BM's EOS Governance Proposal and Its Disputes

Author: Alexli

Source: Blue Fox Notes

Foreword:

Blockchain governance involves not only parameter adjustments or software upgrades, but also the adjustment of interests of different participants. It is always controversial about what is good governance. BM's recent proposal for the EOS equity pledge pool is in favor and there are also objections. There are two articles below, one is the proposed article of BM, and the other is an objection by a community user Alexli. Behind different views represent different interests, so don't listen to the opinions of any party and make your own judgments.

- Respond to the call! Zeng Hao, founder of Ant Node Alliance, led the European encryption journey

- Yang Dong, Renmin University of China: The regulation of the blockchain needs to break the tradition and “chain the chain”

- Report | New users enter the market less, beware of short-term market down risk

Then the question comes. From the perspective of the currency holder, from the perspective of ecological development, does the BM proposal take care of the majority? Will future EOS governance be dominated by block producers, or will Block.one dominate? Will any of them really pay attention to the interests of the holders? Will it really make the best governance decisions for the long-term development of the ecology? Are ordinary currency holders really involved in governance? Is EOS inflation reasonable? Why can't we adjust the inflation rate according to market demand? Just because it is related to the security of the system? … There are too many questions to think about here. Also welcome to leave a message.

The first one: blockchain governance recommendations

The purpose of blockchain governance is to make decisions for the best interests of as many people as possible, while minimizing the chance that a small group of people will act in this way: sacrificing the community to satisfy themselves.

The key is the unanimity of interests and the choice of the parties with the greatest losses if the network is unable to reach its potential. True proof of equity is consistent with long-term interests and gives control to those who have long-term commitments.

From an objective proof point of view, we conservatively assume that all accounts that vote for a block producer are owned by the producer. We can also consider voting and “purchase voting” as “equity leasing” for entry to the top block producers. Since there is little difference between leasing and selling in an untrusted repurchase agreement, this behavior is not unethical and attempts to prevent it is in fact a potential violation of ownership rights.

In order to ensure that in addition to the long-term vision and "betting their own interests", only those who hold the tokens in the equity contract for a long time are eligible to vote. The pledge income they earn can compensate for the loss of liquidity, and its gain should be proportional to the length of time the token is locked. It is best to lock the token for as long as possible based on market-determined interest rates.

Therefore, I propose to create six pledge pools: 3 months, 6 months, 12 months, 2 years, 5 years, and 10 years. In a network with a supply of 1 billion tokens, each pool will receive 5 million tokens a year (assuming the network is 100% reliable). (Blue Fox Note: 6 pools, an average of 5 million tokens per pool, it is difficult to add a total of 30 million tokens, which means that the inflation rate reaches 3%, although each pool income is 5 million tokens per year However, due to the longer-term pool, the fewer participants, the higher the income will be. The March and June periods have better liquidity, and more people will participate, which means proportionally. The less the income will be)

Users can buy pledge pools to allocate revenue in the pool in terms of tokens. The user's voting weight depends on the sum of their ownership in each pool. This means that the annual inflation rate paid to different pledge pools is 3%.

Funds are drawn from the pledge pool at most once a week. Tokens in the March pledge pool can be drawn at a rate of approximately 7% per week. The pledge tokens in the 10-year pledge pool can be extracted at a rate of 0.2% per week.

The tokens in the equity pool are taken from the "resources" pool, so it cannot be lent to REX, which adds a single token bandwidth to all tokens in REX. The equity pledge pool can be seen as a bond, and the token is now withdrawn from circulation and returned to circulation in a way that will earn interest from inflation at some point in the future.

As long as your tokens remain in the pledge pool, they will have compound interest, and the proceeds will be proportional to the total pledge in each pool. Pledged tokens can be transferred from a shorter-term pool to a longer-term pool without delay. Therefore, token holders can transfer all tokens in their March period pool to a 10-year pool at any time. However, you cannot transfer tokens from a ten-year pool to a shorter-term pool, which can only be extracted at a rate of 0.2% per week.

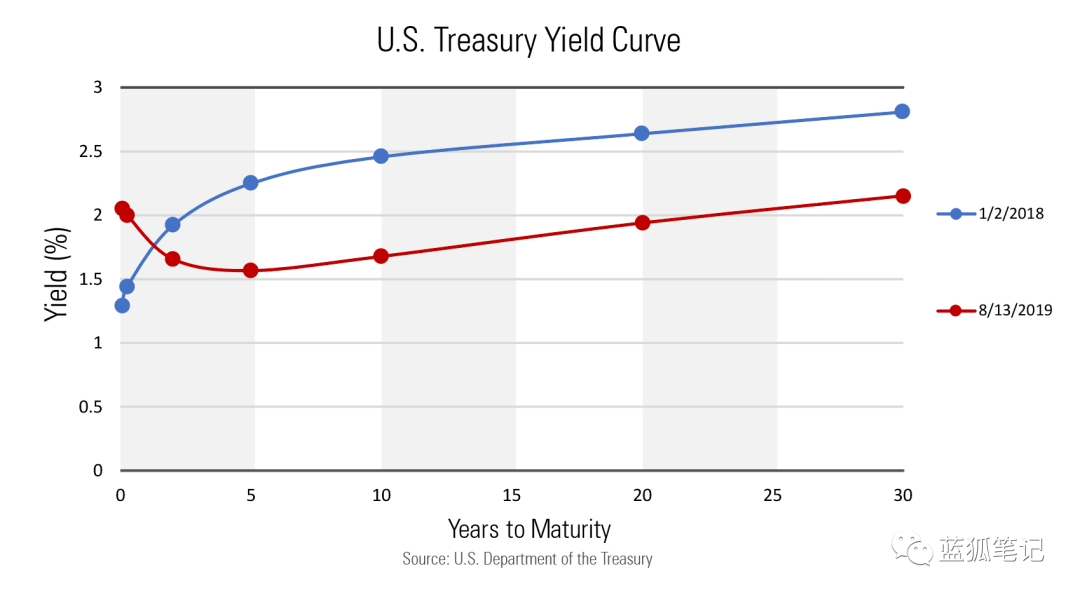

As a result of this pledge system, market forces will set yield curves based on a balance of equity power and liquidity demand. More people are willing to give up three months of liquidity, so they will get lower returns and less power.

Once everyone has pledged and voted, 21 block producers will be selected on the basis of “one generation, one vote” and weighted according to the percentage of the pledge token. These block producers are paid proportionally based on their votes, rather than being paid based on each block.

Anything that pays block producers a linear relationship with their votes encourages witch attacks and leads to concentration of power rather than spreading power to 21 different block producers, one trying to control two When there are more than one slot, there may be only 20 or less. (Blue Fox Note: There are only 21 slots in total. If one person controls multiple slots, it means the lack of opportunities for others)

The remuneration of block producers should be reduced to 0.5% of the supply per decade (according to global reliability discounts, which means the reliability of operation). Ultimately, the largest token holders will likely control who is the block producer. Therefore, the benefits paid to the equity pledge pool are likely to flow to the same group of people running production nodes.

If the network cannot ensure reliable production of blocks, then all decentralization in the world will not help. Therefore, all inflation is measured by a 7-day average availability that is increased to a power of ten. At 99% reliability, the total inflation rate will be 90% of the maximum inflation rate of 3.5%.

If the block producers start to miss the block and the reliability drops to 97%, then everyone's revenue will fall to 73% of the maximum annual return. This means that if voters (equity holders) do not vote for reliable producers, they will be punished.

expected outcome

Exchanges will not be able to vote with the user's tokens because most of the token control is tied to long-term pledge contracts. The model of one generation of coins and one ticket, as well as the proportion of votes, will end the situation in which two block producers are controlled by one subject.

By only pledge tokens to vote, we ensure that everyone wants to be a block producer in which they are betting their own interests, even the lowest producer slots may be reliable.

Perhaps the most striking result is the discovery of true market-based interest rates and annual earnings. Smaller equity pledges can gain additional influence and higher returns by participating in long-term pledge pools.

REX will define the shortest (3 days) pledge pool revenue, and tokens in REX will no longer have voting rights. These efforts to seek income should be moved to the pledge pool. Everything in this proposal is for the community to consider and may be one of many possible solutions.

Second:

Why don't we support BM and EOS New York's EOS main network governance proposal?

The EOS main network was activated by more than 15% of the main network token holders in 2018, which represents the wishes of the token holders, which also enabled the community to make EOS the EOS main network. This is a true model of “civil rule” in the blockchain world, and the consensus of DPOS is derived from this, which is a chain authorized by the token holder. This also makes these side chains unable to compete with the EOS main network. This is impossible in the past, and it is impossible now and in the future.

Therefore, the rules of the EOS main network are also recognized by most token holders. This is undeniable. The premise of any major changes should be recognized by the majority, and the consensus on the compensation of the producers of the main network block should also be changed with the consent of the majority.

Let us return to the question itself. Why do you need to propose an improvement? What improvements? What is the cost? Do we need this rule? Can these rules really solve the problem?

The answer is no. This is not worth it, and the cost is too high to solve any problems. First EOS is a project with a market capitalization of more than $4 billion. Any major change will affect the rights of the token holder.

First, both proposals will change the current inflation model. The current inflation rate is 1%, which means that about 10 million EOS per year will be paid to block producers to keep the network running. The value of this part is about $30 million a year.

According to BM's proposal, the overall inflation rate of the system will increase to 3.5% per year, of which 3% will be allocated to the token holders of the pledge pool for a total of 3 months, 6 months, 1 year, 5 years and 10 The pledge pool for the year, and the block producer's revenue will be reduced to 0.5%, and the spare block producers will be cancelled (Blue Fox note: there is also a 2-year pledge pool in the BM original). what does this mean? An inflation rate of 3.5% means that an additional $110 million worth of tokens will be issued each year.

This will weaken the value of our tokens. The current pledge pool has pledge more than 50% of the tokens, which is already large, so it cannot support more tokens into the pledge pool. If it is necessary to lock the token in order to increase the token price, then this seems unlikely. Eliminating spare block producers will make the network more central. Other "small" block producers with ideal ambitions will have no chance, which is not ideal.

So, can this proposal that allows the entire market to pay $100 million to solve the problem? No, it can't. The block producers of the exchange will still be in the top 21 positions.

As for EOS New York's proposal, it proposes to completely eliminate the 1% limit for block producers and link the block producer's earnings to Rex's dynamics. Moreover, it also proposes to introduce voters' inflection points and introduce many complex algorithms into the returns of block producers. What problem did it solve for token holders? No, no problem has been solved.

The only problem that is solved is the problem they want to solve. Just to remove the restrictions, and what is the actual annual inflation? No one knows, no one can get an intuitive number. Can someone control it? Of course it is possible, it is closely related to Rex and voting. Is it worth it to take such a big risk to solve the problem they want to solve? Obviously, this is not worth it.

What improvements have these so-called improvements made? No. What they want to improve is what they think should be improved. Therefore, this problem cannot be solved and inflation is increasing. This is not a good thing for token holders. Especially in the bear market. The market is sluggish. Other projects are trying to reduce inflation, such as ETH 2.0, and they will adapt to the market environment and reduce inflation.

Is there any real improvement in the governance of the main network? Or are there any advantages in these proposals?

Of course there are. For example, the part of improving network quality – the revenue of block producers is tied to their performance. This will impose penalties on which block producers are missing blocks. In addition, adding a function that allows spare block producers to randomly generate blocks on the current basis will make the entire system more decentralized.

With a note, how to achieve the goal of “serving the money holder” during the bear market? The problem is simple: pay attention to the interests of token holders and value the opinions of token holders. Legally, Block.one is definitely not related to the EOS main network. The community started the main network. The token holder who agreed to start the main network has nothing to do with the EOS token holder of ERC-20. So, what should the role of Block.one on the main network be? Worth pondering. But in any case, the main governance body of the EOS main network should be the token holder and the block producer.

The DPOS authorization comes from the holder of the token, and the block producer determines the current model based on the wishes of the token holder. This is the mode of “holding people to enjoy”. No one should override the wishes of all token holders. Therefore, if the proposal is not supported, the token holder has to do: very simple, vote. Support for block producers who do not support these proposals.

Supplementary update: For the BM proposal, there is a problem:

Currently, Block.one has 100 million tokens for 10 years of mortgage. Obviously, B1 is the body with the most tokens on the market. According to BM's proposal, we assume that the pledge pools in March/June/1/5th year are different weights, only the top 21 block producers, and no spare block producers. Let us assume that each mortgage pool has different weights:

- The token weight of the 10-year pledge pool: 10

- The token weight of the 5-year pledge pool: 5

- Token weight of the 1-year pledge pool: 1

- The token weight of the 6-month pledge pool: 0.5

- The token weight of the 3-month pledge pool: 0.25

Block.one has 100 million votes. It chooses a 10-year period, which means a weight of 10. The effect of multiplication is equal to 1 billion votes. Even in the market, even if 900 million votes are selected for one year, the voting weight is only 900 million, which is less than B1.

Even if the weights of each equity pool are the same, the weight of each equity pool is independent and assumes:

- The voting weight of the 10-year mortgage pool is 1 and B1 has 50 million votes;

- The 5-year mortgage pool has a voting weight of 1, and B1 has 30 million votes;

- The voting weight of the 1-year pledge pool is 1, B1 has 20 million votes; the other token holders have 20 million votes;

- The voting weight of the 6-month pledge pool is 1, and the other token holders have 100 million votes;

- The voting weight of the 3-month pledge pool is 1, and the other token holders have 100 million votes.

In practice, most people will not choose long-term. Currently only B1 chooses long term. With this configuration, B1 can easily obtain the weight of the 10-year and 5-year pledge pools, as well as the weight of half of the 1-year pledge pool, thus obtaining 50% of the total votes, while other token holders only Can have a 50% weight.

Token holders always have different opinions. Therefore, no matter how it is distributed, it will lead to the assumption that the weighting effect of the pledge pool, B1 can use these votes to control the block producers, which is disadvantageous for decentralization.

—— Risk Warning: All articles in Blue Fox Notes can not be used as investment suggestions or recommendations. Investment is risky. Investment should consider individual risk tolerance. It is recommended to conduct in-depth inspections of the project and carefully make your own investment decisions.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Research Report | Blockchain Economics Panorama and Future: Exchange Compliance

- Babbitt Column | Digital Sterling: The Vision and Heart of the Financial Technology Story

- User Experience Survey: What is the next wave of DeFi users?

- People's Network Review "Analysis of Blockchain" 2: How to occupy the commanding heights of innovation

- Why is the distribution of bitcoin fair?

- QKL123 Quote Analysis | The end of Bitcoin, Bakkt's ambition (1030)

- Where are you, my blockchain is back?