Can't beat Bitcoin in 2019, where is the strength of Ethereum in 2020?

Source: OKEx

Translation: First Class (First.VIP) _Maggie

The price of Ethereum has been underperforming this year. This second-largest cryptocurrency has gained less than 5% this year, and Bitcoin still has a surprising 95% increase year-to-date, even if there is a wave of selling at the beginning of the year. With the successful implementation of the Istanbul upgrade and the increasing popularity of DeFi, is it reasonable for investors to have "bullish sentiment" about ETH? Ethereum's recognition in financial institutions has increased significantly, what does it mean for ordinary investors?

ETH underperforms

Bitcoin has always been the most widely used cryptocurrency in the world, and it is often used as the benchmark in the cryptocurrency field. From beginning to end, its performance has been an important market focus. In fact, the current cryptocurrency market looks very different from when Bitcoin first debuted a decade ago. The rapid development of the crypto field has broadened the wider crypto market, bringing increased investment and application demand for altcoins such as ETH, XRP and EOS. Although the ETH price rebounded sharply from the end of 2017 to the beginning of 2018, the price performance of ETH this year was significantly worse than that of BTC.

- Review Ethereum 2019: speak with data

- Industry Blockchain Weekly 丨 31 Provinces Release Policy Information, Blockchain Concept Stocks Expand

- Rebirth! Digital Assets (DA) receives $ 35 million Series C funding led by Australian Securities Exchange (ASX)

Figure 1: Market performance of Ethereum and Bitcoin year to date; Source: Tradingview

Although the unsatisfactory performance of Ethereum 2019 can be attributed to the many factors that are intertwined, conducting multiple layers of analysis can give us a more comprehensive understanding of Ethereum and see if Ethereum can fight back in the long run.

Network assessment

In the Internet era, investors may sometimes find it difficult to value new economic companies using traditional valuation methods. FAANG stock is a good example. Despite being criticized for its high valuation, this most influential giant technology group is still one of the key driving forces of the stock market.

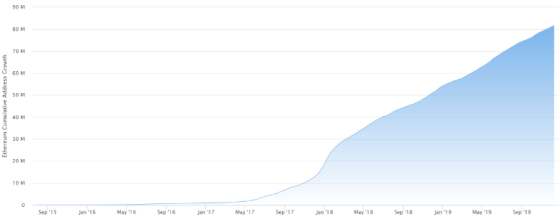

Similar to FAANG stock, many people think that cryptocurrency is also a network value-driven asset, which means that the more people use it, the higher the value. There are more than 81 million unique addresses in the entire Ethereum network, and this number has been steadily increasing since the beginning of last year.

Figure 2: Ethereum address growth chart; Source: Etherscan.io

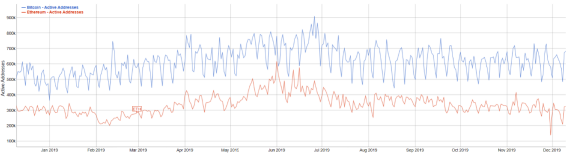

However, things don't seem to stand up to scrutiny when considering usage factors. Since the number of Ethereum event addresses hit 600K in June 2019, it has been stable at around 300K. Similarly, in the second half of this year, the number of active Bitcoin addresses fluctuated between 500K and 700K, reaching 900K in late June.

Figure 3: Ethereum and Bitcoin active addresses in the past year; Source: Bitinfochart

DeFi: Ethereum's growth momentum?

We can evaluate another aspect of the Ethereum blockchain is the rise of DeFi.

Maker has been a leader in Ethereum-based DeFi, and its smart contract hosting platform allows users to mortgage, trade, and borrow crypto assets. In November, the MakerDAO agreement was upgraded to create a variety of collateral DAI (or MCD), which accepts ETH as collateral generated by the DAI.

Ethereum is the largest pillar of the entire DeFi world. DeFiPulse data shows that DeFi has locked up to 2.7 million Ether in the system, accounting for 2.5% of the total ETH supply. The Makers alone hold at least $ 325 million in DeFi, accounting for about half of the DeFi lockup.

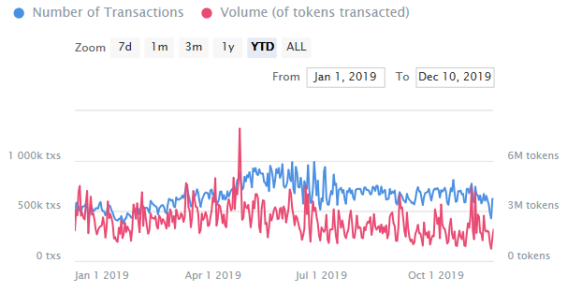

The market seems to be paying for the optimistic outlook for DeFi, and it is becoming increasingly popular elsewhere. We believe that Ethereum benefits from the favorable conditions of DeFi growth in the long run, and we expect that more and more high-value transactions will enter the Ethereum blockchain , which may have a positive impact on the price of ETH in the long run.

Figure 4: Ethereum's transaction times and volume; Source: IntoTheBlock

Figure 5: Total value locked in DeFi (USD); Source: DeFiPulse

From a macro perspective, the birth of DeFi also changed the market's expectations for Ethereum. From utility tokens to more like a high-value transaction settlement application. In addition, although Bitcoin has long been regarded as a value store, DeFi can also pave the way for Ethereum to strengthen its value storage characteristics. We expect that this transition will become clearer in 2020 as the DeFi market expands rapidly.

Business participation wins appeal

Increasing corporate interest may be another fundamental factor that is expected to affect the future development of Ethereum, especially in the banking industry .

Earlier this month, banking giant Standard Chartered announced its joining the Enterprise Ethereum Alliance (EEA) . EEA claims that it is an organization dedicated to developing an open and decentralized network and blockchain specifications for global businesses and consumers. Other large multinational banks such as J.P. Morgan Chase, Holland International Group, Citibank, and Spanish Bank of Spain have become members of the EEA.

However, this may not be Standard Chartered's first blockchain investment, and the bank has also established a strategic partnership with Ripple, especially in terms of payments. However, joining the EEA not only indicates that banks want to further introduce blockchain technology, but may also focus on Ethereum and even ETH.

There is a timetable for any upcoming Ethereum project from Standard Chartered. Nevertheless, the EEA is still doing a lot of work. One example is Quorum, backed by JP Morgan. In the foreseeable future, key members of the EEA may launch more similar projects.

In addition, Ernest & Young announced that it has made a significant technological breakthrough that allows private transactions to run on the public Ethereum blockchain at a lower cost. In this way, we can expect to see more companies transferring ETH and other Ethereum-based tokens in private names on the public blockchain.

in conclusion

Since the second quarter of 19, the price performance of Ethereum has worsened. The disadvantages of the Ethereum network and ETH prices may be attributed to investment needs, consensus costs, network speeds, and other market factors. However, the rise and maturity of DeFi, the growing interest of enterprises, and network upgrades are expected to push Ethereum as the mainstay of the digital financial world . In the long run, these developments will also be the main driving force for the continued prosperity of the Ethereum ecosystem.

Reprinted please retain copyright information, thanks for reading.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Can smart contracts exist without blockchain? The answer from S & P Global is YES

- Can I understand the blockchain consensus mechanism after watching "Lipstick One Brother" live?

- Omni receives funding from Tether to support new version development, will allow users to buy Bitcoin using any on-chain asset

- Filecoin mainnet test, "first move" miners may be eliminated

- Where can I find DeFi data? Here is your strongest strategy

- The value of hedging is second only to MakerDao's Defi project Synthetix. What support is behind?

- Venezuela will start airdropping petroleum coins this week, earning $ 30 per person