Zhu Jiaming: The Digital Economy Fifty Years, From "Singularity" to "Big Bang"

This article is the third lecture of Mr. Zhu Jiaming in the third phase of the X-lab Open Class of Tsinghua University on April 15, 2019. Xia Li, director of the Tsinghua x-lab blockchain laboratory, served as the moderator. The speaker made a review and technical revision based on the live recordings. Zhu Jiaming is a famous economist in China. He received his Ph.D. in economics from the Chinese Academy of Social Sciences in 1988. He currently works at the University of Vienna. His masterpiece is "From Freedom to Monopoly: China's Monetary Economy for Two Thousand Years."

Zhu Jiaming: Ladies and gentlemen, good evening!

In fact, this topic should be the digital economy for sixty years. The brain thinks this way, but on the PPT, it is written for fifty years. Soon everyone will understand why it is sixty years, not fifty years.

Before starting Lecture tonight, I first proposed a new question in the history of human economy: Is the human economic form gradually evolving and evolving? Still, the human economic form is just like the natural world, there is a mutation phenomenon? As far as I know, economic historians have not systematically raised such questions. My answer is: The history of human economic development has both an evolutionary and evolving economic form, as well as a sudden economic shape. The formation and development of the primary, secondary, tertiary, and even fourth industries that people are familiar with are essentially an evolutionary model. The emergence of the primary industry is almost in sync with human learning of labor and manufacturing tools. The so-called modern processing industry has evolved from the handicraft industry, and the handicraft industry originally existed in the early economic activities of mankind. The industrial revolution is not a "mutation." As for the service industry of the tertiary industry, since ancient times, the service industry originated from the division of labor, which is related to the earliest existence of human economic life. What is the most basic characteristic of this economic form that naturally evolves? It is an economic activity based on material resources, subject to the limited resources, land, manpower and capital. For thousands of years, people have become very familiar with such economic models and have become accustomed to living and creating in such economic growth. As human civilization progresses, these economic forms will continue to evolve.

- Market Analysis on May 5: A Brief Talk on the Similarities between the Current Market and the Beginning of the 17th

- Facebook data leakage victim: Since it is impossible to prevent data from being sold, it is better to sell it myself.

- Babbitt column | Blockchain + Construction: Lubricants for urbanization machines?

However, at least since the 1960s, mankind has created another type of economy. There is no inevitable, direct relationship between this type of economy and the traditional economic form, and it is not directly related to the original economic development process. This type of economy does not have to be based on traditional production factors. The theme I am talking about tonight, the digital economy, belongs to this type of economy. There is no inevitability for human beings to produce a digital economy, but it has arisen.

Compared with the traditional non-digital economy, the process of digital economy generation is peculiar. Its starting point is not material, not labor and production, but thought. On Lecture tonight, I define this idea as a "singularity" that leads to a new economic form. Therefore, there is only this topic for this evening: the digital economy for 50 years: from "singularity" to "big bang". Of course, another reason that motivated me to choose such a topic is that the astronomical community recently photographed a "black hole", inspiring more professionals to explore the relationship between "black hole", "singularity" and the Big Bang.

I hope to spread such thoughts, logic and facts through today's entire Lecture: today's digital economy is considerable, but it is a kind of "out of nothing" economy that originated from the "singularity" of thought. According to Hawking's theory of the Big Bang, the universe begins with a singularity equivalent to the size of a button. This argument is not strict, just a metaphor for everyone. In any case, the "singularity" needs to have three conditions: the first is small, the second, the quality is extremely heavy, and the third is extremely high density. The "singularity" of the digital economy is in full compliance with the three standards.

Here are six questions: 1. The digital economy: the first big bang. 2. Digital Economy: The Second Big Bang. 3. The superposition of two digital economic explosions. 4. Redefine the digital economy. 5. The digital economy has had a profound impact on the transformation of the contemporary economy. 6. Conclusions and Outlook: Reshaping the future of mankind, country, society and commerce.

1. Digital economy: the first big bang

Today, people are familiar with the digital economy that has long been "vulgarized" from a purely singular "singularity", a perfect "singularity", with clear time, place, characters, and ideological content.

Time: June 24, 1961 Venue: MIT Character: Dr. Leonard Kleinrock (1934) Thought content: Information Flow in Large Communication Nets. For the first time in human history, the theory of "packet-switching" was put forward.

Leonard Kleinrock, 1934 to present

Information Flow in Large Communication Nets

Information Flow in Large Communication Nets

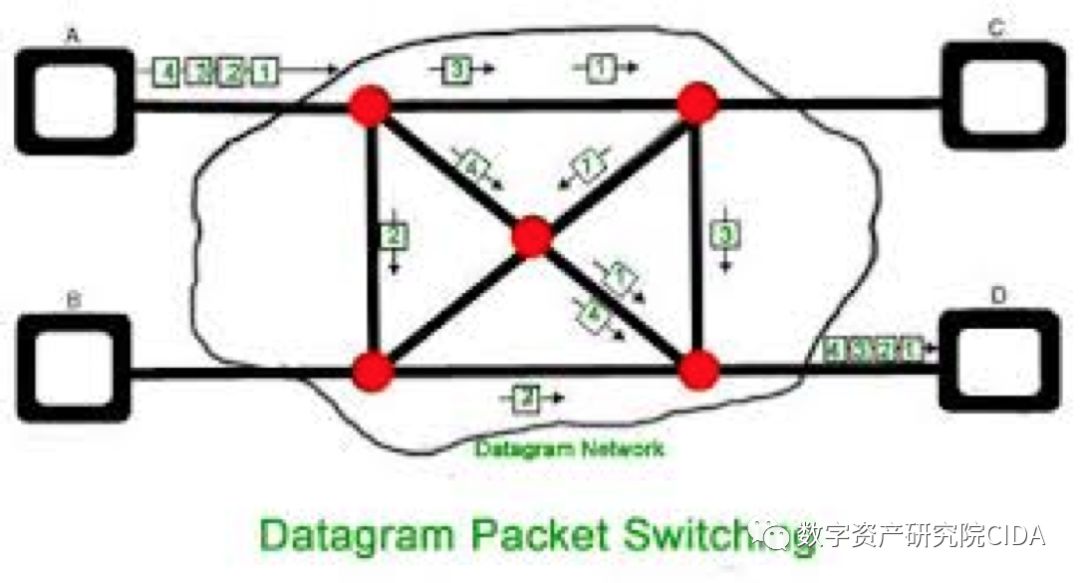

Before Cranrock submitted his doctoral thesis, there were already two things in the world: one was information, the information already existed for too long; the other was the so-called communication method. Taking the United States at the time as an example, AT&T is already a big company, supporting a huge world communication network. However, the transmission of information by telegrams and telephones is limited. When the phone is overloaded, there will be a busy, busy tone. Obviously, solving the communication problem of information requires new ideas. For example, is there a way to decompose large-scale information, send it out through a network, and then reassemble the deconstructed information. Cranrock's genius is not only to raise such a problem, but also to demonstrate his solution, turn information into a lot of Packet, then spread it through the network, then transmit it and reassemble it.

Of course, there are certain controversies about the contribution of Cranrock. However, I still firmly believe that it is Cranrock's doctoral thesis that created the first "singularity" of the digital economy. In 1964, Cranrock's first book, Communication Network, was published, which developed the idea of packet switching. Think about it carefully, it was 1961, 58 years ago, Cranrock was 27 years old.

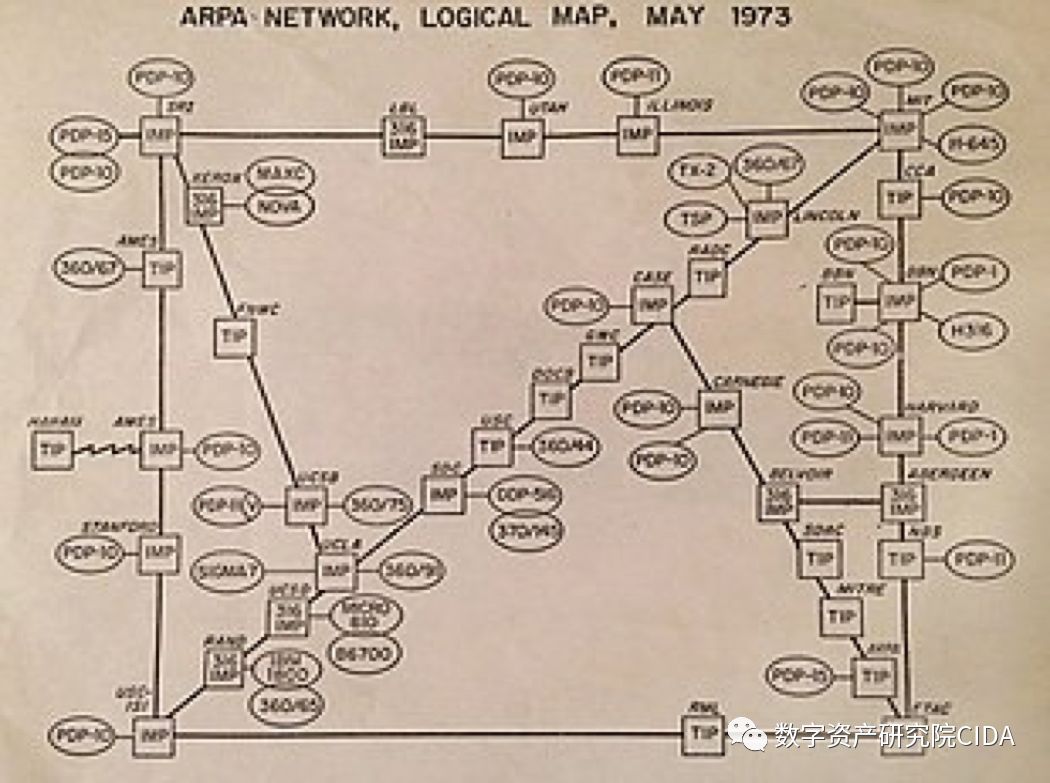

Later history proves that the whole digital economy really originated from a thought "singularity" of Cranrock, and the process of its detonation lasted for half a century. The first round of the explosion was marked by the fact that in 1969, ARPANet achieved networking success at the four major nodes of UCLA, Stanford University, the University of California, St. Barth, and the University of Utah. The human society has since entered the network era and laid the foundation. The infrastructure of the digital economy. From 1961 to 1969, this explosion took eight years, mainly in the ideological explosion, which proved that Cranrock's ideas were practicable.

After that, the first digital economic explosion went through several rounds, mainly in the 1970s to the 1980s, the 1990s, and the 2000s to the 2010s.

In the 1970s and 1980s, the Internet advanced by leaps and bounds. In the 1970s, it was largely solved: the world began to lay the cable supporting the Internet, connecting the world and forming a physics infrastructure to support the later digital economy.

During this period, there have been some historical milestones: E-mail "@" birth, TCP (Transmission Control Protocol) development; Symbolics.com – first ".com" wave; Microsoft Windows impact; 30 years In 1989, the World Wide Web & Hyper Text Transfer Protocol was formed.

Entering the 1990s, the singularity continued to explode and the pattern changed. People suddenly discovered that the so-called Internet quickly broke through the E-mail phase based on personal connections, and Internet-based digital economic entities have sprung up. In the 1990s, I was mainly in Boston, and I personally witnessed the emergence of the following companies: 1990: Archie, the first web search engine; 1994: Netscape and Yahoo!; 1995: Amazon (Amazon) .com), Haitao (eBay) AltaVista; 1998: Google. In China, Tencent in 1998 and Alibaba in 1999 were born. Since then, the digital economy has ceased to be a non-conscious evolution. These new economic entities have become the wave of children, becoming players and beginning to dominate the digital economy.

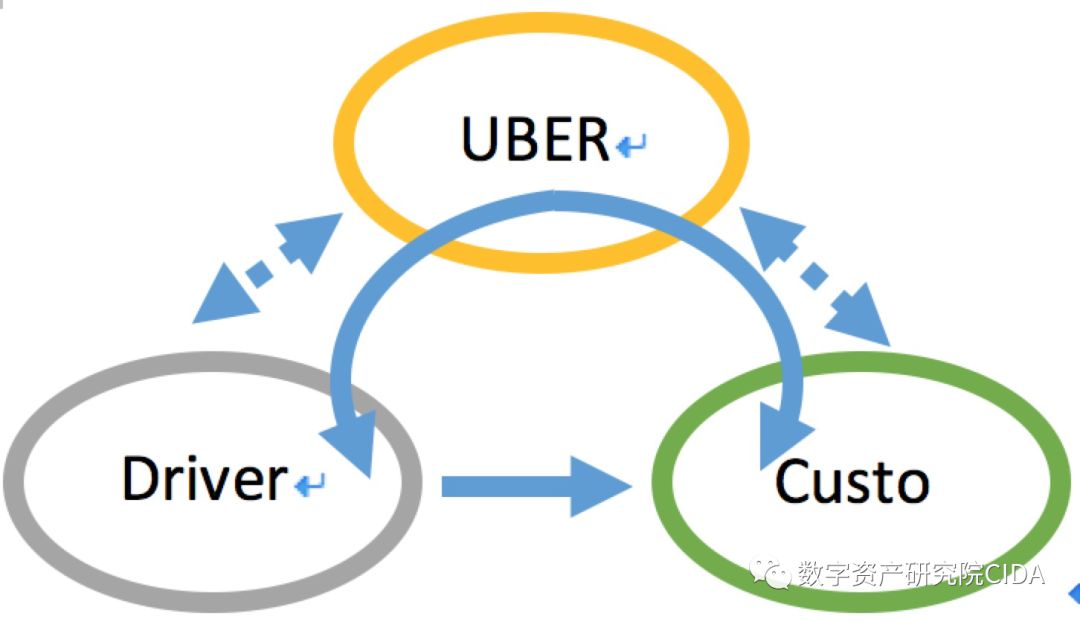

From the 2000s to the 2010s, new digital economic entities represented in the form of social platforms have entered the historical arena. Wikipedia in 2001; Alipay in 2003; Facebook in 2004; Youtube in 2005; Twitter in 2006; Iphone in 2007; Uber in 2009 ; WeChat in 2013. Not only that, new economic models, or new business models have emerged. I personally don't like the concept of "business model." However, I am definitely in Uber mode, especially drawing a Uber model.

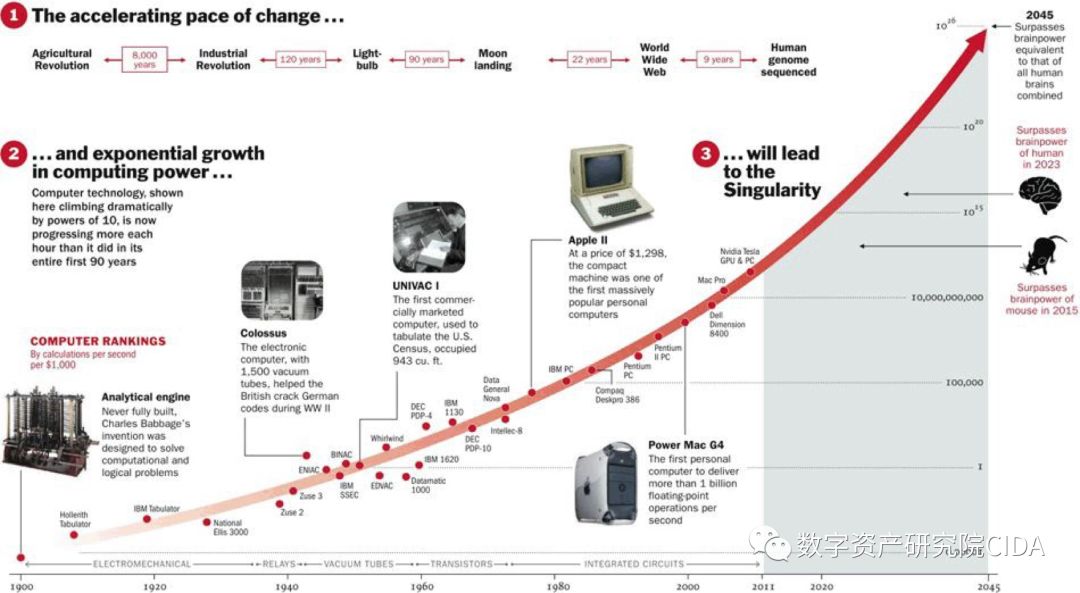

The first to explode the first big explosion of the digital economy is undoubtedly the two laws that are often mentioned in recent years: Moore's Law and Metcalfe's law. The inventor of Moore's Law was one of Intel's founders, Gordon Moore (1929-), which was proposed in 1974. It was originally described that integrated circuits are available at constant prices. The number of components housed will double approximately every 18-24 months and performance will double. This law reveals the speed of advances in information technology. In 1995, Moore wrote in the Economist magazine: "What worries me most is the increase in cost,… This is another index curve." His statement is called the second law of Moore.

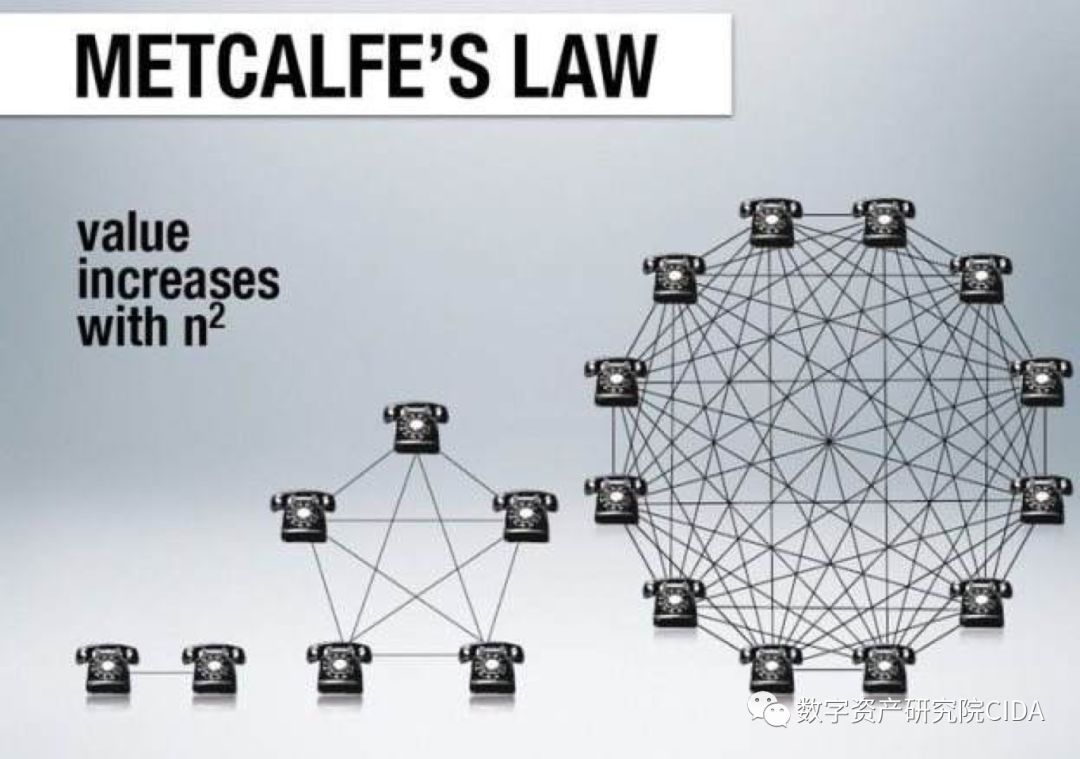

The core content of Metcalfe'slaw is that the value of the network is equal to the square of the number of network nodes, and the value of the network is proportional to the square of the number of users connected to the network. In other words, Metcalfe's law reveals the rule that the value of the Internet increases in arithmetic progression or quadratic equation as the number of users grows. Metcalfe's law was proposed by George Gilde, in 1993, to commemorate and affirm the pioneer of computer networks, Robert Metcalfe (1946-), founder of 3Com. According to Metcalfe's law, the more users of a network, the greater the value of the entire network and each computer in the network, that is, the value of the network V = K × N2 (K is the value coefficient, N is amount of users). Since the 1990s, the Internet has not only presented this extraordinary exponential growth trend, but also exploding extensively into the economic and social fields.

It is worth emphasizing that the biggest change in the 1990s was the “perfect” combination of WallStreet, Venture Capital and Silicon Valley in the explosive organization of the digital economy. The Nasdaq, which was once unknown and not considered by traditional capital, dominated this capital market. Nasdaq has been created since 1971 with an index of 100 points.

In the 1990s, Nasdaq entered a golden age of ten years, from 500 points in 1991 to an acceleration after 1998, to 5,000 points on March 9, 2000. However, a few days later, on March 13, 2000, the Internet bubble burst, 500 companies listed on the Nasdaq went bankrupt, 40% withdrew, 80% fell more than 80%, and evaporated $3 trillion. Despite this, after the bubble, the surviving digital economy entered a new stage of development.

In the eight years after the dotcom bubble burst in 2000, a global financial crisis broke out in 2008, which affected the traditional economic sector and the emerging digital economy. I chose a photo of Lehman Brothers closing on Monday, September 15, 2008.

The impact of this crisis is profound and lasting. In 2012, after the crisis, the occupation of the Wall Street movement took place, challenging the combination of capital and technology represented by Wall Street and Nasdaq. The most representative slogan of this sport is: Weare the 99%. This movement reflects the American people's awareness that the beneficiaries of the IT scale and the expansion of the digital economy are only a very small number of people. While creating a group of new rich people, they also create new inequalities and create new wealth distribution problems.

So far, I have sorted out the history from 1961 to 2008, the main process of the first big explosion of the digital economy. The use of "singularity" to the "big bang" is not only far-fetched, but also It is appropriate: the digital economy does originate from an idea, a doctoral thesis. At the time, not many people in the world had such an idea. China's 1961 was an extremely difficult period. There was no Chinese communication expert, or scientists were able to ask such questions at that time. Since 1961, it has been a wave of explosions, and by the 2008 world financial crisis, a cycle has been completed. The rapid development of the digital economy, once embraced and supported by people, has driven the large-scale development of the global macro economy, and ultimately did not allow humans to avoid a larger economic crisis, the 2008 world financial crisis.

Second, the digital economy: the second big bang

The story is not over. Now I am going to talk about the second singularity and the related second big bang. The second singularity, as well as time, place, and characters, also started with an article.

Time: November 1, 2008 Venue: a website, metzdowd.com, cryptography Info Page-Cryptography mailing list List Character : Satoshi Nakamoto Thought : An article, "Bitcoin: A Peer-to-Peer Electronic Cash System (Bitcoin: A Peer-to-Peer Electronic Cash System)

Compared with the dozens of doctoral thesis of Cranrock in 1961, Nakamoto's papers on Bitcoin in 2008 were much shorter, but several pages. But the result is the same, because this bitcoin paper has sparked another type of continuing big bang in the digital economy of the past decade, changing people's cognitive inertia about wealth. In this sense, the "singularities" of the two big bangs have striking similarities: they all come from an idea, the form is a thesis, and the weight of the material form is negligible.

If so, what is the difference between Nakamoto's paper and the Cranrock paper? That is, Cranrock's paper has no monetary value utility, and Nakamoto's paper soon gave birth to the first blockchain and the first bitcoin. However, the value of the beginning is extremely limited. The story behind people knows that although the price of Bitcoin is ups and downs, the price of Bitcoin is still equal to thousands of dollars. What I want to emphasize today is, don't worry about how valuable Bitcoin is, but should care about Bitcoin originating from an idea, an Idea, an article, no matter how long and arduous the development process behind it. At least, compared to the explosion process triggered by Cranrock's paper in 1961, the explosion process caused by Nakamoto's bitcoin article is much shorter in time and much larger.

The first transaction of Bitcoin: 400BTC = 1USD (equivalent to 0.0025USD, 0.17RMB); on December 17, 2017, the highest price of Bitcoin was $1,873; the market value reached $332.827 billion; today, April 15, 2019 The price of Bitcoin was US$5183.3 (a decrease of 73.92%) and the market value was US$91.464 billion (a decrease of 72.52%).

The second round of the big bang caused by Nakamoto's article occurred between 2013 and 2014. The initiator was Vitalik Buterin, who was around 20 years old. The result of the explosion was the birth of Ethereum. Ethereum has become a public blockchain platform with open source and smart contracts, or a "next-generation cryptocurrency and decentralized application platform."

In 2014, Ethereum ICO crowdfunding success, Ethereum became the second largest encrypted digital currency. Ethereum's highest price time: December 17, 2017, the price is 1431 US dollars; the market value reached 138.825 billion US dollars. Today, on April 15, 2019, the price was $168.2; the market value was $17.776 billion.

Vitalik's Ethereum is a big event in the history of encrypting digital currency since 2008, which has formed a scale that has stimulated the expansion of the blockchain application environment.

Because of Bitcoin and Ethereum, the number of encrypted digital currencies worldwide has exploded.

The names and market values of the top 15 encrypted digital currency banks are as follows:

I chose the 15 encrypted digital currencies ranked so far. I dare not say that the order is stable, and I dare not say that the value of the top 15 is stable. However, their overall disappearance is a small probability.

Furthermore, there are various types of trading platforms for encrypted digital currencies in the world. The most famous one was MtGox. China called "Moutougou". The translation was indecent and it was closed after a great contribution. Now there are coins and fire coins related to the Chinese.

People need to face up to the total market value of encrypted numbers. We need to use the GDP of countries around the world as a frame of reference. In January 2018, the total market value of encrypted numbers reached an all-time high, totaling more than $830 billion. There are no more than 20 countries with a world GDP of more than $800 billion. This figure is close to the GDP of the Netherlands in the past, Saudi Arabia's GDP. Today, on April 15, 2019, the total market value of encrypted numbers has shrunk dramatically, totaling $176.9 billion. Even this figure is close to the GDP of countries such as Qatar, Algeria and Kazakhstan. In other words, because the owner of the encrypted digital currency has a limited population, the market value of the per capita encrypted digital currency will be significantly higher than the per capita GDP of comparable countries.

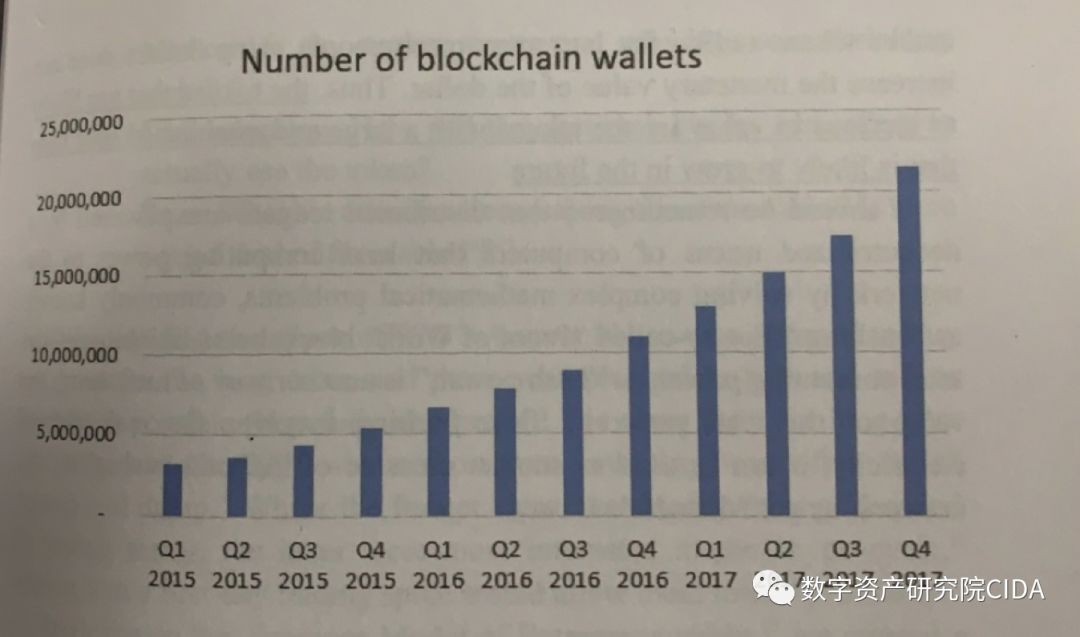

A friend of mine has just brought a book from the United States, "Blockchain Econmoics", published in 2019, with at least five authors, and the publisher is WorldScientific. This book has the value of being translated into Chinese. I downloaded two pictures of the book on page 131. One picture shows how the blockchain wallet grew at a rate of just a few years from 2015 to 2017. Another picture shows the expansion of the blockchain Market capitalization from 2015 to 2017.

What I want to say here is that you need to use Open Min to look at Bitcoin, Ethereum and other more specialized encrypted digital currencies. A few years ago, I said in an interview with Asia Weekly: Encrypting digital currency is no longer a fire of the stars, and it is forming a prairie. After a few years, this momentum has been difficult to reverse. Everyone can think about it. From the article of Nakamoto of 2008, the history of alternative wealth promoted by Bitcoin has only been ten years.

Now, I need to recall what I said at the beginning of today's speech: Human beings have two forms of wealth. One is that this form of wealth exists from the time of human beings. It evolves and progresses in a linear equation model. There is also a form of "out of nothing" that develops in a nonlinear mode. This "out of nothing" wealth form has a history of less than 60 years. Therefore, we have to accept the fact that there are still a group of people in this world who do not rely on the traditional model and create alternative wealth models that are likely to represent an alternative to humanity. Not only that, but their wealth is hard to be deprived, and these wealth exists in various "wallets" in the cloud. With strong and constantly improving technical support, its core technology is the blockchain.

Over the decade, blockchain thinking and technology have changed dramatically, and it is becoming a cluster that will be combined with all economic sectors. It even includes law, science, society, and so on. This is a picture I told at Peking University last month to describe the changes in the blockchain:

3. The superposition of the "two explosions" in the digital economy

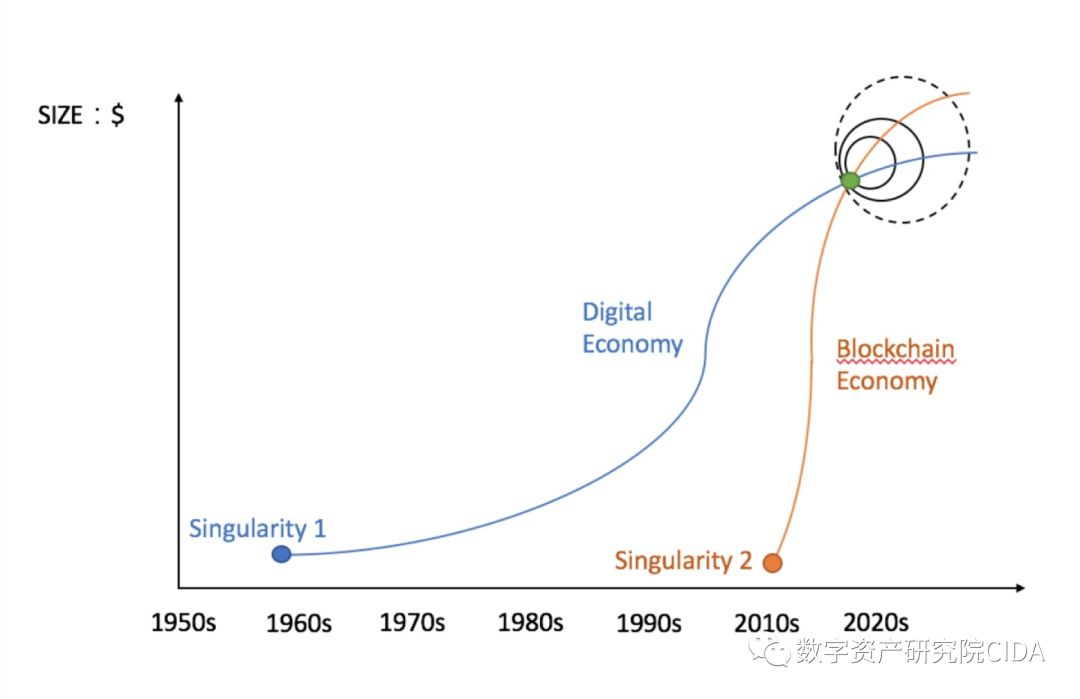

Now we are going to discuss more interesting issues, the first digital economic explosion since the 1960s, and the second digital economic explosion that was triggered by the birth of Bitcoin in 2008. The effect led to a new explosion. I very much hope that everyone will be excited because we are now at the junction of the two big bangs. So I drew such a picture:

Here, I divide the digital economy into two types: Type I is a digital economy based on the ICT revolution, represented by blue "singularities" and blue curves, reflecting probably from the 1960s to the 2010s. The trend is that the curve should have declined around 2000 and is more in line with history. Type II is a new digital economy platform originally originated from Bitcoin. It is represented by orange-red "singularity" and orange-red curve. The slope of the orange-red curve on the way is very accurate.

It is worth noting and studying: When do the blue and orange curves intersect? Why do you intersect? What are the characteristics of intersection? It is now clear that the intersection time is 2017. 1CO becomes the main form of intersection. The digital economy has developed into a historical stage of self-development of new financial and monetary instruments and transformation of the capital model. Since then, the digital economy has begun to form a transformation into a complete industrial chain and value, and to the new economic form.

We are now at such a moment, the superposition of two types of digital economic explosions is still in progress, continue to generate huge energy, and it is difficult to carry out quantitative analysis. However, the contribution of the explosion stack to GDP is significant, and it is still uncontroversial.

Fourth, redefine the digital economy

It is not a simple task on how to define the "digital economy". In order to prepare for Lecture tonight, I conducted the necessary literature search on the definition of “digital economy” and found that at least from 1996 until 2018, quite a few scholars attempted to define the digital economy. One scholar, Tapstott, tried to define the digital economy in 1996. It is said that recently he worked with his son and wrote a monograph on the blockchain.

If you look at Wikipedia, the digital economy is defined as an economic activity based on the IT revolution and the ICT revolution, or supported by IT technology and ICT technology. This is obviously not enough. The difficulty in defining the "digital economy" is mainly due to the constant acceleration of the evolution of the structure, mechanism, scale and technological foundation of the digital economy, and it has a high impact on and the transformation of economic organizations, economic systems and even business models. In short, the digital economy is a highly dynamic and increasingly complex concept. Not only that, but the traditional economic concept has been difficult to adapt to the digital economy. For example, the production factors and cost concepts of the digital economy have gradually drifted away from the traditional economy, and even different.

Further, in the 1990s, it was easier to distinguish the boundaries between the digital economy and the non-digital economy. Today, it is becoming more and more difficult to make such a distinction. For example, is Industry 4.0 an upgraded version of the traditional processing industry, or is it already a digital economy?

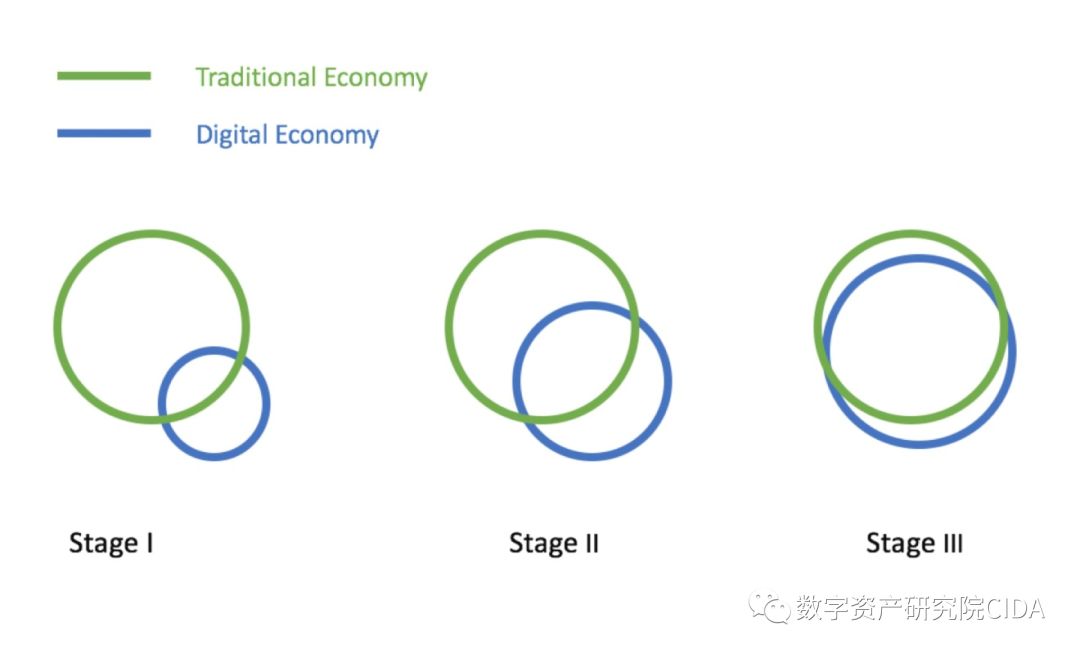

The digital economy has not only created a new economic form, but also transformed the original economic form. Assuming that the green circle represents the traditional economy and the blue circle represents the digital economy, the global trend is in the second stage. See below:

In the third stage, the blue circle and the green circle are in a coincident state, reaching the state of total eclipse, which is not far off.

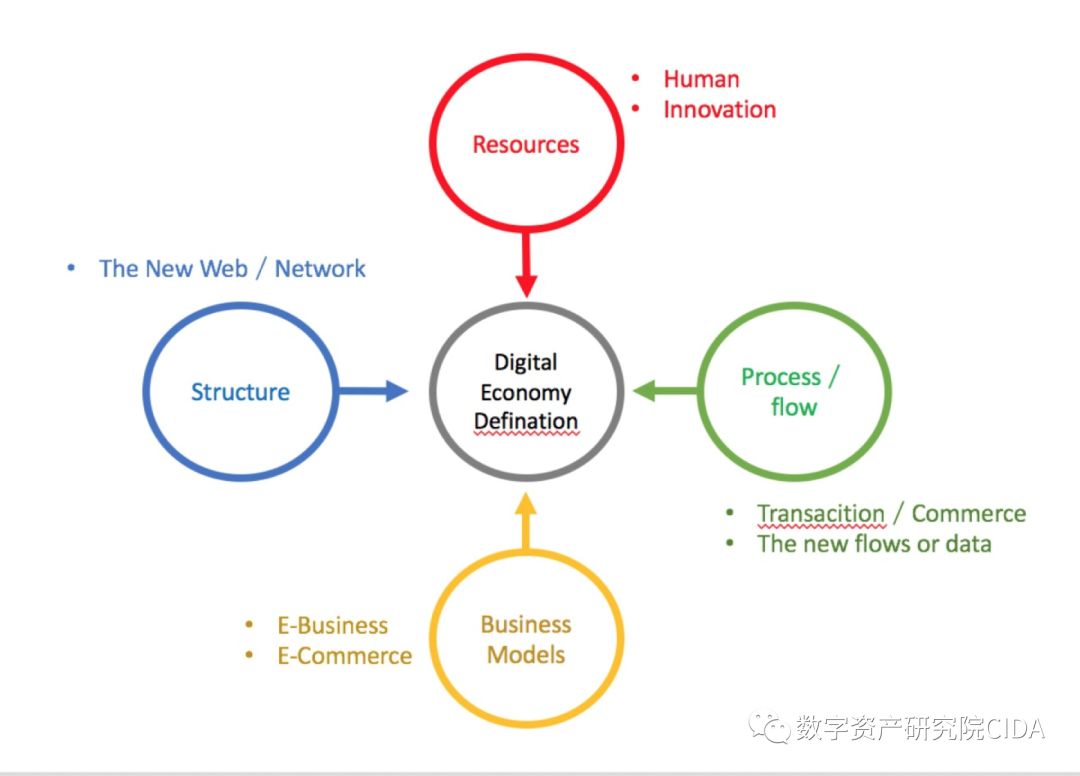

In any case, in the historical period of the 2020s, thinking about the digital economy now requires consideration of fundamental aspects such as resources, processes, structures, and business models to avoid blindness. See below:

In short, if the "singularity" of the digital economy is traced back to the early 1960s, it has now passed for nearly sixty years. During the period, the concept of the digital economy continued to expand.

In the above picture, the black dots and lines represent "singularity" and early expansion; the blue circle is the technical basis of the early digital economy; the orange circle is a narrow digital economy; the green circle is transformed by the digital economy. The economy represents the broad digital economy. People are now at a turning point from a narrow digital economy to a broad digital economy. At such a time, the distribution system and the employment system will change. The so-called DigEconomy is formed in this context. Recently, the 996 and ICU issues that people have paid attention to and discussed are an extreme phenomenon of the zero-work economy. My position is clear and I am willing to stand on the side of the 996 camp.

5. The digital economy has a profound impact on the transformation of the contemporary economy.

Over the past half century, the impact of the digital economy on the contemporary economic system has been profound and sustained.

First, it changed the industrial structure. Directly stimulated the fourth, fifth, and even Nth industries, enriching the shape of the infrastructure, resulting in a complicated industrial structure.

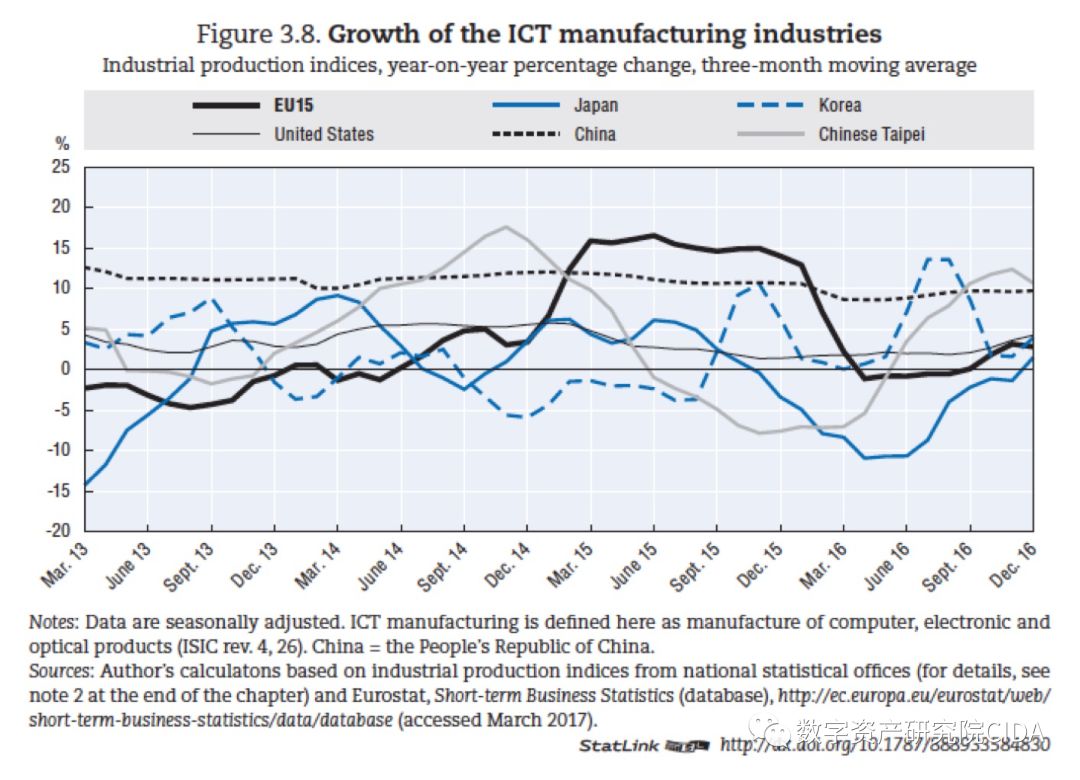

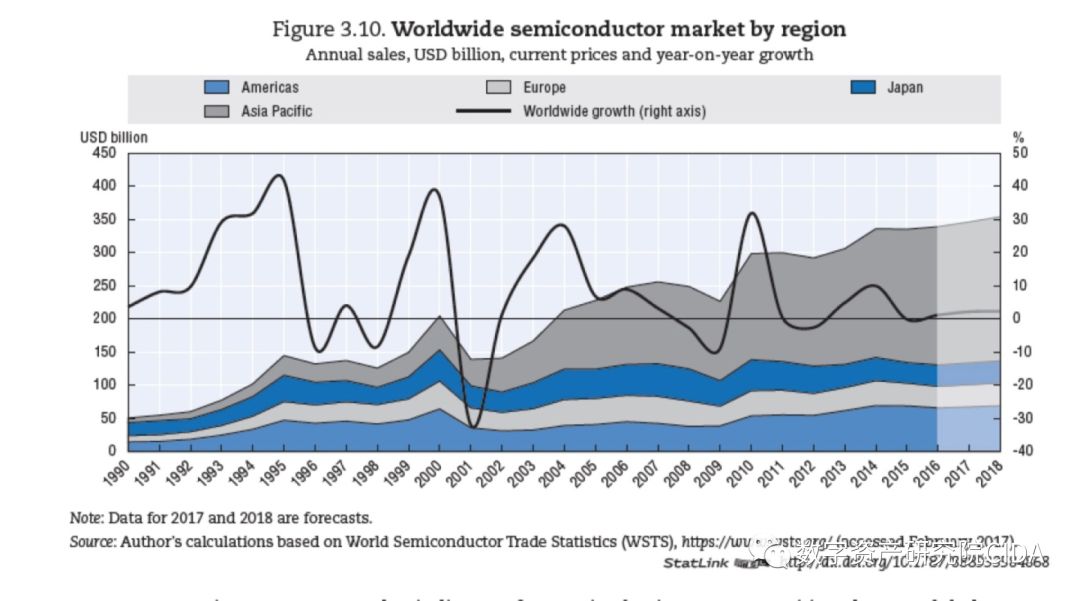

Second, it changed the technical foundation of the processing industry. Recently, the OECD presented a report on the digital economy, mainly targeting the six economies of the EU-15, Japan, South Korea, the United States, China and Taiwan, demonstrating the impact of ICT on the processing industry and the service industry, especially the chip industry.

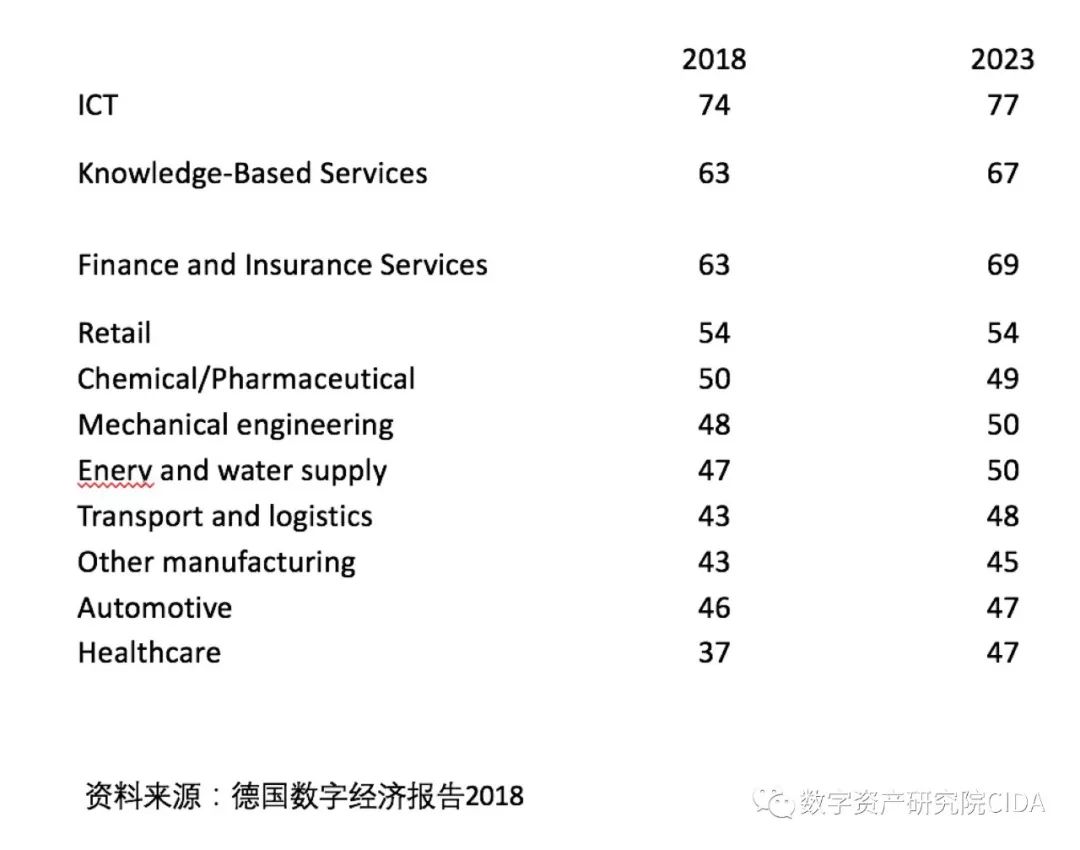

In 2018, Germany published a report on the digital economy. The classification of the digital economy is more detailed, from ICT to knowledge industry, financial insurance, retail, to traditional processing industries. The last one is the health industry, and the digital process can be seen in the industry. The length of influence and future trends.

Third, digital assets support a contribution rate of more than 50% of world GDP growth.

Fourth, change the shape of the company. On the one hand, transforming traditional enterprises to adapt to the transformation of the digital economy; on the other hand, creating new enterprises that adapt to the digital economy, especially to the blockchain. Now, any enterprise needs to realize the transformation of digitalization and even "algorithm". Otherwise, it is difficult to coordinate big data processing, AI intervention, and blockchain embedding, and ultimately ensure that enterprises can be in the increasingly space and time dimension. Survival.

Fifth, change the business model.

Sixth, change the employment pattern. The biggest change is the more flexible employment model I just mentioned.

Seventh, change the structure of international trade. The Sino-US trade friction is essentially that China's advantage is traditional industry; while the US advantage is the digital economy. The surplus of traditional Chinese industries can be offset by expanding each digital economy product. However, the digital economy is more closely integrated with intellectual property. Therefore, the United States places intellectual property at a very important position. In the long run, the balance of Sino-US trade will ultimately seek to balance the two countries in the digital economy.

In addition, the digital economy has changed the monetary system and capital markets. The emergence of Bitcoin and Ethereum has spurred hundreds of cryptocurrencies to go to market, proving that Hayek’s non-monetization can become a reality. At the same time, more and more national governments around the world are studying and creating legally encrypted digital currencies. In the past decade, when people were paying attention to and discussing the international financial order in the post-Bretton Woods conference era, the traditional monetary system was changing, and legal and illegal encryption of digital currencies had become a reality. In this regard, we must abandon the "elite" consciousness. The traditional patterns and boundaries of money, capital, and finance are accelerating change. Today, there are two news: First, the IMF launched an encrypted digital currency. Second, Busan was selected as the free zone for Korean encrypted digital currency.

Finally, it is necessary to pay attention to the long-term impact of the digital economy on the "business cycle" and the macro economy.

Conclusions and Prospects: Reshaping the future of mankind, country, society and commerce.

First of all, I need to pay attention to the status of the four roles in the digital economy: first, scientists; second, engineers; third, entrepreneurs; fourth, the government. I did not emphasize the status of capital, because the importance of capital in the process of the digital economy is relatively declining compared to the status of science and technology. Going back decades, who would have foreseen that the world ultimately depends on Code, which is determined by the algorithm?

Second, I use three "S" results to summarize the sustainability of the digital economy: first, speed; second, Scope; third, Spread.

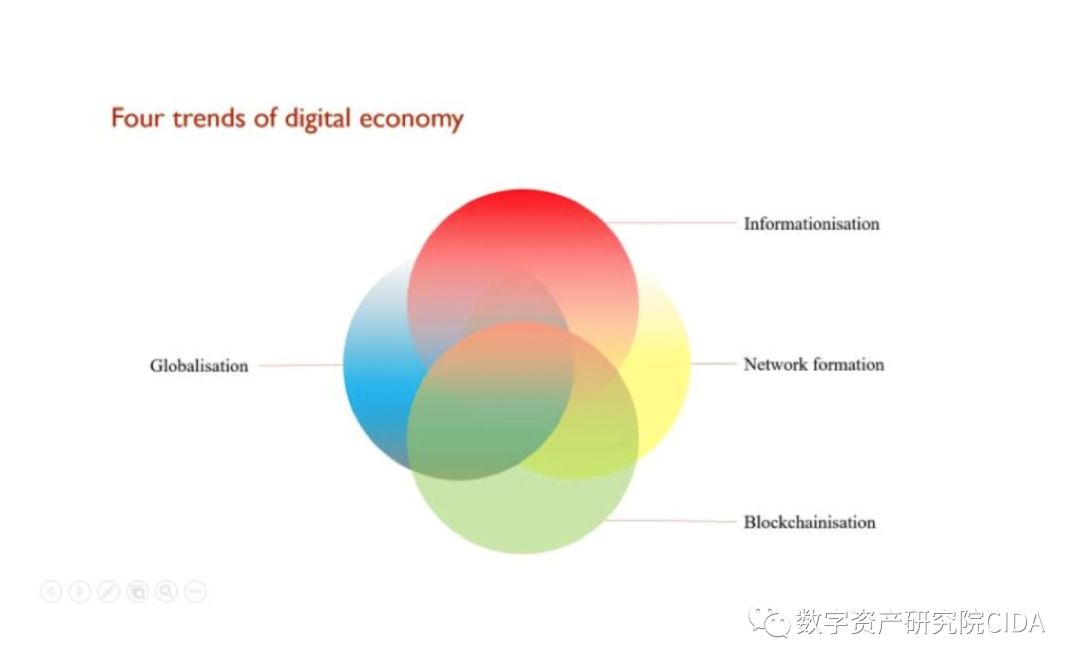

Finally, the decision on the digital economy is "four modernizations": one is "informatization", one is "globalization", one is "networking", and there is also a "blockchaining". I am not at ease with the concept of "blockchaining". Before Lecture tonight, I carefully searched the literature and did have this concept in the English-speaking world.

I am going to talk about this topic today: the digital economy for 50 years: from "Singularity" to "Big Bang" of "Digital Economy – from a Singularity to the Big Bang". It happened that before the start of Lecture, I walked on the campus and saw the concert advertisement of BigBang. I am happy for this coincidence, took a photo, as the last page of the PPT tonight, share with you.

thank you all!

Zhu Jiaming 2011.04.14 in Beijing·Tsinghua x-lab

Appendix: Q&A

Q1: Today you mentioned the increase in the geometric progression that may occur after the intersection of the two curves of the blockchain and the digital economy. For what we are seeing now, the increasingly polarized wealth in various countries, you think it will be Better, or worse?

Zhu Jiaming: The key word of my today's lecture is the number. The two big explosions of the digital economy and their "overlay" effects have not yet fully manifested. However, what you said because of the polarization of wealth caused by the digital economy will obviously continue.

The issues we need to care about include: the digital economy has led to the "digital divide," and behind the "digital divide," it is actually the ownership of numbers, data, and information. Now, people find that data, information, knowledge, and ideas can't avoid how they are generated. Who should the owner be, how are the boundaries of use rights and ownership defined? The harsh facts nowadays are: numbers and data are created by the vast majority of the people, and the producers and producers of information are the natural owners of information. But they are hard to be the true owners of numbers. They are forced or, at their absolute discretion, to transfer their data to economic entities or power agencies with digital processing power. This data monopoly has exacerbated the digital divide, which in turn constitutes the underlying cause of the polarization of the digital economy.

Furthermore, the geometric growth of the digital economy since 1961 has generated enormous wealth energy. While promoting social progress, the world is facing an unprecedented new inequality. This kind of inequality is more challenging than food, clothing and housing, based on inequalities in material production and material wealth. In the past year or two, the influx of traditional capital into the blockchain and encrypted digital fields has intensified the erosion of the original ecology and the deviation from the original intention of pursuing a wealth distribution model.

Q2: Traditional capital in the blockchain and encrypted digital currency field is a process of redistribution of wealth to a considerable extent. The new Internet companies we are seeing now are products of the new generation, and the traditional family, such as the Rockefeller family, are moving down. Is there a trend of faster and faster capital growth and a relatively low GDP growth?

Zhu Jiaming: First of all, any economic transformation will lead to the redistribution of wealth, accompanied by a large-scale "cutting amaranth" phenomenon. Ancient and modern Chinese and foreign, this is no more. However, in the history of human economy, the number of major transformations is quite limited. However, in the past few decades, as the progress of science and technology has accelerated and the economic impact has intensified, there has been a trend of increasing the frequency of transformation, and one transformation has stimulated and bred another transformation.

In the transformation of the digital economy, new capital and new wealth models are naturally generated. The cycle of the explosion of wealth has become shorter. With Nasdaq Power, four billionaires related to the digital economy were created early in the market. Today, in terms of the speed at which the British blockchain economy creates wealth, it is only about five years to build a wealthy owner with a billion-dollar basis. What is worthy of recognition is that such a new wealth model leads newcomers to become capital owners, always better than wealth is always controlled by the old family.

Further, if the growth rate of newly generated incremental capital far exceeds the growth rate of stock capital, it is a historical progress. I describe tonight that in the era of digital economy, the two big bangs were not linear processes but nonlinear processes. The last incremental capital deposited is far greater than the stock capital. This means that the world has a new group of capital, a change, and the new owner of capital is a new generation. The main body of human wealth is shifting to the three generations of X, Y, and Z. Facebook has no problem, but it represents a future model of reform space. This issue is worthy of further observation and discussion.

In addition, the digital economy relies on the spirit of open source and technology, and its essence is inseparable from the open society. In the 1990s, people discussed the Borderless Economy. History has shown that the biggest feature of the digital economy is the natural borderless economy. The scale of the digital economy has been expanded to benefit from globalization. Now, there are still many people who think about the economy and can't get rid of the notion of the material form economy. For example, in the case of more than half of the world's GDP coming from the digital economy, talking about the international economy, and what the "Baltic Index" is, is obviously seriously outdated. You know, for the digital economy, service trade, intellectual property education, financial markets, where ships and containers are needed.

Q3: I understand that traditional capital and materialized form economy are inseparable. In the stage of digital asset development, will it be combined with virtualized economy? And you have been talking about singularity, when it comes to the importance of thought, why in the conclusions that follow you, the four roles of scientists, engineers, entrepreneurs, and government are emphasized, and why are you not talking about the role of thought? In the course of future development, will the thoughts also play a role in deepening, promoting, and even sublimating? There is another question. In your conclusion, the impact of the digital economy on the state and society is related to the issue of social ethics in the process of digital capital development. Of course, the law is also included. I believe that the impact of the digital economy on social ethics in this aspect should have a great impact on customs, culture, and national and regional aspects. So don't know what you think about these aspects? Also, the digital economy is very important for the country and the state. Because now, in the process of digital capital development, there is a contradiction between the state and the state. What do you think about the digital economy versus the state, such as the existing power structure, or the interest structure, currency distribution rights?

Zhu Jiaming: You are asking big questions. Let me talk about ideas first. Thought is always the first driving force of history. At many critical times in history, the ability to generate key ideas and to create characters that create key ideas is always very limited and scarce. The singularity of these two thoughts that I am going tonight is to prove that in such a critical moment of history, just the need for such an idea has produced such a person, and it is rare to write such an article. I dare not say it now, but I don’t have a third example at the moment. Einstein's thoughts and articles are important, but he does not immediately have a direct impact on wealth. Therefore, in the long process of human history, the main mode of ideological influence is gradual and subtle.

Discussing capital in today's context requires a return to the digital economy. Tonight, I divided the digital economy into two types: Type A and Type B. From 1961 to 2008, before the A type was dominant, the so-called venture capital concept and the concept of the GEM came into being. Nasdaq came into being, especially here, whether it is the GEM or Nasdaq. , still need traditional gold and silver. Since 2008, the B type has risen. Ethereum 1CO was alive and successful, creating a model that does not require traditional capital. After 2017, the intersection of two types of digital economy stimulated the 1CO climax, and the universalization of cutting leeks not only proved that capital can be created out of thin air, but also proved that Support investment through non-traditional financial resources. In this process, the participants can be the beneficiaries by breaking the pattern that capital is owned by a few. Now, it is entering the classical and classic concept of capital or outdated, or needs to be revised, and the "capital" is inconclusive.

As for the impact of the digital economy on society, it will continue to experience and observe. One thing is certain, that is, in the unconscious of people, they have been threatened to the era of forced life in the digital economy. Look at the subway, men, women and children, who does not look at the phone? I recently participated in a project to discuss 8K+5G+AI, plus the smart phone, how will it affect economic activities and daily life? People will see the clue before and after the Olympics to be held in Japan soon. We can't know what the world will be like, but the cost of adapting to this change will be higher and higher, and most people will become increasingly confused.

As for the impact of the digital economy on the political situation, I don't want to say too much about this issue, and I can discuss it later. A few years ago, there was a book that was very fashionable two years ago, called "The Failure of the Country." This book tells a lot of truth. But it sees the impact of the digital economy on modern countries. A recent article on the Internet lists the milestones of the US communications media revolution and politics: Roosevelt's success relies on radio, Kennedy's success depends on television, Obama's success depends on the Internet, and today's Trump's success depends on Twitter. Not only that, but it has also opened the "Twittering State" precedent. The old man wrote dozens or even more tweets every day, which led to the penetration, timeliness and precision of the ideas and information he hoped to spread, and at the same time realized speed, scope and spread. By the way, I don't agree with the impossible triangle of the blockchain, nor do I agree with the so-called Mundell impossible triangle. I see more of the various possible triangles. The Trump rule uses a possible triangle that satisfies both speed, scope, and spread.

Q4: In the current world, because of the digital economy, the ethnic groups are all different in terms of food, clothing, housing and transportation: Beijing has two classes to buy a house and not to buy a house. The line is for people who are dripping and not dripping, and my father is more difficult to take a taxi. The digital change has caused 90% of people to fall, and the digital change has turned the normal working person into 996. Does the digital economy make human progress easier, or is it harder? The second question, you have in-depth experience in the United States, Europe, and China. The annual VC transaction volume is 100 billion US dollars of investment. Last year, the United States was 10 billion yuan in transaction volume, China was 105 billion, and the world was only 200 billion. This change has 40 hours of working days for Europeans. The result is backward. After that, China is catching up. Which three represent the regions that represent the future of human evolution in the future?

Zhu Jiaming: First of all, what I want to say is that my life, running around the world, is not my choice, the fate. In the past few decades of living abroad, I have stayed in Vienna for the longest time. Vienna has the privilege of being rated as the best city in the world for human life. In the first and second places, it has never lost its third place. This year is still the first. For many years, I have spoken everywhere in Europe: Europe is by no means a decline in Europe. The evaluation of Europe cannot be based on the growth rate of GDP, nor is it necessary to use the proportion of the digital economy in GDP as an indicator. I hope that everyone sees that the Austrian voters have fallen to 16 years old N years ago. They will not elect even the wise grandfathers as presidents. The prime ministers they elected are young and under 30 years old. Also, the EU Constitution is worth studying. The Constitution gives every citizen of the European Union such power, and when their individual rights conflict with their country, the EU stands on the side of each individual. The EU countries also have a high degree of attention to the environment and a tradition and system of deep bone marrow maintenance. In short, Europe is a region of humanity in the world. The world needs the balance of the EU sector.

Regarding VC, I hope that everyone will pay attention not only to its scale, but also to its geographical distribution and industrial distribution. The vast majority of VCs in the United States are in Silicon Valley, which means that the VCs in the Silicon Valley are the highest in the world, and only VCs can reach this level.

Q5: In the past, economists generally believed that the socialism and welfareism practiced in Northern Europe did not last long and the quality of life was high. This is the future of mankind. Now, driven by numbers and capital, it seems that Silicon Valley, Boston, China's Wudaokou and Zhongguancun are more representative of the future of mankind? Or, if the digital giant continues to move forward, is it a relatively comfortable life like Nordic and Austria that is the future of human evolution, or Silicon Valley?

Zhu Jiaming: Human beings are entering the "new dual society." Traditional dual society refers to the coexistence of agriculture and industry. The "new dual society" is mainly the coexistence of the digital economy and the non-digital economy. In today's developed countries, the important indicator is the high proportion of the digital economy in GDP, while the so-called backward or developing countries, the proportion of the digital economy in GDP is too low. Whether the digital society must mean high welfare and high happiness index for the people is actually worth discussing. If people choose to live in a social life dominated by the digital economy and digital technology, or in a social life that is not dominated by the digital economy and digital technology? I guess there will be many people who choose the latter or return to the latter. I am a person like this.

Q6: Professor Zhu is good. I understand that when you talk about the blockchain economy, you emphasize the situation and trend of the digitization of trading objects and trading currencies. In 2019, JP Morgan issued a stable currency, and Facebook outside China, issued a stable currency to 70% of Internet users. In a case, how do you understand the stable currency? I am concerned about the more representative USDT in the stable currency. Will the USDT form a decentralized system of issuing dollars or a mechanism? In the past ten years, the pass-through economy, blockchain economy, 1.0 is a stock token, and it is inseparable from the shadow of equity. The issue of the company's equity has always been very sensitive. The Great Depression of 1929 was due to the problem of equity. The essence of the problem of China's ten-year stock market is that the equity is not solved well. The same is true of the three-board market. ICU and STO are like this. The country also has its certificate. Some people say that money is the stock of the country. So I wrote a book, the book name is "General Certificate", expounding the concept just now. 2019 is not an era of stable currency. If there is a stable currency, the country will not be too worried, because there will be no ups and downs, this is a new era. In short, how do you view the stable currency, is there a new opportunity and possibility to stabilize the currency?

Zhu Jiaming: The question you asked is very serious. This involves three types of issues that need to be considered at the same time: First, the theoretical problem, that is, there is no stable currency in the end? My answer is no. Stabilizing coins is a kind of human expectation, an illusion, and it is easy to think of the pursuit of "perpetual motion." Because, if there is a stable currency, then what is a stable currency, what kind of standards and conditions do you need to stabilize the currency? In my limited knowledge, this problem has not been solved. For a long time, everyone is discussing a problem that has a problem in its own premises. Even in the gold standard era, gold is not a stable currency. After that, when various credit currencies, or French currency, replaced the gold standard, the stable currency was completely lost. As for the relationship between USDT and the US dollar, it was originally a "paradox" because the US dollar itself is not a stable currency. How can a dollar-based currency become a stable currency?

Second, the reality of choice. Looking now, it is a more realistic choice to send a corresponding digital currency based on the US dollar or other legal currency. I believe that if the world's legal currency creates a cryptographic digital currency connected to it, that is, adding a legal digital currency beyond the traditional monetary system, if the current illegal digital currency is tolerated, the world monetary system will be in " The ternary structure, the world monetary system will tend to be stable. Because the three fulcrums are more stable than one fulcrum. In short, we should be pursuing a stable monetary system, rather than a stable currency that pursues imagination.

Third, the exchange rate is always an insurmountable technical issue. In the early 1970s, Nixon cut the relationship between gold and the US dollar. From then on, the core issue of the world monetary system was the exchange rate issue. In real economic life, the value of each currency changes at all times. Today, no country or monetary authority can formulate its monetary policy without neglecting the exchange rate. The exchange rate issue involves the issue of nominal exchange rate and real exchange rate. . Now, because of the emergence and expansion of encrypted digital currency, in addition to the exchange rate between traditional French currency, the exchange rate relationship between digital currency and traditional currency has increased. The exchange rate system will be more complicated in the foreseeable future. Therefore, the desire to stabilize the currency can only be more utopia.

Q7: Information inequality is an important issue. The first digital economic bang ended, and the causes of the 2008 world financial crisis, including the bankruptcy of Lehman Brothers, were related to information inequality and asymmetry. As you just said, we also see that all the inequalities of information appear from both the commercial level and the political level. Will this inequality affect the outcome of the second digital economic explosion? If so, will it be through the third singularity or through what kind of method?

Zhu Jiaming: Now I can't answer the question of whether there is a third "singularity". Generally speaking, the singularity has two meanings. One of them is the singularity that Musk tells everyone. It means that human beings will definitely go to a new singularity. After this singularity, the whole human existence pattern has changed. The second is the singularity of the astronomical big bang theory. I borrow the singularity of this meaning to describe the evolution of the digital economy.

There are many problems in this world now, and there is a total surplus. The first is the excess of material products, which is behind overcapacity. Producing so many pairs of shoes every day, in fact, one person and three pairs of shoes is enough, producing so many shoes, so many clothes. Not only that, but there is excess money and liquidity. Originally M2 has been a lot in the world, it is already a lot of money, but M2 continues to be super-scale. The next one is capital surplus. We have no way to assess the second digital economic explosion and have a profound impact on the world monetary and financial system because time is too short.

More serious is the excess of information, excess data, and meaningless excess of non-material products. These different types of excesses not only accumulate in geometric progression, but also continue to explode and interact. At such historical heights, we need to be alert to information inequality, like capital inequality, currency inequality, and material wealth inequality, causing permanent damage to human progress.

So far, I have answered a total of seven questions. Human wisdom and experience are very limited. However, it is still necessary to adhere to the original concept and value the mind. To do this, we need to learn, we need a strong sense of history, and all valuable ideas need time to be recognized and influenced. Therefore, we should not use today as the standard, but the future as the yardstick.

Thank you again!

Original title: "Zhu Jiaming | Digital Economy 50 Years: From "Singularity" to "Big Bang"

Source: "Digital Assets Institute CIDA"

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- USDT Thunder, how big is the impact on Bitcoin?

- I regret to miss Google’s Buffett and intend to get involved in the blockchain.

- The blockchain application closest to the money has landed: Will the decentralized financial market blow out?

- In-depth discussion of blockchain thinking mode (bottom)

- Ma Qianli, Vice President of Babbitt: Exploration and Application of Blockchain in the Wave of Big Data

- Facebook Stabilization Project Project Libra is exposed, similar to loyalty points

- How to inherit bitcoin heritage? Professional lawyer gives the answer