The blockchain application closest to the money has landed: Will the decentralized financial market blow out?

Recently, the lEO (Initial Exchange Offering), which has attracted people's attention, seems to have been rushing and rushing. It has been a few months since it has been quiet in the currency.

The reason for this is that the rise of lEO is still due to investors' enthusiasm for cryptocurrency , and is willing to pay for such future investments. However, due to the lack of supervision, many investors have gradually turned a blind eye to lEO, and expectations and trust have begun to drain.

Throughout the development of cryptocurrency, the evolution of cryptocurrency is accompanied by chaos and hope , as if to breed a dust-free lotus in the mud, one of which is now called DeFi (decentralized finance), which is considered to be the current block. One of the development prospects of the chain.

01 What is DeFi (Decentralized Finance)?

- In-depth discussion of blockchain thinking mode (bottom)

- Ma Qianli, Vice President of Babbitt: Exploration and Application of Blockchain in the Wave of Big Data

- Facebook Stabilization Project Project Libra is exposed, similar to loyalty points

DeFi is a shorthand for English Decentralized Finance. Translation is decentralized finance, as opposed to traditional centralized financial systems.

In the traditional financial system, financial services, including financing investment, savings, credit, settlement, securities trading, commercial insurance and financial information consulting, are provided by users of centralized financial institutions. Financial institutions use currency trading to integrate value-added items and provide users with convenient value circulation and value-added services.

Users who want to use these services must go through financial institutions and accept the complex terms of financial institutions. As for whether the service can be completed or not, it depends on the service efficiency and security of the financial institution. This is also the main drawback of the centralized financial system.

For simple cross-border remittances, the Nigerian Jodie, who works in the United States, wants to send money to her cousin. She usually needs to transfer money through a bank or remittance company. This process usually takes 3-15 days or even longer. The reason is that the distance between the two places is far, the area where the cousin is located does not have banking services, the currency environment in Nigeria is not very stable, and the foreign exchange settlement is very complicated. Therefore, Judy's remittance needs to pass through multiple transfer companies to finally reach the cousin. Since each transit provider is not a free service, it is likely that a large fee has been deducted when the remittance arrives. Even if Judy doesn't want to accept it, because he has no choice, he can only endure.

There are always more ways than difficulties, so some people are beginning to study how to get rid of the centralized financial system to provide financial services.

However, due to the restriction of the currency centralization property (the legal currency is issued and managed by the state), users are always unable to freely distribute the value of wealth. Even financial institutions cannot avoid the supervision of centralized currency, so users can only choose and center. Cooperation in the financial system.

Now, cryptocurrencies such as Bitcoin give users new hope. The decentralized nature of cryptocurrencies makes it possible to freely circulate wealth , thus reviving the idea of a decentralized financial system:

Our wealth is now free to control. If there is no centralized financial institution involved, can we freely carry out various financial services?

The answer is yes.

02 DeFi practical application and classification

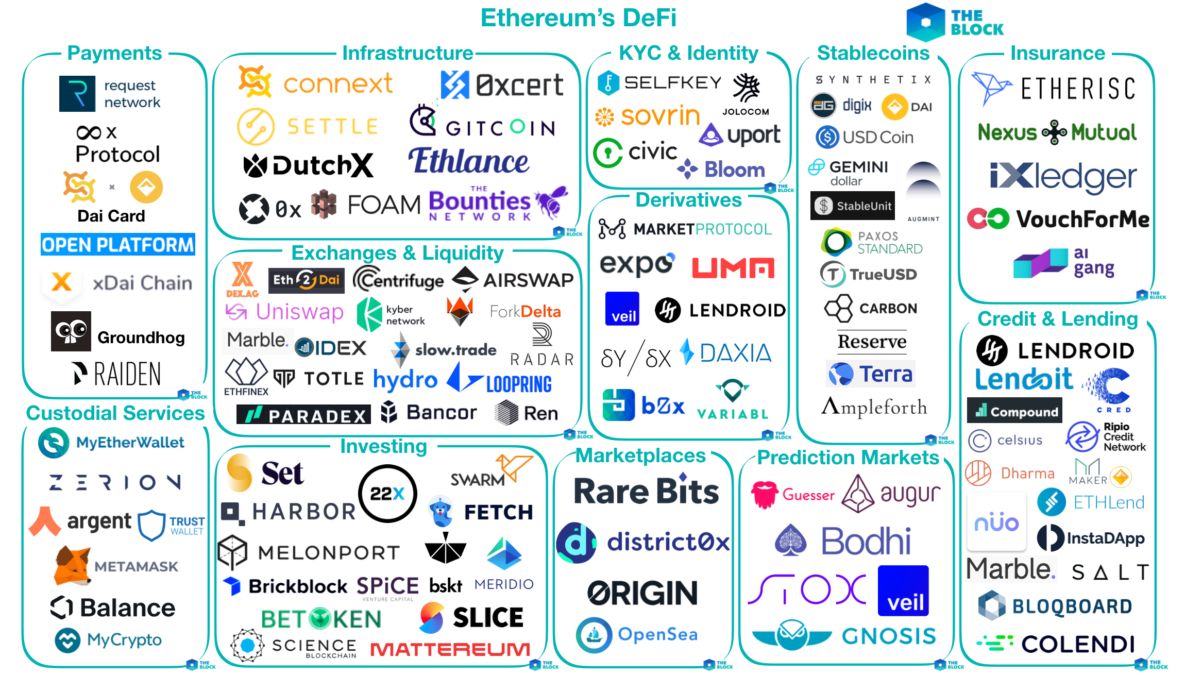

The concept of DeFi has become popular because of its real application . Let's take a look at the ETF's ecology as an example to see what DeFi services companies have:

Image source: TheBlockCrypto

This is the DeFi company based on the Ethereum blockchain, which was counted by The Block media in March this year, and there are already thousands of them. The market value of these companies is said to have exceeded $10 billion.

These are just based on the Ethereum project. DeFi companies based on other public chains have not yet counted. According to the data on DApp Total, the DeFi application based on the EOS public chain REX is just on the DeFi leaderboard for just a few days during May 1st. Two.

The emergence of these companies and projects has confirmed the feasibility of DeFi's vision . There is a view that DeFi should be used more widely to provide more convenient services for those who pursue a free financial environment.

Industry experts have systematically classified these DeFi companies, which can be roughly divided into:

1, payment class 2, loan class 3, stable currency 4, asset tokenization class 5, decentralized exchange…

1, payment class

DeFi companies in the payment category provide financial services for payment transfers . They usually establish or directly use decentralized assets on the blockchain, ie cryptocurrencies. Users are then allowed to make free trade transfers through these assets. Users only need a wallet address to hold and use their own cryptocurrency. The transfer payment of cryptocurrency is not interfered by any enterprise or intermediary. The enterprise mainly provides technical support and account services, and some enterprises also provide acceptance services between cryptocurrency and legal currency.

For example, in these decentralized payment systems, Judy of the United States wants to remit money to the cousin of the family. She only needs to exchange the money she wants to exchange for cryptocurrency, and then transfer the cryptocurrency to the cousin of Nigeria. After the cousin receives the transfer, the cryptocurrency can be exchanged for local legal currency. This completes the remittance process. The whole process takes only a few hours or even minutes at the earliest, and the handling fee is minimal.

There are already many companies that provide these services, and similar service organizations have begun to appear in regions such as South Korea and India.

2. Loans

DeFi's loan application is another new attempt to decentralize finance . It is more democratic and free than a centralized loan application.

In traditional loans, users need to submit an application and mortgage to a bank or financial institution to obtain a license such as a “home loan”. Whether the loan is approved and the amount of the loan is determined by the banking institution.

In the DeFi loan, the user is not limited to being a bank or financial institution, but is directly applying to a wider range of voluntary lenders. Although it can be done in traditional finance, it is not efficient. It is difficult for individual users to find a large number of voluntary lenders on their own. Secondly, there is no intermediate constraint, and it is difficult to guarantee the security of both parties. Therefore, DeFi loans are used. Blockchain and smart contracts solve the most costly "trust" problem in these traditional loans .

The agreement to provide DeFi loan services can be built on the Ethereum blockchain, allowing participants to borrow and access different forms of mortgage debt, and through a series of automated procedures and blockchain technology guarantees to complete user lending, Mortgage, lending and repayment. Such as the Dharma Protocol.

3. Stabilizing coins

Compared to other cryptocurrencies with large price fluctuations, stable currency fluctuations are much smaller. It can provide users with services such as exchange media and value storage, as well as value identifiers for other cryptocurrencies. The USDT we are familiar with is the representative of stable currency. In addition to its own public chain, it has recently issued a new TRC agreement token on the Tron.

Needless to say, the use of stable coins is not known. Traders who often operate in the currency market know the benefits of stable coins – circulation is more stable and can also be used as a safe haven. In the future, it may become a common medium of exchange between different cryptocurrency assets, through which it can freely exchange different cryptocurrencies.

In addition to USDT, other stable currency projects include MakerDAO, GUSD, USDC, etc., and members of the stable currency are still increasing.

4, asset tokenization class

This type of financial service is relatively small because it is subject to more stringent regulatory requirements. It uses the blockchain's cryptographic assets to digitize real-world goods or services. The STO that was hotly discussed some time ago is one of the representatives of such financial services.

STO uses token-based thinking to digitize ownership of financial assets such as stocks or bonds through blockchain technology to facilitate faster circulation. But it also further clarifies the relevant process standards and investor qualifications.

The lEO we mentioned at the beginning of the article should also belong to the category of asset tokenization, except that it does not explicitly limit the assets of stocks or securities to be digital like STO. lEO still follows the thinking of lCO – anything can be Use Token to refer to its value and digitize it. The difference between lEO and lCO is that lCO is open to the public, while lEO sells directly to investors through exchanges.

5, DEX trading platform

DEX is relative to a centralized cryptocurrency exchange. When a user deposits an asset into a centralized exchange, he actually loses actual control over the asset. Whether users can safely use assets or retrieve them in time depends on the integrity of the exchange. In the case of previous years, there are not many examples of DEX coin running, which has caused many users to suffer huge losses.

DEX solved this problem. In DEX, users still own assets, and the exchange only provides transaction information and matching services. The user temporarily mortgages the assets in the exchange during the transaction process, but requires the mutual permission of both parties and the exchange to move the mortgaged assets, thus ensuring the security of the user's assets. Bintion's recently launched DEX is the best example.

From the above classification, we can see that DeFi covers almost all the services of traditional finance, and it provides users with equal access to financial services, and is no longer restricted by centralized financial institutions .

03 The difference between DeFi and FinTech

DeFi is a decentralized finance, and FinTech is a financial technology. These two are the concepts of the current financial and scientific circles, but it is difficult to distinguish the differences.

DeFi is a decentralized financial system and is a shorthand for Decentralized Finance. It can be understood as a specific standard business form or financial system.

FinTech is a composite of Financial + Technology, meaning that companies use technology as a core driver to apply new technologies (such as artificial intelligence, blockchain, cloud computing, big data, etc.) to the financial sector. , thereby improving the efficiency and profitability of the company. It is a description of the company's strategic behavior, and more emphasis on the status and role of technology in the company's financial behavior.

Careful friends can find that FinTech's use of new technologies can include blockchains , so in a broad sense DeFi companies should also be a classification of FinTech.

Because DeFi is a new technology based on blockchain to build a decentralized financial services system, we can understand this: FinTech, which mainly uses blockchain technology to improve the efficiency and profitability of corporate financial services, we call it DeFi Enterprise . For example, in order to prevent fraud, JD.com used FinTech to establish a risk control system to evaluate the risks of 300 million people, while saving manpower and improving the service efficiency of enterprises.

At this time, Jingdong is a typical FinTech company. If JD also provides decentralized payment services, even if the payment business is not the main business, it can be said to be a DeFi company.

04 summary

In short, DeFi is a new financial system based on the development of blockchain technology and core ideas. It can provide users with equal access to financial services, no longer restricted by centralized financial institutions, allowing users to participate in financial activities. It is more democratic, and the desire for people to pursue financial freedom is one step closer to reality.

Perhaps it can be said simply that DeFi has a richer way of freely controlling your wealth because it does not require permission from banks or financial institutions.

DeFi provides a wide range of decentralized financial services through blockchains and cryptocurrencies. Currently, DeFi mainly includes payments, loans, stable currencies, asset tokenization and decentralized exchanges. As the scope of the application expands, I believe that there will be more DeFi services in the future, and some forms may be unimaginable now.

Do you think that the emergence of DeFi will accelerate the entry of more traditional financial practitioners into the blockchain industry? why? Welcome to share your opinion in the message area

——End——

『Declaration : This article is the author's independent point of view, does not represent the vernacular blockchain position, and does not constitute any investment advice or advice. 』

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- How to inherit bitcoin heritage? Professional lawyer gives the answer

- Four major net reds in the currency circle, positively responding to the community's top ten "century problems"

- Storj: Amazon S3 Competitor | Babbitt Home Accelerator Technology Open Class Preview Interview

- In-depth discussion of blockchain thinking mode (upper part)

- Is Facebook the biggest player in the cryptocurrency field? Insider: No, it runs counter to the cryptocurrency

- What is the valuation and rising logic of Bitcoin?

- QKL123 Blockchain Leaderboard (April 2019)