Buffett: Does Bitcoin produce no value? I think it is correct, but not all right.

Future believes that it is correct, but not all right.

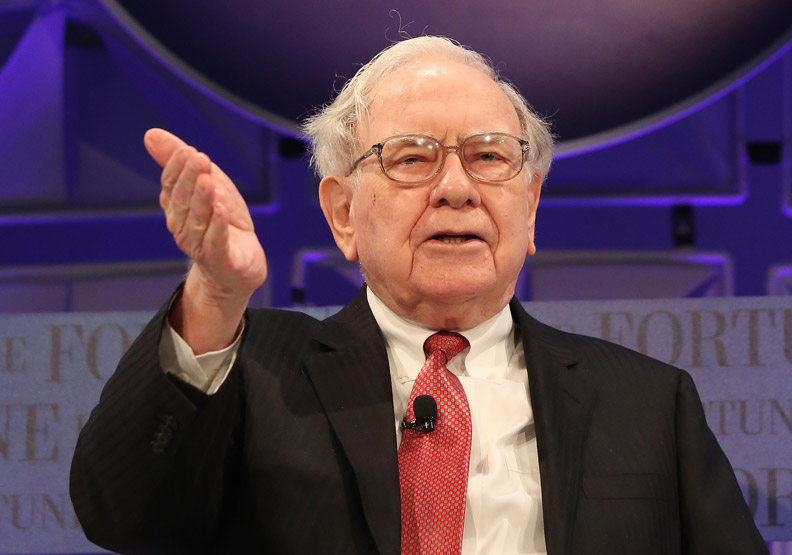

Warren Buffett, known as the "share god", is the greatest practitioner of Benjamin Graham's value investing theory. Buffett believes in value investing, and in partnership with Charlie Munger, has developed the theory of value investing into a more asset-worthy investment practice than the original way of investing in undervalued stocks.

- One hand Yangou IEO, Bitfinex LEO is not worth buying

- The dark night is approaching, DApp rivers and lakes staged a realistic version of "Wolfman Kill"

- Tether Chronicles

This statement once again provoked a heated discussion. Although everyone knows that Buffett has not been optimistic about digital currency, there are also many debaters who have raised objections, such as the speculative value of BTC, consensus value, appreciation potential, and anti-expansion value. Refutation of scarcity and so on.

But in fact, all these rebuttals and debates are meaningless, because the rebuttals and Buffett are not on a track at all, and the value of mutual understanding is not a concept, although it is the same word.

Buffett's value perspective: value investment value.

(Core: generate free cash flow + management + undervalued)

Refuting the perspective of the value of Bitcoin: speculative value.

(Core: news face + supervision + emotion + update, etc.)

So from the starting point is not the same, of course, the understanding is not the same, we first briefly understand the value investment philosophy.

Value investment definition and simple background introduction:

Graham and his student Buffett believe that the essence of value investing is to buy stocks at prices below their intrinsic value. The discount on the intrinsic value of the market price of the stock is what Graham calls the marginof safety. Graham recommends a defensive investment strategy that emphasizes trading at a price below the tangible book value to hedge the operational risks that future companies may face.

In cooperation with Munger, Buffett took the value investment theory one step further. He focused on finding a 'findingan outstanding company at a sensible price' instead of buying it at a low price. the company.

The value originally referred to by value investing pioneers was book value, a concept that evolved greatly in the 1970s. Book value is most useful in industries where most assets are tangible assets, and patents, know-how, software copyrights, brands, goodwill, etc., are difficult to quantify. When an industry or business is experiencing rapid technological advancement, the value of the asset is not easily assessed.

What Buffett said: From the perspective of value investment theory, the current digital currency does not have a stable positive income asset as a foreshadowing, and all public chains are basically purely paying no gains (too early), and there is no way to estimate value. Estimated is also a complete speculation or a simple deduction with a data model. Therefore, from the theoretical point of view of value investment, Buffett said that there is nothing wrong with it, and indeed there is no value at all. But Buffett also felt a little regret for not investing in Apple and some new technology companies in the past, because the valuation model and price-earnings ratio of technology companies are indeed quite different from traditional enterprises and there are too many uncertain factors. Moreover, technology and technology are not easy to quantify the valuation, so the blockchain project does not have too much income at the moment and does not mean that there will be no profit value in the future.

The value that some speculators understand : speculative value, the value that many speculators understand and the value value that the elders say is not the same thing. From the perspective of the bitcoin cycle, although there is no physical support, there is definitely speculative potential value. of. So the value mentioned here is completely different from another definition. It is like you can also say that the second-hand computer you bought is valuable. The value of your fragrant leaves is worthy of consensus. Value, but not the value in value investment theory. So understand this, you will want to open, and not panic and aggressive. As we said before, speculation is only suitable for small amounts of money (relative to your volume), too large a quota is easy to cause risks, because speculation is like gambling, high odds must have a high risk.

So after the elaboration and description of the above examples, perhaps we understand the difference between the value of value investment and the value of potential speculation.

Therefore, Mr. Buffett said that there is no mistake in the value of digital currency from the perspective of value investment, but he did not say that there is no speculative value. (Meng and Buffett still do not like speculation very much, and think that they have disrupted the financial market, especially the option leverage, but since everything can be generated, it represents demand, and some people have games, which does not mean that speculation does not make money. Opportunities and values are only a lot more risky).

But you can also look for opportunities that are underestimated or that you know in depth but that others don't understand under the premise of objective understanding of the project. Such behavior is very similar to the core theory of value investing. In speculation, the idea of value investment can also be applied, so the thinking of value investment allows us to earn a lifetime, but at the same time requires you to continuously learn and make continuous progress.

Here is a simple example. Mr. Munger also cited examples of horse racing. During the World Cup, Croatia and Argentina had a group match. The odds in Croatia are around 5, which proves that the whole world is optimistic about Argentina.

However, after studying the game in Argentina and the Croatian World Cup team, I found that the Argentine midfielder is a very weak link, while the Croatian midfielder is a diamond midfielder, Modric (Real Madrid), Rakitic ( Barcelona), striker Manzukic (Juventus), these points are very restrained by Argentina. Therefore, I personally think that Croatia has been overestimated, so I bought it in Croatia, but the people around me did not recognize it. They think that there are Messi, Aguero and Higuain in Argentina. Meiqiwang’s front line is really powerful, but both forced Messi to play in the midfield. So, the fact is that Croatia’s midfielder completely suppressed Argentina’s final 3:0 victory over Argentina.

This is just a simple example. It also shows the application of value investment ideas in speculation. It also requires you to understand the objective understanding of your participation in the digital currency market. When you speculate on BTC, ETH , ADA , EOS. When we use digital currency such as XRP , XLM, etc., do we have objective judgments on the whole project and strength, and think calmly? I think a large part of people will feel tired, and this has the opportunity for the swindler to take the opportunity to squat, so learn to make our best weapon.

The so-called Token value investment and Buffett value investment concept are still somewhat different, so I hope everyone will not be confused.

I am also a believer in value investing, but I am also full of curiosity and interest in the venture capital world.

Personally think: When the amount is small, potential speculation is a shortcut that allows you to grow wealth quickly. Ai Xiou has already made many people speculate and get rich, although this shortcut is full of risks and unethical people. But when our own size is large enough, the value of investing in learning and accumulating knowledge may be our best destination . Once the world’s richest man, a client of Ray Dalio, the manager of Bridge Water Fund, also broke the position because he did not promptly avoid futures risks. , instant bankruptcy, wealth turned into nothing. This also shows that too much speculation is too horrible.

There are currently several types of Token values (not 100% complete ):

Speculative value added

Price is also a manifestation of value. Many air coins have little value in their bones, but it is valuable. This is also like a lot of acting people who don’t have acting skills but are expensive to play (so the contrast is not right, at least people are acting)

2. Reward

Many public chains require miners and obscure people to maintain, so people always need reward mechanisms to have enthusiasm, and always can't be selfless. Therefore, the reward effect of tokens is reflected. The so-called mining is just like this. (But some mines are shared or read or like, like our platform)

3. Voting rights

Since it is a decentralized place, voting governance is inevitable, so many tokens have this function, such as ht, okb, bnb, etc., after voting will make their own rights more. However, it is objectively said that the voting participation of the currency circle is still the capital side. Several people account for the vast majority of votes. Is this really a good phenomenon? The value of tokens in the consensus mechanism such as Proofof stake, Dpos is also a reflection

4. Dividend rights

This is currently mainly the role of platform currency, similar to the way stock dividends play. For example, Fcoin, the dividend mechanism introduced by Coinex, the dividend of many exchanges is also this model, but where does the dividend of the exchange platform currency come from? Only the handling fee?

Many other mainstream currencies do not currently have similar features, and if they are launched, they will be a big plus.

However, some mainstream currency holders will receive airdrop airdrops, such as holding NEO for GAS at the time and NAS for ATP.

5. Special potential function

Each currency also has its own unique places, such as Bitcoin's stored value function, eth's participation in the project ico function (btcbch neo eos, etc.), future STO use, xrpstellar in moving bricks and forex on the fast and dapp tokens The unique role is its main function. ADA will be used for stable payments in all aspects of government and life, etc.

6. Company perspective

Token can save the company a lot of cost and financing more quickly. Including the convenience of taxation, this is the founder of a project that may be in the future, and I said that they create tokens at almost zero cost, but as long as we do something good, this is a win-win situation. But many people are also running for the money, which is not very good. Let us not let convenience become a weapon of deception

In summary, Token has the added value of the future and the value of participating in it. But there are also a lot of things that really don't make sense. Moderate control of risk potential speculation + stable value investment in future large amounts of funds.

The biggest advantage of value investment knowledge is not to make profits, but to enrich our knowledge, exercise our way of thinking, and make our own ability and judgment ability to be objectively improved, so that even in speculation, there will be greater The chance is to avoid the mines and tiankeng.

▌ author & public number : Future brother

▌Communication: santiago0071 Remarks Please explain

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Zhu Jiaming: The Digital Economy Fifty Years, From "Singularity" to "Big Bang"

- Market Analysis on May 5: A Brief Talk on the Similarities between the Current Market and the Beginning of the 17th

- Facebook data leakage victim: Since it is impossible to prevent data from being sold, it is better to sell it myself.

- Babbitt column | Blockchain + Construction: Lubricants for urbanization machines?

- USDT Thunder, how big is the impact on Bitcoin?

- I regret to miss Google’s Buffett and intend to get involved in the blockchain.

- The blockchain application closest to the money has landed: Will the decentralized financial market blow out?