Full Text of Bloomberg’s Interview with He Yi: “I’m the One Who Introduced CZ to Crypto Trading”

Bloomberg interview with He Yi: "I introduced CZ to crypto trading."Original Title: Crypto’s Most Powerful Woman Speaks Out as Crisis Rocks Binance

Original Author: Muyao Shen and Justina Lee

Original Source: Bloomberg Crypto

Translated by: Leo & czgsws

- Future Web3 New Chapter: Triple Impact of VSAP on Exchanges, Financial Markets, and TradFi

- Future of Web3: Triple Impact of VSAP on Exchanges, Financial Markets, and TradFi

- BlackRock’s Bitcoin ETF Key Dates and Timeline for Listing

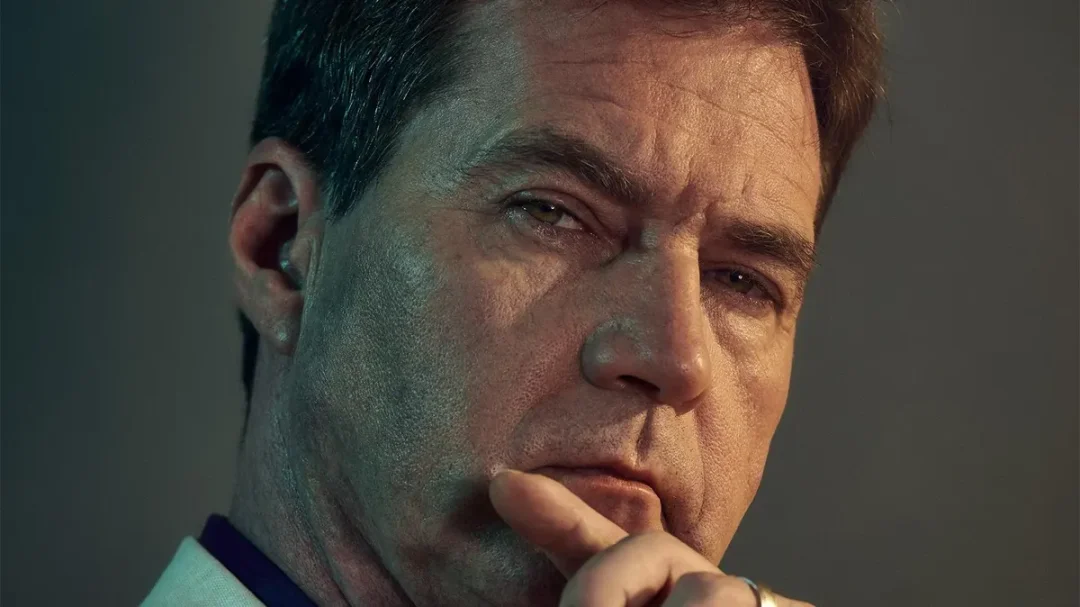

For the past six years, one of Binance’s female executives has successfully avoided global attention, even in the face of crackdowns on cryptocurrencies by governments around the world. Her name is He Yi.

As a heavyweight co-founder trapped in the cryptocurrency empire, He Yi is one of the most powerful players in this $1.2 trillion industry. With regulatory crackdowns deepening, Binance, the world’s largest cryptocurrency exchange, is also facing a survival crisis, which means He Yi will suffer significant losses.

After successfully marketing Binance through media platforms in the early days, He Yi, a former Chinese TV presenter, played a key role in Binance’s rapid rise. Now, she is facing the most dangerous moment in the company’s history, as the exchange dominates not only token trading and venture capital, but also the digital art space. The U.S. SEC accused Binance of illegal operations, violating trading rules and non-compliance in a civil lawsuit, while regulators in countries from France to Australia are also scrutinizing the exchange.

With the market now under regulatory pressure, executives are also facing billions of dollars in risk. According to Bloomberg Billionaires Index, Binance CEO CZ’s net worth is about $29 billion, and He Yi, as an early shareholder, also has a huge fortune (her shareholding has not been disclosed). Their wealth is shared in many ways: they have been business and life partners and have raised children together.

In a series of Bloomberg interviews, including one in Dubai before the SEC filed its new lawsuit, He Yi tried to convey two key messages. First, the differences between Binance and regulators are not as great as they seem. Second, the platform is far from as terrible as critics say it is.

Last month, she said at the five-star Address Fountain Views hotel in Dubai: “If they really take the time to understand our industry, they will find that if Binance does not comply, almost no global exchange or offshore company can be said to be compliant.”

Despite claiming not to have an official headquarters, Binance’s theoretical headquarters in Dubai makes it more difficult to be sued and regulated. But CZ and He Yi have already rooted themselves in this company’s second home in the Gulf city-state of Dubai. She compares her relationship with CZ to college roommates. At first glance, this kind of combination and the governance issues it raises are reminiscent of SBF’s relationship with Caroline during FTX’s heyday, but He Yi refuses to be compared.

The U.S. regulatory agency’s allegations mark the end of the era when crypto was “uninhibited.” He Yi expressed a more soothing tone in a WhatsApp message.

“We respect the attitude of regulatory agencies, whether they support or oppose the development of crypto. I understand that the overall intention of regulation is good in order to protect investors.”

It should be noted that Binance is not the only company facing regulatory impact. The U.S. SEC has also accused mainstream crypto platforms such as Coinbase Global Inc. and Kraken of violating securities rules. However, the scope and severity of the charges against Binance are more concerning. U.S. officials allege that the company lacks sufficient anti-money laundering controls, trading volume is surging, and client assets are being mishandled. According to Bloomberg News, it is also under investigation by the Justice Department, and Binance’s U.S. platform is being cut off from the banking system, with similar banking-related issues impacting other areas of the company.

U.S. investigations are not always aimed at individual or corporate charges, and the Justice Department has not announced any cases against CZ or other Binance executives. U.S. regulators have also not charged He Yi with any violations.

A Binance spokesperson told Bloomberg News about the company’s response to the SEC complaint earlier this month. Binance called the regulatory action “disappointing” and said it would defend itself, claiming that customer funds on its platform have never been at risk.

Behind the scenes, He Yi and Binance have a huge influence, with the trading platform accounting for about half of all crypto trading volume and Binance having about 8,000 employees worldwide. He Yi is also responsible for Binance Labs, a venture capital fund worth billions of dollars that supports more than 200 projects, including the decentralized file-sharing platform BitTorrent and the blockchain gaming giant Axie Infinity. He Yi is also acclaimed for her work in promoting the development of BNB Chain, whose native token was recently deemed an unregistered security by the U.S. SEC, and she has helped regulate customer business and acquisition businesses such as CoinMarketCap.

During an interview in Dubai, He Yi stated that she only brought one bodyguard with her. She said that her limited English proficiency was one of the reasons why she never became a Binance representative. She admitted it was one of her weaknesses in an interview with Bloomberg. However, the company’s executives tried to downplay their connection to China as China is implementing a ban on crypto trading.

“When I interact with Western journalists or make public speeches, people might think we are a Chinese company, right?” The most powerful woman in the crypto industry spoke out when the crisis came.

Early evidence collected by the U.S. SEC in the Binance case reveals He Yi’s involvement with Binance. In the translated transcript of a 2019 audio file released on June 6th, spokesman CZ mentions her name, which is part of how Binance avoided restrictions and made the decision to allow U.S. users to access its larger Binance.com platform.

In the eyes of critics, Binance’s operations still resemble those of a startup, with governance and ownership structures shrouded in shadow, and its promises to millions of users can essentially be summed up as “trust us.” However, in He Yi’s view, Binance offers more transparency than the critics claim and has been working with U.S. regulators all along, although U.S. authorities have objected to this.

He Yi also admits that “global regulatory trends are inevitable” for the crypto industry.

He Yi did not respond to the SEC’s allegations that market makers associated with CZ traded on Binance, that these firms used so-called wash trading to inflate trading volumes, and that customer funds had been mixed and freely transferred in and out of various accounts. Meanwhile, she stressed that unlike the charges against FTX, Binance did not misappropriate user funds for its own purposes, nor did it use its native token, BNB, as collateral for lending.

There are increasing speculations about the post-CZ era that’s coming. Although CZ has not expressed a willingness to relinquish power anytime soon, this possibility is becoming more and more apparent. When asked if she had thought about a Binance without herself and CZ, He Yi said they both have backup executives who are currently undergoing training, but she refused to reveal their names for now. “I think we’ll be fine. We’re not a single point of failure.”

Unlike Wall Street, where trading is conducted through a Daisy Chain of intermediaries, centralized cryptocurrency exchanges handle all transactions from matching orders to holding customer assets, exposing investors to potential conflicts of interest and counterparty risk. Binance is attempting to reshape its image by bolstering its compliance staff as scrutiny of cryptocurrency businesses intensifies. However, there are signs that its loyal fan base is beginning to fracture in the wake of charges in the US. According to industry analytics firm CCData, Binance’s market share in derivatives and spot markets has declined from earlier peaks this year.

Austin Campbell, a part-time professor at Columbia Business School who previously worked at BlockFi, said, “Binance is in a disadvantaged position because Western regulators are pursuing this business model – either having a completely independent custodian or stricter rules around custody, user fund handling, and responsibility bundling.”

In 2014, when He Yi entered the cryptocurrency space for the first time on the OKCoin trading platform, China was the center. By then, she was already famous as a travel show host and served as a judge in reality shows to promote the platform. He Yi recalled that in the same year, she hired CZ as the chief technology officer because of his extensive experience in engineering trading systems and his work experience at Bloomberg LP, the parent company of Bloomberg News.

In 2017, when CZ invited her to be a consultant to Binance, He Yi had already left the virtual currency industry and become an executive at a live broadcast company. That summer, she helped Binance rewrite part of the ICO’s white paper and later agreed to join Binance. Unlike most co-founders, she was not technically part of the company when Binance was founded. However, people familiar with her early background generally believe that her fame in the Chinese cryptocurrency community was crucial to Binance’s rapid success at the time, when Binance was still a newcomer compared to trading platforms such as OKCoin and Huobi.

Six years later, the cryptocurrency industry has been punished for becoming a breeding ground for so-called illegal activities, and Binance’s enthusiasm for market share has become the platform’s goal. With its trading promotion activities, it is, to some extent, even more extreme than Robinhood. For example, by mid-2021, users could withdraw up to two Bitcoins without providing any identification. It also listed some tokens that were proven to be useless, including the TerraUSD algorithmic stablecoin that crashed last year. For cryptocurrency critics, Binance has earned profits from retail gamblers who can hardly understand them.

It’s a well-known fact among insiders of the cryptocurrency community that He Yi and CZ have a child together. How does she describe their relationship? He Yi takes issue with some characterizations.

“In the entertainment circle, there’s a term called ‘CP,'” she says, referring to a Chinese internet slang that refers to fans wishing two people, whether onscreen or in real life, would develop a romantic relationship.

He Yi also refers to Zhao as a comrade in arms, as well as a college roommate. She says their relationship didn’t begin until after she joined Binance. He Yi compares it to Amazon, where Jeff Bezos’ ex-wife MacKenzie Scott was an early contributor, though she admits it’s not a “perfect” comparison. For one, Scott didn’t have the deep involvement in Amazon’s multibillion dollar business that He Yi has with Binance.

As for similarities with SBF and Caroline, He Yi emphasizes the differences.

“There’s a significant difference here: Caroline is an employee, and I’m a partner. Co-founders require more than just a dating relationship. Co-founder relationships are about camaraderie, whereas dating relationships are about chemistry. The former is based on shared beliefs and transcends gender, whereas the latter is based on physical attraction and selfish desire.”

He Yi also notes that her status as a cryptocurrency pioneer predates CZ’s. “Even if you don’t consider personal relationships, I’m the person who brought CZ into the cryptocurrency trading business,” she says. “CZ brought me into Binance based on my achievements,” she adds.

But for regulators concerned about blurred lines and concentrated power, the situation raises danger signals. He Yi is in charge of both the department that invests in cryptocurrency projects and the department that decides which projects to list. Binance director Vishal Sacheendran has said that the Binance token listing team, led by He Yi, is so secretive that few insiders know who its members are. The company says this is part of an effort to reduce potential conflicts of interest. However, the business model sounds particularly opaque in the wake of FTX’s collapse, in part because of the convoluted relationship between its trading platform business and trading arm Alameda Research.

It should be noted that large cryptocurrency exchanges typically consolidate a range of financial services that would never exist under one roof in traditional finance. But the diversity of investments, as well as the opaqueness of management, suggests that Binance’s core still feels like it is under strict control. According to reports, He Yi downplayed concerns about conflicts of interest. “Many of the projects we invest in are not actually listed. There are different leaders and different teams, and the two teams are completely independent,” she said.

In any case, U.S. regulators appear determined to crack down on the cryptocurrency giant and declare much of the industry illegal. Something may have to give. It’s unclear what specific concessions He Yi and CZ are willing to make now, though she acknowledged that the era of free-wheeling cryptocurrency is over.

“If you can’t beat them, you have to surrender,” He Yi said.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Can you make money by running a node? How to choose a public chain? We talked to a node operator.

- Victory belongs to the long-termists: June 2023 Secondary Market Trading Strategy

- Will the growth of the NFT market in 2023 come from new capital entering or from old capital circulating?

- Conversation with three senior KOLs: Bitcoin’s four-year halving cycle, the new narrative of the next bull market, and Ethereum’s “dominant” position

- First leveraged Bitcoin ETF in the US quietly opens, with a first-day trading volume of nearly $5.5 million.

- Will Bitcoin’s ecosystem be the focus of the next bull market? 5 major logics support its rapid rise.

- What are the considerations behind the “coveted” grayscale Bitcoin spot ETF?