Fearless deep bear, why does Starbucks dare to continue selling NFTs?

Why does Starbucks dare to sell NFTs?In the NFT market, Starbucks not only fears the bear market, but also thrives.

On August 2nd, this coffee brand released its 12th NFT series “Green Apron”, inspired by Starbucks’ most classic barista uniform. The price of the Green Apron NFT is $100 per unit, with a total of 5,000 units. After it went on sale, it quickly sold out, and in the secondary market, the cheapest one also rose to $123.

It is worth noting that the total market value of the NFT market has dropped from $10.6 billion a year ago to $5.7 billion today, and even the top NFT series have been greatly affected. However, Starbucks has almost ignored the market freeze period. Since starting its NFT plan in December last year, every NFT it has released has been priced at a premium. Not only has it not failed to meet expectations, but some have even generated more than double the return.

- Half-hearted response and slow ecological development, is Litecoin (LTC) completely cold this time?

- Reflections after ChinaJoy What Are We Really Expecting from GameFi to Web3 Games?

- No one is interested in halving. How can Litecoin, which has been silent for a long time, break out of its ecological development dilemma?

By binding its physical brand IP with NFT, Starbucks has developed a successful digital marketing strategy. So, can its experience be replicated?

01 Starbucks’ new NFT is selling like crazy again

In the early morning of August 2nd, Starbucks launched its 12th NFT series on the NFT market Nifty Gateway, named “Green Apron”.

“Green Apron” is one of Starbucks’ classic symbols. It is the standard uniform for Starbucks baristas and is a tangible representation of the brand’s long history. From the original “Pike Place Apron” to the “Siren” apron seen today, although the uniforms of Starbucks baristas have been updated over the past 50 years, green has always been its most recognizable color.

The Green Apron NFT series has a limited edition of 5,000 units, with a unit price of $100. When it went on sale in the early morning of August 2nd, only members of Starbucks’ Odyssey NFT program and internal employees could purchase it in advance, and the public could only access the purchase portal three hours later.

Just like previous releases, these NFTs quickly sold out and entered the secondary market. $123 is the floor price for the Green Apron NFT after 15 hours of release. This means that anyone who buys an NFT can easily make $23.

Don’t underestimate this 23% increase, because the current NFT market is in a deep bear market.

Data from third-party platform NFTGO shows that the total market value of the NFT market has dropped from $10.6 billion a year ago to $5.7 billion today. Well-known NFTs such as Bored Ape Yacht Club and Azuki have also seen their floor prices greatly reduced, and many other NFTs have lost liquidity altogether.

In such a market environment, Starbucks’ NFT series is like a market anomaly. Each release sells out quickly, and none of the NFTs have fallen below their release price.

In December last year, Starbucks officially entered the NFT market with its “Odyssey Journey Program”. “Odyssey” comes from Greek mythology and tells the story of the hero Odysseus’ 10-year journey back home after the end of the Trojan War. Nowadays, “Odyssey” is often used to describe an adventurous and exploratory journey. Starbucks named its NFT program after this to indicate its long-term and continuous exploration of NFTs.

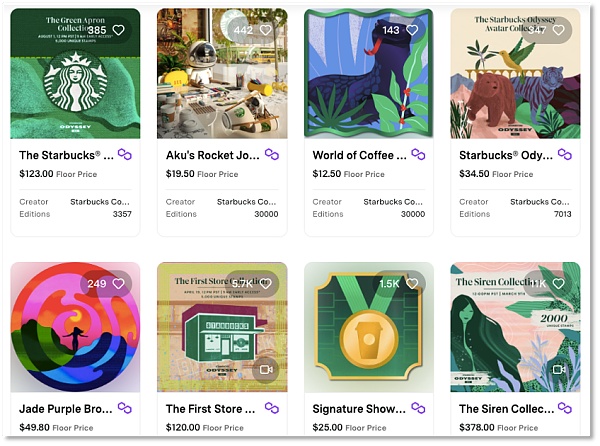

Indeed, for more than half a year, Starbucks has issued new NFTs almost every month, including 4 that are available for purchase and the rest can be obtained by completing tasks. Most of the NFT designs are also closely related to the brand culture, covering the story background of the first store, coffee beans, and iconic mermaids, etc.

Part of the NFT series issued by Starbucks

Part of the NFT series issued by Starbucks

On March 10th of this year, Starbucks first launched the paid NFT series “Siren”, limited to 2000 copies, each with a mermaid image derived from Greek mythology, priced at $100 each, and sold out in 18 minutes after the release. Now, the floor price of this series of NFTs is $378, which is 3.78 times higher than the issuance price.

In April, the First Store Collection NFT series by Starbucks was sold for $99, with a total of 5000 copies. Now its floor price is $120; in June, the Avatar Collection NFT series was sold for $25, with a total of 7000 copies, and each user could purchase up to 3 pieces. Currently, its floor price is $34.5.

Starbucks keeps turning its classic elements into NFTs and has gained market popularity. This hot buying sentiment contrasts sharply with the freezing NFT market.

What did Starbucks do right with its NFTs, ignoring the deep bear market?

02 Attaching Real Rights to NFTs to Lower the Barrier to “Buy It”

So far, Starbucks is undoubtedly the best case of combining a physical brand with NFTs. It continuously injects brand elements and stories into NFTs, each of which is linked to brand actions.

Prior to the sale of the apron NFT, Starbucks launched a new coffee flavor in May this year, the Apron Blend. Unlike other in-store coffees, it is created by Starbucks employees. Starbucks received nearly 24,000 submissions, shaping the flavor and roasting curve of the Apron Blend.

The Apron Blend is also endowed with charity connotations – for every cup of Apron Blend sold, Starbucks will donate $0.1 to its CUP Fund. The CUP Fund is an emergency relief fund initiated by employees 25 years ago, aimed at providing assistance to employees in times of need, such as family emergencies or after natural disasters.

New flavors, new IPs, new connotations – the Apron Blend stands out in Starbucks’ NFT series, and it also increases its collectible value. Emotional significance is just one aspect, and rights are the most attractive part of Starbucks’ NFT series. For most people, the benefits of owning Starbucks NFTs are more important.

In terms of rights design, Starbucks combines it with its well-established loyalty program. Each NFT is designed with a range of points related to scarcity. By accumulating more points, users can unlock some unique benefits and experiences. For example, users with 1000-2999 points can get a virtual coffee course or a Starbucks Coffee Passport; users with 3000-5000 points can choose to name a coffee tree, participate in a virtual tasting event with a bag of coffee, or receive a Starbucks cold cup; users with over 6000 points can choose a customized MiiR 360 Traveler camping cup, 30 days of free drinks, or an experience at a Starbucks boutique store.

In addition to physical rewards, Starbucks NFT rights also include various rewards that incorporate brand culture and experiences, such as virtual coffee-making courses. The most popular ones are collaborations with artists and invitations to participate in Starbucks Reserve Roasteries.

Generally speaking, NFTs that can be obtained for free by completing tasks correspond to 125 points, while NFTs priced at $100 correspond to 1500 points. Many people buy NFTs with the idea of collecting them and earning points as rewards. If they don’t want to hold them anymore, they can also profit from them in the secondary market. After the release of the Green Apron NFT, some users shared screenshots of their purchases and excitedly said, “Each one can earn 1500 points. It’s time to unlock the level 4 benefits.”

Some users are very interested in accumulating points.

Some users are very interested in accumulating points.

It can be seen that Starbucks’ equity system is designed to provide users with sufficient incentives. One point that cannot be ignored is that Starbucks itself is already a globally renowned IP, and its accumulated brand culture and large user base provide a strong guarantee for the design and sale of its NFTs. Therefore, Starbucks’ path is not easy to replicate.

In addition to the effectiveness of equity incentives, Starbucks also considered the issue of entry barriers for the market group when launching NFTs.

When issuing NFTs using the Web3 approach of blockchain, Starbucks’ target group includes both the Web3-native group familiar with wallet transactions on the chain, as well as a broader consumer group accustomed to the Internet (Web2) or conventional payment methods.

You will find that every Starbucks NFT is issued on the Polygon blockchain, which has lower transaction costs (the interaction between users and the blockchain network requires network GAS fees), making it convenient for Web3 natives to purchase them. Even without a blockchain wallet, ordinary users can directly purchase NFTs through credit cards or debit cards within the Starbucks app.

In this way, Starbucks’ large consumer base can reach NFTs using familiar payment methods without the need to understand concepts such as encryption wallets, mnemonic phrases, and GAS fees from the beginning. And those native groups that do not need Web3 market education, who are familiar with the rules of the NFT market, can quickly send Starbucks NFTs to the secondary market.

With the increase in the number and categories of NFTs, the Starbucks digital community formed by holders is also growing stronger. People in the community discuss NFTs and coffee, gradually forming consensus and deepening loyalty to the Starbucks brand. This may be a long-term indicator that Starbucks values in addition to making money by selling NFTs.

A traditional food brand that has completed the digital transformation of the sales process through an app has now used NFTs to accumulate traffic, integrating part of the offline consumer group with online traffic, and using NFTs to achieve a closer emotional connection between users and the brand. For Starbucks, this is a convenient way to understand user loyalty and develop brand and product development plans based on it, and it is both trendy and effective.

Starbucks’ successful attempt in the NFT field has also provided a model for other commercial IPs. The combination of NFT and brand consumers’ rights and interests is not only one of the ways for traditional brands to do digital marketing, but also provides a breakthrough for the NFT IP market. The phase of speculative NFT markets based on images and designs is coming to an end, and the next phase of market hot-selling items is likely to come from NFT series that are associated with physical brands, tied to actual rights and interests, and can interact with actual consumption scenarios.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Worldcoin has suspended its services in Kenya and plans to cooperate with regulatory agencies.

- Australian ASIC sues eToro over contract for difference products.

- Curve is deeply involved in a security incident, how to establish a defense mechanism to prevent hackers and trace funds?

- Data Interpretation Holders reluctant to sell, Starbucks NFT series profitable across the board.

- Governance Methods and Solutions of Four Platforms under Curve Liquidation Crisis

- Opinion Could Swell become a strong competitor to Lido?

- Coinbase’s estimated revenue for the second quarter of 2023 non-transactional revenue surpasses its transactional revenue for the first time.