Report | New users enter the market less, beware of short-term market down risk

Source: TokenGazer

Foreword

On October 25th, Bitcoin rose more than 30% in one day. Whether the next period of time can continue the previous gains depends on whether the popularity of Bitcoin can continue.

USDT new/active address number

- Research Report | Blockchain Economics Panorama and Future: Exchange Compliance

- Babbitt Column | Digital Sterling: The Vision and Heart of the Financial Technology Story

- User Experience Survey: What is the next wave of DeFi users?

If the number of new/active addresses in USDT and Ethereum increases, it means that the data on the chain has been improved. The increase in the number of new addresses also means that new users will enter the market. Buying USDT from off-market is also an important way for new Chinese users to enter the market.

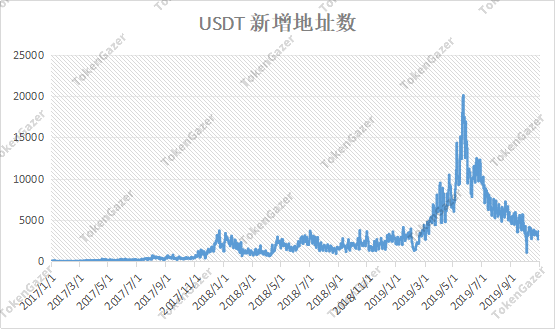

The USDT still accounts for more than 80% of the stable currency market share, and the transaction volume accounts for more than 85%. The number of new addresses has increased synchronously with the market value of USDT since 2018, reflecting the level of new users to a certain extent. The number of new USDT addresses has increased significantly since March 2019, and reached the highest level in the number of new days before Facebook announced Libra.

However, after China’s strong support for blockchain technology and landing application announcement on October 25, the new address of USDT did not rebound significantly, and the current growth rate is still in the decline channel.

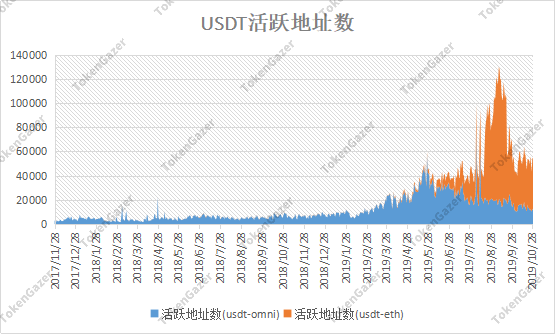

In terms of the number of USDT active addresses, we calculate the current public link of USDT with relatively high practicality, based on the USDT active address issued by BTC OMNI, and the USDT active address based on Ethereum. As you can see from the statistics chart, the number of active addresses has increased steadily since the beginning of 2019. It may also be affected by Libra news, and the overall active address peaked at the end of August. At present, the overall number of active addresses is relatively stable, and there is no obvious increase.

USDT market value

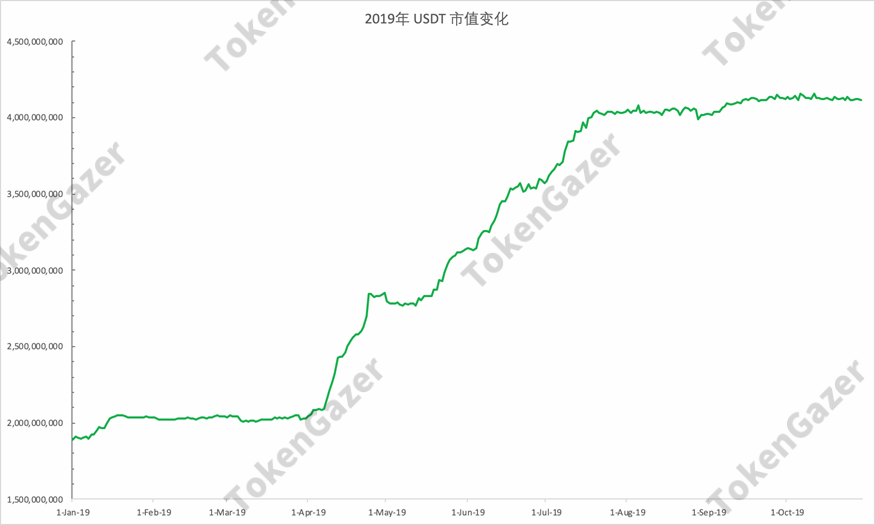

The USDT market capitalization is a measure of funds in the cryptocurrency market. The market value of the USDT began to rise before and after Wall Street began to report Facebook's “cryptocurrency project”, which meant more funds were entering the cryptocurrency market through Tether. We believe that the large increase in the USDT's large probability is related to Facebook Libra, and Libra's launch plan has led to the entry of a large amount of funds. However, this growth trend continued into a platform period in mid-July.

The data in the above chart is as of October 29, 2019. Since we saw the news on the 25th, there has not been much change in the USDT market value, which means that there is not a lot of money due to the news entering the field through Tether. Below we combine USDT over-the-counter premium data for analysis.

USDT Off-Site Premium

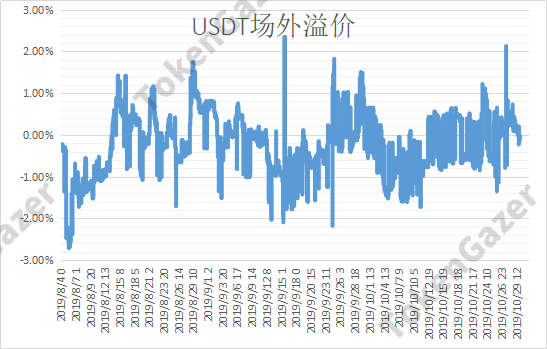

Using the USDC off-exchange price/exchange rate-1 to indicate the premium of USDT in China, the USDT off-market premium continued to fall after a short-term 2% on October 27, and the premium has now completely disappeared. This shows that this market did not lead to the continuous inflow of off-exchange funds. Therefore, we believe that the driving force for this news is still mainly the funds on the market.

Ethereum active / new address

The number of active addresses and new addresses of Ethereum began to rise in February this year, and reached a peak in June, and then began to fall back. The number of active addresses and new addresses of Ethereum is highly correlated with its market price, reflecting the activity of the Ethereum network and the number of new users. Before the announcement of the news on the 25th, the number of daily active addresses and new addresses of the Ethereum network fluctuated smoothly. It can be observed that the news on the 25th did not have a visible impact on them. In other words, although the news on the 25th made the price of the cryptocurrency market higher, from the data of the Ethereum network, it did not directly bring new traffic to the Ethereum network. Considering the threshold for the use of cryptocurrency networks, the impact of this message may need to be released slowly.

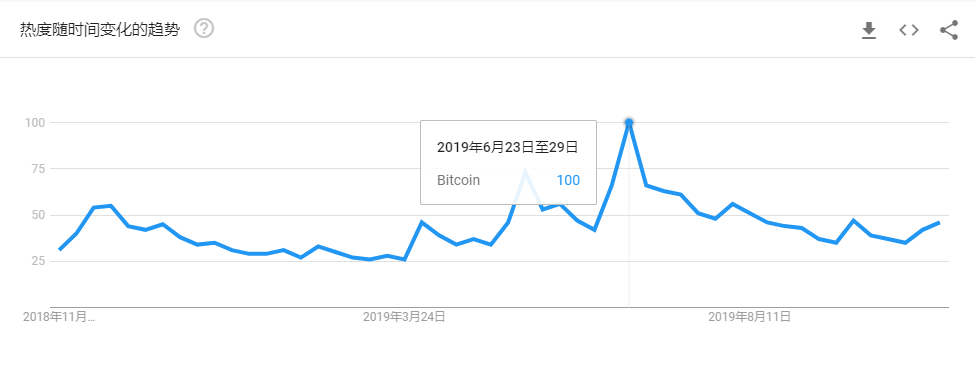

Google "Bitcoin" search index

The relevant search index can respond well to the heat and new traffic, and new users may search before entering the market. In the past year, the maximum value of the Google Bitcoin search index appeared after the release of the Libra white paper in June, after which the heat was gradually declining. On October 25, after the announcement of the relevant news, the Google Bitcoin search index rose by a limited margin and quickly fell back to the previous level. The good news in China did not have much impact on the Google Bitcoin search index.

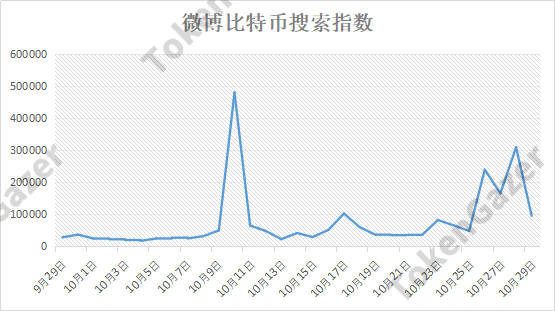

Weibo "Bitcoin" search index

The microblogging bitcoin search index was significantly higher than usual on the three days of October 26-28, but it dropped sharply on the 29th. Even when the heat is the highest on the 28th, it is not as good as October 10. At that time, Zhao Changpeng replied on Twitter that the user could use Alipay to purchase cryptocurrency on the currency security OTC, and a screenshot of the Alipay Twitter account responding to “No, you cannot” was widely circulated.

in conclusion

There is no significant increase in the number of new/active addresses of USDT and Ethereum, indicating that the message on the 25th has no significant impact on the data on the chain, which means that there are not a large number of new users entering the cryptocurrency market. At the same time, the market value of USDT did not increase significantly. USDT's over-the-counter premium and Google/Weibo search index have fallen back to the level before the announcement. The heat of bitcoin has not continued, and there is no sign of continuous inflow of off-exchange funds. Given that the current bitcoin price is still more than 20% higher than the more than 7,000 US dollars on October 25, the impact of the news has been digested by the market in the short term. Although we believe that bitcoin still has room to rise in the long run, it may be difficult to have a large increase in the short term, and beware of the risk of falling bitcoin prices in the short term.

Copyright Information and Disclaimer

Unless otherwise stated herein, all content is original and researched and produced by TokenGazer. No part of this content may be reproduced in any form or in any other publication without the express consent of TokenGazer.

TokenGazer's logos, graphics, logos, trademarks, service marks and titles are TokenGazer Inc.'s service marks, trademarks (whether registered or not) and/or trade dress. All other trademarks, company names, logos, service marks and/or trade dress ("Third Party Trademarks") mentioned, displayed, quoted or otherwise indicated herein are the exclusive property of their respective owners. . You may not copy, download, display, use as a meta-tag, misuse or otherwise utilize a mark or third-party mark without the prior written permission of TokenGazer or the owner of such third party mark. .

This document is for informational purposes only and all information contained herein should not be used as a basis for investment decisions.

This document does not constitute investment advice or assist in determining specific investment objectives, financial conditions and other investor needs. If investors are interested in investing in digital assets, they should consult their own investment advisors. Investors should not rely on this article for legal, tax or investment advice.

The asset prices and intrinsic values mentioned in this study are not static. The past performance of an asset cannot be used as a basis for future performance of any of the assets described herein. The value, price or income of certain investments may be adversely affected by exchange rate fluctuations.

Certain statements contained herein may be TokenGazer's assumptions about future expectations and other forward-looking statements, and known and unknown risks and uncertainties that may cause actual results, performance or events and statements and Suppose there is a substantial difference.

In addition to forward-looking statements as a result of contextual derivation, there are words of “may, future, should, may, can, expect, plan, intend, anticipate, believe, estimate, predict, potential, predict or continue” Similar expressions identify forward-looking statements. TokenGazer is not obligated to update any forward-looking statements contained herein, and Buyer shall not place excessive reasons on such statements, which merely represent opinions prior to the deadline. While TokenGazer has taken reasonable care to ensure that the information contained herein is accurate, TokenGazer makes no representations or warranties, either expressed or implied, including the liability of third parties, for its accuracy, reliability or completeness. You should not make any investment decisions based on these inferences and assumptions.

Investment risk warning

Price fluctuations: In the past, digital currency assets have single-day and post-price fluctuations.

Market acceptance: Digital assets may never be widely adopted by the market, in which case single or multiple digital assets may lose most of their value.

Government regulations: The regulatory framework for digital assets remains unclear, and regulatory and regulatory restrictions on existing applications may have a significant impact on the value of digital assets.

This article is original content, please indicate the source.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- People's Network Review "Analysis of Blockchain" 2: How to occupy the commanding heights of innovation

- Why is the distribution of bitcoin fair?

- QKL123 Quote Analysis | The end of Bitcoin, Bakkt's ambition (1030)

- Where are you, my blockchain is back?

- The Central Political Bureau collectively learns the blockchain technology to transmit the signal? Interpretation of the former chairman of the China Securities Regulatory Commission, Xiao Gang

- Jia Nan Zhi Zhi will be listed in the US, what is the composition of the “blockchain first stock”?

- Deloitte uses zero-knowledge proof technology to improve the privacy attributes of its blockchain platform