amazon Web Services has caused anomalies in many exchange transactions.

4.5 Binance plans to build a regional version of Libra

According to the official announcement of Binance, Binance will create an independent "regional version of Libra" called "Venus". Binance will provide full-process technical support, compliance risk control system and multi-dimensional cooperation network to help the regional version of Libra "Rising Star" rise. In addition, the announcement stated that Binance has reserved a public-chain technology and cross-border payment system for the safe operation of the new stable certification.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Viewpoint | What is the ultimate ideal for blockchain economic system design and blockchain technology?

- I left the project side and went to the exchange.

- Babbitt Column | Blockchain Project Governance, Rules and Influence

- "The Eye of the Government" Chainalysis: Most Bitcoin mixed currency transactions are legal transactions

- The so-called "Defi", how much do you go to the center?

- Programmer Xiao Ge told: What is the experience of all the wages only bitcoin?

- Babbitt column | Shenzhen digital currency mobile payment pilot zone prequel